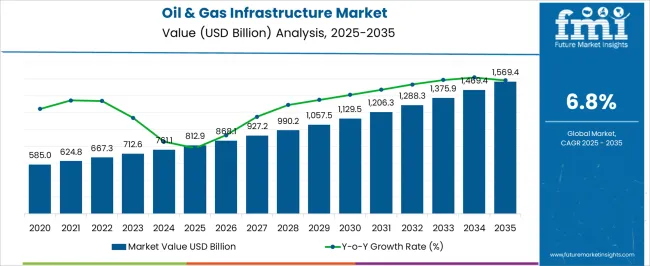

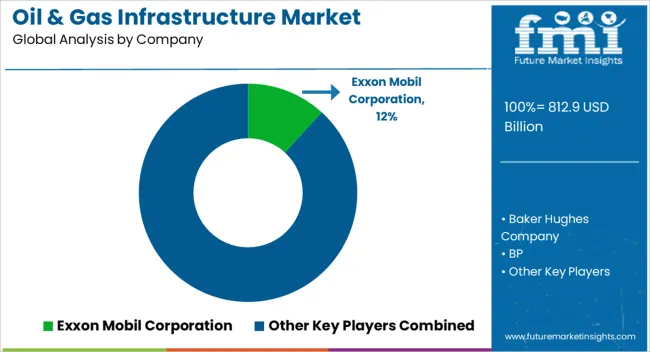

The Oil & Gas Infrastructure Market is estimated to be valued at USD 812.9 billion in 2025 and is projected to reach USD 1569.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period. The market’s growth trajectory reflects steady investments in upstream, midstream, and downstream infrastructure, driven by increasing energy demand, modernization of aging assets, and the integration of digital technologies for enhanced operational efficiency. In 2025, the market will reach USD 812.9 billion, supported primarily by new refinery capacities, pipeline expansions, and offshore development projects.

During the period from 2025 to 2030, the market experiences consistent year-on-year growth, with incremental annual increases averaging around USD 55–65 billion, reaching approximately USD 990.2 billion by 2030. This phase is characterized by scaling operations, particularly in emerging markets where energy infrastructure development is critical to meeting rising consumption. From 2030 to 2035, the market moves into a consolidation phase, with growth rates slightly moderating but still strong, fueled by optimization of existing infrastructure, expansion of liquefied natural gas terminals, and enhanced pipeline networks. By 2035, the market value will reach USD 1,569.4 billion, nearly doubling over the decade. Overall, the steady year-on-year growth underscores the resilience and strategic importance of oil and gas infrastructure in global energy supply chains.

Project engineers evaluate infrastructure specifications based on pressure rating capabilities, corrosion resistance characteristics, and operational lifecycle expectations when planning offshore drilling platforms, liquefied natural gas terminals, and crude oil refinement facilities requiring reliable hydrocarbon processing capabilities. System design involves analyzing flow capacity requirements, safety system integration, and environmental protection protocols while considering geological conditions, regulatory compliance mandates, and operational efficiency optimization factors necessary for profitable energy production. Investment decisions balance capital expenditure magnitudes against production revenue potential, incorporating operational cost reduction, safety enhancement, and environmental compliance benefits that justify massive infrastructure deployment through measurable return on investment achievement.

Construction operations require specialized fabrication techniques, heavy lift installation procedures, and comprehensive testing validation that achieve petroleum industry safety standards while managing project complexity throughout demanding offshore, onshore, and subsea environments. Project coordination involves managing equipment procurement, installation scheduling, and commissioning protocols while addressing environmental permitting, safety certification, and regulatory approval processes specific to oil and gas infrastructure development. Quality assurance encompasses pressure testing, welding inspection, and systems integration verification that ensure specification compliance while supporting operational safety requirements and environmental protection obligations throughout extended facility lifecycles.

| Metric | Value |

|---|---|

| Oil & Gas Infrastructure Market Estimated Value in (2025 E) | USD 812.9 billion |

| Oil & Gas Infrastructure Market Forecast Value in (2035 F) | USD 1569.4 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The Oil & Gas Infrastructure market is undergoing structural transformation due to increased global energy demand, investments in cross-border transportation networks, and efforts to modernize aging pipeline systems. Current developments are being shaped by rising exploration and production activity, along with strategic geopolitical initiatives aimed at improving energy security.

Government-backed infrastructure programs and private sector capital inflows are also contributing to the expansion and digitalization of midstream assets. As observed in energy company disclosures and infrastructure project press statements, advanced materials and remote monitoring technologies are enabling greater efficiency and reduced environmental risk across pipeline operations.

The future outlook remains strong as countries diversify their energy supply routes and strengthen transmission capabilities for both traditional hydrocarbons and transitional fuels such as natural gas. Market momentum is being further supported by regulatory emphasis on safety compliance and emission management, creating long-term opportunities for infrastructure expansion and resilience building within the oil and gas sector.

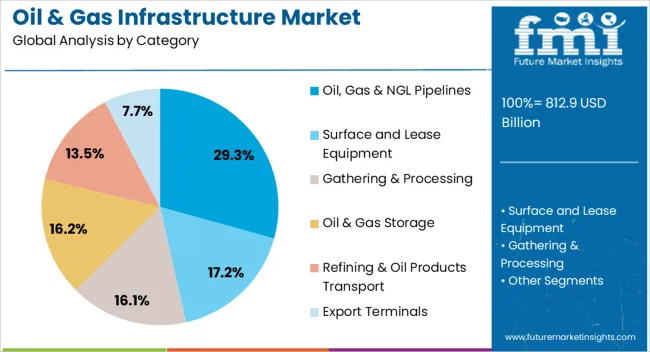

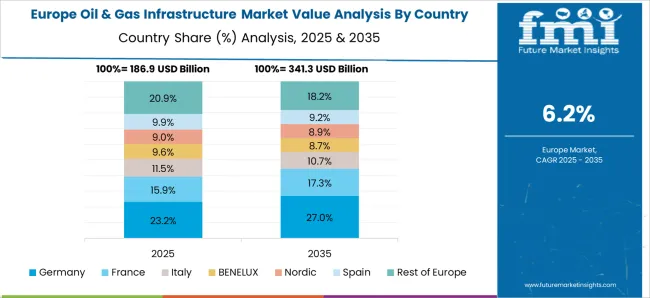

The oil & gas infrastructure market is segmented by category and geographic regions. By category, the oil & gas infrastructure market is divided into Oil, Gas & NGL Pipelines, Surface and Lease Equipment, Gathering & Processing, Oil & Gas Storage, Refining & Oil Products Transport, and Export Terminals. Regionally, the oil & gas infrastructure industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oil, gas and NGL pipelines segment is projected to account for 29.3% of the Oil & Gas Infrastructure market revenue share in 2025, positioning it as the leading category. This dominance is being attributed to sustained investment in pipeline expansion and replacement projects driven by the need for secure, large-volume transport of hydrocarbons across domestic and international networks. It has been observed in operator updates and midstream project announcements that this segment plays a central role in reducing bottlenecks and enhancing supply reliability.

The ability of pipeline infrastructure to provide cost-efficient, continuous flow over long distances is being recognized as a strategic advantage by energy-producing countries and commercial consortia. Additionally, technological enhancements in pipeline integrity monitoring, corrosion prevention and automation are improving operational safety and longevity.

These improvements are aligning with regulatory requirements for environmental safeguards and leak detection, further reinforcing the segment’s market leadership The critical role pipelines play in interconnecting upstream and downstream operations continues to support their prominence in infrastructure investments.

The oil and gas infrastructure market is expanding globally to support upstream exploration, midstream transport, and downstream processing. Rising energy demand, growing industrialization, and the need to enhance storage and distribution capabilities drive infrastructure development. Key components include pipelines, storage tanks, terminals, refineries, and offshore platforms. Investments in modernization, digital monitoring, and maintenance of aging assets are essential. North America, the Middle East, and Asia-Pacific lead due to energy production and consumption hubs, while emerging economies focus on expanding pipeline and storage networks to ensure energy security.

Pipeline and storage capacity development is crucial for seamless oil and gas distribution. New pipelines reduce transport bottlenecks and enable efficient crude and gas movement across regions. Storage tanks and terminals ensure supply stability and support fluctuations in global demand. Construction projects must address safety, environmental regulations, and seismic or climatic challenges. Adoption of corrosion-resistant materials, real-time monitoring systems, and automated valves enhances operational reliability. Investments in strategic storage hubs in key industrial zones help mitigate supply disruptions, strengthen market resilience, and support export-import operations, ensuring steady growth for infrastructure stakeholders.

Modern infrastructure increasingly relies on digital monitoring and control systems to optimize operations. SCADA (Supervisory Control and Data Acquisition) and IoT-enabled sensors provide real-time data on flow rates, pressure, and equipment health. These systems help detect leaks, prevent failures, and ensure compliance with environmental and safety regulations. Remote monitoring reduces operational costs and allows rapid response to emergencies. Advanced analytics enable predictive maintenance, reducing downtime and enhancing asset longevity. Infrastructure projects incorporating these systems gain competitive advantages by offering higher reliability, operational efficiency, and improved risk management for both upstream and midstream operators.

Emerging economies present significant potential for new infrastructure, driven by rising energy consumption and industrialization. Investments in offshore platforms, LNG terminals, and inland storage facilities are increasing to support production and supply. Offshore development requires specialized vessels, modular platforms, and advanced subsea technology to operate safely in deepwater environments. Governments in Africa, Southeast Asia, and Latin America provide incentives for foreign investments and partnerships. Companies capable of delivering efficient, safe, and compliant infrastructure solutions benefit from first-mover advantages in these untapped markets. Expanding operations in these regions helps diversify supply routes and strengthen global energy distribution networks.

Aging infrastructure and strict regulatory requirements influence market growth and operational decisions. Regular inspection, repair, and modernization of pipelines, storage tanks, and processing units are critical to ensure safety and environmental compliance. Non-compliance can result in heavy fines, operational shutdowns, and reputational damage. Adoption of standardized safety protocols, certified materials, and documentation ensures adherence to local and international regulations. Asset reliability is enhanced through preventive maintenance and risk assessment programs. Companies investing in skilled workforce training, quality assurance, and robust maintenance schedules can sustain long-term operations and maintain market competitiveness.

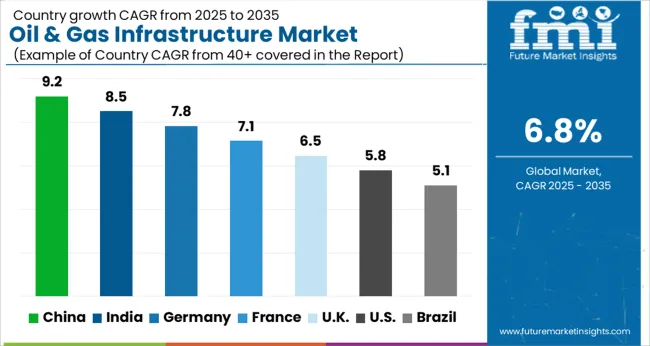

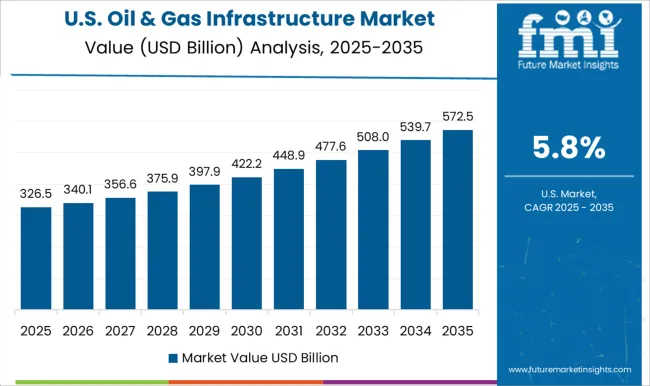

The global oil & gas infrastructure market is projected to grow at a CAGR of 6.8%, fueled by rising energy demands and ongoing investments in exploration and pipeline development. China leads the market with a 9.2% growth rate, driven by large-scale energy projects and expanding refinery capacities. India follows at 8.5%, supported by infrastructure expansion in upstream and midstream sectors. Germany shows steady growth at 7.8%, leveraging advanced technology and energy transition initiatives. The UK and USA record growth rates of 6.5% and 5.8%, respectively, reflecting stable demand in established energy markets. This report includes insights on 40+ countries; the top countries are shown here for reference.

The oil & gas infrastructure market in China is growing at 9.2%, supported by rising energy demand, industrial expansion, and government initiatives to enhance energy security. China is investing heavily in pipelines, storage facilities, refineries, and offshore platforms to meet the country’s growing consumption and maintain stable supply chains. The development of advanced technologies for pipeline monitoring, leak detection, and facility management is enhancing operational efficiency and safety standards. Increased collaboration with international companies and adoption of digital solutions for asset management are also driving market growth. With the Chinese government prioritizing energy infrastructure modernization, the market is poised for sustained expansion. Domestic investments in liquefied natural gas (LNG) terminals, petrochemical complexes, and offshore extraction projects further strengthen the infrastructure ecosystem, creating opportunities for contractors, equipment suppliers, and service providers.

The oil & gas infrastructure market in India is growing at 8.5%, fueled by increasing domestic energy consumption and government investments in refining, pipeline, and storage projects. India is modernizing its existing infrastructure while building new facilities to support the rising demand for oil, natural gas, and petrochemical products. Strategic initiatives include expanding LNG terminals, enhancing crude oil import capabilities, and improving pipeline networks across regions. Public-private partnerships, along with foreign investments, are playing a key role in advancing infrastructure capabilities. The adoption of advanced monitoring systems, automated facility management, and safety technologies is enhancing operational efficiency and reducing environmental impact. With the country aiming to improve energy security and reduce supply disruptions, India’s oil & gas infrastructure market is expected to grow steadily, offering opportunities for equipment suppliers, EPC contractors, and technology providers.

Oil & gas infrastructure market in Germany is expanding at 7.8%, driven by modernization efforts, energy transition goals, and maintenance of existing assets. The country is investing in pipelines, storage facilities, and refinery upgrades to ensure reliable supply chains and meet environmental standards. Advanced monitoring technologies, predictive maintenance systems, and digital solutions for operational efficiency are increasingly being adopted. Germany’s focus on energy security, combined with regulatory frameworks promoting safe and efficient infrastructure operations, is stimulating market development. Investments in liquefied natural gas (LNG) terminals, import infrastructure, and integration with renewable energy sources are further supporting growth. The market offers opportunities for technology providers, engineering firms, and EPC contractors to contribute to infrastructure modernization, safety enhancements, and environmental compliance. Germany is poised for steady expansion in its oil & gas infrastructure sector as demand remains stable and modernization continues.

The oil & gas infrastructure market in the United Kingdom is growing at 6.5%, supported by ongoing upgrades to pipelines, refineries, and offshore facilities. The UK is focused on maintaining operational efficiency, ensuring energy security, and meeting stringent environmental standards. Investments in digital solutions, asset monitoring, and predictive maintenance technologies are helping optimize infrastructure operations while reducing risk. The development of LNG terminals, modernization of offshore platforms, and expansion of storage capacities are key market drivers. Collaborations between government agencies, private companies, and technology providers are strengthening the country’s oil & gas ecosystem. The market is expected to expand steadily, with growth opportunities for service providers, equipment manufacturers, and engineering contractors involved in infrastructure maintenance, safety upgrades, and efficiency enhancements.

The oil & gas infrastructure market in the United States is growing at 5.8%, supported by investments in pipelines, refineries, storage facilities, and offshore platforms. The USA is focusing on maintaining reliable supply chains, enhancing energy security, and integrating advanced technologies to improve operational efficiency. Adoption of digital asset management, leak detection systems, and predictive maintenance solutions is driving infrastructure modernization. Investments in liquefied natural gas (LNG) terminals, refinery expansions, and pipeline networks support both domestic consumption and export capabilities. Regulatory compliance, safety standards, and environmental considerations also influence infrastructure development. The market offers opportunities for contractors, equipment suppliers, and technology providers to participate in modernization projects and improve operational resilience. With steady energy demand and ongoing infrastructure upgrades, the USA oil & gas infrastructure market is expected to experience moderate growth.

The Oil & Gas Infrastructure Market is witnessing robust development as global energy companies invest in modernization, digitalization, and sustainability-driven upgrades. Leading players such as Exxon Mobil Corporation, Shell plc, BP p.l.c., and TotalEnergies SE are spearheading large-scale projects to enhance exploration, refining, and transportation efficiency while aligning with net-zero transition goals.

Engineering and service providers like Halliburton Company, SLB (Schlumberger Limited), and Baker Hughes Company are introducing advanced digital solutions, predictive maintenance systems, and AI-driven monitoring technologies that improve operational reliability and reduce environmental footprints. Midstream operators including Energy Transfer LP, Enterprise Products Partners L.P., Kinder Morgan Inc., and Williams Companies Inc. continue to expand pipeline networks, storage capacities, and LNG terminals to meet rising global energy demand.

Occidental Petroleum Corporation, Chevron Corporation, and ConocoPhillips are prioritizing carbon capture and hydrogen-ready infrastructure investments, particularly in North America. European firms such as Royal Vopak N.V. and Centrica plc are transitioning towards integrating renewable gas and biofuel logistics. With growing focus on energy security and low-carbon infrastructure, the market is evolving from traditional oil-centric assets toward resilient, digital, and sustainable infrastructure networks supporting the future energy ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 812.9 Billion |

| Category | Oil, Gas & NGL Pipelines, Surface and Lease Equipment, Gathering & Processing, Oil & Gas Storage, Refining & Oil Products Transport, and Export Terminals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Exxon Mobil Corporation, Baker Hughes Company, BP p.l.c., Centrica plc, Chevron Corporation, ConocoPhillips, Energy Transfer LP, Enterprise Products Partners L.P., Hatch Ltd., Halliburton Company, Kinder Morgan Inc., Marathon Oil Corporation, NGL Energy Partners LP, Occidental Petroleum Corporation, ONEOK Inc., Royal Vopak N.V., SLB (Schlumberger Limited), Shell plc, TotalEnergies SE, Williams Companies Inc. |

| Additional Attributes | Dollar sales by type including pipelines, storage tanks, and offshore platforms, application across upstream, midstream, and downstream operations, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing global energy demand, exploration and production activities, and investments in modernizing oil and gas infrastructure. |

The global oil & gas infrastructure market is estimated to be valued at USD 812.9 billion in 2025.

The market size for the oil & gas infrastructure market is projected to reach USD 1,569.4 billion by 2035.

The oil & gas infrastructure market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in oil & gas infrastructure market are oil, gas & ngl pipelines, surface and lease equipment, gathering & processing, oil & gas storage, refining & oil products transport and export terminals.

In terms of , segment to command 0.0% share in the oil & gas infrastructure market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Growth – Trends & Forecast 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Hose Assemblies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Oil And Gas Electric Submersible Pump Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Fittings Market Growth - Trends & Forecast 2025 to 2035

Oil and Gas Valve Market Growth – Trends & Forecast 2024-2034

Oil and Gas Data Monetization Market

Oil and Gas Pipeline Management Software Market

Oil And Gas Security And Services Market

Gas Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA