The high clear film market is expanding steadily due to the rising demand for advanced packaging materials that offer superior clarity, durability, and barrier protection. Growth is being driven by increased utilization across food, beverage, and consumer goods sectors where visual appeal and product protection are critical.

The current market landscape is characterized by technological improvements in film extrusion, coating, and lamination processes, which have enhanced optical transparency and strength performance. Regulatory focus on sustainable materials and recyclability is influencing material selection and production standards.

The future outlook remains positive as manufacturers continue to innovate with bio-based and high-performance polymers to meet evolving customer and environmental requirements Growth rationale is centered on the combination of expanding retail packaging, industrial usage, and the growing preference for high-clarity flexible films that ensure visibility, protection, and print compatibility, thereby supporting consistent market expansion and product differentiation across global end-use industries.

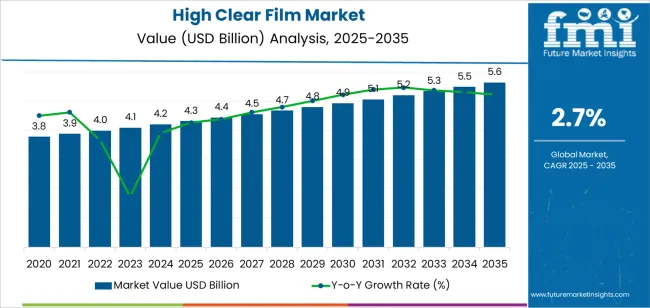

| Metric | Value |

|---|---|

| High Clear Film Market Estimated Value in (2025 E) | USD 4.3 billion |

| High Clear Film Market Forecast Value in (2035 F) | USD 5.6 billion |

| Forecast CAGR (2025 to 2035) | 2.7% |

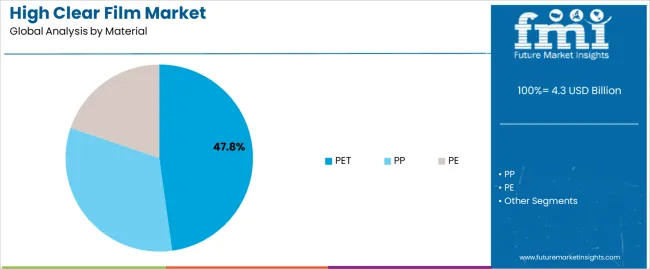

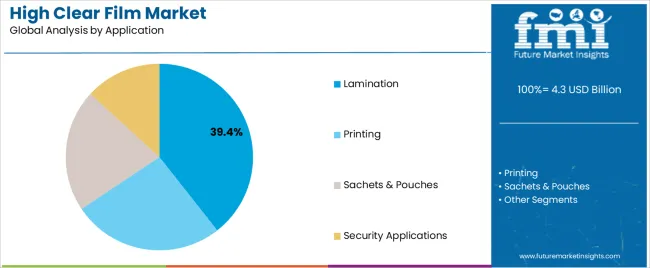

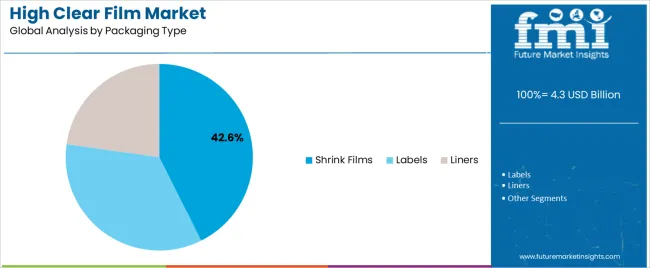

The market is segmented by Material, Application, and Packaging Type and region. By Material, the market is divided into PET, PP, and PE. In terms of Application, the market is classified into Lamination, Printing, Sachets & Pouches, and Security Applications. Based on Packaging Type, the market is segmented into Shrink Films, Labels, and Liners. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The PET segment, accounting for 47.80% of the material category, has maintained its dominance owing to its excellent optical transparency, tensile strength, and barrier properties. Its wide applicability across packaging and lamination has made it the preferred choice for manufacturers aiming to enhance visual presentation and durability.

Consistent availability of PET resins and advancements in polymer engineering have improved product performance and processing efficiency. The material’s recyclability and compliance with global sustainability standards have reinforced its adoption in both developed and emerging regions.

Continued research into lightweight and bio-modified PET variants is expected to further improve cost efficiency and environmental compatibility, supporting the material’s leading position in the high clear film market.

The lamination segment, representing 39.40% of the application category, has emerged as a key growth area due to increasing usage in food packaging, labeling, and commercial printing. Its prominence stems from the need for protective, glossy, and visually appealing layers that enhance product durability and shelf presentation.

The segment’s market share has been sustained by demand from consumer goods and flexible packaging sectors, where lamination provides moisture resistance and structural integrity. Improvements in adhesive technologies and heat-sealing methods have enhanced the quality and longevity of laminated products.

As industries continue to prioritize visual branding and material performance, the lamination segment is expected to remain integral to overall market development and innovation.

The shrink films segment, holding 42.60% of the packaging type category, has been leading the market due to its versatility and efficiency in wrapping and bundling various products. The segment’s dominance is driven by its superior clarity, adaptability to irregular shapes, and ability to provide tight, protective seals.

Demand has been further supported by growth in retail and logistics applications where aesthetic presentation and product safety are prioritized. Technological advancements in heat-shrink processes and polymer formulation have improved mechanical properties and printability, enabling greater design flexibility.

With continued adoption in food, beverage, and industrial packaging, the shrink films segment is expected to sustain its leadership and drive innovation within the high clear film market over the forecast period.

The high clear film market from 2020 to 2025 validated a growth trajectory characterized by a CAGR of 1.7%. During this period, the market witnessed several factors influencing technological advancements, evolvement of consumer preferences, and shifts in industry regulations.

The need for better optical qualities and improved product performance propelled a spike in demand from the electronics, automotive, and packaging sectors.

From 2025 to 2035, the film market is projected to experience a notable acceleration in growth, with a forecasted CAGR of 2.7%. This expected surge reflects various factors that help to shape the market landscape. The expansion of applications across diverse industries and boom in consumer awareness regarding the benefits of high-quality films.

With major advancements such as thinner and more flexible materials and enhanced sustainability features, manufacturers are thus expected to capitalize on emerging opportunities and cater to evolving customer demands.

| Historical CAGR 2020 to 2025 | 1.7% |

|---|---|

| Forecast CAGR 2025 to 2035 | 2.7% |

The table presented showcases the top five countries based on revenue, with India occupying a significant CAGRs of the market.

Packaging and pharmaceutical industries are the main users of the high-clarity film market in India. High-clear films are essential for packaging materials because they offer superior printability, barrier qualities, and clarity for various goods.

In the pharmaceutical business, they are widely used in blister packs, strip packs, and sachet pharmaceutical packaging to guarantee product integrity and regulatory compliance.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 1.6% |

| Canada | 1.2% |

| Italy | 1.6% |

| China | 4.7% |

| India | 6.4% |

In the United States, high clear films are extensively used in the electronics industry. They are applied in display screens, touch panels, and optical components, enhancing the visual clarity and functionality of electronic devices such as smartphones, tablets, and televisions. High clear films improve user experience and heightened aesthetics in electronic products.

Within the automotive sector, high clear films find significant utilization in the United States. They are employed in automotive applications such as heads-up displays (HUDs), instrument panels, and window films.

These films enhance the visibility, durability, and safety features of automotive components, contributing to the overall performance and appearance of vehicles on American roads.

In Canada, the market is predominantly driven by the packaging industry. High clear films are widely used in packaging materials to enhance product visibility, protect goods from external factors such as moisture and UV radiation, and improve shelf appeal.

They find applications in food packaging, consumer goods packaging, and pharmaceutical packaging, meeting the diverse packaging requirements of Canadian industries.

High-clarity films are widely used in the Italian textile and fashion sectors. These films are used to coat clothing, shield fragile materials, and give clothes a shiny appearance.

The premium appearance and feel of fashion merchandise is enhanced by high-clarity films, which lend a touch of luxury to branded products in the Italian fashion sector.

In China, the market is characterized by its multifaceted application across various industries. High clear films are widely utilized in electronics, automotive, packaging, and construction sectors. In the electronics industry, they contribute to the visual clarity and functionality of electronic devices.

In automotive applications, they enhance the aesthetics and performance of automotive components. High clear films play a crucial role in the packaging industry, offering superior optical properties and versatility for diverse packaging needs in the rapidly growing consumer market in China.

The packaging and pharmaceutical sectors primarily drive the market in India. High clear films are extensively used in packaging materials, offering excellent clarity, barrier properties, and printability for various products.

High clear films are utilized in the pharmaceutical sector for blister packaging, strip packaging, and sachets, ensuring product integrity, tamper resistance, and compliance with regulatory standards in the Indian pharmaceutical market.

The below section shows the leading segment. Based on packaging type, the shrink films segment is accounted to hold a market share of 36.1% in 2025. Based on the application, the sachets and pouches segment is anticipated to hold a market share of 31.4% in 2025.

The enhanced display and protection that shrink films offer packaged goods drive their use. The growing need from consumers for packaging formats that are portable and easy to use is driving the growth of sachets and pouches.

| Category | Market Share in 2025 |

|---|---|

| Shrink Films | 36.1% |

| Sachets and Pouches | 31.4% |

Based on packaging type, the shrink films category is predicted to have a 36.1% market share in 2025. Because shrink films can shape themselves to fit the product when heated, they are a popular choice for safe and aesthetically pleasing packaging solutions for various items.

This segmental dominance demonstrates the industry-wide acceptance and adaptability of shrink films in the food and beverage, cosmetics, and pharmaceutical sectors.

Application-based projections indicate that the sachets and pouches segment will account for 31.4% of the market in 2025. Sachets and pouches provide practical packaging options for single-use or small products. Their mobility, simplicity of usage, and capacity to preserve food freshness make them popular.

The expansion of this market reflects the growing demand in the consumer products sectors of food, personal care, and healthcare for portable and easy-to-transport package formats.

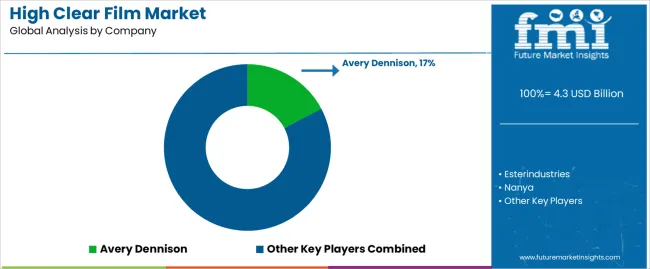

A number of significant players compete for market share worldwide in the highly competitive high clear film market structure. Regional companies are important since they provide specialized market niches and specific demand.

Generally, the market is distinguished by a blend of well-established titans and agile contenders, propelling innovation and cultivating competitiveness. Some of the key developments are:

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 4.2 billion |

| Projected Market Valuation in 2035 | USD 5.5 billion |

| Value-based CAGR 2025 to 2035 | 2.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Material, Application, Packaging Type, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Esterindustries; Nanya; Duratarps; Dehui Film; Avery Dennison; Eastman Performance Films; REEDEE Co. Ltd; Sino Vinyl; GSWF |

The global high clear film market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the high clear film market is projected to reach USD 5.6 billion by 2035.

The high clear film market is expected to grow at a 2.7% CAGR between 2025 and 2035.

The key product types in high clear film market are pet, pp and pe.

In terms of application, lamination segment to command 39.4% share in the high clear film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA