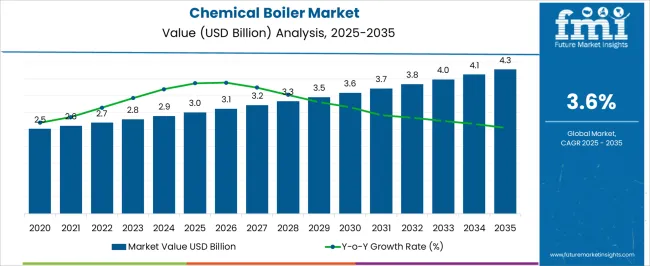

The chemical boiler market is expected to grow from USD 3.0 billion in 2025 to USD 4.3 billion by 2035, registering a 3.6% CAGR and generating an absolute dollar opportunity of USD 1.3 billion. Growth is driven by rising industrialization, increased demand for process steam in chemical, pharmaceutical, and food processing industries, and the need for energy-efficient, reliable boiler solutions.

Technological improvements, including enhanced heat transfer, corrosion resistance, and automation, further support adoption across global markets. Acceleration and deceleration patterns reveal shifts in market momentum over the forecast period. From 2025 to 2028, the market shows steady acceleration, led by North America and Europe, where upgrades to aging boiler systems and regulatory compliance drive incremental demand. Between 2029 and 2032, growth experiences moderate deceleration due to stabilization of adoption in mature regions and supply chain pressures affecting raw material availability. From 2033 to 2035, the market accelerates again, particularly in the Asia Pacific and Latin America, driven by expanding chemical production, industrial infrastructure development, and rising energy efficiency mandates.

The USD 1.3 billion opportunity illustrates a cyclical yet upward trend, where early-stage adoption, mid-period moderation, and late-stage regionally driven acceleration collectively shape the global chemical boiler market trajectory, demonstrating predictable and sustainable growth patterns between 2025 and 2035.

| Metric | Value |

|---|---|

| Chemical Boiler Market Estimated Value in (2025 E) | USD 3.0 billion |

| Chemical Boiler Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The chemical boiler market is primarily driven by the chemical and petrochemical sector, which accounts for around 45% of the market share, as boilers are essential for process heating, steam generation, and chemical reactions. The pharmaceutical and biotechnology segment contributes about 23%, using boilers for sterilization, process heating, and controlled reactions in drug production. The food and beverage industry represents close to 17%, deploying boilers for cooking, pasteurization, and sterilization processes. The textile and paper sector accounts for roughly 10%, applying boilers in dyeing, bleaching, and pulp processing. The remaining 5% comes from small-scale industrial units, research laboratories, and educational institutions requiring compact, efficient, and reliable steam generation systems.

The market is advancing with developments in energy efficiency, emissions reduction, and material durability. High-efficiency designs and optimized heat transfer techniques are being adopted to reduce fuel consumption and operational costs. Low-NOx and environmentally compliant combustion systems are increasingly integrated to meet regulatory standards. Modular and compact boilers simplify installation and maintenance for diverse industrial processes. Manufacturers are focusing on corrosion-resistant materials, advanced control systems, and customizable solutions for sector-specific requirements. Rising industrialization, stringent environmental norms, and growing demand for process heating solutions continue to drive global chemical boiler adoption.

The chemical boiler market is evolving steadily, driven by the increasing need for efficient heat generation systems across a wide range of industrial applications. Rising demand for process heating in chemical manufacturing, combined with stricter energy efficiency regulations and emission control standards, is pushing facilities to adopt advanced boiler technologies.

The market is further shaped by growing investments in capacity expansion and modernization of aging infrastructure, particularly in emerging economies. Enhanced focus on operational efficiency, fuel savings, and reduced carbon footprints continues to influence procurement decisions.

In the coming years, the integration of automation and remote monitoring capabilities into boiler systems is expected to improve performance and reliability. The convergence of performance, sustainability, and safety requirements positions the chemical boiler market for consistent growth across diverse end-use segments

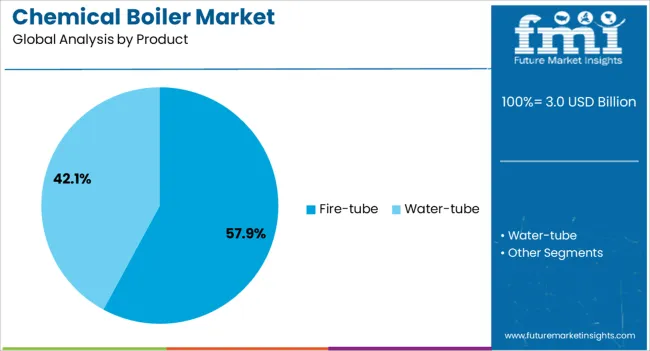

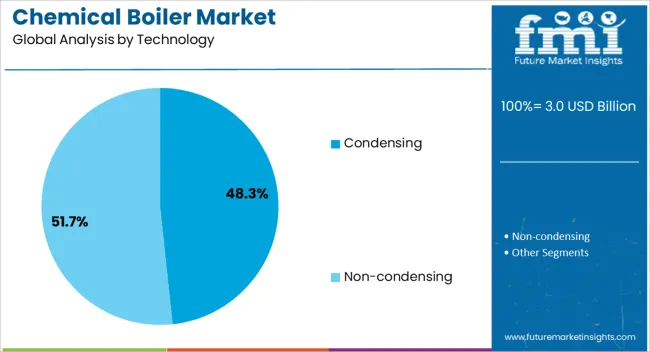

The chemical boiler market is segmented by capacity, product, technology, fuel, and geographic regions. By capacity, chemical boiler market is divided into 10 MMBTU/hr, 10–25 MMBTU/hr, 25–50 MMBTU/hr, 50–75 MMBtu/hr, 75–100 MMBTU/hr, 100–175 MMBTU/hr, 175–250 MMBTU/hr, and > 250 MMBTU/hr. In terms of product, chemical boiler market is classified into Fire-tube and Water-tube. Based on technology, chemical boiler market is segmented into Condensing and Non-condensing. By fuel, chemical boiler market is segmented into Natural gas, Oil, Coal, and Others. Regionally, the chemical boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

chemical-boiler-market-analysis-by-product

The 10 MMBTU/hr capacity segment holds a 19% market share, reflecting its relevance in mid-scale industrial operations that require moderate yet efficient thermal output. These boilers are particularly suited for batch processing and continuous flow heating applications in chemical plants.

Their ability to balance performance with footprint and cost makes them a preferred choice among medium-sized facilities aiming to optimize energy use without oversizing equipment. Adoption is further supported by ease of installation, integration with auxiliary systems, and the ability to meet regional compliance standards.

As chemical manufacturers expand operations in both developed and emerging markets, this capacity range continues to find strong demand in settings where flexibility and energy efficiency are prioritized. Continued technological refinement and customization options are expected to support stable growth in this segment

The fire-tube product segment commands a leading 58% share in the chemical boiler market due to its robust design, ease of operation, and cost-effectiveness. These boilers are widely adopted in the chemical industry for applications requiring consistent and moderate pressure steam generation.

Their simple construction and ability to handle fluctuating loads make them suitable for a range of heating processes in both large and small-scale operations. Manufacturers continue to enhance fire-tube designs by integrating improved control systems and advanced safety mechanisms to meet evolving industrial requirements.

The segment’s growth is also driven by reduced maintenance needs and improved fuel-to-steam efficiency, which are essential for minimizing downtime in chemical production lines. As regulatory pressure increases and energy management becomes a priority, fire-tube boilers are expected to retain strong market traction

The condensing technology segment leads with a 48% market share, owing to its superior energy efficiency and lower greenhouse gas emissions. Condensing boilers are designed to extract additional heat from exhaust gases, making them particularly attractive in chemical facilities focused on maximizing thermal efficiency and minimizing operational costs.

Their ability to achieve higher efficiency ratings—often exceeding 90%—has made them a preferred choice in regions with stringent environmental standards. Growth in this segment is also supported by favorable return on investment, especially when used in continuous process applications where heat recovery can be fully utilized.

Technological advancements have improved durability and compatibility with a variety of fuels, broadening their applicability in diverse chemical production environments. As industries transition towards sustainable operations, condensing boilers are poised to become a standard in new system installations and retrofits

The chemical boiler market is expanding globally due to rising demand from chemical manufacturing, pharmaceuticals, petrochemicals, and food processing industries. Boilers are essential for generating steam, maintaining process heat, and supporting chemical reactions. Asia Pacific leads consumption with over 40% of global installations, driven by industrialization and new plant construction. North America and Europe emphasize high-efficiency and low-emission boilers to comply with environmental regulations. Technological developments in waste heat recovery, modular designs, and corrosion-resistant materials enhance operational efficiency. Rising demand for continuous and batch process applications is creating measurable opportunities for market growth.

The chemical boiler market is primarily driven by the need for precise and reliable heat supply in chemical and industrial processes. Boilers provide high-pressure steam, hot water, and thermal energy for chemical reactions, distillation, and sterilization. Industries such as pharmaceuticals, petrochemicals, and specialty chemicals rely on boilers with capacities ranging from 2 to 50 tons per hour and pressure ratings up to 40 bar. Adoption of energy-efficient boilers with efficiency above 90% reduces operational costs and emissions. Process automation, safety standards, and maintenance optimization further support market adoption. Increasing construction of chemical plants, refinery upgrades, and industrial expansion in Asia Pacific, Europe, and North America are strengthening growth.

Waste heat recovery integration in chemical boilers presents significant opportunities by improving energy efficiency by up to 15–20%. Adoption of modular boiler designs enables rapid installation, scalability, and maintenance flexibility in chemical plants. Expansion of pharmaceutical and specialty chemical production in Asia Pacific and Latin America creates strong demand for medium- and high-capacity boilers. Environmental regulations promoting emission reduction drive the use of low-NOx and ultra-low emission boilers. Industrial electrification and steam-based renewable integration offer additional opportunities for hybrid boiler systems. Manufacturers investing in corrosion-resistant alloys, automated monitoring, and predictive maintenance solutions are positioned to capture emerging opportunities across industrial, commercial, and chemical process applications globally.

Current trends in the chemical boiler market include adoption of advanced automation, high-performance materials, and low-emission technologies. PLC-controlled systems and IoT-enabled monitoring allow real-time performance tracking, predictive maintenance, and energy optimization, improving operational efficiency by 10–15%. Use of stainless steel, alloy cladding, and corrosion-resistant coatings extends boiler life in high-chemical environments. Low-NOx and ultra-low emission boilers are increasingly installed to meet global environmental standards, particularly in Europe and North America. Compact modular boilers are gaining traction in Asia Pacific for small- and medium-scale chemical plants. Digital platforms for fuel optimization, remote diagnostics, and automated safety controls are also influencing market expansion, enhancing performance and compliance.

Despite strong demand, the chemical boiler market faces challenges due to high capital investment, operational complexity, and regulatory requirements. High-efficiency and low-emission boilers cost 20–40% more than conventional units, limiting adoption in small-scale or cost-sensitive plants. Fluctuating fuel prices and supply chain disruptions impact operational expenses and procurement. Compliance with environmental, safety, and emission standards varies by country, creating technical and legal hurdles for manufacturers. Maintenance complexity, corrosion issues, and downtime during retrofitting reduce operational efficiency.

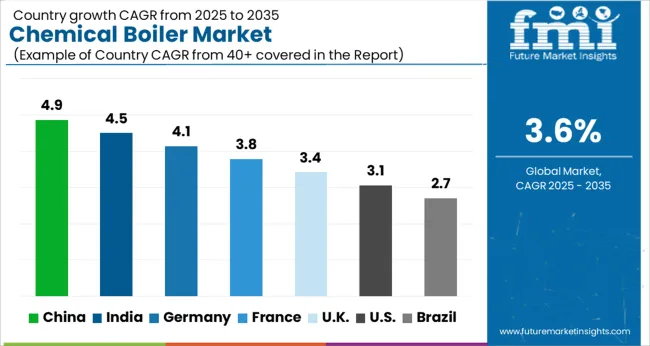

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| UK | 3.4% |

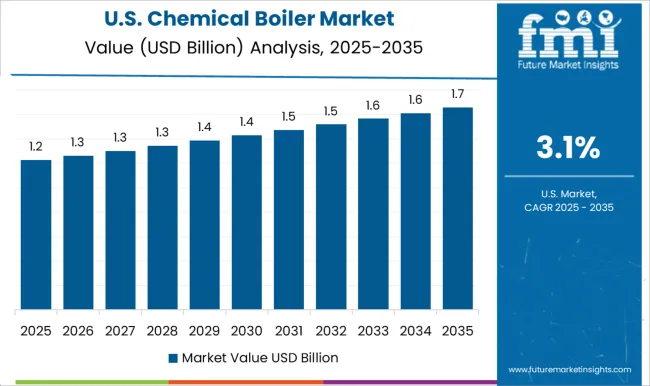

| USA | 3.1% |

| Brazil | 2.7% |

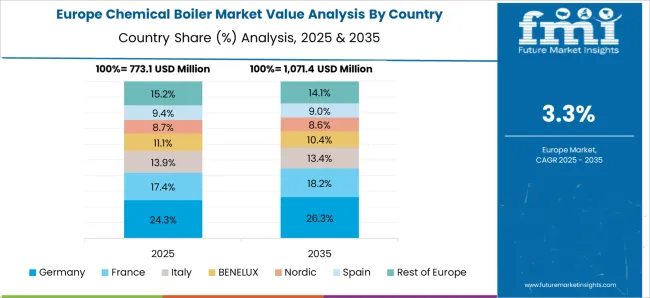

The chemical boiler market is projected to grow at a global CAGR of 3.6% through 2035, driven by rising industrial production, chemical processing, and demand for energy-efficient boiler systems. China leads at 4.9%, a 1.36× multiple over the global benchmark, supported by BRICS-driven growth in chemical manufacturing, industrial plants, and energy infrastructure. India follows at 4.5%, a 1.25× multiple, reflecting expansion in chemical processing, pharmaceuticals, and industrial applications. Germany records 4.1%, a 1.14× multiple, shaped by OECD-backed innovation in high-efficiency boilers and industrial safety standards. The United Kingdom posts 3.4%, 0.94× the global rate, with adoption concentrated in industrial facilities and chemical production units. The United States stands at 3.1%, 0.86× the benchmark, with steady uptake in chemical, pharmaceutical, and energy sectors. BRICS economies drive the majority of market volume, OECD countries emphasize efficiency and technological advancement, while ASEAN nations contribute through industrial growth and chemical production. This report includes insights on 40+ countries; the top markets are shown here for reference.

The chemical boiler market in China is projected to grow at a CAGR of 4.9%, driven by industrial growth, expansion of chemical and pharmaceutical manufacturing, and rising demand for energy-efficient boiler systems. Leading players such as Zhejiang Boiler, Harbin Boiler, and Dongfang Electric are supplying high-capacity, automated chemical boilers with advanced control and emission reduction technologies. Adoption is concentrated in chemical plants, pharmaceutical facilities, and food processing industries. Technological trends focus on improved heat efficiency, safety systems, and emission compliance. Government policies supporting industrial modernization and energy efficiency reinforce market growth. Rising demand for reliable, low-maintenance boilers accelerates adoption across industrial sectors in China.

The chemical boiler market in India is expected to expand at a CAGR of 4.5%, driven by growth in chemical manufacturing, pharmaceuticals, and food processing sectors. Key suppliers such as Thermax, Forbes Marshall, and Babcock provide energy-efficient and automated chemical boiler systems. Adoption is concentrated in industrial plants, chemical parks, and large-scale food processing facilities. Technological advancements include improved heat recovery, safety systems, and fuel flexibility. Government initiatives promoting industrial modernization, energy efficiency, and emission control reinforce market growth. Rising demand for low-maintenance, high-performance boilers supports adoption across India.

The chemical boiler market in Germany is projected to grow at a CAGR of 4.1%, supported by industrial modernization, energy efficiency initiatives, and strict emission regulations. Leading companies such as Bosch, Viessmann, and Babcock focus on advanced automated boiler systems for chemical, pharmaceutical, and food processing applications. Adoption is concentrated in industrial parks, chemical complexes, and research facilities. Technological trends emphasize emission control, fuel flexibility, and automated monitoring. Government incentives promoting energy-efficient systems and industrial sustainability reinforce market growth. Increasing demand for high-quality, low-maintenance boilers accelerates adoption in Germany.

The chemical boiler market in the United Kingdom is projected to grow at a CAGR of 3.4%, driven by chemical, pharmaceutical, and food processing industries seeking reliable and energy-efficient boiler systems. Key suppliers such as Babcock, Spirax Sarco, and Bosch provide automated, high-performance chemical boilers. Adoption is concentrated in industrial facilities, chemical parks, and processing plants. Technological trends focus on emission reduction, energy efficiency, and process automation. Government policies supporting industrial modernization, energy efficiency, and emission standards reinforce market growth. Rising industrial demand for reliable and low-maintenance boilers supports steady adoption in the United Kingdom.

The chemical boiler market in the United States is expected to grow at a CAGR of 3.1%, driven by industrial manufacturing, chemical processing, and food production sectors. Leading manufacturers such as Cleaver-Brooks, Babcock, and Bosch provide high-capacity, automated, and emission-compliant boiler systems. Adoption is concentrated in chemical plants, industrial complexes, and large-scale food processing units. Technological trends include energy-efficient designs, automated monitoring, and emission control. Government regulations promoting energy efficiency, safety, and environmental compliance reinforce market adoption. Rising demand for reliable and low-maintenance systems supports steady growth in the USA market.

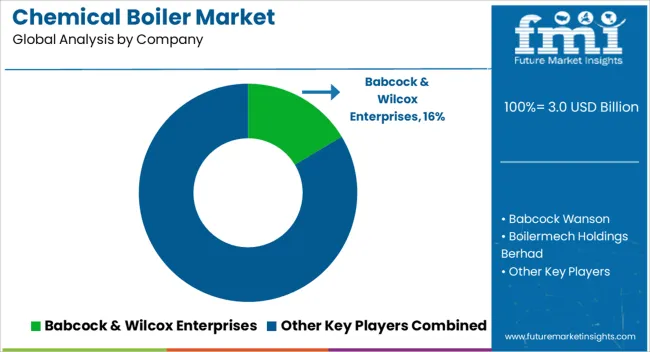

Competition in the chemical boiler industry is being driven by efficiency, reliability, and compliance with industrial safety and environmental standards. Babcock & Wilcox Enterprises and Babcock Wanson are being advanced with high-capacity, high-efficiency boilers engineered for chemical, pharmaceutical, and food processing applications. Boilermech Holdings Berhad and Clayton Industries are being positioned with modular and compact boiler systems that provide flexible operation, energy savings, and rapid installation. Cleaver-Brooks and Cochran are being showcased with multi-fuel and low-emission boilers, catering to industries requiring precise temperature control and process consistency.

FERROLI S.p.A., Forbes Marshalls, and Fulton are being applied with corrosion-resistant and automated systems that ensure long-term operational stability and reduced maintenance costs. Hurst Boiler & Welding, John Cockerill, and Maxima Boilers are being highlighted with specialized designs for steam generation, thermal efficiency, and integration with advanced monitoring systems. Miura America and Rentech Boiler Systems are being advanced with compact, high-efficiency boilers that maximize heat transfer while minimizing energy consumption.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 Billion |

| Capacity | 10 MMBTU/hr, 10–25 MMBTU/hr, 25–50 MMBTU/hr, 50–75 MMBtu/hr, 75–100 MMBTU/hr, 100–175 MMBTU/hr, 175–250 MMBTU/hr, and > 250 MMBTU/hr |

| Product | Fire-tube and Water-tube |

| Technology | Condensing and Non-condensing |

| Fuel | Natural gas, Oil, Coal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Babcock & Wilcox Enterprises, Babcock Wanson, Boilermech Holdings Berhad, Clayton Industries, Cleaver-Brooks, Cochran, FERROLI S.p.A, Forbes Marshalls, Fulton, Hurst Boiler & Welding, John Cockerill, Maxima Boilers, Miura America, and Rentech Boiler Systems |

| Additional Attributes | Dollar sales by boiler type and end use, demand dynamics across chemical, pharmaceutical, and industrial sectors, regional trends in process heating adoption, innovation in efficiency, emission control, and safety, environmental impact of fuel use and wastewater, and emerging use cases in hybrid heating systems and process optimization. |

The global chemical boiler market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the chemical boiler market is projected to reach USD 4.3 billion by 2035.

The chemical boiler market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in chemical boiler market are 10 mmbtu/hr, 10–25 mmbtu/hr, 25–50 mmbtu/hr, 50–75 mmbtu/hr, 75–100 mmbtu/hr, 100–175 mmbtu/hr, 175–250 mmbtu/hr and > 250 mmbtu/hr.

In terms of product, fire-tube segment to command 57.9% share in the chemical boiler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Condensing Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Boiler Water Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Water Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA