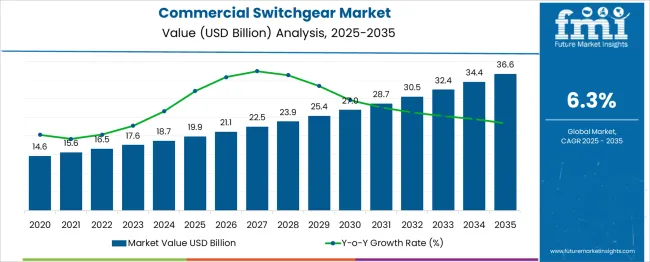

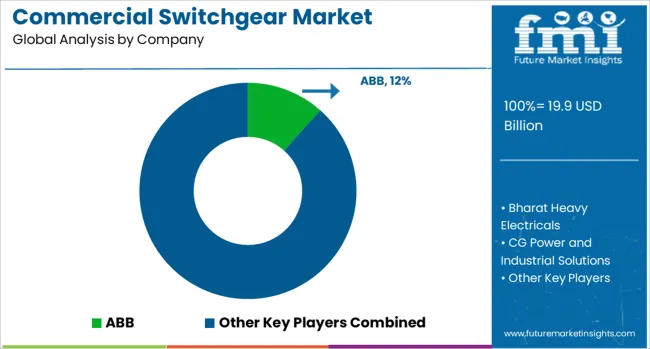

The Commercial Switchgear Market is estimated to be valued at USD 19.9 billion in 2025 and is projected to reach USD 36.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Switchgear Market Estimated Value in (2025 E) | USD 19.9 billion |

| Commercial Switchgear Market Forecast Value in (2035 F) | USD 36.6 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The commercial switchgear market is witnessing sustained growth due to rising electricity demand, infrastructure modernization, and increasing focus on energy efficiency across commercial facilities. Rapid urban development and the proliferation of data centers, office buildings, and retail complexes have amplified the need for reliable and scalable power distribution solutions.

Switchgear plays a critical role in ensuring electrical safety, managing load distribution, and minimizing downtime across critical operations. The integration of smart monitoring features and digital control systems has further enhanced product value, aligning with ongoing digitalization trends in commercial infrastructure.

Future growth is expected to be driven by regulatory support for safer electrical systems and the push toward sustainable buildings. With a continued emphasis on power reliability and grid stability, the commercial switchgear market is positioned for consistent advancement, particularly in regions undergoing large-scale commercial development and energy reform.

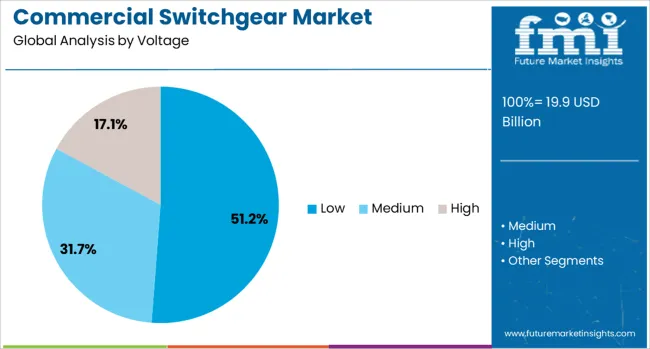

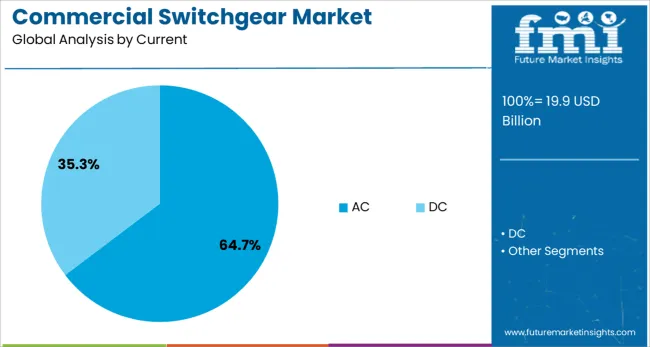

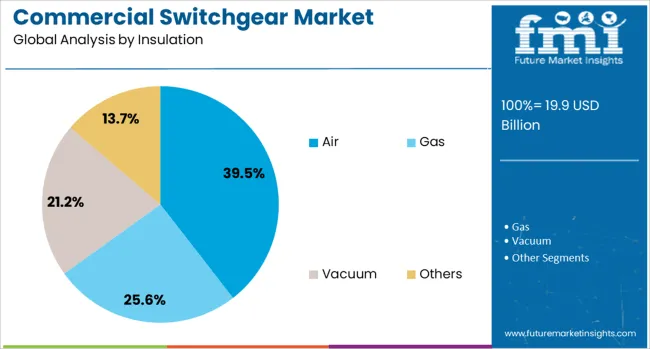

The commercial switchgear market is segmented by voltage, current, and insulation and geographic regions. By voltage of the commercial switchgear market is divided into Low, Medium, and High. In terms of current of the commercial switchgear market is classified into AC and DC. Based on insulation of the commercial switchgear market is segmented into Air, Gas, Vacuum, and Others. Regionally, the commercial switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low voltage segment holds a dominant 51.2% market share in the commercial switchgear market, supported by its widespread use in office buildings, malls, educational institutions, and commercial complexes. Low voltage switchgear is preferred for its cost efficiency, safety features, and adaptability in managing electrical distribution for lighting, HVAC systems, and power outlets.

The growth in distributed energy systems and retrofitting of old infrastructure with energy-efficient electrical components has further driven demand for low voltage equipment. Technological advancements such as IoT integration and real-time fault monitoring have increased the utility of low voltage switchgear in smart commercial environments.

Additionally, regulatory norms mandating safety and protection standards in building electrical systems continue to reinforce the need for reliable low voltage solutions. As commercial building activity intensifies globally, this segment is expected to maintain its leadership within the market.

AC switchgear leads the market in the current category with a substantial 64.7% share, driven by its widespread applicability across commercial installations and its compatibility with standard grid systems. The prevalence of alternating current in commercial power distribution networks makes AC switchgear the go-to choice for safe and efficient energy control.

This segment benefits from decades of technological maturity, standardized design, and the ease of integration with a broad range of electrical systems. Additionally, the expansion of commercial establishments and the increasing complexity of electrical networks have necessitated robust AC switchgear capable of handling variable load demands.

Advancements in arc fault protection, thermal monitoring, and modular configurations have strengthened the segment’s competitiveness. Continued investments in modernizing commercial electrical infrastructure are expected to support the sustained dominance of AC switchgear in the market.

The air insulation segment captures a notable 39.5% share in the commercial switchgear market, favored for its environmental friendliness, operational simplicity, and cost-effectiveness. Air-insulated switchgear is extensively used in commercial applications where space is available, offering safety and performance at lower installation and maintenance costs compared to more complex insulation technologies.

This segment is also gaining traction due to increasing concerns around the environmental impact of SF₆-based systems, positioning air insulation as a more sustainable alternative. Manufacturers are responding with compact, modular air-insulated solutions that suit modern commercial layouts.

Improvements in dielectric strength, fault tolerance, and system durability have enhanced the performance of air-insulated switchgear in demanding commercial environments. As sustainability and safety regulations continue to evolve, the air insulation segment is expected to expand steadily within the commercial market landscape.

Demand for commercial switchgear is accelerating due to rising retrofit programs, digitization in power distribution, and stricter safety mandates. Sales of smart switchgear systems with arc-flash protection and condition monitoring are increasing rapidly across commercial buildings, particularly in North America and Western Europe.

Demand for digitally enabled commercial switchgear rose by 28% in 2024 as real-time diagnostics and predictive failure analysis became standard in new office, data center, and retail installations. Over 35% of newly commissioned systems in commercial projects included IoT-enabled circuit breakers and thermal sensors, enabling early detection of load imbalances and insulation degradation. Facilities using SCADA-integrated smart switchgear recorded a 19% reduction in electrical downtime and a 21% decline in emergency repair costs. Growth is strongest in mid- and high-rise commercial buildings undergoing digital retrofitting.

Sales of arc-resistant switchgear expanded by 24% in 2024 as older commercial infrastructure in urban zones underwent electrical upgrades. Compact switchgear systems made up 31% of commercial switchgear shipments in high-density city environments where space optimization and safety compliance are essential. Modular switchgear with internal arc-fault containment and low-maintenance vacuum circuit breakers reduced panel replacement time by 38%. Strongest traction is evident in multi-use commercial towers, healthcare campuses, and educational institutions that prioritize zero-downtime operations and modern fault isolation mechanisms.

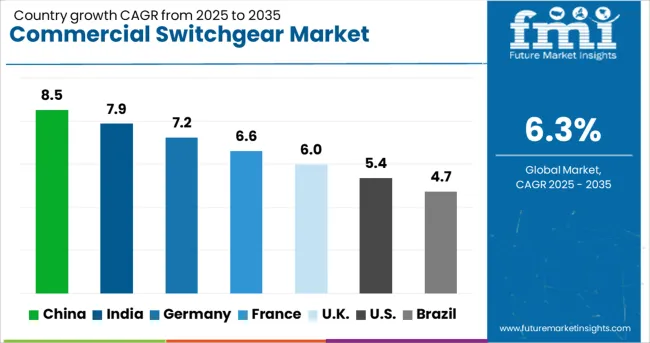

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The global market is projected to grow at a CAGR of 6.3% from 2025 to 2035, driven by expansion of commercial buildings, industrial electrification, and investments in smart grids. China leads with a CAGR of 8.5%, supported by rapid infrastructure development, retrofitting of aging electrical systems, and robust growth in commercial real estate. India follows with 7.9%, where smart city programs, demand for uninterrupted power supply, and Make in India initiatives are fueling switchgear adoption. Germany is forecast to expand at 7.2%, supported by stringent energy efficiency standards and rising commercial construction in urban centers. The United Kingdom is expected to grow at 6.0%, driven by building electrification upgrades and a shift toward net-zero energy structures. The United States is projected to grow at 5.4%, supported by grid modernization and electrical component upgrades across healthcare, retail, and data center sectors. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at a 8.5% CAGR, driven by rapid infrastructure expansion, modernization of aging power distribution systems, and rising commercial real estate investments. Smart building projects in Tier 1 and Tier 2 cities are increasing demand for advanced low-voltage and medium-voltage switchgear solutions. Domestic manufacturers dominate the segment with cost-effective solutions, while global players cater to high-specification projects in industrial parks and commercial complexes. Adoption of digital switchgear systems with real-time monitoring is growing as businesses prioritize energy management and fault detection. Integration with renewable energy systems in commercial properties further supports market momentum.

India is forecast to grow at a 7.9% CAGR, supported by government-backed smart city programs and a surge in commercial infrastructure development. Demand for reliable and uninterrupted power supply is driving adoption of intelligent switchgear in sectors such as IT parks, malls, and hospitality projects. The Make in India initiative is encouraging domestic manufacturing, while global brands form partnerships to localize production. Investments in metro networks, airports, and retail spaces add further momentum. Integration of switchgear with IoT-enabled energy monitoring systems is emerging as a critical trend for energy efficiency and remote diagnostics in urban and semi-urban regions.

Germany is expected to grow at a 7.2% CAGR, driven by stringent energy efficiency norms and the modernization of commercial buildings to meet EU climate goals. Rising demand for advanced low-voltage and medium-voltage systems is prominent in smart offices, retail complexes, and data centers. German manufacturers focus on digital-ready switchgear with integrated predictive maintenance features to ensure operational continuity. Expansion of electric mobility infrastructure, particularly EV charging stations in commercial zones, adds a new dimension to switchgear demand. Public-private investment in energy-efficient retrofits of commercial properties is further reinforcing growth.

The United Kingdom is projected to grow at a 6.0% CAGR, driven by electrification upgrades in commercial buildings and the transition to net-zero energy structures. Demand for switchgear is increasing in office renovations, retail modernization, and high-density residential complexes. Government incentives for energy-efficient buildings are encouraging installation of smart switchgear solutions with real-time energy monitoring capabilities. Partnerships between OEMs and building management system providers are enhancing interoperability and integration for modern commercial facilities. Rising EV adoption is also supporting installation of robust electrical distribution systems across parking and fleet infrastructure.

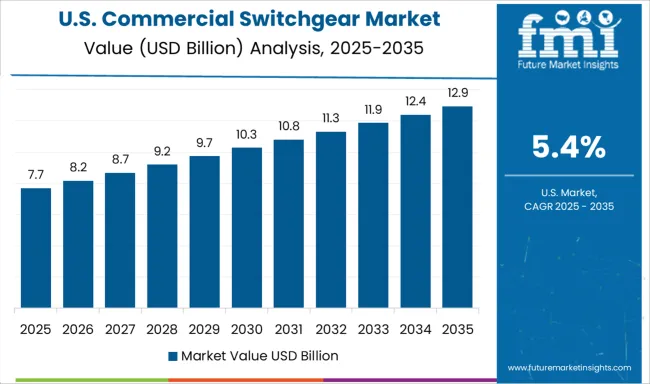

The United States is forecast to grow at a 5.4% CAGR, supported by grid modernization and the replacement of aging electrical infrastructure in commercial spaces. Investments in healthcare facilities, retail chains, and data centers are driving demand for high-reliability switchgear systems. Integration of digital and remote monitoring technologies is gaining traction to meet operational efficiency requirements. Utilities and facility managers increasingly favor modular switchgear designs for scalability and reduced downtime during maintenance. Electrification of commercial fleets and EV infrastructure deployment adds a significant layer of demand in the medium-voltage category.

ABB leads the commercial switchgear market with its modular platforms and smart grid compatibility. Schneider Electric, Siemens, and Eaton remain strong competitors, offering low- and medium-voltage switchgear with embedded IoT to support advanced building automation. Mitsubishi Electric, Hitachi, and Fuji Electric have increased their footprint in Asia-Pacific with high-performance GIS and integrated safety systems. General Electric continues to serve large commercial and institutional projects in North America and the Middle East. BHEL, CG Power, and HD Hyundai Electric are meeting the demand of India and Southeast Asia. Hyosung, Toshiba, Ormazabal, and Lucy Group are expanding portfolios with compact, eco-efficient designs suited for retrofits and urban installations.

In June 2024, Siemens Energy announced a USD 108.1 million investment to expand its Frankfurt switchgear facility, increasing production of its NXPLUS C 24 blue GIS, a fluorinated-gas-free arc-resistant medium-voltage switchgear. This initiative supports grid decarbonization and is expected to create up to 400 jobs.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.9 Billion |

| Voltage | Low, Medium, and High |

| Current | AC and DC |

| Insulation | Air, Gas, Vacuum, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, Schneider Electric, Siemens, Skema, and Toshiba |

| Additional Attributes | Dollar sales by switchgear type (low‑, medium‑, high‑voltage and insulation media) and end‑user (commercial, utilities, industrial), demand dynamics across grid modernization and smart buildings, regional leadership in Asia‑Pacific and North America, innovation in IoT-enabled digital switchgear and SF₆‑free designs, environmental impact from emissions and lifecycle substitutions. |

The global commercial switchgear market is estimated to be valued at USD 19.9 billion in 2025.

The market size for the commercial switchgear market is projected to reach USD 36.6 billion by 2035.

The commercial switchgear market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in commercial switchgear market are low, medium and high.

In terms of current, ac segment to command 64.7% share in the commercial switchgear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Oil Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Air Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA