The Soy Protein Ingredient Market is estimated to be valued at USD 11.6 billion in 2025 and is projected to reach USD 18.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Soy Protein Ingredient Market Estimated Value in (2025 E) | USD 11.6 billion |

| Soy Protein Ingredient Market Forecast Value in (2035 F) | USD 18.1 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The soy protein ingredient market is experiencing strong growth, driven by increasing consumer preference for plant-based nutrition and protein-rich dietary options. Rising awareness regarding health benefits associated with soy protein, including cholesterol reduction, muscle maintenance, and overall wellness, is shaping demand in both developed and emerging markets. Expanding applications across food and beverage sectors, including nutritional bars, dairy alternatives, and beverages, are providing avenues for market expansion.

Technological advancements in protein extraction and formulation are enhancing solubility, digestibility, and functional performance, making soy protein suitable for diverse applications. The growing adoption of clean label and allergen-free products is further promoting the use of soy protein ingredients.

Increasing investment in plant-based protein research and rising awareness about sustainable protein sources are also contributing to market growth As consumers increasingly seek healthier and environmentally sustainable diets, the market for soy protein ingredients is expected to expand steadily, supported by innovation in processing techniques and product development that cater to evolving dietary preferences and functional food requirements.

The soy protein ingredient market is segmented by product type, form, end use, and geographic regions. By product type, soy protein ingredient market is divided into Soy Isolates, Soy Concentrates, and Textured Soy Protein. In terms of form, soy protein ingredient market is classified into Powder and Liquid. Based on end use, soy protein ingredient market is segmented into Food & Beverages, Foodservice (Horeca), Beverages, Others (Infant Formula, Sports Nutrition), Pharmaceuticals, and Cosmetic & Personal Care. Regionally, the soy protein ingredient industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The soy isolates segment is projected to hold 48.2% of the soy protein ingredient market revenue share in 2025, establishing itself as the leading product type. This leadership is being driven by its high protein content, low fat and carbohydrate composition, and superior functionality compared to other soy protein forms. Soy isolates provide excellent emulsifying and gelling properties, making them highly suitable for application in a wide range of food and beverage products.

The segment is supported by increasing consumer demand for protein-enriched diets, particularly in health-conscious and fitness-focused populations. Enhanced solubility and neutral flavor profile allow easier incorporation into beverages, bakery items, and nutrition bars.

Additionally, the ability to meet dietary and regulatory standards in multiple regions has further strengthened adoption Growing awareness regarding plant-based protein benefits and the increasing need for high-quality protein sources in processed foods are expected to sustain the growth of soy isolates as the dominant product type in the market.

The powder form segment is anticipated to capture 62.8% of the soy protein ingredient market revenue share in 2025, making it the leading form segment. Its prominence is being driven by versatility in formulation, ease of handling, longer shelf life, and stability across various storage and processing conditions.

Powders can be easily integrated into beverages, bakery products, and protein supplements without affecting taste or texture, supporting their widespread adoption in food and beverage manufacturing. The segment benefits from increased demand for plant-based protein in ready-to-drink products, meal replacements, and functional foods where solubility and consistency are critical.

Technological advancements in drying, micronization, and functional enhancement of powders are improving dispersibility and nutritional performance, encouraging manufacturers to adopt this form Powdered soy protein is also favored for large-scale production due to reduced transportation and storage costs, further reinforcing its position as the preferred form in the global soy protein ingredient market.

The food and beverages end use segment is expected to account for 29.8% of the soy protein ingredient market revenue share in 2025, positioning it as the leading end-use industry. This segment is being driven by the increasing inclusion of soy protein in beverages, dairy alternatives, nutrition bars, bakery products, and meal replacements. Rising consumer interest in functional foods that promote wellness, weight management, and muscle health has created strong demand in this sector.

The segment benefits from manufacturers focusing on product innovation and fortification to meet nutritional standards while addressing taste, texture, and solubility requirements. Growing vegan and flexitarian populations are accelerating adoption of soy protein-enriched food and beverage products.

Additionally, favorable regulatory policies supporting plant-based proteins in multiple regions are further enhancing utilization Continuous product development and incorporation of soy protein in mainstream food and beverage items are expected to reinforce the dominance of this end-use segment and drive long-term market expansion.

The Soy Protein Ingredient market is valued at USD 10.2 Billion in 2025 and is projected to grow at a CAGR of 4.5% during the forecast period, to reach a value of USD 15.9 Billion by 2035. Newly released data from Future Market Insights market analysis shows that global Soy Protein Ingredient demand is projected to grow year-on-year (Y-o-Y) growth of 3.7% in 2025.

| Attributes | Details |

|---|---|

| Market Size Value in 2025 | USD 10.2 Billion |

| Market Forecast Value in 2035 | USD 15.9 Billion |

| Global Growth Rate (2025 to 2035) | 4.5% CAGR |

| Forecast Period | 2025 to 2035 |

| Collective Value Share: Top 3 Countries (2025A) | 39.4% |

The global soy protein industry is expanding as a result of consumers switching from animal to plant-based proteins. Organic food ingredients used in food processing include soy protein, they are made from soybean meal that has been hulled and defatted. Defatted and dehulled soybean is frequently processed into soy flours, soy protein isolates, and soy protein concentrates, three types of high-grade proteins.

Due to its organic makeup, soy protein ingredients frequently replace animal protein in food products sold around the world. Minerals like fiber, calcium, iron, potassium, magnesium and vitamin B are all abundant in soy proteins, Protein content is also high in soy proteins. As a result, they can offer all the essential amino acids required for the body's growth and development.

Additionally, due to increased awareness of the negative effects of consuming animal protein, consumers are likewise increasing their consumption of plant-based products. Adults typically find animal protein to be less healthy, which has caused consumers to turn to plant-based foods.

The market grew with a CAGR of 4.1% between 2025 to 21 as no age group is excluded from the health advantages of soy protein ingestion. Comparing soy protein to animal proteins reveals that it is both inexpensive and secure. Another benefit for the global soy protein ingredients market is the longest shelf life of products made of plant matter. Contrary to animal-based products, which frequently degrade if improperly stored or not used within a certain time frame, plant-based ingredients rarely deteriorate.

Ingredients derived from soy protein are thought to be beneficial for those with obesity-related illnesses such as inflammation and fatty liver disease. The market is expected to experience a significant increase due to the rising incidence of obesity and the link between fatty liver disease and certain life-threatening illnesses like cardiovascular disease. Consumer interest in plant-based proteins and the growing trend toward healthier meals will keep opening up new business options.

Over the past few years, there has been a significant shift toward vegetarianism, which has boosted the demand for soy protein ingredients. Regarding animal welfare, consumers are getting increasingly concerned. The setting and circumstances in which people are born and raised are becoming more and more conscious. One of the main factors influencing consumer preference for plant-based goods like soy protein components is a concern for animal welfare. Additionally, many consumers are experiencing allergies and dietary intolerances, which has increased the demand for plant-based substitutes like soy protein ingredients.

North America is expected to continue to be one of the most lucrative markets during the forecast period, according to FMI. One of the major drivers of growth in the area is the high level of purchasing power.

Additionally, the USA is one of the largest marketplaces in the world, which makes it a valuable market for soy protein Ingredient manufacturers. The United States will control 88.8% of the North American market in 2025, according to the FMI.

Besides high spending power, awareness regarding the prevalence of chronic ailments has been pushing USA consumers towards a healthy lifestyle. This is expected to present lucrative opportunities for soy protein ingredient sales in the country.

During the forecast period, the UK soy protein ingredient market is anticipated to expand at a 5.1% CAGR (2025 to 2035). The growing research demonstrating soy protein's multiple health advantages over animal proteins is helping to fuel market expansion. Consumers in the United Kingdom are becoming more and more aware of the advantages of a plant-based diet, which is opening up new market expansion prospects.

Additionally, during the next five years, it is anticipated that sales of beef alternatives would rise by 25% in the United Kingdom alone. The trend of vegetarianism becoming more popular as a lifestyle option is spreading throughout Europe.

According to FMI, one of the biggest markets for soy protein components is the United Kingdom. Increasing healthcare spending is one of the main reasons for this increase. The Office for National Statistics in the UK estimates that 10% of the nation's Gross Domestic Product (GDP) was spent on healthcare in 2025. Moreover, the UK is projected to offer enticing chances for market expansion as attention on healthcare is expected to grow.

Due to its rapid, convenient, and simple solubility and discernibility in any liquid type, such as milk, water, etc., the dry form segment commands the highest part of the market for soy protein ingredients. As a result, the market for soy protein ingredients in dry form is seeing exponential growth due to the growing demand for handy products around the world. Additionally, a rise in the demand for goods with added protein is driving up the price of soy protein ingredients globally.

One of the industries that are expanding globally is the bakery and confectionery market. By using soy protein elements, a range of protein ingredients is being developed, including salami, tofu, cheese, beverages, and infant formula.

Additionally, consuming soy food items has several health benefits, including avoiding obesity and regulating blood sugar levels, thus the end usage of soy protein isolate in bakeries and confectionary is anticipated to increase rapidly.

Businesses in the soy protein isolate market are focusing on strategic mergers and acquisitions. Entering the fastest-growing markets is a major trend for both present businesses and private and financial investors. For instance, Cargill Inc., a privately held American multinational food company with headquarters in Minnetonka, Minnesota, and a Delaware incorporation Together with Quantified Ventures and Iowa Soya, Cargill formed a collaboration.

Due to the lack of reports of supply-demand shortages in recent years, businesses are concentrating on boosting the output capacity of manufacturing facilities in addition to their merger and acquisition strategies.

| Attribute | Details |

|---|---|

| Market Size Value in 2025 | USD 10.2 Billion |

| Market Forecast Value in 2035 | USD 15.9 Billion |

| Global Growth Rate | 4.5% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2025 to 2025 |

| Market Analysis | MT for Volume and USD Billion for Value |

| Key Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Argentina, Chile, Peru, Germany, France, Italy, Spain, UK, Netherlands, Belgium, Nordic, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Singapore, Australia, New Zealand, GCC Countries, South Africa, Central Africa, North Africa, and others |

| Key Market Segments Covered | Product Type, Form, End-Use Application |

| Key Companies Profiled |

|

| Pricing | Available upon Request |

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

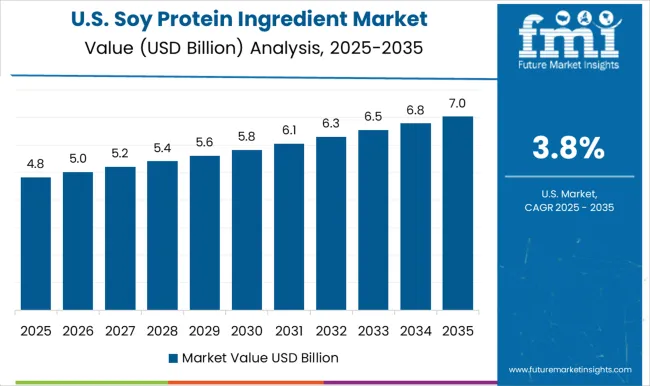

| USA | 3.8% |

| Brazil | 3.4% |

The Soy Protein Ingredient Market is expected to register a CAGR of 4.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.1%, followed by India at 5.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.4%, yet still underscores a broadly positive trajectory for the global Soy Protein Ingredient Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.2%. The USA Soy Protein Ingredient Market is estimated to be valued at USD 4.3 billion in 2025 and is anticipated to reach a valuation of USD 6.2 billion by 2035. Sales are projected to rise at a CAGR of 3.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 592.5 million and USD 386.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.6 Billion |

| Product Type | Soy Isolates, Soy Concentrates, and Textured Soy Protein |

| Form | Powder and Liquid |

| End Use | Food & Beverages, Foodservice (Horeca), Beverages, Others (Infant Formula, Sports Nutrition), Pharmaceuticals, and Cosmetic & Personal Care |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer Daniels Midland (ADM) Company, Dean Foods Company, Armor Proteins, Gelita Group, Bunge Alimentos SA, Kerry Ingredients Inc., Burcon NutraScience, Cargill Health & Food Technologies, E. I. du Pont de Nemours and Company, Kellogg Company, Doves Farm Foods, Kraft Foods Group Inc., Manildra Group, MGP Ingredients, Omega Protein Corporation, George Weston Foods, and Others |

The global soy protein ingredient market is estimated to be valued at USD 11.6 billion in 2025.

The market size for the soy protein ingredient market is projected to reach USD 18.1 billion by 2035.

The soy protein ingredient market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in soy protein ingredient market are soy isolates, soy concentrates and textured soy protein.

In terms of form, powder segment to command 62.8% share in the soy protein ingredient market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soy Protein Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Soy Protein Isolate Market Size, Growth, and Forecast 2025 to 2035

Soy Protein Concentrate Market Growth - Plant-Based Protein & Industry Expansion 2024 to 2034

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Pea Protein Ingredients Market Insights - Plant-Based Nutrition Growth 2025 to 2035

Soybean Enzymatic Protein Market Size and Share Forecast Outlook 2025 to 2035

Whey Protein Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Protein Hydrolysate Ingredient Market

Demand for Soy Protein Isolates in EU Size and Share Forecast Outlook 2025 to 2035

Native Whey Protein Ingredients Market

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Soy-based Chemical Market Size and Share Forecast Outlook 2025 to 2035

Soy Lecithin Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Soy Nuts Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA