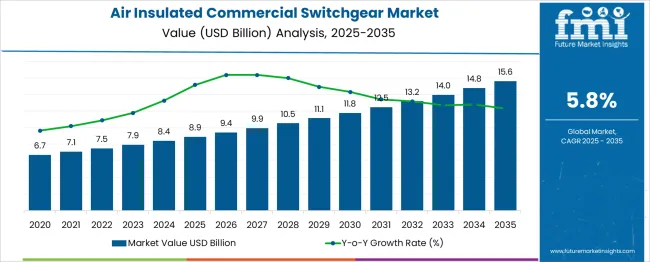

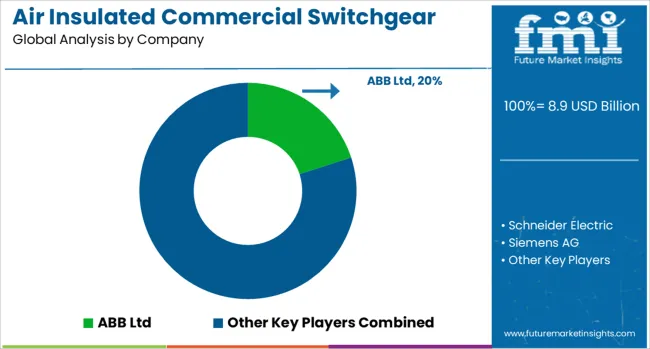

The Air Insulated Commercial Switchgear Market is estimated to be valued at USD 8.9 billion in 2025 and is projected to reach USD 15.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. This growth can be broken down into two distinct 5-year blocks. Between 2025 and 2030, the market is expected to expand from USD 8.9 billion to USD 11.8 billion, delivering an absolute growth of USD 2.9 billion with a multiplying factor of 1.32x. This period is projected to benefit from the modernization of low-voltage distribution systems, urban grid reliability upgrades, and safety-driven retrofits in commercial buildings across Asia and Europe.

During the second block from 2030 to 2035, the market is forecasted to increase from USD 11.8 billion to USD 15.6 billion, resulting in an absolute gain of USD 3.8 billion and a multiplying factor of 1.32x. This phase is expected to see stronger gains due to standardization of equipment in smart commercial zones, policy-led replacement of aging switchgear units, and increased integration of digital monitoring in HVAC and lighting controls. The faster value gain in the second block reflects both higher baseline spending and anticipated price escalation due to advanced compliance-ready switchgear technologies.

| Metric | Value |

|---|---|

| Air Insulated Commercial Switchgear Market Estimated Value in (2025 E) | USD 8.9 billion |

| Air Insulated Commercial Switchgear Market Forecast Value in (2035 F) | USD 15.6 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The air insulated commercial switchgear market accounts for approximately 10–12 % of the overall power distribution equipment segment due to its usage in medium-voltage systems across commercial and utility infrastructures. It represents around 35–40 % of the transmission and distribution infrastructure market, particularly in indoor substations and grid extension projects. Within the industrial facilities market, its share stands at 25–30 %, driven by applications in manufacturing plants, chemical facilities, and data centers where operational continuity and arc protection are essential. It contributes 10–15 % to the building electrification segment, especially in commercial complexes, retail centers, and large residential properties. In the rail infrastructure sector, its share remains below 5 %, limited to control rooms and secondary substations supporting transit operations. The shift toward eco-efficient alternatives are driving demand for SF₆-free air insulated switchgear systems with solid dielectric insulation and vacuum interrupters. Compact modular units are being adopted in urban installations where space constraints and safety requirements are critical.

Embedded sensors, real-time diagnostics, and digital control panels are becoming standard to support grid automation and predictive maintenance. Growing reliance on medium-voltage equipment in solar and wind integration projects is prompting adaptations in design and thermal performance. Manufacturers are prioritizing smart connectivity, configurable switchgear architectures, and maintenance-free components to meet the evolving technical needs of smart buildings, substations, and distributed energy applications.

The air insulated commercial switchgear market is undergoing significant transformation due to the rising demand for safe, compact, and environmentally responsible electrical distribution solutions across urban and semi-urban areas. This market has been expanding steadily as regulatory frameworks prioritize the replacement of aging infrastructure with newer, low-maintenance switchgear technologies.

The demand has been further driven by increasing commercial energy consumption, the rapid expansion of commercial real estate, and the need for uninterrupted power distribution in sensitive installations. Air-insulated systems have gained prominence due to their cost-efficiency and operational safety in indoor environments, particularly where space is not severely constrained.

Innovations in dielectric materials, arc control mechanisms, and modular configurations have improved system performance, reduced downtime, and lowered lifecycle costs. With the commercial sector seeking scalable and sustainable energy management infrastructure, air-insulated switchgear has emerged as a preferred solution, poised to capture increasing investments and deployment opportunities over the coming years..

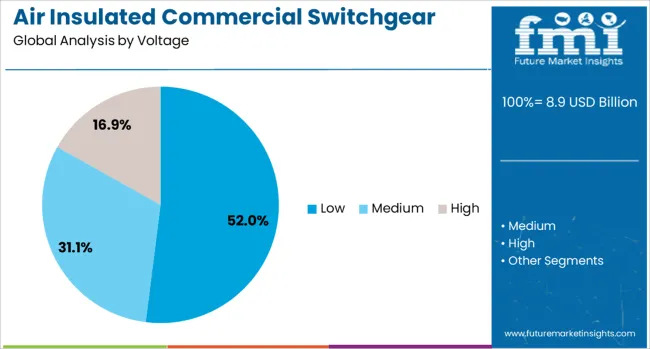

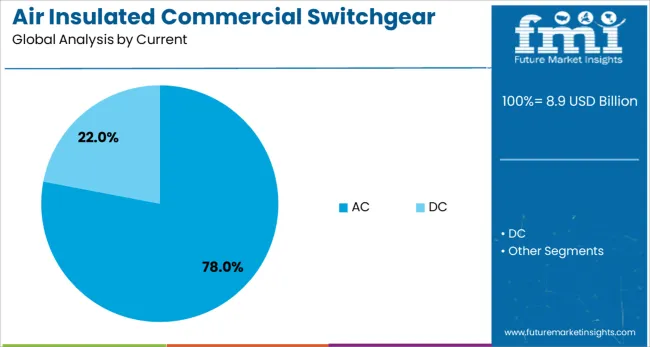

The air insulated commercial switchgear market is segmented by voltage and current and geographic regions. By voltage of the air insulated commercial switchgear market is divided into Low, Medium, and High. In terms of current of the air insulated commercial switchgear market is classified into AC and DC. Regionally, the air insulated commercial switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low voltage segment is projected to hold 52% of the Air Insulated Commercial Switchgear market revenue share in 2025, making it the dominant voltage category. The growth of this segment has been supported by increasing utilization of low voltage systems in commercial buildings, office complexes, and small to medium-sized facilities where power loads remain within standardized limits.

The demand has been sustained by the ease of installation, minimal spatial requirements, and reduced cost of ownership associated with low voltage switchgear systems. These units have been favored in infrastructure upgrades and new developments where regulatory compliance and operational safety remain critical.

Furthermore, low voltage air insulated switchgear offers enhanced fault management and system protection without compromising on environmental and budgetary constraints. As energy consumption across commercial applications continues to rise, the demand for reliable and compact distribution systems has further reinforced the market position of low voltage solutions within this category..

The AC segment is expected to account for 78% of the air-insulated commercial Switchgear market revenue share in 2025, establishing itself as the leading current type. This dominance has been driven by the widespread use of alternating current in commercial distribution networks, where its efficiency in long-distance transmission and compatibility with most electrical infrastructure offer operational advantages.

The preference for AC systems has been shaped by decades of standardization in electrical equipment and consistent supply requirements in commercial facilities such as malls, corporate buildings, and hospitals. Air-insulated switchgear designed for AC applications has benefited from streamlined integration, lower switching losses, and reliable fault interruption performance.

In addition, simplicity of maintenance and cost effectiveness have supported their adoption over direct current alternatives. As commercial energy usage trends continue to favor scalable and grid-compatible infrastructure, AC-based switchgear systems have continued to dominate installations due to their reliability and economic benefits..

Air insulated commercial switchgear demand has been supported by grid-connected installations across commercial facilities in regions where infrastructure expansion has been accelerating. Mid-voltage systems have been used in buildings where switchgear rooms must accommodate limited clearance. Installation activity has remained concentrated in regions handling 11 kV to 33 kV grid connections, particularly in multi-floor structures. Compact AIS panels have replaced legacy systems in over 45% of recent upgrades in Tier 1 cities. Modular layouts, safer compartmentalization, and fault isolation have guided design shifts in commercial deployment strategies.

Urban development across Asia, the Middle East, and parts of South America has contributed over 50% of new AIS switchgear installations in commercial settings since 2022. Over 68% of high-rise commercial projects in India and Southeast Asia now specify air insulated systems for floor-level substations. In the Middle East, over 35% of mixed-use buildings under construction in 2024 adopted 24 kV AIS systems due to reduced maintenance requirements. Across smart cities in Latin America, modular AIS units were deployed in 60% of mall and hospital construction sites. Compact configurations have enabled compliance with local safety codes while supporting higher HVAC, elevator, and lighting loads. Integration with low-loss copper busbars and automated feeder management has also supported AIS selection in multi-tenant buildings with increasing peak hour energy requirements.

Over 40% of facility managers in developed markets reported concerns over manual maintenance schedules for air insulated switchgear. Annual insulation integrity checks and contact inspections have required system shutdowns in 25–30% of commercial properties relying on AIS. North American regions enforcing IEEE C37.20.7 arc standards have driven up AIS unit costs by 18–22% over the past four years. In high-humidity zones, failure rates for poorly maintained AIS units have reached 9%, compared to under 2% for sealed systems. Regulatory changes in Europe have led to replacement of AIS in over 12,000 buildings since 2020 due to clearance violations or non-compliant arc containment ratings. These limitations have shifted some procurement toward gas-insulated or vacuum-based configurations where lifecycle service access or indoor air quality is prioritized.

Over 65% of commercial AIS switchgear launched in 2023 included digital monitoring, self-diagnostics, or predictive fault features. Remote diagnostics have cut service response time by nearly 40% in buildings using smart switchgear panels. In modular campuses and distributed retail setups, segment-wise energy consumption tracking via digital AIS has led to 12–18% efficiency gains. Data from 4,000 installations in Southeast Asia showed a 28% drop in unplanned maintenance in properties that adopted AIS with IoT-connected breaker management. In smart commercial hubs across Korea and Japan, modular AIS installations with bus coupler flexibility were used in 72% of new projects over 10,000 sq m. These platforms have been integrated into energy dashboards used to automate lighting, HVAC, and EV charging infrastructure in grid-interactive buildings.

By 2024, over 30% of large-scale commercial switchgear projects across urban India, the UAE, and Western Europe adopted hybrid systems combining AIS modules with vacuum interrupters or gas-insulated panels. Twin-layout configurations were used in over 18,000 installations to reduce arc flash risk while retaining maintenance flexibility. Digital breaker systems integrated into AIS panels reduced fault isolation time by 55% in multi-zoned facilities. In high-occupancy buildings, adoption of thermal sensors and fault waveform analytics allowed over 22% reduction in unexpected load trips. AIS systems certified to IEC 62271 standards with green insulation options were selected in 48% of LEED and EDGE-certified commercial projects. As retrofit cycles advance, older switchgear installations have been phased out in over 60,000 commercial properties globally, with modular AIS retrofits used in roughly 37% of those.

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

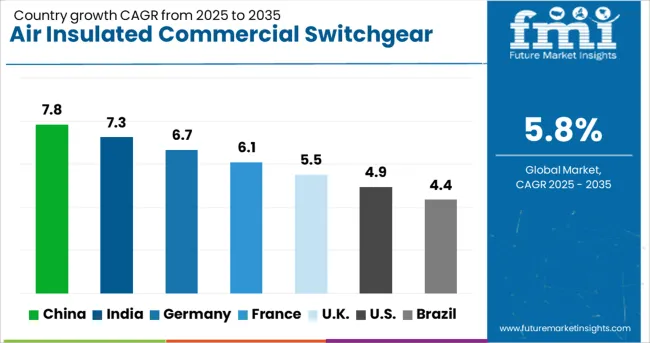

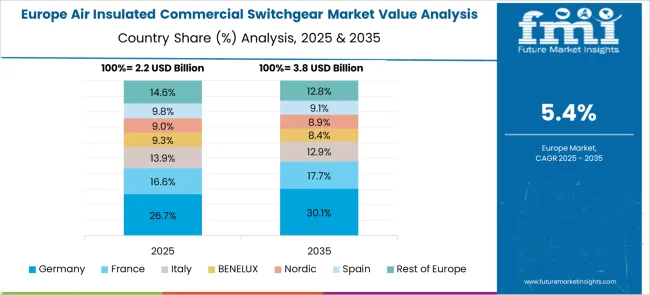

Global demand for air insulated commercial switchgear is projected to grow at a CAGR of 5.8% from 2025 to 2035. Among the five benchmark markets profiled out of 40+ analyzed, China leads with a CAGR of 7.8%, followed by India at 7.3%, Germany at 6.7%, the United Kingdom at 5.5%, and the United States at 4.9%. These figures translate to a +34% premium for China, while India and Germany exceed the global baseline at +26% and +16% respectively. The UK lags slightly at –5% below baseline, while the US trails further at –16%. China and India are experiencing industrial grid enhancements, driving demand for air insulated units. Germany shows elevated utility-scale upgrades. Slower growth in the US and UK relates to stronger competition from gas-insulated switchgear and updated infrastructure requirements. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The air insulated commercial switchgear market in China is forecast to register a CAGR of 7.8% between 2025 and 2035. Growth in the country has been driven by grid decentralization in Tier 2 industrial clusters and electrification projects requiring modular medium-voltage infrastructure. The installation of air insulated units has been prioritized across substation extensions supporting renewable integration in southern and central provinces. Engineering firms in Guangdong and Jiangsu are promoting air insulated panels for fire-prone zones where dry insulation remains mandatory. Market share has been influenced by domestic firms such as Chint Electric and NR Electric, which are offering digitally enabled switchgear with predictive maintenance software to appeal to EPC contractors in provincial tenders.

India is projected to experience a 7.3% CAGR in the air insulated commercial switchgear market from 2025 to 2035. Regional distribution companies have scaled adoption of air insulated technologies due to rising transformer failures and power quality disruptions. Installations have accelerated across Gujarat and Maharashtra under state-led T&D revamp programs. Air insulated systems have been preferred in high-humidity coastal clusters due to their moisture-resistant configuration. Local manufacturers including L&T Electrical and Siemens India have promoted single-bay modular systems tailored for public infrastructure projects. Demand has been partially insulated from gas-insulated alternatives due to high SF6 regulatory constraints.

Germany is forecast to post a CAGR of 6.7% between 2025 and 2035 for air insulated commercial switchgear. Deployment is driven by substation retrofitting programs across federal regions with aging grid assets. Federal subsidies for clean switchgear variants have bolstered demand in railway electrification and utility-grade wind integration. Air insulated systems have been selected for their ease of recycling and low embedded emissions. Siemens AG and EATON have led product innovation with SF6-free solutions featuring smart grid integration modules. The market remains resilient to cost-driven imports due to localized specification standards for German DIN-certified products.

The United Kingdom is expected to grow at a 5.5% CAGR in the air insulated commercial switchgear market from 2025 to 2035. Growth remains closely tied to brownfield upgrades in legacy housing estates and compliance-driven commercial retrofits. Localized energy systems in Wales and Scotland have adopted medium-voltage air insulated switchgear for cost-effective resilience. British firms such as Lucy Electric and Brush Switchgear have focused on indoor AIS configurations with low-profile busbars suited for narrow utility cabinets. Gas-insulated units continue to dominate large-scale infrastructure, limiting AIS penetration into some urban segments.

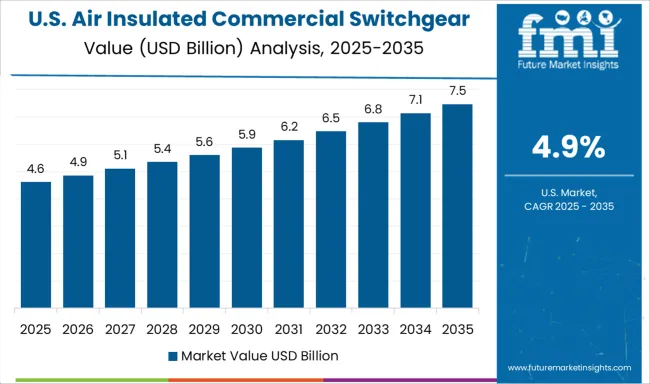

The air insulated commercial switchgear market in the United States is anticipated to grow at a CAGR of 4.9% from 2025 to 2035. The market has been pressured by preference for gas-insulated and hybrid units in critical infrastructure segments. Nonetheless, AIS adoption persists in retrofit projects within the Midwest and Southern states, where low-load commercial users prioritize upfront cost and serviceability. ABB and Powell Industries have targeted industrial parks with pre-engineered switchgear assemblies suitable for quick-turn installations. Safety codes have continued to shape AIS adoption patterns, especially in fire-rated enclosures in California and Texas.

ABB Ltd continues to expand its portfolio of air insulated switchgear by targeting large commercial installations such as business parks and metro stations. Its UniGear line has been adapted to meet space-saving needs and safety enhancements. The company has also invested in regional assembly facilities to improve turnaround times for customized orders. Schneider Electric has focused on modular switchgear systems with simplified maintenance features, primarily for office complexes and retail zones.

Strategic alliances with construction contractors have helped strengthen its project pipeline across Southeast Asia and the Middle East. Siemens AG has enhanced its 8DJH series to address the rising demand for compact switchgear in commercial real estate. Retrofit compatibility and ease of integration with existing control panels have remained central to its growth strategy. Eaton Corporation has focused on low-voltage air insulated units for distribution across small- to mid-size commercial buildings. Its emphasis on fire safety and arc fault containment has supported adoption in healthcare and hospitality sectors.

Mitsubishi Electric has released compact, front-access switchgear aimed at space-constrained commercial basements and utility rooms. Its investment in local technician training programs has reinforced post-sales service delivery in key regional markets across Asia and Europe.

AirSet and EasySET systems were introduced with SF₆-free and installation-friendly features. Mitsubishi released a 24 kV AIS with advanced diagnostics. Siemens expanded its Frankfurt facility with a €100M investment.

Larsen & Toubro secured AIS contracts across Asia. UK Power Networks adopted clean-air AIS in collaboration with Siemens. These verified events reflect active modernization and eco-focused progress in medium-voltage commercial switchgear technology.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.9 Billion |

| Voltage | Low, Medium, and High |

| Current | AC and DC |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB Ltd, Schneider Electric, Siemens AG, Eaton Corporation, and Mitsubishi Electric |

The global air insulated commercial switchgear market is estimated to be valued at USD 8.9 billion in 2025.

The market size for the air insulated commercial switchgear market is projected to reach USD 15.6 billion by 2035.

The air insulated commercial switchgear market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in air insulated commercial switchgear market are low, medium and high.

In terms of current, ac segment to command 78.0% share in the air insulated commercial switchgear market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Oil Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Air Insulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Aircraft MRO Market Size and Share Forecast Outlook 2025 to 2035

Commercial Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Air Fryer Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Air Fryer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Commercial Aircraft Video Surveillance Systems Market Growth - Trends & Forecast 2025 to 2035

Commercial Aircraft Wings Market

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgears (GIS) Market

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Two Winding Air Insulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA