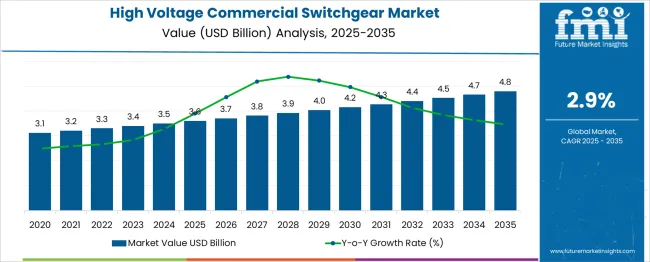

The High Voltage Commercial Switchgear Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 4.8 billion by 2035, registering a compound annual growth rate (CAGR) of 2.9% over the forecast period. A Growth Rate Volatility Index (GRVI) analysis indicates a relatively stable, low-volatility growth pattern over the forecast period, with only modest fluctuations in the annual growth rate. Between 2025 and 2030, the market grows from USD 3.6 billion to USD 4.2 billion, contributing USD 0.6 billion in growth, with a CAGR of 2.8%. This phase shows steady growth as demand for high voltage switchgear remains stable across industries such as utilities, manufacturing, and infrastructure.

The relatively slow and consistent growth is driven by the gradual increase in electricity demand, alongside the need for grid modernization and expansion. From 2030 to 2035, the market continues to grow from USD 4.2 billion to USD 4.8 billion, adding USD 0.6 billion in growth, with a slightly higher CAGR of 3.0%. The slight acceleration in the later phase reflects steady investments in energy infrastructure, particularly in developing economies where energy access and grid reliability are being prioritized. The GRVI indicates that the market will experience predictable growth with minimal volatility, driven by long-term infrastructure projects and the ongoing need for reliable, efficient high voltage switchgear solutions across industries.

| Metric | Value |

|---|---|

| High Voltage Commercial Switchgear Market Estimated Value in (2025 E) | USD 3.6 billion |

| High Voltage Commercial Switchgear Market Forecast Value in (2035 F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

The High Voltage Commercial Switchgear market is undergoing significant transformation, driven by rising investments in grid modernization, industrial automation, and urban infrastructure development. As power demand continues to rise across commercial and utility sectors, there has been growing reliance on advanced switchgear technologies that ensure safety, operational continuity, and fault management.

The market has been propelled by aging transmission networks being upgraded with smart grid-compatible systems, along with the need for compact, reliable, and environmentally compliant switchgear installations. Regulatory mandates aimed at reducing power outages and minimizing greenhouse gas emissions are reinforcing adoption across emerging and developed economies.

Manufacturers are increasingly focusing on modular switchgear solutions that offer easy installation, remote monitoring, and high efficiency, which aligns with the evolving needs of modern electrical distribution networks. Continued technological advancements in arc fault protection, insulation, and compact system design are expected to support sustained market expansion across commercial and industrial segments globally..

The high voltage commercial switchgear market is segmented by current, insulation, and geographic regions. The current high-voltage commercial switchgear market is divided into ACDC. In terms of insulation, the high voltage commercial switchgear market is classified into Gas, Air, Vacuum, and others. Regionally, the high voltage commercial switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

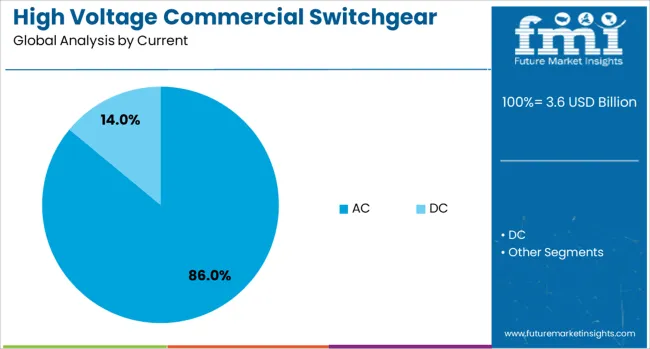

The AC current segment is projected to hold 86% of the High Voltage Commercial Switchgear market revenue share in 2025, establishing it as the leading current type. This dominance has been attributed to the global prevalence of alternating current systems in commercial power infrastructure. AC-based switchgear has been widely preferred due to its compatibility with long-distance power transmission and distribution networks, which are fundamental to utility-scale operations.

The efficiency and economic viability of AC systems have driven their widespread adoption in both new installations and retrofit projects. Additionally, advancements in AC switchgear design have enabled improved voltage regulation, overload handling, and arc fault protection, which are essential for ensuring uninterrupted commercial operations.

Regulatory emphasis on power quality, safety, and energy efficiency has further encouraged the deployment of AC switchgear in critical applications. As the commercial sector continues to expand in urban environments, the reliance on well-established AC networks has reinforced the segment’s position as the market leader..

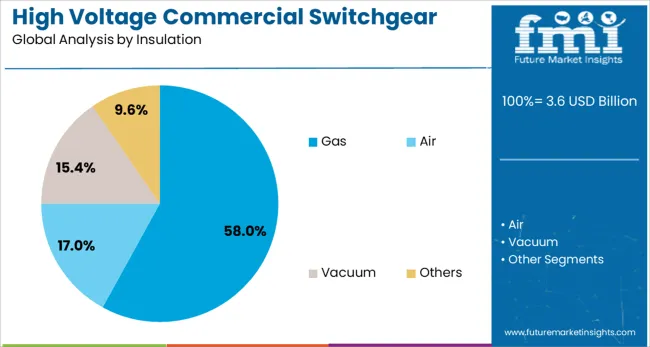

The gas insulation segment is expected to account for 58% of the High Voltage Commercial Switchgear market revenue share in 2025, positioning it as the dominant insulation type. This segment’s growth has been driven by the superior dielectric properties and compact size offered by gas-insulated switchgear systems. These systems have been extensively adopted in commercial environments where space constraints, safety standards, and environmental reliability are of critical importance.

The ability of gas insulation to minimize the risk of internal faults while ensuring long-term operational stability has made it a preferred choice for high-voltage applications. Technological enhancements in sealed compartments and environmentally friendly insulating gases have further improved system efficiency and reduced maintenance needs.

As urban infrastructure becomes more densely populated, the need for space-efficient and high-performance insulation systems has elevated the importance of gas-insulated switchgear in the commercial segment. The continued adoption of advanced switchgear configurations in smart buildings and energy-intensive facilities has solidified this segment’s market leadership..

The demand for high voltage commercial switchgear is rising as industries require reliable, efficient, and safe electrical systems to manage the transmission and distribution of electricity. These switchgear systems are essential for protecting electrical circuits in commercial infrastructure, ensuring that power is distributed effectively and safely. As the global focus shifts towards modernizing power grids, increasing energy demand, and integrating renewable energy, the need for high voltage switchgear continues to grow. Despite challenges like high installation costs and complex regulatory requirements, technological advancements and the expansion of commercial infrastructure provide ample growth opportunities for the market.

The demand for high voltage commercial switchgear is driven by the growing need for reliable and safe power distribution systems, especially in commercial and industrial settings. As urbanization and infrastructure development increase globally, efficient power management becomes crucial. High voltage switchgear systems are used to protect electrical equipment and ensure the safe distribution of electricity across grids. The integration of renewable energy sources, such as solar and wind power, requires advanced switchgear systems to manage power flows and maintain grid stability. Additionally, government investments in modernizing electrical grids and expanding power infrastructure are further fueling the demand for high voltage commercial switchgear.

A significant challenge in the high voltage commercial switchgear market is the high initial cost of installation and maintenance. High voltage switchgear systems require substantial investment in both equipment and infrastructure. Furthermore, the complexity of these systems often leads to high operational and maintenance costs. Compliance with stringent regulatory standards for safety and environmental impact adds another layer of complexity. These regulations, especially those related to energy efficiency and emissions control, can increase both upfront costs and the time needed for installation and certification. Smaller commercial enterprises may face financial barriers in adopting high voltage switchgear systems due to these factors.

There are substantial opportunities in the high voltage commercial switchgear market, particularly driven by advancements in technology and the ongoing modernization of power grids. Innovations in digital switchgear, which allows for remote monitoring, control, and predictive maintenance, are increasing the efficiency and reliability of switchgear systems. As the global demand for electricity rises and the adoption of renewable energy sources grows, the need for advanced power distribution systems will continue to expand. Moreover, initiatives to upgrade and modernize aging electrical infrastructure in both developed and emerging markets provide additional opportunities for the growth of high voltage commercial switchgear.

A key trend in the high voltage commercial switchgear market is the increasing integration of smart technologies, such as digital controls, sensors, and automation, to enhance operational efficiency and system reliability. These smart systems enable remote monitoring, real-time diagnostics, and faster decision-making, which reduce downtime and improve grid stability. Another significant trend is the growing demand for switchgear solutions designed to integrate renewable energy sources, such as solar and wind power, into existing grids. These systems require advanced switchgear to manage the variability and complexity of renewable energy flows, ensuring the efficient and safe distribution of power. As the push for greener, smarter grids continues, high voltage commercial switchgear systems are evolving to meet the needs of modern power infrastructure.

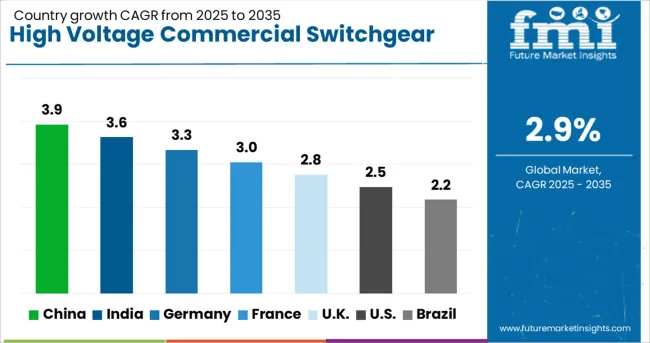

| Country | CAGR |

|---|---|

| China | 3.9% |

| India | 3.6% |

| Germany | 3.3% |

| France | 3.0% |

| UK | 2.8% |

| USA | 2.5% |

| Brazil | 2.2% |

The touchless sensing market is projected to grow at a CAGR of 15% from 2025 to 2035, fueled by the adoption of gesture recognition systems, biometric authentication, and contactless interfaces across consumer electronics, healthcare, and automotive sectors. China, a leading BRICS economy, dominates with 20.3%, supported by large-scale smart device deployment and automotive technology integration. India, also within BRICS, follows at 18.8%, driven by digital transformation initiatives and demand for hygiene-focused solutions. Among OECD markets, Germany posts 17.3%, emphasizing industrial automation and secure access systems. The United Kingdom records 14.3%, while the United States grows at 12.8%, reflecting heavy investment in biometric security and interactive touchless technologies. The analysis includes over 40 countries, with the top five detailed below.

The high voltage commercial switchgear market in China is growing at a strong CAGR of 3.9%. The demand is primarily driven by the country’s rapid industrial expansion, coupled with increasing investments in smart grid infrastructure and renewable energy projects. The Chinese government’s commitment to building a robust energy infrastructure and upgrading the national grid to support renewable energy integration is significantly boosting the market. Major sectors like manufacturing, power generation, and transmission are the largest consumers of high voltage switchgear, driven by the growing demand for energy efficiency and grid reliability.

The market for high voltage commercial switchgear in India is expanding at a CAGR of 3.6%, driven by increased infrastructure development, government-backed energy projects, and a growing need for reliable power distribution systems. The country is investing heavily in renewable energy projects, including solar and wind, which are key drivers of demand for switchgear solutions. India’s push for rural electrification and the modernization of urban infrastructure are contributing to the increased adoption of high voltage switchgear, which is essential for efficient and safe power transmission across the country.

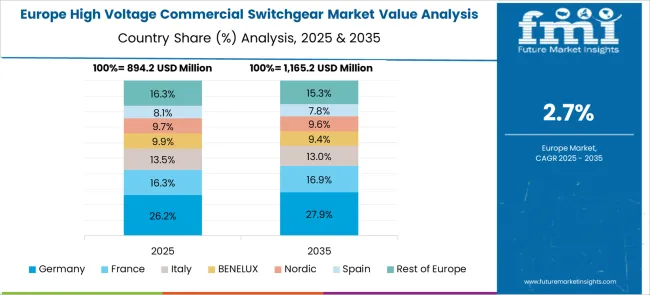

The high voltage commercial switchgear market in Germany is projected to grow at a CAGR of 3.3%, driven by its energy transition strategy, known as Energiewende. As the country pushes for greater renewable energy integration, particularly from offshore wind farms, the need for efficient power distribution systems continues to rise. Germany’s strong manufacturing base and its industrial reliance on reliable and advanced electrical infrastructure contribute to the steady demand for high voltage switchgear. The government’s focus on grid modernization, smart grids, and energy storage systems plays a critical role in sustaining growth in this sector.

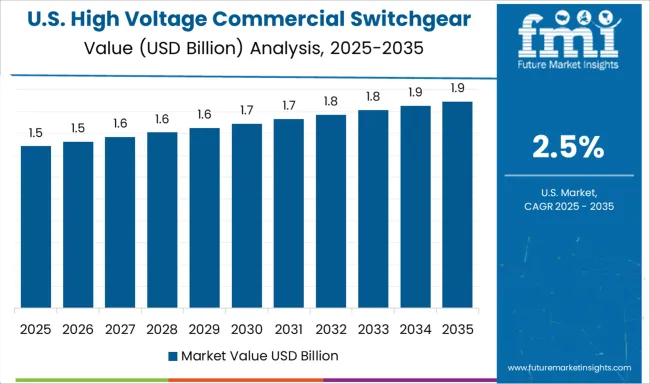

The United States is witnessing steady growth in the high voltage commercial switchgear market, with a CAGR of 2.5%. The country’s mature power infrastructure is undergoing significant upgrades as part of modernization efforts and in response to the integration of more renewable energy sources, particularly wind and solar. The increasing frequency of extreme weather events also drives the demand for resilient and reliable switchgear systems. Focus on smart grid technologies and energy efficiency initiatives further contributes to the ongoing need for high voltage switchgear solutions to manage the complexities of power distribution.

The UK high voltage commercial switchgear market is set to grow at a CAGR of 2.8%, supported by the government’s renewable energy expansion goals, particularly in offshore wind. The demand for switchgear is increasing as the country modernizes its electrical infrastructure to accommodate growing renewable energy sources and improve grid efficiency. The UK also focuses on carbon neutrality by 2050, which is fueling investments in energy-efficient power transmission solutions. Regulations to enhance power grid resilience are pushing the adoption of advanced switchgear technologies, ensuring more reliable power distribution systems.

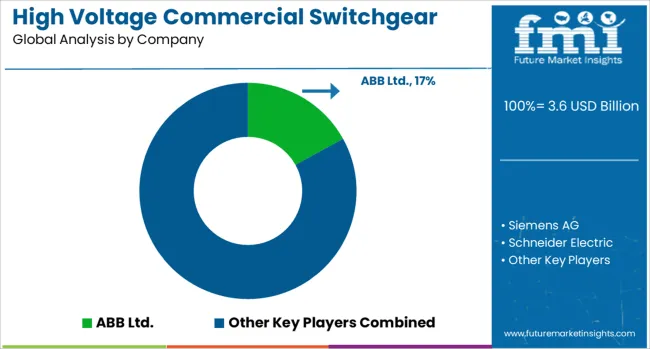

The high voltage commercial switchgear market is dominated by leading companies that provide advanced electrical solutions for the safe and efficient distribution of electricity in commercial, industrial, and infrastructure applications. ABB Ltd. is a market leader, offering a wide range of high-voltage switchgear solutions designed to meet global safety and efficiency standards, focusing on automation, smart grids. Siemens AG is another key player, providing innovative and reliable high voltage switchgear solutions, with a strong emphasis on energy management, grid integration, and digitalization. Schneider Electric specializes in offering modular, smart, and eco-friendly switchgear solutions, integrating digital technologies and real-time monitoring for efficient power distribution and improved operational safety. Eaton Corporation delivers high-performance commercial switchgear designed for energy efficiency, fault protection, and load management, with a strong focus on sustainable energy solutions.

Mitsubishi Electric Corporation provides robust and technologically advanced switchgear solutions that prioritize reliability, safety, and optimal power distribution in high-demand commercial environments. Toshiba Corporation is also a prominent player, offering high-voltage switchgear that caters to various industries, focusing on innovative designs and advanced technologies to enhance system reliability and reduce energy loss.Competitive differentiation in this market is driven by product innovation, energy efficiency, compliance with international standards, and the ability to integrate with modern grid systems. Barriers to entry include high capital investment, technology development costs, and the need for expertise in high-voltage electrical systems. Strategic priorities include developing smart switchgear solutions, improving energy management systems, and expanding into emerging markets with high infrastructure demand.

In December 2024, ABB announced its acquisition of the power electronics unit of Gamesa Electric from Siemens Gamesa. This acquisition, expected to close in the second half of 2025, aims to strengthen ABB's position in renewable power conversion technology. The deal includes over 100 specialized engineers and two factories in Madrid and Valencia.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Current | AC and DC |

| Insulation | Gas, Air, Vacuum, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB Ltd., Siemens AG, Schneider Electric, Eaton Corporation, Mitsubishi Electric Corporation, and Toshiba Corporation |

| Additional Attributes | Dollar sales by switchgear type (circuit breakers, switch disconnectors, transformers) and end-use segments (commercial buildings, industrial facilities, infrastructure projects). Demand dynamics are influenced by the growing need for reliable power distribution, increasing demand for energy-efficient systems, and the adoption of smart grid technologies. Regional trends show strong growth in North America and Europe, driven by modernization of electrical grids and rising demand for sustainable energy solutions, while Asia-Pacific is expanding due to rapid industrialization and urbanization. |

The global high voltage commercial switchgear market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the high voltage commercial switchgear market is projected to reach USD 4.8 billion by 2035.

The high voltage commercial switchgear market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in high voltage commercial switchgear market are AC and dc.

In terms of insulation, gas segment to command 58.0% share in the high voltage commercial switchgear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

High Purity Carbonyl Iron Powder (CIP) Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

High Frequency Chest-Wall Oscillation Devices Market Size and Share Forecast Outlook 2025 to 2035

High-purity Fluoropolymer Valves Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Pharmaceutical Packaging Films for Blister Market Size and Share Forecast Outlook 2025 to 2035

High Current Ion Implanter Market Size and Share Forecast Outlook 2025 to 2035

High Rate Discharge Test Machine Market Size and Share Forecast Outlook 2025 to 2035

High-precision Confocal Sensor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Carbon Fiber Precursor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA