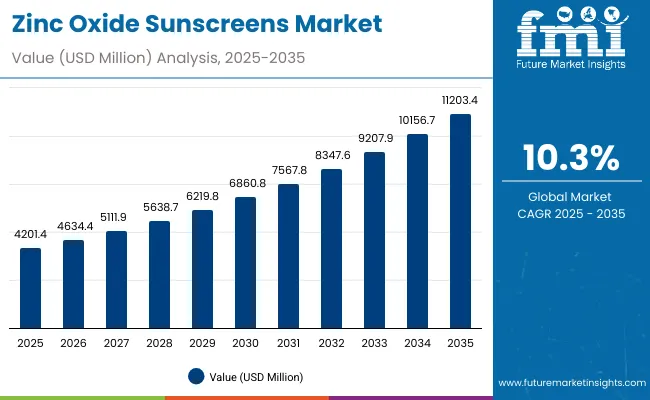

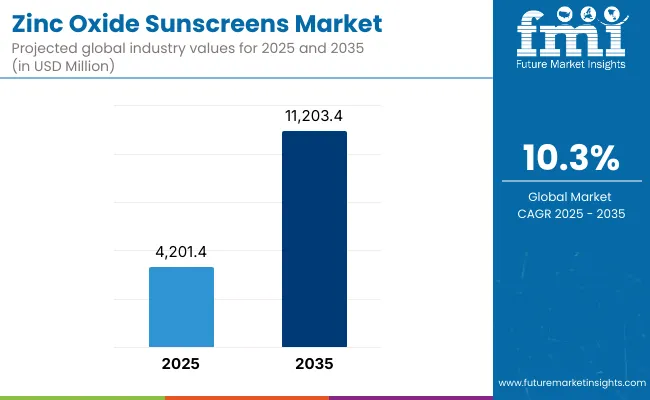

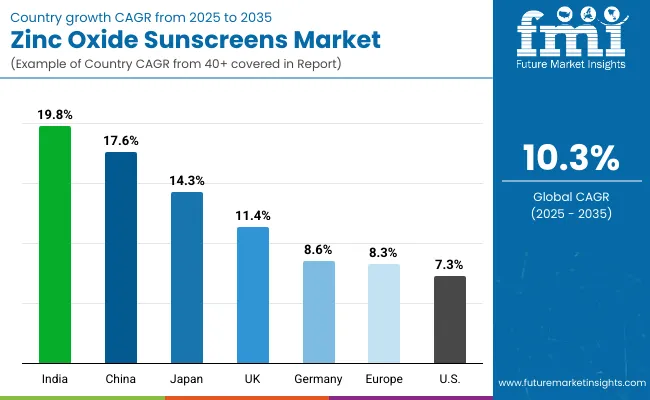

A global valuation of USD 4,201.4 Million is anticipated for the Zinc Oxide Sunscreens Market in 2025, which is projected to climb to USD 11,203.4 Million by 2035. This translates into an absolute expansion of nearly USD 7,002.0 Million over the decade, representing a 2.7X increase in market size. The growth reflects a CAGR of 10.3% during the assessment period, underscoring a robust trajectory supported by evolving consumer behavior, regulatory clarity, and dermatologist endorsements.

Zinc Oxide Sunscreens Market Key Takeaways

| Metric | Value |

|---|---|

| Zinc Oxide Sunscreens Market Estimated Value in (2025E) | USD 4,201.4 million |

| Zinc Oxide Sunscreens Market Forecast Value in (2035F) | USD 11,203.4 million |

| Forecast CAGR (2025 to 2035) | 10.3% |

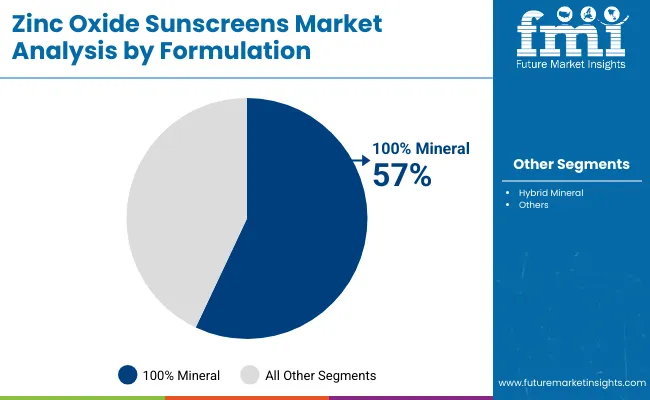

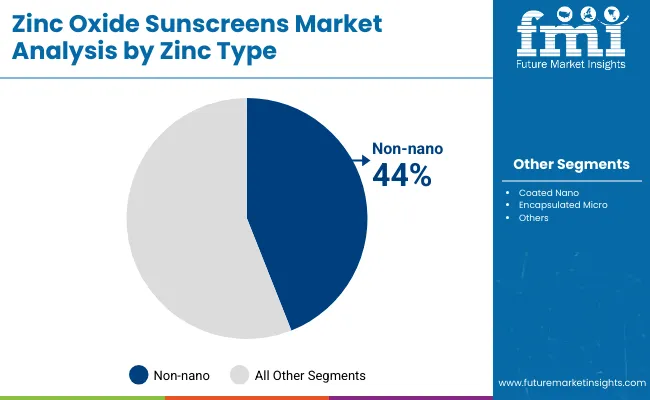

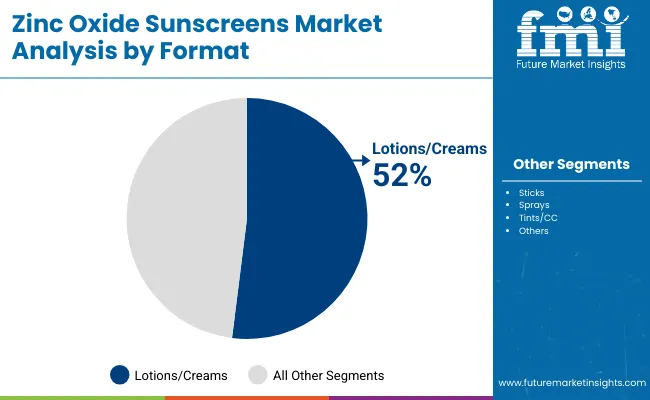

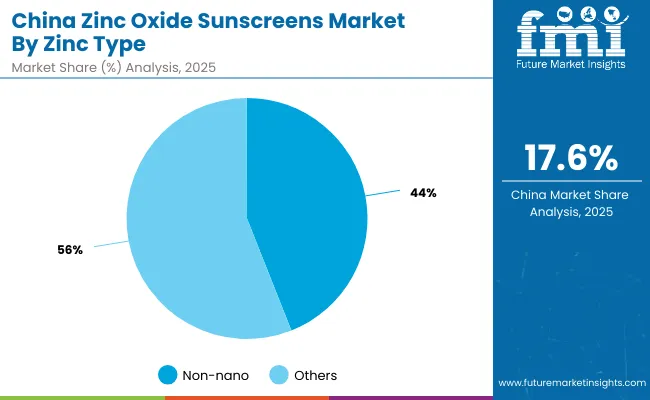

Between 2025 and 2030, the market is expected to expand from USD 4,201.4 Mn to USD 6,860.8 Mn, generating additional revenue of USD 2,659.4 Mn. This phase will contribute 38% of total decade growth and will be characterized by increasing adoption of 100% mineral formulations, which already account for 57.0% of value in 2025. The demand during this period is expected to be reinforced by the dominance of lotions and creams, representing 52.0% of the market, as daily skincare integration strengthens their role in consumer routines. Non-nano zinc, with a 44.0% share, will continue to gain preference in pharmacy and derm-led channels, supported by sustainability and reef-safe claims.

The second half of the forecast, from 2030 to 2035, is projected to add USD 4,342.6 Mn, contributing 62% of the total growth. Stronger momentum is expected to be delivered by emerging economies such as China and India, with CAGR levels of 17.6% and 19.8% respectively. During this period, expansion of e-commerce, community retail, and cosmetic-integration formats will accelerate, reinforcing mineral sunscreens as a mainstream category within global sun protection.

From 2020 to 2024, mineral sunscreens gained wider clinical and consumer recognition, creating a favorable launchpad for 2025. By 2025, the market is estimated at USD 4,201.4 Mn, and is expected to reach USD 11,203.4 Mn by 2035, marking a 2.7X expansion. The first growth phase (2025–2030) will be anchored by strong adoption of 100% mineral formulations and daily-wear formats like lotions and creams, which collectively dominate segmental share.

Competitive dynamics are anticipated to evolve as specialist brands, such as EltaMD and Blue Lizard, consolidate trust in derm-led channels, while multiproduct players like Neutrogena and La Roche-Posay expand hybrid portfolios. Regional acceleration will be pronounced in China and India, where CAGR levels of 17.6% and 19.8% respectively outpace global averages, supported by e-commerce penetration and rising disposable incomes.

By 2035, innovation in sheer formulations, reef-safe claims, and e-commerce-driven personalization is expected to redefine brand loyalty. Competitive edge will rely less on product breadth alone and more on scientific substantiation, digital engagement, and recurring consumption models, ensuring sustained leadership in the global sun protection landscape.

The growth of the Zinc Oxide Sunscreens Market is being propelled by rising awareness of skin health, increasing preference for clean-label formulations, and growing regulatory scrutiny over chemical UV filters. Adoption has been supported by dermatologist recommendations, with zinc oxide being positioned as a safe, broad-spectrum, and reef-friendly alternative. Demand has been reinforced by consumer concerns over allergies and sensitivity, which has elevated the role of mineral-only formulations that already command the majority share.

Expansion is further being driven by the appeal of non-nano variants, which are anticipated to gain traction as environmental organizations and retailers emphasize reef-safe compliance. Digital commerce and dermatology channels have amplified accessibility, with personalized routines and product bundling expected to strengthen usage frequency. Rapid growth across emerging economies, particularly China and India, is accelerating market penetration, supported by rising disposable incomes and expanding urban skincare adoption. With product innovation in sheer and tinted formulations addressing cosmetic integration needs, zinc oxide sunscreens are expected to shift from niche use toward mainstream daily skincare, thereby sustaining long-term growth.

The Zinc Oxide Sunscreens Market has been segmented across key parameters to provide clarity on evolving consumer preferences and innovation pathways. Formulation choices have shaped the market, with mineral-only variants capturing a dominant position as trust in safer and eco-friendly compositions has strengthened. Zinc type has emerged as a decisive factor, as demand has been influenced by environmental regulations and consumer awareness of ingredient safety. Formats such as lotions and creams have remained at the forefront due to their compatibility with daily routines, while newer formats are expected to expand penetration through convenience and aesthetic integration. Collectively, these segments highlight how performance, safety, and usability are driving long-term adoption patterns.

| Segment | Market Value Share, 2025 |

|---|---|

| 100% mineral | 57% |

| Others | 43.0% |

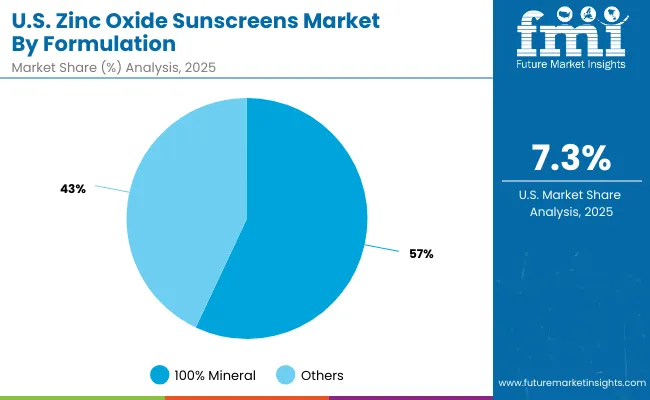

The 100% mineral segment is anticipated to hold 57.0% of the market share in 2025, equivalent to USD 2,394.80 Million. Growth has been fueled by increasing awareness of safety concerns linked to chemical filters and rising demand for reef-safe and pediatric-friendly solutions. Dermatologist endorsements and regulatory approvals are expected to strengthen credibility, making this segment the preferred choice among health-conscious consumers. Hybrid formulations may continue to serve niche aesthetics-driven demand, yet clear safety positioning is expected to allow 100% mineral sunscreens to retain dominance.

| Segment | Market Value Share, 2025 |

|---|---|

| Non-nano | 44% |

| Others | 56.0% |

Non-nano zinc is expected to command 44.0% of market share in 2025, representing USD 1,848.62 Million. Growth in this segment is being driven by rising environmental advocacy and retailer policies mandating reef-safe compliance. Non-nano products have been perceived as safer alternatives, which has reinforced adoption in pharmacies and premium retail channels. Although texture and spreadability challenges remain, formulation innovation is projected to enhance user experience, supporting broader appeal. The continued shift toward transparency in labeling is expected to strengthen the trajectory of non-nano zinc sunscreens across global markets.

| Segment | Market Value Share, 2025 |

|---|---|

| Lotions/creams | 52% |

| Others | 48.0% |

Lotions and creams are projected to secure 52.0% of the market share in 2025, valued at USD 2,184.73 Million. This dominance is underpinned by their compatibility with everyday skincare routines and dermatologist recommendations. Their ability to integrate into morning and makeup regimens is expected to keep them as the preferred choice for broad-spectrum protection. While sprays, sticks, and tinted formats are likely to grow faster due to convenience and cosmetic appeal, lotions and creams will continue to capture mainstream adoption. Consumer loyalty, reinforced by familiarity and ease of application, is projected to maintain their leadership over the decade.

Adoption of zinc oxide sunscreens is influenced by evolving consumer safety perceptions and environmental priorities, even as challenges in formulation aesthetics and cost dynamics restrict broader penetration across diverse retail and clinical channels.

Regulatory Alignment with Reef-Safe Standards

Growing alignment of global regulatory frameworks with reef-safe and mineral-only labeling has been reshaping sunscreen portfolios. Regulatory bodies in North America, Europe, and Asia have increasingly scrutinized chemical UV filters for their ecological and dermatological impact. As this shift continues, zinc oxide is being positioned as one of the few universally recognized safe filters. Compliance with these evolving mandates has not only reduced risk for manufacturers but also created an opportunity to command premium pricing. Dermatologist endorsements and NGO-backed certifications are expected to enhance consumer trust, accelerating adoption across both mass and premium categories.

Formulation Challenges with Non-Nano Variants

Despite safety benefits, non-nano zinc formulations have encountered significant hurdles in texture and cosmetic elegance. Their tendency to leave a white cast has limited acceptance in darker skin tones and cosmetic layering applications. Manufacturers are facing cost implications as they invest in advanced dispersion technologies and hybrid delivery systems to address these limitations. Without breakthrough innovation in sensorial performance, broader demographic adoption may remain constrained. Retailers are also increasingly selective, prioritizing products that balance compliance with aesthetics. This dual pressure has raised barriers to scaling non-nano zinc variants in cost-sensitive markets, restraining the pace of growth in what is otherwise a high-potential segment.

| Country | CAGR |

|---|---|

| China | 17.6% |

| USA | 7.3% |

| India | 19.8% |

| UK | 11.4% |

| Germany | 8.6% |

| Japan | 14.3% |

The global Zinc Oxide Sunscreens Market reflects diverse country-level growth trajectories, influenced by regulatory frameworks, consumer awareness, and dermatological adoption. The most dynamic momentum is expected in Asia, where India (19.8% CAGR) and China (17.6% CAGR) are projected to lead. Expansion in these markets will be powered by heightened awareness of UV damage, rapid digital retail penetration, and increasing adoption of mineral-only sun protection in urban centers. India’s trajectory will be reinforced by affordability-driven mass retail strategies, while China’s growth will be accelerated by e-commerce ecosystems and premium dermocosmetic demand.

Japan, with a forecast CAGR of 14.3%, is anticipated to capitalize on its strong cosmetics industry and innovation in sheer, tinted formulations tailored for daily skincare regimens. In Europe, moderate but steady growth is expected, with Germany at 8.6% and the UK at 11.4%, supported by strict compliance standards, environmentally conscious consumers, and preference for reef-safe products. Broader Europe is projected at 8.3%, signaling consistent replacement of chemical filters by mineral-based alternatives.

The USA market, at a CAGR of 7.3%, is expected to expand more gradually due to its maturity but will benefit from strong dermatologist endorsements and increasing pediatric use. Overall, regional diversity highlights how consumer education, retail models, and regulatory alignment are shaping adoption globally.

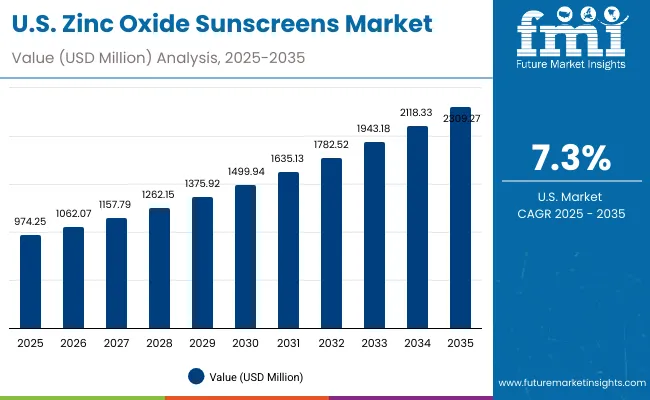

| Year | USA Zinc Oxide Sunscreens Market (USD Million) |

|---|---|

| 2025 | 974.25 |

| 2026 | 1062.07 |

| 2027 | 1157.79 |

| 2028 | 1262.15 |

| 2029 | 1375.92 |

| 2030 | 1499.94 |

| 2031 | 1635.13 |

| 2032 | 1782.52 |

| 2033 | 1943.18 |

| 2034 | 2118.33 |

| 2035 | 2309.27 |

The Zinc Oxide Sunscreens Market in the United States is projected to grow at a CAGR of 7.3% from 2025 to 2035, expanding from USD 974.25 Million in 2025 to USD 2309.27 Million by 2035. Growth is expected to be supported by clinical endorsements and increasing consumer awareness of mineral formulations. Dermatologist-led education has reinforced adoption, particularly among pediatric and sensitive-skin users.

Expansion is anticipated to be reinforced by the dominance of 100% mineral formulations, which already hold a significant share of the USA market. Consumer demand is being accelerated by heightened concerns over reef safety, allergen-free protection, and the replacement of chemical UV filters. Expanding penetration across e-commerce and derm-clinic channels is projected to drive accessibility, while the mass retail sector is expected to consolidate demand for affordable mineral-only offerings.

A CAGR of 11.4% is expected for the UK Zinc Oxide Sunscreens Market through 2035. Growth is anticipated to be supported by dermatology-led education, retailer stewardship on reef-safe shelves, and high daily-wear compliance driven by fair-skin photoprotection norms. Premium mineral-only lines are projected to remain prominent as clinical credibility and cosmetic elegance improve. E-commerce and pharmacy partnerships are expected to streamline replenishment, while refill and subscription models should enhance repeat purchase behavior. Regulatory alignment with EU-style ingredient scrutiny is likely to favor transparent labeling and evidence-backed claims.

A CAGR of 19.8% is projected for India, positioning the country as the fastest-growing major market. Expansion is expected to be propelled by hot-climate photoprotection needs, widening dermatology access, and rapid digital commerce adoption. Affordability-led packs and localized shade/tint ranges are likely to unlock mass adoption beyond metros. Pharmacy and modern trade are expected to professionalize assortments, while influencer dermatology is anticipated to normalize daily reapplication behavior. Compliance-led messaging around school-going children and outdoor workers is projected to raise household ownership of multiple formats.

A CAGR of 17.6% is anticipated for China, with the market estimated at ~USD 497.95 Million in 2025 and characterized by a 44%/56% non-nano/other zinc-type split. Growth is expected to be underpinned by sophisticated dermocosmetic demand, KOL-driven content commerce, and rapid adoption of sheer, makeup-compatible mineral bases. Cross-border and domestic prestige brands are projected to scale through marketplace festivals and dermatologist co-creation. Regulatory attention to ingredient transparency is likely to sustain mineral credibility and reduce volatility in consumer trust.

![Europe Zinc Oxide Sunscreens Market] Europe Zinc Oxide Sunscreens Market]](https://www.futuremarketinsights.com/report-images/image/europe-zinc-oxide-sunscreens-market].webp)

| Country | 2025 |

|---|---|

| USA | 23.2% |

| China | 11.9% |

| Japan | 6.9% |

| Germany | 15.3% |

| UK | 8.0% |

| India | 4.8% |

| Country | 2035 |

|---|---|

| USA | 20.6% |

| China | 12.8% |

| Japan | 8.3% |

| Germany | 13.3% |

| UK | 7.2% |

| India | 5.9% |

A CAGR of 8.6% is forecast for Germany, reflecting disciplined growth in a safety- and compliance-centric market. Retailers are expected to enforce stringent substantiation for reef-safe and hypoallergenic claims, favoring mineral-only portfolios. Pharmacy dominance is projected to persist, while drugstore chains are likely to broaden access with derm-endorsed private labels. Texture advances that minimize white cast are anticipated to widen user inclusivity and sustain year-round use, not just holiday purchase peaks.

| Segment | Market Value Share, 2025 |

|---|---|

| mineral | 57% |

| Others | 43% |

The USA Zinc Oxide Sunscreens Market is projected at USD 974.25 Million in 2025. Within this, 100% mineral formulations contribute 57.0%, equal to USD 555.32 Million, while other formulations account for 43.0%, or USD 418.93 Million. This dominance of mineral-only variants signals a clear consumer preference for dermatologist-backed, reef-safe, and sensitive-skin-compatible solutions. Growing concerns about chemical UV filters and stricter environmental scrutiny have reinforced the shift toward mineral formats, making them the foundation of long-term category growth.

This segment’s leadership is expected to be supported by pediatric-focused marketing and clinical endorsements that underline hypoallergenic benefits. Meanwhile, hybrid formulations will continue to serve consumers seeking enhanced cosmetic appeal but are unlikely to displace the trust commanded by pure zinc oxide bases. The market landscape will increasingly reward brands offering evidence-backed claims and improved cosmetic elegance, particularly in daily-wear and family-use products.

| Segment | Market Value Share, 2025 |

|---|---|

| Non-nano | 44% |

| Others | 56% |

The Zinc Oxide Sunscreens Market in China is projected at USD 498.0 Million in 2025. Within this, non-nano zinc accounts for 44.0% (USD 219.10 Million), while other zinc types contribute 56.0% (USD 278.85 Million). This balanced split highlights how both performance and aesthetics are shaping consumer preference. While non-nano formulations are increasingly favored for their reef-safe positioning and NGO-backed endorsements, smoother application and superior cosmetic integration continue to support other zinc variants.

The competitive dynamic in China is expected to be strongly influenced by digital retail ecosystems and KOL-driven education, which are normalizing daily sunscreen use. Cross-border and domestic dermocosmetic brands are anticipated to leverage festivals and live-commerce events to scale both premium and mass-market offerings. Regulatory oversight emphasizing ingredient transparency is expected to reinforce consumer trust, making non-nano labeling an increasingly powerful differentiator.

| Company | Global Value Share 2025 |

|---|---|

| EltaMD | 8.1% |

| Others | 91.9% |

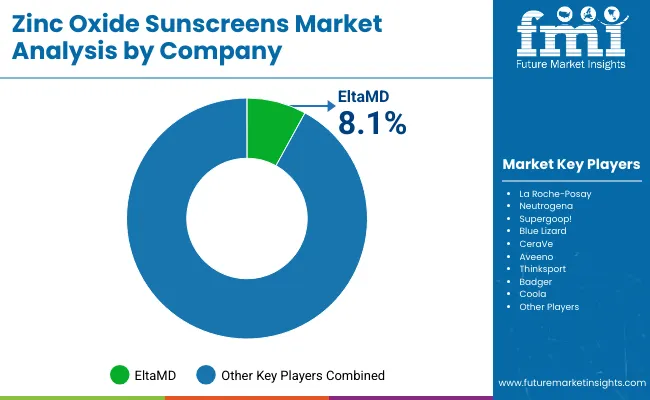

The Zinc Oxide Sunscreens Market is moderately fragmented, with specialist dermatology-backed leaders, multiproduct skincare giants, and niche natural brands competing across a wide spectrum of consumer needs. The leading player, EltaMD, is estimated to hold a global value share of 8.1% in 2025, positioning it as the dominant brand within this category. Its leadership has been reinforced by dermatologist endorsements, strong penetration in professional clinic channels, and consistent product validation around sensitive-skin and pediatric usage.

Other major brands such as La Roche-Posay, Neutrogena, Supergoop!, Blue Lizard, CeraVe, Aveeno, Thinksport, Badger, and Coola form the broader competitive set. These players, although individually smaller in share, collectively contribute to the remaining 91.9% of the market. Their strategies are expected to center on cosmetic elegance, digital-first marketing, and expansion through e-commerce platforms.

Niche specialists like Thinksport and Badger are carving loyalty among eco-conscious and reef-safe consumers, while global skincare houses such as Neutrogena and La Roche-Posay leverage extensive distribution networks to compete across both premium and mass-market price bands. Competitive differentiation is expected to shift toward integrated dermatology partnerships, transparent reef-safe labeling, and personalization-driven digital commerce models.

Key Developments in Zinc Oxide Sunscreens Market

| Item | Value |

|---|---|

| Quantitative Units | USD 4,201.4 Million (2025); USD 11,203.4 Million (2035); CAGR 2025 to 2035: 10.3% |

| Formulation (Component-equivalent) | 100% mineral, Hybrid/other mineral blends |

| Zinc Type | Non-nano, Other zinc grades (incl. coated nano/encapsulated micro where applicable) |

| Format (Type-equivalent) | Lotions/creams, Sticks, Sprays, Tints/CC, Others |

| Key Claims/Use-Cases (End-use-equivalent) | Pediatric/sensitive-skin routines, Broad-spectrum daily wear, Outdoor/athletic protection, Reef-safe positioning, Dermatology-recommended care |

| Channels | Pharmacies/drugstores, E-commerce, Mass retail, Dermatology clinics |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; United Kingdom; Germany; Japan |

| Leading 2025 Segment Indicators | 100% mineral: 57.0% (USD 2,394.80 Million); Non-nano zinc: 44.0% (USD 1,848.62 Million); Lotions/creams: 52.0% (USD 2,184.73 Million) |

| Market Concentration | Top brand (EltaMD): 8.1% global value share (2025); Others combined: 91.9% |

| Key Companies Profiled | EltaMD; La Roche-Posay; Neutrogena; Supergoop!; Blue Lizard; CeraVe; Aveeno; Thinksport; Badger; Coola |

| Regulatory & Quality Notes | Reef-safe and labeling scrutiny expected to intensify; dermatologist endorsements and transparent safety dossiers projected to shape listings |

| Additional Attributes | Mineral-only premiumization; texture/whitening minimization R&D; subscription and refill models via e-commerce; growing non-nano shelf space; pediatric and daily-wear adoption; cost management for zinc-oxide grades; evidence-backed claims and clinical testing emphasized |

The global Zinc Oxide Sunscreens Market is estimated to be valued at USD 4,201.4 million in 2025.

The market size for the Zinc Oxide Sunscreens Market is projected to reach USD 11,203.4 million by 2035.

The Zinc Oxide Sunscreens Market is expected to grow at a CAGR of 10.3% between 2025 and 2035.

The key product types in the Zinc Oxide Sunscreens Market include lotions/creams, sticks, sprays, and tints/CC creams, with lotions and creams leading at 52.0% share in 2025.

In terms of formulation, the 100% mineral segment is projected to command 57.0% share, equal to USD 2,394.80 million, in the Zinc Oxide Sunscreens Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zinc Oxide for Sunscreens Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Zinc-tin Alloy Sputtering Target Market Size and Share Forecast Outlook 2025 to 2035

Zinc Acetate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Dialkyldithiophosphates Additive Market Size and Share Forecast Outlook 2025 to 2035

Zinc Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chloride Market Analysis - Size, Share, and Forecast 2025 to 2035

Zinc Citrate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Sulphate Market Size, Growth, and Forecast 2025 to 2035

Zinc Methionine Chelates Market - Growth & Demand 2025 to 2035

Zinc-Air Batteries Market Growth – Trends & Forecast 2023-2033

Zinc Oxide Block Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Market Forecast and Outlook 2025 to 2035

Nano Zinc Oxide Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Zinc Coatings Market Size and Share Forecast Outlook 2025 to 2035

Demand for Zinc-Tin Alloy Sputtering Target in UK Size and Share Forecast Outlook 2025 to 2035

Encapsulated Zinc Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Zinc Powder Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA