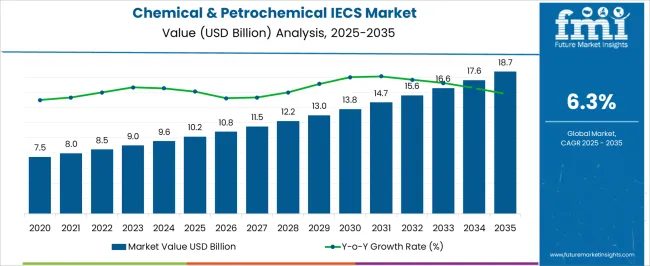

The Chemical & Petrochemical IECS Market is estimated at USD 10.2 billion in 2025 and is projected to reach USD 18.7 billion by 2035, reflecting a CAGR of 6.3%. Regulatory frameworks play a pivotal role in shaping market dynamics, as stringent environmental, safety, and operational standards drive the adoption of integrated electrical and control systems across chemical and petrochemical facilities. Compliance with regulations such as process safety management (PSM), hazardous area classification guidelines, and electrical installation standards ensures that plants maintain operational safety and minimize environmental impact, prompting consistent investment in IECS technologies.

Over the forecast period, regulatory mandates targeting emission reductions, energy efficiency, and automation of hazardous processes are expected to accelerate the integration of advanced monitoring, control, and protection systems. Facilities operating in regions with stricter compliance requirements are likely to adopt IECS solutions more rapidly, leading to incremental year-on-year market growth. Furthermore, periodic revisions of industry-specific regulations will necessitate system upgrades, influencing procurement cycles and capital expenditure planning.

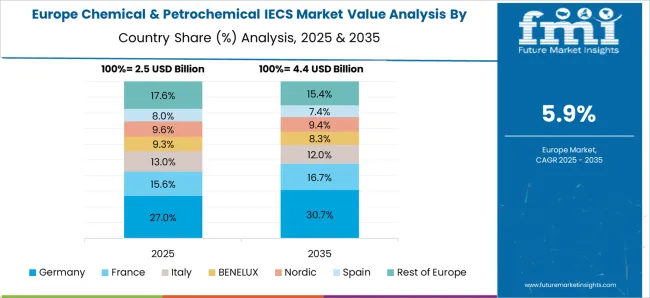

The regulatory environment also differentiates growth across regions, with markets in North America and Europe experiencing steady growth due to proactive enforcement, while emerging economies in Asia-Pacific may exhibit accelerated adoption as industrial modernization aligns with global safety and environmental standards. Consequently, the Chemical & Petrochemical IECS Market demonstrates a strong regulatory-driven expansion trajectory, ensuring sustained demand and compliance-aligned technology deployment from 2025 to 2035.

| Metric | Value |

|---|---|

| Chemical & Petrochemical IECS Market Estimated Value in (2025 E) | USD 10.2 billion |

| Chemical & Petrochemical IECS Market Forecast Value in (2035 F) | USD 18.7 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The Chemical and Petrochemical Industrial Emission Control Systems (IECS) market is progressing steadily as industries focus on reducing harmful emissions and meeting stringent environmental regulations. The growing emphasis on sustainability and air quality improvement has driven investments in emission control technologies across chemical processing and petrochemical facilities.

Advances in pollution control equipment have enabled more efficient removal of particulate matter and other pollutants, supporting cleaner production processes. Regulatory pressures from government agencies continue to promote the adoption of systems that minimize environmental impact while maintaining operational efficiency.

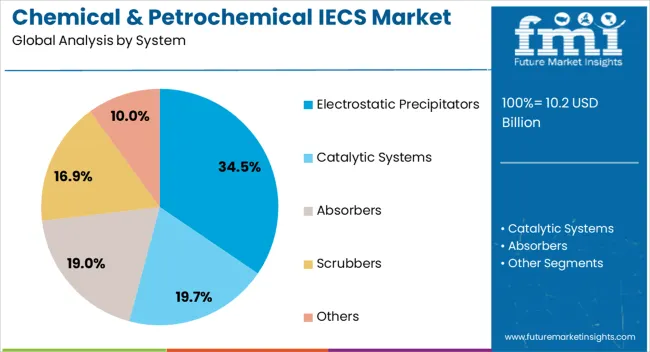

Increased awareness of the health and environmental risks associated with industrial emissions has further encouraged the integration of advanced emission control solutions. Future market growth is expected to be fueled by modernization of older plants and expanding petrochemical production in emerging economies. Segmental growth is projected to be led by Electrostatic Precipitators, given their effectiveness in capturing fine particles and suitability for various industrial applications.

The chemical & petrochemical IECS market is segmented by system and region. By system, the market is divided into electrostatic precipitators, catalytic systems, absorbers, scrubbers, and others. Regionally, the industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Electrostatic Precipitators segment is expected to account for 34.5% of the Chemical and Petrochemical IECS market revenue in 2025, retaining its position as the leading system type. These systems have been favored due to their high efficiency in removing fine particulate matter from industrial exhaust gases.

Electrostatic precipitators operate by charging particles and collecting them on oppositely charged plates, making them effective for controlling emissions in high-temperature and high-volume applications common in chemical and petrochemical plants. Their reliability and low operating costs have contributed to widespread adoption in facilities aiming to comply with strict emission standards.

Additionally, ongoing improvements in precipitator design have enhanced performance and reduced maintenance requirements. As industries continue to adopt cleaner technologies and upgrade emission control equipment, electrostatic precipitators are expected to maintain their dominant market share.

The chemical and petrochemical IECS (Integrated Electrical & Control Systems) market has been expanding due to the increasing complexity and automation of chemical and petrochemical plants. These systems have been widely utilized to control processes, monitor equipment, and ensure operational safety and efficiency. Market growth has been supported by advancements in digital instrumentation, control software, and industrial networking. Rising demand for process optimization, energy efficiency, and regulatory compliance has further strengthened the deployment of IECS in chemical and petrochemical industries globally.

The growing need for enhanced operational efficiency has been a major driver of the chemical and petrochemical IECS market. Integrated electrical and control systems have been deployed to monitor process parameters, automate production sequences, and reduce downtime in chemical manufacturing, refinery operations, and petrochemical production units. Real-time data collection, predictive analytics, and process visualization have enabled plant operators to identify inefficiencies, prevent equipment failures, and optimize throughput. In addition, integration with supervisory control and data acquisition (SCADA) systems has improved decision-making, scheduling, and resource management. As chemical and petrochemical plants expand production capacity and incorporate complex processes, the adoption of IECS has become essential for operational reliability, cost reduction, and quality assurance in industrial operations worldwide.

Technological innovations have significantly improved the functionality, efficiency, and reliability of chemical and petrochemical IECS. Advanced control software, programmable logic controllers (PLCs), and digital instrumentation have enabled precise regulation of temperature, pressure, flow, and chemical composition. The integration of industrial IoT, wireless sensors, and cloud-based monitoring has facilitated real-time data analytics and remote management. Modular and scalable designs have allowed customization for different plant sizes and process requirements, while cybersecurity measures have ensured secure operation of critical infrastructure. These technological enhancements have improved predictive maintenance, energy management, and process safety. By combining automation, digital analytics, and operational flexibility, IECS has become a critical enabler for modern chemical and petrochemical manufacturing operations.

Compliance with safety regulations and environmental standards has been a significant factor driving the adoption of chemical and petrochemical IECS. Plants have been required to adhere to industrial safety guidelines, emission control regulations, and process hazard analysis standards. IECS has been deployed to monitor critical process parameters, trigger alarms for deviations, and ensure safe shutdown in case of emergencies. Integration with safety instrumented systems (SIS) has improved risk mitigation and operational reliability. The ability to maintain accurate records, generate automated compliance reports, and ensure traceability has reinforced the use of IECS in highly regulated environments. Regulatory mandates combined with the need for safe and reliable operations have driven consistent adoption of integrated electrical and control systems across chemical and petrochemical industries worldwide.

The growing adoption of smart plant initiatives, digital twin technologies, and process automation has created new opportunities in the chemical and petrochemical IECS market. Integration of predictive analytics, machine learning, and AI-enabled control has enabled real-time optimization of complex chemical processes. Remote monitoring and cloud-based supervisory systems have allowed centralized control of multiple plant locations, improving efficiency and reducing operational costs. Expansion of green chemical processes and energy-efficient operations has further encouraged the deployment of advanced IECS. As chemical and petrochemical companies aim to increase operational visibility, reduce downtime, and optimize energy usage, the demand for scalable, intelligent, and connected electrical and control systems is expected to grow globally.

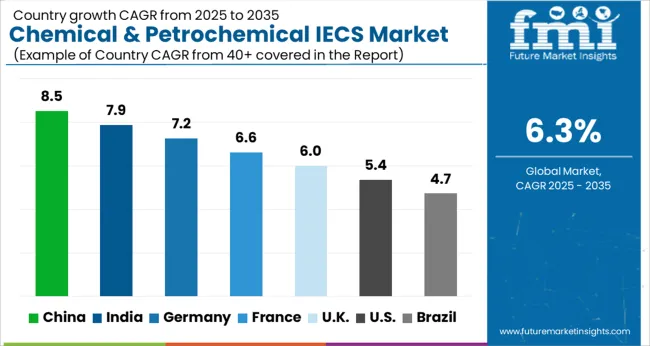

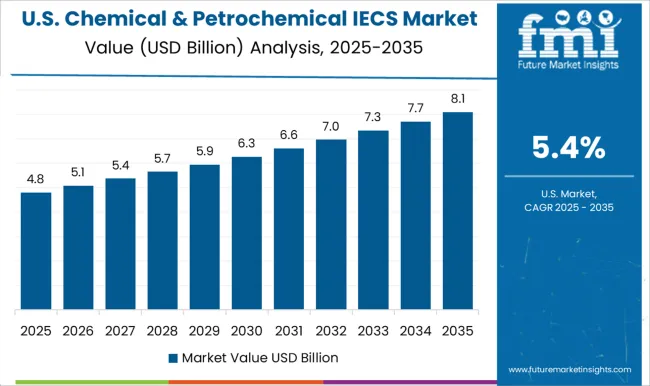

The market is expected to grow at a CAGR of 6.3% between 2025 and 2035, driven by rising demand for process automation, safety compliance, and digital monitoring in chemical plants. China leads with an 8.5% CAGR, supported by large-scale industrial modernization and adoption of advanced IECS solutions. India follows at 7.9%, fueled by growth in refining and chemical production capacities. Germany, at 7.2%, benefits from stringent industrial safety standards and process optimization initiatives. The UK, with a 6.0% CAGR, focuses on enhancing operational efficiency and regulatory compliance, while the USA, at 5.4%, experiences steady adoption across established petrochemical industries. This report includes insights on 40+ countries; the top markets are shown here for reference.

The chemical and petrochemical IECS industry in China is expected to expand at a CAGR of 8.5% from 2025 to 2035, supported by refinery modernization and adoption of automated instrumentation systems. Integration of predictive analytics and IoT-based monitoring is increasing operational efficiency and minimizing downtime. Domestic technology providers are partnering with operators to implement real-time control solutions. Focus on energy optimization and environmental compliance is strengthening the demand. Advanced alarm management and operator training are further enhancing system reliability and performance.

India is forecast to grow at a CAGR of 7.9% over 2025 to 2035, driven by refinery upgrades and increased production of specialty chemicals. Implementation of integrated control systems is supporting operational reliability and energy efficiency. Partnerships with global and local technology providers are facilitating automation initiatives. Regulatory focus on industrial safety is encouraging IECS adoption. Predictive maintenance and process optimization programs are gaining momentum, increasing operational uptime and safety standards.

Sales in Germany are expected to grow at a CAGR of 7.2% between 2025 and 2035, supported by automation in high-precision chemical manufacturing. Refineries and chemical plants are deploying energy management solutions to reduce emissions and optimize production. Collaboration with European technology vendors is facilitating installation of advanced monitoring systems. Regulatory requirements on safety and environmental efficiency are encouraging faster adoption of IECS technologies.

The United Kingdom industry is projected to grow at a CAGR of 6.0%, driven by refinery automation upgrades and process optimization efforts. Integrated control systems are being deployed for real-time monitoring and predictive maintenance. Partnerships with technology providers and research institutions are encouraging adoption of advanced instrumentation. Emphasis on operator training and safety audits is improving operational reliability and compliance with environmental regulations.

The United States market is expected to expand at a CAGR of 5.4%, supported by continuous automation and smart monitoring across petrochemical plants. Cloud-based analytics and predictive maintenance solutions are enhancing operational efficiency. Regulatory standards on safety and environmental compliance are motivating IECS adoption. Leading operators are partnering with instrumentation providers to integrate modern control systems across critical operations while employee training improves system utilization and risk mitigation.

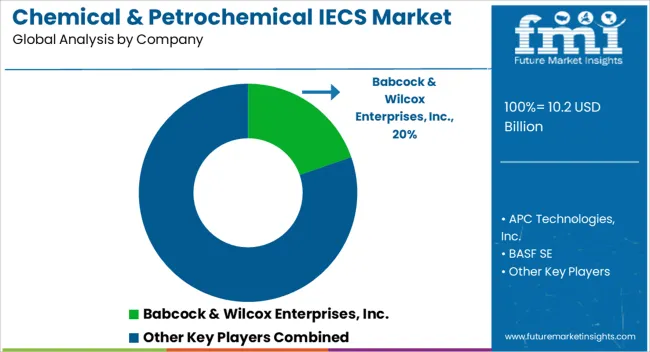

The market is shaped by growing demand for emission control, process optimization, and energy-efficient solutions across refineries and chemical plants. Babcock & Wilcox Enterprises delivers integrated environmental systems, including scrubbers and filtration units, optimizing plant performance while reducing emissions. APC Technologies focuses on tailor-made solutions for industrial gas treatment, ensuring compliance with environmental regulations.

BASF SE leverages its chemical expertise to provide innovative sorbents and catalysts for efficient pollutant removal. CECO ENVIRONMENTAL and DÜRR Group design modular and scalable systems for particulate and gas control, addressing diverse plant requirements. FLD Smidth and Fujian Longking specialize in air pollution control and flue gas treatment solutions for large-scale operations. Fuel Tech Inc. develops combustion optimization and emission reduction technologies, while GEA Group and General Electric provide integrated systems combining process efficiency and environmental compliance.

KC Cottrell India and John Wood Group PLC deliver tailored scrubbers, filters, and auxiliary systems to reduce operational emissions. Monroe Environmental Corp., S.A. HAMON, and MITSUBISHI HEAVY INDUSTRIES offer advanced industrial gas cleaning solutions with global deployment. TAPC, Thermax Limited, and Zhejiang Feida Environmental Protection Technology focus on customized and cost-effective IECS technologies for chemical and petrochemical applications.

Entry barriers include regulatory compliance, technical expertise, and high capital investment requirements, making expertise and reliability key differentiators. Providers offering scalable, efficient, and fully integrated systems maintain strong positions in the competitive market.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| System | Electrostatic Precipitators, Catalytic Systems, Absorbers, Scrubbers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Babcock & Wilcox Enterprises, Inc., APC Technologies, Inc., BASF SE, CECO ENVIRONMENTAL, DÜRR Group, FLD Smidth, Fujian Longking Co., Ltd., Fuel Tech Inc., GEA Group, General Electric, KC Cottrell India, John Wood Group PLC, Monroe Environmental Corp., S.A. HAMON, MITSUBISHI HEAVY INDUSTRIES, LTD., TAPC, Thermax Limited, and Zhejiang Feida Environmental Protection Technology Co., Ltd. |

| Additional Attributes | Dollar sales by system type and end-use application, demand dynamics across chemical processing, petrochemical refining, and industrial manufacturing, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in integrated control technologies, process optimization algorithms, and predictive maintenance solutions, environmental impact of energy efficiency improvements, emissions reduction, and waste minimization, and emerging use cases in digital twin integration, real-time plant monitoring, and automated process safety management. |

The global chemical & petrochemical IECS market is estimated to be valued at USD 10.2 billion in 2025.

The market size for the chemical & petrochemical IECS market is projected to reach USD 18.7 billion by 2035.

The chemical & petrochemical IECS market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in chemical & petrochemical IECS market are electrostatic precipitators, catalytic systems, absorbers, scrubbers and others.

In terms of , segment to command 0.0% share in the chemical & petrochemical IECS market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA