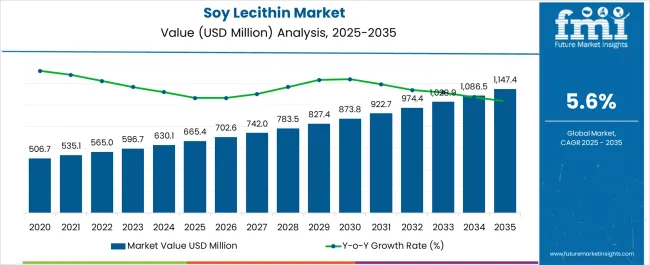

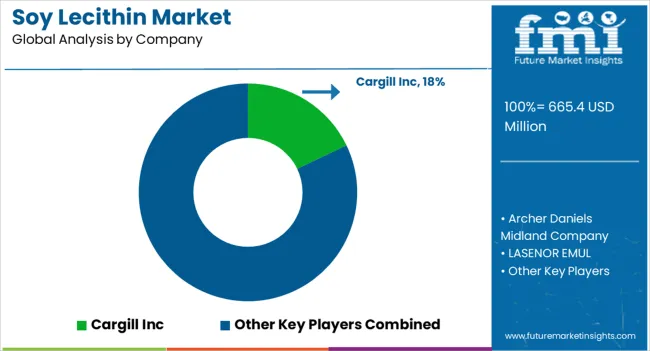

The Soy Lecithin Market is estimated to be valued at USD 665.4 million in 2025 and is projected to reach USD 1147.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Soy Lecithin Market Estimated Value in (2025 E) | USD 665.4 million |

| Soy Lecithin Market Forecast Value in (2035 F) | USD 1147.4 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

The soy lecithin market is experiencing notable growth, supported by its increasing utilization in the food, pharmaceutical, and cosmetics industries due to its multifunctional properties. Its widespread adoption is being driven by rising demand for natural emulsifiers and stabilizers that align with clean-label and non-GMO trends. Growing health awareness among consumers and the shift toward plant-based ingredients are further reinforcing market demand.

Soy lecithin is being recognized for its role in improving product texture, extending shelf life, and supporting low-fat and low-cholesterol formulations, which are key drivers in food and beverage applications. Technological advancements in extraction processes are improving product purity, catering to specialized applications such as nutraceuticals and infant nutrition.

Expanding use in dietary supplements, owing to its potential benefits for cardiovascular and cognitive health, is broadening its market scope As regulatory authorities continue to support the use of soy-based ingredients for functional and nutritional benefits, the soy lecithin market is positioned to achieve steady growth, with its role in sustainable and health-oriented product development reinforcing its long-term outlook.

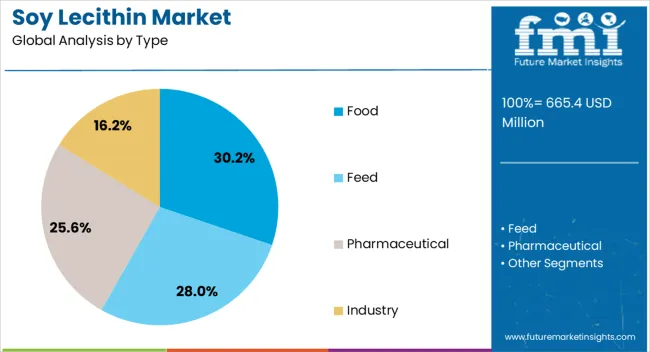

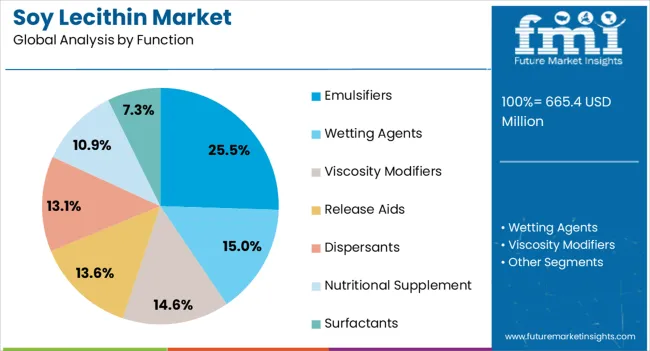

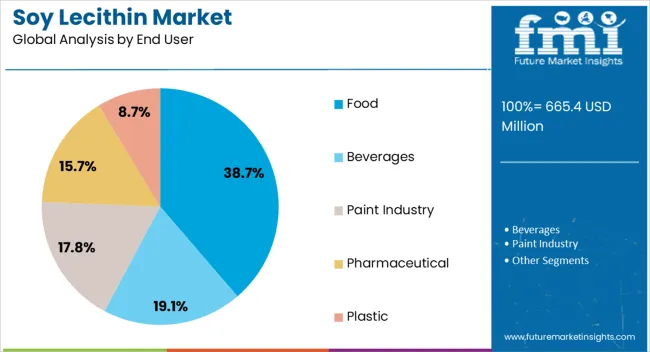

The soy lecithin market is segmented by type, function, end user, and geographic regions. By type, soy lecithin market is divided into Food, Feed, Pharmaceutical, and Industry. In terms of function, soy lecithin market is classified into Emulsifiers, Wetting Agents, Viscosity Modifiers, Release Aids, Dispersants, Nutritional Supplement, and Surfactants. Based on end user, soy lecithin market is segmented into Food, Beverages, Paint Industry, Pharmaceutical, and Plastic. Regionally, the soy lecithin industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food type segment is projected to hold 30.2% of the soy lecithin market revenue share in 2025, making it the largest product type. This leadership is being supported by the rising use of soy lecithin in bakery, confectionery, dairy, and processed food products where it acts as an effective emulsifier, stabilizer, and dispersing agent. Its role in enhancing texture, improving mixing of ingredients, and extending shelf life is driving adoption in mass production of packaged food.

Increasing consumer preference for natural and clean-label ingredients has strengthened demand for soy lecithin as a plant-derived alternative to synthetic additives. The segment is further benefiting from the surge in demand for plant-based and vegan products, where soy lecithin supports formulation without compromising taste or quality.

Food manufacturers are prioritizing ingredients that deliver functionality and consumer trust, which is enabling soy lecithin to consolidate its leadership As health-conscious consumption patterns rise globally, the food segment’s reliance on soy lecithin for innovation and reformulation is expected to reinforce its dominant position.

The emulsifiers function segment is expected to account for 25.5% of the soy lecithin market revenue share in 2025, establishing itself as the leading functional category. Its dominance is being attributed to soy lecithin’s strong ability to stabilize mixtures of immiscible ingredients such as oil and water, which is critical in bakery, chocolate, beverage, and dairy products. This functionality ensures consistent product quality, improved mouthfeel, and enhanced shelf stability, making it highly valued by manufacturers.

The segment is gaining momentum as food companies emphasize cleaner formulations with fewer synthetic additives, aligning with consumer demand for naturally derived functional ingredients. Soy lecithin’s emulsifying properties are also extending into pharmaceuticals and cosmetics, where it aids in drug delivery systems and skincare formulations.

Continuous innovation in processing methods is improving lecithin purity and functionality, broadening its application scope The preference for multifunctional, cost-effective, and label-friendly emulsifiers is expected to ensure that this segment retains its leadership role, with adoption reinforced by global trends in product innovation and health-oriented consumer preferences.

The food end user segment is projected to capture 38.7% of the soy lecithin market revenue share in 2025, making it the leading end-use category. This dominance is being reinforced by the extensive use of soy lecithin in processed foods, ready-to-eat meals, snacks, and beverages, where it enhances texture, stability, and flavor retention. Growing global consumption of packaged and convenience foods is driving segment growth, supported by rapid urbanization and changing lifestyles.

The food industry is prioritizing plant-based and sustainable ingredients, and soy lecithin meets these requirements while offering functional benefits. Rising consumer awareness about health and wellness is leading to higher demand for products with reduced trans fats and cholesterol, where soy lecithin is widely incorporated.

The segment is also benefiting from strong investments by manufacturers in innovative formulations, particularly in confectionery and dairy, where lecithin improves processing efficiency and end-product quality As demand for nutritious, clean-label, and plant-based food options expands globally, the food end user segment is positioned to sustain its leadership in the soy lecithin market.

Soy Lecithin Unlocks Deliciousness in Vegan Food Formulations

The plant-based revolution is embracing soy lecithin. This natural emulsifier, derived from soybeans, is finding a new home in vegan and plant-based food formulations. Its ability to keep oil and water happily mixed is key for creating that creamy texture consumers love in everything from vegan mayo and salad dressings to dairy-free ice cream. As plant-based alternatives continue to rise in popularity, soybean lecithin is becoming an essential tool for manufacturers to create delicious and satisfying vegan options.

Tech Boosts Plant-Based Powerhouse

The rise of plant-based eating is spurring innovation in soy lecithin production. Advancements in extraction and processing techniques of soy lecithin are unlocking the full potential of this natural emulsifier. New methods utilize enzymes or low-heat processes, resulting in higher-purity lecithin with improved functionality. This translates to a more versatile ingredient for manufacturers.

The new advancements also enable the creation of lecithin with specific functionalities, like improved fat dispersion or enhanced stability, further optimizing its performance in various plant-based applications. With ongoing technological breakthroughs, soy bean lecithin is poised to become an even more valuable tool for creating delicious and satisfying vegan alternatives.

Price Fluctuations and Quality Control Remain Hurdles

While the soy bean lecithin market enjoys a positive outlook, a few restrictions warrant mention. Fluctuations in soybean prices can directly impact production costs. Additionally, concerns around potential allergens and ensuring consistent quality necessitate robust regulations and stringent quality control measures throughout the supply chain. Addressing these challenges will be crucial for the market's continued smooth operation.

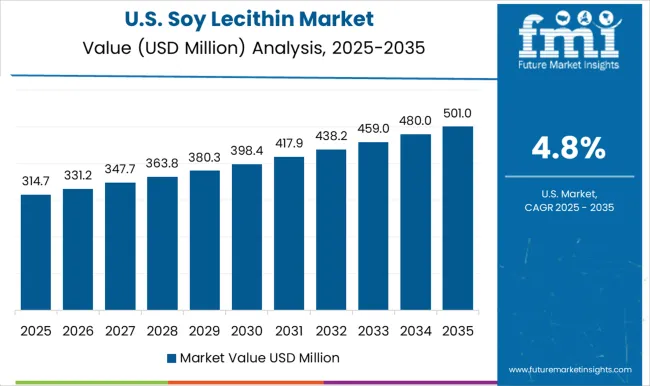

Demand for soy lecithin in the United States is on the rise due to a confluence of factors catering to both consumer preferences and market trends. Soy lecithin aligns perfectly with the growing consumer demand for natural and clean-label ingredients. Its plant-based origin and availability of non-GMO options resonate with health-conscious individuals seeking to avoid synthetic additives.

Soy lecithin offers potential health benefits like aiding digestion and cholesterol management. This aligns with the growing interest in functional foods that deliver health advantages beyond basic nutrition.

The demand for soy lecithin in the United Kingdom is increasing for several reasons, mirroring certain global trends. Surging popularity of vegan and plant-based alternatives extends to the United Kingdom.

Soy lecithin's ability to create creamy textures in vegan products like mayonnaise, dressings, and ice cream is crucial for its success. Further, the United Kingdom government's emphasis on healthy eating contributes to a rise in health-conscious consumers seeking natural solutions like soy lecithin.

China's soy lecithin market is experiencing a surge in demand due to a confluence of global trends and factors specific to the Chinese market. The growing preference for natural and minimally processed ingredients is also evident in China. Soybean lecithin's plant-based origin and clean label status align perfectly with this trend.

The rapid urbanization in China has led to a shift towards convenience foods, where soy lecithin acts as a valuable emulsifier and texturizer, extending shelf life and improving mouthfeel. Moreover, sustainability concerns are driving a shift towards plant-based alternatives, positioning soybean lecithin as a viable and eco-friendly option in China, which has an increasing focus on sustainability initiatives.

The paint industry is a hidden driver of soybean lecithin market growth. This natural emulsifier keeps paint components like pigments from separating, resulting in consistent color and a smooth finish. It can even enhance color vibrancy and act as a substitute for harsher wetting agents.

Soy lecithin's mild antioxidant properties may contribute to a longer paint shelf life. By enabling the creation of high-quality paints with these benefits, the paint industry fuels demand for soybean lecithin within the broader market.

The pharmaceutical industry is finding increasing value in soy lecithin, a natural ingredient with properties that enhance drug delivery. Soybean lecithin acts as a natural emulsifier, preventing oil and water-based components in medications from separating. This ensures consistent drug distribution within a dosage form. Furthermore, it can encapsulate certain drugs, potentially improving their effectiveness and absorption within the body.

Beyond its functional benefits, soy lecithin's plant-based origin and biocompatible nature make it a potentially safer alternative to synthetic emulsifiers in some cases. This combination of functionality, versatility, and potential cost-effectiveness is driving the demand for soy bean lecithin in the pharmaceutical industry.

The competitive landscape of the soy lecithin industry is heating up. Players are developing a wider range of lecithin products, from high-purity options for pharmaceuticals to specific emulsifiers for food, catering to diverse industry needs. Organic and non-GMO lecithin is gaining traction to meet clean label demands.

Technology is another key battleground. Advancements in processing techniques are yielding higher-purity and more functional lecithin, expanding its applications. Finally, sustainability is a growing weapon, with companies implementing eco-friendly practices throughout the supply chain to attract environmentally conscious consumers and businesses.

Industry Updates

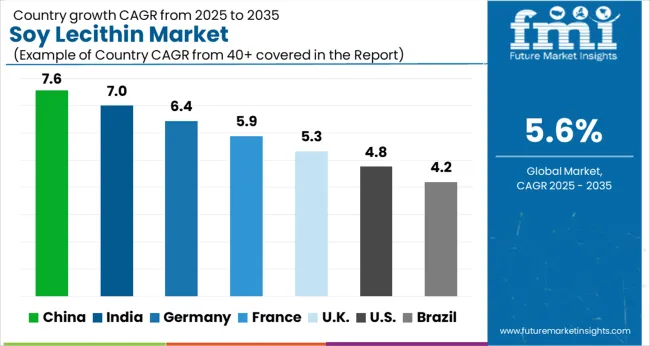

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The Soy Lecithin Market is expected to register a CAGR of 5.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.6%, followed by India at 7.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.2%, yet still underscores a broadly positive trajectory for the global Soy Lecithin Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.4%. The USA Soy Lecithin Market is estimated to be valued at USD 246.3 million in 2025 and is anticipated to reach a valuation of USD 392.1 million by 2035. Sales are projected to rise at a CAGR of 4.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 34.1 million and USD 17.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 665.4 Million |

| Type | Food, Feed, Pharmaceutical, and Industry |

| Function | Emulsifiers, Wetting Agents, Viscosity Modifiers, Release Aids, Dispersants, Nutritional Supplement, and Surfactants |

| End User | Food, Beverages, Paint Industry, Pharmaceutical, and Plastic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill Inc, Archer Daniels Midland Company, LASENOR EMUL, DuPont de Nemours, Lecico Gmbh, Wilmar International, Ruchi Soya Industries Ltd, and Ceresking Ecology & Technology Co. Ltd |

The global soy lecithin market is estimated to be valued at USD 665.4 million in 2025.

The market size for the soy lecithin market is projected to reach USD 1,147.4 million by 2035.

The soy lecithin market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in soy lecithin market are food, feed, pharmaceutical and industry.

In terms of function, emulsifiers segment to command 25.5% share in the soy lecithin market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soybean Enzymatic Protein Market Size and Share Forecast Outlook 2025 to 2035

Soy-based Chemical Market Size and Share Forecast Outlook 2025 to 2035

Soy Protein Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Soy Protein Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Soy Nuts Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soybean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Soy-Based Meat Alternative Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy-based Food Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Soybean Meal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy Isoflavones Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy Protein Isolate Market Size, Growth, and Forecast 2025 to 2035

Soy Food Products Market Analysis by food, beverages, oils and product type Through 2035 food, beverages, oils and product type

Soy Milk Market Analysis by Product Type, Category, Application, Distribution Channel and Region Through 2035

Soy Beverage Market Analysis by Product Type, Flavor, and Distribution Channel Through 2035

Soy Protein Concentrate Market Growth - Plant-Based Protein & Industry Expansion 2024 to 2034

Soy Polysaccharides Market

Soy Hydrolysates Market

Soybean Oil Market

Non-GMO Soya Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA