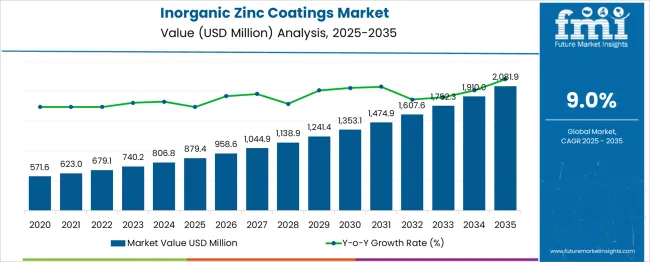

The Inorganic Zinc Coatings Market is estimated to be valued at USD 879.4 million in 2025 and is projected to reach USD 2081.9 million by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period. In the first five-year phase (2025–2030), the market will expand from USD 879.4 million to USD 1,353.1 million, delivering an incremental gain of USD 473.7 million, which accounts for 39.4% of the total opportunity. This growth is primarily driven by rising investments in corrosion protection solutions for infrastructure, oil & gas pipelines, and marine applications, alongside stricter regulatory requirements for asset durability.

The second half (2030–2035) is projected to contribute USD 728.8 million, or 60.6% of incremental growth, indicating stronger momentum as offshore wind farms, energy facilities, and industrial plants demand advanced coating technologies for extended service life. Annual additions during the first phase average USD 94 million per year, while later years will accelerate due to the adoption of high-performance inorganic zinc coatings with improved adhesion and low-VOC properties. Manufacturers focusing on innovative formulations and expansion into emerging economies will be best positioned to capitalize on this USD 1.2 billion opportunity as infrastructure modernization accelerates globally.

| Metric | Value |

|---|---|

| Inorganic Zinc Coatings Market Estimated Value in (2025 E) | USD 879.4 million |

| Inorganic Zinc Coatings Market Forecast Value in (2035 F) | USD 2081.9 million |

| Forecast CAGR (2025 to 2035) | 9.0% |

The inorganic zinc coatings market holds a strong position within several coating and corrosion protection sectors. In the protective coatings market, its share is about 12–14%, as inorganic zinc coatings are a preferred choice for heavy-duty anti-corrosion applications in harsh environments. Within the corrosion-resistant coatings market, it accounts for approximately 18–20%, reflecting its superior performance in marine, oil and gas, and industrial structures compared to organic alternatives. In the industrial coatings market, the share stands at 6–8%, as this segment also includes epoxy, polyurethane, and powder coatings. For the metal surface treatment and finishing market, inorganic zinc coatings contribute around 4–5%, as galvanization and electroplating dominate other applications. In the construction and infrastructure coatings market, its share is nearly 7–8%, driven by usage in bridges, pipelines, and structural steel projects requiring long-term corrosion protection. Growth is supported by rising investments in infrastructure, offshore energy projects, and regulatory compliance for extended asset life. Inorganic zinc coatings are favored for their excellent adhesion, abrasion resistance, and cathodic protection properties, making them essential for high-performance coating systems. As global demand for durable, low-maintenance protective solutions grows, the inorganic zinc coatings market is expected to expand its share within these parent markets over the coming years.

The inorganic zinc coatings market is exhibiting strong growth driven by its superior corrosion resistance properties and increasing demand across heavy-duty infrastructure applications. These coatings are being increasingly utilized in environments requiring long-term durability, especially in areas prone to harsh climatic and chemical exposure.

The rising focus on asset longevity in sectors such as construction, marine, oil and gas, and transportation has contributed to the sustained demand. Inorganic zinc coatings have been recognized for their ability to provide cathodic protection, which reduces the need for frequent maintenance and enhances cost-efficiency over the lifecycle of metal structures.

With regulatory frameworks becoming more stringent around environmental protection and material degradation, end users are transitioning toward coatings that align with safety, performance, and compliance standards. The market outlook remains optimistic, supported by the ongoing expansion of industrial infrastructure, global port developments, and energy-related projects that continue to rely on high-performance protective coatings..

The inorganic zinc coatings market is segmented by type, application, end use, and geographic regions. The inorganic zinc coatings market is divided into Alkali silicate water-borne and Ethyl silicate solvent-borne. The inorganic zinc coatings market is classified into Marine, Oil & gas, Power generation, Transport & automotive, Construction, and Other (agriculture, chemical processing). The end use of the inorganic zinc coatings market is segmented into Industrial, Commercial, and Residential. Regionally, the inorganic zinc coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

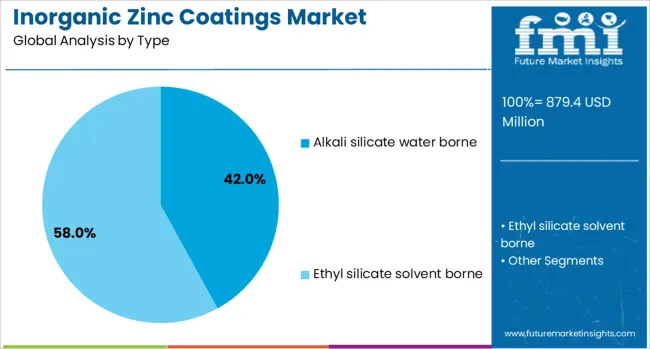

The alkali silicate water borne type segment is projected to account for 42% of the inorganic zinc coatings market revenue share in 2025, establishing it as the leading coating type. Its prominence has been driven by superior adhesion properties, environmental compliance, and reduced volatile organic compound emissions. This coating type has been widely adopted for large-scale industrial applications due to its ease of application, reduced curing time, and strong resistance to chemical degradation.

The water-based formulation aligns with increasing regulatory requirements focused on environmental sustainability, making it a preferred choice in both developed and emerging markets. The growing shift toward eco-conscious solutions without compromising performance has supported the segment’s adoption across various infrastructure projects.

Furthermore, its compatibility with steel substrates and proven long-term corrosion resistance in aggressive marine and coastal environments have reinforced its role as a cost-effective and durable solution. The ongoing transition from solvent-based to water-borne technologies continues to favor this segment’s leadership in the overall market..

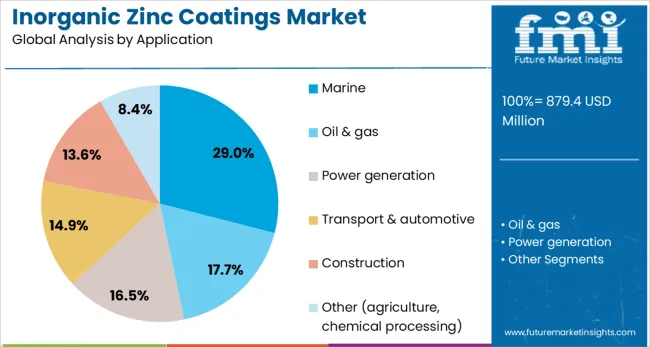

The marine application segment is expected to capture 29% of the inorganic zinc coatings market revenue share in 2025, representing the largest application category. This leadership position has been driven by increasing requirements for anti-corrosive coatings on vessels, offshore platforms, and coastal infrastructure. Exposure to high salinity, constant moisture, and mechanical stress makes marine environments particularly susceptible to rapid metal degradation.

Inorganic zinc coatings have demonstrated long-lasting protection in such conditions, significantly extending the maintenance cycles of metal structures. The segment’s growth has also been encouraged by global investments in naval modernization, commercial shipbuilding, and the expansion of port and harbor facilities.

As maritime regulations tighten regarding vessel maintenance and environmental impact, there is growing emphasis on using coatings that offer high performance with minimal ecological footprint. The marine industry’s ongoing push for operational efficiency, asset protection, and regulatory compliance continues to drive the demand for inorganic zinc solutions in this application segment..

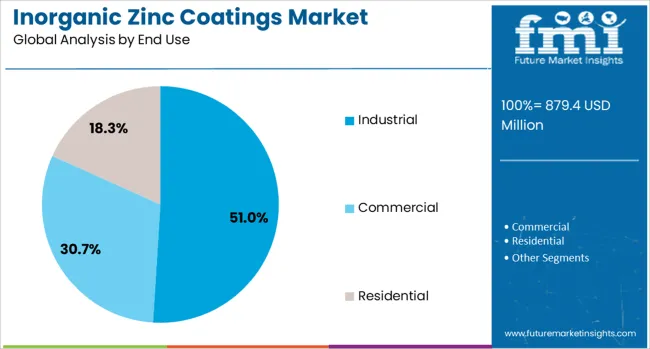

The industrial end use segment is projected to hold 51% of the inorganic zinc coatings market revenue share in 2025, positioning it as the dominant end-use category. This dominance has been attributed to the widespread use of corrosion-resistant coatings in manufacturing facilities, refineries, power plants, and process industries. Industrial environments often expose equipment and structural components to harsh chemicals, high humidity, and extreme temperatures, all of which necessitate durable surface protection.

The adoption of inorganic zinc coatings in this segment has been supported by their ability to minimize corrosion-related downtime, extend asset life, and reduce long-term maintenance costs. As capital investments rise in sectors such as oil and gas, energy, and heavy engineering, demand for protective coatings that ensure long-term performance has intensified.

Additionally, industrial operators are increasingly aligning with sustainability objectives and operational safety protocols, both of which favor the use of high-performance, low-emission coating systems. This strategic alignment has further cemented the leadership of the industrial segment within the overall market..

The inorganic zinc coatings market is expanding due to demand for corrosion protection in oil and gas, marine, and infrastructure projects. Stringent industry standards and rising investment in offshore energy projects have supported growth. Opportunities are arising from pipeline rehabilitation, renewable energy foundations, and defense applications. Emerging trends include high-performance hybrid coatings and rapid-cure systems for time-sensitive projects. However, challenges such as high application costs, surface preparation requirements, and volatile raw material prices hinder adoption. Overall, the market shows resilience with strong uptake in sectors prioritizing durability and long-term structural integrity.

The primary growth driver for the inorganic zinc coatings market is the escalating requirement for corrosion resistance across critical infrastructure and energy sectors. In 2024 and 2025, extensive application was observed in offshore oil rigs, wind turbine bases, and bridges, where durability standards have become more stringent. Infrastructure modernization projects in Asia-Pacific and North America have significantly boosted coating demand for steel structures. The reliance on inorganic zinc systems stems from their superior barrier properties and extended lifecycle benefits, which outperform many alternative solutions in harsh environmental and industrial conditions.

Significant opportunities are being created by the expansion of offshore wind farms, subsea pipelines, and naval projects. In 2025, the integration of inorganic zinc coatings in floating platforms and transmission towers highlighted their role in ensuring long-term protection in aggressive marine conditions. Pipeline rehabilitation initiatives in Europe and North America further supported new contracts for coating suppliers. Manufacturers investing in formulations compatible with cathodic protection and improved adhesion on high-strength steel are well positioned to capitalize on these opportunities, particularly as energy projects emphasize durability and operational safety.

Emerging trends in the market include the development of hybrid inorganic-organic coatings and rapid-cure zinc systems. In 2024, coatings with improved curing speed gained adoption in bridge maintenance projects where downtime reduction was critical. Hybrid systems combining inorganic zinc primers with epoxy or polyurethane topcoats were favored for enhanced flexibility and resistance in chemical-exposed environments. Additionally, formulations optimized for automated spray application have become increasingly popular among large-scale industrial users. These advancements signal a transition toward performance-driven solutions addressing both application efficiency and structural longevity requirements.

Restraints in the market are primarily linked to the high cost of application and extensive surface preparation requirements for inorganic zinc coatings. In 2025, smaller contractors in emerging economies avoided these coatings due to elevated expenses compared to conventional anticorrosive alternatives. The need for abrasive blasting and precise environmental conditions during application has limited their use in certain field projects. Volatility in zinc pricing further pressures manufacturers and end-users, impacting overall adoption. These constraints highlight the need for cost-effective application techniques and optimized formulations to sustain growth momentum.

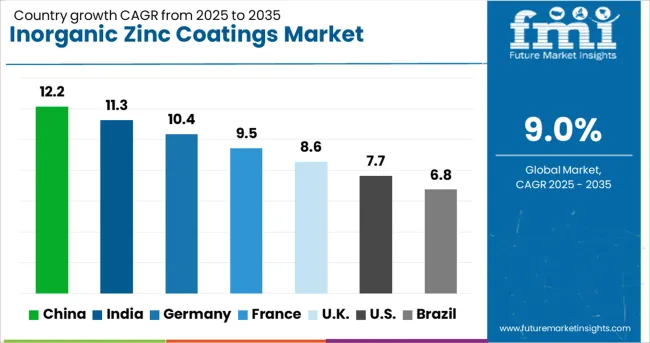

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

The global inorganic zinc coatings market is forecasted to grow at 9.0% CAGR during 2025–2035. China leads with 12.2% CAGR, supported by extensive infrastructure projects, marine applications, and industrial asset protection. India follows at 11.3%, driven by heavy investment in energy, construction, and oil & gas sectors. France posts 9.5% CAGR, benefiting from strict EU environmental norms and demand for high-performance anti-corrosion coatings. The UK grows at 8.6%, while the United States records 7.7%, reflecting steady replacement demand in a mature industrial landscape. Asia-Pacific dominates the global market, leveraging scale and government-backed infrastructure expansion, while Western markets prioritize eco-compliant formulations and long-term corrosion resistance technologies.

China leads the global inorganic zinc coatings market with an anticipated 12.2% CAGR through 2035. High demand is driven by major infrastructure projects, bridges, and offshore installations requiring extended corrosion protection. Government-backed initiatives for expanding marine and shipbuilding activities boost the use of inorganic zinc-rich primers in harsh environments. Manufacturers are innovating with eco-compliant, high-solids formulations to meet emission control norms while delivering superior adhesion and durability. Growth in the wind energy sector further accelerates the adoption of zinc coatings for turbine towers and steel components exposed to saline and humid conditions.

The inorganic zinc coatings market in India is projected to grow at 11.3% CAGR, supported by heavy investment in oil & gas infrastructure, refineries, and transportation projects. Large-scale bridge and port construction under government programs significantly drives adoption of zinc coatings for structural steel protection. The energy sector contributes further demand from thermal plants and renewable power projects where corrosion control is critical. Domestic producers are expanding capacity to cater to rising consumption, while global coating majors introduce advanced zinc silicate systems for enhanced abrasion resistance in industrial applications.

France posts a 9.5% CAGR, driven by strict EU directives mandating high-performance anti-corrosion systems for public infrastructure and industrial facilities. Demand is robust across renewable energy installations, transportation hubs, and chemical processing plants. Inorganic zinc coatings dominate for their superior protection in high-temperature and aggressive environments. French manufacturers are focusing on low-VOC, high-solids zinc primers to align with environmental compliance standards. Adoption in offshore platforms and energy assets along the French coastline further supports market expansion. Advanced testing protocols ensure longevity and compliance with EU sustainability targets.

The United Kingdom is expected to grow at 8.6% CAGR, supported by infrastructure modernization and refurbishment of aging bridges, tunnels, and industrial facilities. Maritime projects and naval defense programs also increase demand for durable zinc coatings in corrosion-prone environments. Major oil terminals and offshore wind installations require heavy-duty coatings to withstand saline conditions, boosting adoption of inorganic zinc-rich primers. Manufacturers in the UK focus on developing formulations compatible with automated application systems to reduce downtime in large projects. Sustainability regulations prompt innovation in solvent-reduced coatings for energy-efficient application processes.

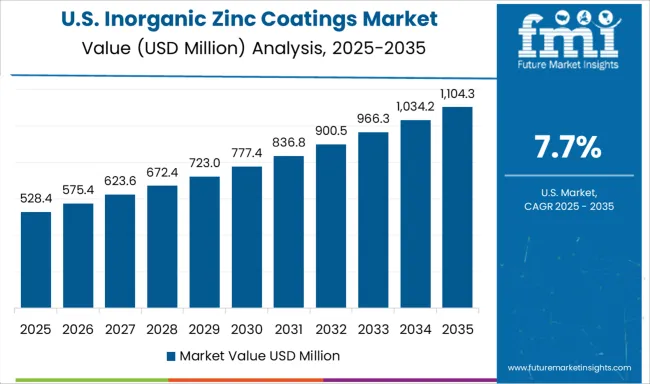

The United States records a 7.7% CAGR, reflecting steady but slower growth in a mature industrial landscape. Demand remains strong in petrochemical plants, marine terminals, and defense infrastructure, where long-term corrosion protection is essential. Rising investment in renewable energy and port expansion projects supports zinc coating adoption. USA manufacturers focus on advanced zinc-rich epoxy primers combined with silicate coatings to deliver superior adhesion and extended service life. Federal and state-level environmental guidelines encourage the development of low-VOC and solvent-free systems, creating opportunities for eco-friendly product innovation.

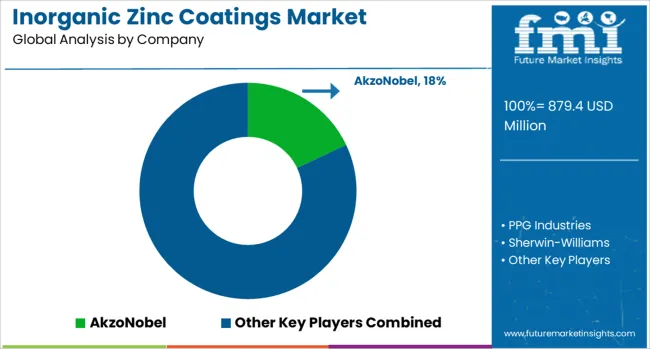

The inorganic zinc coatings market is moderately consolidated, with AkzoNobel recognized as a leading player due to its wide portfolio of high-performance corrosion protection solutions and strong presence across marine, oil & gas, and industrial sectors. The company’s coatings are known for exceptional adhesion, durability, and compatibility with harsh environments, making it a preferred choice for critical infrastructure applications. Key players include PPG Industries, Sherwin-Williams, Jotun, and Hempel A/S. These companies specialize in inorganic zinc-rich coatings formulated with superior galvanic protection properties, widely used for structural steel, bridges, offshore platforms, and power plants.

Their offerings focus on ensuring long-term corrosion resistance, ease of application, and compliance with international safety and environmental standards. Market growth is driven by rising investments in infrastructure development, energy projects, and offshore operations where corrosion control is essential. Leading manufacturers are investing in next-generation coatings with improved surface tolerance, rapid curing times, and low-VOC formulations to meet evolving regulatory requirements.

Additionally, advancements in automated application technologies and integration with digital inspection tools are shaping future demand. Asia-Pacific dominates the market due to significant infrastructure expansion and industrialization, while North America and Europe maintain strong demand driven by maintenance and refurbishment projects in energy and transportation sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 879.4 Million |

| Type | Alkali silicate water borne and Ethyl silicate solvent borne |

| Application | Marine, Oil & gas, Power generation, Transport & automotive, Construction, and Other (agriculture, chemical processing) |

| End Use | Industrial, Commercial, and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AkzoNobel, PPG Industries, Sherwin-Williams, Jotun, and Hempel A/S |

| Additional Attributes | Dollar sales by product type (ethyl-silicate vs zinc-rich epoxy) and application (oil & gas, marine, construction, automotive). Asia-Pacific leads as the fastest-growing region with infrastructure expansion, while North America maintains demand through strict compliance. Buyers favor extended corrosion protection, low-VOC coatings, and fast-curing options. Innovations include hybrid dual-component systems and eco-friendly silicate binders. |

The global inorganic zinc coatings market is estimated to be valued at USD 879.4 million in 2025.

The market size for the inorganic zinc coatings market is projected to reach USD 2,081.9 million by 2035.

The inorganic zinc coatings market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in inorganic zinc coatings market are alkali silicate water borne and ethyl silicate solvent borne.

In terms of application, marine segment to command 29.0% share in the inorganic zinc coatings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inorganic Cobalt Blue Pigments Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Scintillators Market Size and Share Forecast Outlook 2025 to 2035

Inorganic filler Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Oxides Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Salts Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Fungicide Market - Growth & Demand 2025 to 2035

Industry Share Analysis for Inorganic Scintillators Companies

Inorganic Flame Retardants Market

Inorganic Ion Exchange Materials Market

White Inorganic Pigment Market Size and Share Forecast Outlook 2025 to 2035

Zinc-tin Alloy Sputtering Target Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Block Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Market Forecast and Outlook 2025 to 2035

Zinc Oxide Sunscreens Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide for Sunscreens Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Zinc Acetate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Dialkyldithiophosphates Additive Market Size and Share Forecast Outlook 2025 to 2035

Zinc Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chloride Market Analysis - Size, Share, and Forecast 2025 to 2035

Zinc Citrate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA