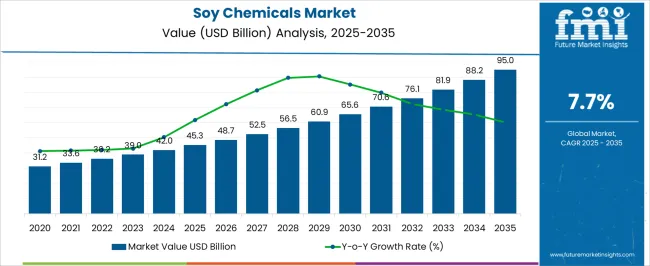

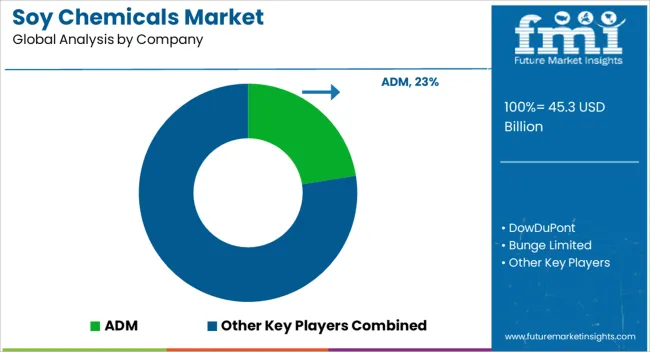

The soy chemicals market is projected to grow from USD 45.3 billion in 2025 to USD 95.0 billion by 2035, expanding at a CAGR of 7.7% over the forecast period. This doubling in value reflects accelerating demand for bio-based alternatives in plastics, lubricants, coatings, adhesives, and personal care industries.

Between 2025 and 2030, the market is expected to rise from USD 45.3 billion to around USD 65.6 billion, driven by increasing awareness of sustainability, favorable regulatory frameworks for renewable feedstocks, and the competitive pricing of soy-based derivatives compared to petroleum-based products.

From 2031 to 2035, the market will further expand from USD 70.9 billion to USD 95.0 billion, with growth propelled by technological advancements in soy processing, improved yield efficiencies, and penetration into high-value applications such as biodegradable plastics, green solvents, and bio-based surfactants.

| Metric | Value |

|---|---|

| Soy Chemicals Market Estimated Value in (2025 E) | USD 45.3 billion |

| Soy Chemicals Market Forecast Value in (2035 F) | USD 95.0 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The soy chemicals market is witnessing steady expansion driven by the shift toward plant-based, biodegradable alternatives across industrial and consumer applications. Rising concerns over environmental sustainability, along with regulatory restrictions on petrochemical-based substances, have encouraged widespread adoption of soy-derived chemicals.

Industries such as coatings, adhesives, personal care, and plastics are actively transitioning to renewable feedstocks to align with carbon reduction goals. The scalability of soybean cultivation, especially in North America and parts of Asia-Pacific, has ensured stable raw material availability, reinforcing confidence in long-term supply chains.

Ongoing investments in bio-refining technologies and product innovation are supporting diversification of applications and performance characteristics of soy-based inputs. As circular economy models gain traction, soy chemicals are expected to play an increasingly strategic role in supporting material circularity and industrial decarbonization objectives.

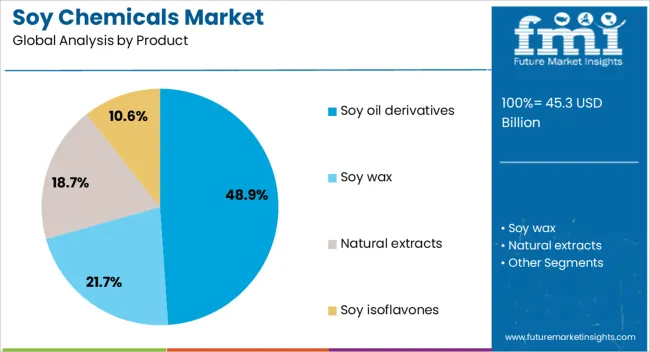

The soy chemicals market is segmented by product and geographic regions. By product, the market is divided into Soy Oil Derivatives, Soy Wax, Natural Extracts, and Soy Isoflavones. Regionally, the soy chemicals industry is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Soy oil derivatives are projected to account for 48.90% of the total soy chemicals market revenue in 2025, making them the leading product category. This dominance is being driven by their versatility, renewable sourcing, and compatibility with a wide range of downstream applications.

These derivatives are widely used in the production of bio-lubricants, inks, surfactants, and coatings, where their non-toxic and biodegradable nature meets evolving regulatory and consumer expectations. Technological advancements in oil processing have enhanced purity and functional consistency, enabling broader industrial adoption.

Additionally, strong export potential, particularly in regions emphasizing green procurement, has supported large-scale investments in soy oil derivative production. With increased pressure to reduce reliance on fossil-derived inputs, soy oil derivatives are expected to maintain their lead as preferred bio-based alternatives across multiple sectors.

Soy chemicals are expanding across biodiesel, polymers, surfactants, and processing innovations. Strong raw material availability and industrial adoption trends are ensuring sustained growth across multiple downstream industries.

The adoption of soy chemicals in biodiesel and bio-lubricants has accelerated due to their renewable origin, cost stability, and performance efficiency. Biodiesel derived from soy methyl esters provides cleaner combustion, reducing emissions while meeting industry fuel standards. In bio-lubricants, soy oil offers excellent lubricity, oxidative stability, and biodegradability, making it a preferred choice in applications such as marine engines, industrial gear systems, and agricultural equipment. Strategic government blending mandates, especially in transport fuel, and the shift of industrial operators toward environmentally acceptable lubricants have strengthened demand. The presence of integrated processing facilities in soybean-producing regions ensures consistent raw material supply. Advancements in transesterification techniques are improving production yields, further supporting industrial adoption across multiple energy and mechanical sectors.

Soy-based polyols and epoxidized soybean oil (ESO) have gained prominence as essential feedstocks in polymer and resin production. These derivatives serve as plasticizers, stabilizers, and cross-linking agents, offering flexibility, durability, and chemical resistance in end products. Industries manufacturing coatings, sealants, and flexible PVC components increasingly favor soy chemistry due to its performance compatibility and cost advantages over petroleum-based inputs. Automotive, construction, and packaging sectors are incorporating soy derivatives in insulation foams, interior components, and protective coatings. Technical refinements have improved polymer integration, enhancing product quality while meeting compliance standards. With continuous innovation in formulation chemistry, soy chemicals are positioned to capture greater value within the materials industry by enabling durable and versatile product designs.

Soy chemicals have carved a significant space in surfactant manufacturing, supplying fatty acid derivatives and glycerol for detergents, emulsifiers, and cleaners. Their ability to provide excellent foaming, emulsifying, and wetting properties makes them suitable for both household and industrial cleaning solutions. Personal care brands are integrating soy-derived surfactants for gentle yet effective formulations, appealing to consumers seeking plant-based ingredients. The industrial cleaning sector benefits from their performance under varying pH conditions and compatibility with other functional additives. Innovations in fractionation and esterification processes have enhanced functional stability, expanding usage into high-performance formulations. With expanding detergent production in emerging economies, the role of soy-based surfactants continues to strengthen in both consumer and institutional product segments.

The soy chemicals industry has benefited from advancements in extraction, refining, and chemical modification processes. Solvent extraction efficiency improvements and enzymatic conversion methods have elevated yield and purity, enhancing economic viability. By-products such as lecithin and soy protein are being valorized, creating additional revenue streams for producers. Industry participants are leveraging integrated supply chains, from soybean cultivation to chemical conversion, to maintain cost competitiveness and supply reliability. Strategic partnerships between agricultural cooperatives and chemical manufacturers are accelerating capacity expansion. With stronger feedstock security and processing capabilities, soy chemicals are positioned to meet growing multi-sector demand. Continuous focus on feedstock optimization and waste minimization has reinforced their standing in global bio-based chemical markets.

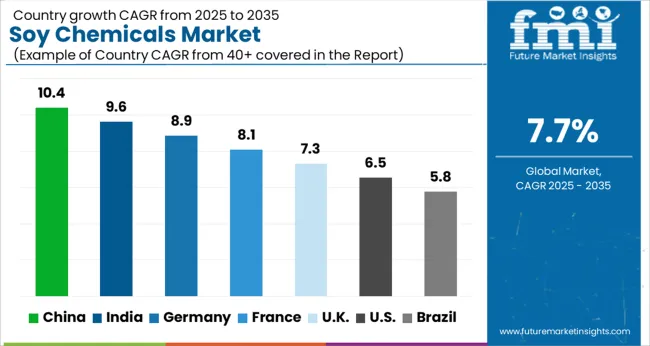

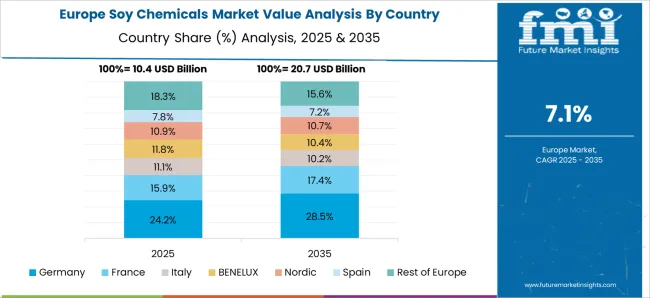

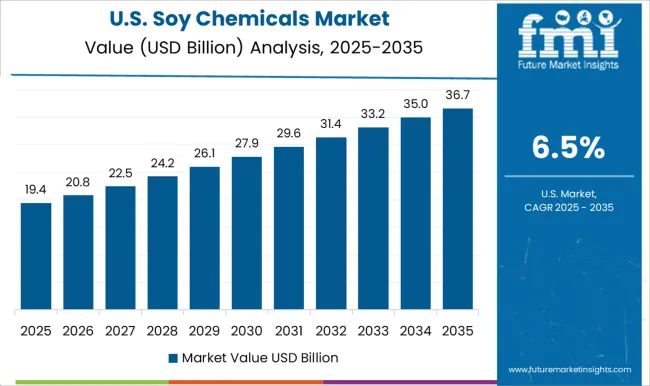

The soy chemicals industry is forecast to expand at a global CAGR of 7.7% between 2025 and 2035, supported by increasing integration into biodiesel, surfactants, polymers, and industrial lubricants. China leads with a CAGR of 10.4%, driven by large-scale biodiesel blending programs, industrial lubricant adoption, and extensive capacity in soy processing facilities. India follows at 9.6%, benefiting from strong agricultural feedstock availability, growing surfactant demand in home care, and increased use of soy polyols in automotive and construction materials. France grows at 8.1%, influenced by resin, coatings, and detergent sectors, while the United Kingdom at 7.3% and the United States at 6.5% focus on specialized, compliance-driven uses in lubricants and cleaning products. These countries form strategic benchmarks for capacity planning, feedstock optimization, and distribution network expansion within a competitive bio-based chemicals landscape.

China is forecasted to achieve a CAGR of 10.4% for 2025–2035, higher than the approximately 9.2% observed between 2020–2024. The improvement is supported by expanding biodiesel blending mandates, rapid detergent production growth, and increasing use of soy polyols in polyurethane applications. Strong feedstock processing capacity and competitive production costs keep China well-positioned in global trade. Industrial lubricants have steadily adopted soy-based esters for enhanced performance and biodegradability. The role of soy chemicals in PVC cable insulation and flexible foams has strengthened due to consistent quality output. With processing hubs located near major ports, China benefits from efficient supply chains that sustain high-volume exports and domestic consumption.

India is projected to record a CAGR of 9.6% for 2025–2035, higher than the approximately 8.4% achieved between 2020–2024. The acceleration is linked to increased detergent manufacturing, growing biodiesel blending targets, and wider adoption of soy derivatives in adhesives and coatings. Local feedstock availability and improved solvent extraction efficiency support consistent supply. The packaging industry has incorporated soy inks, while automotive and construction have embraced soy polyols for foams and insulation. With expanding cold-chain infrastructure and improved supply logistics, industrial users have increased reliance on soy chemistry. India’s cost competitiveness and expanding processing capabilities provide a strong platform for further market penetration across multiple end-use sectors.

France is estimated to deliver a CAGR of 8.1% for 2025–2035, up from approximately 7.0% during 2020–2024. This improvement comes from rising demand in coatings, sealants, and resin formulations where soy polyols and epoxidized soybean oil deliver performance and compliance benefits. Household and institutional cleaning sectors have expanded the use of soy-based surfactants for mild yet effective formulations. Automotive and appliance manufacturers have incorporated soy foams for insulation and comfort applications. Local producers collaborate with OEMs to optimize product characteristics for processing consistency. France’s market trajectory reflects a balance of specialty performance applications and regulatory-compliant formulations that sustain long-term adoption of soy chemistry.

The UK is expected to achieve a CAGR of 7.3% for 2025–2035, compared to about 6.1% recorded during 2020–2024. The uplift is attributed to broader plant-based surfactant adoption in detergents, increased soy polyol approvals in polyurethane manufacturing, and stable logistics following supply disruptions. Industrial lubricants and cleaning products have also strengthened soy derivative usage. Improved yields in epoxidation and transesterification have enhanced cost efficiency, supporting expanded market coverage. The UK’s shift toward compliance-friendly, bio-based inputs is encouraging greater investment in application-specific soy formulations, positioning it for consistent mid-term growth.

The USA is projected to grow at a CAGR of 6.5% for 2025–2035, higher than the approximately 5.8% seen between 2020–2024. Gains are driven by steady adoption of soy-based lubricants in industrial and municipal fleets, expansion of plant-based cleaning lines, and integration of soy polyols into bedding and furniture foams. Flexible PVC manufacturers have maintained demand for epoxidized soybean oil as a stabilizer and partial plasticizer. Domestic soy availability ensures secure feedstock supply, while technical support from chemical blenders promotes customized product adoption. The USA market maintains a quality-driven growth pattern supported by diversified industrial applications.

Prominent players include ADM, DowDuPont, and Bunge Limited, each recognized for extensive processing capabilities, diversified soy derivative portfolios, and global supply chain integration. Cargill has maintained a competitive edge through large-scale crushing operations, application-specific product development, and targeted expansion in biodiesel, epoxidized soybean oil, and soy polyol markets. Ag Processing Inc. (AGP) leverages cooperative-based ownership to secure consistent feedstock sourcing and offers a broad range of refined soy products to domestic and export markets.

These companies differentiate themselves through processing efficiency, technical innovation in formulation chemistry, and the ability to deliver consistent quality for industrial and consumer-facing applications. Global expansion strategies include investment in high-capacity crushing facilities, optimization of transesterification and epoxidation processes, and partnerships with end-users in automotive, construction, packaging, and home care sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product | Soy oil derivatives, Soy wax, Natural extracts, and Soy isoflavones |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ADM, DowDuPont, Bunge Limited, Cargill, Ag Processing Inc. (AGP) |

| Additional Attributes | Dollar sales, share, growth rate by region, end-use segment performance, competitive landscape, pricing trends, raw material cost analysis, regulatory impact, trade flows, capacity expansions, product innovation pipeline, distribution channels. |

The global soy chemicals market is estimated to be valued at USD 45.3 billion in 2025.

The market size for the soy chemicals market is projected to reach USD 95.0 billion by 2035.

The soy chemicals market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in soy chemicals market are soy oil derivatives, soy wax, natural extracts and soy isoflavones.

In terms of , segment to command 0.0% share in the soy chemicals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soybean Enzymatic Protein Market Size and Share Forecast Outlook 2025 to 2035

Soy-based Chemical Market Size and Share Forecast Outlook 2025 to 2035

Soy Lecithin Market Size and Share Forecast Outlook 2025 to 2035

Soy Protein Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Soy Protein Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Soy Nuts Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Soybean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Soy-Based Meat Alternative Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy-based Food Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Soybean Meal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy Isoflavones Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy Protein Isolate Market Size, Growth, and Forecast 2025 to 2035

Soy Food Products Market Analysis by food, beverages, oils and product type Through 2035 food, beverages, oils and product type

Soy Milk Market Analysis by Product Type, Category, Application, Distribution Channel and Region Through 2035

Soy Beverage Market Analysis by Product Type, Flavor, and Distribution Channel Through 2035

Soy Protein Concentrate Market Growth - Plant-Based Protein & Industry Expansion 2024 to 2034

Soy Polysaccharides Market

Soy Hydrolysates Market

Soybean Oil Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA