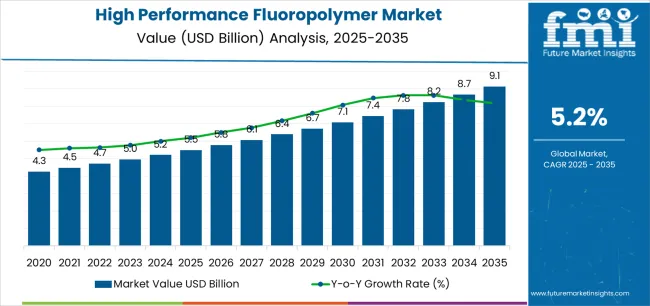

The High Performance Fluoropolymer Market is estimated to be valued at USD 5.5 billion in 2025 and is projected to reach USD 9.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The high performance fluoropolymer market is experiencing robust growth driven by increasing demand for materials offering superior chemical resistance, thermal stability, and electrical insulation. Current market conditions reflect expanding applications across industrial processing, coatings, and electronics sectors, supported by technological innovation and regulatory emphasis on durable, low-emission materials. Manufacturers are investing in process optimization and advanced compounding techniques to enhance performance consistency and meet evolving industry standards.

Rising adoption in critical sectors such as semiconductors, automotive, and energy is further strengthening demand. The future outlook remains positive as sustainability-driven initiatives and product innovation stimulate substitution of conventional polymers with high-performance alternatives.

Growth rationale is anchored in the material’s unique ability to perform under extreme conditions, its long service life, and its role in improving operational efficiency across end-use industries These dynamics collectively position the market for steady expansion and enhanced value creation over the coming years.

| Metric | Value |

|---|---|

| High Performance Fluoropolymer Market Estimated Value in (2025 E) | USD 5.5 billion |

| High Performance Fluoropolymer Market Forecast Value in (2035 F) | USD 9.1 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

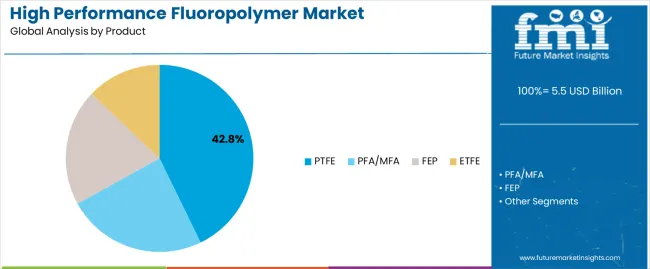

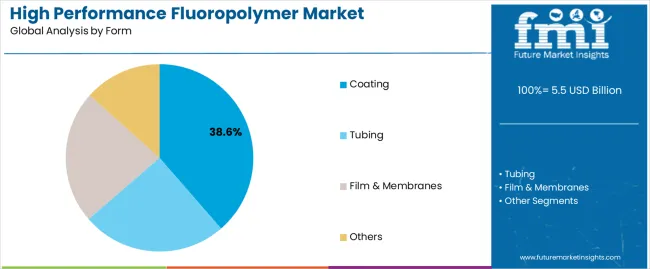

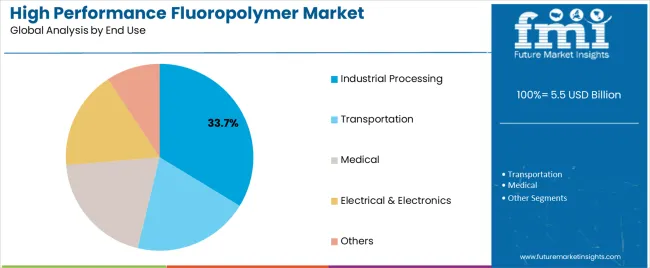

The market is segmented by Product, Form, and End Use and region. By Product, the market is divided into PTFE, PFA/MFA, FEP, and ETFE. In terms of Form, the market is classified into Coating, Tubing, Film & Membranes, and Others. Based on End Use, the market is segmented into Industrial Processing, Transportation, Medical, Electrical & Electronics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The PTFE segment, accounting for 42.80% of the product category, has retained its dominance due to its unmatched resistance to heat, chemicals, and friction. Its broad applicability in sealing, insulation, and non-stick coating solutions has ensured consistent demand across industrial and consumer sectors.

Process advancements have improved purity levels and mechanical performance, enabling PTFE to meet stringent regulatory and operational standards. Market growth has been reinforced by stable supply networks and diversification of end-use applications in electronics and automotive systems.

Continuous research to enhance recyclability and processing efficiency is expected to strengthen the segment’s competitive advantage and maintain its leadership within the high performance fluoropolymer market.

The coating segment, representing 38.60% of the form category, has been leading due to its critical role in improving surface durability, corrosion resistance, and operational lifespan of industrial components. Adoption has been supported by increased deployment across chemical processing, cookware manufacturing, and automotive applications.

Advancements in dispersion technology and surface treatment processes have improved adhesion and uniformity, enhancing performance reliability. Regulatory focus on low-VOC and eco-friendly formulations has encouraged innovation in water-based fluoropolymer coatings.

The segment’s expansion is being reinforced by rising replacement demand in industrial equipment maintenance and infrastructure protection, ensuring sustained market share and long-term growth potential.

The industrial processing segment, holding 33.70% of the end-use category, continues to lead the market owing to extensive utilization of fluoropolymers in harsh operating environments. Their exceptional resistance to solvents, acids, and high temperatures makes them indispensable in chemical plants, refineries, and semiconductor manufacturing facilities.

Growing focus on process safety, operational reliability, and extended equipment lifecycle has driven consistent demand for high-grade fluoropolymer linings, gaskets, and tubing. Industry modernization and expansion of manufacturing infrastructure in emerging economies are contributing to steady consumption growth.

Ongoing development of specialized fluoropolymer compounds tailored to high-performance industrial applications is expected to further consolidate the segment’s leadership position in the market.

The global demand for the high performance fluoropolymer market was estimated to reach a valuation of USD 4.3 billion in 2020, according to a report from Future Market Insights (FMI). From 2020 to 2025, the high performance fluoropolymer market witnessed significant growth, registering a CAGR of 4.1%.

| Historical CAGR from 2020 to 2025 | 4.1% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 5.5% |

Fluoropolymer based composite materials are a new breakthrough in the high performance fluoropolymer sector. These composites combine the distinct features of fluoropolymers with other materials like ceramics or nanoparticles.

Hybrid materials exhibit higher strength, wear resistance, as well as thermal conductivity, among other performance characteristics, opening up new application possibilities in harsh situations.

The market for high performance fluoropolymer is expected to grow in the future due to these factors:

Increasing Demand for Automotive and Electronics Sector to Boost Sales

The growing demand from the automotive sector is a major factor propelling the high performance fluoropolymer market. Fluoropolymers are necessary for many automotive applications, such as electrical harnesses, gaskets, and seals.

Their exceptional endurance in challenging working settings, chemical resistance, and thermal stability are the main reasons for this demand.

The high performance fluoropolymer industry is seeing increased demand from the electronics sector. Fluoropolymers are essential for many electronic applications, such as printed circuit boards, semiconductor production, and cable insulation.

Their superior electrical qualities, resistance to chemicals, and thermal stability, which satisfy the demanding specifications of electronic components and devices, are what fuel this demand.

Complex Manufacturing Challenges to Impede the Market Growth

Manufacturing processes in the high performance fluoropolymer market are complicated and need specialized equipment and knowledge, which can raise production costs and lead times.

Supply chain issues are brought on by the restricted availability of raw ingredients, especially for some fluoropolymer variants.

Variations in formulation needs and end user specifications make it difficult to provide consistent performance and quality across a range of applications, necessitating ongoing research and development efforts on the part of producers.

This section focuses on providing detailed analysis of two particular market segments for high performance fluoropolymer, the dominant product and the significant form. The two main segments discussed below are the PTFE and tubing.

| Product | PTFE |

|---|---|

| CAGR from 2025 to 2035 | 5.3% |

The PTFE product segment to gain traction and expand with a 5.3% CAGR through 2035. PTFE (polytetrafluoroethylene) is set to become the top selling item in the high performance fluoropolymer market due to its distinctive combination of features.

PTFE is widely used in sectors including automotive, electronics, and chemical processing due to its remarkable chemical resistance, low friction coefficient, and great temperature stability. Its longevity and non stick qualities also make it more appealing for a range of uses.

This fuels its rising demand and leading position in the global high performance fluoropolymer market.

| Form | Tubing |

|---|---|

| CAGR from 2025 to 2035 | 5.2% |

During the forecast period, the tubing form segment is likely to garner a 5.2% CAGR. Tubing is becoming more and more popular as the leading form in the global high performance fluoropolymer market owing to its adaptability and numerous industrial uses.

It is essential in industries including automotive, aerospace, and healthcare due to its resistance to high pressure, corrosive chemicals, and severe temperatures. Tubing has exceptional elasticity, toughness, and abrasion resistance, which enables it to function dependably under harsh conditions and contributes to its growing market share.

This section will go into detail on the high performance fluoropolymer markets in a few key countries, including the United States, the United Kingdom, China, Japan and South Korea. This segment will focus on the key factors that are driving up demand in these countries for high performance fluoropolymer.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| The United States | 5.7% |

| The United Kingdom | 6.7% |

| China | 5.8% |

| Japan | 6% |

| South Korea | 6.8% |

The United States high performance fluoropolymer ecosystem is anticipated to gain a CAGR of 5.7% through 2035. High performance fluoropolymers are crucial to the regional booming oil and gas sector since they offer outstanding chemical resistance and endurance in harsh conditions when used as seals, gaskets, and linings in drilling equipment and pipelines.

High performance fluoropolymers are required by the nation's advanced manufacturing sector, which places a high value on innovation and technology. These polymers are used in 3D printing, automotive components, and electronic devices, and are advantageous due to their special qualities, which include low friction, electrical insulation, and thermal stability.

The high performance fluoropolymer market in the United Kingdom is expected to expand with a 6.7% CAGR through 2035.

The aerospace sector in the United Kingdom requires high performance fluoropolymers for advanced applications such as engine parts, aircraft components, and aerospace coatings, where these materials provide remarkable heat resistance, chemical inertness, and lightweight construction.

Fluoropolymers are needed in the region's renewable energy sector due to the increased emphasis on renewable energy sources. These polymers are useful in solar panels, wind turbines, as well as energy storage systems because of their resilience to weather and extreme temperatures.

The high performance fluoropolymer ecosystem in China is anticipated to develop with a 5.8% CAGR from 2025 to 2035. The need for high performance fluoropolymers is driven by the rapid industrialization and growth in the manufacturing sector in China.

These materials are crucial for applications requiring superior thermal stability, chemical resistance, and durability in a variety of industries, including electronics, chemical processing, and the automotive industry.

Fluoropolymers, which have a low environmental impact and can replace less sustainable alternatives in industries like wastewater treatment, construction, and packaging, are in high demand due to the regional stricter environmental regulations and growing emphasis on sustainability.

The high performance fluoropolymer industry in Japan is anticipated to reach a 6% CAGR from 2025 to 2035. High performance fluoropolymers are necessary for crucial applications including circuit boards, electronic components, and semiconductor production in the advanced electronic sector of Japan.

These materials offer crucial qualities like chemical resistance and thermal stability.

Since fluoropolymers are biocompatible, sterile, and chemically inert, the Japan healthcare industry depends on them for the production of medical devices such as implants, catheters, and surgical tools. This has LED to an increase in demand for specific formulations of fluoropolymer.

The high performance fluoropolymer ecosystem in South Korea is likely to evolve with a 6.8% CAGR during the forecast period. The semiconductor sector in South Korea is booming, and a major part of its production process uses high performance fluoropolymers because of their remarkable qualities including chemical resistance and thermal stability.

Due to their longevity and resilience to adverse climatic conditions, specialist materials like fluoropolymers are needed by the green energy sector in South Korea for use in solar panels, fuel cells, and wind turbines.

The key companies in the global high performance fluoropolymer market are continuously pursuing strategic initiatives aimed at fortifying their market positions.

Considerable attention is being paid to research and development in order to present novel formulations of fluoropolymers with improved performance attributes. The goal of pursuing strategic partnerships and collaborations is to increase product ranges and market reach.

Investing in sustainable fluoropolymer technology is becoming more popular, which is in line with the growing focus on environmentally friendly products.

In order to maintain market growth and competitiveness, efforts are focused on broadening the application areas of high performance fluoropolymers, expanding into developing markets, and expanding geographically. The key players in this market include:

Significant advancements in the high performance fluoropolymer market are being made by key market participants, and these include:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.2% from 2025 to 2035 |

| Market value in 2025 | USD 5.5 billion |

| Market value in 2035 | USD 9.1 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product, Form, End Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

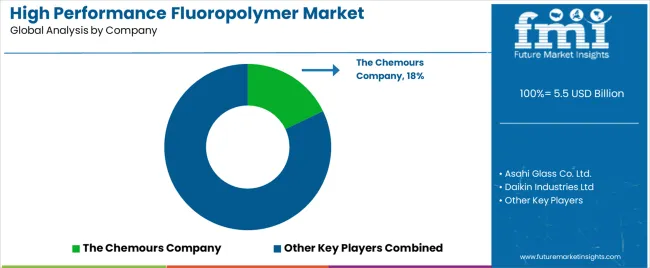

| Key Companies Profiled | The Chemours Company; Asahi Glass Co. Ltd.; Daikin Industries Ltd; The 3M Company; Dongyue Group Ltd.; Solvay S.A.; Gujrat Fluorochemicals Limited; Halopolymer OJSE.; Hubei Everflon Polymer Co. Ltd.; Saudi Basic Industries Corporation (SABIC); Shanghai 3F New Materials Company Ltd |

| Customization Scope | Available on Request |

The global high performance fluoropolymer market is estimated to be valued at USD 5.5 billion in 2025.

The market size for the high performance fluoropolymer market is projected to reach USD 9.1 billion by 2035.

The high performance fluoropolymer market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in high performance fluoropolymer market are ptfe, pfa/mfa, fep and etfe.

In terms of form, coating segment to command 38.6% share in the high performance fluoropolymer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High Performance Carbon Fiber Precursor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Mercury Sorbent Market Size and Share Forecast Outlook 2025 to 2035

High-performance Electric Sports Cars Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Computing Market Size and Share Forecast Outlook 2025 to 2035

High Performance Polyamides Market Size and Share Forecast Outlook 2025 to 2035

High Performance Data Analytics (HPDA) Market Size and Share Forecast Outlook 2025 to 2035

High Performance Pigments Market Size and Share Forecast Outlook 2025 to 2035

High Performance Trucks Market Size and Share Forecast Outlook 2025 to 2035

High Performance Barrier Films Market Size, Growth, and Forecast 2025 to 2035

High Performance Message Infrastructure Market Size, Growth, and Forecast 2025 to 2035

High-Performance Fibers for Defense Market Report – Demand, Trends & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA