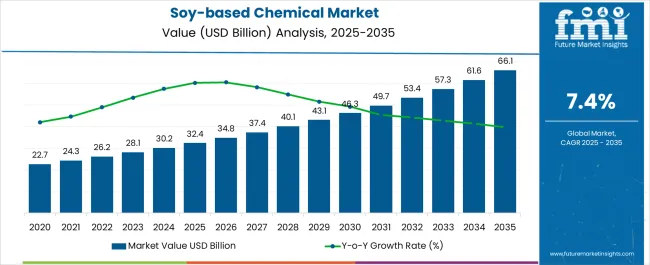

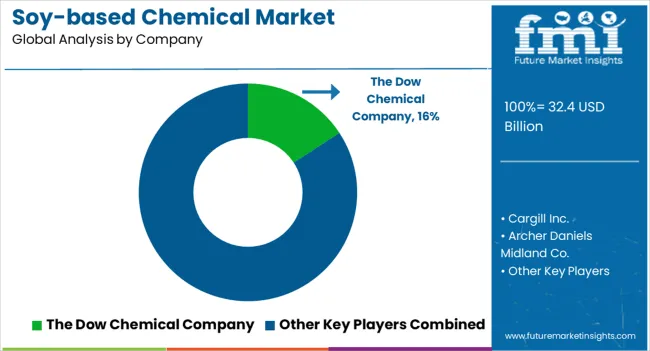

The Soy-based Chemical Market is estimated to be valued at USD 32.4 billion in 2025 and is projected to reach USD 66.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| Soy-based Chemical Market Estimated Value in (2025 E) | USD 32.4 billion |

| Soy-based Chemical Market Forecast Value in (2035 F) | USD 66.1 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The soy-based chemical market is experiencing notable growth, supported by the increasing global demand for sustainable and renewable alternatives to petroleum-derived products. Soy-based chemicals are gaining strong traction due to their biodegradability, lower carbon footprint, and cost competitiveness compared to synthetic counterparts. Rising environmental regulations and consumer preference for eco-friendly products are driving manufacturers to adopt soy derivatives in diverse applications ranging from biofuels and lubricants to polymers and coatings.

Advancements in processing technologies and biotechnology are improving product yields, purity, and performance characteristics, making soy-based chemicals more commercially viable for large-scale applications. The growing focus on circular economy practices is encouraging industries to reduce reliance on fossil-based raw materials and adopt renewable inputs such as soy.

Investments in agricultural innovation and sustainable farming practices are further supporting consistent supply availability As industries worldwide prioritize reducing greenhouse gas emissions and achieving sustainability targets, the soy-based chemical market is expected to expand steadily, positioning itself as a critical contributor to the transition toward greener industrial ecosystems.

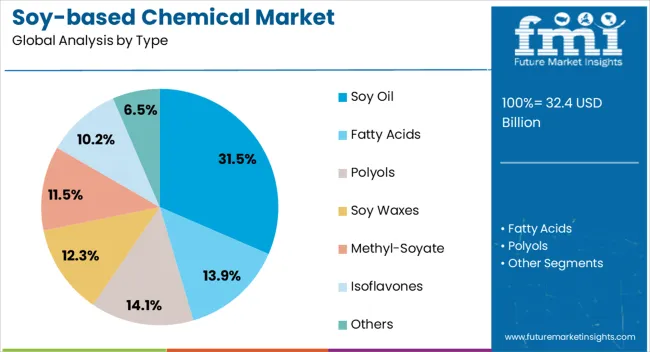

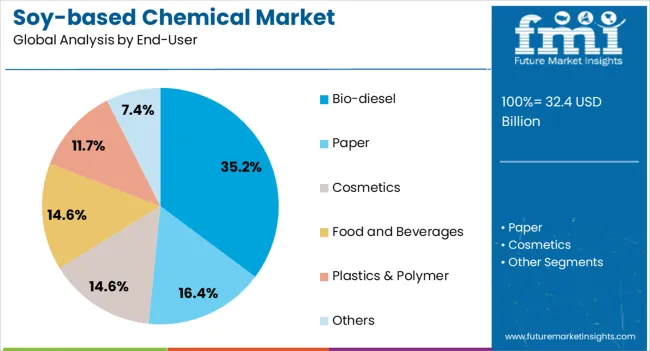

The soy-based chemical market is segmented by type, end-user, and geographic regions. By type, soy-based chemical market is divided into Soy Oil, Fatty Acids, Polyols, Soy Waxes, Methyl-Soyate, Isoflavones, and Others. In terms of end-user, soy-based chemical market is classified into Bio-diesel, Paper, Cosmetics, Food and Beverages, Plastics & Polymer, and Others. Regionally, the soy-based chemical industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The soy oil segment is projected to hold 31.5% of the soy-based chemical market revenue share in 2025, making it the leading product type. Its dominance is attributed to its wide availability, cost-effectiveness, and versatility as a feedstock for a broad range of chemical derivatives. Soy oil is extensively utilized in the production of biofuels, industrial lubricants, resins, and oleochemicals, benefiting from its renewable nature and strong supply base.

The segment is being further supported by ongoing research aimed at enhancing soy oil’s stability, oxidative resistance, and performance under industrial conditions. Its adaptability in both energy-related and non-energy-related applications is reinforcing demand, as industries increasingly prefer sustainable inputs that align with global environmental standards.

The ability to produce soy oil in large volumes across multiple geographies ensures consistent availability and competitive pricing, strengthening its position in the market As demand for bio-based chemicals accelerates, soy oil is anticipated to remain the key driver in enabling the large-scale production of renewable chemical alternatives, ensuring its continued leadership within the industry.

The bio-diesel segment is anticipated to account for 35.2% of the soy-based chemical market revenue share in 2025, establishing itself as the leading end-use category. Growth in this segment is being driven by increasing government mandates and policy incentives promoting renewable energy adoption and reducing dependence on fossil fuels. Soy-based bio-diesel offers notable environmental advantages, including reduced greenhouse gas emissions, lower sulfur content, and improved biodegradability, making it a preferred alternative in the transportation and industrial fuel sectors.

Expanding blending requirements across North America, Europe, and parts of Asia are further accelerating demand. Advances in transesterification and catalytic processing are improving bio-diesel yields and reducing production costs, enhancing its competitiveness against conventional diesel.

The segment’s expansion is also being supported by increasing demand from fleet operators and industries seeking compliance with strict emission norms and sustainability commitments As global economies prioritize cleaner energy transitions, the soy-based bio-diesel segment is expected to reinforce its position as the largest consumer of soy-derived chemicals, driving long-term growth opportunities across multiple regions.

Trends towards Eco-friendly and Green Soy-based Chemicals

Rising environmental consciousness among consumers is driving demand for eco-friendly products. As consumers seek sustainable alternatives, there's a growing preference for soy-based chemicals over petroleum-derived counterparts due to their biodegradability and reduced environmental impact.

Regulatory Support to Drive Demand for Soy-based Chemicals

Government regulations and policies favoring bio-based products are providing a significant impetus to the market. Incentives such as tax credits, subsidies, and mandates promoting the use of renewable resources are encouraging manufacturers to invest in soy-based alternatives.

Expanding Application Scope Influencing the Soy-based Chemical Market

Soy-based chemicals are finding applications across a broad spectrum of industries, including cosmetics, food, agriculture, textiles, and packaging. As research and development efforts continue to innovate, new applications and formulations are being explored, further expanding the market reach of soy-based products.

Innovations in Packaging for Soy-based Chemicals

Ongoing advancements in biotechnology and chemical engineering are enhancing the efficiency and performance of soy-based chemical production processes. Improved extraction methods, enzymatic modifications, and genetic engineering techniques are enabling the development of novel soy-based compounds with enhanced functionalities and properties.

Price Volatility to Hinder Growth

Fluctuations in the prices of soybeans and other agricultural commodities can affect the cost competitiveness of soy-based chemicals compared to their petrochemical counterparts. Variability in crop yields, weather conditions, and global market dynamics contribute to price instability, posing challenges for players in planning and pricing strategies.

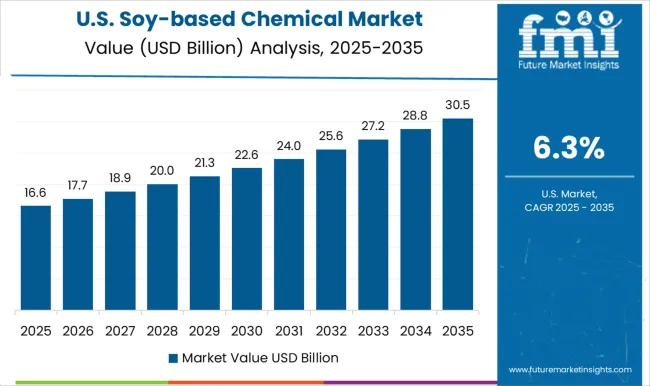

The United States is witnessing a surge in demand for sustainable products, particularly soy-based chemicals, due to their renewable nature and reduced environmental impact. This trend is driven by consumer preferences for environmentally responsible products and corporate sustainability initiatives.

Government policies and incentives, such as the BioPreferred Program administered by the USDA, are boosting the market. Tax credits and grants also incentivize investment in research and innovation.

Collaboration among industry stakeholders, including manufacturers, researchers, and government agencies, is driving innovation and expansion. These partnerships facilitate knowledge exchange and accelerate the development of new soy-based products and technologies.

Additionally, increasing consumer awareness of the environmental and health benefits of soy-based chemicals is driving growth. Companies are investing in marketing and educational campaigns to highlight the advantages of soy-based products, such as biodegradability, renewable sourcing, and non-toxic properties.

The government is promoting the development of bio-based industries, including soy-based chemicals, to achieve sustainable development goals and reduce reliance on fossil fuels. Policies and incentives, such as subsidies, tax breaks, and research grants, are encouraging investment in bio-based technology and fostering innovation.

Rising environmental awareness among consumers and policymakers is driving demand for eco-friendly products, with soy-based chemicals gaining popularity as sustainable alternatives in industries like cosmetics, food, packaging, and textiles. Soy-based chemicals' versatility is driving growth in manufacturing, agriculture, construction, and automotive industries, fostering innovation and product development opportunities.

China is enhancing the performance and competitiveness of soy-based chemicals through technological advancements in biotechnology, enzymatic conversion, and chemical engineering. Collaboration between industry players, research institutions, and government agencies is facilitating knowledge exchange and innovation.

Market liberalization policies and trade agreements are opening up new opportunities for the industry, allowing companies to access advanced technologies, expand their product portfolios, and penetrate global markets. With increasing awareness of plastic pollution and environmental degradation, China is shifting towards sustainable packaging solutions, with soy-based bioplastics being a renewable alternative to conventional petroleum-based plastics.

Demand for bio-based products derived from renewable resources like soy oil is on the rise due to environmental concerns and climate change. Technological advancements in processing methods, such as solvent extraction, cold pressing, and enzymatic hydrolysis, are improving the efficiency and yield of soy oil extraction and refining processes.

The soy-based chemical industry is shifting towards high-value specialty chemicals, with manufacturers investing in research and development to create innovative formulations. Government regulations and standards, such as the Renewable Fuel Standard in the United States and the European Union's Renewable Energy Directive, are incentivizing the production of biofuels derived from soy oil.

Soy oil producers and chemical manufacturers are also integrating sustainability principles into their supply chains, implementing eco-friendly production processes and sourcing responsibly.

The paper industry is embracing sustainable practices to reduce its environmental impact. Soy-based coatings and additives are being used to reduce reliance on fossil fuels and carbon emissions. These coatings are compliant with environmental regulations like the EPA Clean Air Act, and their performance and quality improvement are being enhanced.

The cost competitiveness of soy-based solutions is driving market adoption, as economies of scale and technological advancements reduce production costs. Consumers are increasingly choosing eco-friendly products, with brands using soy-based coatings and additives to differentiate their offerings and appeal to environmentally conscious consumers.

The global industry is fragmented, with leading manufacturers focusing on technology and product quality. Key companies are adopting marketing strategies like mergers and acquisitions, new products, and production capacity expansions. They are investing in research and development to expand product lines.

To survive in a competitive market, the silicone industry must provide cost-effective products to expand and thrive. The Dow Chemical Company, Cara Plastics Inc., and Ag Environmental Products LLC are the key players in the soy-based chemical industry.

Industry Updates

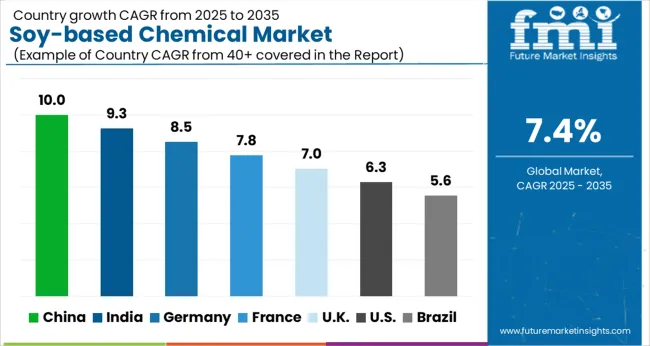

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

The Soy-based Chemical Market is expected to register a CAGR of 7.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.0%, followed by India at 9.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.6%, yet still underscores a broadly positive trajectory for the global Soy-based Chemical Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.5%. The USA Soy-based Chemical Market is estimated to be valued at USD 12.0 billion in 2025 and is anticipated to reach a valuation of USD 22.1 billion by 2035. Sales are projected to rise at a CAGR of 6.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.6 billion and USD 1.1 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 32.4 Billion |

| Type | Soy Oil, Fatty Acids, Polyols, Soy Waxes, Methyl-Soyate, Isoflavones, and Others |

| End-User | Bio-diesel, Paper, Cosmetics, Food and Beverages, Plastics & Polymer, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Dow Chemical Company, Cargill Inc., Archer Daniels Midland Co., Elevance Renewable Sciences Inc., Cara Plastics Inc., Ag Environmental Products LLC, Renewable Lubricants Inc., Soy Technologies LLC, BioBased Technologies LLC, Soyaworld Inc., and Vertec BioSolvents Inc. |

The global soy-based chemical market is estimated to be valued at USD 32.4 billion in 2025.

The market size for the soy-based chemical market is projected to reach USD 66.1 billion by 2035.

The soy-based chemical market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in soy-based chemical market are soy oil, fatty acids, polyols, soy waxes, methyl-soyate, isoflavones and others.

In terms of end-user, bio-diesel segment to command 35.2% share in the soy-based chemical market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA