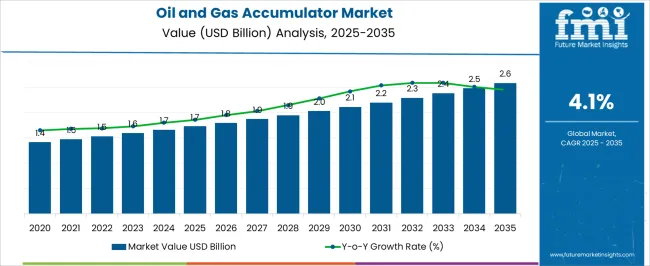

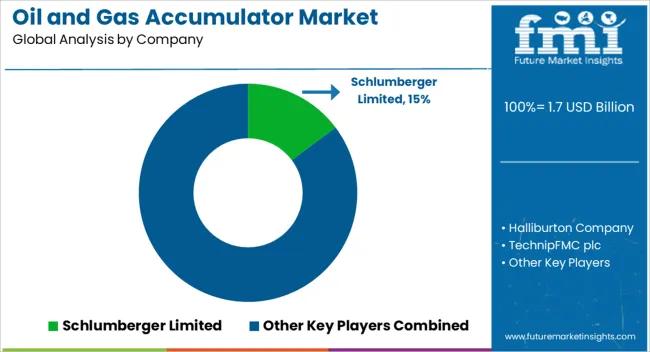

The Oil and Gas Accumulator Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Oil and Gas Accumulator Market Estimated Value in (2025 E) | USD 1.7 billion |

| Oil and Gas Accumulator Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The oil and gas accumulator market is experiencing steady growth, driven by the critical role of accumulators in optimizing hydraulic systems, maintaining pressure stability, and improving operational efficiency in oil and gas operations. Increasing investment in upstream and midstream infrastructure, coupled with the rising demand for efficient energy storage solutions, is fueling the adoption of advanced accumulator technologies.

The market is being further supported by technological advancements in hydraulic and pneumatic systems, which enable higher reliability, safety, and energy efficiency. Growing emphasis on minimizing equipment downtime, reducing maintenance costs, and improving operational safety in high-pressure applications is contributing to market expansion.

Regulatory standards in major oil-producing regions are also encouraging the adoption of high-performance accumulators to ensure compliance with environmental and operational guidelines As upstream exploration and production activities expand, and energy companies increasingly seek reliable solutions for pressure management and energy storage, the oil and gas accumulator market is expected to maintain sustained growth, with manufacturers focusing on innovation, durability, and system integration to meet evolving industry requirements.

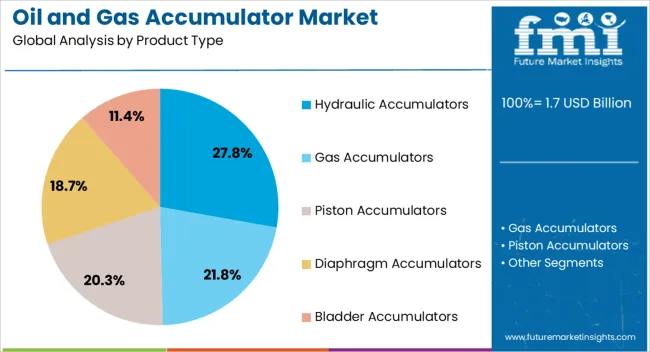

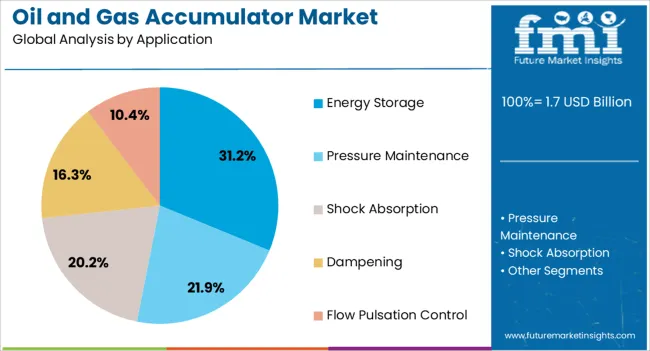

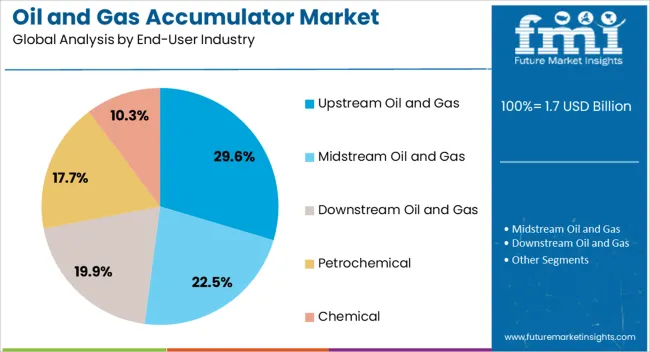

The oil and gas accumulator market is segmented by product type, application, end-user industry, material, capacity, and geographic regions. By product type, oil and gas accumulator market is divided into Hydraulic Accumulators, Gas Accumulators, Piston Accumulators, Diaphragm Accumulators, and Bladder Accumulators. In terms of application, oil and gas accumulator market is classified into Energy Storage, Pressure Maintenance, Shock Absorption, Dampening, and Flow Pulsation Control. Based on end-user industry, oil and gas accumulator market is segmented into Upstream Oil and Gas, Midstream Oil and Gas, Downstream Oil and Gas, Petrochemical, and Chemical. By material, oil and gas accumulator market is segmented into Carbon Steel, Stainless Steel, Aluminum, and Composite Materials. By capacity, oil and gas accumulator market is segmented into Medium Capacity (10–100 Liters), Small Capacity (Below 10 Liters), and Large Capacity (Above 100 Liters). Regionally, the oil and gas accumulator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hydraulic accumulators segment is projected to hold 27.8% of the oil and gas accumulator market revenue share in 2025, positioning it as the leading product type. Its growth is being driven by its ability to store and release hydraulic energy efficiently, ensuring pressure stability and smooth operation of high-performance equipment in oil and gas facilities.

The segment is benefiting from increased adoption in drilling rigs, production platforms, and other high-pressure hydraulic systems, where operational safety and energy efficiency are critical. Technological advancements in sealing, material strength, and energy absorption capabilities have enhanced reliability and service life, making hydraulic accumulators the preferred choice for critical applications.

The flexibility of these accumulators to integrate into complex hydraulic circuits without major system modifications is also contributing to their market leadership As operators seek to reduce energy losses and ensure continuous operations under fluctuating load conditions, hydraulic accumulators are expected to remain dominant in the market, supported by ongoing innovations in performance optimization and system compatibility.

The energy storage application segment is anticipated to account for 31.2% of the oil and gas accumulator market revenue share in 2025, establishing itself as the leading application area. Its growth is being driven by the increasing need to store energy efficiently for high-pressure hydraulic systems, which are essential for drilling, production, and transportation activities.

Accumulators in this application reduce energy waste by maintaining system pressure, storing excess hydraulic energy, and releasing it when required, thereby enhancing overall system efficiency. Adoption is further supported by oil and gas operators seeking to minimize operational costs and improve system reliability in remote or high-demand environments.

Advances in accumulator technology, including improved pressure ratings, materials, and design innovations, have enabled enhanced energy storage capabilities and longer operational lifespans As energy efficiency and operational continuity continue to be prioritized across upstream oil and gas facilities, energy storage applications are expected to maintain leadership in market demand, driven by both technological enhancements and regulatory pressures to optimize energy utilization.

The upstream oil and gas segment is projected to hold 29.6% of the oil and gas accumulator market revenue share in 2025, making it the leading end-use industry. This dominance is being driven by the intensive use of accumulators in drilling, exploration, and production operations, where hydraulic systems require precise pressure management and energy storage capabilities.

The segment is supported by increasing exploration activities in both conventional and unconventional reserves, which require reliable and high-performance accumulator solutions. Operators are prioritizing safety, system reliability, and energy efficiency to minimize downtime and maximize output in challenging operational environments.

The adoption of accumulators in subsea systems, offshore platforms, and onshore drilling rigs is further reinforcing segment growth, as these devices help maintain system stability under fluctuating load conditions Continuous innovations in accumulator design, materials, and integration capabilities are enabling upstream operators to enhance operational efficiency while complying with stringent safety and environmental standards, thereby sustaining the segment’s leadership in the market.

The global oil & gas accumulator market is expected to grow significantly in coming years, despite recent plummeting of crude oil market. With an increase in crude oil prices, the drilling activities across the globe are expected to pick up pace, resulting in an increase in the global oil & gas accumulator market.

An accumulator is a device used to store potential energy. The energy is stored in the form of compressed gas, spring or a raised weight, which is used to exert force on incompressible liquid. The global oil and gas accumulator market report assesses various aspects and importance of accumulators in the oil and gas industry.

The crude oil and natural gas production is increasing so as to satisfy the ever increasing demand for energy. The increase in production is one of the key drivers for the global oil and gas accumulator market, as increased production requires more number of rigs.

Within the global oil & gas accumulator market, accumulators are used in drilling rigs as well as in Blow-Out Preventers (BOPs). An increasing number of wells results in growing demand for accumulators.

The global oil & gas accumulator market has been segmented according to regions across the globe, as North America, Latin America, Eastern Europe, Western Europe, Asia-Pacific and Middle East & Africa.

Due to high drilling activities in the North American region as compared to other regions across the globe, the global oil & gas accumulator market represents an increased usage of accumulators in the North American market in 2025.

As far as the type of accumulators are concerned, the global oil & gas accumulator market has also been segmented according to the types of accumulators used in the oil & gas industry such as bladder type, piston type, diaphragm type and spring type.

The bladder type accumulators are most widely used type of accumulators in the global oil & gas accumulator market. The bladder type accumulators are also expected to be one of the fastest growing accumulators when compared on the basis of annual growth rate with other accumulator types.

For applications in the oil and gas industry, the global oil & gas accumulator market has been segmented into applications such as in BOPs, mud pumps and others. BOPs account for most wide application of accumulators in the global oil & gas accumulator market.

This is due to the fact that accumulators possess the capability to operate BOPs in case of a power failure, which is one of the key reasons for its dominance the global oil & gas accumulator market in coming years.

In the global oil & gas accumulator market, key global market players include companies such as Bosch Rexroth AG, Eaton Corporation, Parker-Hannifin Corporation, Tobul Accumulator Inc., and Nippon Accumulator Co. Ltd.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

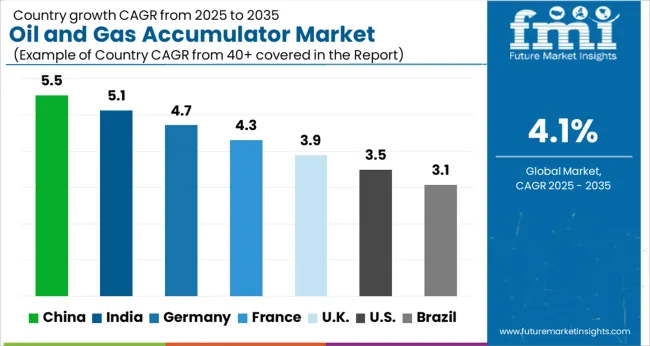

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The Oil and Gas Accumulator Market is expected to register a CAGR of 4.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.5%, followed by India at 5.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.1%, yet still underscores a broadly positive trajectory for the global Oil and Gas Accumulator Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.7%. The USA Oil and Gas Accumulator Market is estimated to be valued at USD 588.1 million in 2025 and is anticipated to reach a valuation of USD 828.3 million by 2035. Sales are projected to rise at a CAGR of 3.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 85.1 million and USD 55.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Product Type | Hydraulic Accumulators, Gas Accumulators, Piston Accumulators, Diaphragm Accumulators, and Bladder Accumulators |

| Application | Energy Storage, Pressure Maintenance, Shock Absorption, Dampening, and Flow Pulsation Control |

| End-User Industry | Upstream Oil and Gas, Midstream Oil and Gas, Downstream Oil and Gas, Petrochemical, and Chemical |

| Material | Carbon Steel, Stainless Steel, Aluminum, and Composite Materials |

| Capacity | Medium Capacity (10–100 Liters), Small Capacity (Below 10 Liters), and Large Capacity (Above 100 Liters) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schlumberger Limited, Halliburton Company, TechnipFMC plc, Parker Hannifin Corporation, Dover Corporation, GE Oil Gas, Aker Solutions ASA, Weatherford International plc, National Oilwell Varco, Inc., NOV Inc., Cameron International Corporation, FMC Technologies, Inc., Hydril Company, LLC, and Cooper Cameron Corporation |

The global oil and gas accumulator market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the oil and gas accumulator market is projected to reach USD 2.6 billion by 2035.

The oil and gas accumulator market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in oil and gas accumulator market are hydraulic accumulators, gas accumulators, piston accumulators, diaphragm accumulators and bladder accumulators.

In terms of application, energy storage segment to command 31.2% share in the oil and gas accumulator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil Accumulator Market Growth – Trends & Forecast 2024-2034

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Growth – Trends & Forecast 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Hose Assemblies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Oil And Gas Electric Submersible Pump Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Fittings Market Growth - Trends & Forecast 2025 to 2035

Oil and Gas Valve Market Growth – Trends & Forecast 2024-2034

Oil and Gas Data Monetization Market

Oil and Gas Pipeline Management Software Market

Oil And Gas Security And Services Market

Gas Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA