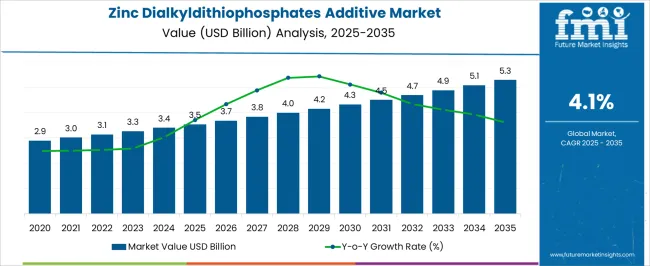

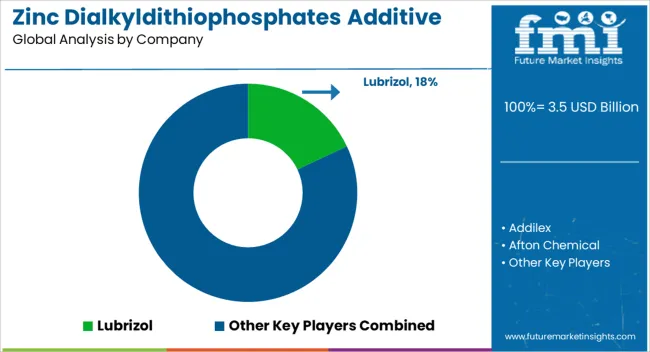

The zinc dialkyldithiophosphates (ZDDP) additive marketis estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. This represents a compound annual growth rate (CAGR) of 4.1%, indicating consistent expansion driven by both automotive and industrial lubricant demand. ZDDP is primarily used as an anti-wear and antioxidant additive in engine oils, protecting engines from wear and oxidation under high-temperature and high-pressure conditions, which maintains performance and extends equipment life.

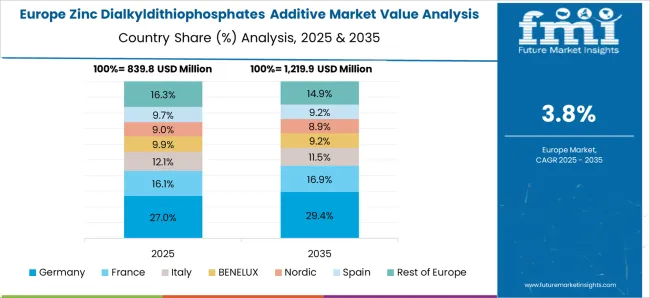

Several factors contribute to market growth. The rising global vehicle population, increasing industrial machinery usage, and stringent emission and engine protection standards are driving demand for high-performance lubricants containing ZDDP. Additionally, the shift towards synthetic and high-performance oils emphasizes the need for effective anti-wear additives, further boosting market adoption. Regional demand varies, with North America and Europe leading due to established automotive industries, while Asia-Pacific shows significant growth potential fueled by rapid industrialization and increasing vehicle sales.

However, environmental regulations limiting phosphorus content in lubricants may challenge ZDDP usage, prompting innovation in low-phosphorus alternatives.

| Metric | Value |

|---|---|

| Zinc Dialkyldithiophosphates Additive Market Estimated Value in (2025 E) | USD 3.5 billion |

| Zinc Dialkyldithiophosphates Additive Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The zinc dialkyldithiophosphates additive market is undergoing consistent growth due to its critical role in providing antiwear, antioxidation, and corrosion inhibition functions in lubrication systems. The current market landscape reflects increasing consumption across automotive and industrial sectors, driven by heightened performance requirements in lubricants and regulatory emphasis on extending engine life.

Technological developments in oil formulations and evolving engine design specifications are encouraging lubricant manufacturers to retain highly effective additives like zinc dialkyldithiophosphates, particularly for demanding operating conditions. Growth is further influenced by rising vehicle production, increasing global mobility, and the preference for high-performing engine oils that comply with performance certifications.

While sustainability trends are pushing the industry to explore ashless alternatives, zinc-based additives continue to hold a dominant presence due to their cost-effectiveness and proven reliability under high thermal stress. As industries and transportation sectors focus more on engine efficiency and long-term equipment durability, the demand for this additive is expected to maintain upward momentum.

The zinc dialkyldithiophosphates additive market is segmented by type, application, end use industry, and geographic regions. By type, the zinc dialkyldithiophosphates additive market is divided into Secondary alkyl zinc dialkyldithiophosphates and Primary alkyl zinc dialkyldithiophosphates. In terms of application, the zinc dialkyldithiophosphates additive market is classified into Engine oil additives, Antioxidants and corrosion inhibitors, Gear oils, Hydraulic fluids, Compressor and turbine oils, and Others. Based on end-use industry, the zinc dialkyldithiophosphates additive market is segmented into Automotive, Industrial machinery, and Others. Regionally, the zinc dialkyldithiophosphates additive industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The secondary alkyl zinc dialkyldithiophosphates type is expected to contribute 57.8% of the total revenue share in the Zinc Dialkyldithiophosphates Additive Market in 2025, making it the dominant segment by type. This leadership is being driven by the superior thermal and oxidative stability offered by secondary alkyl variants compared to primary alkyl counterparts.

These characteristics make them particularly suitable for high-temperature engine environments and extended drain intervals, both of which are increasingly demanded in modern vehicle maintenance cycles. The strong performance of this subsegment has also been supported by its enhanced antiwear properties, which are critical in protecting engine components under heavy loads.

Lubricant formulators have shown a preference toward these variants due to their consistent performance across a range of base oils and engine types. As engine design becomes more compact and efficient, the need for reliable high-performance additives has elevated the demand for secondary alkyl formulations, reinforcing their leading market position.

The engine oil additive application segment is projected to hold 42.6% of the total market share in 2025, making it the largest segment by application. This dominant position is being supported by the essential function zinc dialkyldithiophosphates play in enhancing the durability and oxidative stability of engine oils.

These additives are integral to preventing wear and controlling sludge formation in internal combustion engines, which continues to represent a large proportion of global vehicle fleets. The continued reliance on traditional fuel-based vehicles in both developed and developing economies has maintained strong demand for high-performing engine oils, thereby supporting additive consumption.

The effectiveness of these additives in meeting industry standards and their compatibility with existing oil formulations have made them indispensable in lubricant blending. With automotive manufacturers and oil producers prioritizing engine cleanliness and efficiency, the application of these additives in engine oils remains the most substantial driver of market growth.

The automotive end use industry segment is anticipated to account for 66.3% of the total market revenue in 2025, establishing it as the most dominant end-use category. This leading share is being driven by the extensive use of zinc dialkyldithiophosphates additives in automotive lubricants to meet the demanding wear protection and thermal resistance requirements of engines.

The continuous expansion of vehicle ownership, particularly in emerging markets, has led to higher lubricant consumption and, subsequently, greater additive demand. Automotive OEMs and lubricant manufacturers have prioritized maintaining engine longevity and reliability, which has further reinforced the use of these additives in engine oil formulations.

As emission norms become more stringent and operating conditions more severe, the importance of proven and efficient additive systems has grown. The long-standing application of these additives in commercial vehicles, passenger cars, and high-performance engines continues to ensure the automotive sector remains the core revenue contributor to the overall market.

Zinc dialkyldithiophosphates (ZDDP) additives are primarily driven by the automotive sector and their essential role in engine oil formulations. Regulatory changes, industrial demand, and a focus on performance and efficiency will continue to shape the market.

The demand for zinc dialkyldithiophosphates (ZDDP) additives is largely driven by their widespread use in the automotive sector, particularly in engine oils. ZDDP additives improve the anti-wear properties and extreme pressure resistance of oils, ensuring better engine protection. The automotive industry's continued push for high-performance lubricants to meet the needs of modern engines, especially those in passenger vehicles and heavy-duty trucks, boosts the demand for ZDDP. As more vehicles require longer service intervals, the role of ZDDP additives in enhancing oil performance becomes increasingly critical. Moreover, stringent emission norms and the push for fuel efficiency further drive their application in both gasoline and diesel engines.

Stricter regulatory requirements regarding the toxicity and environmental impact of lubricants are reshaping the ZDDP market. Although ZDDP has long been favored for its performance, concerns regarding the impact of phosphorus on emissions systems, especially in modern catalytic converters, are influencing product formulations. Regulations, such as those on reducing phosphorus content in oils, are pushing manufacturers to explore alternatives while maintaining the effectiveness of ZDDP in high-pressure environments. However, balancing regulatory compliance with performance requirements remains a challenge, driving the ongoing evolution of ZDDP formulations that minimize environmental impact while maintaining oil efficiency.

Beyond automotive applications, the demand for ZDDP additives is growing in industrial and commercial sectors, particularly in heavy machinery, marine engines, and gear oils. ZDDP additives play a crucial role in protecting engines and equipment operating under high-stress conditions, where extreme pressure and wear resistance are essential. The construction, mining, and power generation industries are key contributors to this growth, where machinery downtime due to lubrication failures is costly. ZDDP’s proven effectiveness in these harsh environments ensures its continued relevance, especially as industries strive for reliable, long-lasting machinery performance, further reinforcing its demand across diverse industrial applications.

As end-users demand higher-performing and more fuel-efficient engines, ZDDP additives continue to evolve. The focus is now shifting towards enhancing the fuel economy, reducing friction, and increasing the lifespan of engine oils. Modern engines, which require higher load-bearing and more durable lubricants, push the demand for ZDDP additives that can withstand high-temperature and high-stress environments. Oil formulations that offer a balance between performance and environmental safety are in high demand, leading to a shift towards optimized ZDDP products that meet stringent specifications while maintaining lubrication quality. Manufacturers are also increasingly emphasizing the efficiency of their products to cater to performance-driven applications in both automotive and industrial sectors.

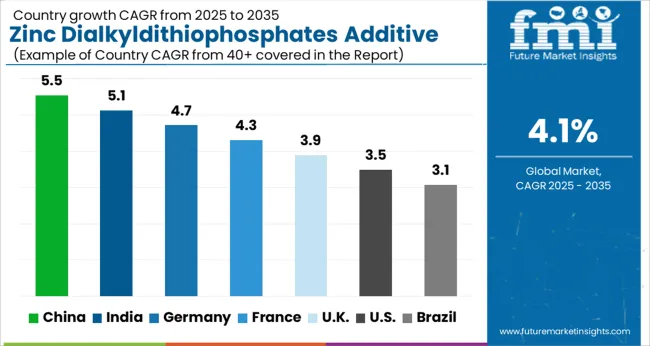

The Zinc Dialkyldithiophosphates (ZDDP) additives market is projected to expand globally at a CAGR of 4.1% from 2025 to 2035, driven by rising demand in the automotive and industrial sectors. China leads with a CAGR of 5.5%, supported by the country’s large automotive manufacturing base and increasing demand for high-performance lubricants in both domestic and industrial applications. India follows with a CAGR of 5.1%, driven by a growing automotive industry, increasing production of lubricants, and the expansion of infrastructure projects. France grows at 4.3%, benefiting from its strong automotive and industrial sectors, while the UK at 3.9% and the USA at 3.5% are expected to see steady growth, driven by regulatory standards and a focus on advanced lubrication solutions. These countries represent strategic focal points for product development, regulatory compliance, and market expansion within the ZDDP additives industry, establishing benchmarks for the global lubricant and additive market.

China is projected to achieve a CAGR of 5.5% for 2025–2035, higher than the 4.9% observed between 2020–2024. This growth is supported by the rising demand for high-performance lubricants in the automotive sector, especially with the increase in vehicle production and the need for advanced engine oils. Stricter emission regulations and the drive for fuel-efficient vehicles further boost the adoption of ZDDP additives. Local manufacturing capabilities and competitive pricing make ZDDP additives increasingly popular, especially in industrial applications. With major industrial hubs and strong infrastructure, China benefits from optimized logistics and a large-scale supply chain.

India is forecast to achieve a CAGR of 5.1% for 2025–2035, higher than the 4.3% recorded between 2020–2024. The improvement is linked to expanding automotive production, higher demand for lubricants, and a growing industrial base. The increasing adoption of ZDDP additives is driven by the need for improved engine protection in both passenger vehicles and commercial vehicles. The availability of local feedstocks, lower production costs, and growing automotive demand make India a key player in the ZDDP market. India’s rapidly expanding automotive sector and infrastructure development continue to foster demand for advanced additives.

Germany is expected to achieve a CAGR of 4.7% for 2025–2035, following a CAGR of 4.2% from 2020–2024. The market’s growth is driven by Germany’s strong automotive sector, which relies on high-quality engine oils that use ZDDP additives for superior performance. The demand for ZDDP additives is further supported by stringent environmental regulations and consumer demand for fuel-efficient vehicles. Additionally, the increased focus on optimizing industrial machinery and heavy-duty vehicle performance boosts the adoption of ZDDP additives. Germany’s central location in Europe and robust manufacturing capabilities provide strong growth prospects.

France is forecast to experience a CAGR of 4.3% for 2025–2035, compared to 3.8% from 2020–2024. This growth is driven by increasing demand for high-performance engine oils in both automotive and industrial sectors. France’s automotive industry is adopting advanced lubricants to meet stricter emission standards, while the industrial and commercial sectors are increasing their use of ZDDP additives for machinery and equipment maintenance. The rising demand for fuel-efficient, low-emission vehicles also supports the growth of ZDDP additives. France’s focus on innovation in automotive manufacturing continues to strengthen the role of ZDDP in lubricant formulations.

The UK is expected to see a CAGR of 3.9% for 2025–2035, higher than the 3.2% recorded between 2020–2024. The growth is attributed to increasing demand for lubricants in automotive and industrial sectors that require high-performance oils. The UK’s regulatory framework, which encourages the adoption of advanced, eco-friendly lubricants, will further drive ZDDP adoption. The rise in fleet management services and growing automotive production also contributes to this growth. As the demand for high-efficiency engines and better fuel economy increases, the need for ZDDP additives in lubricants will continue to grow.

Lubrizol leads the market, known for its strong focus on high-performance additives and its global manufacturing network. Addilex provides specialized formulations for automotive lubricants, emphasizing high-quality additives for engine protection. Afton Chemical continues to dominate with a diverse portfolio of additives, including ZDDP, focusing on fuel and lubricant efficiency across industries.

Chevron Oronite stands out by developing ZDDP formulations that optimize wear protection, enhancing the performance of lubricants in automotive and industrial applications. Chetas Biochem and Ganesh Benzoplast focus on providing tailored solutions for specific engine oil formulations, contributing significantly to the Indian market. Infineum, Gbl Chemical, and RB Products continue to enhance their position by offering cutting-edge ZDDP formulations that cater to both conventional and synthetic oils. Ruhani Lubricants focuses on the development of ZDDP additives for industrial machinery, capitalizing on the demand for cost-effective, high-performance additives. Yasho Industries ensures competitiveness with a robust product offering that caters to regional needs in Asia. These companies differentiate themselves through technical innovation, strong customer relationships, and the ability to respond to regulatory changes in different regions. Their competitive strategies focus on expanding their portfolios, improving formulation chemistry, and ensuring product reliability to meet both automotive and industrial lubricant demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Type | Secondary alkyl zinc dialkyldithiophosphates and Primary alkyl zinc dialkyldithiophosphates |

| Application | Engine oil additive, Antioxidants and corrosion inhibitors, Gear oils, Hydraulic fluids, Compressor and turbine oils, and Others |

| End Use Industry | Automotive, Industrial machinery, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lubrizol, Addilex, Afton Chemical, Chetas Biochem, Chevron Oronite, Ganesh Benzoplast, Gbl Chemical, Infineum, RB Products, Ruhani Lubricants, and Yasho Industries |

| Additional Attributes | Dollar sales trends across regions, market share by automotive, industrial, and heavy-duty sectors, and growth projections for engine oil and lubricants markets. |

The global zinc dialkyldithiophosphates additive market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the zinc dialkyldithiophosphates additive market is projected to reach USD 5.3 billion by 2035.

The zinc dialkyldithiophosphates additive market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in zinc dialkyldithiophosphates additive market are secondary alkyl zinc dialkyldithiophosphates and primary alkyl zinc dialkyldithiophosphates.

In terms of application, engine oil additive segment to command 42.6% share in the zinc dialkyldithiophosphates additive market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zinc Oxide Market Forecast and Outlook 2025 to 2035

Zinc Oxide Sunscreens Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide for Sunscreens Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Zinc Acetate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chloride Market Analysis - Size, Share, and Forecast 2025 to 2035

Zinc Citrate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Sulphate Market Size, Growth, and Forecast 2025 to 2035

Zinc Methionine Chelates Market - Growth & Demand 2025 to 2035

Zinc-Air Batteries Market Growth – Trends & Forecast 2023-2033

Nano Zinc Oxide Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Zinc Coatings Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Zinc Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing With Metal Powders Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing and Material Market Trends - Growth & Forecast 2025 to 2035

Additives for Floor Coatings Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA