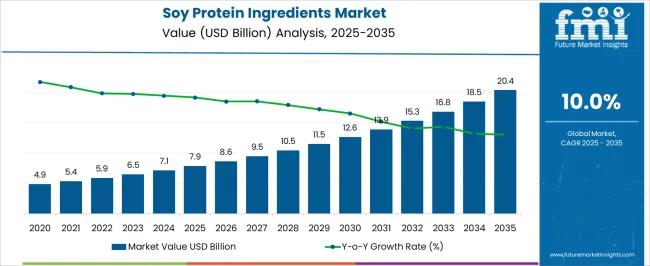

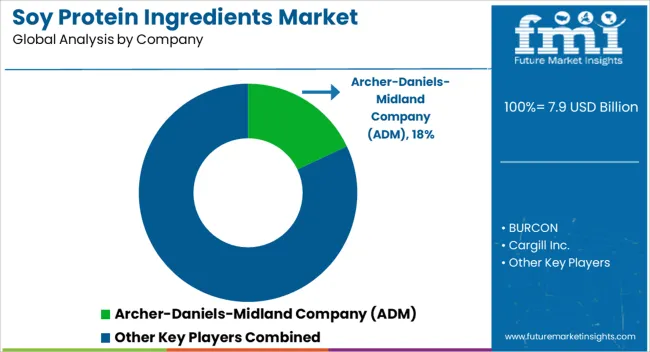

The soy protein ingredients market is estimated at USD 7.9 billion in 2025 and is projected to reach USD 20.4 billion by 2035, representing a CAGR of 10.0%. The market exhibits significant regional growth imbalance, driven by differing consumption patterns, regulatory frameworks, and supply chain infrastructure across Asia-Pacific, Europe, and North America.

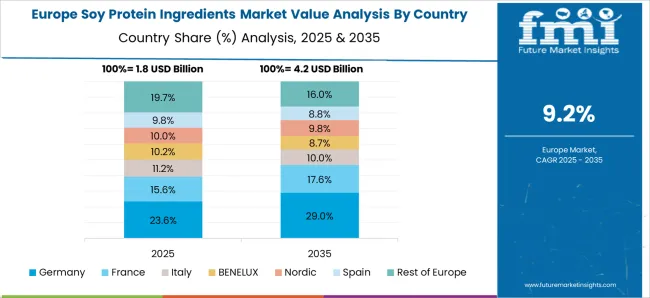

Asia Pacific accounts for the largest share of market demand due to rapidly expanding food processing industries, rising preference for plant-based protein sources, and increasing incorporation of soy protein in functional foods and beverages. China, Japan, and India are key contributors, supported by strong domestic production capacities and growing consumer awareness regarding nutritional benefits. Europe demonstrates moderate growth, with markets in Germany, France, and the United Kingdom leading adoption.

Growth is influenced by regulatory support for protein-enriched food products, health-conscious consumer behavior, and the development of plant-based dairy and meat alternatives. The adoption rate is tempered by higher raw material costs and regulatory compliance requirements that impact the pace of product innovation. North America shows steady expansion, driven by widespread demand in foodservice, bakery, and sports nutrition applications, with the United States leading in both production and consumption.

By 2035, the Asia-Pacific region is expected to maintain a dominant market share, exceeding 50% of the global value, while Europe and North America will continue to grow at moderate rates. The regional imbalance reflects the interplay of demographic trends, dietary preferences, regulatory incentives, and industrial capacity, highlighting the strategic importance of regional focus for market players targeting long-term growth.

| Metric | Value |

|---|---|

| Soy Protein Ingredients Market Estimated Value in (2025 E) | USD 7.9 billion |

| Soy Protein Ingredients Market Forecast Value in (2035 F) | USD 20.4 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

Rising demand for functional food and beverages, along with the increasing global focus on health and wellness, is contributing significantly to market growth. Industry publications and food innovation news highlight that soy protein’s complete amino acid profile and digestibility are factors that continue to influence its widespread use.

Additionally, food manufacturers are investing in soy-based ingredient development to cater to vegan, vegetarian, and flexitarian diets. Press releases from key food producers suggest that technological advancements in protein extraction and flavor masking are further enhancing product appeal.

The future outlook remains favorable as regulatory bodies encourage the use of sustainable and non-animal protein sources. Consumer awareness surrounding the environmental impact of animal agriculture and the nutritional benefits of soy protein is expected to drive consistent demand across food and beverage applications globally.

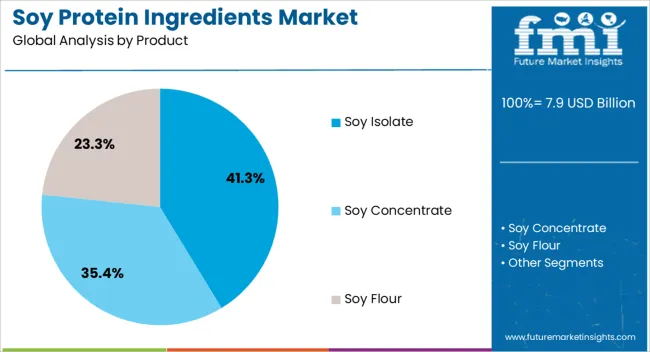

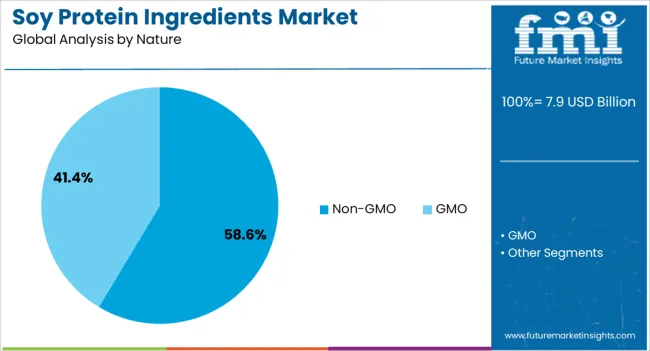

The soy protein ingredients market is segmented by product, nature, application, and geographic regions. By product, the soy protein ingredients market is divided into Soy Isolate, Soy Concentrate, and Soy Flour. In terms of nature, the soy protein ingredients market is classified into Non-GMO and GMO.

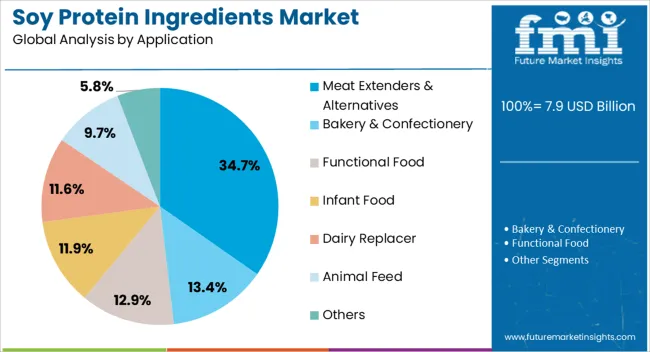

Based on application, the soy protein ingredients market is segmented into Meat Extenders & Alternatives, Bakery & Confectionery, Functional Food, Infant Food, Dairy Replacer, Animal Feed, and Others. Regionally, the soy protein ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The soy isolate segment is expected to contribute 41.3% of the Soy Protein Ingredients market revenue share in 2025, making it the leading product category. Its dominance is being driven by the high protein concentration it offers, along with its functional versatility across food and beverage applications.

Industry sources note that soy isolates provide excellent emulsification, water absorption, and texture enhancement properties, making them ideal for use in meat alternatives, dairy substitutes, and sports nutrition. The segment’s growth has also been supported by innovations in taste improvement and solubility, addressing historical consumer concerns.

Press materials from food technology firms have emphasized the widespread adoption of soy isolates in ready-to-eat and convenience foods, as manufacturers seek to boost protein content without compromising on texture or flavor. These functional advantages, coupled with broad regulatory acceptance and a strong track record of safety, have reinforced the leading position of soy isolate in the product category.

The non-GMO segment is projected to account for 58.6% of the Soy Protein Ingredients market revenue share in 2025, making it the leading category by nature. Growth in this segment is being fueled by increasing consumer demand for clean-label and transparent food sources. Food industry news and manufacturer updates indicate a strong preference among health-conscious consumers for non-genetically modified ingredients, particularly in North America and Europe.

Retailers and foodservice providers have responded by expanding their non-GMO product lines, creating additional momentum for this segment. In addition, regulatory frameworks and certification programs are reinforcing supply chain traceability, further encouraging the use of non-GMO soy protein ingredients.

The segment’s leadership is also being supported by food processors seeking to align with ethical sourcing practices and avoid the regulatory complexities associated with GMO labeling. As a result, non-GMO soy protein continues to be adopted at scale across multiple food categories, ensuring its sustained dominance in the market.

The meat extenders and alternatives segment is anticipated to hold 34.7% of the Soy Protein Ingredients market revenue share in 2025, establishing it as the leading application category. This growth is being driven by rising global interest in plant-based diets, ethical food consumption, and the reduction of animal-based products.

As noted in food innovation articles and company product launches, soy protein is widely used in meat analogues for its ability to mimic the texture and mouthfeel of conventional meat while delivering high protein content. Food manufacturers are increasingly incorporating soy protein into hybrid products and fully plant-based alternatives to meet growing demand from flexitarian consumers.

Additionally, concerns around meat supply chain sustainability and carbon footprint have accelerated the use of soy-based meat extenders in institutional and retail food products. The segment’s leadership is being further strengthened by its role in addressing global food security and its alignment with dietary trends focused on reducing cholesterol and saturated fat intake.

The market has expanded due to increasing demand for plant-based nutrition, high-protein foods, and alternative protein solutions in food and beverage products. Soy protein isolates, concentrates, and textured proteins are widely incorporated in bakery, dairy alternatives, meat substitutes, and nutritional supplements. Growth has been driven by consumer awareness of health benefits, functional properties, and clean-label ingredients. Technological advancements in extraction, processing, and fortification have enhanced solubility, texture, and digestibility, reinforcing adoption across diverse applications and supporting market expansion globally.

Soy protein ingredients have been widely adopted due to their functional versatility and nutritional benefits. Solubility, emulsification, water-binding capacity, and gelation properties allow incorporation into diverse products such as protein bars, plant-based dairy, meat analogs, and beverages. Fortified formulations with vitamins, minerals, and amino acids have been developed to enhance nutritional profiles and meet consumer health expectations. Textured soy protein has been used to mimic meat textures, improving sensory acceptance of plant-based products. Continuous research has improved protein extraction techniques to reduce off-flavors and enhance digestibility. Functional and sensory improvements have strengthened application opportunities, encouraging manufacturers to develop innovative products that cater to fitness, weight management, and wellness-oriented consumers. Consequently, functional benefits and product innovation have become central drivers in the soy protein ingredients market globally.

The growth of the soy protein ingredients market has been influenced by rising health awareness and changing dietary habits. Increasing preference for high-protein diets, plant-based nutrition, and lactose-free alternatives has driven consumer adoption of soy-based products. Regulatory authorities and health organizations have promoted protein-rich diets to combat lifestyle-related diseases, further reinforcing consumption trends. Vegan, vegetarian, and flexitarian populations have contributed to the demand for soy protein ingredients as alternatives to animal-derived proteins. Awareness campaigns regarding cholesterol reduction, cardiovascular health, and muscle maintenance have encouraged incorporation of soy protein in ready-to-drink beverages, protein powders, and nutritional bars. These dietary trends, combined with lifestyle-conscious purchasing behaviors, have strengthened market penetration across functional foods, sports nutrition, and plant-based product segments globally.

Industrial adoption of soy protein ingredients has expanded across food processing, bakery, confectionery, and beverage manufacturing. The ability to enhance texture, shelf life, and protein content has driven usage in meat analogs, dairy alternatives, protein-enriched snacks, and nutritional formulations. Supply chain improvements, including sourcing of non-GMO soybeans, scalable processing facilities, and cold-chain logistics, have facilitated consistent ingredient availability. Partnerships between manufacturers and ingredient suppliers have enabled custom formulations tailored for specific applications. Additionally, foodservice providers and ready-to-eat product manufacturers have increasingly incorporated soy protein to meet consumer demands for health-oriented options. The expansion of industrial applications and efficient supply chains has created a reliable market for soy protein ingredients, reinforcing adoption in both mainstream and specialized food segments globally.

Regulatory frameworks and sustainability initiatives have influenced the growth of soy protein ingredients. Food safety authorities have established quality and labeling standards to ensure allergen management, non-GMO certification, and traceability. Governments and industry bodies have promoted plant-based protein adoption to reduce environmental impact, including lower greenhouse gas emissions and land use compared to animal-based proteins. Sustainability-focused sourcing, including responsible soybean cultivation and supply chain transparency, has gained importance among manufacturers and consumers. The fortification guidelines and nutritional labeling requirements have guided product development and quality assurance. Compliance with safety and sustainability standards has reinforced confidence in soy protein ingredients, facilitating market growth by meeting consumer expectations for health, environmental responsibility, and high-quality plant-based nutrition worldwide.

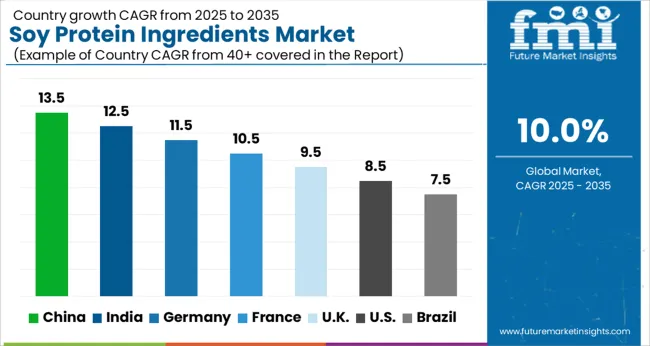

The market is projected to grow at a CAGR of 10.0% from 2025 to 2035, driven by increasing demand for plant-based proteins, functional food applications, and nutritional supplements. China leads with a 13.5% CAGR, expanding production and adoption in food and beverage industries. India follows at 12.5%, supported by growing awareness of plant-based diets and fortified food products. Germany, at 11.5%, benefits from advanced food processing technologies and high consumer preference for protein-rich foods. The UK, growing at 9.5%, emphasizes innovation in plant-based nutrition and functional ingredients. The USA, at 8.5%, sees steady demand from dietary supplements, meat alternatives, and health-focused food products. This report covers 40+ countries, with the top markets highlighted here for reference.

China is projected to grow at a CAGR of 13.5% in the market from 2025 to 2035, driven by rising demand in food processing and nutritional products. Manufacturers are focusing on high-protein formulations, functional ingredients, and plant-based protein alternatives. The expanding bakery, dairy, and beverage industries are integrating soy protein to enhance nutritional value and meet consumer health trends. Domestic producers are investing in advanced extraction technologies and supply chain efficiencies to cater to increasing demand for clean label and fortified food products.

India is anticipated to grow at a CAGR of 12.5% in the industry over 2025–2035, supported by rising nutritional awareness and food fortification initiatives. Demand from bakery, confectionery, and beverage sectors is increasing, with manufacturers exploring functional proteins for health-conscious consumers. Domestic and international players are expanding production capacities and launching fortified soy protein products. E-commerce platforms are further facilitating access to fortified and plant-based protein ingredients across urban and semi-urban regions.

Germany is forecast to grow at a CAGR of 11.5% in the market from 2025 to 2035, driven by the adoption of plant-based diets and clean label trends. Food manufacturers are integrating soy protein in dairy alternatives, bakery products, and protein-enriched snacks. Regulatory standards for food labeling and high-quality protein sourcing are influencing production processes. Strategic collaborations between ingredient suppliers and food processors are enhancing product availability and functional quality in the market.

The United Kingdom is expected to grow at a CAGR of 9.5% in the market from 2025 to 2035, driven by rising demand for plant-based nutrition and functional food products. Manufacturers are developing fortified soy protein blends for beverages, snacks, and bakery applications. Growing health-conscious consumer segments and retail expansion of protein-enriched foods are boosting market penetration. Domestic production and formulation innovations are complementing import reliance on high-quality soy protein.

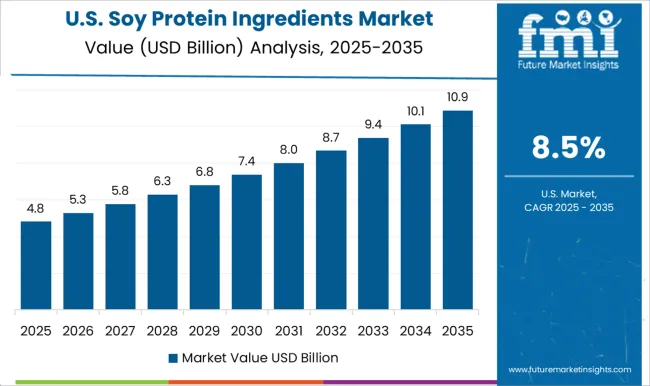

The United States is forecast to expand at a CAGR of 8.5% in the market between 2025 and 2035, supported by high demand in plant-based foods and nutritional supplements. Manufacturers are integrating soy protein in bakery, beverage, and dairy alternative sectors. Innovation in protein extraction, texturization, and fortification is shaping the competitive landscape. Rising consumer preference for clean label and sustainable proteins is accelerating market adoption, while strategic partnerships between suppliers and food processors are ensuring consistent supply.

The market is shaped by key global players delivering high-quality protein solutions for food, beverage, and nutritional applications. Archer-Daniels-Midland Company (ADM) continues to lead, offering an extensive portfolio of soy protein isolates, concentrates, and textured proteins, supporting diverse applications in plant-based food products. Cargill Inc. emphasizes innovation in functional and nutritional performance, catering to the growing demand for plant-based proteins and fortified food formulations. DuPont leverages its expertise in protein science to provide versatile soy protein solutions with improved solubility, emulsification, and texturization properties for both industrial and consumer applications.

Wilmar International and BURCON focus on sustainable extraction and processing techniques to ensure high-quality isolates, addressing clean-label trends without compromising functionality. Sotexpro and CHS Inc. contribute with region-specific production and tailored formulations targeting emerging markets. Other noteworthy participants include Farbest Brands, Sonic Biochem, Prinova Group LLC, Medix Laboratories, Chaitanya Chemicals, Bioway, and Batory Foods, who emphasize cost-effective supply chains, strategic partnerships, and R&D-driven product enhancement. Key strategies in the market involve new product launches, application-based customization, and collaborative initiatives with food manufacturers to expand usage. Entry barriers are significant due to the capital-intensive extraction processes, quality compliance requirements, and technological expertise necessary for consistent high-grade protein production.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.9 Billion |

| Product | Soy Isolate, Soy Concentrate, and Soy Flour |

| Nature | Non-GMO and GMO |

| Application | Meat Extenders & Alternatives, Bakery & Confectionery, Functional Food, Infant Food, Dairy Replacer, Animal Feed, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer-Daniels-Midland Company (ADM), BURCON, Cargill Inc., Dupont, Sotexpro, Wilmar International, CHS Inc., Farbest Brands, Sonic Biochem, Prinova Group LLC, Medix laboratories, Chaitanya Chemicals, Bioway, and Batory Foods |

| Additional Attributes | Dollar sales by ingredient type and application segment, demand dynamics across food and beverage, animal feed, and nutraceuticals, regional trends in production and consumption across North America, Europe, and Asia-Pacific, innovation in texturized soy protein, isolate and concentrate formulations, and flavor masking technologies, environmental impact of soy cultivation and processing, deforestation, and water usage, and emerging use cases in plant-based meat alternatives, high-protein beverages, and functional nutrition products. |

The global soy protein ingredients market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the soy protein ingredients market is projected to reach USD 20.4 billion by 2035.

The soy protein ingredients market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in soy protein ingredients market are soy isolate, soy concentrate and soy flour.

In terms of nature, non-GMO segment to command 58.6% share in the soy protein ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soy-based Chemical Market Size and Share Forecast Outlook 2025 to 2035

Soy Lecithin Market Size and Share Forecast Outlook 2025 to 2035

Soy Nuts Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soybean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Soy-Based Meat Alternative Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy-based Food Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Soybean Meal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy Isoflavones Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy Food Products Market Analysis by food, beverages, oils and product type Through 2035 food, beverages, oils and product type

Soy Milk Market Analysis by Product Type, Category, Application, Distribution Channel and Region Through 2035

Soy Beverage Market Analysis by Product Type, Flavor, and Distribution Channel Through 2035

Soy Polysaccharides Market

Soy Hydrolysates Market

Soybean Oil Market

Soy Protein Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Soy Protein Isolate Market Size, Growth, and Forecast 2025 to 2035

Soy Protein Concentrate Market Growth - Plant-Based Protein & Industry Expansion 2024 to 2034

Soybean Enzymatic Protein Market Size and Share Forecast Outlook 2025 to 2035

Non-GMO Soya Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA