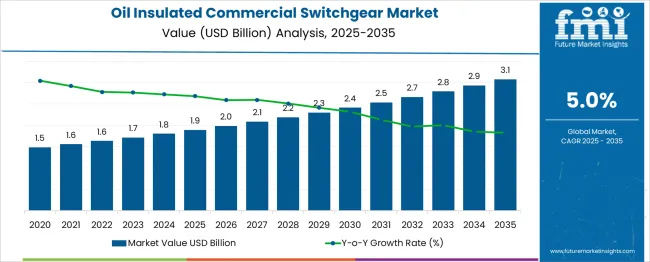

The Oil Insulated Commercial Switchgear Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. This early-phase growth is driven by the increasing demand for reliable and high-performance electrical systems in commercial buildings, manufacturing, and industrial infrastructure. The market will benefit from rising adoption of oil-insulated switchgear due to its higher insulation properties and long lifespan, particularly in high-voltage applications. The second half (2030–2035) will contribute USD 0.9 billion, representing 64.3% of the total growth, reflecting continued demand for efficient, compact, and high-performance switchgear as industries upgrade their electrical systems for sustainability and digitalization.

Annual increments average USD 0.2 billion per year in the first phase, while later years will see stronger growth driven by increased infrastructure investments and the growing need for an uninterrupted power supply. Manufacturers focusing on automation, energy efficiency, and advanced features will capture the largest share of this USD 1.2 billion opportunity globally.

| Metric | Value |

|---|---|

| Oil Insulated Commercial Switchgear Market Estimated Value in (2025 E) | USD 1.9 billion |

| Oil Insulated Commercial Switchgear Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The Oil Insulated Commercial Switchgear market is gaining traction as infrastructure modernization and grid stability become critical to commercial and industrial expansion. Growth is being shaped by the increasing deployment of high-reliability power distribution systems, particularly in regions facing harsh environmental conditions where oil insulation offers long-term operational durability. The market is being further propelled by increasing electricity consumption, expansion of commercial complexes, and stringent regulatory demands for safety and fire resistance in power systems.

Oil insulated switchgears are favored for their ability to perform consistently in adverse conditions, where other insulation technologies may be limited. Additionally, the long maintenance cycles and strong dielectric properties of oil as an insulator are contributing to greater adoption.

As digitalization and load growth reshape power demand across commercial sectors, the need for secure, fault-resistant, and space-efficient switchgear systems is expected to grow steadily. These factors are collectively strengthening the outlook for oil insulated technologies in the commercial switchgear space..

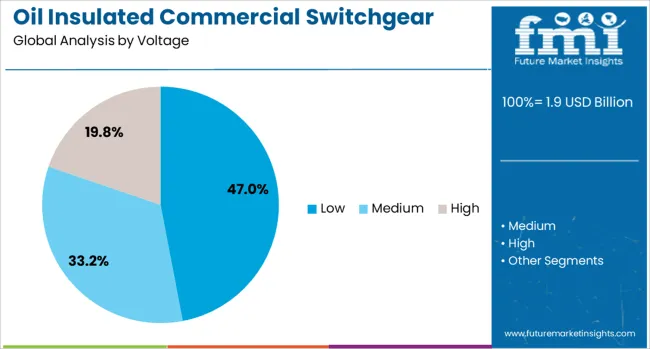

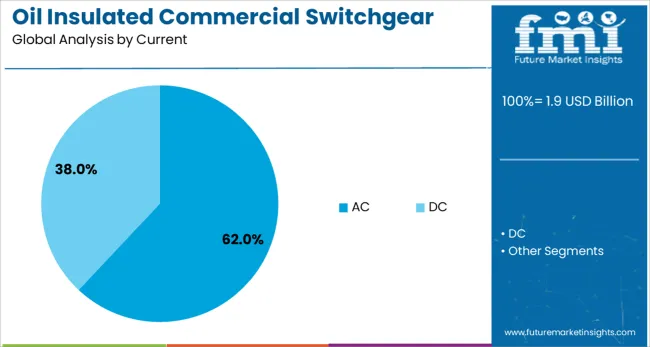

The oil insulated commercial switchgear market is segmented by voltage, current, and geographic regions. The voltage of the oil-insulated commercial switchgear market is divided into Low, Medium, and High. In terms of the current state of the oil-insulated commercial switchgear market, it is classified into ACDC. Regionally, the oil-insulated commercial switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low voltage segment is projected to hold 47% of the Oil Insulated Commercial Switchgear market revenue share in 2025, making it the dominant voltage category. This growth has been supported by widespread adoption in retail centers, office complexes, and commercial buildings where reliable power distribution at lower voltage levels is essential. Oil insulated low voltage switchgears are being increasingly chosen for their high durability, compact footprint, and strong insulation performance in constrained installation environments.

Their resilience against temperature fluctuations and operational stress has made them suitable for continuous service in demanding settings. Preference for this segment has also been driven by its ability to handle short circuit conditions effectively while reducing the risk of internal arc faults.

In addition, regulatory compliance for commercial safety standards has reinforced the transition to safer, longer-lasting switchgear systems. These operational and economic advantages are encouraging commercial developers to favor oil insulated low voltage solutions, consolidating the segment’s lead in the market..

The alternating current segment is expected to account for 62% of the Oil Insulated Commercial Switchgear market revenue share in 2025, establishing it as the leading current type. This dominance has been attributed to the widespread use of alternating current in commercial infrastructure, where it remains the standard for power distribution. Oil insulated AC switchgears are being increasingly deployed in applications requiring stable, low-maintenance equipment that can handle frequent switching cycles and load variations.

Their ability to perform under high humidity and temperature variations without degradation has further increased their appeal. In commercial projects, the demand for switchgear that supports grid interoperability, energy efficiency, and future scalability is influencing the selection of AC systems.

The extended service life and cost efficiency of oil insulated AC configurations are contributing to long-term investment strategies by commercial stakeholders. As urban energy needs evolve, the AC segment is expected to maintain its prominence by offering a reliable platform for safe and uninterrupted electrical operations..

The oil-insulated commercial switchgear market is expanding, driven by the growing need for efficient power distribution systems and reliable electrical grids. Opportunities in industrial and commercial sectors, along with trends towards compact and high-performance solutions, are fueling growth. However, high initial costs and maintenance challenges may hinder adoption. By 2025, addressing these issues through cost-effective designs and more accessible solutions will be critical to sustaining market expansion.

The oil-insulated commercial switchgear market is driven by the increasing need for reliable power distribution systems across industries. The demand for efficient and safe electrical systems in commercial, industrial, and residential applications is fueling market growth. Oil-insulated switchgears are preferred for their enhanced insulation and long-term reliability in high-voltage systems. As the global focus shifts towards improving energy infrastructure, the market is expected to see continued expansion, with increased adoption in emerging economies by 2025.

Opportunities in the oil-insulated commercial switchgear market are growing in both industrial and commercial sectors. The need for robust and durable power distribution systems in manufacturing plants, office complexes, and data centers is driving market adoption. Additionally, the push for electrical grid modernization is expanding demand for high-quality switchgear solutions. By 2025, key opportunities will emerge as industries continue to invest in efficient power distribution and safer grid operations.

Emerging trends in the oil-insulated commercial switchgear market show a shift towards compact, high-performance solutions. Manufacturers are increasingly focusing on developing smaller, more efficient units that offer better performance while occupying less space. These products offer advantages like reduced maintenance needs and enhanced operational efficiency. As industries seek space-saving and cost-effective alternatives, compact oil-insulated switchgears are expected to dominate the market by 2025, ensuring easier integration into tight spaces without compromising on power reliability.

The oil-insulated commercial switchgear market faces challenges related to high initial investment and ongoing maintenance costs. Although oil-insulated switchgears offer superior insulation and reliability, their high cost compared to air-insulated systems can deter small to mid-sized businesses from adopting them. Moreover, the need for regular maintenance and monitoring of oil levels adds to the operational expenses. These factors may limit market growth, particularly in regions with budget constraints, unless cost-effective solutions are developed.

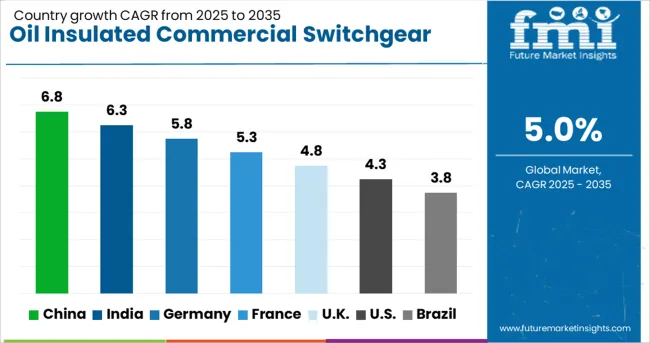

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

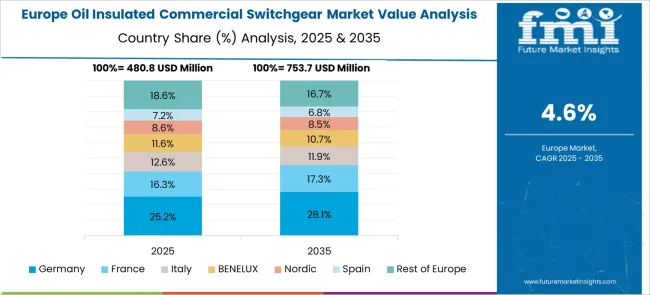

The global oil insulated commercial switchgear market is projected to grow at a 5% CAGR from 2025 to 2035. China leads with a growth rate of 6.8%, followed by India at 6.3%, and France at 5.3%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. These differences in growth rates are influenced by regional energy demand, industrial expansion, and advancements in electrical infrastructure. Emerging markets like China and India are witnessing higher growth due to rapid urbanization, increasing industrialization, and expanding electricity grids, while more mature markets like the USA and the UK experience steady growth due to existing infrastructure and technological upgrades. This report includes insights on 40+ countries; the top markets are shown here for reference.

The oil insulated commercial switchgear market in China is growing at a strong pace, with a projected CAGR of 6.8%. China’s rapid urbanization, industrial expansion, and ongoing investments in electrical infrastructure are driving the demand for oil-insulated switchgear. As the country continues to develop its energy grid to support growing industrial and commercial needs, the adoption of reliable and high-performance switchgear solutions becomes crucial. Additionally, China’s focus on renewable energy integration, smart grid technology, and power generation further accelerates the market’s growth, making it a key region for oil insulated commercial switchgear applications.

The oil insulated commercial switchgear market in India is projected to grow at a CAGR of 6.3%. India’s expanding energy sector, driven by rising industrial demand, government infrastructure initiatives, and the push for energy access in rural areas, is propelling the demand for oil-insulated switchgear. Additionally, the country’s growing focus on modernizing the power grid, integrating renewable energy sources, and enhancing electrical safety is further driving market growth. The increasing adoption of advanced grid technologies, along with India’s ongoing push toward industrialization and infrastructure development, supports continued demand for oil insulated switchgear solutions.

The oil insulated commercial switchgear market in France is projected to grow at a CAGR of 5.3%. France’s strong industrial sector, coupled with its investments in energy infrastructure and renewable energy integration, is driving the demand for oil-insulated switchgear. The country’s commitment to reducing carbon emissions and enhancing power distribution networks further supports the adoption of reliable and safe electrical components. The increasing emphasis on grid stability, along with advancements in power generation technologies, is contributing to the steady demand for oil insulated switchgear solutions in France’s energy sector.

The oil insulated commercial switchgear market in the United Kingdom is projected to grow at a CAGR of 4.8%. The UK continues to focus on modernizing its power infrastructure and integrating renewable energy sources, which drives the demand for oil-insulated switchgear. The increasing adoption of smart grid technologies and the need for safe and efficient electrical components in residential, commercial, and industrial applications further contribute to market growth. Despite the more mature market, steady demand for electrical safety solutions, driven by regulatory standards and power distribution needs, ensures sustained market expansion.

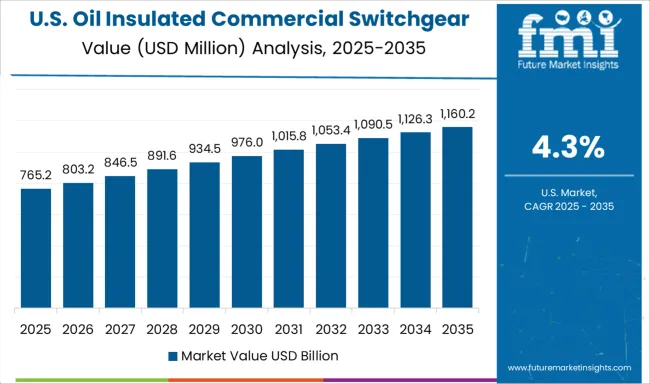

The oil insulated commercial switchgear market in the United States is expected to grow at a CAGR of 4.3%. Although the market is more mature, steady demand for oil-insulated switchgear continues, particularly in the energy and industrial sectors. The USA is focused on upgrading its aging power grid, integrating renewable energy sources, and improving power reliability, which drives the need for reliable and durable switchgear. Additionally, the ongoing demand for electrical safety solutions in industrial applications and the increased focus on grid resilience contribute to the market’s continued expansion, albeit at a slower pace compared to emerging markets.

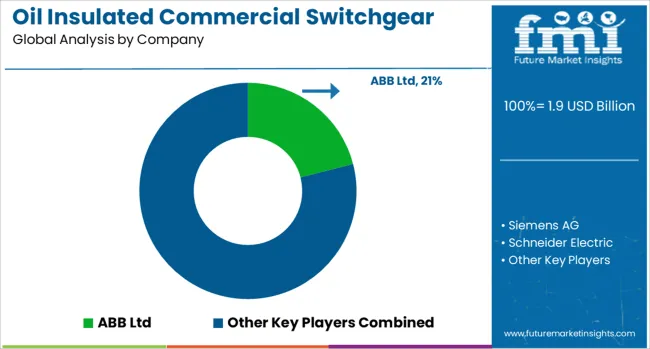

The oil-insulated commercial switchgear market is dominated by ABB Ltd, which leads with its comprehensive range of high-performance, oil-insulated switchgear solutions designed for efficient power distribution in commercial and industrial applications. ABB’s dominance is reinforced by its advanced engineering capabilities, strong global presence, and commitment to providing reliable, energy-efficient products that meet evolving industry demands. Key players such as Siemens AG, Schneider Electric, and Eaton Corporation maintain significant market shares by offering oil-insulated switchgear that ensures safety, durability, and seamless integration with existing power grids. These companies focus on minimizing energy losses, enhancing system reliability, and complying with international safety standards.

Emerging players like Mitsubishi Electric Corporation and CG Power and Industrial Solutions are expanding their market presence by providing specialized oil-insulated switchgear solutions for niche sectors such as renewable energy integration, industrial power management, and large commercial buildings. Their strategies include improving energy efficiency, reducing maintenance costs, and developing compact, flexible systems for diverse power applications. Market growth is driven by the increasing demand for reliable, efficient, and sustainable energy distribution systems, rising industrial infrastructure investments, and the need for smarter grid solutions. Innovations in eco-friendly insulating oils and digital control technologies are expected to further shape competitive dynamics in the global oil-insulated commercial switchgear market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Voltage | Low, Medium, and High |

| Current | AC and DC |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB Ltd, Siemens AG, Schneider Electric, Eaton Corporation, Mitsubishi Electric Corporation, CG Power and Industrial Solutions, and Others |

| Additional Attributes | Dollar sales by switchgear type and application, demand dynamics across industrial, commercial, and utility sectors, regional trends in oil-insulated switchgear adoption, innovation in energy efficiency and environmental impact reduction, impact of regulatory standards on safety and performance, and emerging use cases in renewable energy integration and smart grid technologies. |

The global oil insulated commercial switchgear market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the oil insulated commercial switchgear market is projected to reach USD 3.1 billion by 2035.

The oil insulated commercial switchgear market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in oil insulated commercial switchgear market are low, medium and high.

In terms of current, AC segment to command 62.0% share in the oil insulated commercial switchgear market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Oil Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Commercial Oil Extraction Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Commercial Boiler Market

Commercial Charbroiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Commercial Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgears (GIS) Market

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Air Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA