The commercial aircraft MRO market is estimated to be valued at USD 118.1 billion in 2025 and is projected to reach USD 163.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

Between 2025 and 2030, the market is expected to expand steadily from USD 118.1 billion to USD 138.9 billion, highlighting a consistent year-on-year increase. This period of growth reflects rising aircraft fleets, greater demand for heavy checks, and the necessity of maintaining airworthiness standards. Airlines are prioritizing cost efficiency, which is leading to increased outsourcing of MRO services to specialized providers. The steady growth curve shows how industry reliance on predictive maintenance, improved spare parts management, and extended aircraft lifecycles is shaping the trajectory of this market.

From 2030 to 2035, the market will continue to advance, moving from USD 138.9 billion to USD 163.4 billion, reflecting a stable and predictable rise. This stage highlights continued investments in maintenance capacity expansion, particularly in Asia-Pacific, which is expected to emerge as a major hub for MRO services due to its growing commercial aircraft base. Engine overhauls and component repairs will remain leading segments, supported by the need for reliability and operational efficiency. The year-on-year growth pattern also suggests increased focus on digital monitoring tools and structured maintenance contracts, allowing operators to manage costs while improving fleet performance. This curve shape indicates a reliable, steady growth path for stakeholders, where long-term opportunities exist in both mature and emerging aviation markets.

| Metric | Value |

|---|---|

| Commercial Aircraft MRO Market Estimated Value in (2025 E) | USD 118.1 billion |

| Commercial Aircraft MRO Market Forecast Value in (2035 F) | USD 163.4 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The commercial aircraft MRO market secures an essential share across several parent markets, underscoring its central role in aviation safety, reliability, and cost management. Within the global aviation services market, commercial aircraft MRO represents about 25%, as maintenance is one of the largest service categories after passenger handling and operations. In the aerospace maintenance and engineering market, its share rises to around 30%, reflecting the dominance of scheduled checks, component overhauls, and engineering upgrades for passenger aircraft fleets. Within the civil aviation industry market, MRO accounts for nearly 15%, indicating its role as a vital enabler of operational efficiency within airlines and airport systems. In the aviation aftermarket services market, commercial aircraft MRO captures approximately 40%, making it the most significant sub-segment since airlines rely heavily on third-party and in-house MRO providers for aircraft lifecycle support.

Finally, within the transportation and logistics infrastructure market, the share of commercial aircraft MRO is close to 5%, a relatively small but essential contribution considering the broad scale of logistics and transport services that include air, sea, and land systems. Collectively, these percentages highlight that commercial aircraft MRO has its strongest positioning in aerospace-focused domains, particularly within aftermarket services and engineering, while its more moderate share in civil aviation and logistics underscores its supporting role in the broader transportation ecosystem. This distribution shows both its specialized importance and its reliance on the overall health of the global airline industry.

The commercial aircraft MRO market is expanding steadily, driven by increasing global aircraft fleets, heightened safety regulations, and growing air travel demand. Airlines are emphasizing cost-effective maintenance strategies to maximize aircraft uptime and extend asset life.

Technological integration in MRO operations such as predictive analytics and digital twins is enhancing efficiency and reducing turnaround time. Additionally, the resurgence of narrowbody aircraft operations post-pandemic and fleet modernization trends in Asia-Pacific and the Middle East are bolstering regional and global MRO demand.

As OEM partnerships evolve and independent players scale capabilities, the competitive landscape continues to diversify in favor of responsive, tech-enabled MRO services.

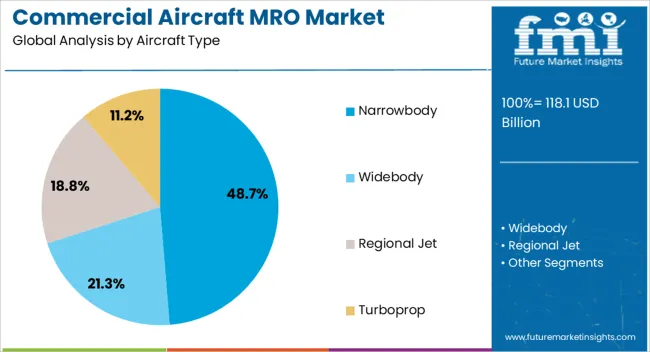

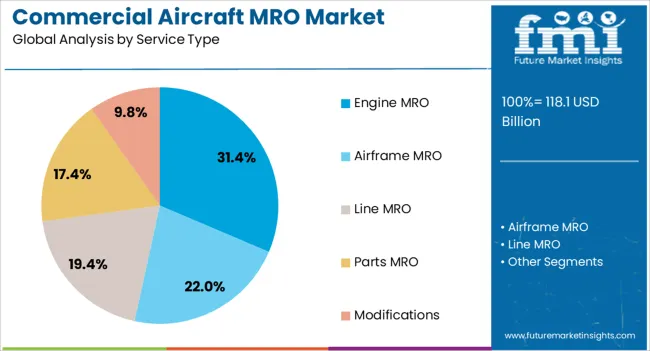

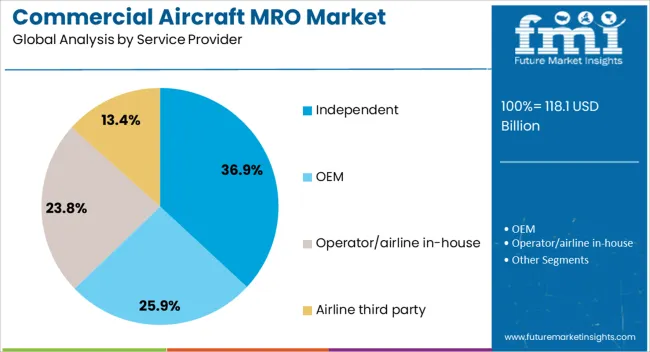

The commercial aircraft MRO market is segmented by aircraft type, service type, service provider, and geographic regions. By aircraft type, commercial aircraft MRO market is divided into narrowbody, widebody, regional jet, and turboprop. In terms of service type, commercial aircraft MRO market is classified into engine MRO, airframe MRO, line MRO, parts MRO, and modifications. Based on service provider, commercial aircraft MRO market is segmented into independent, OEM, operator/airline in-house, and airline third party. Regionally, the commercial aircraft MRO industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Narrowbody aircraft are projected to hold the dominant share of 48.70% in the commercial aircraft MRO market by 2025. Their leadership is driven by their extensive use in short-to-medium-haul routes, especially in emerging economies where low-cost carriers are expanding. The high flight frequency of narrowbody jets results in more frequent maintenance cycles, increasing demand for both line and heavy maintenance. Additionally, the popularity of models like the Airbus A320neo and Boeing 737 MAX, which require dedicated engine and avionics upkeep, has solidified narrowbody aircraft as a key driver for MRO service providers. The segment benefits further from fleet standardization efforts that simplify inventory and training requirements for MRO operations.

Engine MRO is expected to account for 31.40% of the total market share in 2025, positioning it as the top service type. This segment's growth is anchored by the engine’s critical role in aircraft performance and its high cost in the maintenance value chain. The demand for fuel-efficient engines and the adoption of next-generation propulsion systems are also requiring specialized expertise and parts. With engine maintenance cycles being longer and more expensive, airlines and lessors are investing in predictive diagnostics to manage long-term costs. The rise of power-by-the-hour (PBH) contracts has further accelerated demand for advanced engine MRO partnerships globally.

Independent providers are anticipated to lead the market with 36.90% share by 2025, driven by their flexibility, pricing competitiveness, and rapid adaptation to customer-specific requirements. These players are expanding their capabilities through strategic alliances with OEMs, airports, and airlines, especially in fast-growing regions like Asia-Pacific and Latin America. Independents also benefit from a neutral position across multiple aircraft platforms, enabling them to service diverse fleets without proprietary limitations. As airlines seek to diversify their maintenance sources beyond OEMs and in-house setups, independent MROs are scaling investments in digitalization, certifications, and modular maintenance offerings to meet increasing global demand.

The commercial aircraft MRO market is expanding as airlines prioritize safety, efficiency, and compliance while managing growing fleets. Opportunities are strengthening in emerging aviation hubs, while trends emphasize outsourcing, predictive maintenance, and integrated service models. Challenges remain in skilled workforce shortages, supply chain risks, and high maintenance costs. In my opinion, MRO providers that focus on regional expansion, workforce development, and advanced service integration will secure stronger positioning, ensuring long-term competitiveness and reliability in the global aviation services industry.

Demand for commercial aircraft MRO has been reinforced by the growing need to maintain safety, operational efficiency, and compliance with aviation standards. Airlines are increasingly relying on MRO providers to extend fleet lifecycles and optimize aircraft availability amid rising passenger traffic. Engine overhauls, airframe checks, and component repairs remain core service areas driving market momentum. In my opinion, demand will remain strong as airlines focus on cost control while ensuring maximum safety, positioning MRO services as indispensable to the commercial aviation ecosystem.

Opportunities are emerging in Asia-Pacific, the Middle East, and Latin America, where expanding fleets and new airline operators are creating a surge in MRO requirements. Partnerships with local providers and establishment of regional MRO facilities are proving advantageous for global players entering these high-growth markets. Cargo airlines and low-cost carriers are also fueling demand for cost-efficient maintenance solutions. I believe companies that invest in regional facilities, skilled workforce development, and partnerships with airlines will secure significant opportunities as aviation hubs outside North America and Europe strengthen.

Trends in the commercial aircraft MRO market indicate growing outsourcing of maintenance operations as airlines seek to reduce operational costs. Predictive maintenance powered by advanced analytics is gaining traction, helping operators minimize downtime and improve planning. Another trend is the consolidation of MRO providers to offer integrated service packages across airframes, engines, and components. In my opinion, these trends show a decisive shift where efficiency, integration, and data-driven strategies are shaping MRO services, ensuring long-term relevance in a highly competitive aviation services landscape.

Challenges include high maintenance costs, supply chain disruptions, and shortages of skilled technicians. Fluctuating raw material prices and spare part availability often delay critical maintenance schedules, affecting airline operations. The shortage of experienced engineers and licensed technicians is a persistent barrier, particularly in regions with fast-growing fleets. In my assessment, only MRO providers that invest in workforce training, supply chain resilience, and flexible pricing models will be able to address these hurdles effectively and remain competitive in both established and emerging aviation markets.

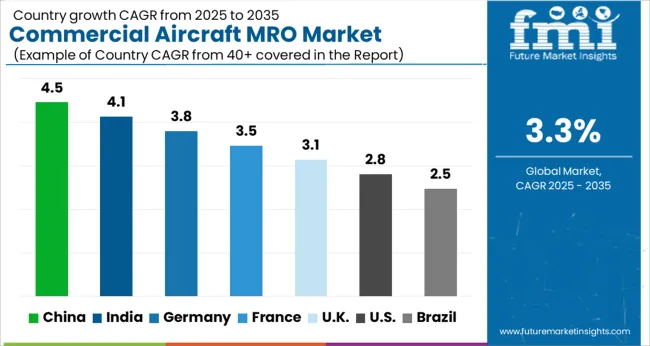

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

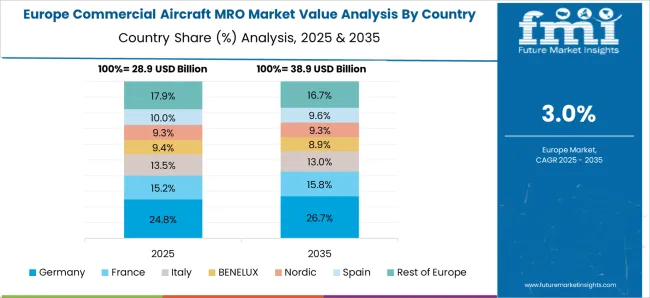

The global commercial aircraft MRO (Maintenance, Repair, and Overhaul) market is projected to grow at a CAGR of 3.3% from 2025 to 2035. China leads with a growth rate of 4.5%, followed by India at 4.1%, and Germany at 3.8%. The United Kingdom records a growth rate of 3.1%, while the United States shows the slowest growth at 2.8%. Growth is supported by rising passenger air traffic, fleet modernization, and the outsourcing of maintenance services to specialized providers. Emerging economies such as China and India are benefitting from airport expansions and cost advantages, while mature markets like the USA and UK are focused on predictive maintenance, digitalization, and upgrades of older fleets. This report includes insights on 40+ countries; the top markets are shown here for reference.

The commercial aircraft MRO market in China is projected to grow at a CAGR of 4.5%. Expansion is fueled by the country’s rapid increase in passenger traffic and fleet size. Both full-service and low-cost carriers are investing heavily in maintenance partnerships to ensure operational efficiency and compliance with international aviation standards. Domestic companies are improving their technological capabilities and introducing predictive maintenance systems to shorten turnaround times. Strategic collaborations between Chinese providers and global MRO firms are also strengthening the country’s ecosystem. With government support for aviation infrastructure and a push to establish China as an Asia-Pacific MRO hub, adoption is expected to accelerate.

The commercial aircraft MRO market in India is expected to grow at a CAGR of 4.1%. Increasing aircraft orders by domestic airlines and a surge in air passenger demand are major drivers of market expansion. India’s competitive labor costs and central geographic location make it attractive for regional MRO outsourcing. The government is encouraging investments in MRO facilities through policy reforms, tax incentives, and support for airport-based clusters. As fleet modernization continues, demand for heavy checks, engine servicing, and component repair is expected to rise. The presence of international partnerships is further boosting India’s capacity to service both domestic and foreign airlines efficiently.

The commercial aircraft MRO market in Germany is projected to grow at a CAGR of 3.8%. Germany’s strong aviation ecosystem and skilled engineering workforce are supporting steady demand. Airlines and MRO providers are increasingly adopting digital solutions, including AI-driven predictive maintenance, to reduce operating costs and improve safety. Demand for component overhauls, engine checks, and avionics upgrades remains high as carriers modernize their fleets. Germany’s central location in Europe makes it a key hub for international airlines seeking reliable MRO services. Continuous investment in digital infrastructure and advanced engineering capabilities ensures the market’s competitiveness.

The commercial aircraft MRO market in the UK is projected to grow at a CAGR of 3.1%. Growth is underpinned by the country’s strong aerospace industry and its role as a service hub for European and transatlantic routes. Airlines are adopting digital tools for predictive maintenance and smart logistics, improving cost efficiency and reducing turnaround times. Brexit-related supply chain challenges are encouraging localized MRO capabilities, which strengthens domestic capacity. Innovation in eco-friendly maintenance practices and the servicing of new-generation aircraft also provide growth opportunities. Although slower than in Asia, the UK continues to hold importance in global MRO networks.

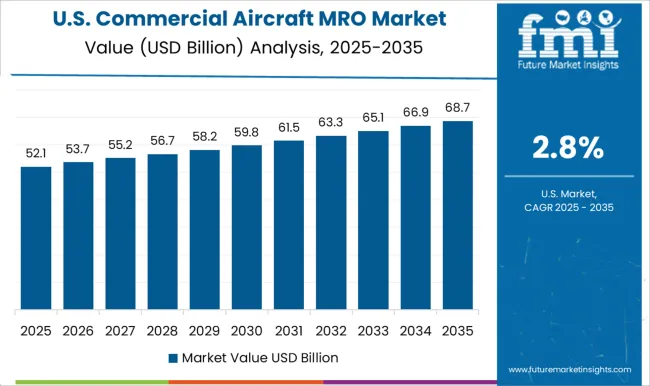

The commercial aircraft MRO market in the USA is projected to grow at a CAGR of 2.8%. As the largest global aviation market, the USA maintains steady demand despite slower growth. Aging fleets are driving requirements for heavy checks, engine overhauls, and avionics upgrades. Airlines and MRO firms are integrating advanced predictive maintenance tools and digital platforms to reduce downtime and improve cost efficiency. Strong domestic presence of leading global MRO providers enhances competitiveness, while ongoing fleet modernization continues to support long-term demand. Despite being mature, the USA market remains a key hub for innovation and advanced servicing practices.

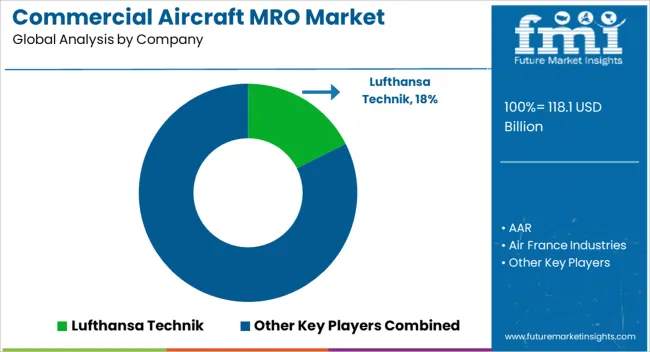

Competition in the commercial aircraft MRO market has been shaped by a blend of airline-affiliated service providers, independent MRO specialists, and engine manufacturers. Lufthansa Technik has been regarded as a benchmark player, combining technical authority with global coverage across airframe, component, and engine maintenance. AAR has been reinforcing its role as an independent provider by targeting fleet operators with flexible service packages and supply chain solutions. Air France Industries and KLM Engineering & Maintenance have been consolidating strength through combined resources, serving both group airlines and third-party customers with a comprehensive portfolio.

Ameco has been commanding attention in Asia, leveraging its joint venture legacy and strong presence in China to capture large volumes of widebody maintenance. Delta TechOps has been establishing authority as an airline MRO arm with significant capacity for third-party work, building credibility through operational excellence. GE Aviation, Rolls Royce, Safran, MTU Aero Engines, and RTX have been focusing on engine MRO, where proprietary knowledge and exclusive service agreements provide a competitive advantage. HAECO, GMF AeroAsia, and Turkish Technic have been regarded as regional hubs that extend capacity across airframe and heavy maintenance. Honeywell has been recognized for avionics and auxiliary systems, where its aftermarket expertise secures a unique place in the market. Strategic differentiation among these firms has been defined by scale, specialization, and customer reach.

Lufthansa Technik, Air France Industries, and Delta TechOps have been recognized as full-service leaders, offering integrated solutions across fleets of varying complexity. Independent providers such as AAR, HAECO, and MRO Holdings have been competing by providing cost-effective options and flexible contract structures. Engine-focused giants like GE Aviation, Rolls Royce, Safran, and MTU Aero Engines have been dominating long-term service agreements, where technical exclusivity has secured high-margin contracts. Honeywell and RTX have been reinforcing their authority in systems MRO, aligning avionics and electronics with reliability demands. Regional players such as GMF AeroAsia, ST Engineering, SIA Engineering Company, TAP Maintenance & Engineering, and SR Technics have been anchoring competitiveness through geographic accessibility and targeted specialization. Market leadership has been influenced by the ability to deliver consistent turnaround times, competitive pricing, and technical depth, with airlines favoring those providers that combine global networks with proven reliability.

| Item | Value |

|---|---|

| Quantitative Units | USD 118.1 billion |

| Aircraft Type | Narrowbody, Widebody, Regional Jet, and Turboprop |

| Service Type | Engine MRO, Airframe MRO, Line MRO, Parts MRO, and Modifications |

| Service Provider | Independent, OEM, Operator/airline in-house, and Airline third party |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lufthansa Technik, AAR, Air France Industries, Ameco, Delta TechOps, GE Aviation, GMF AeroAsia, HAECO, Honeywell, MRO Holdings, MTU Aero Engines, Rolls Royce, RTX, Safran, SIA Engineering Company, SR Technics, ST Engineering, TAP Maintenance & Engineering, and Turkish Technic |

| Additional Attributes | Dollar sales by service type (engine overhaul, airframe maintenance, component repair), Dollar sales by aircraft type (narrow-body, wide-body, regional jets), Trends in predictive maintenance and digital diagnostics, Use of advanced materials and composite repairs, Growth in fleet expansion and aging aircraft servicing, Regional service hubs across North America, Europe, and Asia-Pacific. |

The global commercial aircraft MRO market is estimated to be valued at USD 118.1 billion in 2025.

The market size for the commercial aircraft MRO market is projected to reach USD 163.4 billion by 2035.

The commercial aircraft MRO market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in commercial aircraft MRO market are narrowbody, widebody, regional jet and turboprop.

In terms of service type, engine MRO segment to command 31.4% share in the commercial aircraft MRO market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA