The chemical mechanical planarization (CMP) market is anticipated to witness consistent growth between 2025 and 2035, supported by the rising need for semiconductor production, high-end wafer processing, and accurate surface finishing technologies.

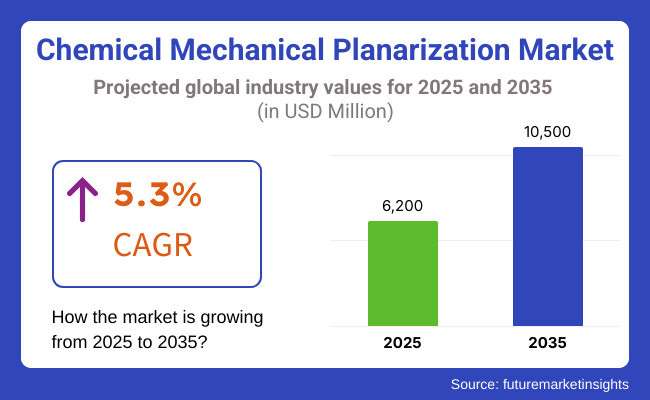

The market is likely to grow to USD 6,200 million in 2025 and increase to USD 10,500 million by 2035, demonstrating a compound annual growth rate (CAGR) of 5.3% during the forecast period.

CMP is a crucial process in IC fabrication and MEMS devices manufacturing and optical components manufacturing, which has led to its massive implementation in the electronics industry. Changes in the market landscape: smaller node technology, growing demand for consumer electronics, and innovation in material planarization methods.

Moreover, the progress of high-performance computing, AI-enabled processors, and 5G infrastructure construction further stimulates the market growth.

Despite the strong growth potential, the market is hindered by factors such as high equipment cost, slurry disposal and environmental concerns, and complex and multi-material planarization processes. From R&D investments to sustainable CMP solutions and global supply chain optimization to address these challenges and secure their standing in the market.

North America has the most significant share in the chemical mechanical planarization (CMP) market, owing to a strong semiconductor industry presence, increasing requirement for advanced electronic devices and substantial R&D investments. The USA is spearheading the region, where large semiconductor manufacturers, as well as material suppliers, are at the forefront of CMP slurries, pads and equipment innovation.

The global shift of the semiconductor industry towards advanced nodes and 3D packaging technologies continues to drive the need for precision CMP solutions; Moreover, key technology companies' and government entities' support for local semiconductor manufacturing continues to fuel the expansion of the market.

Yet expansion could be affected by challenges including supply chain disruptions and high manufacturing costs. In order to remain competitive, companies are targeting sustainable CMP solutions, optimized slurry formulations, and improvements in process efficiency.

Demand for CMP is expected to grow in Europe, especially in Germany, France, and the United Kingdom, with significant investments in nanotechnology and semiconductor fabrication. Automotive electronics, industrial automation, and the IoT (Internet of Things) are driving the growing demand for planarization methods with higher precision.

This is partly due to heightened environmental is being driven by increasingly stringent environmental regulations and sustainability initiatives, leading to innovation in the form of green CMP slurries and recycling technologies.

However, high research and development (R&D) costs and competitions from Asian Manufacturers are expected to hinder the growth of the market. Industry players are taking steps forward in the market by leveraging strategic relationships, doing automation breakthroughs, and adopting energizing processes in their CMP.

Asia-Pacific accounts for the largest and fastest-growing region in the CMP market, led by semiconductor manufacturing giants like China, Taiwan, South Korea, and Japan. The burgeoning growth of 8K televisions, 5G infrastructure, and artificial intelligence applications require deep spending on next-generation wafer processing technologies.

Local governments are providing strong state support, including subsidies and policy initiatives, to promote the semiconductor sector, enhancing the production of CMP materials and equipment.

While logistics reportedly remains a problem, with the ability to obtain needed construction materials on time, in some cases, some political disputes (such as with Iran) may only be temporary and, at least in the short term, falling oil and metal prices after episodes of high inflation may result in new realities, including lower overall cost of based materials, labour or even logistics (for example if some metals are only available from enemy countries or their allies).

To solidify their presence in the region, companies are increasingly centered on localized manufacturing, next-gen CMP consumables, and basic collaborations with semiconductor foundries.

Challenges

High Cost and Process Complexity

The high cost of CMP equipment, consumables, and process optimization is one of the key challenges in the chemical mechanical planarization (CMP) market. With the increasing complexity in semiconductor devices as the nodes shrink, the demand for precision polishing becomes critical, thus the need for CMP slurries, pads and high-end polishing equipment follows.

These high costs make them prohibitively expensive for smaller semiconductor manufacturers and foundries. Moreover, CMP process itself is very complex and sensitive, necessitating fine-tuned control of the process parameters, secretion of defects such as dishing and erosion, which can affect the performance of the chip.

To address these issues, manufacturers must focus on research & development to make processes more efficient, reduce the material waste, and create CMP solutions that are economical. Automation and AI-driven process control implementations can further enable improvements in yield rates and reductions in manufacturing costs.

Opportunities

Growing Demand for Advanced Semiconductor Nodes

With the growing demand for high-performance computing and AI in addition to 5G applications, there is a need for more advanced semiconductor nodes that heavily rely on CMP for the planarization of wafer surfaces.

As the semiconductor industry pushes beyond the 3nm node and other small-form-factor technologies, CMP is a crucial process in achieving high-fidelity fabrication of increasingly powerful, smaller devices. Also, the increased use of 3D stacking and heterogeneous integration technologies is demanding tighter, more controlled CMP processes.

Use of new slurry formulations, pad materials, and process monitoring tools will provide the right competitive opportunity for companies to expand their market potential. As fabless design company’s scale up to meet demand, as well as the global expansion in semiconductor manufacturing, CMP will continue on its exponential growth pathway as witnessed over the last several decades, looking ahead.

Over the period from 2020 to 2024, the CMP market grew steadily as semiconductor manufacturing expanded and advanced node technologies were increasingly adopted. There was an increasing demand for many types of CMP consumables like slurries and polishing pads (PPS) that are designed for specific wafer-based materials.

Yet, factors like supply chain bottlenecks and increasing raw material prices heavily weighed on market stability. The trend was shifted towards slurry efficiency, defectivity, and real-time process monitoring in 2023 to tune CMP performance.

2025 to 2035: The major trend driving developments in CMP will be the enhanced complexity of semiconductor designs, combined with the adoption of next-generation chip architectures. The industry's cut line will be defined by AI-driven process enhancements, nanomaterial-dispersed slurries, and sustainable CMP solutions.

In addition, the local supply chain and production capability for CMP will be in high demand with semiconductor manufacturing going local in other locations including the USA, China, and Europe. Disruptive technologies are also likely to include dry CMP and non-contact planarization techniques.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increasing environmental regulations on CMP slurry disposal |

| Technological Advancements | Advancements in slurry formulations and pad conditioning |

| Industry Adoption | CMP crucial for sub-7nm semiconductor nodes |

| Supply Chain and Sourcing | Dependence on limited suppliers for CMP consumables |

| Market Competition | Dominance of major CMP consumables manufacturers |

| Market Growth Drivers | There is an increasing demand for chips for high-performance computing and AI |

| Sustainability and Energy Efficiency | Adoption of water-saving and slurry-recycling technologies |

| Consumer Preferences | Preference for cost-effective, high-yield CMP processes |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Focus on sustainable and eco-friendly CMP materials |

| Technological Advancements | AI-driven process automation and predictive CMP modelling |

| Industry Adoption | Expansion of CMP in 3D stacking and heterogeneous integration |

| Supply Chain and Sourcing | Diversification of supply chains and regional manufacturing investments |

| Market Competition | Rise of new players and innovative start-ups in specialized CMP solutions |

| Market Growth Drivers | It builds on billions of dollars in new investments in global semiconductor fabrication plants |

| Sustainability and Energy Efficiency | Complementary large scale implementation of green CMP solutions & waste minimization |

| Consumer Preferences | Demand for ultra-precision, defect-free planarization for next-gen chips |

Chemical Mechanical Planarization (CMP) United States market is influenced by various factors that include the technology and economic environment of the semiconductor industry to the demands of the consumer electronic-micro depositories. As one of the largest combined semiconductor manufacturers, the United States is seeing increasing adoption of CMP technology for wafer fabrication and integrated circuit (IC) production.

Moreover, the rising demand for miniaturization and better performance in electronic devices is stimulating the demand for CMP equipment and slurries.

Additionally, the development of cutting-edge materials as well as chemical mechanical polishing (CMP) solutions for upcoming semiconductor nodes is also aiding the market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

The CMP market in the United Kingdom is progressing with a moderate growth rate due to the growing of research and development activity for semiconductor technology. Demand for CMP solutions is driven the UK’s growing focus on fabricating next-generation chips, photonic devices and quantum computing components.

Moreover, multidisciplinary integration of CMP in advanced packaging and MEMS (Micro-Electro-Mechanical Systems) has been contributing to the growth of the market as well. The different tech hubs and semiconductor research institutes should help reinforce the UK’s position in the world CMP market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

The EU Chemical Mechanical Planarization market is growing, driven by investments in semiconductor manufacturing, mainly in Germany, France, and the Netherlands. The EU’s focus on semiconductor manufacturing technological sovereignty and self-sufficiency is driving the demand for CMP processes.

Moreover, the utilization of CMP in manufacturing high-performance computing chips, automotive electronics, as well as internet of things (IoT) devices, is also propelling the growth of market. Efforts at enhancing CMP materials, such as reduced-defect slurries and new pads, are also helping broaden market space.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

Japan continues a key market for CMP, with its well-established semiconductor and consumer electronics industries providing robust contributions. CMP technology is gaining traction in the semiconductor industry due to it fulfils the need for high-precision planarization in the fabrication of logic and memory chips.

Additionally, the consistent investment in advanced materials and chemical formulations for CMP slurries in the country is fuelling technological advancements. Companies in Japan have been working on improving CMP efficiency in response to the growing demands of computing driven by AI and automotive semiconductor applications.

This, along with the growing adoption of CMP for production of 3D NAND and FinFET transistors, help to boost the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

South Korea’s CMP market has been growing rapidly because of its semiconductor giants’ dominance in the sector and their investments in next-generation chip technologies. One key growth driver is the increasing demand for advanced CMP solutions in DRAM and NAND flash memory fabrication.

Moreover, South Korean semiconductor companies are putting emphasis on mass production of ultra-thin wafers, which will lead to the demand for accurate process of planarization. Government programs to bolster South Korea’s role in the global semiconductor supply chain are also driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The Chemical Mechanical Planarization (CMP) Market is forecasted to see increased demand, during the upcoming years, owing to the demand for advanced semiconductor manufacturing processes, miniaturized electronic devices, and high-performance computing applications.

Chemical mechanical polishing (CMP) is a process used in the manufacturing of integrated circuits (ICs), as well as wafer thinning and 3D packaging, to create smooth, defect-free surfaces for subsequent processing. The growing utilization of AI, IoT, and 5G technologies has increased the requirement for accurate wafer planarization methods, creating a further promise in the market for CMP tools and consumables.

As the semiconductor industry continues to shift into smaller nodes, higher transistor density, and better energy efficiency, CMP technologies have become indispensable to maintain yield, reliability, and uniformity in device fabrication. Apart from several parameters, stringent quality standards, technological innovations, and the rising adoption of More-than-Moore’s (MtM) technologies are the contributing factors driving growth in the CMP market.

CMP consumables consist of slurries, pad conditioning agents, slurries, and slurry remineralizing activators, and such a large market share dominance has been aided by the essential role of this type of CMP in material removal, surface smoothing, and defect elimination. CMP consumables are diverse and include slurries, pads, conditioning disks, post-CMP cleaning solutions, etc. that works towards achieving the required maximal level of planarization.

CMP slurries are one of the most commonly used consumables required for abrasive polishing, material selectivity, and uniform surface finish. As the need for more complex final products arises, the industry has responded with novel slurry recipe configurations, high rate/low defectivity materials systems, and dual-component slurries with programmable selectivity.

Eco-friendly and economical slurries have also gained popularity as semiconductor manufacturers adopt sustainability and waste reduction initiatives in their fabrication processes.

Chemical mechanical polishing (CMP) pads are also an important kind of consumable consumables that provides a dynamic and HDD tissue in the treatment of luminal linter for the precise removal of materials and defects.

As multi-patterning lithography, FinFET architectures, and 3D NAND structures have increased in character and demand, enhancements to the CMP pad landscape have been centered on longer pad lifetimes, better surface textures, and improvements in planarization efficiency.

It is expected that the ongoing development of copper, tungsten, and dielectric CMP applications will continue to drive demand for high-performance CMP consumables in the years to come.

CMP equipment and consumables are crucial for wafer planarization, and although CMP equipment is also supplied, CMP consumables are frequently swapped and process-optimized, leading to a higher share of the overall market and continued revenue streams for manufacturers.

The leading-edge CMP segment holds the prominent position among the CMP technologies, driven by sub-7nm semiconductor fabrication, advanced logic devices, and next-generation memory technology. Advanced CMP enables the manufacturing of high-performance processors, artificial intelligence (AI) chips and 5G-compatible devices that all require precision planarization to improve yield and reduce the number of defects.

Advanced transistor architectures such as FinFET and Gate-All-Around (GAA) are highly dependent on advanced CMP to deliver nanoscale uniformity, interconnect integrity, and enhanced electrical performance. Moreover, the transition to extreme ultraviolet (EUV) lithography has driven the need for ultra-precise CMP processes, advanced endpoint detection techniques and defect-free polishing solutions.

Additionally, the relentless trends of 3D ICs, advanced packaging, and heterogeneous integration have made leading-edge CMP a necessity to modern day semiconductor fabrication.

Although some advanced CMP technologies are increasingly using More-than-Moore's (MtM) and emerging applications for power devices, MEMS, RF components, and optoelectronics, they will be largely available as mature processes focusing on specialized materials and controlling high-cost processes. High-end CMP continues as the leading segment, due to its direct relationship with high-performance computing, data centers, and AI workloads.

Major driving factors for the Chemical Mechanical Planarization (CMP) Market are the growth in the demand for metal oxide semiconductor (MOS), and the manufacturing processes involved in the fabrication of integrated circuits (ICs) and wafer-level packaging.

CMP is a crucial and widely used process that achieves the global and local planarity required for subsequent high-performance device operation in semiconductor wafers.

Moreover, the increasing sophisticated of electronic elements and latest technology trends such as 3D NAND, FinFET, and advanced logic devices will drive the acceptance of CMP technology. Furthermore, the CMP market is stimulated by the growing use of AI along with 5G connectivity and the Internet of Things (IoT).

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Applied Materials Inc. | 18-22% |

| Ebara Corporation | 15-20% |

| Lapmaster Wolters (Precision Surfacing Solutions) | 10-15% |

| Cabot Microelectronics (CMC Materials) | 8-12% |

| Fujimi Incorporated | 5-10% |

| Other Industry Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Applied Materials Inc. | Develops CMP equipment and slurries for semiconductor manufacturing. |

| Ebara Corporation | Specializes in CMP polishing tools and slurry distribution systems. |

| Lapmaster Wolters | Offers precision CMP polishing and grinding solutions for wafer processing. |

| Cabot Microelectronics (CMC Materials) | Makes high-performance CMP slurries, pads, and post-CMP cleaning chemicals. |

| Fujimi Incorporated | Makes CMP abrasives and polishing compounds for semiconductor use. |

Key Company Insights

Applied Materials Inc. (18-22%)

As a leading CMP solution provider, Coverage Devices offers cutting-edge CMP tools, slurries and innovative applications for semiconductor processing. The firm aims to help create next-generation chip manufacturing by improving material removal rate efficiency and process control.

Ebara Corporation (15-20%)

As a leading CMP polishing tools and equipment provider, Ebara Corporation provides a high-precision wafer planarization solution that includes an innovative polishing system, high-performance pads, and abrasives that deliver excellent performance. The company is focusing on advanced CMP to empower semiconductor manufacturing at sub-10nm nodes.

Lapmaster Wolters (10-15%)

Lapmaster Wolters products offer precision CMP and wafer grinding solutions focused on high-end semiconductor applications. It wants to strengthen its position in the global wafer fabrication market by improving efficiency in terms of its CMP wafers.

Cabot Microelectronics (CMC Materials) (8-12%)

CMC Materials is a leading supplier of CMP slurries and polishing pads for logic, memory, and advanced packaging applications. The company is ramping up R&D for next-generation CMP consumables.

Fujimi Incorporated (5-10%)

Fujimi Incorporated specializes in supplying high-purity abrasives and polishing systems for CMP applications. The firm is prioritizing the enhancement of slurry formulations catered for cutting-edge semiconductor processes.

Other Key Players (30-40% Combined)

A few of the companies, both emerging and already established, that drive growth through technological development and sustainability. Notable players include:

The overall market size for the chemical mechanical planarization market was USD 6,200 million in 2025.

The chemical mechanical planarization market is expected to reach USD 10,500 million in 2035.

The chemical mechanical planarization market is expected to grow at a CAGR of 5.3% during the forecast period.

The demand for the chemical mechanical planarization market will be driven by increasing advancements in semiconductor manufacturing, rising demand for miniaturized electronic devices, growing adoption of advanced materials in the chip fabrication process, technological innovations in wafer processing, and expanding applications in integrated circuit production.

The top five countries driving the development of the chemical mechanical planarization market are the USA, China, Japan, South Korea, and Germany.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 4: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 5: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 6: North America Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 7: North America Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 8: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: Latin America Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 11: Latin America Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 12: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: Europe Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 15: Europe Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 16: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 17: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: Asia Pacific Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 19: Asia Pacific Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 20: Asia Pacific Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 21: Middle East & Africa Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 22: Middle East & Africa Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 23: Middle East & Africa Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 24: Middle East & Africa Market Value (US$ Million) Forecast by Application, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Technology, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 9: Global Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 10: Global Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 11: Global Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 12: Global Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 13: Global Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 17: Global Market Attractiveness by Type, 2022 to 2032

Figure 18: Global Market Attractiveness by Technology, 2022 to 2032

Figure 19: Global Market Attractiveness by Application, 2022 to 2032

Figure 20: Global Market Attractiveness by Region, 2022 to 2032

Figure 21: North America Market Value (US$ Million) by Type, 2022 to 2032

Figure 22: North America Market Value (US$ Million) by Technology, 2022 to 2032

Figure 23: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 24: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 28: North America Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 29: North America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 30: North America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 31: North America Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 34: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 37: North America Market Attractiveness by Type, 2022 to 2032

Figure 38: North America Market Attractiveness by Technology, 2022 to 2032

Figure 39: North America Market Attractiveness by Application, 2022 to 2032

Figure 40: North America Market Attractiveness by Country, 2022 to 2032

Figure 41: Latin America Market Value (US$ Million) by Type, 2022 to 2032

Figure 42: Latin America Market Value (US$ Million) by Technology, 2022 to 2032

Figure 43: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 44: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 48: Latin America Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 54: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 57: Latin America Market Attractiveness by Type, 2022 to 2032

Figure 58: Latin America Market Attractiveness by Technology, 2022 to 2032

Figure 59: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 60: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 61: Europe Market Value (US$ Million) by Type, 2022 to 2032

Figure 62: Europe Market Value (US$ Million) by Technology, 2022 to 2032

Figure 63: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 64: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 68: Europe Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 69: Europe Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 71: Europe Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 72: Europe Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 75: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 77: Europe Market Attractiveness by Type, 2022 to 2032

Figure 78: Europe Market Attractiveness by Technology, 2022 to 2032

Figure 79: Europe Market Attractiveness by Application, 2022 to 2032

Figure 80: Europe Market Attractiveness by Country, 2022 to 2032

Figure 81: Asia Pacific Market Value (US$ Million) by Type, 2022 to 2032

Figure 82: Asia Pacific Market Value (US$ Million) by Technology, 2022 to 2032

Figure 83: Asia Pacific Market Value (US$ Million) by Application, 2022 to 2032

Figure 84: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 85: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 88: Asia Pacific Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 89: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 90: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 91: Asia Pacific Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 92: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 93: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 94: Asia Pacific Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 95: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 96: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 97: Asia Pacific Market Attractiveness by Type, 2022 to 2032

Figure 98: Asia Pacific Market Attractiveness by Technology, 2022 to 2032

Figure 99: Asia Pacific Market Attractiveness by Application, 2022 to 2032

Figure 100: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 101: Middle East & Africa Market Value (US$ Million) by Type, 2022 to 2032

Figure 102: Middle East & Africa Market Value (US$ Million) by Technology, 2022 to 2032

Figure 103: Middle East & Africa Market Value (US$ Million) by Application, 2022 to 2032

Figure 104: Middle East & Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 105: Middle East & Africa Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 106: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 107: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 108: Middle East & Africa Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 109: Middle East & Africa Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 110: Middle East & Africa Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 111: Middle East & Africa Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 112: Middle East & Africa Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 113: Middle East & Africa Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 114: Middle East & Africa Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 115: Middle East & Africa Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 116: Middle East & Africa Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 117: Middle East & Africa Market Attractiveness by Type, 2022 to 2032

Figure 118: Middle East & Africa Market Attractiveness by Technology, 2022 to 2032

Figure 119: Middle East & Africa Market Attractiveness by Application, 2022 to 2032

Figure 120: Middle East & Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Chemical Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Chemical Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA