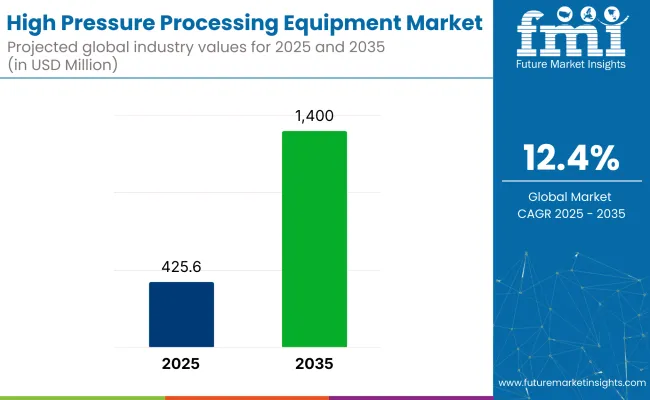

The global high pressure processing (HPP) equipment market is projected to reach a valuation of USD 1400 million by 2035, up from USD 425.6 million in 2025, reflecting a robust compound annual growth rate (CAGR) of 12.4% over the forecast period. This growth in demand is being driven by the convergence of regulatory pressure, evolving consumer preferences, and the operational advantages of non-thermal processing technology.

The demand for extended shelf life and chemical-free preservation has positioned HPP as a critical tool in the food industry. Unlike thermal pasteurization, HPP maintains the sensory and nutritional integrity of perishable products. Its effectiveness in inactivating Listeria monocytogenes, Salmonella, and E. coli O157:H7-without altering product taste or texture-has earned it validation from food safety authorities across North America, Europe, and Asia-Pacific.

Adoption has accelerated across premium food categories. In the United States, Suja Juice, a Coca-Cola-backed company, scaled its HPP use to meet Whole Foods’ sourcing standards. Starbucks’ Evolution Fresh uses HPP to produce premium cold-pressed juices now distributed across more than 8,000 retail locations.

In Europe, seafood processor Grupo Nueva Pescanova adopted HPP for bivalve purification to meet EU hygiene regulations while minimizing the need for preservatives. In Japan, Nippon Ham uses HPP in its ready-to-eat meat division to reduce microbial risk without compromising product freshness. Notably, HPP’s role in post-packaging sanitation has gained relevance amid growing concerns over cross-contamination. This has positioned the technology as a strategic investment for exporters in Mexico, Thailand, and India seeking to meet USDA and EU import standards.

Technology providers such as Hiperbaric, Avure Technologies, and Multivac have led advancements in HPP design, introducing systems with enhanced throughput, modular scalability, and digital condition monitoring. Integration with IoT-based diagnostics and AI-driven predictive maintenance now offers significant operational savings and downtime prevention for large-scale processors.

Policy and certification frameworks are accelerating deployment. The USDA High Pressure Processing Certification Program, EU EcoDesign compliance for low-energy industrial equipment, and regional grant programs (e.g., Canada’s AgriAssurance program) have collectively reinforced market momentum.

Emerging markets are also gaining ground. In Indonesia, the Ministry of Marine Affairs is collaborating with equipment vendors to pilot HPP systems in tuna and shrimp processing zones. Singapore’s Food Innovation & Resource Centre has supported HPP adoption among urban farms and clean-label startups under its Singapore Food Story R&D Programme.

HPP is no longer a niche technology. It has become an essential part of next-generation food processing infrastructure for both multinational brands and mid-sized regional players. Continued adoption is expected as the industry aligns with more stringent safety standards, environmental regulations, and consumer expectations across global markets.

The global high-pressure processing (HPP) equipment market has been segmented by application, product type, and vessel arrangement. Each segment reflects distinct operational preferences and strategic deployment across the food and beverage industry. Demand for HPP technology has been consistently supported by its ability to ensure food safety, extend shelf life, and preserve the nutritional and sensory qualities of products-meeting rising consumer expectations for clean-label and minimally processed foods.

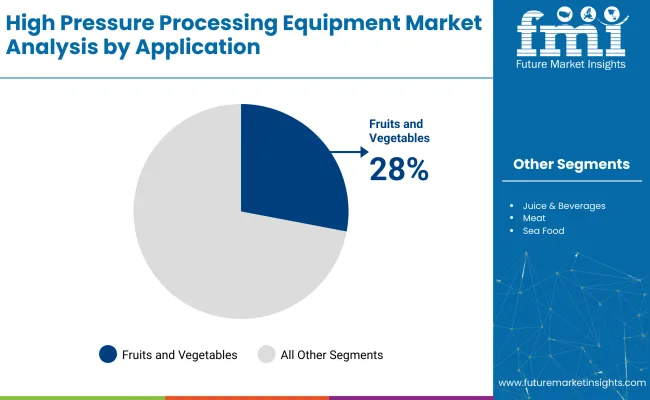

A market share of 28% is expected to be held by the fruits and vegetables segment in 2025, with a projected CAGR of 12.7% through 2035. HPP is being widely adopted for items such as guacamole, salsa, hummus, and cut fruit mixes. At Calavo Growers in the United States, HPP has been implemented to maintain freshness and microbial safety in guacamole products distributed to major retailers like Costco and Walmart. The use of HPP has enabled longer shelf life without additives, supporting supply chain efficiency and consumer trust.

The meat processing segment is forecast to hold a 23% market share in 2025, growing at a CAGR of 11% through the forecast period. HPP is being applied to deli meats, sausages, and heat-and-eat meals. For example, Hormel Foods uses HPP for its Natural Choice product line to eliminate the need for preservatives while maintaining compliance with USDA safety standards. In the seafood industry, companies such as Motivatit Seafoods have utilized HPP for over a decade to assist in oyster shucking and to extend shelf life, improving food safety and operational efficiency.

Cold-pressed juice brands including Suja Life (USA), Preshafood (Australia), and Raw Pressery (India) rely entirely on HPP to retain nutrient content and avoid thermal degradation. Starbucks' Evolution Fresh uses HPP for freshness preservation, allowing national-scale refrigerated distribution without preservatives. Niche categories such as dairy, baby food, and pet food are also being increasingly addressed.

Once Upon a Farm applies HPP to baby food to retain nutrients and ensure microbiological safety-an approach that has helped the brand expand in major USA retail chains. Mumme’s Inc., a Texas-based company, has adopted HPP in its pet food manufacturing process to meet rising consumer demand for cleaner ingredients and improved pet nutrition.

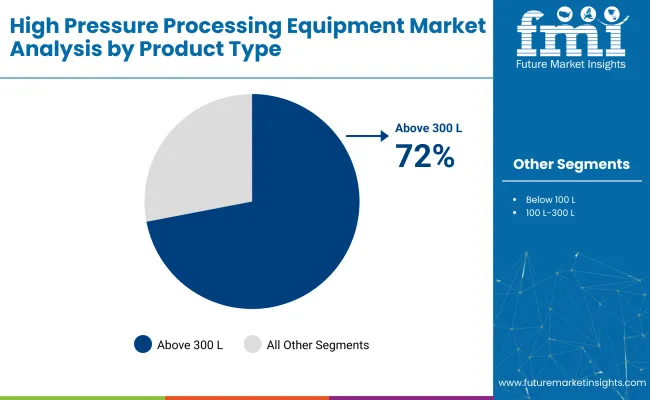

Equipment with chamber capacities above 300 liters is projected to hold a 72% market share in 2025, with a CAGR of 9.6% over the forecast period. These large-capacity systems are being used by multinational manufacturers such as Campbell Soup Company and Maple Leaf Foods for central production facilities. Providers like Hiperbaric are offering models such as the 525L and 1350L units with built-in automation, remote diagnostics, and integration with smart factory systems to optimize uptime and throughput. Mid-capacity systems (100-300 liters) are being selected by regional food manufacturers.

These units offer a balanced solution for batch production, regional distribution, and cost control. True Fruits in Germany and Blend & Press in the United Kingdom have adopted these systems to scale artisanal product lines while expanding their footprint across Europe.

Smaller systems, below 100 liters, are commonly used in pilot labs, food tech incubators, and by early-stage startups. These systems are enabling innovation by allowing low-volume testing of formulations such as probiotic beverages and clean-label sauces. Several food technology hubs in Southeast Asia and Latin America have started leasing small-capacity HPP units to support local entrepreneurs.

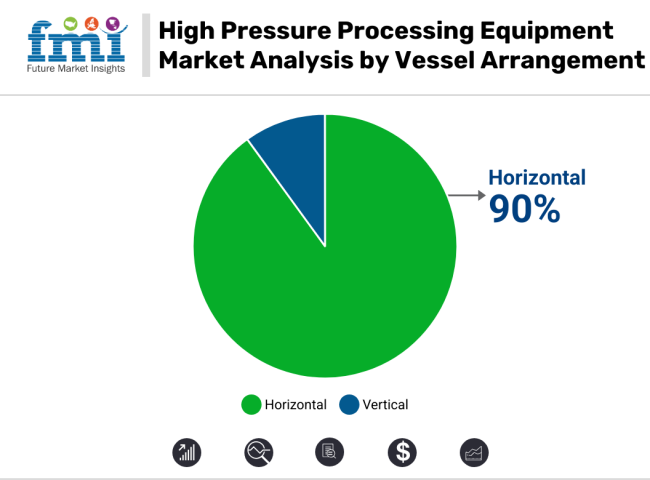

Horizontal vessels are expected to dominate with a 90% market share in 2025 and a CAGR of 14% through 2035. These systems are preferred in high-volume operations for their rapid cycle times and compatibility with conveyor-based automation. Fresherized Foods, the company behind Wholly Guacamole, utilizes horizontal HPP systems to process hundreds of tons weekly, ensuring consistent quality and reducing labor-related bottlenecks.

Vertical vessels, although less common, are being used in facilities with space constraints or where modular configurations are required. Juice processors and food labs in urban centers across Southeast Asia have adopted vertical systems to retrofit existing production spaces without major capital investment.

Need for a High Initial Investment and Complex System Integration

Here we have used High Pressure Processing (HPP) Equipment Market to discuss the key issues including high initial investment cost, technical complexities, and requirements of specialized infrastructure. Such investment of HPP technology in food & beverage processing, pharmaceuticals, and biotechnology depends on capital expenditure by the companies, which may be hindrance for small and mid-sized players. Moreover, adaptive engineering solutions and high-grade labour are needed to integrate HPP equipment into current production lines without impairment of operations.

Key points: Manufacturers must optimize for low-cost, modular system design, inline solutions providing automation tools that are, affordable and efficient to high-pressure processing. Where cost is a factor in driving adoption, working with regulatory agencies to simplify and streamline compliance and providing alternative financing options are also important.

Increasing Demand for Clean Label and Extended-Shelf-Life Products

High Pressure Processing Equipment Market has an incredible opportunity owing to the growing requirement among consumers to utilize minimally processed, preservative-free, and longer shelf-life products. The HPP technology successfully inactivates pathogens while maintaining the nutrition, flavour and texture of food and beverages.

This makes it an ideal solution for producers who want to address the clean-label trend while maintaining product quality. In addition, the growing emphasis on sustainability is poised to boost interest in HPP as an energy-efficient alternative to heat pasteurization.

As businesses head towards a sustainable and health-conscious consumerism, those that invest in sustainable processing methods, packaging compatibility with recyclability and real-time quality monitoring systems, thus cutting down on waste, will be competitive in the market.

The United States HPP equipment market is on the rise with increasing demand for clean-label and minimally processed foods, rising adoption in meat and juice processing, and strict FDA food safety regulations. The Food Safety Modernization Act (FSMA) and USDA guidelines are pushing food manufacturers to implement HPP technology to achieve pathogen reduction and a longer shelf life.

HPP systems are widely used in the ready-to-eat (RTE) meal and cold-pressed juice industries, as they guarantee nutrient retention and flavour preservation. Furthermore, growing investment in food innovation and automation is also bolstering demand for high-throughput HPP solutions.

The United States HPP equipment market is poised for strong growth given continued technological advancements and consumers' growing awareness of HPP benefits.

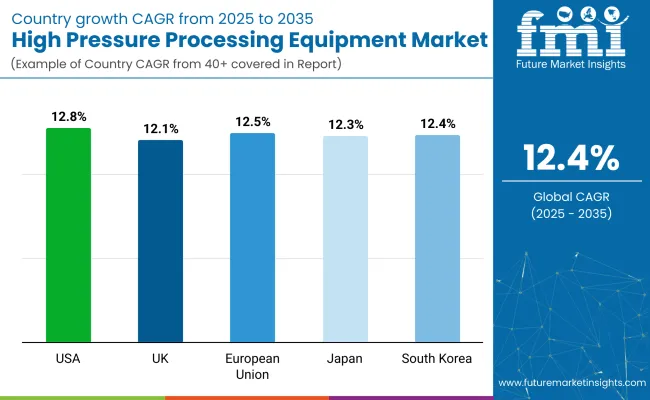

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.8% |

The UK HPP equipment market is expanding with increasing demand for food safety solutions, rising adoption in the beverage industry, and government regulations favouring non-thermal food preservation. The UK Food Standards Agency (FSA) guidelines focusing on pathogen reduction and/or extended shelf life through use of technology have pushed food manufacturers to invest in HPP technology.

Arla Foods, which produces 26 million litters of milk per day, is one of Indigo's key adopters, as they are finding innovative methods of preserving the milky taste without requiring additives, other than Indigo's natural introduction, to satisfy consumer requirements for clean-label products. Moreover, increasing investment in high-tech food processing facilities also aids in the adoption of HPP equipment.

Due to rising consumer awareness and strong regulatory support for non-thermal processing, the UK HPP equipment market is expected to grow at a moderate rate.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 12.1% |

Europe HPP equipment market capacity is overcoming at a significant growth rate, owing to the food safety regulations, increased consumption of organic and preservative-free food and growing investment in advanced food processing technologies. Germany, France, and Italy are at the forefront of HPP adoption in meat, dairy, seafood, and beverages.

Due to the EU’s stringent food safety and sustainability regulations, there is a boom in non-thermal food preservation techniques, and as they relate to pathogen elimination and shelf-life extension, high pressure processing has become a go-to solution. Similarly, the increasing demand for HPP treated products is being driven by the booming organic food industry in the European region.

The rapid growth of technologies in the automation sector along with further investments in the high efficiency of the HPP systems will boost the growth of EU HPP equipment the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 12.5% |

The growth of the Japanese HPP equipment market is driven by increasing demand for HPP-based solutions to improve food safety and quality, rising adoption in seafood and beverage industries, and strong government food safety regulations. Currently, the consumption of ready to eat meals, premium juice, along with sushi, sashimi, which is mainly traditional Japanese food is expected to experience a surge along with HPP technology as Japan is now into fresh and natural food.

Japan’s focus by its government on food safety and innovation is further motivating food producers to install HPP equipment in their production lines. The emergence of functional and fortified foods in Japan further demonstrates how high-pressure processing (HPP) will create new opportunities for health beverages (HBP) and plant-based products.

Demand for advanced food processing solutions in Japan, along with spurring investments in automation, is expected to continue driving steady growth of the Japanese HPP equipment market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.3% |

HPP is a technology used to preserve consumables such as food and beverages with high pressure processing; The South Korean HPP equipment market is expected to grow at a steady pace, due to the demand for high-quality preservation of food items, expanding use of ready-to-eat meals and increasing adoption in the beverage industry. South Korea’s rapidly expanding food and beverage industry is investing in HPP systems to improve product safety and shelf life.

Meat and seafood industries are large adopters, using HPP to decrease risks of contamination and to meet international export standards. Demand for HPP processing is also growing as the popularity increases of items such as cold-pressed juices, functional drinks, and higher-end dairy products.

The South Korean HPP equipment market is expected to flourish owing to the continuous development in smart food processing and rising investments in high-pressure technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.4% |

The growing demand for non-thermal food preservation, extending shelf life, and retaining nutrients in packaged foods & beverages, are contributing the growth of the high-pressure processing (HPP) equipment market.

Companies are now developing automated HPP systems, artificial intelligence-based process optimization and energy-efficient pressure technology to improve food safety, sustainability and production efficiency. Global food processing equipment manufacturers and HPP system providers, are a part of this category and direct a lot of R&D efforts towards batch, semi-continuous, and continuous HPP systems.

Hiperbaric S.A. (20-25%)

HPP equipment market, Hiperbaric provides scalable batch processing solutions, AI-enabled food safety monitoring and sustainable HPP technology.

JBT Corporation (Avure Technologies Inc.) (15-20%)

They specialize in automation and high-speed HPP systems, helping to provide efficient non-thermal food preservation for packaged products.

Thyssenkrupp AG (10-14%)

Industrial-strength HPP equipment is available from Thyssenkrupp for meat, dairy and seafood processing at specific pressure control levels.

Bao Tou KeFa High Pressure Technology Co., Ltd. (7-11%)

Bao Tou KeFa specializes in HPP, providing cost-effective high-volume solutions with a strong emphasis on food safety, retention of nutrients, and increased shelf life for products.

Multivac Sepp Haggenmüller SE & Co. KG (5-9%)

Automated integration of HPP systems with food packaging to ensure that the processed products meet the world global food safety standards.

Other Key Players (40-50% Combined)

Several industrial equipment and food processing companies contribute to next-generation HPP technology, AI-enhanced food safety, and sustainable high-pressure solutions. These include:

The global market is expected to reach USD 1,400 million by 2035, growing from USD 425.6 million in 2025, during the forecast period.

The 100-300 litres and above 300 litres segments are projected to drive market growth, supported by increasing demand from large-scale food processors seeking high throughput and enhanced operational efficiency in food safety and preservation.

The packaged food and beverages sector is the leading application segment, driven by consumer preference for clean-label, preservative-free products with extended shelf life, and the rapid adoption of HPP technology by premium food brands.

Key drivers include the growing need for food safety and extended shelf life, rising demand for fresh and minimally processed food, increasing adoption of HPP in organic and functional food products, and continuous advancements in food processing technology.

Top contributing countries include the USA, Japan, Germany, France, and China, supported by strong food & beverage industries, high regulatory standards, and rising consumer demand for fresh, safe, and clean-label food products.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA