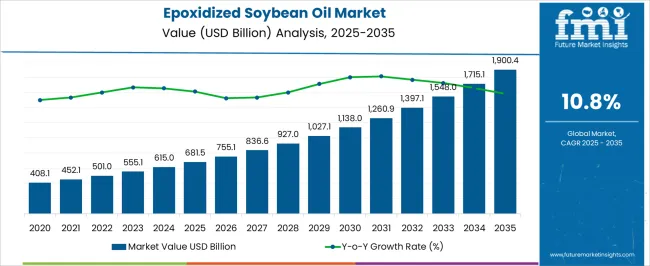

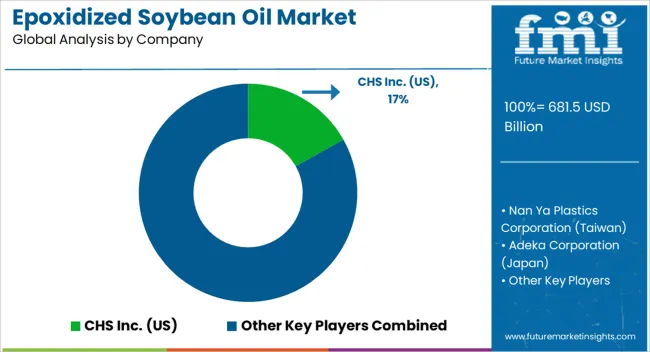

The epoxidized soybean oil market is estimated to be valued at USD 681.5 billion in 2025 and is projected to reach USD 1900.4 billion by 2035, registering a compound annual growth rate (CAGR) of 10.8% over the forecast period.

Analysis of growth momentum indicates a strong acceleration trajectory across the forecast period, driven by increasing demand in flexible PVC applications, wire and cable insulation, and plasticizer substitutes. In the early years, from 2025 to 2028, moderate momentum is observed as manufacturers gradually adopt epoxidized soybean oil in response to regulatory pressures favoring bio-based additives and safer alternatives to phthalates. From 2029 to 2032, the market exhibits heightened momentum due to expanding industrial applications, rising awareness about environmental and health safety, and growing integration in packaging, automotive, and construction sectors. This period represents the most significant acceleration in adoption, supported by technological improvements in production efficiency and product consistency.

Minor moderation in growth momentum is noted around 2033–2034, largely due to temporary supply constraints and regional market saturation, but overall expansion remains robust. By 2035, momentum is reinforced as emerging markets increase utilization, global PVC consumption rises, and demand for sustainable, high-performance additives strengthens. The year-on-year progression from 681.5 USD billion to 1,900.4 USD billion illustrates a consistent upward momentum, with peaks driven by regulatory adoption, industrial integration, and substitution trends, reflecting that epoxidized soybean oil is becoming a pivotal component in bio-based chemical solutions.

| Metric | Value |

|---|---|

| Epoxidized Soybean Oil Market Estimated Value in (2025 E) | USD 681.5 billion |

| Epoxidized Soybean Oil Market Forecast Value in (2035 F) | USD 1900.4 billion |

| Forecast CAGR (2025 to 2035) | 10.8% |

The epoxidized soybean oil (ESBO) market is strongly shaped by five interconnected parent markets, each contributing differently to overall demand and growth. The plasticizers market holds the largest share at 25%, driven by increasing adoption of ESBO as a bio-based, non-toxic alternative to phthalate-based plasticizers in PVC applications, enhancing flexibility and stability in products like flooring, cables, and films. The food and beverage packaging market contributes 29.3%, with ESBO used in films, containers, and packaging materials to maintain product safety, extend shelf life, and comply with clean-label and non-GMO trends. The adhesives and sealants market accounts for 15%, where ESBO improves flexibility, reduces volatility, and ensures regulatory compliance in construction and automotive applications.

The automotive sector holds a 10% share, leveraging ESBO in lubricants and coatings to enhance performance and meet environmental standards. Finally, the coatings market represents 5%, incorporating ESBO in UV-cure applications to improve crosslinking, durability, and performance of inks and adhesives. Collectively, plasticizers, food and beverage packaging, and adhesives account for 69.3% of overall demand, highlighting that sustainable materials adoption, regulatory compliance, and performance enhancement remain the primary growth drivers, while automotive and coatings applications provide steady, complementary demand globally.

The epoxidized soybean oil market is experiencing significant growth driven by its wide-ranging applications in plasticizers, stabilizers, and coatings, particularly in the food and beverage, packaging, and industrial sectors. The market expansion is being influenced by increasing global demand for environmentally friendly and sustainable alternatives to traditional phthalate-based plasticizers. Rising awareness regarding health and environmental concerns associated with synthetic additives is encouraging manufacturers to adopt bio-based solutions, which are biodegradable, non-toxic, and derived from renewable resources.

Technological advancements in epoxidation processes are enhancing product quality, performance, and versatility across multiple applications. The growth of the global packaging and food processing industries is further supporting the demand for high-purity epoxidized soybean oil. Government initiatives promoting sustainable and green chemicals are also creating favorable market conditions.

As industries seek to reduce carbon footprints and meet international regulatory standards, epoxidized soybean oil is increasingly being positioned as a key solution for environmentally conscious manufacturing The market is expected to continue its upward trajectory, supported by innovation in formulation technologies and expanding application scope.

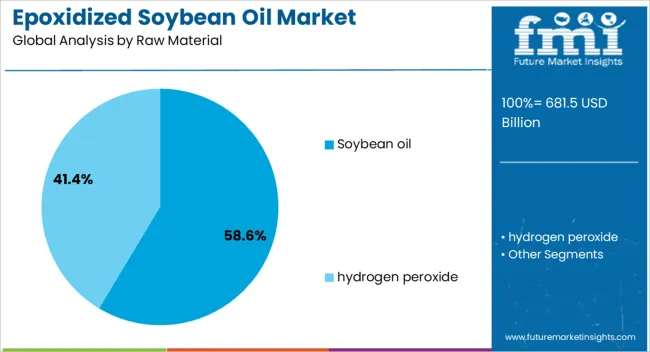

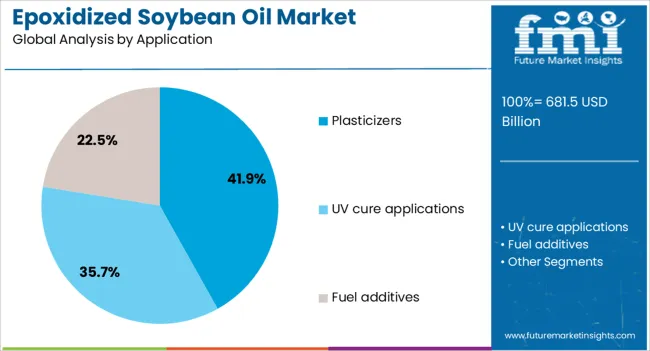

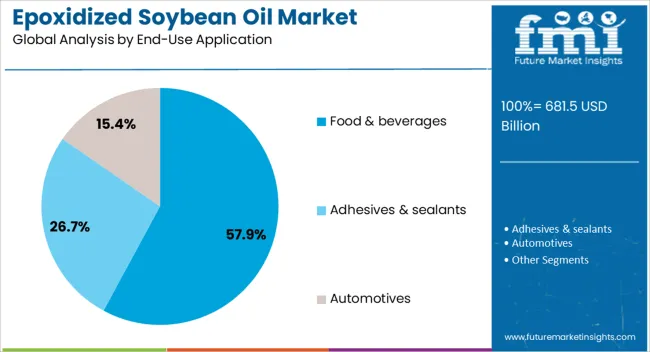

The epoxidized soybean oil market is segmented by raw material, application, end-use application, and geographic regions. By raw material, epoxidized soybean oil market is divided into soybean oil and hydrogen peroxide. In terms of application, epoxidized soybean oil market is classified into plasticizers, UV cure applications, and fuel additives. Based on end-use application, epoxidized soybean oil market is segmented into food & beverages, adhesives & sealants, and automotives. Regionally, the epoxidized soybean oil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The soybean oil raw material segment is projected to hold 58.6% of the epoxidized soybean oil market revenue share in 2025, making it the leading raw material type. Its dominance is being driven by the abundant global availability of soybean oil, high-quality oil content, and cost-effectiveness compared to alternative plant oils.

The high unsaturated fatty acid content in soybean oil allows for efficient epoxidation reactions, producing epoxidized soybean oil with superior performance characteristics such as flexibility, heat resistance, and chemical stability. The segment is being further supported by expanding soybean cultivation in key producing regions, enabling a reliable and sustainable supply chain for manufacturers.

The adoption of soybean oil as the primary feedstock is also encouraged by its compatibility with diverse industrial processes, including plasticizer production, polymer stabilization, and coatings As demand for bio-based and environmentally friendly chemical inputs grows, the use of soybean oil as the main raw material is expected to maintain its leadership position, providing consistent quality and performance for epoxidized soybean oil production across multiple applications.

The plasticizers application segment is anticipated to account for 41.9% of the epoxidized soybean oil market revenue share in 2025, establishing it as the leading application category. Its dominance is being driven by the growing demand for flexible and durable polymer products in the construction, automotive, and packaging industries. Epoxidized soybean oil is increasingly preferred over phthalate-based plasticizers due to its non-toxic, environmentally friendly, and biodegradable properties, aligning with global sustainability initiatives and regulatory requirements.

The material is being utilized to enhance flexibility, improve thermal stability, and reduce brittleness in polyvinyl chloride and other polymer products. Continuous innovations in polymer formulation techniques have allowed greater incorporation of epoxidized soybean oil without compromising material performance, further reinforcing its adoption.

Market growth is also being influenced by rising awareness among manufacturers regarding product safety and eco-friendly alternatives, which is accelerating the shift toward bio-based plasticizers The versatility and compatibility of epoxidized soybean oil with various polymer matrices are expected to sustain its leading position in the application segment over the coming years.

The food and beverages end-use application segment is projected to hold 57.9% of the epoxidized soybean oil market revenue share in 2025, making it the dominant end-use industry. Its leadership is being driven by the increasing adoption of epoxidized soybean oil as a stabilizer and antioxidant in packaging materials, coatings, and films used in food contact applications.

The material’s ability to improve flexibility, thermal resistance, and chemical stability of packaging films is being leveraged to extend shelf life, maintain product quality, and ensure compliance with food safety regulations. Demand growth is further supported by the expansion of the global packaged food and beverage industry, which requires high-performance, environmentally friendly, and regulatory-compliant additives.

The segment is also benefiting from rising consumer preference for sustainable packaging materials derived from renewable sources, which aligns with broader corporate sustainability initiatives The consistent performance, biodegradability, and compatibility of epoxidized soybean oil in food-grade applications are expected to maintain its dominant position in the end-use industry segment, supporting ongoing market growth and adoption across diverse geographic regions.

The epoxidized soybean oil market is expanding due to growing demand in PVC and plastic applications where durability, flexibility, and safety are critical. Regulatory compliance, particularly in food contact and medical applications, drives adoption and market acceptance. Technological advancements in production, epoxidation efficiency, and product quality improve performance, stability, and yield, enabling broader applications. Industrial, construction, packaging, and electrical sectors provide strong growth opportunities. Rising interest in bio-based, non-toxic alternatives to phthalates further strengthens ESBO adoption

The epoxidized soybean oil market is growing due to its increasing use as a plasticizer and stabilizer in PVC applications. ESBO enhances flexibility, durability, and heat resistance in flexible PVC products, including cables, flooring, packaging films, and medical devices. The shift from phthalate-based plasticizers to bio-based alternatives is driving adoption, as manufacturers seek safer and non-toxic solutions. Rising industrial production, infrastructure development, and consumer demand for durable and high-performance plastic products are supporting market growth. ESBO’s multifunctional properties, including improved processing stability and resistance to thermal and oxidative degradation, further strengthen its position in the plastics sector.

Regulatory frameworks governing food contact materials, chemical safety, and environmental impact significantly shape the ESBO market. ESBO is widely accepted as a non-toxic plasticizer for food-grade PVC films, packaging, and containers. Compliance with FDA, EFSA, and ISO standards ensures safety and market acceptance. Stricter regulations on phthalates and other harmful plasticizers are encouraging manufacturers to adopt bio-based alternatives like ESBO. Certification and labeling requirements reinforce credibility and drive adoption in sensitive applications such as medical devices, food packaging, and toys. Regulatory adherence is critical for export-oriented producers and enhances trust among industrial users.

Technological developments in epoxidation processes, catalyst optimization, and refining techniques are improving ESBO production efficiency and quality. Innovations allow higher epoxide content, better stability, and consistent performance across applications. Production advancements reduce by-products, improve yield, and lower operational costs, making ESBO more competitive against synthetic plasticizers. R&D efforts focus on enhancing compatibility with various polymers, extending product applications in flexible and rigid PVC, and meeting specialized end-use requirements. Quality improvements and tailored formulations help manufacturers differentiate offerings and meet increasingly stringent industrial and consumer expectations.

The ESBO market is fueled by rising industrial demand, particularly in construction, electrical, automotive, and packaging sectors. PVC-based cables, flooring, roofing sheets, and flexible films increasingly rely on ESBO for stability and durability. Food packaging and medical applications are driving bio-based plasticizer adoption, with an emphasis on non-toxicity and compliance with safety regulations. Infrastructure growth, rising consumer awareness of safer materials, and industrial expansion contribute to market penetration. Manufacturers are focusing on developing region-specific solutions and forming partnerships with polymer producers to ensure supply consistency and meet rising demand across multiple sectors.

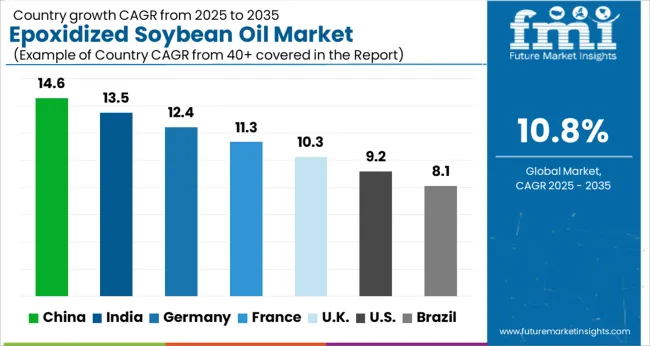

| Country | CAGR |

|---|---|

| China | 14.6% |

| India | 13.5% |

| Germany | 12.4% |

| France | 11.3% |

| UK | 10.3% |

| USA | 9.2% |

| Brazil | 8.1% |

The global epoxidized soybean oil market is projected to grow at a CAGR of 10.8% from 2025 to 2035. China leads expansion at 14.6%, followed by India at 13.5%, Germany at 12.4%, the UK at 10.3%, and the USA at 9.2%. Growth is driven by increasing demand for bio-based plasticizers, rising applications in PVC products, and the shift toward environmentally compliant additives. China and India dominate production and consumption due to large-scale industrial use and expanding polymer manufacturing, while Germany, the UK, and the USA focus on high-purity formulations, specialty applications, and advanced compounding technologies to meet regulatory and performance requirements. The analysis includes over 40 countries, with the leading markets detailed below.

The epoxidized soybean oil market in China is projected to grow at a CAGR of 14.6% from 2025 to 2035, driven by increasing demand in the plastics, PVC stabilizers, and coating industries. ESBO is widely used as a plasticizer and stabilizer in flexible PVC applications, which are expanding in construction, automotive, and packaging sectors. Domestic manufacturers are investing in production capacity, process optimization, and R&D for higher purity and multifunctional grades. Collaborations with international suppliers enable technology transfer, improved product formulations, and compliance with global standards. Rapid industrialization, urban construction, and rising consumer goods production further accelerate market adoption. Applications in wire and cable insulation, flooring, and synthetic leather are creating diversified demand, supporting long-term growth in both industrial and commercial segments.

The ESBO market in India is expected to grow at a CAGR of 13.5% from 2025 to 2035, driven by growing demand in PVC, plasticizers, and coating applications. Adoption is supported by rising industrialization, infrastructure development, and expanding automotive and packaging sectors. Domestic manufacturers are enhancing production capacity and introducing high-purity and multifunctional ESBO grades to meet industry requirements. Collaborations with global technology providers facilitate product innovation, compliance with international standards, and optimized processing methods. The growing preference for environmentally friendly and non-toxic plasticizers in flexible PVC applications is contributing to market expansion. Rapid urbanization, increased consumer spending, and growth in construction materials further enhance ESBO adoption across industrial and commercial applications.

Germany’s ESBO market is projected to grow at a CAGR of 12.4% from 2025 to 2035, driven by industrial demand for PVC stabilizers, coatings, and plasticizer applications. The market is supported by increasing adoption of high-performance, multifunctional ESBO in flexible PVC for automotive interiors, construction materials, and electrical insulation. Manufacturers focus on R&D, high-purity production, and environmentally compliant processes to meet stringent EU regulations. Collaborations with international suppliers ensure technology transfer, innovative formulations, and consistency in quality. Applications in flooring, synthetic leather, wire and cable insulation, and packaging are further contributing to market growth. Germany’s emphasis on sustainability, energy efficiency, and advanced material adoption strengthens demand for ESBO solutions.

The UK ESBO market is expected to grow at a CAGR of 10.3% from 2025 to 2035, influenced by demand from PVC, flexible plastic, coatings, and industrial applications. Manufacturers are introducing high-performance ESBO grades that improve thermal stability, plasticization, and durability. Adoption is further driven by the construction, automotive, electrical, and packaging sectors, where flexible PVC products are increasingly used. Strategic partnerships with international suppliers and R&D collaboration enable technology transfer, formulation improvements, and compliance with UK and EU standards. The focus on eco-friendly, non-toxic, and multifunctional plasticizers in consumer products and industrial applications is further accelerating market growth. Urban infrastructure projects, automotive production, and packaging expansion continue to strengthen ESBO adoption.

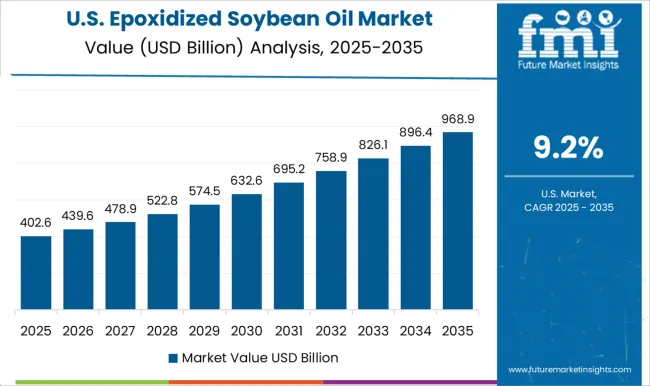

The USA ESBO market is projected to grow at a CAGR of 9.2% from 2025 to 2035, fueled by demand in PVC stabilization, coatings, adhesives, and plasticizer applications. Increasing adoption in construction materials, automotive interiors, wire and cable insulation, and packaging drives market expansion. Manufacturers focus on high-purity ESBO grades, process optimization, and environmentally friendly formulations to meet regulatory requirements and industry standards. Collaborations with global technology providers enable advanced product development, quality consistency, and multifunctional solutions for industrial and consumer applications. Rising demand for flexible PVC and non-toxic plasticizers in consumer goods, along with industrial infrastructure growth, supports market adoption across multiple sectors, ensuring steady growth over the forecast period.

Competition in the epoxidized soybean oil (ESBO) market is shaped by product purity, consistency, and application versatility. CHS Inc. leads with high-quality ESBO solutions for plasticizers, stabilizers, and polymer processing, emphasizing regulatory compliance and global supply capabilities. Nan Ya Plastics Corporation (Taiwan) and Adeka Corporation (Japan) compete with ESBO products tailored for PVC, coatings, and flexible plastics, focusing on performance stability, thermal resistance, and low migration properties. Cargill (US) differentiates through sustainable sourcing of soybean oil and advanced epoxidation processes, targeting industrial and consumer applications. Valtris (US) and Galata Chemicals LLC (US) provide specialty ESBO grades with high epoxy content for improved flexibility, color retention, and compatibility with various polymers.

Regional and mid-sized players such as Hairma Chemicals (GZ) Ltd. (China), SHANDONG LONGKOU LONGDA CHEMICAL INDUSTRY CO., LTD, and Inbra Industries Quimicas, Ltd. (Brazil) offer tailored ESBO products for local polymer, PVC, and additive markets. Strategies emphasize process optimization, adherence to environmental and food-contact regulations, and development of high-performance grades. Companies invest in R&D to improve epoxy value, oxidative stability, and migration resistance, while partnerships with plastic and PVC manufacturers support market adoption.

Product brochure content is detailed and technical. ESBO offerings include liquid and resin-grade products with specifications on epoxy value, viscosity, acid value, and thermal stability. Application guidelines for PVC stabilizers, coatings, adhesives, and flexible plastics are provided. Packaging formats, storage conditions, and safety instructions are described. Performance characteristics such as compatibility with co-plasticizers, color stability, and low odor are highlighted, reflecting a market focused on functional versatility, quality consistency, and regulatory compliance for industrial polymer applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 681.5 Billion |

| Raw Material | Soybean oil and hydrogen peroxide |

| Application | Plasticizers, UV cure applications, and Fuel additives |

| End-Use Application | Food & beverages, Adhesives & sealants, and Automotives |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CHS Inc. (US), Nan Ya Plastics Corporation (Taiwan), Adeka Corporation (Japan), Cargill (US), Valtris (US), Galata Chemicals LLC (US), Hairma Chemicals (GZ) Ltd. (China), SHANGDONG LONGKOU LONGDA CHEMICAL INDUSTRY CO., LTD, and Inbra Industries Quimicas, Ltd. (Brazil) |

| Additional Attributes | Dollar sales by application (plasticizers, stabilizers, coatings) and grade, share by region and end-use segment, growth trends, regulatory standards, raw material sourcing, performance characteristics, and competitive positioning. |

The global epoxidized soybean oil market is estimated to be valued at USD 681.5 billion in 2025.

The market size for the epoxidized soybean oil market is projected to reach USD 1,900.4 billion by 2035.

The epoxidized soybean oil market is expected to grow at a 10.8% CAGR between 2025 and 2035.

The key product types in epoxidized soybean oil market are soybean oil and hydrogen peroxide.

In terms of application, plasticizers segment to command 41.9% share in the epoxidized soybean oil market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soybean Enzymatic Protein Market Size and Share Forecast Outlook 2025 to 2035

Soybean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Soybean Meal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soybean Oil Market

Key Companies & Market Share in the High Oleic Soybean Sector

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA