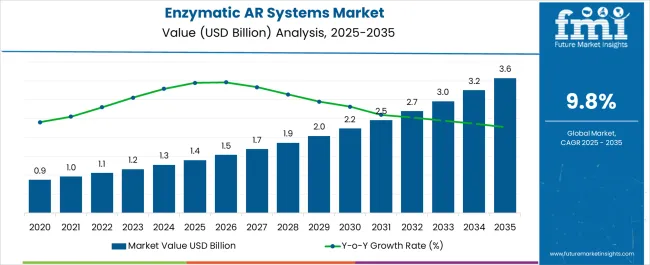

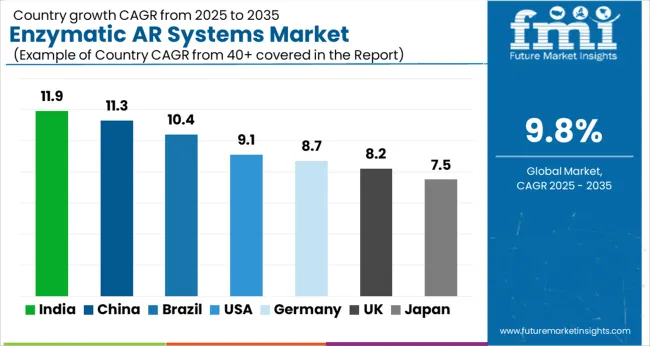

The global enzymatic acrylamide-reduction systems market is projected to grow from USD 1.4 billion in 2025 to approximately USD 3.6 billion by 2035, recording an absolute increase of USD 2.2 billion over the forecast period. This translates into a growth of 157.1% over the decade. The market is forecast to expand at a compound annual growth rate (CAGR) of 9.8%, with the overall market size projected to grow by nearly 2.57x by the end of the forecast period.

The market is growing due to increasing regulatory pressure, rising consumer awareness, and industry demand for safer food products. Acrylamide, a potentially harmful compound formed in starchy foods during high-temperature cooking, has been linked to health risks, prompting stricter guidelines from food safety authorities. Food manufacturers are adopting enzymatic solutions, particularly asparaginase, to effectively reduce acrylamide formation without altering taste, texture, or appearance. Growing consumer preference for clean-label and healthier processed foods further supports adoption. Advances in enzyme technology and production efficiency are also lowering costs, making these systems more accessible and commercially viable across the food industry.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.4 billion |

| Industry Value (2035F) | USD 3.6 billion |

| CAGR (2025 to 2035) | 9.8% |

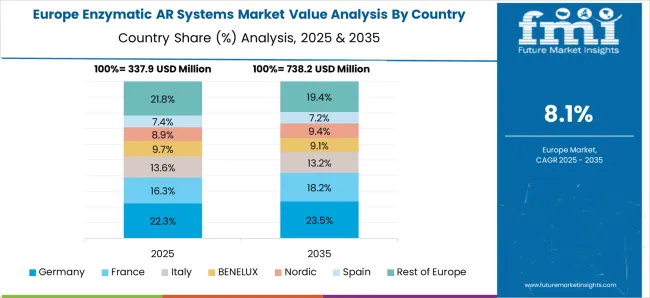

From 2020 to 2024, the market rose from USD 0.7 billion to USD 1.4 billion, propelled by heightened food safety regulations and growing consumer awareness of acrylamide's health implications. The European Union's benchmark regulations for acrylamide levels in various food categories catalyzed early adoption among major food processors. North American and Asian markets followed with implementation of voluntary and mandatory guidelines, establishing the foundation for the 2025 to 2035 growth cycle.

Between 2025 and 2030, the market is projected to expand from USD 1.4 billion to USD 2.3 billion, adding approximately USD 900 million. Growth in this first phase will be supported by increasing regulatory scrutiny on acrylamide levels in processed foods, particularly in the European Union and North America, driving adoption across bakery and snack food manufacturing. Industrial users are emerging as major demand drivers, seeking compliance with food safety benchmarks while maintaining product quality and consumer acceptance.

From 2030 to 2035, the market is expected to grow from USD 2.3 billion to USD 3.6 billion, a further increase of USD 1.3 billion. This second phase will be shaped by expanded applications in coffee processing and infant foods, deeper penetration in emerging markets, and the development of multi-enzyme blends optimized for specific food matrices. Technology refresh cycles will emphasize integrated enzyme-pack solutions, while regulatory developments will focus on harmonizing acrylamide reduction standards across global markets.

Food safety authorities worldwide are implementing stricter acrylamide limits in processed foods, creating mandatory compliance requirements for manufacturers. The European Union's benchmark regulations for potato products, cereal-based foods, and coffee have established precedents that other regions are adopting. This regulatory environment is driving systematic implementation of acrylamide reduction technologies across industrial food processing operations.

Growing consumer understanding of acrylamide as a potential carcinogen is pushing food brands to proactively reduce these compounds in their products. Premium and health-focused brands are using enzymatic reduction systems as a competitive advantage, while mass-market producers are implementing these technologies to meet consumer expectations and avoid regulatory penalties.

Recent developments in enzyme stability, dosing precision, and integration with existing processing equipment have reduced implementation barriers for food manufacturers. Multi-enzyme blends and in-process dosing systems allow processors to achieve significant acrylamide reduction without major changes to production lines or product formulations.

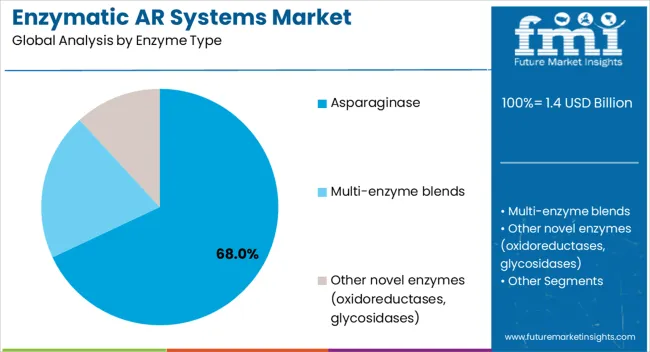

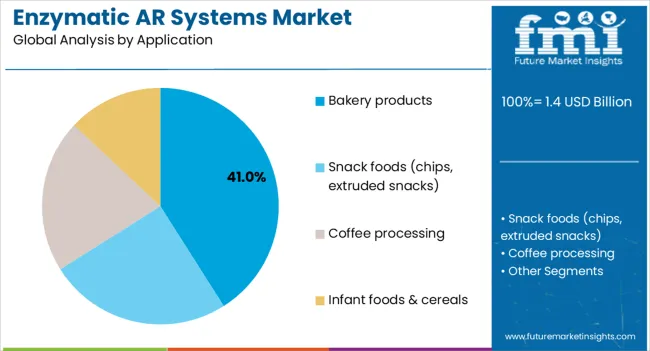

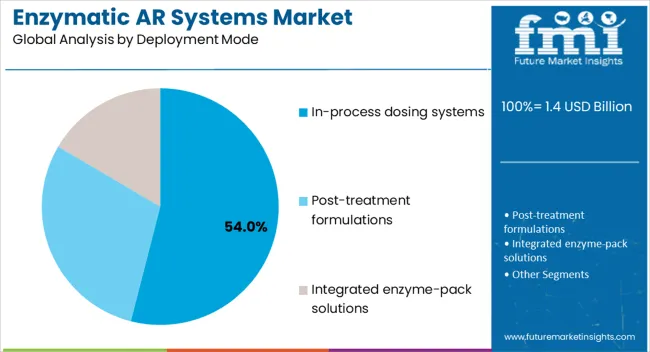

The market is segmented by enzyme type into asparaginase, multi-enzyme blends, and other novel enzymes. By application, the market includes bakery products, snack foods, coffee processing, and infant foods & cereals. Deployment modes comprise in-process dosing systems, post-treatment formulations, and integrated enzyme-pack solutions. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

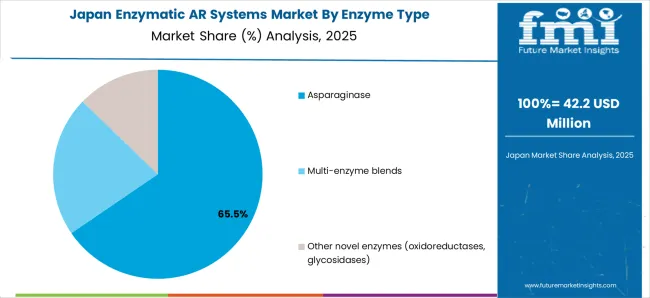

Asparaginase enzymes are projected to command a dominant 68% share of the enzymatic acrylamide-reduction systems market by 2025, cementing their role as the industry standard solution. Their efficacy stems from the ability to specifically hydrolyze asparagine, the amino acid precursor that reacts during high-temperature cooking to form acrylamide. By removing this key substrate, asparaginase achieves significant and reliable reductions across a wide range of food applications, including potato-based snacks, bakery products, and cereal-derived foods. This proven mode of action has led to broad regulatory acceptance worldwide, providing food producers with a safe, compliant, and trusted method for meeting increasingly strict acrylamide limits.

The widespread adoption of asparaginase is also driven by its cost-effectiveness in large-scale industrial settings. Enzyme formulations have been optimized for robustness, ensuring stability under diverse processing conditions while minimizing dosage requirements. Compared to novel enzymatic approaches, asparaginase offers both a predictable performance profile and ease of integration into existing production lines. While multi-enzyme blends and innovative oxidoreductases are gaining traction in niche or complex applications, asparaginase’s scalability, track record, and regulatory familiarity position it as the cornerstone of acrylamide reduction strategies for global food manufacturers seeking both safety assurance and operational efficiency.

Bakery products are set to account for 41% of enzymatic acrylamide-reduction applications in 2025, reflecting the widespread challenge of acrylamide formation in baked goods. Bread, biscuits, crackers, and breakfast cereals are particularly susceptible due to the Maillard reaction between sugars and asparagine during high-temperature baking. Regulatory agencies have placed heightened focus on cereal-based foods, especially those consumed by children, making acrylamide compliance a top priority for industrial bakers. Enzymatic systems, particularly asparaginase, have proven effective in lowering acrylamide levels without compromising product quality, flavor, or texture-factors critical to consumer acceptance.

Snack foods represent another 28% of applications, with potato chips, French fries, and extruded snacks requiring targeted enzymatic intervention due to high processing temperatures. Coffee, at 20% of the market, is a rapidly growing segment, as roasting naturally produces acrylamide, and consumer awareness of contaminants in beverages is rising. Meanwhile, infant foods and baby cereals represent 11% of applications, a category under intense regulatory oversight given the vulnerability of the target population. In all cases, enzymes provide manufacturers with a reliable, scalable solution to balance safety, quality, and compliance, establishing bakery products and snacks as the key drivers of demand in this expanding market.

In-process dosing systems are forecasted to capture 54% of deployment modes in 2025, highlighting their operational advantages in large-scale food manufacturing. These systems allow enzymes to be added directly during processing, enabling real-time control over dosage, activity, and timing. By integrating enzyme delivery into production lines, manufacturers can optimize acrylamide reduction based on specific product formulations and processing parameters, whether in dough mixing, potato blanching, or coffee roasting. This flexibility ensures consistent outcomes while minimizing waste and maximizing cost efficiency.

Beyond precision, in-process dosing enhances scalability, making it particularly well-suited for high-volume bakery, snack, and coffee operations. Automation and digital monitoring further improve efficiency by reducing manual intervention and ensuring quality consistency across batches. Post-treatment enzyme applications, accounting for 29% of the market, are generally used where enzymatic activity can be introduced after initial processing but before final heat treatment, such as in certain bakery or extruded products. Integrated enzyme-pack solutions, representing 17% of the market, provide turnkey systems that combine tailored enzyme blends with dedicated dosing equipment and monitoring capabilities. Collectively, these deployment modes reflect the industry’s shift toward flexible, efficient, and technologically advanced systems that ensure regulatory compliance while preserving food quality.

Food processors are increasingly adopting multi-enzyme systems that combine asparaginase with complementary enzymes to address diverse acrylamide formation pathways. These blends offer enhanced reduction efficiency in complex food matrices and provide manufacturers with flexibility to optimize formulations for specific products and processing conditions.

Advanced enzymatic reduction systems increasingly incorporate sensors and digital monitoring capabilities that track enzyme activity, acrylamide levels, and processing conditions in real time. This integration enables manufacturers to maintain consistent reduction performance while documenting compliance with regulatory requirements.

Enzyme manufacturers are developing specialized formulations for emerging applications including plant-based meat alternatives, ready-to-eat meals, and specialty coffee products. These applications require customized enzyme solutions that account for unique ingredients, processing conditions, and product performance requirements.

India's enzymatic acrylamide-reduction systems market is projected to grow at 11.9% CAGR through 2035, the highest globally. The Food Safety and Standards Authority of India (FSSAI) has implemented stricter acrylamide monitoring requirements for packaged snack foods, driving adoption among domestic and international manufacturers. The country's expanding processed food sector, particularly in snack foods and bakery products, is creating substantial demand for acrylamide reduction technologies. Local manufacturers are partnering with enzyme suppliers to develop cost-effective solutions suited to Indian food processing operations and consumer preferences.

China's market is expected to expand at 11.3% CAGR, supported by the country's rapidly growing coffee retail sector and increasing regulatory attention to acrylamide in infant foods. Chinese coffee roasters are implementing enzymatic reduction systems to meet export requirements and domestic quality standards. The government's focus on food safety, particularly for products consumed by children, is driving adoption in cereal and baby food manufacturing. Domestic enzyme manufacturers are expanding production capabilities to serve both local and regional markets.

Brazil's enzymatic acrylamide-reduction systems market is projected to grow at 10.4% CAGR, supported by the country's expanding processed food industry and increasing export focus. Brazilian bakery manufacturers are implementing enzymatic systems to meet international quality standards for exported products. The domestic snack food industry is adopting these technologies to align with multinational standards and consumer health trends. Government initiatives promoting food safety and quality are supporting market expansion.

The US market is expected to grow at 9.1% CAGR, driven by FDA guidance on acrylamide mitigation and voluntary industry initiatives. American food processors are implementing enzymatic systems to demonstrate commitment to food safety and consumer health. The coffee industry, particularly specialty roasters, is adopting these technologies to differentiate products and meet premium market expectations. Large-scale bakery operations are integrating enzymatic systems into existing production lines to achieve consistent acrylamide reduction.

Germany's market is projected to expand at 8.7% CAGR, reflecting the country's leadership in implementing EU acrylamide benchmarks. German food manufacturers are investing in advanced enzymatic systems to maintain compliance with strict regulatory requirements for bakery products and potato chips. The country's strong food processing industry and export focus are driving demand for reliable acrylamide reduction technologies. Technical innovation in enzyme formulations and delivery systems is supporting market growth.

The UK market is expected to grow at 8.2% CAGR, with post-Brexit compliance frameworks maintaining alignment with EU acrylamide standards. British food retailers are implementing strict acrylamide controls for private-label products, driving adoption among contract manufacturers. The country's focus on food safety and quality assurance is supporting investment in enzymatic reduction systems across bakery and snack food production. Export-oriented manufacturers are maintaining EU compliance requirements.

Japan's enzymatic acrylamide-reduction systems market is projected to grow at 7.5% CAGR, focused on niche applications in green tea processing and high-tech bakery operations. Japanese food manufacturers are implementing enzymatic systems for specialized products requiring precise acrylamide control. The country's advanced food processing technology sector is developing innovative enzyme formulations for traditional and modern food applications. Export-oriented manufacturers are adopting these systems to meet international quality standards.

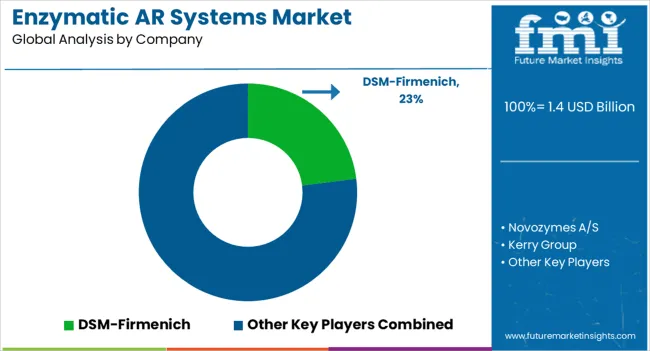

The enzymatic acrylamide-reduction systems market is evolving rapidly, shaped by fierce competition between established global enzyme producers and specialized ingredient innovators. With growing regulatory scrutiny on acrylamide levels in baked and fried foods, manufacturers are under pressure to adopt effective solutions that reduce this process contaminant without compromising product quality.

As a result, enzyme developers are prioritizing research into multi-enzyme blends that target acrylamide precursors more efficiently, while also improving thermal stability and pH tolerance to withstand industrial-scale processing conditions. Another area of innovation lies in integrated delivery systems, where enzymes are combined with tailored carriers or co-ingredients, enabling food producers to streamline implementation and achieve consistent results across diverse applications such as snacks, baked goods, and coffee.

DSM-Firmenich is projected to lead the market with a 23% share in 2025, leveraging its extensive enzyme portfolio and deep expertise in food ingredient solutions. The company’s strength lies in its holistic approach, combining high-performance enzyme formulations with technical application support, regulatory expertise, and global distribution networks. This integrated model has fostered strong partnerships with major food processors worldwide, reinforcing DSM-Firmenich’s leadership position and enabling it to set industry benchmarks for both performance and compliance in acrylamide reduction.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 billion |

| Enzyme Type | Asparaginase, Multi-enzyme Blends, Other Novel Enzymes |

| Application | Bakery Products, Snack Foods, Coffee Processing, Infant Foods & Cereals |

| Deployment Mode | In-process Dosing Systems, Post-treatment Formulations, Integrated Enzyme-pack Solutions |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China, France, Italy, India, Brazil |

| Key Companies Profiled | DSM-Firmenich, Novozymes A/S, Kerry Group, BASF SE, Amano Enzyme, Nagase Group, Chr. Hansen, Specialty Enzymes & Probiotics, Dyadic International |

| Additional Attributes | Dollar sales by enzyme type and application segment, regional demand trends, competitive landscape, buyer preferences for liquid versus powder formulations, integration with clean-label and low-acrylamide positioning, innovations in processing techniques, thermal stability, and functionality optimization for baked, fried, and roasted products |

The global enzymatic acrylamide-reduction systems market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the enzymatic acrylamide-reduction systems market is projected to reach USD 3.6 billion by 2035.

The enzymatic acrylamide-reduction systems market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in enzymatic acrylamide-reduction systems market are asparaginase, multi-enzyme blends and other novel enzymes (oxidoreductases, glycosidases).

In terms of application, bakery products segment to command 41.0% share in the enzymatic acrylamide-reduction systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enzymatic RNA Manufacturing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enzymatic DNA Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Enzymatic Cleaning Market – Demand, Innovations & Forecast 2025 to 2035

Enzymatically Interesterified Oils Market

Enzymatically Hydrolyzed Carboxymethyl Cellulose Market

Soybean Enzymatic Protein Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Cough systems Market

Backpack Systems Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Systems Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Catheter Systems Market

Reporter Systems Market

Aerostat Systems Market

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Air Brake Systems Market Growth & Demand 2025 to 2035

Metrology Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA