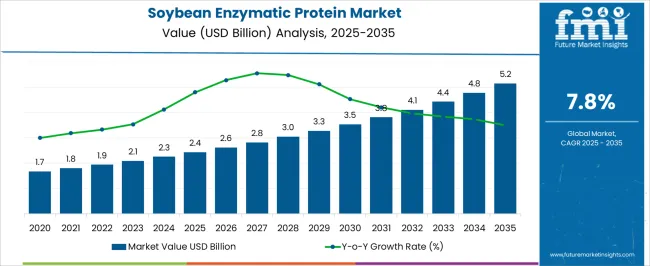

The soybean enzymatic protein market is projected to grow from USD 2.4 billion in 2025 to USD 5.2 billion in 2035, with a CAGR of 7.8%. During the early adoption phase (2020–2024), the market expanded slowly from USD 1.7 billion to USD 2.4 billion as food manufacturers and ingredient suppliers explored enzymatic protein applications in plant-based foods, beverages, and nutritional products. This phase focused on proving functionality, taste, and texture benefits while addressing production scalability.

By 2025, the market will reach USD 2.4 billion, signaling readiness for wider incorporation into mainstream formulations and broader consumer acceptance. Between 2025 and 2035, the market transitions through scaling (2025–2030) and consolidation (2030–2035). By 2030, the market will surpass USD 3.3 billion, driven by increased adoption in functional foods, protein-enriched beverages, and alternative protein products.

During the consolidation phase, growth moderates slightly as the market matures, reaching USD 5.2 billion by 2035, with established suppliers consolidating their presence and smaller players either aligning with or exiting the market. The 7.8% CAGR highlights steady growth, reflecting a shift from experimental integration to mainstream utilization across a variety of food and nutrition segments.

| Metric | Value |

|---|---|

| Soybean Enzymatic Protein Market Estimated Value in (2025 E) | USD 2.4 billion |

| Soybean Enzymatic Protein Market Forecast Value in (2035 F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The soybean enzymatic protein market is influenced by several broader markets, each contributing to its overall growth. The plant-based protein sector drives about 30%, as demand for alternative protein sources directly fuels market expansion. Functional foods and beverages account for 20%, providing applications where enzymatic proteins enhance nutritional content and product texture. The global soybean market contributes 15%, supplying the raw material required for protein extraction and enzymatic processing. Nutritional supplements represent 10%, as these proteins are increasingly incorporated into powders, shakes, and fortified products. Food and beverage processing equipment accounts for 8%, enabling efficient production and enzyme-based modifications. The dairy alternatives market influences 7%, as enzymatic proteins are used to improve taste, solubility, and performance in non-dairy products.

Health and wellness consumer trends contribute 5%, reflecting interest in high-protein diets and plant-based nutrition. Lastly, regulatory and quality assurance services account for 5%, ensuring safety, labeling compliance, and product consistency.

The Soybean Enzymatic Protein market is experiencing steady growth driven by increasing demand for plant-based protein alternatives and health-focused dietary products. The current market scenario reflects rising adoption across the food and beverage industry, driven by consumers seeking functional ingredients that support digestive health, immune function, and overall wellness. Technological advancements in enzymatic protein extraction have improved product quality, solubility, and flavor profile, enhancing their appeal for incorporation into beverages, nutritional bars, and processed foods.

Growing awareness of sustainable food sources and the environmental benefits of plant-based proteins is shaping the market outlook, especially in regions with rising urbanization and changing dietary patterns. Investment in research and development to enhance bioavailability and sensory characteristics of soybean enzymatic protein is expected to further expand its applications.

Additionally, collaborations between ingredient manufacturers and food processors are enabling innovative product offerings The increasing focus on clean label and non-GMO ingredients supports market adoption, making soybean enzymatic protein a preferred choice for manufacturers seeking functional, high-quality, and sustainable protein solutions.

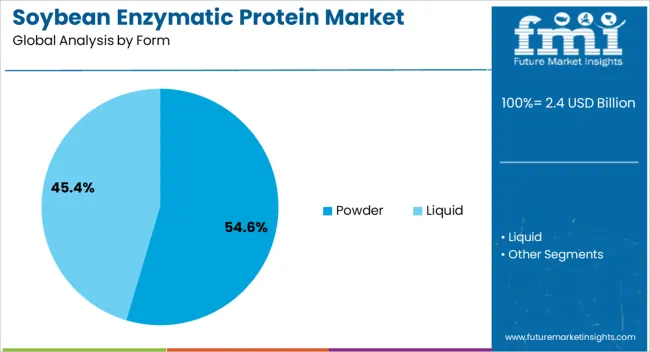

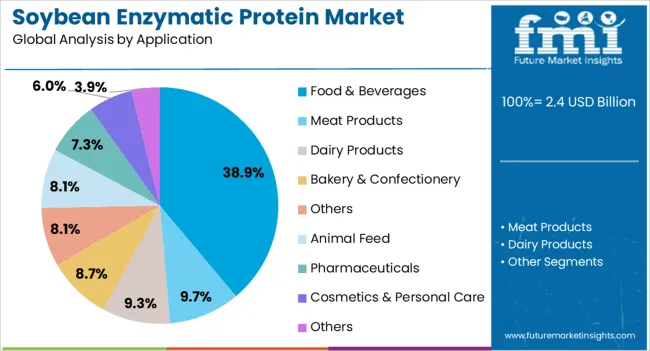

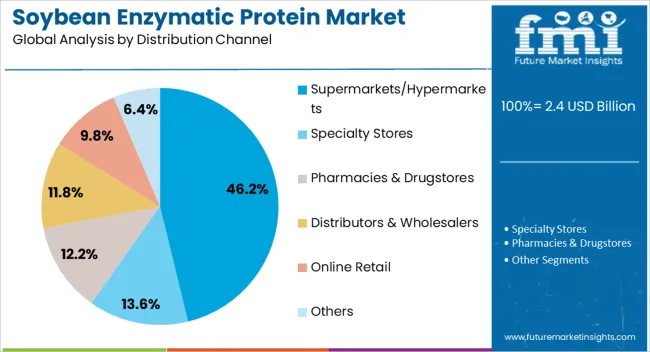

The soybean enzymatic protein market is segmented by form, application, distribution channel, and geographic regions. By form, soybean enzymatic protein market is divided into Powder and Liquid. In terms of application, soybean enzymatic protein market is classified into Food & Beverages, Meat Products, Dairy Products, Bakery & Confectionery, Others, Animal Feed, Pharmaceuticals, Cosmetics & Personal Care, and Others. Based on distribution channel, soybean enzymatic protein market is segmented into Supermarkets/Hypermarkets, Specialty Stores, Pharmacies & Drugstores, Distributors & Wholesalers, Online Retail, and Others. Regionally, the soybean enzymatic protein industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder form is projected to hold 54.60% of the Soybean Enzymatic Protein market revenue share in 2025, making it the leading form. This dominance is being attributed to its versatility and ease of incorporation into a wide range of food and beverage products. Powdered soybean enzymatic protein allows precise dosing, uniform distribution, and enhanced shelf stability, which are critical for manufacturers aiming to maintain consistent product quality.

Adoption has been further supported by the ability to blend powders with other functional ingredients without compromising taste or texture. The format is also favored for its convenience in transportation, storage, and on-site preparation, enabling large-scale applications in industrial and commercial settings.

Growth has been reinforced by increasing demand from dietary supplement producers and manufacturers of protein-enriched beverages, nutrition bars, and bakery products The scalability of powder formulations, combined with the growing focus on plant-based diets and protein fortification, is expected to sustain its leading market position.

The food and beverages application segment is expected to account for 38.90% of the Soybean Enzymatic Protein market revenue share in 2025, making it the leading application area. This leadership is being driven by the growing consumer preference for functional and high-protein food products that promote health and wellness. Soybean enzymatic protein has been increasingly used in beverages, dairy alternatives, nutritional bars, and bakery products due to its excellent solubility, digestibility, and neutral flavor profile.

The segment’s growth has been further accelerated by rising health consciousness, an increasing focus on plant-based diets, and demand for clean label ingredients. Manufacturers are leveraging soybean enzymatic protein to develop products that meet the nutritional needs of diverse consumer segments, including athletes, elderly individuals, and health-conscious urban populations.

The ability to fortify foods without altering texture or taste has supported adoption in both industrial and retail food production Continued innovation and the integration of soybean enzymatic protein into convenient, functional food products are expected to sustain the segment’s leadership in the market.

The supermarkets and hypermarkets distribution channel is projected to hold 46.20% of the Soybean Enzymatic Protein market revenue share in 2025, making it the leading channel. This dominance is being attributed to the extensive reach and accessibility of these retail formats, which enable widespread availability of soybean enzymatic protein products to consumers. Supermarkets and hypermarkets facilitate bulk purchasing, promotional visibility, and the opportunity to educate consumers through in-store marketing and product information.

Growth has been supported by the increasing consumer trend toward one-stop shopping for health and wellness products, including protein-enriched foods and beverages. The channel’s ability to provide consistent product availability and variety encourages trial and repeat purchases, reinforcing its market position.

Additionally, partnerships between manufacturers and large retail chains have enabled better shelf placement and promotional support, boosting sales The growing demand for plant-based and functional protein products in mainstream retail environments is expected to sustain the leadership of supermarkets and hypermarkets in the distribution of soybean enzymatic protein.

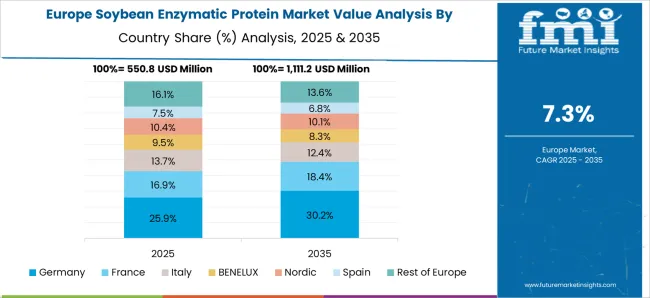

The soybean enzymatic protein market is growing due to rising demand for plant-based protein in food, beverage, and nutritional supplements. North America and Europe lead with high-purity, specialty protein products for sports nutrition, functional foods, and clean-label applications. Asia-Pacific is witnessing rapid growth driven by increasing vegetarian and vegan diets, protein-fortified products, and food processing innovations. Manufacturers differentiate through enzymatic treatment methods, protein digestibility, flavor masking, and application versatility. Regional differences in dietary habits, regulatory frameworks, and processing infrastructure influence adoption, product development, and market positioning globally.

Enzymatic treatment is key for enhancing protein functionality, digestibility, and flavor profile. North America and Europe focus on advanced enzymatic hydrolysis, proteolysis, and fermentation methods to produce high-purity, neutral-flavor proteins suitable for beverages, nutrition bars, and infant formulas. Asia-Pacific markets often adopt cost-effective enzymatic processes for traditional food applications, tofu, and protein-fortified snacks. Differences in processing techniques impact solubility, bioavailability, and sensory attributes. Leading suppliers invest in proprietary enzymatic methods to meet premium application standards, while regional manufacturers focus on scalable, cost-efficient approaches. Variations in enzymatic processing shape product performance, application versatility, and adoption across functional food, dietary supplement, and plant-based protein sectors globally.

Protein digestibility and amino acid composition are critical factors driving consumer acceptance. North America and Europe demand high-quality soybean enzymatic proteins with balanced essential amino acids and low allergenic potential for infant nutrition, sports supplements, and medical nutrition. Asia-Pacific consumers increasingly seek digestible protein for general dietary enrichment and functional foods. Differences in nutritional profiles affect formulation, labeling compliance, and market positioning. Suppliers offering high-digestibility, fortified proteins gain premium adoption, while regional producers prioritize affordable protein solutions with adequate functional benefits. Nutritional quality contrasts shape adoption patterns, product development, and competitiveness across global food and beverage, nutraceutical, and health-focused applications.

Regulatory frameworks and labeling requirements significantly influence soybean enzymatic protein adoption. Europe and North America enforce strict guidelines for allergen labeling, protein purity, and nutritional claims, particularly for infant formula and medical nutrition products. Asia-Pacific markets exhibit varied regulatory rigor; developed countries follow similar standards, while emerging regions emphasize general food safety compliance. Differences in regulatory compliance affect product approval timelines, certification, and labeling practices. Suppliers providing certified, compliant proteins gain market credibility and access to premium applications, while regional producers focus on cost-effective, locally approved solutions. Regulatory contrasts shape adoption, international trade opportunities, and strategic positioning across global plant-based protein markets.

Soybean enzymatic proteins are utilized across beverages, baked goods, nutrition bars, and meat analogs. North America and Europe emphasize high-value applications in functional foods, dietary supplements, and clean-label products requiring neutral flavor, high solubility, and stability. Asia-Pacific adoption is driven by traditional foods, protein-fortified snacks, and plant-based meat alternatives, balancing affordability with functional performance. Differences in application versatility affect production planning, product innovation, and market segmentation. Suppliers offering tailored, functional proteins capture premium opportunities, while regional manufacturers supply cost-effective, multipurpose proteins. Functional application contrasts shape adoption, product differentiation, and competitiveness across the global soybean enzymatic protein market.

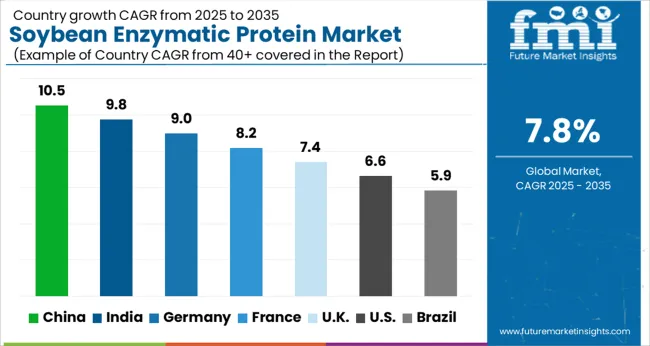

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The global soybean enzymatic protein market was projected to grow at a 7.8% CAGR through 2035, driven by demand in food processing, nutritional supplements, and functional ingredient applications. Among BRICS nations, China recorded 10.5% growth as large-scale production and processing facilities were commissioned and compliance with food and safety standards was enforced, while India at 9.8% growth saw expansion of manufacturing units to meet rising regional demand. In the OECD region, Germany at 9.0% maintained substantial output under strict industrial and regulatory frameworks, while the United Kingdom at 7.4% relied on moderate-scale operations for food and supplement applications. The USA, expanding at 6.6%, remained a mature market with steady demand across commercial and functional ingredient segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The soybean enzymatic protein market in China is growing at a CAGR of 10.5% due to increasing demand from the food, beverage, and nutritional supplement industries. Manufacturers are using enzymatic processes to enhance protein digestibility, functionality, and nutritional value for applications such as plant based beverages, protein powders, and meat alternatives. Rising health consciousness and growing interest in plant based diets are driving adoption. Food processing companies are investing in innovative solutions to produce high quality enzymatic proteins that meet consumer preferences. Distribution through food ingredient suppliers, health stores, and online platforms ensures accessibility. Research and development in enzymatic processes and protein formulation is supporting product innovation. China’s expanding food and nutrition sector and large population base make it a key market for soybean enzymatic proteins.

Soybean enzymatic protein market in India is expanding at a CAGR of 9.8% driven by rising consumer interest in nutritional foods, plant based diets, and functional ingredients. Manufacturers are producing enzymatically processed soybean proteins for protein powders, dairy alternatives, and bakery applications. Growth is supported by increasing health awareness and demand for protein enriched diets across urban populations. Food processing companies are adopting advanced enzymatic techniques to enhance protein functionality and digestibility. Distribution through ingredient suppliers, health stores, and e commerce platforms improves availability for both manufacturers and end consumers. India’s food industry growth and growing interest in plant based nutrition are key drivers for the market, making soybean enzymatic protein a preferred ingredient in functional and health focused food products.

Soybean enzymatic protein market in Germany is growing at a CAGR of 9.0% supported by increasing consumer preference for plant based diets and functional nutrition. Manufacturers are producing enzymatically processed soybean proteins to improve digestibility, taste, and texture in beverages, protein powders, and meat alternatives. Retailers and food ingredient suppliers provide easy access to high quality protein products for both industrial and consumer applications. Growth is fueled by rising health consciousness, demand for natural ingredients, and popularity of plant based and vegetarian products. Companies are investing in research and development to enhance enzymatic processing efficiency and protein functionality. Germany remains a key European market due to strong demand for health focused and plant derived protein solutions.

The United Kingdom market is expanding at a CAGR of 7.4% with growing demand for plant based protein products and functional ingredients. Consumers are increasingly seeking protein enriched beverages, meat alternatives, and bakery products. Manufacturers are utilizing enzymatic processing to enhance protein quality, solubility, and digestibility. Distribution through health stores, food ingredient suppliers, and online channels improves accessibility. Rising awareness about health and nutrition, coupled with interest in sustainable and plant based diets, is fueling market growth. Food processing companies are investing in innovative protein solutions to meet consumer expectations. The United Kingdom continues to see steady adoption of enzymatic soybean protein in health focused and functional food applications.

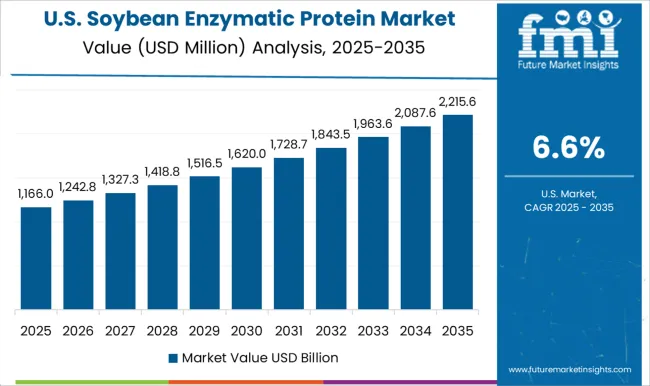

The United States market is growing at a CAGR of 6.6% driven by rising consumption of plant based foods, protein enriched products, and functional nutrition. Manufacturers are producing enzymatically treated soybean proteins to improve taste, solubility, and nutritional value for beverages, bakery items, and meat alternatives. Distribution through ingredient suppliers, health stores, and e commerce channels ensures product availability. Growth is supported by increasing health consciousness, adoption of vegetarian and vegan diets, and consumer preference for functional and natural ingredients. Research in enzymatic processing techniques enhances protein functionality and product performance. The United States remains a key market for soybean enzymatic proteins due to strong consumer interest in plant based nutrition and functional food products.

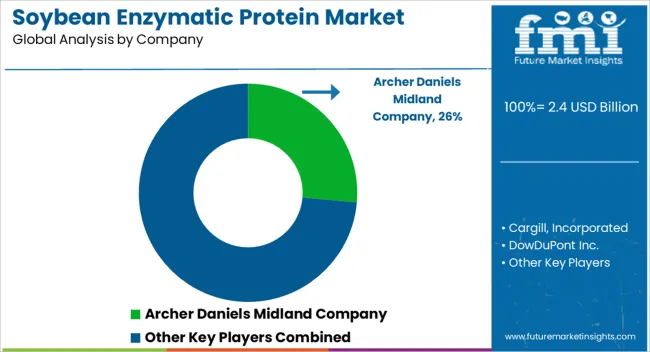

The global soybean enzymatic protein market is experiencing steady growth as demand rises for plant-based proteins, functional food ingredients, and sustainable protein alternatives. Key suppliers driving this market include Archer Daniels Midland Company, Cargill, Incorporated, DowDuPont Inc., Kerry Group, CHS Inc., Fuji Oil Co., Ltd., Wilmar International Limited, Ag Processing Inc., Crown Soya Protein Group, Shandong Yuwang Ecological Food Industry Co., Ltd., Devansoy Inc., Foodchem International Corporation, Batory Foods, Farbest Brands, and Agroselprom. These companies are at the forefront of producing high-quality enzymatically processed soybean proteins that enhance digestibility, functional properties, and nutritional profiles for various applications across the food and beverage, nutraceutical, and animal feed sectors. Archer Daniels Midland Company and Cargill, Incorporated are global leaders in soybean protein production, leveraging advanced enzymatic processing techniques to provide proteins suitable for beverages, meat analogs, and protein supplements. DowDuPont Inc. and Kerry Group focus on delivering soybean protein ingredients with tailored solubility, emulsification, and gelation properties, catering to the growing clean-label and plant-based product trends. CHS Inc. and Fuji Oil Co., Ltd. specialize in functional protein isolates and concentrates that enhance texture, stability, and nutritional value in food formulations, aligning with consumer preferences for protein-enriched diets. Suppliers such as Wilmar International Limited and Ag Processing Inc. provide large-scale enzymatically modified soybean proteins for industrial and commercial applications, including bakery, dairy, and meat substitute products. Crown Soya Protein Group and Shandong Yuwang Ecological Food Industry Co., Ltd. emphasize sustainable production practices and high-quality protein extraction to meet both domestic and international market requirements. Meanwhile, Devansoy Inc., Foodchem International Corporation, Batory Foods, Farbest Brands, and Agroselprom focus on niche applications, delivering specialty enzymatic soybean proteins with functional and nutritional benefits for health-conscious consumers. The market growth is fueled by increasing awareness of plant-based nutrition, rising demand for protein-fortified products, and the shift toward environmentally sustainable food production. Enzymatically processed soybean proteins offer enhanced digestibility, improved bioavailability, and better functional performance in formulations, making them a preferred choice for manufacturers and consumers alike. Leading suppliers are continuously innovating to expand product portfolios, improve process efficiency, and meet global nutritional and sustainability standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Form | Powder and Liquid |

| Application | Food & Beverages, Meat Products, Dairy Products, Bakery & Confectionery, Others, Animal Feed, Pharmaceuticals, Cosmetics & Personal Care, and Others |

| Distribution Channel | Supermarkets/Hypermarkets, Specialty Stores, Pharmacies & Drugstores, Distributors & Wholesalers, Online Retail, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer Daniels Midland Company, Cargill, Incorporated, DowDuPont Inc., Kerry Group, CHS Inc., Fuji Oil Co., Ltd., Wilmar International Limited, Ag Processing Inc., Crown Soya Protein Group, Shandong Yuwang Ecological Food Industry Co., Ltd., Devansoy Inc., Foodchem International Corporation, Batory Foods, Farbest Brands, and Agroselprom |

| Additional Attributes | Dollar sales vary by product type, including isolate, concentrate, and textured protein; by application, such as food & beverages, dietary supplements, and animal feed; by end-use industry, spanning nutrition, food processing, and pharmaceuticals; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for plant-based proteins, clean-label products, and functional nutrition solutions. |

The global soybean enzymatic protein market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the soybean enzymatic protein market is projected to reach USD 5.2 billion by 2035.

The soybean enzymatic protein market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in soybean enzymatic protein market are powder and liquid.

In terms of application, food & beverages segment to command 38.9% share in the soybean enzymatic protein market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soybean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Soybean Meal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soybean Oil Market

Epoxidized Soybean Oil Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the High Oleic Soybean Sector

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Enzymatic RNA Manufacturing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enzymatic DNA Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Enzymatic Acrylamide-Reduction Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enzymatic Cleaning Market – Demand, Innovations & Forecast 2025 to 2035

Enzymatically Interesterified Oils Market

Enzymatically Hydrolyzed Carboxymethyl Cellulose Market

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA