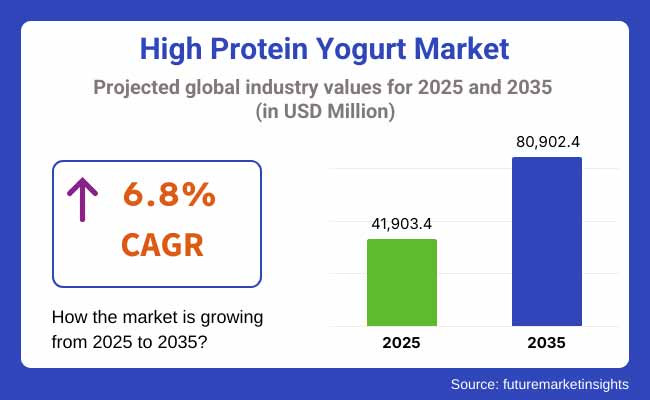

The High Protein Yogurt Market is expected to witness steady growth between 2025 and 2035, driven by rising consumer demand for protein-rich diets, growing awareness about gut health, and increasing adoption of functional dairy products. The market is projected to be valued at USD 41,903.4 million in 2025 and is anticipated to reach USD 80,902.4 million by 2035, reflecting a CAGR of 6.8% over the forecast period.

High protein yogurt is a popular choice due to its muscle-building effects, ability to increase feelings of fullness, and its function in digestive health. Market expansion is driven by the increasing demand for clean-label, probiotic-rich, and lactose-free high-protein yogurt variants.

But wild swings in the price of dairy, plant-based yogurt alternatives, and worries over vitamin D derived from non-natural sources form barriers to wider adoption in the market.

Innovative fermentation techniques, AI-enabled dairy formulation, and sustainable dairy farming practices are improving product quality, texture, and proteomic bioavailability. Further desirable trends are the growth of sports nutrition, the availability of gut-friendly probiotic yogurt, and the range of meal replacement yogurt products, which are expanding the potential for growth across functional food segments.

North America accounts for the highest growth in high-protein yogurt, spurred by high consumer preference for protein-enriched diets, growing demand for dairy products focused on gut health, and strong retail growth of functional foods. Greek yogurt, Icelandic , and dairy-free protein yogurt sales are flourishing across the United States and Canada, as are investments in fermented dairy innovations for sports nutrition and weight management.

The European high-protein yogurt adoption is also gradually increasing, driven by high demand for natural dairy proteins, growing preference for traditional fermented dairy, and regulatory support for clean-label dairy production.

Countries including Germany, the UK, France, and the Netherlands have been pioneers in high-protein yogurt production, plant-based protein yogurt innovations, and functional probiotic formulations. The EU's emphasis on sustainable dairy sourcing and reduced sugar consumption could further increase demand for fortified and natural protein-rich yogurts.

Asia-Pacific will be the quickest-growing area because of increasing disposable incomes, increasing health consciousness, increasing demand for protein-enhanced dairy foods in China, Japan, India, and Australia. China remains a significant source for dairy and alternative protein production, and plant-based and fermented dairy mimics are being developed more and more through investment by Japan and South Korea. India's customary yogurt culture is shifting towards fortified high protein forms, supporting growth for the market.

Challenges: Dairy Price Volatility and Competition from Plant-Based Alternatives

Nutritional differences and satiety-enhancing benefits aside, the challenges of rising milk prices, sustainability issues in dairy farming, and the emergence of plant-based protein yogurts as competition show that higher protein isn't a ticket to guaranteed success in the yogurt aisle. Competition from ready-to-drink protein drinks and protein bars also influences market positioning.

Opportunities: Functional Nutrition and Clean-Label Innovations

New avenues for growth are opening as the adoption expands of things like bioactive peptides, probiotics that improve gut health and AI-powered dairy fermentation processes. The demand for low-lactose, A2 dairy-based, and high-protein vegan formulations is a growing trend expected to contribute to the long-term growth of the overall market.

Moreover, the growth of sustainable dairy production practices, personalized nutrition, and hybrid dairy-plant protein mixes have continued to further drive the demand for next-generation high-protein yogurt products.

High Protein Yogurt Market is plastic dehydrated container or carton that consists of yogurt and anything protein. The transition towards Greek varieties, vegetation-based mostly high-protein options and probiotic-rich editions continued, especially among consumers aiming for fitness, following weight-loss diets and people with lactose intolerance.

Advancements in fermentation methods, natural protein enhancement and AI-enhanced taste formulation led to superior taste, texture and nutrition. Nevertheless, drivers such as the highly variable dairy pricing, disrupted supply chain, and alternate dairy high protein options (e.g., protein shakes, bars) acted as a hindrance for market growth.

For 2025 to 2035, expect to see market evolution with AI-powered personalized nutrition emerging, precision fermentation used to make dairy-free high-protein yogurts, block chain-enabled dairy supply chain transparency.

Implementing smart microbiome-enhanced yogurt formulations, AI-assisted demand forecasting, and enzyme-modified high-digestibility proteins will make products more appealing to consumers and ultimately offer them functional health benefits. Pending progress in lab-grown dairy proteins, AI-based taste customization, and intelligent packaging with real-time freshness tracking, will continue to reshape the industry.

Zero-waste yogurt production, AI-based gut health diagnostic systems, and carbon-neutral dairy farming will make inroads into market trends, promising a new era of sustainability, health benefits, and product innovation.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EFSA, and organic dairy certification standards. |

| Product Innovation | Use of Greek yogurt, dairy-based protein fortification, and natural probiotics. |

| Industry Adoption | Growth in fitness, weight management, and functional dairy markets. |

| Smart & AI-Enabled Solutions | Early adoption of automated dairy processing, AI-driven product development, and digitalized supply chain monitoring. |

| Market Competition | Dominated by dairy manufacturers, functional food brands, and protein supplement companies. |

| Market Growth Drivers | Demand fuelled by rising protein consumption, growing fitness trends, and increased consumer awareness of gut health. |

| Sustainability and Environmental Impact | Early adoption of biodegradable yogurt packaging, sustainable dairy farming, and reduced sugar formulations. |

| Integration of AI & Digitalization | Limited AI use in product development, retail analytics, and digital marketing. |

| Advancements in Manufacturing | Use of traditional dairy fermentation, manual quality control, and conventional packaging. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven nutrition tracking, block chain-backed dairy sourcing, and zero-carbon dairy production mandates. |

| Product Innovation | Adoption of precision-fermented protein yogurt, AI-assisted microbiome-personalized formulations, and bioengineered gut-friendly proteins. |

| Industry Adoption | Expansion into AI-driven personalized nutrition, smart packaging with real-time probiotic viability tracking, and precision dairy farming for protein enhancement. |

| Smart & AI-Enabled Solutions | Large-scale deployment of AI-powered probiotic strain optimization, block chain-backed dairy traceability, and predictive analytics for consumer health benefits. |

| Market Competition | Increased competition from AI-integrated nutrition startups, precision fermentation-based dairy alternatives, and personalized functional food developers. |

| Market Growth Drivers | Growth driven by AI-assisted real-time gut microbiome analysis, bioengineered high-digestibility proteins, and fully sustainable dairy and plant-based yogurt production. |

| Sustainability and Environmental Impact | Large-scale transition to zero-waste yogurt production, AI-optimized resource efficiency, and block chain-tracked carbon-neutral dairy and plant-based yogurt supply chains. |

| Integration of AI & Digitalization | AI-powered real-time gut microbiome analysis, automated smart yogurt dispensers, and block chain-backed farm-to-table transparency. |

| Advancements in Manufacturing | Evolution of lab-grown dairy proteins, AI-assisted fermentation process optimization, and fully biodegradable smart-packaging with freshness indicators. |

The USA has a significant share of the overall market for high protein yogurt as well, driven by increasing consumer interest in functional and nutrient-dense dairy products, rising awareness surrounding protein-rich diets, and the growing popularity of Greek and Icelandic-style yogurt types.

The market is being majorly driven by the growth of fit lifestyles and weight management trends. Further, innovations in dairy processing such as high-protein filtration methods and lactose-free formulations, are augmenting product portfolio. Addition of plant-based high-protein yogurt alternatives is also defining the industry trends as manufacturers are launching their vegan and dairy-free options.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.1% |

The market is propelled by a combination of factors, including an increasing demand for healthy snack options and growing adoption of protein-rich foods among fitness and health enthusiasts along with a growing interest in gut-friendly probiotic dairy products.

Trends in functional food and clean-label yogurt expand product diversity More and more consumers are concerned with sustainable packaging and ethical sourcing of the dairy used in the product. The increasing popularity of sugar-free, high-protein yogurt with enriched vitamins and minerals is also driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.6% |

Europe's high protein yogurt market is led by Germany, France and Netherlands, with a well-established dairy industry infrastructure, along with increasing demand for protein-enriched foods and popularity of high-protein diets, owing to muscle recovery and health & wellness like factors. Sustainable protein yogurt products and organic dairy farming are indeed being driven forward in the EU.

Moreover, the market innovation is motivated by advances in dairy fermentation techniques coupled with new combinations of flavours. Rising adoption of plant-based protein sources in yogurts formulations is another factor contributing to the market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.9% |

Consumer awareness and understanding of protein's importance in healthy aging is rising, along with the demand for probiotic-enriched dairy products, and functional food interest is also growing, making Japan's high protein yogurt market slightly more prosperous. Innovation in high-protein yogurt formulations is being facilitated by the country’s strength in precision fermentation and dairy innovation.

Yogurt products are also seeing the influence of the incorporation of collagen and other health-enhancing ingredients in their development. Industry trends are also being influenced by the growing popularity of portable yogurt drinks and single-serving packs of protein yogurt.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.5% |

The growing reliance of consumers on protein-enhanced functional foods, along with growing investment in dairy innovation in the market is projecting South Korea as the strongest-growing market for high protein yogurt. Inspiration: The demand for premium protein yogurt is being driven by the country’s influence on clean-label nutrition and high-quality dairy sourcing.

Other developments, such as developments in plant-based yogurt alternatives and sugar-free protein yogurt solutions, continue to bring variety to the category. The increasing influence of e-commerce and direct-to-consumer yogurt subscription services is also boosting market adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

Organic High Protein Yogurt Gains Momentum as Consumers Opt for Clean-Label, Sustainable Dairy Choices

Health-conscious consumers tend to choose clean-label, chemical-free, and environmentally sustainable food, which has resulted in the high growth of the Organic High Protein Yogurt segment. Typical yogurt is made using synthetic fertilizers, synthetic hormones, and genetically modified organisms (GMOs), whereas organic yogurt is not, making it a common choice for those who favour both the ethical and health conscious side of dietary trends.

Adoption has been driven by the rising demand for premium-quality organic dairy products, containing higher protein levels, gut-friendly probiotics, and lower environmental impact. Within the health-conscious demographic, more than 55% of consumers who purchase yogurt are specifically looking for organic-certified high-protein food products for meal replacement, post-workout supplementation and digestive support.

Real-time animal health monitoring, block chain-backed traceability, and automated organic compliance checks ensure consumer trust and transparency, all of which have stimulated greater adoption of AI-powered dairy farming technologies.

The organic high protein yogurt segment, despite its health benefits, ethical farming, and environmental responsibility, struggles with elevated production costs, limited supply chains, and time-consuming organic certification regulations.

Nonetheless, advancements in precision dairy farming, artificial-intelligence-led organic yield optimization, and eco-packaging solutions are enhancing functionality, affordability, and accessibility, ensuring a robust growth trajectory for organic high-protein yogurt globally.

Conventional High Protein Yogurt Maintains Strong Market Presence Due to Cost Efficiency and Mass Availability

The conventional high protein yogurt segment is responsible for the largest share of the market, especially when viewed on a mass-market, food service, and industrial dairy application basis. Conventional yogurt has the advantage of cheaper production, more efficient supply chains, and easier availability to a wider range of consumers compared to organic varieties.

The adoption has been driven by the growing demand for low-cost, protein-enriched dairy products with extended shelf life and mass-market appeal. According to studies, 70% of the main stream dairy consumers prefer consuming conventional high-protein yogurt as their daily consumption, breakfast meal pairings, and snack frustrations.

With the market active on both supply and demand side since high-efficiency dairy processing plants with automated yogurt culturing, high-speed protein fortifications and AI-driven quality control have sprung, steady supply and cost-effective production have become the industry has become an enormous opportunity.

Adoption has also been spurred by advances in dairy fermentation technologies including real-time monitoring of probiotic viability, AI-enhanced lactose optimization, and block chain-backed ingredient traceability to ensure optimal product consistency and nutritional integrity across batches.

Although it will dominate in terms of affordability and high-volumes, the Conventional High Protein Yogurt segment will be impeded by an increase in demand for cleaner-label options as well as the need to reduce additives of consumer concern, along with competition that is gaining alignment with organic dairy ingredients.

But new advances in clean-label development, AI-based dairy quality improvement and green packaging solution are raising consumer perception, product transparency and sustainability, to maintain the growth of regular high-protein yogurt on the market for decades to come.

Spoonable High Protein Yogurt Leads Market Demand as Consumers Seek Thick, Nutrient-Dense Dairy Alternatives

Thick texture, high levels of satiety, and versatility of consumption in meals are factors that gain Spoonable High Protein Yogurt a strong market foothold. A thick, protein-dense food typically eaten as part of a meal or a snack on the go, spoonable yogurt is a world away from its drinkable cousins.

Growing demand for Greek style, Icelandic and fortified spoonable yogurt varieties, with offers including increased protein per serving, probiotic-rich content, and a longer shelf life has led to adoption. More than 65% of high-protein yogurt-eaters prefer spoonable formats for breakfast, meal replacement and exercises recovery, studies show.

The growth of new spoonable yogurt formats with plant-based protein fortification, functional superfood inclusions as well as sugar-free options has bolstered market demand, generating higher product variety and consumer interest.

Innovations like real-time protein adjustment for yogurt or AI-augmented probiotic cultures are driving adoption in yogurt, while authentication through block chain technology ensures quality and trust with brands.

While there are benefits in terms of satiety, taste preference, and nutritional density, there are a number of factors which are also drawbacks of the Spoonable High Protein Yogurt segment; these include a higher per-unit bottleneck and production cost, as well as higher cooling needs and low portability.

Nonetheless, new developments with freeze-dried spoonable yogurt along with AI-controlled texture enhancement, and biodegradable single-serve types of packaging are optimizing efficiency, utility, and environmental sustainability, promising a trajectory of persistent expansion for spoonable high-protein yogurt across the globe.

Drinkable High Protein Yogurt Gains Popularity as On-the-Go Nutrition Becomes a Key Consumer Preference

The drinkable high protein yogurt category sees substantial demand from professionals with busy schedules, fitness-minded individuals, and health-oriented customers looking for on-the-go, protein-rich dairy drinks. Unlike traditional spoonable yogurt, drinkable yogurts are quickly consumed, easy to carry and offer a nutrient boost without a mealtime wait.

Growing demand for on-the-go consumption, high protein content on ready-to-drink dairy beverage products, introduce improved fluid characteristics, probiotic content, and functional ingredient mix has further facilitated the industry growth.

The introduction of new formulations of drinkable yogurt with plant-based protein, sugar-free, and high-fibre will contribute toward the growing demand in the market due to greater market penetration and the availability of broad range of products.

Moreover, the application of either smart technologies such as real-time tracking of survival of probiotics in beverages, AI-based refinement of mouthfeel, or block chain-based ingredient verification has also further facilitated adoption due to enhanced quality and consumer trust.

These are increasingly portable and convenient, as well as being hydrating in nature, but the drinkable high protein yogurt segment also faces drawbacks, including a shorter shelf life post-opening, higher packaging costs, and concerns over added sugars in some flavoured varieties.

But with new shelf-stable drinkable yogurt innovations, AI-driven ingredient balancing, and biodegradable bottle solutions it's making them more sustainable, accessible, and appealing to consumers, paving the way for continued worldwide drinkable high-protein yogurt market growth.

Some of the major factors driving the growth of the study are growing acceptance of high-protein dairy products, increasing health-conscious people, and the development of dairy processing techniques.

Thanks to increasingly used applications in food nutrition, weight management, and functional foods, the market is growing steadily. Two of the major trends impacting the industry include the advent of plant-based high-protein yogurts and clean label formulations combined with fortified yogurts with probiotics and other essential nutrients.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Danone S.A. | 12-16% |

| Chobani LLC | 10-14% |

| General Mills, Inc. (Yoplait) | 8-12% |

| FAGE International S.A. | 6-10% |

| Siggi’s Dairy | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Danone S.A. | Develops high-protein dairy and plant-based yogurts with probiotic and functional health benefits. |

| Chobani LLC | Specializes in Greek-style high-protein yogurts with natural and organic ingredient formulations. |

| General Mills, Inc. (Yoplait) | Offers fortified high-protein yogurts with added vitamins, minerals, and probiotics. |

| FAGE International S.A. | Focuses on strained Greek yogurt with high protein content and minimal sugar. |

| Siggi’s Dairy | Provides Icelandic-style skyr yogurt with high protein, low sugar, and clean-label ingredients. |

Key Company Insights

Danone S.A. (12-16%)

Danone leads in high-protein yogurt innovation, offering both dairy and plant-based alternatives with functional health benefits.

Chobani LLC (10-14%)

Chobani specializes in Greek-style high-protein yogurts, emphasizing organic and clean-label formulations.

General Mills, Inc. (Yoplait) (8-12%)

General Mills focuses on fortified high-protein yogurts, enhancing consumer nutrition with added probiotics and vitamins.

FAGE International S.A. (6-10%)

FAGE pioneers in strained Greek yogurts, maintaining high protein content with minimal sugar for health-conscious consumers.

Siggi’s Dairy (4-8%)

Siggi’s offers Icelandic-style skyr yogurts with high protein and low sugar, catering to clean-label product demand.

Other Key Players (45-55% Combined)

Several dairy and alternative dairy producers contribute to the expanding High Protein Yogurt Market. These include:

The overall market size for the high protein yogurt market was USD 41,903.4 million in 2025.

The high protein yogurt market is expected to reach USD 80,902.4 million in 2035.

The demand for high protein yogurt will be driven by increasing consumer preference for protein-rich and functional foods, rising adoption of high-protein diets among fitness enthusiasts, growing popularity of plant-based and dairy-free protein yogurts, and advancements in probiotic and gut health-focused formulations.

The top 5 countries driving the development of the high protein yogurt market are the USA, Germany, China, France, and Canada.

The Conventional High Protein Yogurt is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 22: North America Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 32: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 34: Latin America Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 42: Western Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: Western Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 46: Western Europe Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Western Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 52: Eastern Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: Eastern Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 56: Eastern Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 58: Eastern Europe Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Eastern Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 76: East Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 78: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 80: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 82: East Asia Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 84: East Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 88: Middle East and Africa Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 90: Middle East and Africa Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 92: Middle East and Africa Market Volume (MT) Forecast by Source, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 94: Middle East and Africa Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 96: Middle East and Africa Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 12: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 20: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 24: Global Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Nature, 2023 to 2033

Figure 32: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 33: Global Market Attractiveness by Source, 2023 to 2033

Figure 34: Global Market Attractiveness by Flavor, 2023 to 2033

Figure 35: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 48: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 52: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 56: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 60: North America Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: North America Market Attractiveness by Nature, 2023 to 2033

Figure 68: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 69: North America Market Attractiveness by Source, 2023 to 2033

Figure 70: North America Market Attractiveness by Flavor, 2023 to 2033

Figure 71: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 84: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 88: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 92: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 96: Latin America Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Flavor, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 120: Western Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 124: Western Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 128: Western Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 132: Western Europe Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Western Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Nature, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by Flavor, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 156: Eastern Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 160: Eastern Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 164: Eastern Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 168: Eastern Europe Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: Eastern Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Nature, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by Flavor, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by Flavor, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 228: East Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 232: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 236: East Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 240: East Asia Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 244: East Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 247: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 249: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 250: East Asia Market Attractiveness by Flavor, 2023 to 2033

Figure 251: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Flavor, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High-Protein Plant-Based Cheese Alternatives in the EU Analysis Size and Share Forecast Outlook 2025 to 2035

High-Protein Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Protein Dog Food Market Analysis - Size, Share & Forecast 2025 to 2035

High Protein Flour Market Analysis – Size, Share & Forecast 2024-2034

High Protein Cat Food Market

Demand for Textured Pea for High Protein Savory in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Textured Wheat Systems for High-protein Savory in the EU Size and Share Forecast Outlook 2025 to 2035

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Purity Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA