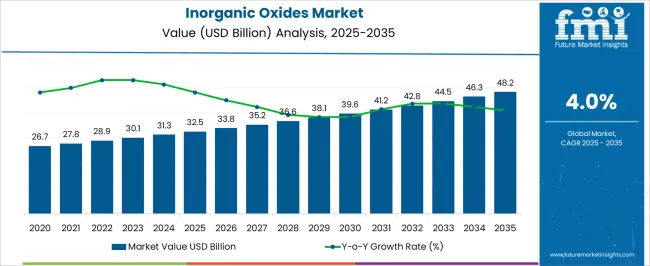

The Inorganic Oxides Market is estimated to be valued at USD 32.5 billion in 2025 and is projected to reach USD 48.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Inorganic Oxides Market Estimated Value in (2025 E) | USD 32.5 billion |

| Inorganic Oxides Market Forecast Value in (2035 F) | USD 48.2 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The inorganic oxides market is gaining significant momentum, driven by their broad utility in diverse industrial and commercial applications. Demand growth is being strongly supported by their critical role as functional additives in catalysts, pigments, coatings, ceramics, and specialty chemicals. Increasing consumption in industries such as electronics, chemicals, and construction is creating sustained growth opportunities.

Advancements in processing technologies and improvements in purity levels are enhancing product quality and application efficiency, further strengthening adoption. Rising investments in chemical manufacturing and materials science innovation are reinforcing the use of inorganic oxides for high-performance industrial processes. The growing shift toward environmentally sustainable formulations is encouraging manufacturers to develop oxide materials that improve efficiency while minimizing environmental impact.

Additionally, expanding infrastructure projects, rising demand for high-performance coatings, and the increasing use of oxides in advanced electronics are fueling the market outlook As global industrial activity continues to expand and technology-driven industries evolve, the inorganic oxides market is expected to witness steady growth with strong adoption across established and emerging economies.

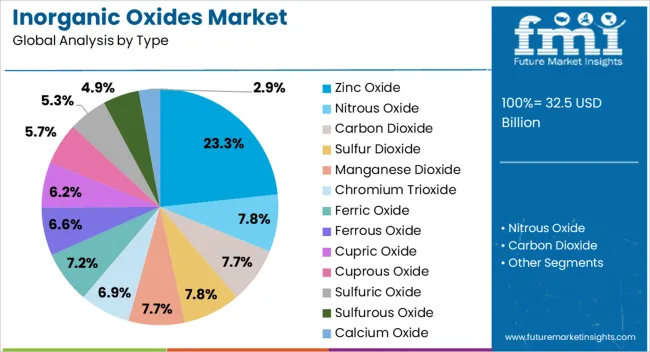

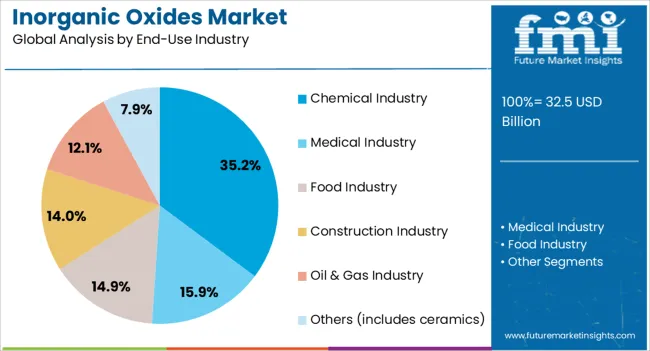

The inorganic oxides market is segmented by type, end-use industry, and geographic regions. By type, inorganic oxides market is divided into Zinc Oxide, Nitrous Oxide, Carbon Dioxide, Sulfur Dioxide, Manganese Dioxide, Chromium Trioxide, Ferric Oxide, Ferrous Oxide, Cupric Oxide, Cuprous Oxide, Sulfuric Oxide, Sulfurous Oxide, and Calcium Oxide. In terms of end-use industry, inorganic oxides market is classified into Chemical Industry, Medical Industry, Food Industry, Construction Industry, Oil & Gas Industry, and Others (includes ceramics). Regionally, the inorganic oxides industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The zinc oxide type segment is projected to account for 23.3% of the inorganic oxides market revenue share in 2025, positioning it as a leading type. This leadership is being reinforced by its widespread application in rubber manufacturing, ceramics, coatings, and pharmaceuticals, where its multifunctional properties provide significant performance benefits. Zinc oxide offers high chemical stability, ultraviolet absorption capability, and excellent catalytic performance, making it indispensable across multiple industries.

The segment is experiencing strong adoption in the production of rubber tires, where it improves durability, strength, and resistance to wear. Rising demand for UV-protective coatings, sunscreens, and personal care products is also contributing to its growth, given zinc oxide’s safety and effectiveness as a protective agent.

Additionally, its role in electronics, particularly in varistors and semiconductors, is expanding with the growth of consumer electronics markets The ability of zinc oxide to provide consistent performance in diverse industrial and consumer applications ensures that the segment will continue to maintain a strong market presence, supported by ongoing innovation and expanding industrial demand.

The chemical industry segment is expected to represent 35.2% of the inorganic oxides market revenue share in 2025, establishing itself as the leading end-use industry. This dominance is being driven by the extensive utilization of inorganic oxides as catalysts, fillers, pigments, and reactive agents in chemical manufacturing processes. Their role in enhancing process efficiency, improving product stability, and enabling high-quality formulations makes them essential for a wide range of chemical products.

The segment is witnessing sustained demand due to the rising production of coatings, plastics, adhesives, and specialty chemicals, where oxides are indispensable for performance and durability. Growing investments in the global chemical sector, especially in Asia-Pacific and the Middle East, are further boosting the demand for oxide materials.

Environmental regulations encouraging cleaner production processes are also driving the adoption of oxides that help reduce emissions and improve energy efficiency As chemical manufacturers increasingly prioritize efficiency, performance, and sustainability, the reliance on inorganic oxides is expected to expand, reinforcing the chemical industry’s position as the leading consumer of these materials.

An inorganic oxide is a chemical compound that contains one oxygen atom and other elements. Some of the most commonly encountered inorganic oxides are nitrous oxide, carbon dioxide, zinc oxide, sulfur dioxide, manganese dioxide, chromium trioxide, ferric oxide, ferrous oxide, cupric oxide, cuprous oxide, sulfuric oxide, sulfurous oxide and calcium oxide among others.

Some oxides can react directly with water to form an acidic, basic, or amphoteric solution. Different oxides of the same element are distinguished by Roman numerals denoting their oxidation number, e.g. iron (II) oxide versus iron (III) oxide.

Inorganic oxides have a wide variety of applications. One such key inorganic oxide is nitrous oxide that has applications majorly in the medical industry. It is commonly used to produce laughing gas and as an anesthetic (used in a combination with diatomic oxygen to make nitrous oxide and oxygen anesthesia). Other nitrogen oxides such as nitrogen dioxide exist in areas with notable air pollution.

Silicon dioxide is used in the construction industry for the production of portland cement, as a precursor to glass and silicon metal and for food and pharmaceutical applications. Another key product type is iron oxide that has extensive use as a black pigment. Iron oxide is synthesized rather than being extracted from the naturally occurring mineral as the particle size and shape can be varied by the method of production.

Nano particles of iron oxide are used as contrast agents in MRI scanning. Iron oxide can be used along with aluminum and sulfur as an ingredient in a specific type of thermite useful for cutting steel.

Another inorganic oxide, zinc oxide is used as an additive in numerous materials and products including rubber, plastics, ceramics, glass, ointments, adhesives, pigments, foods, batteries, fire retardants and first-aid tapes among others. Carbon dioxide is one of the most important inorganic oxides and is used by food, oil and chemical industries.

In the food Industry, carbon dioxide is generally used as a food additive and is approved for use by the FDA.

The growth and expansion of end user industries such as chemical, food, ceramics and medical will be a major driving factor for the consumption of inorganic oxides. In addition, rapid urbanization of emerging economies has led to boom in construction industry and oil and gas industry, which is in turn is expected to drive the inorganic oxides market.

The consumption of inorganic oxides will only increase in the emerging economies. Brazil, Russia, China and India are expected to be the largest consumers of inorganic oxides. However, environmental concerns and government regulations could hamper the growth of inorganic oxides market.

Geographically, Asia Pacific Excluding Japan (APEJ) is one the largest consumer of inorganic oxides, primarily driven by the growth of key end user industries such as oil and gas, food and chemical. China and India are the primary consumers of inorganic oxides in APEJ due to rapid industrialization, rising income levels and changing consumer lifestyle.

In addition, the proliferation of oil and gas related activities in APEJ have increased the consumption of key inorganic oxides such as carbon dioxide for oil recovery purposes. Carbon dioxide, when dissolved into the underground crude oil, significantly reduces its viscosity, and changes surface chemistry enabling the oil to flow more rapidly through the reservoir to the removal well.

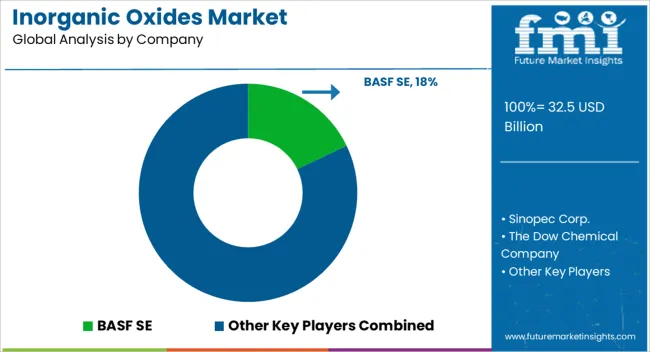

Some of the key players in inorganic oxides market are BASF SE, Sinopec Corp., The Dow Chemical Company, Incos srl P.I., Exxon Mobil Corporation, DuPont, Mitsubishi Chemical Corporation, SABIC, Cathay Industries and Total among others.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

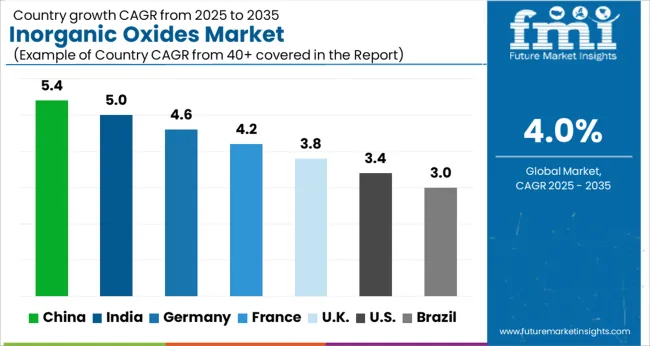

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The Inorganic Oxides Market is expected to register a CAGR of 4.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.4%, followed by India at 5.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.0%, yet still underscores a broadly positive trajectory for the global Inorganic Oxides Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.6%. The USA Inorganic Oxides Market is estimated to be valued at USD 12.0 billion in 2025 and is anticipated to reach a valuation of USD 16.7 billion by 2035. Sales are projected to rise at a CAGR of 3.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.5 billion and USD 928.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 32.5 Billion |

| Type | Zinc Oxide, Nitrous Oxide, Carbon Dioxide, Sulfur Dioxide, Manganese Dioxide, Chromium Trioxide, Ferric Oxide, Ferrous Oxide, Cupric Oxide, Cuprous Oxide, Sulfuric Oxide, Sulfurous Oxide, and Calcium Oxide |

| End-Use Industry | Chemical Industry, Medical Industry, Food Industry, Construction Industry, Oil & Gas Industry, and Others (includes ceramics) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Sinopec Corp., The Dow Chemical Company, Incos srl P.I., Exxon Mobil Corporation, DuPont, Mitsubishi Chemical Corporation, SABIC, and Cathay Industries |

The global inorganic oxides market is estimated to be valued at USD 32.5 billion in 2025.

The market size for the inorganic oxides market is projected to reach USD 48.2 billion by 2035.

The inorganic oxides market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in inorganic oxides market are zinc oxide, nitrous oxide, carbon dioxide, sulfur dioxide, manganese dioxide, chromium trioxide, ferric oxide, ferrous oxide, cupric oxide, cuprous oxide, sulfuric oxide, sulfurous oxide and calcium oxide.

In terms of end-use industry, chemical industry segment to command 35.2% share in the inorganic oxides market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inorganic Cobalt Blue Pigments Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Scintillators Market Size and Share Forecast Outlook 2025 to 2035

Inorganic filler Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Salts Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Zinc Coatings Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Fungicide Market - Growth & Demand 2025 to 2035

Industry Share Analysis for Inorganic Scintillators Companies

Inorganic Flame Retardants Market

Inorganic Ion Exchange Materials Market

White Inorganic Pigment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA