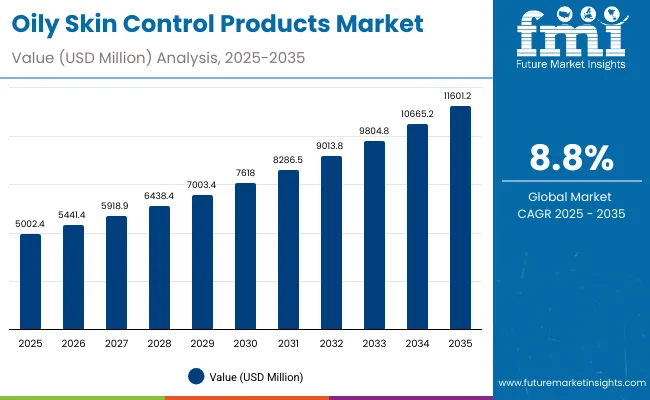

A valuation of USD 5,002.4 million is projected for the oily skin control products market in 2025, which is anticipated to rise to USD 11,601.2 million by 2035. This increase of USD 6,598.8 million over the decade signifies more than a two-fold expansion, achieved through a CAGR of 8.8%. Such momentum reflects the steady mainstreaming of oil-regulating and pore-minimizing solutions across global skincare regimes.

Oily Skin Control Products Market Key Takeaways

| Metric | Value |

|---|---|

| Oily Skin Control Products Market Estimated Value in (2025E) | USD 5,002.4 million |

| Oily Skin Control Products Market Forecast Value in (2035F) | USD 11,601.2 million |

| Forecast CAGR (2025 to 2035) | 8.80% |

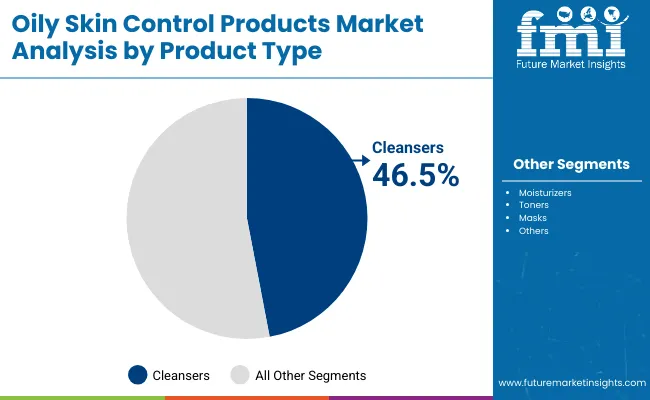

During the first half of the assessment period (2025-2030), the market is expected to expand from USD 5,002.4 million to USD 7,618.0 million, contributing USD 2,615.6 million, which equals nearly 40% of the total incremental growth. This phase is likely to be driven by heightened adoption among younger consumers, particularly teenagers and young adults, alongside rapid digital retail penetration. The prominence of cleansers, accounting for 46.5% of value share in 2025, is anticipated to be reinforced during this period, supported by consumer reliance on daily-use products for effective sebum management.

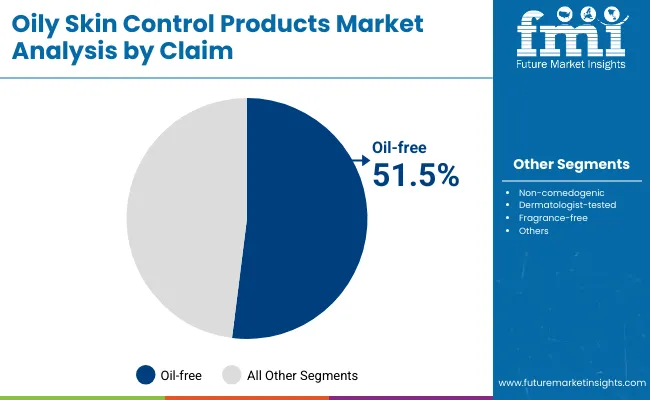

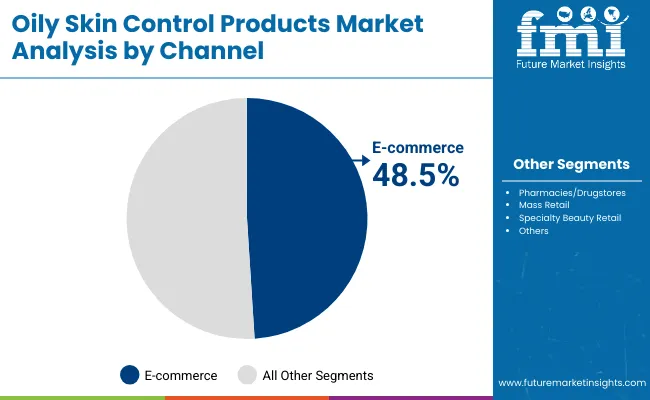

The second half (2030-2035) is forecasted to add USD 3,983.2 million, equal to about 60% of the total growth, as the market climbs from USD 7,618.0 million to USD 11,601.2 million. This acceleration is expected to be powered by strong gains in Asia, with China and India recording double-digit CAGRs of 17.6% and 20.2%, respectively. Oil-free claims, capturing 51.5% of value in 2025, are projected to remain dominant, while e-commerce channels are anticipated to maintain nearly half of global distribution, reflecting the durability of digital-first purchasing habits.

From 2020 to 2024, the market for oily skin control products advanced steadily, driven by growing awareness of skin health and heightened preference for targeted solutions. By 2025, demand is anticipated to reach USD 5,002.4 million, with a significant reliance on oil-free formulations and daily-use cleansers. The competitive environment is expected to be shaped by La Roche-Posay, which holds 8.5% share globally, while the remainder is distributed among established dermatology-led and mass-market brands.

Over the decade to 2035, the market is forecasted to more than double in size, supported by accelerating adoption in Asia-Pacific, where China and India are projected to record CAGRs of 17.6% and 20.2% respectively. E-commerce is anticipated to maintain nearly half of the overall distribution, underscoring the lasting shift to digital-first purchasing. Competitive advantage is expected to transition toward claims credibility, formulation safety, and direct-to-consumer engagement. Emerging digital-native brands are likely to capture share, although legacy leaders are projected to maintain dominance through dermatological trust and global retail networks.

Growth in the oily skin control products market is being fueled by rising awareness of skin health, with consumers increasingly seeking targeted solutions for sebum regulation, pore minimization, and long-lasting matte effects. Demand is being amplified by lifestyle changes, urban stressors, and climatic conditions that heighten oil-related skin concerns. Expansion is also being driven by teenagers and young adults, who represent a significant consumer base due to higher incidences of oily skin during early adulthood.

E-commerce platforms are enabling greater accessibility, offering diverse options that cater to both premium and mass-market preferences. Oil-free and non-comedogenic claims are strengthening consumer trust, while innovations in active ingredients such as niacinamide, salicylic acid, and zinc PCA are providing improved efficacy. Rapid growth in Asia-Pacific, particularly China and India, is expected to redefine market dynamics, as affordability, dermatological credibility, and digital-first engagement continue to shape purchasing behavior and accelerate adoption across regions.

The oily skin control products market has been segmented into Claim, Channel, and Product Type, reflecting how consumer trust, retail dynamics, and usage patterns are shaping growth trajectories. Within the claim segment, oil-free solutions and other dermatologist-tested claims are highlighted, showcasing consumer demand for clinically validated and skin-safe formulations. The channel segmentation covers both e-commerce and offline retail, underlining the balance between digital convenience and professional credibility offered by pharmacies and specialty stores.

Product type segmentation includes cleansers, moisturizers, toners, and masks, capturing the shift from daily-use essentials to multi-step skincare routines designed for holistic oily-skin management. Together, these categories provide a comprehensive view of how innovation, consumer behavior, and accessibility are expected to redefine adoption and competitive positioning over the forecast period.

| Claim | Market Value Share, 2025 |

|---|---|

| Oil-free | 51.5% |

| Others | 48.5% |

The claim segment is projected to be led by oil-free products in 2025, holding 51.5% share and valued at USD 2,575.8 million. This dominance is expected to be reinforced by growing consumer preference for formulations that effectively control sebum without causing irritation. Dermatologist-tested and non-comedogenic positioning is likely to strengthen adoption, particularly among teenagers and young adults who form the largest demand pool. The remaining 48.5% share, representing USD 2,425.4 million, is anticipated to be supported by claims such as fragrance-free and sensitive-skin suitability. The segment outlook is shaped by rising awareness of skin barrier protection and by an increasing demand for transparent, science-backed product claims that inspire consumer trust across global markets.

| Channel | Market Value Share, 2025 |

|---|---|

| E-commerce | 48.5% |

| Others | 51.5% |

The channel segment is forecasted to be led by offline retail formats in 2025, contributing 51.5% share with USD 2,577.0 million in value. Pharmacies, specialty beauty stores, and mass retailers are projected to maintain relevance by offering in-person consultations and trusted recommendations that drive purchase decisions. E-commerce, valued at USD 2,424.2 million and representing 48.5% of the market, is expected to remain a close contender, supported by convenience, wider assortment, and digital-first consumer engagement. Hybrid purchasing behavior is anticipated, with consumers increasingly researching online before buying offline or vice versa. Competitive differentiation is likely to emerge from omni-channel strategies, where personalization, subscription models, and direct-to-consumer innovations redefine how oily skin solutions are delivered to end users worldwide.

| Product Type | Market Value Share, 2025 |

|---|---|

| Cleansers | 46.5% |

| Others | 53.5% |

The product type segment is expected to be led by categories beyond cleansers, collectively accounting for 53.5% share in 2025 with a valuation of USD 2,678.1 million. This includes moisturizers, toners, and masks, which are increasingly being positioned as complementary solutions for holistic oily skin management. Cleansers, with a 46.5% share valued at USD 2,323.2 million, are anticipated to maintain strong relevance due to their status as daily essentials. The segment outlook reflects an evolution from single-function cleansing toward multi-step regimens, where oil-balancing moisturizers and toners are adopted for sustained results. Consumer education, ingredient transparency, and dermatologist endorsements are projected to elevate trust and accelerate the diversification of oily skin solutions within this segment over the coming decade.

The oily skin control products market is being reshaped by evolving consumer routines and dermatology-led innovations. While clinical validation enhances product trust, shifting retail landscapes and heightened digital influence are redefining how consumers evaluate, purchase, and remain loyal to skincare brands worldwide.

Clinical Validation as a Market Catalyst

Clinical validation and dermatologist endorsements are expected to act as decisive growth catalysts in the oily skin control products market. As consumers increasingly seek evidence-backed assurances, formulations demonstrating proven efficacy in oil absorption and pore minimization are likely to secure preference. Clinical studies not only elevate brand credibility but also enhance consumer willingness to adopt premium-priced solutions. This emphasis on medical legitimacy is projected to widen acceptance across skeptical consumer groups and foster regulatory compliance advantages. By reinforcing science-led positioning, companies are anticipated to differentiate themselves and capture durable trust, particularly in markets where dermatology-driven purchasing behavior dominates.

Convergence of Skincare and Digital Ecosystems

A defining trend is expected to emerge from the convergence of skincare and digital ecosystems, where personalized recommendations, AI-driven skin assessments, and virtual consultations are increasingly embedded in consumer journeys. This integration is reshaping product discovery, enabling consumers to match oily skin concerns with tailored solutions. Data-driven personalization platforms are anticipated to strengthen direct-to-consumer loyalty and drive higher repeat purchases. Simultaneously, social commerce is projected to accelerate category adoption, particularly in Asia-Pacific, where digital engagement forms the backbone of beauty consumption. This transformation signifies a shift from transactional purchasing to an interactive, continuous brand-consumer relationship anchored in digital trust.

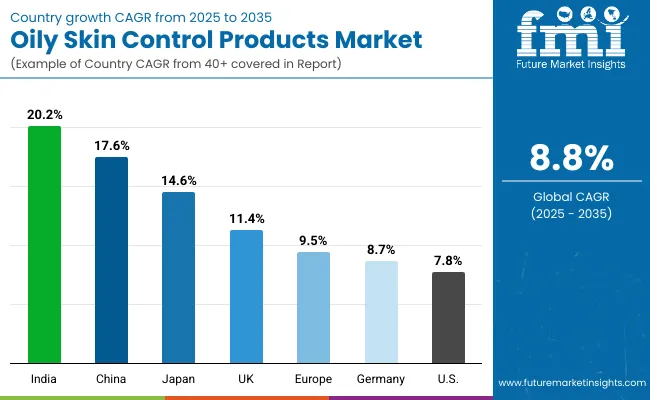

| Countries | CAGR |

|---|---|

| China | 17.6% |

| USA | 7.8% |

| India | 20.2% |

| UK | 11.4% |

| Germany | 8.7% |

| Japan | 14.6% |

The global oily skin control products market is projected to expand at varied speeds across major countries, reflecting differences in consumer demographics, dermatological awareness, and digital retail adoption. India is forecasted to lead with a CAGR of 20.2% between 2025 and 2035, supported by a rapidly urbanizing population, growing disposable incomes, and a rising youth base with heightened skincare concerns. China is expected to follow closely with 17.6% CAGR, driven by middle-class expansion, strong e-commerce ecosystems, and rising demand for dermatologist-approved solutions. Japan’s 14.6% CAGR highlights a premiumization trend, where consumers increasingly prioritize clinically validated and science-led skincare innovations.

In Europe, moderate growth is anticipated, with the UK at 11.4% and Germany at 8.7%, supported by high consumer trust in dermatological brands and stringent quality standards. The broader European market is projected to grow at 9.5%, benefiting from established retail networks and sustainable packaging preferences. The USA, while mature, is expected to grow at 7.8%, reflecting stable but slower expansion due to already high market penetration. Overall, regional dynamics suggest that Asia-Pacific will act as the growth engine for the next decade, while Europe and North America are likely to maintain strength through brand credibility, clinical research, and innovation in digital-first retail strategies.

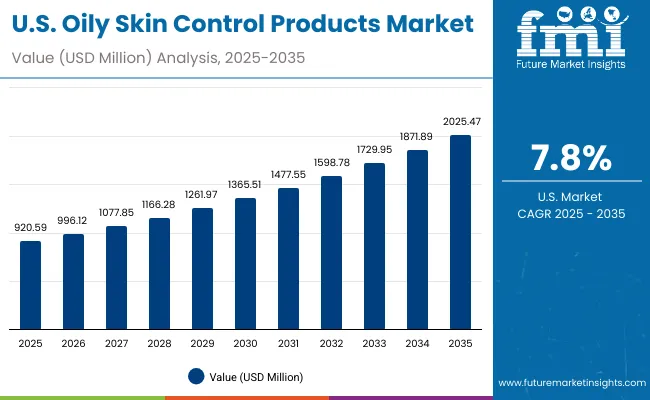

| Year | USA Oily Skin Control Products Market (USD Million) |

|---|---|

| 2025 | 920.59 |

| 2026 | 996.12 |

| 2027 | 1,077.85 |

| 2028 | 1,166.28 |

| 2029 | 1,261.97 |

| 2030 | 1,365.51 |

| 2031 | 1,477.55 |

| 2032 | 1,598.78 |

| 2033 | 1,729.95 |

| 2034 | 1,871.89 |

| 2035 | 2,025.47 |

The oily skin control products market in the United States is projected to grow at a CAGR of 8.3% from 2025 to 2035, rising from USD 920.59 million to USD 2,025.47 million. This trajectory reflects stable yet strong expansion, supported by premium skincare adoption, consumer emphasis on clinically validated claims, and high penetration of both offline and digital channels. Oil-free and non-comedogenic formulations are expected to remain central to purchasing decisions, while e-commerce is anticipated to strengthen its role in enabling personalization and direct-to-consumer engagement. Established dermatology-led brands are projected to retain leadership, though niche digital-first entrants are likely to challenge incumbents through targeted positioning and consumer-centric marketing.

The oily skin control products market in the UK is projected to grow at a CAGR of 11.4% from 2025 to 2035, reflecting steady expansion in both premium and mass-market segments. Rising awareness of skin health, combined with demand for oil-free and dermatologist-tested claims, is anticipated to strengthen product penetration across younger consumers. Clinical credibility and sustainable formulations are expected to play a central role in driving adoption, particularly as environmentally conscious preferences reshape beauty consumption. Retail pharmacies and specialty beauty chains are forecasted to maintain relevance, though e-commerce will continue to expand its share through subscription-based skincare and digital consultations.

The oily skin control products market in India is forecasted to expand at a CAGR of 20.2% from 2025 to 2035, marking it as the fastest-growing among major economies. Growth is expected to be driven by an expanding urban population, rising disposable incomes, and heightened consumer awareness of dermatological care. E-commerce platforms are anticipated to play a pivotal role in increasing accessibility, with a wide variety of price points catering to both premium and mass-market consumers. The dominance of oil-free claims is projected to be reinforced by high oily skin prevalence in younger demographics, while dermatologist-backed product endorsements are likely to secure consumer trust.

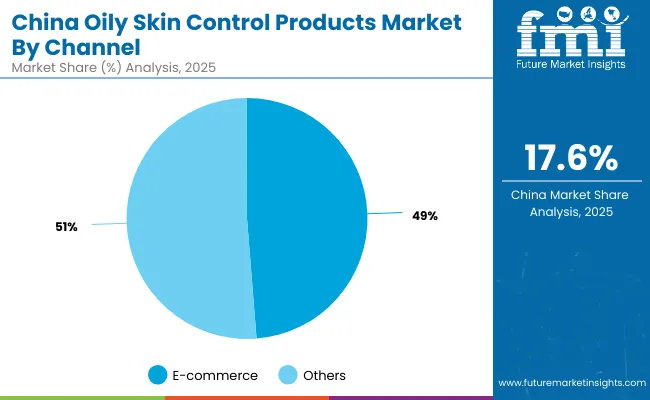

The oily skin control products market in China is expected to expand at a CAGR of 17.6% between 2025 and 2035, supported by rapid urbanization and a growing middle class with increasing purchasing power. Digital-first engagement is projected to dominate, with e-commerce and social commerce driving consumer discovery and purchase behavior. Oil-free and sensitive-skin claims are anticipated to gain strong momentum as consumers seek dermatologist-validated solutions. Local and international players are expected to intensify competition, with innovation in active ingredients like niacinamide and zinc PCA shaping consumer preferences. Premiumization trends are forecasted to accelerate, reflecting growing acceptance of higher-priced science-backed formulations.

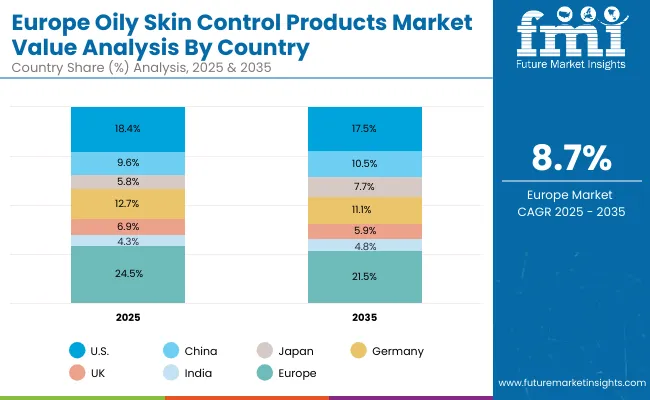

| Countries | 2025 |

|---|---|

| USA | 18.4% |

| China | 9.6% |

| Japan | 5.8% |

| Germany | 12.7% |

| UK | 6.9% |

| India | 4.3% |

| Countries | 2035 |

|---|---|

| USA | 17.5% |

| China | 10.5% |

| Japan | 7.7% |

| Germany | 11.1% |

| UK | 5.9% |

| India | 4.8% |

The oily skin control products market in Germany is projected to register a CAGR of 8.7% from 2025 to 2035, reflecting measured yet consistent growth. Consumer loyalty to dermatologist-led and clinically validated formulations is expected to strengthen demand, particularly in oil-free and non-comedogenic categories. Pharmacies and specialty retail channels are anticipated to remain dominant, supported by high trust in professional recommendations. However, digital commerce is forecasted to gain momentum as consumers adopt subscription-based skincare and online dermatology consultations. Innovation in sustainable packaging and clean formulations is likely to resonate strongly with Germany’s environmentally conscious consumers, reinforcing long-term product adoption.

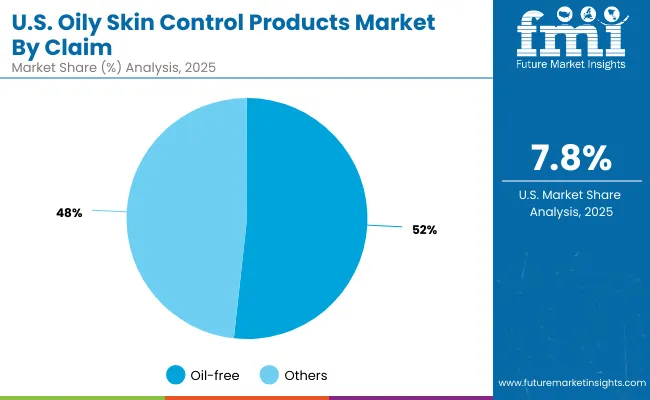

| USA by Claim | Market Value Share, 2025 |

|---|---|

| Oil-free | 51.5% |

| Others | 48.5% |

The USA oily skin control products market is projected at USD 920.59 million in 2025. Oil-free claims contribute 51.5%, equivalent to USD 474.2 million, while other claims collectively account for 48.5% with USD 446.35 million, reflecting a close distribution between the two segments. The dominance of oil-free positioning highlights strong consumer reliance on formulations that effectively manage sebum without clogging pores, a preference amplified by dermatologist endorsements and clinical validation.

Other claims, including fragrance-free and sensitive-skin suitability, demonstrate near-equal traction, supported by rising demand from consumers with heightened awareness of skin sensitivity. This balance between functional oil control and broader skin health claims indicates a diversified pathway for market growth. The competitive outlook is expected to be shaped by brands that can integrate oil-free efficacy with complementary benefits, ensuring sustained consumer trust and premium acceptance.

| China by Channel | Market Value Share, 2025 |

|---|---|

| E-commerce | 48.5% |

| Others | 51.5% |

The oily skin control products market in China is projected at USD 481.3 million in 2025. E-commerce is expected to contribute 48.5%, amounting to USD 233.4 million, while offline and other distribution channels are anticipated to hold 51.5%, valued at USD 247.94 million. This near-equal distribution demonstrates the strength of China’s retail diversity, where both digital and physical ecosystems remain influential. E-commerce growth is expected to be propelled by social commerce platforms, livestreaming sales, and direct-to-consumer models that appeal strongly to younger buyers.

Meanwhile, offline stores, particularly pharmacies and beauty specialty outlets, are projected to retain importance by providing credibility and professional consultation. The long-term outlook suggests that while offline will sustain a marginal lead, digital-first strategies will dominate consumer engagement, reshaping purchase behaviors through personalization and seamless integration of AI-driven skincare assessments.

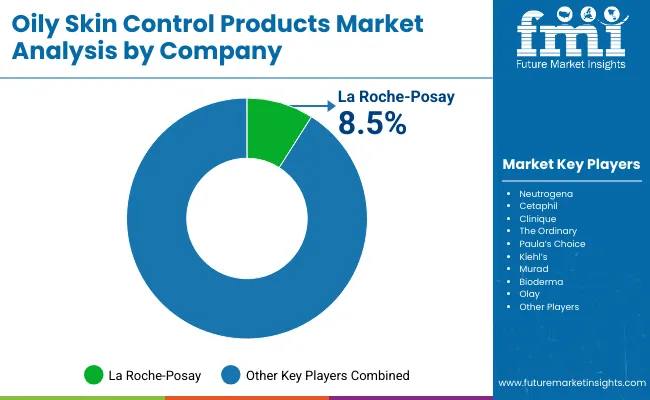

The oily skin control products market is moderately fragmented, with global leaders, established dermatology-driven brands, and niche-focused skincare specialists competing across diverse consumer groups. La Roche-Posay is projected to lead the global market with an 8.5% share in 2025, reflecting its strong credibility in dermatologist-recommended solutions and science-backed formulations. Its positioning within the medical skincare segment has enabled sustained trust, making it the most dominant single player in this category.

Other prominent brands such as Neutrogena, Cetaphil, Clinique, The Ordinary, Paula’s Choice, Kiehl’s, Murad, Bioderma, and Olay contribute collectively to the remaining 91.5% of market value. These companies are expected to strengthen their foothold through innovation in active ingredients such as niacinamide, salicylic acid, and zinc PCA, alongside claim-based positioning including oil-free, non-comedogenic, and dermatologist-tested benefits.

Competitive differentiation is anticipated to increasingly depend on omni-channel strategies, combining offline credibility with digital-first convenience. E-commerce platforms, direct-to-consumer channels, and subscription-based regimens are projected to redefine engagement. Furthermore, premiumization through clinical validation and sustainable packaging is likely to drive long-term loyalty. The future competitive environment is expected to shift from basic efficacy claims toward integrated value propositions that combine dermatological trust, transparent science, and consumer personalization.

Key Developments in Oily Skin Control Products Market

| Item | Value |

|---|---|

| Market Size & Outlook | USD 5,002.4 million (2025E); USD 11,601.2 million (2035F); CAGR 8.8% (2025-2035) |

| Core Segments (for analysis & sizing) | Claim: Oil-free; Others Channel: E-commerce; Others (offline retail incl. pharmacies, mass, specialty) Product Type: Cleansers; Others (moisturizers, toners, masks) |

| Additional Analytical Cuts | Active Ingredients: Niacinamide; Salicylic acid; Clay/minerals; Zinc PCA; Tea tree oil End User: Teenagers/young adults; Adults; Men |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; United Kingdom; Germany; Japan |

| Key Companies Profiled | La Roche-Posay; Neutrogena; Cetaphil; Clinique; The Ordinary; Paula’s Choice; Kiehl’s; Murad; Bioderma; Olay |

| Competitive Snapshot (2025) | La Roche-Posay global value share: 8.5%; Others: 91.5% |

| 2025 Segment Highlights (Global) | Oil-free claim share: 51.5% (USD 2,575.8 million) E-commerce share: 48.5% (USD 2,424.2 million) Cleansers share: 46.5% (USD 2,323.2 million) |

| Country Growth Benchmarks (CAGR 2025-2035) | India 20.2%; China 17.6%; Japan 14.6%; UK 11.4%; Europe 9.5%; Germany 8.7%; USA 7.8% |

| Scope Notes & Use Cases | Sizing and forecasting will be conducted by claim, channel, and product type with cross-tabs to region/country and end user; ingredient trends, clinical claims, and omni-channel shifts will be evaluated for impact on price/mix and adoption. |

The global Oily Skin Control Products Market is estimated to be valued at USD 5,002.4 million in 2025.

The market size for the Oily Skin Control Products Market is projected to reach USD 11,601.2 million by 2035.

The Oily Skin Control Products Market is expected to grow at a CAGR of 8.8% between 2025 and 2035.

The key product types in the Oily Skin Control Products Market are cleansers, moisturizers, toners, and masks.

In terms of claims, oil-free products are projected to command 51.5% share in the Oily Skin Control Products Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skin Tightening Device Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skin-Barrier Strengthening Phospholipids Market Size and Share Forecast Outlook 2025 to 2035

Skin Toner Market Size and Share Forecast Outlook 2025 to 2035

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Skin Grafting System Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skin Perfusion Pressure Testing Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Skin Antiseptic Market - Demand, Growth & Forecast 2025 to 2035

Skin Bioactive Market Analysis - Trends, Growth & Forecast 2025 to 2035

Skin Replacement Market Growth - Trends & Forecast 2024 to 2034

Skin Tears Treatment Market Growth – Industry Outlook & Forecast 2024-2034

Skin Lightening Lip Balm Market Trends – Demand & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA