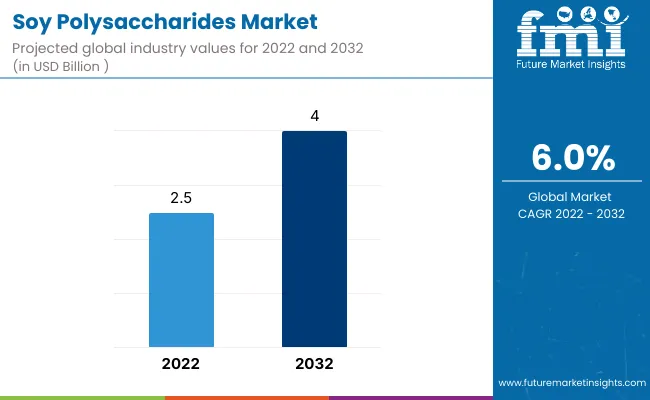

The demand in the global soy polysaccharides market is anticipated to surpass a valuation of US$ 2.5 Bn by 2022, expanding at a CAGR of around 5% to 6% during the forecast period 2022-2032. The soy polysaccharides market is estimated to create an incremental opportunity of more than US$ 4 Bn by the end of 2032. On the basis of application, the lactic acid beverage segment is estimated to lead the market, accounting for more than 45% of the soy polysaccharides sales in 2022.

| Report Attribute | Details |

| Soy Polysaccharides Market Base Year Value (2021) | US$ 2.2 Billion |

| Soy Polysaccharides Market Expected Value (2022) | US$ 2.5 Billion |

| Soy Polysaccharides Market Anticipated Value (2032) | US$ 4 Billion |

| Soy Polysaccharides Market Projected Growth Rate (2022-2032) | 5% to 6% CAGR |

| Soy Polysaccharides Estimated Sales Across Lactic Acid Beverage Segment (2022) | 45% |

Soybean polysaccharides are a type of soluble polysaccharides that are derived from soybean meal, okara, soybean cotyledon, and others. These carbohydrates are decomposed into multiple molecules of monosaccharides using hydrolysis processes. These polysaccharides are increasingly being adopted by health-conscious consumers as it does not contain starch and sugar.

Soy polysaccharides contain galacturonic acid, rhamnose, arabinose, fucose, glucose, galactose, and xylose. They also assist the human body to absorb essential minerals such as potassium and calcium. Also, consumption of these polysaccharides assists in fortifying dietary fiber, reduce cholesterol, and act as fat reducer.

Attributed to this, soy polysaccharides gaining huge popularity across the dietary and nutrient industry. Hence, growing public concern and awareness regarding the health effects of dietary fiber has resulted in bolstering the demand for high-fiber and calorie-reduced products such as soy polysaccharides. This is projected to augment the sales of soy polysaccharides in the global market.

Consumption of soy polysaccharides can cause side effects such as bloating, itching, constipation, rashes, and nausea, due to the effect of proteins lipid and proteins-polysaccharides interactions.

This in addition to, the detrimental effect of these high fiber products on the physical and sensory properties of food and strict government regulations pertaining to the addition of high-fiber products such as soy polysaccharides is further restraining the sales in the market.

A study by FMI states that North America is anticipated to account for a prominent share in the global soy polysaccharides market during the forecast period 2022-2032.

There is a significant rise in consumption of dairy and dairy products such as flavored milk, ice cream, smoothies, shakes, creamers, and others across North America, owing to increasing customer preference for adopting ready-eat and ready-to-use products. Citing this trend, leading industry players across the countries such as the U.S. and Canada are focusing on increasing their production capacity.

For instance, in 2022, Nestlé USA, a leading food and drink processing conglomerate corporation announced investing US$ 675 Mn to construct new flavored milk and coffee creamer production facility in Arizona, the U.S. As soy polysaccharides are extensively used for stabilization of acidic properties in dairy beverages, such developments are estimated to favor the growth in the North America market.

Asia Pacific excluding Japan is projected to register growth at a rapid CAGR in the global soy polysaccharides market between 2022 and 2032, states Future Marker Insights.

Soy polysaccharides are finding a wide range of applications across industries such as food & beverage, bakery, dairy, pharmaceutical, confectioners & desserts, and others. These carbohydrates are increasingly being used as stabilizers and emulsifiers across the aforementioned industries, owing to their natural origin and physicochemical properties, creating strong demand for soy polysaccharides.

Key manufacturers in the market are aiming at introducing novel flavored and light-colored soy polysaccharides for confectionery and baking applications and expanding their soy product manufacturing capacity to cater to this growing demand. This is expected to drive the soy polysaccharides market in Asia Pacific excluding Japan.

Some of the leading players in the soy polysaccharides market are Fuji Oil Holdings Inc., Pingdingshan Jinjing Bio-Tec Co, Ltd, Jrs Pharma Gmbh + Co. KG, IIC AG, Gushen Biological Technology Group, Yiming Biological Products, and others.

Leading participants in the market are focusing at adopting capacity expansion, collaboration, mergers & acquisitions strategies to gain edge in the highly competitive market

| Report Attribute | Details |

| Growth Rate | CAGR of 5% to 6% from 2022 to 2032 |

| Base Year for Estimation | 2021 |

| Historical Data | 2015-2020 |

| Forecast Period | 2022-2032 |

| Quantitative Units | Revenue in USD Billion, Volume in Kilotons and CAGR from 2022-2032 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

|

| Countries Covered |

|

| Key Companies Profiled |

|

| Customization | Available Upon Request |

By Grade:

By Application:

By End Use Industry:

By Region:

FMI projects the demand for soy polysaccharides market to expand at 5% to 6% value CAGR over the forecast period 2022-2032

The soy polysaccharides market is dominated by North America, and this trend is projected to continue for the assessment period.

Fuji Oil Holdings Inc., Pingdingshan Jinjing Bio-Tec Co, Ltd, Jrs Pharma Gmbh + Co. KG, IIC AG, Gushen Biological Technology Group, Yiming Biological Products, and others are some key soy polysaccharides manufacturer.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soybean Enzymatic Protein Market Size and Share Forecast Outlook 2025 to 2035

Soy-based Chemical Market Size and Share Forecast Outlook 2025 to 2035

Soy Lecithin Market Size and Share Forecast Outlook 2025 to 2035

Soy Protein Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Soy Protein Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Soy Nuts Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soybean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Soy-Based Meat Alternative Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy-based Food Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Soybean Meal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy Isoflavones Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy Protein Isolate Market Size, Growth, and Forecast 2025 to 2035

Soy Food Products Market Analysis by food, beverages, oils and product type Through 2035 food, beverages, oils and product type

Soy Milk Market Analysis by Product Type, Category, Application, Distribution Channel and Region Through 2035

Soy Beverage Market Analysis by Product Type, Flavor, and Distribution Channel Through 2035

Soy Protein Concentrate Market Growth - Plant-Based Protein & Industry Expansion 2024 to 2034

Soy Hydrolysates Market

Soybean Oil Market

Non-GMO Soya Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA