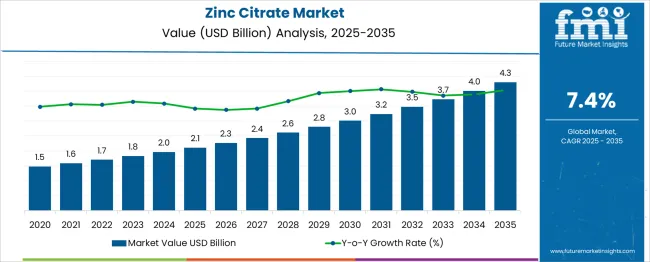

The Zinc Citrate Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

The market is projected to generate an incremental gain of USD 2.2 billion at a CAGR of 7.4%. Analysis of five-year growth contribution reveals a slightly back-weighted expansion. During the first half (2025–2030), the market moves from USD 2.1 billion to 3.0 billion, adding USD 0.9 billion, which accounts for 41% of the total growth opportunity.

Annual values in this phase include 2.3 billion in 2026, 2.4 billion in 2027, 2.6 billion in 2028, 2.8 billion in 2029, and 3.0 billion in 2030, driven primarily by rising demand in dietary supplements, fortified foods, and pharmaceutical applications. The second half (2030–2035) contributes USD 1.3 billion, or 59% of incremental growth, as the market reaches 3.2 billion in 2031, 3.5 billion in 2032, 3.7 billion in 2033, 4.0 billion in 2034, and 4.3 billion in 2035. This indicates stronger growth in later years fueled by expanding nutraceutical penetration, increased preventive healthcare awareness, and broader use in oral care formulations.

Companies aiming to capture this back-weighted opportunity should focus on capacity scaling, clean-label product innovation, and strategic partnerships within functional food and pharma sectors to secure long-term competitiveness.

| Metric | Value |

|---|---|

| Zinc Citrate Market Estimated Value in (2025 E) | USD 2.1 billion |

| Zinc Citrate Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The zinc citrate market occupies a significant niche across multiple parent categories. In the zinc compounds and derivatives market, zinc citrate represents 8–10 % of volume, with other forms like oxide and sulfate dominating bulk industrial and nutritional demand. Within the dietary supplements and nutraceutical ingredients market, zinc citrate holds 12–14 %, because of its favorable absorption profile and digestive tolerance. In the oral care ingredient market, its share is highest at 20–22 %, reflecting wide use for tartar control, plaque inhibition, and gum health in toothpaste and mouthwash formulations.

Within the pharmaceutical excipients and APIs market, zinc citrate captures 5–6 %, given that excipients and active minerals compete with binders, fillers, and herbal actives. In the functional food and beverage ingredient market, the share stands at 7–9 %, driven by fortification trends and demand for immune-supporting snack formats.

While overall shares are modest relative to bulk compounds or broad markets, zinc citrate use is accelerating in health-conscious consumer segments and premium oral-care solutions. Its multifunctional role supports evolving formulation strategies for immune wellness, clean-label supplements, and ingredient transparency.

The Zinc Citrate market is witnessing consistent growth, driven by rising consumer awareness regarding immune health, nutritional deficiencies, and preventive wellness. As global populations seek functional ingredients with proven absorption efficacy, zinc citrate has gained recognition for its superior bioavailability compared to other zinc salts. This trend is further reinforced by increasing demand from the dietary supplement and pharmaceutical sectors, especially in regions facing micronutrient deficiency burdens.

Regulatory approvals and inclusion in permissible additive lists across North America and Europe have enhanced the market’s credibility and global reach. The product’s multifunctional roles in bone health, immunity, and cellular function have encouraged its use in both standalone supplements and multivitamin formulations.

Moreover, the surge in health-conscious lifestyles, aging demographics, and preventive healthcare initiatives is fostering long-term growth opportunities for zinc-based ingredients. Continued investment in clean-label, plant-compatible formulations is expected to broaden the application base of zinc citrate, making it a key component in next-generation wellness and therapeutic products.

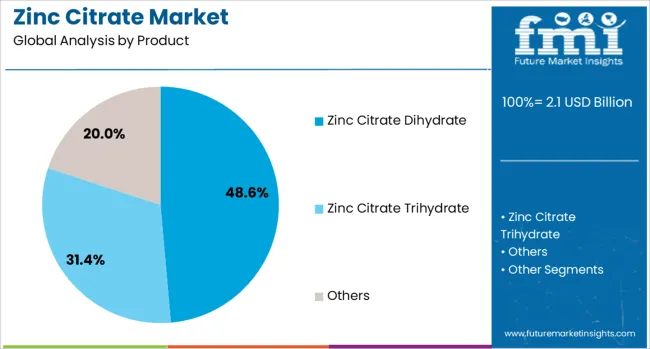

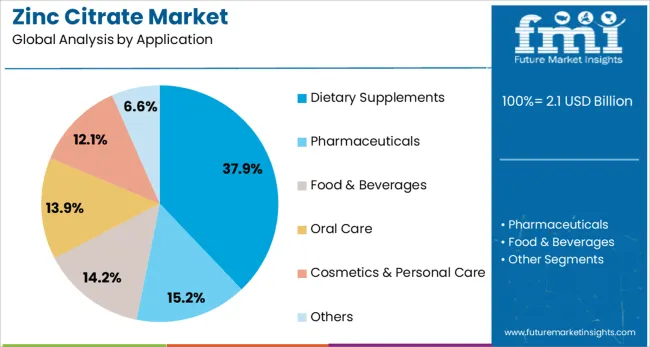

The zinc citrate market is segmented by product, application, and geographic regions. The zinc citrate market is divided into Zinc Citrate Dihydrate, Zinc Citrate Trihydrate, and Others. The zinc citrate market is classified into Dietary Supplements, Pharmaceuticals, Food & Beverages, Oral Care, Cosmetics & Personal Care, and Others. Regionally, the zinc citrate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Zinc citrate dihydrate is anticipated to account for 48.6% of the total revenue share in the zinc citrate market in 2025, making it the most dominant product type. The segment’s prominence is supported by its superior solubility profile, high elemental zinc content, and better gastrointestinal tolerance compared to other forms. Its wide usage across pharmaceutical, dietary supplement, and food fortification applications has contributed to consistent demand from manufacturers aiming for efficient nutrient delivery.

The stability of zinc citrate dihydrate in various formulations, including tablets, capsules, and powdered blends, has further strengthened its utility in consumer health products. Additionally, it aligns well with regulatory frameworks in major markets and is often preferred for its neutral taste and minimal reactivity in multicomponent systems.

The growing emphasis on bioavailable zinc forms in preventive health and therapeutic regimes has reinforced its acceptance among formulators and contract manufacturers. These advantages, combined with the scalability of industrial production, have ensured its leading position in the overall market landscape.

The dietary supplements segment is projected to contribute 37.9% of the total revenue share in the zinc citrate market by 2025, establishing itself as the leading application area. The growing consumer demand for immunity-boosting and mineral-rich supplements has significantly propelled the use of zinc citrate in this category. Its superior bioavailability, combined with its role in immune modulation, antioxidant support, and cellular repair, has made it a popular choice for daily supplementation.

The segment’s growth is also attributed to increased consumption of over-the-counter health products, particularly in response to health concerns related to respiratory and viral infections. Furthermore, product innovation in chewables, gummies, and vegan-friendly formats has expanded accessibility across diverse consumer groups, including children and elderly populations.

The clear positioning of zinc as an essential trace element in numerous health claims and clinical guidelines has elevated its profile among both healthcare professionals and consumers. These drivers continue to anchor the segment’s growth trajectory in the zinc citrate market.

Zinc citrate is widely used as a nutritional supplement in pharmaceuticals, dental care products, and dietary formulations. Its usage in lozenges, effervescent tablets, and oral health products has grown due to its role in supporting immune function, enamel remineralization, and overall wellness. Manufacturers in the food and pharmaceutical sectors have favored zinc citrate for its good bioavailability and mild taste profile. Producers offering pharmaceutical-grade material with certified purity levels, consistent granule size, and strong documentation have positioned themselves to serve both consumer health and oral care markets effectively.

Zinc citrate has been integrated into dietary supplements and cold remedy products due to its purported immune support and bioavailability advantages over other zinc salts. Formulations such as effervescent tablets and lozenges have included zinc citrate to deliver acceptable taste and patient compliance. In oral hygiene products, such as toothpaste and mouthwash, zinc citrate is being utilized for its plaque inhibition and enamel strengthening benefits. Adoption has been supported by consumer awareness of preventive health measures and by clinical literature suggesting benefits in zinc supplementation. As health regulatory bodies have emphasized micronutrient adequacy and preventive care, demand has been sustained in both the functional food and dental science sectors.

Use of zinc citrate has been limited by regulatory frameworks governing allowable daily zinc intake and labeling requirements, leading to compliance requirements that vary across regions. Overconsumption concerns have prompted upper limit restrictions that affect dosage formulation flexibility. Taste masking may be needed because high dosage levels can impart a metallic aftertaste in oral products, complicating consumer acceptance. Stability and solubility issues at high concentrations require careful formulation to avoid precipitation or reduced bioavailability. Supplier traceability and impurity documentation are essential to meet pharmacopeia standards, increasing cost and quality control burden. Smaller supplement brands may face challenges with certification and batch consistency due to resource constraints.

Strong opportunities are arising from incorporation of zinc citrate in dietary supplements due to its high bioavailability and immune support benefits. Expansion of functional beverage and gummy vitamin products has increased demand in the nutraceutical segment. Growth in oral care products such as toothpaste and mouthwash is being supported by zinc citrate’s anti‑plaque and anti calculus properties. Private label brands and health focused startups are introducing clean label formulations that leverage mineral fortification. Partnerships with contract manufacturers are enabling launch of novel zinc citrate ingredient blends. Emerging markets with rising health awareness and preventive healthcare strategies are creating new channels for zinc citrate based innovation and product diversification.

Current trends highlight growing preference for clean label ingredients with clear sourcing and transparency in labeling. Product developers are formulating multi-nutrient solutions by combining zinc citrate with vitamins and plant-based actives to enhance overall health benefits. Encapsulation technology is gaining traction to improve taste masking and solubility in liquid formats. Customized supplement packs featuring zinc citrate are expanding through e-commerce channels. Increased focus on scientific validation of claims and clinically tested formulations is influencing consumer trust. Digital health platforms recommending personalized mineral intake are creating new sales channels. Manufacturers are emphasizing high-purity grades and innovative delivery formats to differentiate in a competitive market landscape.

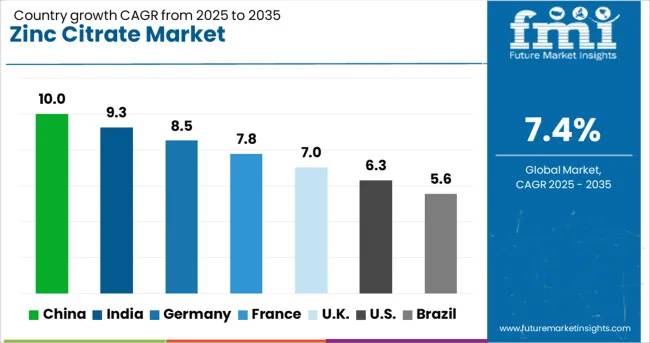

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

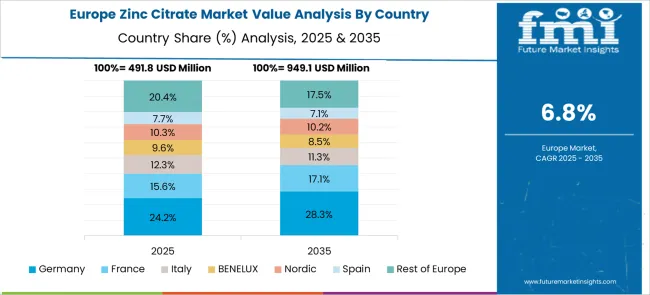

The global zinc citrate market is projected to grow at a 7.4% CAGR from 2025 to 2035, driven by rising demand in dietary supplements, fortified foods, and pharmaceutical formulations. China leads with 10.0%, supported by large-scale production and exports of nutraceutical-grade zinc compounds. India follows at 9.3%, fueled by zinc-based supplement adoption in preventive healthcare and food fortification programs. Among OECD nations, Germany records 8.5%, emphasizing clinical-grade purity and strict compliance with EU directives. France posts 7.8%, driven by the inclusion of zinc citrate in oral care formulations and functional foods. The UK, at 7.0%, is witnessing demand from premium supplement brands and pediatric nutrition. The analysis covers more than 40 countries, with the top five profiled below.

India is forecast to grow at a 9.3% CAGR, driven by its expanding nutraceutical and pharmaceutical sectors. Zinc citrate demand is increasing due to government-backed nutrition programs and rising consumer awareness about mineral deficiencies. Manufacturers are investing in high-purity production techniques for compliance with global pharmacopeia standards. Fortified food products, particularly in dairy and cereal categories, are boosting consumption. The use of zinc citrate in effervescent tablets and chewable formats is also gaining traction. Export opportunities are strengthening as Indian firms supply cost-competitive raw materials to Asian and African markets.

China is expected to grow at a 10.0% CAGR, leading the global zinc citrate market with large-scale production capacity. Strong domestic demand for fortified functional foods and zinc-based supplements underpins this growth. Government programs promoting child nutrition and immunity-building products further accelerate adoption. Chinese manufacturers are leveraging advanced processing technologies to deliver pharma-grade and food-grade zinc citrate for export markets. Expansion in oral care products, including zinc-based mouth rinses, is an emerging trend. Strategic partnerships between local producers and multinational nutraceutical brands are expanding international footprints.

Germany is projected to grow at an 8.5% CAGR, supported by robust demand in dietary supplements and pharmaceutical formulations. The zinc citrate market in Germany emphasizes stringent quality controls and adherence to EU health regulations. Consumer preference for clean-label and clinically validated supplements is driving the adoption of zinc citrate over other salts. Manufacturers are developing innovative delivery formats such as capsules, gummies, and effervescent tablets. The application of zinc citrate in oral health, particularly toothpaste for enamel strengthening, is expanding. Partnerships with healthcare professionals for product endorsements strengthen market credibility.

France is forecast to grow at a 7.8% CAGR, with increasing use of zinc citrate in oral care and fortified foods. The zinc citrate market in France benefits from its integration into toothpastes, mouth rinses, and sugar-free gums targeting oral hygiene. Functional food manufacturers are incorporating zinc citrate in breakfast cereals and dairy products to address mineral deficiencies. Dietary supplement brands emphasize premium-quality zinc citrate sourced from EU-certified facilities to maintain consumer trust. E-commerce platforms are playing a major role in expanding product visibility and offering personalized supplement bundles.

The UK is expected to grow at a 7.0% CAGR, driven by premium supplement brands and innovation in delivery formats. Zinc citrate demand is rising due to its inclusion in pediatric and geriatric nutrition products. Manufacturers are launching vegan and allergen-free zinc citrate formulations to cater to sensitive consumer segments. Growing interest in immune health post-pandemic continues to influence buying patterns. Regulatory compliance under the UK Medicines and Healthcare Products Regulatory Agency (MHRA) ensures high product quality. The rise of direct-to-consumer subscription models for customized supplement packs is reshaping distribution dynamics.

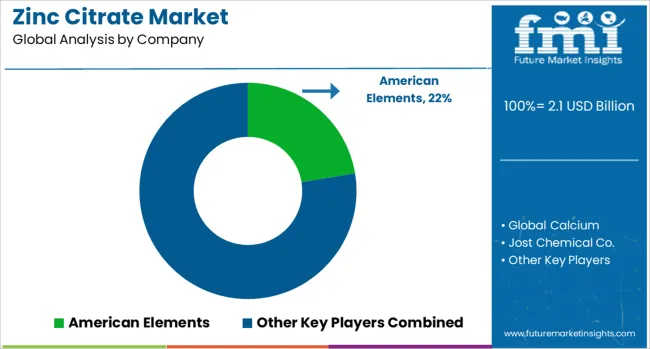

The zinc citrate market is moderately fragmented and driven by established chemical producers and specialized nutraceutical suppliers such as American Elements, Global Calcium, Jost Chemical Co., Seidler Chemical Co., Inc., NOAH Technologies Corporation, L.C. Industries, Inc., and Nutraceutix. These companies cater to key sectors including pharmaceuticals, dietary supplements, food fortification, and personal care, where zinc citrate is valued for its superior solubility, bioavailability, and functionality as a nutritional additive. Jost Chemical and Global Calcium lead in supplying high-purity zinc citrate that meets stringent USP, EP, and FCC standards, while American Elements and NOAH Technologies dominate industrial-grade segments, leveraging advanced processing capabilities for consistent quality. Nutraceutix focuses on microencapsulation and custom solutions to improve stability and absorption in functional food and supplement applications. Industry entry barriers are moderate due to complex chelation processes, certification requirements, and the necessity for strict quality compliance. According to Porter’s Five Forces, substitution risk remains low since zinc citrate provides distinct advantages over other zinc salts, although buyer power is increasing with demand for clean-label and traceable raw materials. Competitive strategies revolve around expanding product portfolios, investing in R&D for enhanced bioavailability, securing raw material supply through backward integration, and forming partnerships with global supplement brands. Future growth will be propelled by rising health awareness, increasing demand for immunity-boosting ingredients, and applications in oral care formulations. Performance metrics such as purity, particle size, dissolution rate, and regulatory adherence will define market leadership, favoring companies that combine innovation, operational efficiency, and strong distribution networks in this growing specialty ingredient market.

On December 11, 2024, Jost Chemical revised specifications for Zinc Citrate Dihydrate USP Low HM Powder (Code 2947), ensuring updated compliance with the latest quality and purity requirements for nutraceutical and pharmaceutical applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Product | Zinc Citrate Dihydrate, Zinc Citrate Trihydrate, and Others |

| Application | Dietary Supplements, Pharmaceuticals, Food & Beverages, Oral Care, Cosmetics & Personal Care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | American Elements, Global Calcium, Jost Chemical Co., Seidler Chemical Co., Inc., NOAH Technologies Corporation, L.C. Industries, Inc., and Nutraceutix |

| Additional Attributes | Dollar sales are segmented by product form (powder, granule, tablet), end-use sector (nutraceuticals, pharmaceuticals, food & beverage), and functionality (immune support, mineral supplementation, fortification). Global demand is driven by increasing health-conscious consumer behavior and supplementation trends. North America and Europe report strong uptake, while Asia‑Pacific is witnessing accelerated growth due to rising wellness markets. Innovation is focused on bioavailability enhancements, chelation techniques, microencapsulation for taste masking, and inclusion in clean-label functional blends. |

The global zinc citrate market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the zinc citrate market is projected to reach USD 4.3 billion by 2035.

The zinc citrate market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in zinc citrate market are zinc citrate dihydrate, zinc citrate trihydrate and others.

In terms of application, dietary supplements segment to command 37.9% share in the zinc citrate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zinc-tin Alloy Sputtering Target Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Block Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Market Forecast and Outlook 2025 to 2035

Zinc Oxide Sunscreens Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide for Sunscreens Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Zinc Acetate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Dialkyldithiophosphates Additive Market Size and Share Forecast Outlook 2025 to 2035

Zinc Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chloride Market Analysis - Size, Share, and Forecast 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Sulphate Market Size, Growth, and Forecast 2025 to 2035

Zinc Methionine Chelates Market - Growth & Demand 2025 to 2035

Zinc-Air Batteries Market Growth – Trends & Forecast 2023-2033

Nano Zinc Oxide Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Zinc Coatings Market Size and Share Forecast Outlook 2025 to 2035

Demand for Zinc-Tin Alloy Sputtering Target in UK Size and Share Forecast Outlook 2025 to 2035

Encapsulated Zinc Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Zinc Powder Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA