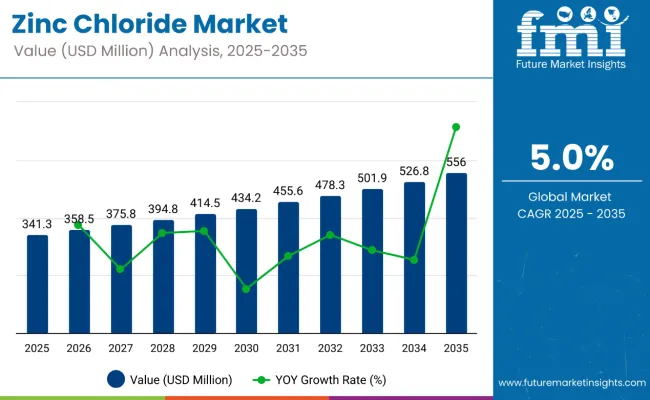

The zinc chloride market is poised for steady growth between 2025 and 2035, driven by increasing demand across diverse industries such as metallurgy, chemical manufacturing, pharmaceuticals, batteries, and water treatment. The market is projected to expand from USD 341.3 million in 2025 to USD 556 million by 2035, reflecting a CAGR of 5.0% over the forecast period.

Zinc chloride is among the most widely used compounds on the market because of its corrosive, hygroscopic, and soluble properties. In addition to electroplating, the textile, petroleum, and fluxed for soldering industries are the major consumers of this material.

The rise in consumption of zinc chloride in dry cell batteries, water treatment chemicals, and as a catalyst in the organic synthesis sector continues to be a dynamic market mover. Furthermore, a marked rise in used water treatment and robust environmental directives have set up a scenario where the need for flocculants based on zinc chloride is needed in water purification systems.

The movement towards sustainable and energy-saving technology is also serving to affirm the zinc chloride market positively. The electric vehicle (EVs) penetration and the increased use of battery zinc technologies pattern are what will bring the markets grow in the long run. The new dynamics that come from pharmaceutical applications and chemical synthesis will be pivotal further boosting the market.

The growing demand for high-purity zinc chloride in batteries, healthcare, and chemical processing is driving the market’s expansion. Increasing research into eco-friendly manufacturing methods and the recycling of zinc-based materials is also expected to support future growth.

Government regulations significantly influence the production, application, and trade of zinc chloride due to its use in industries such as chemicals, textiles, pharmaceuticals, and metallurgy. Regulatory oversight ensures safety, environmental compliance, and product quality across different regions.

The global zinc chloride market is driven by its versatile industrial applications. Trade dynamics reflect the balance between leading producing countries and high-demand regions with limited local supply.

North America continues to be one of the prominent regions for the zinc chloride market, primarily due to the robust demand from battery manufacturing, pharmaceuticals, and industrial water treatment sectors.

The USA and Canada are predominantly acquiring and using more of the zinc chloride in electric vehicle (EV) batteries, catalyst applications, and chemical synthesis. The need for strict regulations on water treatment and waste disposal is, to a greater extent, increasing the realization for complementing zinc chloride with purification solutions.

The establishment of a fully electric vehicle industry in North America is the core ride for the demand of supplementary zinc chloride in battery pour electrolytes. What is more, government schemes which are focused on eco-friendly water treatment and green chemistry are highly likely the factors promoting the industrial use of zinc chloride.

The European zinc chloride market presents stable growth due to the environmental sustainability, industrial innovation, and battery technology advancements. Germany, France, and the UK are recycling, happily manufacturing sustainably, and generously using high-efficiency water treatment solutions that induce a parallel increase in the industrial and environmental application of zinc chloride.

Zinc chloride is largely used as a catalyst in organic reactions, polymer processing, and specialty coatings due to the continuous demand from the European chemical manufacturers. Moreover, the commitment of the European Union to limit carbon emissions and support energy storage solutions of purity further guides the way for exploration of zinc-based battery technologies, thus supporting the market expansion.

Asia-Pacific stands as the fastest racing region for the zinc chloride market, overshadowing the rest due to the following factors: quick industrial advancement, battery manufacturing companies multiplying, and chemical production investments rising. China and India, in particular, are exhibiting a demand for zinc chloride in the metal processing, water treatment, and electronics manufacturing fields.

China still outstands as the foremost player engaging in the production and consumption of zinc chloride thanks to its well-settled chemicals industry and the increased pull factor from electronics and batteries. The usage of zinc chloride in the galvanizing and textile industries is also a major contributor to the region's growth. The expansion of the pharmaceutical sector and the improved industrial wastewater treatment industry in India are new adventures for zinc chloride suppliers.

Japan and South Korea that are known for their high advancements in both energy storage and electronics manufacturing are the main consumers of high-purity zinc chloride in battery production, semiconductor processing, and chemical synthesis. Southeast Asian countries such as Indonesia, Vietnam, and Thailand are also coming into the peripheral vision of the international market due to the auto-industrial sector's growth and practical need for proper wastewater treatment.

Latin America, the Middle East, and Africa are making a utility of the slowly growing market in the zinc chloride sector through the establishment of chemical manufacturing industries, infrastructure development, and water treatment investments. Several companies in countries including Brazil and Mexico are processing zinc chloride for textile, petroleum, and pharmaceutical industries.

The Middle East, moreover states like Saudi Arabia and the UAE, are generating the chemical treatments for water purification projects through the promotion of industrialization. Africa's development of cities and a major shift towards water of good quality to every citizen have added to the increase in zinc chloride in municipal water treatment facilities.

Zinc chloride is a product of the transformation between hydrochloric acid and zinc metal. Both reactants are characterized by the market's volatility and affected by mining output, global traffic, and raw materials availability. Price fluctuations and alternative strategies using other atmospheric and water treatments also affect the situation.

Moreover, logistical bottlenecks, regulatory red tapes, and transport costs are the major factors hindering the smooth global supply zinc chloride Chain. As a Way Out, firms need to engage in local production, solicit different suppliers, and adopt just-in-time inventory systems.

Zinc chloride being a highly corrosive substance if not handled properly is hazardous. It requires proper disposal and manufacturing compliance primarily to mitigate environmental harm. Different countries are making the law stricter on the management of chemical waste and the transportation of hazardous materials which is resultant in high cost of compliance for the manufacturers and users.

As industries continue to put more emphasis on sustainability, companies must harness the potential of manufacturing through greener production technologies, emission reductions, and waste disposal aligned with the global environmental standards.

The vast market of electric vehicles (EV), and applications in renewable energy sectors and mandate additionally launches the market for sections like zinc chloride. This cupola construction reveals an essential yet overweight component of zinc-in-water-air batteries. In fact, zinc chloride, as a counterweight, replaces lithium ions not only for specific applications in the batteries being the main component of water which burns the surface of lithium.

Increasing global funding for sustainable energy storage projects, the battery manufacturers are working on improving the formulations of zinc chloride with additives for better performance and stability which in turn will drive the market.

The need for good wastewater treatment and industrial effluent management is the only source of a continuous rise in demand for systems based on zinc chloride. Due to the stricter laws, industries are using zinc chloride in various treatment processes such as flocculation, coagulation, and pH control in water plants.

Recent innovations in eco-friendly chemistry and clean water sanitation systems are also foreseen to motivate the use of zinc chloride in water treatment and pollution control.

The pharmaceutical and chemical sectors have been incorporating an increased amount of zinc chloride in the processes for example, as a catalyst, dehydrating agent, and reagent in organic synthesis. Its impact in areas like specialty coatings, polymer stabilization, and medical formulations leads to new avenues for market growth.

The upsurge of research on biocompatible and antimicrobial coatings will significantly impact the demand for the high-purity zinc chloride formulations due to the medical device manufacturing and advanced pharmaceutical applications.

The zinc chloride market has registered an upright development from 2020 to 2024, completely thanks to its integration into diverse sectors such as chemical manufacturing, batteries, textiles, and water treatment. The growing industrialization rate and with it the increasing need of zinc chloride in galvanizing, fluxes, and dry cell batteries, was the main driver for this sideways market movement.

The regulatory framework incentivizing the adoption of green manufacturing and waste management practices also affected the market baseline. In the period of 2025 to 2035 the focus of technology on battery improvements, green chemistry growth, and remedial water treatment is envisaged to lead the market.

The principal reasons for the additional increase will be the rise in zinc chloride applications in the production of zero or very low-impact by-products and the development of energy storage products based on new technology.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with chemical safety regulations and waste disposal guidelines. |

| Technological Advancements | Improved synthesis methods for high-purity zinc chloride. |

| Industry-Specific Demand | High usage in batteries, water treatment, and metal processing. |

| Sustainability & Circular Economy | Efforts to reduce hazardous waste and improve efficiency. |

| Market Growth Drivers | Industrial demand, battery production, and metal galvanization. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental policies and circular economy initiatives promoting sustainable production. |

| Technological Advancements | Development of eco-friendly production techniques and recycling innovations. |

| Industry-Specific Demand | Expansion into renewable energy storage, advanced chemical catalysis, and pharmaceuticals. |

| Sustainability & Circular Economy | Large-scale adoption of green chemistry, closed-loop recycling, and bio-based alternatives. |

| Market Growth Drivers | Growth in sustainable energy storage, enhanced water purification technologies, and eco-friendly manufacturing. |

The USA zinc chloride market is currently experiencing a stable increase as a result of the increased applications of zinc chloride in battery production, chemical processing, and water treatment sectors. The main contributor to that growth is the development of electronics and energy storage industries that, in their turn, are most influenced by the switch to zinc-carbon and alkaline batteries.

Moreover, the USA chemical industry persistent commitment to zinc-based catalysts in demand of organic synthesis and petroleum refining stands as the major catalyst for this market increment. Additionally, the increased concern about the environment, through effluent technology and protective coatings in building the infrastructure, are two powerful reasons that drive market development.

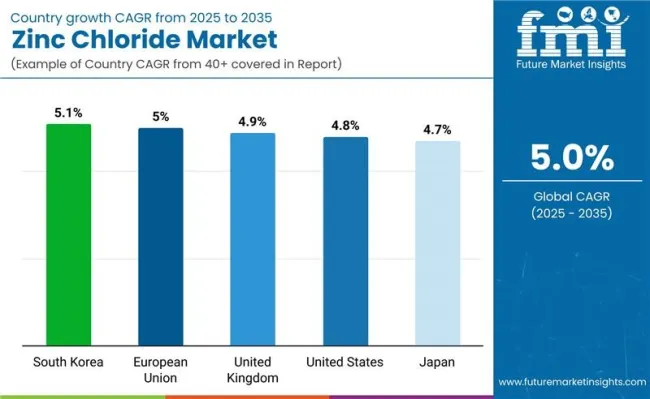

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

The UK zinc chloride market has been growing consistently with the demand increase from the pharmaceutical, chemical, and metallurgical industries. The use of zinc chloride in battery production and industrial coatings is growing rapidly in turn the market growth.

The focus of the country on sustainability and environmental regulations is fueling the adoption of these clean technologies in metal processing and water treatment. Furthermore, the growth of the pharmaceutical industry in the UK is creating a new demand for zinc chloride used in medicinal and chemical synthesis.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.9% |

The zinc chloride market in the European Union stands true to the claim that it is witnessing the development in the face of challenges from the environmental regulations and the increased demand from the industrial applications side as well as innovation in the power battery sector. Germany, France, and Italy, which mainly utilize zinc chloride in energy storage, chemical processing, and water treatment, are the biggest consumers of the product in the EU.

The EU's quest for sustainable energy sources and chemical production encourages the use of highly pure zinc chloride in electroplating, metal treatment, and battery applications. Apart from that, funding for the development of the eco-friendly corrosion inhibitors and catalysts also makes a positive contribution to the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.0% |

The Japanese zinc chloride market is on the rise owing to its mounting use in high-performance batteries, chemical synthesis, and textile processing. The country's prime concentration on the technological as well as the precision chemical manufacturing sectors is pushing the consumption of ultra-pure zinc chloride in electronic and industrial systems.

As Japan's energy storage and renewables development pace grows, the demand for zinc-based batteries and electrochemical applications rises. Furthermore, the country is a force in the specialty chemicals and pharmaceutical sectors, which is fueling its demand for high-purity-grade zinc chloride in the formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The zinc chloride market in the South Korean region is accelerating due to succinctly put, the increasing electronics industry, and the directive pull of energy storage solutions, and innovations in water treatment technologies. The prominent role played by the country's battery manufacturing and zinc-air and rechargeable types of batteries is the main factor behind the market's progress.

The actions of the South Korean government to stimulate and introduce the use of pep sustainable chemical processing and green energy solutions are also aiding the industrial applications of zinc chloride. In addition, the inventions of the country such as in nano-coatings, semiconductor processing, and anti-corrosion treatments are leading to an increase in the demand for high-purity zinc chloride formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

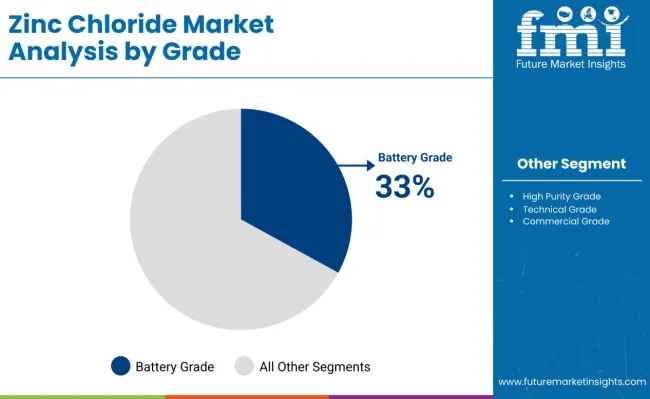

Battery grade zinc chloride finds its application mainly in dry cell batteries and energy storage systems on account of its high conductivity and moisture absorption properties. The surge in demand for portable electronics, electric vehicles, and new renewable energy storage options has become a significant driving force behind this market's growth.

Along with the research that aims at the extension of battery lifespan and the increase of their efficiency, manufacturers are forming new zinc-chloride compounds that will be more efficiently used and have a lower impact on the environment. Moreover, the expected environmentally friendly and recyclable battery technologies will certainly contribute to the more extensive use and acceptance of battery-grade zinc chloride in the near future.

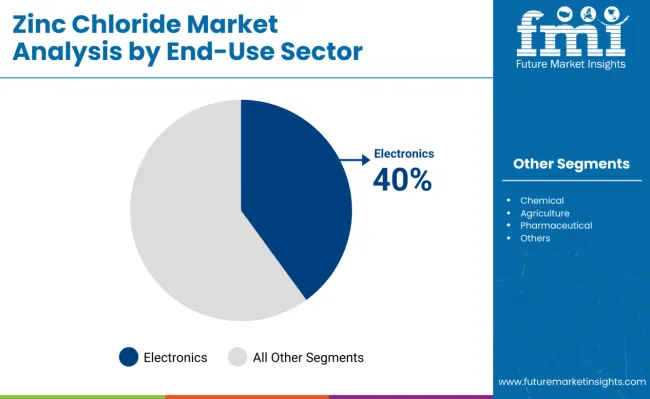

Zinc chloride is widely used in electronics because it serves as an effective flux in soldering processes. It helps remove oxides and impurities from metal surfaces, ensuring better bonding between components and solder.

This results in strong, reliable electrical connections that are essential for circuit performance. Additionally, zinc chloride is highly soluble in water, making it easy to apply and clean after soldering. It also acts as a catalyst in the production of printed circuit boards by aiding in etching processes. Its stability and ability to promote efficient metal bonding contribute to the durability and longevity of electronic devices.

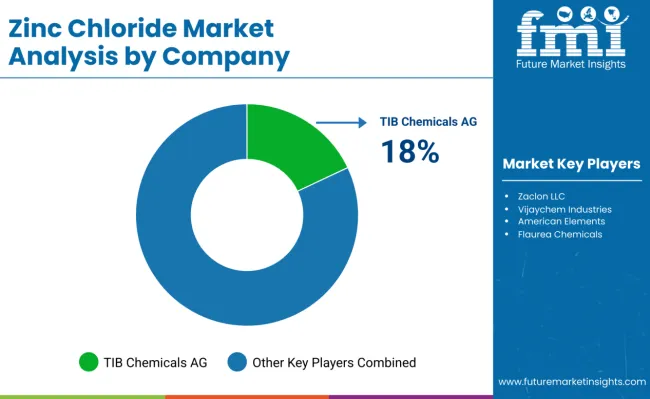

The zinc chloride market is witnessing steady growth, driven by increasing demand across industries such as metallurgy, pharmaceuticals, chemical processing, and batteries. Zinc chloride is widely used as a catalyst, electrolyte component, and in flux applications, making it an essential chemical compound. The rising adoption of rechargeable batteries, along with the growing need for industrial-grade chemicals, is further fueling market expansion.

Technological advancements in zinc chloride production, including the development of high-purity and eco-friendly formulations, are shaping the competitive landscape. Companies are investing in R&D to enhance efficiency, sustainability, and application diversity. Additionally, stringent environmental regulations regarding waste disposal and chemical safety are prompting manufacturers to develop more sustainable production techniques.

| Company Name | Estimated Market Share (%) |

|---|---|

| TIB Chemicals AG | 18-22% |

| Zaclon LLC | 15-18% |

| Vijaychem Industries | 10-14% |

| American Elements | 8-12% |

| Flaurea Chemicals | 5-9% |

| Other Companies | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| TIB Chemicals AG | Produces high-purity zinc chloride for chemical processing, galvanizing, and battery applications, focusing on eco-friendly production. |

| Zaclon LLC | Specializes in industrial-grade zinc chloride formulations for metal treatment, electronics, and water treatment applications. |

| Vijaychem Industries | Develops zinc chloride solutions for pharmaceutical, textile, and electroplating industries, emphasizing quality and cost-effectiveness. |

| American Elements | Supplies ultra-high-purity zinc chloride for scientific research, specialty applications, and advanced manufacturing sectors. |

| Flaurea Chemicals | Focuses on sustainable zinc chloride production, catering to environmental, chemical, and metallurgical industries. |

TIB Chemicals AG is a global leader in the manufacture of zinc chloride and offers high-purity and industrial grade solutions for a wide range of applications. The company emphasizes environmentally-friendly methods and is 100% in compliance with international regulatory standards.

Zinc chloride of TIB Chemicals can be found in many areas like galvanizing, chemical synthesis, and battery manufacturing. Backed up by a strong R&D section, the company is actively working on the development of new formulations with better efficiency and lower environmental impact.

Zaclon LLC is a zinc chloride production industrial company that specializes in the generation of high-performance zinc chloride for applications in metal treatment, water treatment, and chemical processing. The company is now an important player in this business thanks to its reliable, and high-quality formulations meeting industry standards.

In a move to promote sustainability, Zaclon works with the best production techniques and has allied in the quest for eco-friendlier methods of manufacturing zinc chloride in the metal treatment industry, water treatment, and chemical processing sectors.

Vijaychem Industries is a leading manufacturer of zinc chloride solutions, which are mainly supplied to the pharmaceutical, textile, and electroplating sectors.

The Company focuses on manufacturing methodologies which save the costs but not in the quality of the products. It has a vast distribution network that connects it with both local and foreign markets efficiently. In addition, Vijaychem is also promoting research work to create green alternatives while enlarging its application scope in specialized chemical formulations.

American Elements is an ultra-high-purity zinc chloride supplier that provides it for exclusive use in scientific research, electronics manufacturing, and advanced hi-tech sectors. The company is recognized for its quality, innovation, and product customization.

American Elements cooperates with laboratory research institutions and industries in an endeavor to produce next-generation zinc chloride formulations, which comply with cutting-edge technological inventions. It is through a strong global supply chain that American Elements secures its reputation of reliability and a consistent source of products.

Flaurea Chemicals is dedicated to sustainable zinc chloride production and includes the environmental responsibility factor as a priority, therefore- it serves industries that also amortize and apply the environmental responsibility principle.

The company has adapted innovative recycling processes so that they can minimize waste and make their production chain more sustainable. Flaurea Chemicals’ zinc chloride is extensively utilized in metallurgical, chemical, and environmental sectors. By aligning its business philosophy with the global agenda for sustainability, the company has set itself a target of being a pioneer in green chemical production.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 341.3 million |

| Projected Market Size (2035) | USD 556 million |

| CAGR (2025 to 2035) | 5.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and kilotons for volume |

| Grades Analyzed (Segment 1) | High Purity Grade, Battery Grade, Technical Grade, Commercial Grade |

| Forms Analyzed (Segment 2) | Powder, Liquid |

| End Use Sectors Analyzed (Segment 3) | Electronics, Chemical, Agriculture, Pharmaceuticals, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Zinc Chloride Market | TIB Chemicals AG, Zaclon LLC, Eurocontal SA, Airedale Chemical, Weifang Dongfangsheng Chemical Co., Ltd., Merck KGaA, Lipmes, Jinzhou Ji Tian Zinc Industry Co., Ltd., Global Chemical Co., Ltd., GFS Chemicals, Inc., Zimi Chemicals, Noah Chemicals |

| Additional Attributes | Market trends by grade and form, Industrial demand in metallurgy and electronics, Regulatory impact on chemical purity standards, Regional growth in battery manufacturing, Emerging applications in pharmaceuticals and water treatment |

| Customization and Pricing | Customization and Pricing Available on Request |

The market is segmented into High Purity Grade, Battery Grade, Technical Grade, and Commercial Grade.

The industry is categorized into Powder and Liquid.

The market serves Electronics, Chemical, Agriculture, Pharmaceuticals, and Other industries.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global zinc chloride market is projected to reach USD 341.3 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.0% over the forecast period.

By 2035, the zinc chloride market is expected to reach USD 556 million.

The Battery Grade segment is expected to hold a significant share due to its growing application in dry cell batteries and energy storage solutions.

Key players in the zinc chloride market include Eurocontal SA, Airedale Chemical, Weifang Dongfangsheng Chemical Co., Ltd., Lipmes.

Table 01: Global Market Size (US$ million) and Volume (tons) Analysis and Forecast By Grade, 2018 to 2033

Table 02: Global Market Size Volume (tons) Analysis and Forecast By Form, 2018 to 2033

Table 03: Global Market Size Value (US$ million) Analysis and Forecast By Form, 2018 to 2033

Table 04: Global Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use

Table 05: Global Market Size Volume (tons) Analysis and Forecast By Region, 2018 to 2033

Table 06: Global Market Size Value (US$ million) Analysis and Forecast By Region, 2018 to 2033

Table 07: North America Market Size (US$ Thousand) and Volume (tons) Analysis and Forecast By Country, 2018 to 2033

Table 08: North America Market Size (US$ million) and Volume (tons) Analysis and Forecast By Grade, 2018 to 2033

Table 09: North America Market Size Volume (tons) Analysis and Forecast By Form, 2018 to 2033

Table 10: North America Market Size Value (US$ million) Analysis and Forecast By Form, 2018 to 2033

Table 11: North America Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use

Table 12: Latin America Market Size (US$ million) and Volume (tons) Analysis and Forecast By Country, 2018 to 2033

Table 13: Latin America Market Size (US$ million) and Volume (tons) Analysis and Forecast By Grade, 2018 to 2033

Table 14: Latin America Market Size Volume (tons) Analysis and Forecast By Form, 2018 to 2033

Table 15: Latin America Market Size Value (US$ million) Analysis and Forecast By Form, 2018 to 2033

Table 16: Latin America Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use

Table 17: Western Europe Market Size (US$ million) and Volume (tons) Analysis and Forecast By Country, 2018 to 2033

Table 18: Western Europe Market Size (US$ million) and Volume (tons) Analysis and Forecast By Grade, 2018 to 2033

Table 19: Western Europe Market Size Volume (tons) Analysis and Forecast By Form, 2018 to 2033

Table 20: Western Europe Market Size Value (US$ million) Analysis and Forecast By Form, 2018 to 2033

Table 21: Western Europe Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use

Table 22: Eastern Europe Market Size (US$ million) and Volume (tons) Analysis and Forecast By Country, 2018 to 2033

Table 23: Eastern Europe Market Size (US$ million) and Volume (tons) Analysis and Forecast By Grade, 2018 to 2033

Table 24: Eastern Europe Market Size Volume (tons) Analysis and Forecast By Form, 2018 to 2033

Table 25: Eastern Europe Market Size Value (US$ million) Analysis and Forecast By Form, 2018 to 2033

Table 26: Eastern Europe Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use

Table 27: Central Asia Market Size (US$ million) and Volume (tons) Analysis and Forecast By Grade, 2018 to 2033

Table 28: Central Asia Market Size Volume (tons) Analysis and Forecast By Form, 2018 to 2033

Table 29: Central Asia Market Size Value (US$ million) Analysis and Forecast By Form, 2018 to 2033

Table 30: Central Asia Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use

Table 31: Russia & Belarus Market Size (US$ million) and Volume (tons) Analysis and Forecast By Grade, 2018 to 2033

Table 32: Russia & Belarus Market Size Volume (tons) Analysis and Forecast By Form, 2018 to 2033

Table 33: Russia & Belarus Market Size Value (US$ million) Analysis and Forecast By Form, 2018 to 2033

Table 34: Russia & Belarus Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use

Table 35: Balkan & Baltic Countries Market Size (US$ million) and Volume (tons) Analysis and Forecast By Grade, 2018 to 2033

Table 36: Balkan & Baltics Market Size Volume (tons) Analysis and Forecast By Form, 2018 to 2033

Table 37: Balkan & Baltics Market Size Value (US$ million) Analysis and Forecast By Form, 2018 to 2033

Table 38: Balkan & Baltic Countries Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use

Table 39: East Asia Market Size (US$ million) and Volume (tons) Analysis and Forecast By Country, 2018 to 2033

Table 40: East Asia Market Size (US$ million) and Volume (tons) Analysis and Forecast By Grade, 2018 to 2033

Table 41: East Asia Market Size Volume (tons) Analysis and Forecast By Form, 2018 to 2033

Table 42: East Asia Market Size Value (US$ million) Analysis and Forecast By Form, 2018 to 2033

Table 43: East Asia Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use

Table 44: South Asia Pacific Market Size (US$ million) and Volume (tons) Analysis and Forecast By Country, 2018 to 2033

Table 45: South Asia & Pacific Market Size (US$ million) and Volume (tons) Analysis and Forecast By Grade, 2018 to 2033

Table 46: South Asia Pacific Market Size Volume (tons) Analysis and Forecast By Form, 2018 to 2033

Table 47: South Asia Pacific Market Size Value (US$ million) Analysis and Forecast By Form, 2018 to 2033

Table 48: South Asia & Pacific Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use

Table 49: Middle East & Africa Market Size (US$ million) and Volume (tons) Analysis and Forecast By Country, 2018 to 2033

Table 50: Middle East & Africa Market Size (US$ million) and Volume (tons) Analysis and Forecast By Grade, 2018 to 2033

Table 51: Middle East & Africa Market Size Volume (tons) Analysis and Forecast By Form, 2018 to 2033

Table 52: Middle East & Africa Market Size Value (US$ million) Analysis and Forecast By Form, 2018 to 2033

Table 53: Middle East & Africa Market Value (US$ million) and Volume (tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use

Figure 01: Global Historical Market Volume (tons) Analysis, 2018 to 2022

Figure 02: Global Current and Future Market Volume (tons) Analysis, 2023 to 2033

Figure 03: Global Historical Value (US$ million), 2018 to 2022

Figure 04: Global Value (US$ million) Forecast, 2023 to 2033

Figure 05: Global Absolute $ Opportunity, 2018 to 2023 and 2033

Figure 06: Global Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 07: Global Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 08: Global Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 09: Global Market Absolute $ Opportunity by High Purity Grade Segment, 2018 to 2033

Figure 10: Global Market Absolute $ Opportunity by Battery Grade Segment, 2018 to 2033

Figure 11: Global Market Absolute $ Opportunity by Technical Grade Segment, 2018 to 2033

Figure 12: Global Market Absolute $ Opportunity by Commercial Grade Segment, 2018 to 2033

Figure 13: Global Market Share and BPS Analysis By Form, 2023 and 2033

Figure 14: Global Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 15: Global Market Attractiveness Analysis By Form, 2023 to 2033

Figure 16: Global Market Absolute $ Opportunity by Powder Segment, 2018 to 2033

Figure 17: Global Market Absolute $ Opportunity by Liquid Segment, 2018 to 2033

Figure 18: Global Market Share and BPS Analysis by End Use, 2023 and 2023

Figure 19: Global Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 20: Global Market Attractiveness by End Use, 2023 to 2033

Figure 21: Global Market Absolute $ Opportunity by Electronics Segment

Figure 22: Global Market Absolute $ Opportunity by Chemical Segment

Figure 23: Global Market Absolute $ Opportunity by Agriculture Segment

Figure 24: Global Market Absolute $ Opportunity by Pharmaceutical Segment

Figure 25: Global Market Absolute $ Opportunity by Others Segment

Figure 26: Global Market Share and BPS Analysis By Region, 2023 and 2033

Figure 27: Global Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 28: Global Market Attractiveness Analysis By Region, 2023 to 2033

Figure 29: Global Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 30: Global Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 31: Global Market Absolute $ Opportunity by Western Europe Segment, 2018 to 2033

Figure 32: Global Market Absolute $ Opportunity by Eastern Europe Segment, 2018 to 2033

Figure 33: Global Market Absolute $ Opportunity by Central Asia Segment, 2018 to 2033

Figure 34: Global Market Absolute $ Opportunity by Balkan & Baltic Countries Segment, 2018 to 2033

Figure 35: Global Market Absolute $ Opportunity by Russia & Belarus Segment, 2018 to 2033

Figure 36: Global Market Absolute $ Opportunity by East Asia Segment, 2018 to 2033

Figure 37: Global Market Absolute $ Opportunity by South Asia Pacific Segment, 2018 to 2033

Figure 38: Global Market Absolute $ Opportunity by Middle East & Africa Segment, 2018 to 2033

Figure 39: North America Market Share and BPS Analysis By Country, 2023 and 2033

Figure 40: North America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 41: North America Market Attractiveness Analysis By Country, 2023 to 2033

Figure 42: North America Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 43: North America Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 44: North America Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 45: North America Market Share and BPS Analysis By Form, 2023 and 2033

Figure 46: North America Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 47: North America Market Attractiveness Analysis By Form, 2023 to 2033

Figure 48: North America Market Share and BPS Analysis by End Use, 2023 and 2023

Figure 49: North America Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 50: North America Market Attractiveness by End Use, 2023 to 2033

Figure 51: Latin America Market Share and BPS Analysis By Country, 2023 and 2033

Figure 52: Latin America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 53: Latin America Market Attractiveness Projections By Country, 2023 to 2033

Figure 54: Latin America Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 55: Latin America Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 56: Latin America Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 57: Latin America Market Share and BPS Analysis By Form, 2023 and 2033

Figure 58: Latin America Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 59: Latin America Market Attractiveness Analysis By Form, 2023 to 2033

Figure 60: Latin America Market Share and BPS Analysis by End Use, 2023 and 2023

Figure 61: Latin America Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 62: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 63: Western Europe Market Share and BPS Analysis By Country, 2023 and 2023

Figure 64: Western Europe Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 65: Western Europe Market Attractiveness Index By Country, 2023 to 2033

Figure 66: Western Europe Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 67: Western Europe Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 68: Western Europe Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 69: Western Europe Market Share and BPS Analysis By Form, 2023 and 2033

Figure 70: Western Europe Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 71: Western Europe Market Attractiveness Analysis By Form, 2023 to 2033

Figure 72: Western Europe Market Share and BPS Analysis by End Use, 2023 and 2023

Figure 73: Western Europe Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 74: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 75: Eastern Europe Market Share and BPS Analysis By Country, 2023 and 2023

Figure 76: Eastern Europe Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 77: Eastern Europe Market Attractiveness Index By Country, 2023 to 2033

Figure 78: Eastern Europe Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 79: Eastern Europe Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 80: Eastern Europe Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 81: Eastern Europe Market Share and BPS Analysis By Form, 2023 and 2033

Figure 82: Eastern Europe Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 83: Eastern Europe Market Attractiveness Analysis By Form, 2023 to 2033

Figure 84: Eastern Europe Market Share and BPS Analysis by End Use, 2023 and 2023

Figure 85: Eastern Europe Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 86: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 87: Central Asia Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 88: Central Asia Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 89: Central Asia Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 90: Central Asia Market Share and BPS Analysis By Form, 2023 and 2033

Figure 91: Central Asia Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 92: Central Asia Market Attractiveness Analysis By Form, 2023 to 2033

Figure 93: Central Asia Market Share and BPS Analysis by End Use, 2023 and 2023

Figure 94: Central Asia Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 95: Central Asia Market Attractiveness by End Use, 2023 to 2033

Figure 96: Russia & Belarus Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 97: Russia & Belarus Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 98: Russia & Belarus Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 99: Russia & Belarus Market Share and BPS Analysis By Form, 2023 and 2033

Figure 100: Russia & Belarus Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 101: Russia & Belarus Market Attractiveness Analysis By Form, 2023 to 2033

Figure 102: Russia & Belarus Market Share and BPS Analysis by End Use, 2023 and 2023

Figure 103: Russia & Belarus Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 104: Russia & Belarus Market Attractiveness by End Use, 2023 to 2033

Figure 105: Balkan & Baltic Countries Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 106: Balkan & Baltic Countries Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 107: Balkan & Baltic Countries Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 108: Balkan & Baltic Countries Market Share and BPS Analysis By Form, 2023 and 2033

Figure 109: Balkan & Baltic Countries Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 110: Balkan & Baltic Countries Market Attractiveness Analysis By Form, 2023 to 2033

Figure 111: Balkan & Baltic Countries Market Share and BPS Analysis by End Use, 2023 and 2023

Figure 112: Balkan & Baltic Countries Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 113: Balkan & Baltic Countries Market Attractiveness by End Use, 2023 to 2033

Figure 114: East Asia Market Share and BPS Analysis By Country, 2023 and 2033

Figure 115: East Asia Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 116: East Asia Market Attractiveness Projections By Country, 2023 to 2033

Figure 117: East Asia Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 118: East Asia Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 119: East Asia Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 120: East Asia Market Share and BPS Analysis By Form, 2023 and 2033

Figure 121: East Asia Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 122: East Asia Market Attractiveness Analysis By Form, 2023 to 2033

Figure 123: East Asia Market Share and BPS Analysis by End Use, 2023 and 2023

Figure 124: East Asia Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 126: South Asia & Pacific Market Share and BPS Analysis By Country, 2023 and 2023

Figure 127: South Asia & Pacific Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 128: South Asia & Pacific Market Attractiveness Index By Country, 2023 to 2033

Figure 129: South Asia & Pacific Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 130: South Asia & Pacific Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 131: South Asia & Pacific Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 132: South Asia & Pacific Market Share and BPS Analysis By Form, 2023 and 2033

Figure 133: South Asia & Pacific Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 134: South Asia & Pacific Market Attractiveness Analysis By Form, 2023 to 2033

Figure 135: South Asia & Pacific Market Share and BPS Analysis by End Use, 2023 and 2023

Figure 136: South Asia & Pacific Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 137: South Asia & Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 138: Middle East & Africa Market Share and BPS Analysis By Country, 2023 and 2023

Figure 139: Middle East & Africa Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 140: Middle East & Africa Market Attractiveness Index By Country, 2023 to 2033

Figure 141: Middle East & Africa Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 142: Middle East & Africa Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 143: Middle East & Africa Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 144: Middle East & Africa Market Share and BPS Analysis By Form, 2023 and 2033

Figure 145: Middle East & Africa Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 146: Middle East & Africa Market Attractiveness Analysis By Form, 2023 to 2033

Figure 147: Middle East & Africa Market Share and BPS Analysis by End Use, 2023 and 2023

Figure 148: Middle East & Africa Market Y-o-Y Growth Projections by End Use, 2023 to 2033

Figure 149: Middle East & Africa Market Attractiveness by End Use, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zinc Oxide Market Forecast and Outlook 2025 to 2035

Zinc Oxide Sunscreens Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide for Sunscreens Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Zinc Acetate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Dialkyldithiophosphates Additive Market Size and Share Forecast Outlook 2025 to 2035

Zinc Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Citrate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Sulphate Market Size, Growth, and Forecast 2025 to 2035

Zinc Methionine Chelates Market - Growth & Demand 2025 to 2035

Zinc-Air Batteries Market Growth – Trends & Forecast 2023-2033

Nano Zinc Oxide Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Zinc Coatings Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Zinc Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Allyl Chloride Market Size and Share Forecast Outlook 2025 to 2035

Barium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA