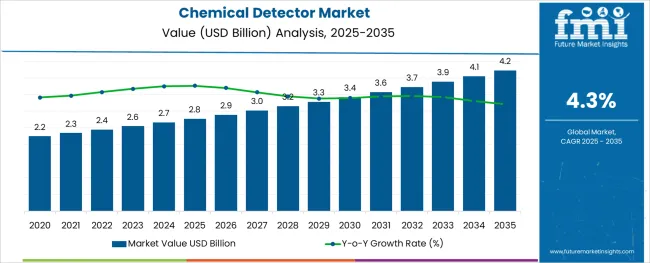

The Chemical Detector Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The chemical detector market is witnessing steady expansion due to heightened global awareness surrounding industrial safety, environmental monitoring, and homeland security. Increasing incidences of hazardous material leaks and growing emphasis on real time detection in high risk environments are prompting industries to adopt advanced sensing technologies.

Governments and private enterprises are investing in compact high sensitivity detectors capable of identifying chemical threats across a broad range of operational settings. Technological improvements in miniaturization, wireless connectivity, and AI enabled analytics have further enhanced the deployment scope of chemical detectors in both portable and fixed systems.

Regulatory compliance requirements across the chemical, petrochemical, and defense sectors are reinforcing the need for reliable detection mechanisms. The market outlook remains favorable as stakeholder focus intensifies on operational safety, emergency response preparedness, and environmental compliance across industrial corridors worldwide.

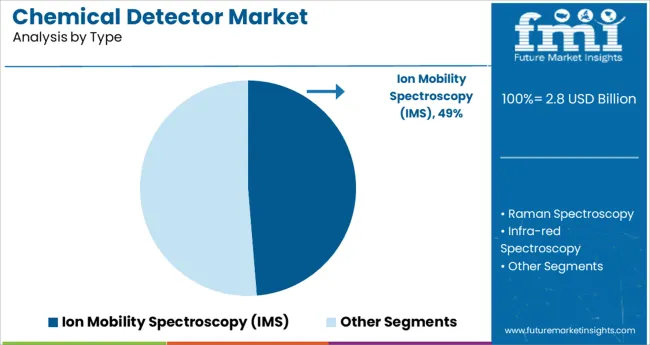

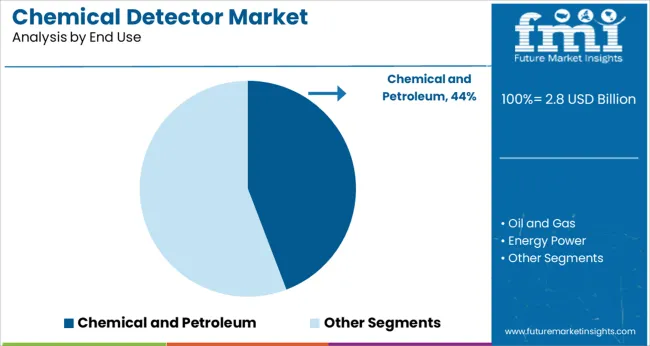

The market is segmented by Type and End Use and region. By Type, the market is divided into Ion Mobility Spectroscopy (IMS), Raman Spectroscopy, Infra-red Spectroscopy, and Others. In terms of End Use, the market is classified into Chemical and Petroleum, Oil and Gas, Energy Power, Defence, Civil Sector, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ion mobility spectroscopy segment is expected to account for 48.70% of total revenue by 2025 within the type category, positioning it as the most prominent segment. This is due to its high detection sensitivity, compact design, and rapid response time making it particularly well suited for field based and mobile chemical threat detection.

Its ability to detect trace levels of volatile organic compounds and chemical warfare agents in real time has enhanced its adoption across security, environmental, and industrial applications. Additionally, the technology’s low power consumption and high portability make it favorable for integration into handheld detectors and portable analyzers.

Ion mobility spectroscopy has also benefited from ongoing research and development aimed at improving its selectivity and response accuracy. As industries demand fast accurate and reliable chemical detection solutions this type remains the preferred choice due to its adaptability, affordability, and wide applicability.

The chemical and petroleum segment is projected to hold 44.20% of total market revenue by 2025 under the end use category making it the leading segment. This growth is being driven by increasing safety regulations, process optimization demands, and a strong emphasis on leak prevention in hazardous industrial environments.

The high risk of toxic exposure and flammable compound release in chemical plants and refineries has intensified the need for advanced detection systems. Additionally, operational continuity and personnel safety have become critical priorities in these industries further pushing the deployment of fixed and portable chemical detectors.

Investments in upgrading safety infrastructure and integrating real time monitoring technologies are reinforcing adoption trends. With stringent regulatory mandates and the critical nature of chemical and petroleum processing operations this end use segment continues to dominate due to its consistent demand for reliable and responsive detection capabilities.

In the past, reliable litmus or reaction tests were used to identify chemicals. Although reliable, this type of testing were time-consuming and need a supply of consumable testing equipment, and could only identify a small number of compounds. With the technological developments in Chemical Detector, different types of sensors can be utilized to detect hazardous chemicals at single points, provides stand-off detection or covers large areas.

Handheld scanners that can quickly find a range of substances are now possible, due to advancements in chemical detectors. Modern sensors make use of a variety of methods, including mass spectrometry, ion-mobility spectrometry, and photo ionization.

As a result, FMI’s Chemical Detector demand projection predicts a CAGR of 4.3% by 2035.

The market for Chemical Detector is expanding because of an increase in threats to homeland security and stricter safety standards. Owing to the increasing production of the toxic chemicals for industrial applications, the concerns regarding accidents and misuse has been increasing.

The market is anticipated to boost owing to the strict governing laws regarding the purchase and sales of dangerous chemicals, also the market is blooming because of increase in the efforts made by the law enforcement and safety and security administrations regarding chemical misuse. Businesses now need chemical detector on their premises to safeguard the safety of their employees. As a result, Chemical Detector is now in high demand across a wide range of industries.

The demand for solutions to halt chemical warfare around the globe has fuelled the demand for chemical detectors. Security threats have increased throughout the years, which is one of the significant trend driving the market growth.

This has led to the increase in use of the chemical monitoring systems, in the defence industry. The market for chemical detector is supplemented by government initiatives to take a proactive approach in the monitoring of chemical plants to prevent chemical mishaps.

The demand is also boosted by the increasing necessity for ensuring public safety in critical infrastructure facilities. The usage of chemical detection devices in nuclear power plants and chemical manufacturing facilities has significantly increased in recent years.

The usage of this technology is increasing in a number of industries. Governments often update their laws to comply with the most recent safety standards, which is providing great opportunity for the market participants.

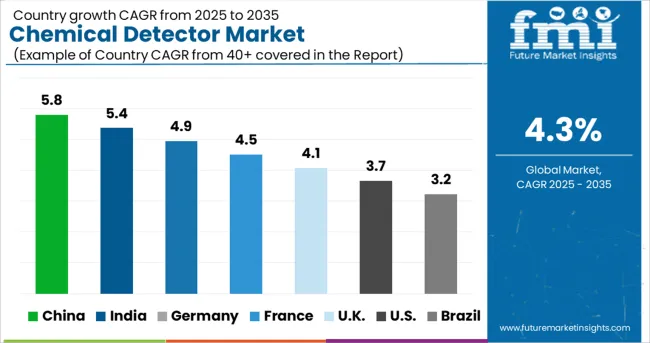

Geographically, the market is sub-segmented into six regions, namely North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East and Africa. China and Japan are the largest consumers of Chemical Detector’s in the East Asia region. Among all these countries, China and Japan, collectively accounted for 15 to 20% of the total Chemical Detector market in 2024.

North America is anticipated to dominate the Chemical Detector market owing to the increase in the number of new participants in the region. This is due to growth in the chemical production and consumption in nations.

The North America market is being driven owing to the substantial technological developments in chemical detection technologies in varied geographies. For instance, Increase in public and private capital expenditure in the USA for research and development activities aimed at improving detection and monitoring systems. Also, the creation of stringent requirements for public safety in industrial facilities has also opened up new opportunities for several regional market.

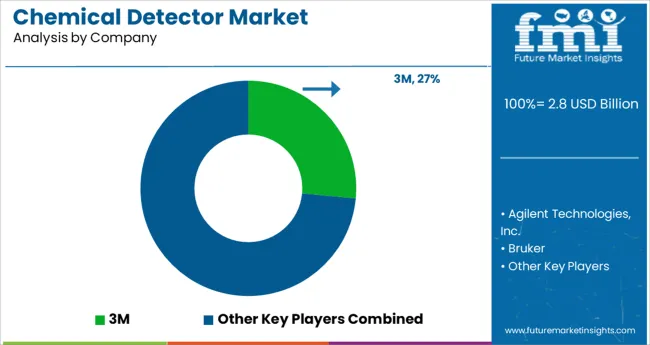

Key players operating in the Chemical Detector market include 3M, Agilent Technologies, Inc., Bruker, Argon Electronics, Environics, FLIR Systems, Inc., QIAGEN, Smiths Detection Group Ltd, Remedios Ltd., Thermo Fisher Scientific, Inc, and others

By establishing new manufacturing units in the targeted market, the major players in the worldwide market are concentrating on increasing their capacities and resources to fulfil the rising demand for Chemical Detector. The major players are also implementing joint venture and collaboration strategies to expand their visibility and assets.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product Type, Application, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East and Africa |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, UK, France, Italy, Spain, BENELUX, Russia, China, Japan, South Korea, India, ASEAN, Australia and New Zealand, GCC Countries, South Africa, Northern Africa, Turkey |

| Key Companies Profiled | 3M; Agilent Technologies, Inc.; Bruker; Argon Electronics; Environics; FLIR Systems, Inc.; QIAGEN; Smiths Detection Group Ltd; Remedios Ltd.; Thermo Fisher Scientific; Bioquell Plc; Federal Resources; General Dynamics Corporation; Chemring Group Plc |

| Customization & Pricing | Available upon Request |

The global chemical detector market is estimated to be valued at USD 2.8 billion in 2025.

It is projected to reach USD 4.2 billion by 2035.

The market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types are ion mobility spectroscopy (ims), raman spectroscopy, infra-red spectroscopy and others.

chemical and petroleum segment is expected to dominate with a 44.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trace Chemical Detector Market Growth – Trends & Forecast 2019-2027

Handheld Chemical and Metal Detector Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA