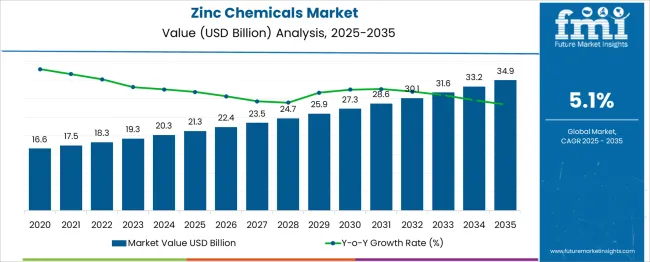

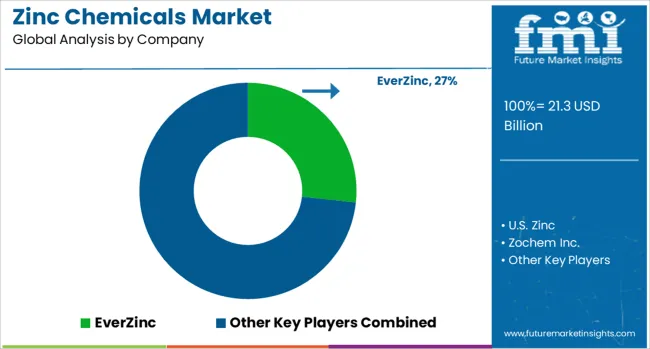

The Zinc Chemicals Market is estimated to be valued at USD 21.3 billion in 2025 and is projected to reach USD 34.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The absolute increase over the forecast period equals USD 13.6 billion, indicating strong demand driven by industrial applications such as galvanization, rubber compounding, agriculture, and paints and coatings. From 2021 to 2030, the market demonstrates a steady rise from USD 16.6 billion in 2021 to USD 25.9 billion in 2030, with annual growth values of USD 17.5 billion (2022), USD 18.3 billion (2023), USD 19.3 billion (2024), USD 20.3 billion (2025), USD 22.4 billion (2026), USD 23.5 billion (2027), USD 24.7 billion (2028), and USD 25.9 billion (2030).

This progression highlights consistent expansion supported by the essential role of zinc chemicals in anti-corrosion coatings for steel structures, which remain crucial for infrastructure and automotive sectors. Demand for zinc oxide in tire manufacturing and cosmetics continues to rise, while zinc sulfate is increasingly used in agriculture to correct soil micronutrient deficiencies. Industrial growth in Asia-Pacific and significant consumption in galvanization for construction materials reinforce overall market performance. Technological upgrades in processing and increased availability of high-purity zinc derivatives are improving efficiency and cost-effectiveness, enabling manufacturers to cater to expanding applications across construction, agriculture, and specialty chemicals. Growing trade volumes and strategic regional investments point toward a stable yet opportunity-rich market outlook through 2030 and beyond.

| Metric | Value |

|---|---|

| Zinc Chemicals Market Estimated Value in (2025 E) | USD 21.3 billion |

| Zinc Chemicals Market Forecast Value in (2035 F) | USD 34.9 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The market holds an estimated 14–16% share of the broader specialty chemicals sector in 2025, signifying its critical role across multiple industrial applications. Within the coatings and corrosion protection segment, zinc chemicals account for nearly 18%, driven by their indispensable use in galvanization processes for steel infrastructure and automotive parts. The rubber industry, particularly tire manufacturing, contributes significantly to demand, giving zinc chemicals approximately 12% share within rubber additives, fueled by increasing vehicle production and replacement cycles.

In agriculture, zinc sulfate occupies a prominent position among micronutrient fertilizers, pushing its share close to 20% in the agricultural micronutrients category, as soil health initiatives gain traction. This market’s influence extends to ceramics, glass, and cosmetics, where zinc oxide remains a preferred compound for its optical and UV-protection properties, solidifying its position in specialty materials.

The dominance of zinc-based anti-corrosion coatings for structural steel underpins sustained reliance from infrastructure and energy sectors. With emerging economies accelerating construction and galvanization activities, the share of zinc chemicals is set to expand within the industrial raw materials landscape. This strategic relevance reflects how zinc chemicals function not merely as supplementary inputs but as core performance enhancers, ensuring durability, operational safety, and productivity across diverse global industries.

The zinc chemicals market is experiencing notable growth, driven by rising applications across the rubber, agriculture, ceramics, and chemical processing industries. The market is benefiting from a steady rise in demand for vulcanization agents, UV protection additives, and catalysts, with zinc oxide and its derivatives finding broad utility in both industrial and specialty chemical production.

As environmental compliance and performance efficiency become critical across downstream sectors, zinc chemicals with tailored purity levels and reactivity are being favored in high-volume applications. The growth is being supported by increasing global investment in infrastructure, automotive production, and polymer manufacturing, where zinc-based additives improve product durability and processing stability.

The market is witnessing supply chain advancements in mining, recycling, and smelting technologies that ensure the consistent availability of refined zinc inputs. Over the coming years, the expansion of end-user industries, coupled with evolving regulatory standards and formulation innovations, is expected to accelerate the adoption of zinc chemicals across both developed and emerging economies.

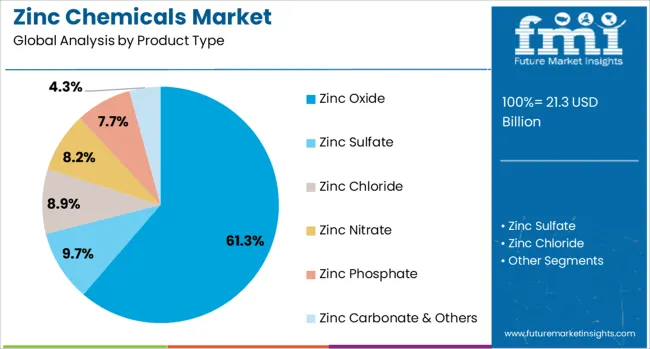

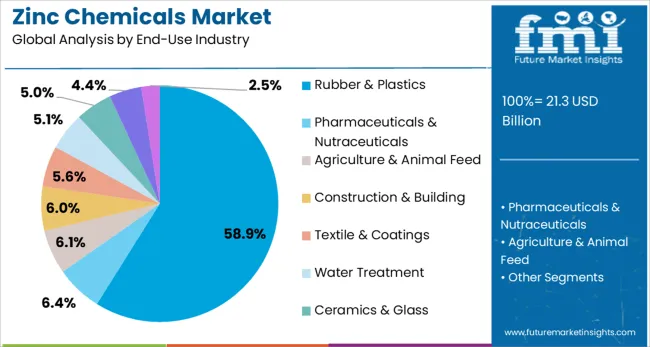

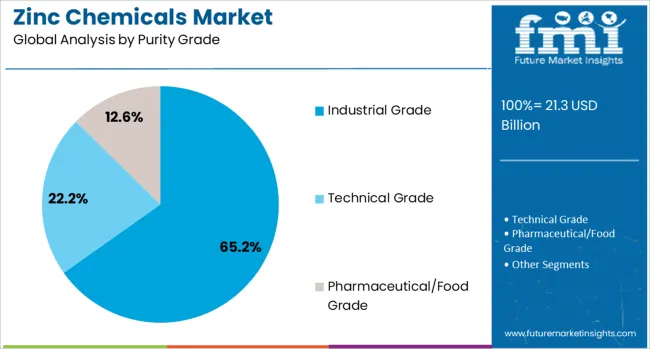

The zinc chemicals market is segmented by product type, end-use industry, purity grade, form, and geographic regions. The zinc chemicals market is divided by product type into Zinc Oxide, Zinc Sulfate, Zinc Chloride, Zinc Nitrate, Zinc Phosphate, and Zinc Carbonate & Others. The zinc chemicals market is classified by end-use industry into Rubber & Plastics, Pharmaceuticals & Nutraceuticals, Agriculture & Animal Feed, Construction & Building, Textile & Coatings, Water Treatment, Ceramics & Glass, Oil & Gas, and Others (electronics, cosmetics, etc.). Based on purity grade, the zinc chemicals market is segmented into Industrial Grade, Technical Grade, and Pharmaceutical/Food Grade. By form, the zinc chemicals market is segmented into Powder & Granules, Liquid Solutions, and Pellets & Flakes. Regionally, the zinc chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The zinc oxide segment is projected to account for 61.3% of the overall revenue share in the zinc chemicals market in 2025, reflecting its critical role across diverse manufacturing processes. This leading position is being driven by its high demand in rubber processing, particularly in tire and tube manufacturing, where it functions as a vulcanizing agent and heat stabilizer.

The segment’s dominance has also been supported by its application in ceramics, paints, and pharmaceuticals, where its antimicrobial and UV-blocking properties enhance product functionality. Technological advancements in micro and nano-grade zinc oxide production have further expanded its applicability in electronics and cosmetics, while maintaining cost efficiency in bulk industrial use.

The compound's compatibility with both organic and inorganic systems has allowed its integration into multiple formulations, making it a versatile material in complex industrial ecosystems. The sustained demand for performance-enhancing additives in rubber and plastic products has positioned zinc oxide as a core component of the zinc chemicals portfolio.

The rubber and plastics end-use segment is anticipated to hold 58.9% of the total revenue share in the zinc chemicals market in 2025, highlighting its foundational role in zinc-based compound utilization. This leadership is driven by the widespread usage of zinc compounds in tire manufacturing, footwear, industrial rubber goods, and polymer stabilization processes. Zinc oxide’s function as a reinforcing agent, thermal conductor, and curing accelerator has supported its extensive use in synthetic and natural rubber systems.

In the plastics industry, zinc chemicals contribute to enhanced UV resistance, flame retardancy, and longevity, which are vital in automotive, construction, and packaging applications. The global rise in vehicle production and urban infrastructure development has boosted the consumption of rubber-based components, thereby driving zinc chemical demand.

Moreover, efforts toward reducing carbon emissions and improving energy efficiency in automotive parts have further strengthened the role of zinc chemicals in advanced polymer applications. These ongoing industrial dynamics are expected to reinforce the segment’s leadership in the coming years.

The industrial grade purity segment is forecast to represent 65.2% of the zinc chemicals market revenue share in 2025, making it the most dominant grade across applications. The prevalence of this segment is attributed to its suitability for large-scale production in sectors such as rubber compounding, ceramics, glass manufacturing, and agriculture.

Industrial-grade zinc chemicals offer an optimal balance of cost and performance, allowing manufacturers to meet production volumes without compromising on essential chemical properties. Their ability to maintain structural integrity, thermal stability, and reactivity under diverse processing conditions has reinforced their adoption in heavy-duty formulations.

Additionally, the segment benefits from robust global supply chains and standardized regulatory approvals that streamline procurement and quality assurance for end users. As industrial manufacturing activities expand in emerging economies and environmental compliance becomes more stringent, the demand for consistent and high-volume industrial grade zinc chemicals is expected to grow further, solidifying its lead within the overall market landscape.

Zinc chemicals are increasingly used in coatings, rubber, agriculture, and plastics, ensuring durability and corrosion resistance across industries. Their adoption in pharmaceuticals and energy storage systems highlights expanding roles in healthcare and advanced battery technologies.

The demand for zinc chemicals has been observed in coatings and corrosion-resistant treatments across automotive and construction sectors. Zinc oxide is widely incorporated in rubber manufacturing for tire durability and heat resistance, while zinc sulfate continues to find acceptance in agricultural micronutrient formulations. Increased emphasis on crop quality has influenced fertilizer blending practices, where zinc-based compounds are regarded as essential for soil enrichment. The growing penetration of zinc stearate in plastic processing and PVC stabilization is notable. These chemicals have maintained relevance in industrial coatings, particularly for galvanizing solutions that enhance surface protection in harsh conditions. This scenario has strengthened the reliance on zinc derivatives across diverse material processing industries.

The pharmaceutical segment has demonstrated an increasing reliance on zinc chemicals for medicinal and nutritional formulations. Zinc oxide and zinc gluconate are recognized as critical components in dermatological creams, lozenges, and dietary supplements. Concurrently, the emerging application of zinc-based compounds in energy storage technologies is gaining prominence due to their role in advanced batteries and electrochemical systems. These applications are projected to create competitive differentiation for suppliers focusing on purity grades and controlled particle sizes. Strategic partnerships between producers and battery technology firms have been pursued to meet performance requirements in grid-scale and backup energy storage solutions. This trend has positioned zinc chemicals as integral components beyond their traditional industrial scope.

Zinc chemicals are widely used in protective coatings, making them vital for infrastructure, automotive, and industrial equipment manufacturing. The anti-corrosion properties of zinc-based coatings ensure longevity of steel components, driving significant demand from sectors requiring high structural reliability. Infrastructure projects, including bridges and rail networks, heavily depend on galvanized steel, further strengthening the position of zinc chemicals. In addition, their role in specialty pigments and catalysts is expanding, supporting performance enhancements in industrial processes. This consistent usage in critical applications ensures that zinc chemicals remain an integral part of industrial supply chains, offering manufacturers opportunities to target diverse end-use sectors with advanced formulations.

The energy sector’s focus on long-lasting infrastructure, including renewable energy installations, is fueling the consumption of zinc-based compounds for structural durability. Zinc oxide continues to play a major role in tire and rubber manufacturing, meeting rising demands from global automotive production and aftermarket services. Healthcare and personal care industries are adding growth momentum as zinc compounds find applications in ointments, sunscreens, and dietary supplements. These diverse applications, coupled with the shift toward high-quality derivatives, position zinc chemicals as a multi-industry necessity. Manufacturers are leveraging these trends by expanding production capacity and introducing tailored products designed for specific functional needs across global markets.

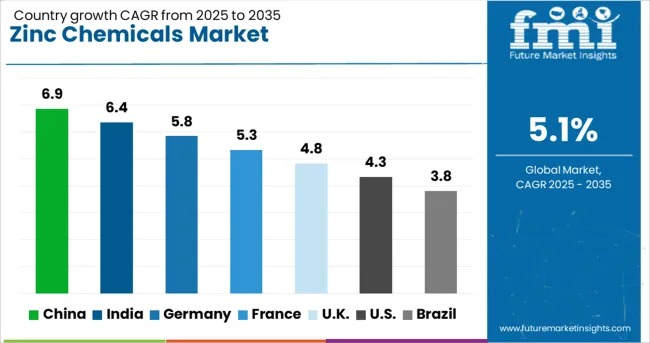

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The zinc chemicals industry, expected to grow at a global CAGR of 5.1% from 2025 to 2035, is witnessing different growth patterns across major economies. A 6.9% CAGR is being reported in China, a BRICS member, as the country expands its industrial coatings, automotive components, and fertilizer sectors. India, another BRICS member, is projected at 6.4%, driven by agricultural micronutrient usage and increasing consumption in rubber processing. Germany, part of the OECD, is observing a 5.8% CAGR supported by demand in advanced coatings and pharmaceutical formulations. Moderate expansion is being recorded in the United Kingdom, an OECD member, with a 4.8% CAGR due to consistent application in PVC stabilization and corrosion prevention. The United States, another OECD member, is expected to maintain a 4.3% CAGR, backed by niche applications in healthcare products and energy storage technologies. These dynamics emphasize Asia-Pacific’s role as a growth hub, while OECD economies maintain steady yet lower expansion. The report includes a detailed evaluation of 40+ countries, with the top five highlighted as key references.

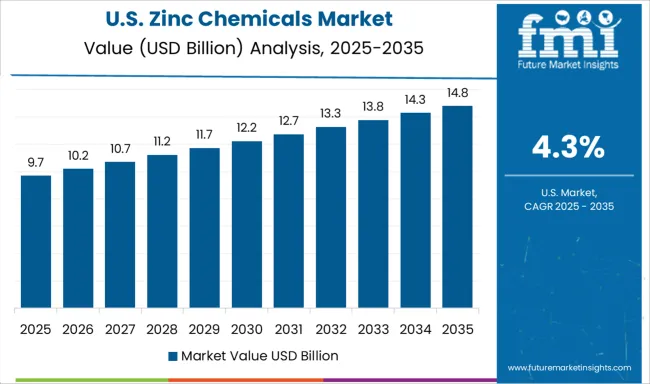

The CAGR for the zinc chemicals market in the United States increased from about 3.2% during 2020–2024 to 4.3% for 2025–2035, indicating renewed momentum driven by selective high-value applications. Earlier growth was restricted due to mature industrial segments and slow adoption of micronutrient-enriched fertilizers. The improvement after 2025 has been attributed to the rising contribution from pharmaceutical-grade zinc oxide and gluconate in dermatology and nutraceuticals. Strategic interest in energy storage applications supported by zinc-based batteries has added incremental demand from grid stability projects. This pattern signifies a transition from conventional consumption in galvanizing and rubber processing to advanced functional uses, positioning the USA market as niche-driven rather than volume-led.

The CAGR in the United Kingdom rose from 3.5% during 2020–2024 to 4.8% across 2025–2035, marking a noticeable improvement despite the country’s mature manufacturing sector. Initial growth was modest because of declining output in traditional rubber and plastic processing. The acceleration after 2025 has been supported by energy transition strategies, where zinc compounds were incorporated into anti-corrosion coatings for offshore wind structures. Pharmaceutical adoption of zinc-based excipients within dermatology and supplement categories has reinforced value growth. This trajectory of strategic diversification is in application areas beyond automotive and construction. The emphasis on high-performance formulations for coatings is expected to keep UK demand stable within premium segments.

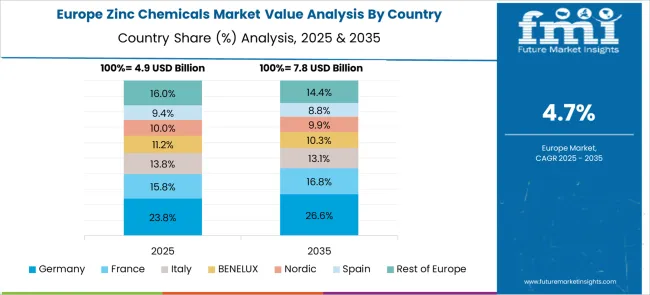

Germany registered a CAGR increase from 4.6% in 2020–2024 to 5.8% for 2025–2035, supported by advances in specialty coatings and structured adoption in healthcare sectors. Earlier growth was limited by production costs and dependency on imported raw materials. Post-2025, regulatory emphasis on quality standards in pharmaceuticals enabled greater utilization of zinc gluconate and zinc oxide in topical and oral formulations. Simultaneously, galvanizing applications in industrial machinery and structural components maintained steady momentum, driven by the need for superior corrosion protection. The German market demonstrates a preference for high-purity grades and customized blends, reflecting a clear shift toward value-oriented demand.

China’s CAGR advanced from 5.4% during 2020–2024 to 6.9% across 2025–2035, highlighting its role as the largest growth contributor globally. Initial expansion was driven by automotive coatings and rapid infrastructure-related galvanizing needs. After 2025, incremental demand emerged from agricultural micronutrient formulations as crop quality initiatives scaled nationwide. Strong adoption of zinc stearate in polymer processing has improved cost efficiency for domestic manufacturers, reinforcing the competitive edge. The integration of zinc-based chemicals into next-generation energy storage solutions has become an emerging driver, with China’s long-term industrial strategies in advanced battery deployment and renewable energy systems.

India’s CAGR rose from 4.8% during 2020–2024 to 6.4% for 2025–2035, signaling significant upward momentum compared to global averages. Early growth was hindered by cost-sensitive market conditions and uneven distribution networks for specialty chemicals. Post-2025, demand accelerated with intensified micronutrient integration in agriculture, driven by soil enrichment programs. The Indian market has shown rising consumption of zinc sulfate and zinc oxide in rubber compounding, with expanding automotive production. Pharmaceutical and nutraceutical applications have also gained traction, contributing to value-added demand. Investment in local manufacturing clusters and policy-driven incentives for specialty chemical production are expected to keep India among the fastest-growing destinations.

In the zinc chemicals market, leading companies are reinforcing their positions through innovation, capacity enhancement, and regional expansion strategies. EverZinc focuses on performance-grade zinc oxide tailored for coatings, energy storage systems, and pharmaceutical applications. Its emphasis on specialized formulations positions the company strongly in premium segments where purity and consistency are critical. USA Zinc operates with a strategic focus on recycling-based supply models, which ensures a sustainable and cost-efficient approach to meeting growing demand. By reducing dependency on mined ore, the company strengthens its ability to serve galvanization, rubber compounding, and industrial coatings markets while maintaining competitive pricing.

Zochem Inc. and Zinc Oxide LLC dominate North America by prioritizing high-quality zinc oxide production for automotive rubber, tire manufacturing, and healthcare sectors. Both companies have invested in advanced processing technologies to ensure uniform particle sizing, supporting strict quality standards required for medical-grade and specialty chemical applications. Weifang Longda Zinc Industry Co., Ltd. has adopted an aggressive expansion plan in Asia, targeting demand from polymer stabilizers, ceramics, and agricultural micronutrient blends. Its strategy combines competitive pricing with a broad portfolio to capture growth in developing economies. Across these players, technological optimization and strategic collaborations remain central to achieving long-term market leadership, ensuring consistent supply for critical industrial applications.

In April 2025, Zochem Inc./Zochem ULC launched ultra-fine zinc oxide for pharma and personal care.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.3 Billion |

| Product Type | Zinc Oxide, Zinc Sulfate, Zinc Chloride, Zinc Nitrate, Zinc Phosphate, and Zinc Carbonate & Others |

| End-Use Industry | Rubber & Plastics, Pharmaceuticals & Nutraceuticals, Agriculture & Animal Feed, Construction & Building, Textile & Coatings, Water Treatment, Ceramics & Glass, Oil & Gas, and Others (electronics, cosmetics, etc.) |

| Purity Grade | Industrial Grade, Technical Grade, and Pharmaceutical/Food Grade |

| Form | Powder & Granules, Liquid Solutions, and Pellets & Flakes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | EverZinc, USA Zinc, Zochem Inc., Zinc Oxide LLC, and Weifang Longda Zinc Industry Co., Ltd. |

| Additional Attributes | Dollar sales, share by product type, regional demand patterns, application-wise consumption, competitive landscape, pricing trends, capacity expansions, regulatory impact, and growth opportunities in coatings, agriculture, and energy storage segments. |

The global zinc chemicals market is estimated to be valued at USD 21.3 billion in 2025.

The market size for the zinc chemicals market is projected to reach USD 34.9 billion by 2035.

The zinc chemicals market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in zinc chemicals market are zinc oxide, zinc sulfate, zinc chloride, zinc nitrate, zinc phosphate and zinc carbonate & others.

In terms of end-use industry, rubber & plastics segment to command 58.9% share in the zinc chemicals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

Zinc-tin Alloy Sputtering Target Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Block Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Market Forecast and Outlook 2025 to 2035

Zinc Oxide Sunscreens Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide for Sunscreens Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Zinc Acetate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Dialkyldithiophosphates Additive Market Size and Share Forecast Outlook 2025 to 2035

Zinc Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chloride Market Analysis - Size, Share, and Forecast 2025 to 2035

Zinc Citrate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Sulphate Market Size, Growth, and Forecast 2025 to 2035

Zinc Methionine Chelates Market - Growth & Demand 2025 to 2035

Zinc-Air Batteries Market Growth – Trends & Forecast 2023-2033

Nano Zinc Oxide Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Zinc Coatings Market Size and Share Forecast Outlook 2025 to 2035

Demand for Zinc-Tin Alloy Sputtering Target in UK Size and Share Forecast Outlook 2025 to 2035

Encapsulated Zinc Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Zinc Powder Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA