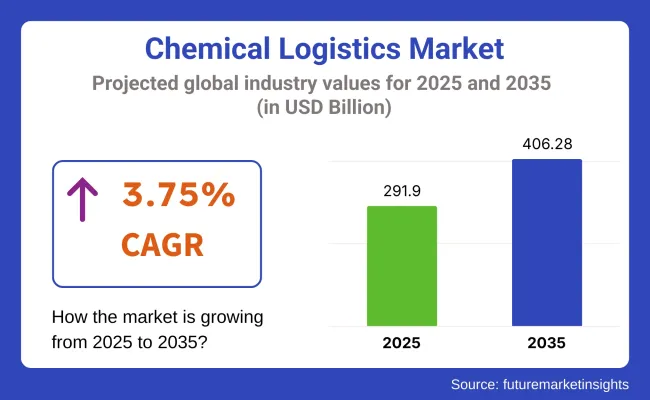

The chemical logistics market is projected to expand steadily, rising from USD 291.90 billion in 2025 to USD 406.28 billion by 2035, registering a CAGR of 3.75%.

This expansion is attributed to increasing global chemical production, heightened regulatory focus on the safe transportation of hazardous materials, and technological upgrades in temperature control and real-time tracking systems. The rising demand for specialty and commodity chemicals in end-use industries, such as automotive, electronics, and pharmaceuticals, is also bolstering market growth.

Among the transportation modes, railways are expected to dominate with a 34.6% share in 2025, driven by their cost-efficiency, safety, and suitability for bulk chemical movement across long distances, particularly in North America and Europe, where extensive rail networks are well-developed.

By chemical type, the commodity chemicals segment is expected to continue its leadership, holding a 49.2% share in 2025. This segment encompasses essential bulk products, including petrochemicals, fertilizers, and industrial gases, that require specialized logistics services to ensure safety and regulatory compliance during storage and transportation.

A significant industry development occurred on April 1, 2025, when Information Services Group (ISG) released its 2025 ISG Provider Lens Agribusiness and Chemicals Services and Solutions report.

The study confirmed that USA chemical producers are actively embracing GenAI, IoT sensors, advanced analytics, and predictive maintenance technologies, resulting in efficiency gains of up to 10% through these digital solutions.

The report, published by ISG via Business Wire and verified by multiple sources, including Cognizant.com, Nasdaq.com, and ISG’s investor site, highlights the industry's ongoing shift toward AI-driven logistics, smart tracking, and automation. This underscores a significant transformation toward digitalization across the global chemical logistics market.

Regionally, the Asia Pacific is expected to remain the fastest-growing market due to the rapid industrialization in nations such as China, India, and Vietnam. Infrastructure improvements and government support for the chemical sector contribute to this momentum.

Meanwhile, North America and Europe continue to lead the integration of automation and regulatory-compliant solutions to ensure operational safety.

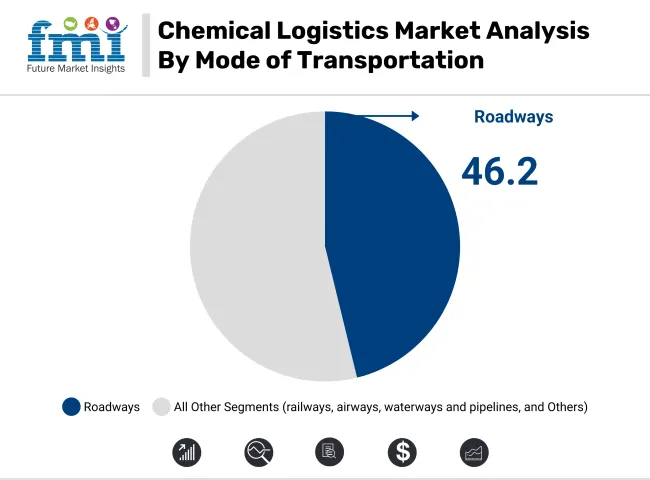

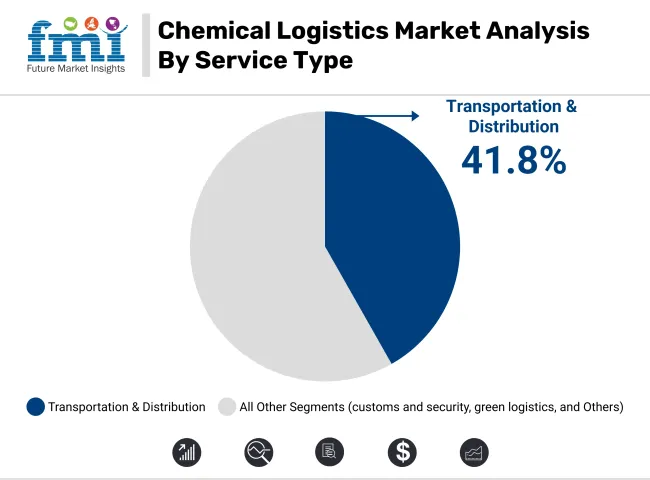

The Roadways transportation mode is set to dominate the chemical logistics market with a projected 46.2% share in 2025, owing to its flexibility and wide network reach. Meanwhile, the Transportation & Distribution services segment will remain the largest, capturing a 41.8% market share in 2025, driven by increasing demand for the safe and timely delivery of hazardous and specialty chemicals.

The roadways segment is expected to account for 46.2% of the global market in 2025, maintaining its leadership due to its unparalleled flexibility, door-to-door service capability, and well-established highway networks. Road transportation is particularly favored for short- to medium-distance deliveries of chemicals, especially in regions such as North America, Europe, and parts of the Asia-Pacific, where infrastructure is robust. This mode enables customized routing, improved handling of hazardous goods, and offers cost advantages for domestic distribution. The rising demand for temperature-controlled and specialized chemical tanks, coupled with regulatory advancements such as ADR (Accord Dangereux Routier) compliance, further strengthens this segment.

Transportation & Distribution services are projected to hold a 41.8% market share in 2025, driven by the essential need for safe, reliable, and compliant chemical delivery systems globally. These services ensure that both bulk and specialty chemicals reach their destinations without risks of leakage, contamination, or regulatory violations. The growth of the pharmaceutical, agrochemical, and petrochemical sectors significantly boosts demand for this segment. Logistics providers are focusing on expanding chemical-dedicated fleets, specialized tankers, and multimodal distribution solutions to address the complex needs of their supply chains. Investments in automation, digital freight platforms, and predictive route optimization are enhancing distribution efficiency.

The chemical logistics market is evolving due to safety regulations, technological integration, and rising demand for sustainable supply chains. Market players focus on compliance, innovation, and operational efficiency to gain competitiveness.

Growing Importance of Regulatory Compliance and Safety Standards

Strict global regulations regarding the storage and transportation of hazardous chemicals are shaping market practices. Authorities such as OSHA and REACH mandate adherence to safety protocols, driving investment in certified warehouses and specialized transport vehicles. Market players are adopting advanced monitoring systems, including IoT sensors, to ensure real-time tracking of chemical cargo. Failures in compliance can lead to severe financial penalties and reputational damage. This focus on safety promotes the use of double-hulled tankers and leak-proof containers. Companies prioritize staff training and emergency response preparedness, ensuring safer handling across the supply chain. Enhanced documentation and digital tracking streamline operations, ensuring full regulatory compliance.

Technological Advancements Enhancing Supply Chain Efficiency

Technological integration is transforming chemical logistics operations, improving supply chain visibility and efficiency. The adoption of AI-powered route optimization tools enables real-time adjustments, resulting in reduced transit times and operational costs. Blockchain platforms are being used to enhance traceability and data security in shipment documentation.

Automated warehousing systems optimize space utilization and inventory management, ensuring proper segregation of hazardous materials. Digital twins simulate logistics processes, identifying bottlenecks and improving planning accuracy. Predictive maintenance enabled by IoT devices reduces equipment downtime, ensuring uninterrupted service.

Collaboration platforms facilitate seamless communication among stakeholders. These innovations support risk mitigation, cost control, and sustainability goals, delivering competitive advantages to proactive logistics providers.

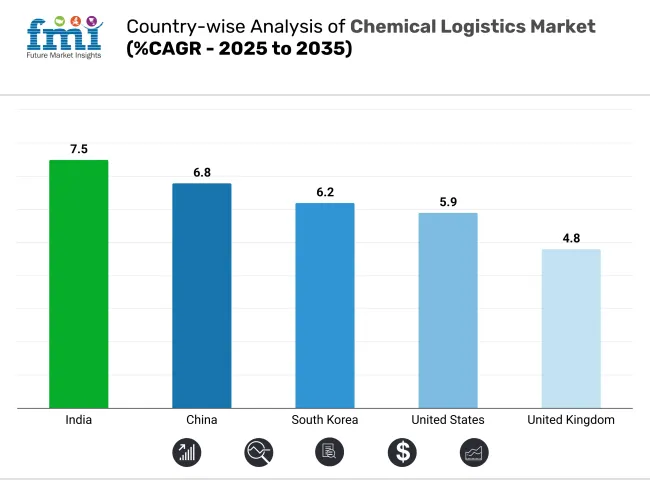

The chemical logistics market analysis highlights major trends shaping global industry growth. The countries identified here offer distinctive opportunities based on storage, transportation, safety, and regulatory frameworks that are crucial to chemical handling. India exhibits unparalleled growth, driven by infrastructure expansion, followed closely by China, which boasts advanced logistics hubs. South Korea, the United States, and Germany also exhibit strong development driven by technology and safety advancements.

India leads the global chemical logistics market, with an impressive projected compound annual growth rate (CAGR) of 7.5 percent from 2025 to 2035. This growth stems from large-scale industrialization, government-driven infrastructure upgrades such as freight corridors, and surging domestic demand for specialty and agrochemicals. Leading firms invest heavily in temperature-controlled storage and safety-compliant transport systems.

Rising export activities in pharmaceuticals and petrochemicals also expand the market scope. Government schemes, such as the National Logistics Policy, enhance operational efficiency and facilitate digital tracking. India’s logistics modernization positions it as the fastest-growing country in this sector, outpacing regional peers in service capability and market reach during the forecast period.

China chemical logistics market is projected to grow at a CAGR of 6.8 percent between 2025 and 2035. Dominated by global giants such as Sinopec and PetroChina, the country leverages its vast inland logistics hubs, expanded rail networks, and advanced warehousing systems. Safety improvements following past industrial incidents drive operational upgrades, including the implementation of real-time monitoring systems.

Growth in domestic demand for specialty and bulk chemicals enhances infrastructure capacity. Export-oriented production in petrochemicals and industrial chemicals adds scale to this market. Strategic alignment with Belt and Road initiatives further boosts China chemical transport networks, solidifying its position as the market share leader globally.

South Korea records a projected CAGR of 6.2 percent for the chemical logistics market during 2025 to 2035. The nation’s competitive edge lies in smart warehousing and AI-driven logistics platforms that optimize chemical handling, storage, and distribution.

Industry players such as Hyundai Glovis implement cutting-edge real-time transport monitoring to ensure safety and compliance. Government incentives supporting clean energy logistics solutions enhance market sustainability. Growing domestic demand for specialty and functional chemicals drives investment in infrastructure upgrades.

Urbanization and rapid industrial development fuel the need for efficient chemical supply chains, positioning South Korea among the fastest-growing countries in the global chemical logistics landscape.

The United States chemical logistics market is projected to grow at a CAGR of 5.9 percent over the forecast period 2025 to 2035. Digitized warehousing systems, AI-powered inventory management, and sustainable transport solutions fuel this expansion.

Multinational corporations such as Dow Chemical and ExxonMobil demand precise, safety-regulated storage and distribution channels. Strict compliance with Environmental Protection Agency (EPA) standards elevates operational complexity while ensuring environmental protection. The nation’s leadership in chemical innovation and industrial manufacturing drives demand for advanced logistics solutions.

Continuous investment in automation, safety infrastructure, and eco-friendly transport technologies secures the United States' top-five position in global market development.

The United Kingdom chemical logistics market is set to grow at a projected CAGR of 4.8% during the forecast period 2025–2035. Growth is driven by increasing focus on sustainable transport solutions, including the adoption of low-emission vehicles and energy-efficient storage facilities.

Post-Brexit trade adjustments demand more resilient and flexible cross-border chemical transport strategies. Key operators such as Suttons Group and Wincanton invest in Reach-compliant warehousing and transport systems to ensure regulatory adherence.

Technological upgrades in tracking and inventory management enhance operational efficiency. These factors collectively reinforce the UK’s evolving position in the European chemical logistics landscape while meeting environmental goals.

The chemical logistics market features a moderately consolidated structure with Tier 1, Tier 2, and Tier 3 players catering to various chemical sectors. Key companies, such as Deutsche Post AG (DHL), DB Schenker, and C.H. Robinson, dominate the market through their global networks, multimodal transport, and digital supply chain solutions, ensuring safety and compliance.

Regional firms such as A&R Logistics, BDP International, BDtrans, Rhenus Logistics, and Ryder System Inc. specialize in bulk liquid transport, ISO tank services, and customized packaging. The growing demand for temperature-controlled warehousing, real-time tracking, and regulatory adherence drives technological integration as a crucial competitive advantage among all market participants.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025E) | USD 291.90 billion |

| Projected Market Size (2035F) | USD 406.28 billion |

| CAGR (2025 to 2035) | 3.75% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for Value & Million Tons for Volume |

| By Mode of Transportation (Segment 1) | Roadways, Railways, Airways, Waterways, Pipelines |

| By Services (Segment 2) | Transportation & Distribution, Storage & Warehousing, Customs & Security, Green Logistics, Consulting & Management Services, Others |

| By End User (Segment 3) | Chemical Industry, Pharmaceutical Industry, Cosmetic Industry, Oil & Gas Industry, Specialty Chemicals Industry, Food, Others |

| Regions Covered | North America, Latin America, Europe, Asia-Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Germany, UK, France, China, Japan, India, ASEAN Countries, GCC Countries, South Africa |

| Key Players Influencing the Market | A&R Logistics, BASF, BDP International, BDtrans, C.H. Robinson Worldwide Inc., Deutsche Bahn (DB) Schenker, Deutsche Post AG (DHL), Rhenus Logistics, Ryder System Inc. |

| Additional Attributes | Dollar sales, share, cost efficiency of multi-modal transport, compliance with chemical safety norms, rising demand for green logistics, integration of digital supply chain systems |

The chemical logistics market is segmented by mode of transportation into roadways, railways, airways, waterways and pipelines.

By services, the market includes transportation and distribution, storage and warehousing, customs and security, green logistics, consulting and management services and others.

By end user, the market covers chemical industry, pharmaceutical industry, cosmetic industry, oil and gas industry, specialty chemicals industry, food and others.

By geography, the market is categorized into North America, Latin America, Europe, Asia Pacific and Middle and East Africa.

The market is expected to reach USD 406.28 billion by 2035.

The market size is estimated at USD 291.90 billion in 2025.

A&R Logistics, BASF, BDP International, BDtrans, C.H. Robinson Worldwide Inc., Deutsche Bahn (DB) Schenker, Deutsche Post AG (DHL), Rhenus Logistics, Ryder System Inc.

Roadways, railways, airways, waterways, and pipelines.

Stringent regulatory policies, global chemical trade expansion, and demand for safe chemical handling solutions.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA