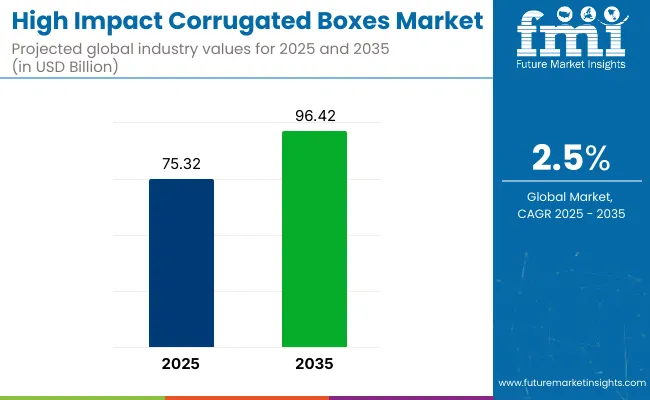

The global high impact corrugated boxes market is valued at USD 75.32 billion in 2025 and is anticipated to be worth USD 96.42 billion by 2035, reflecting a CAGR of 2.5% over the forecast period. This expansion is supported by growing demand for robust and sustainable packaging across various industries, including e-commerce, food and beverages, electronics, and automotive parts.

The need for impact-resistant solutions during transit and last-mile delivery is increasingly being emphasized, particularly due to the rise of online retail activities and evolving consumer preferences for environmentally responsible materials.

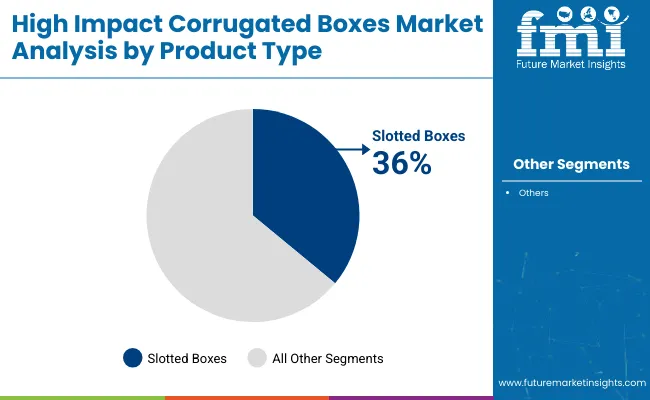

Government mandates and energy-efficiency incentives have been encouraging upgrades to packaging equipment across corrugated box manufacturing lines. The slotted box format is projected to lead the application segment due to its structural versatility and ease of use. Moreover, a transition toward smart, automated corrugation systems, particularly within mid-sized production environments, is accelerating market expansion, driven by the need for flexible, eco-friendly packaging solutions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 75.32 billion |

| Forecast Value (2035) | USD 96.42 billion |

| Forecast CAGR (2025 to 2035) | 2.5% |

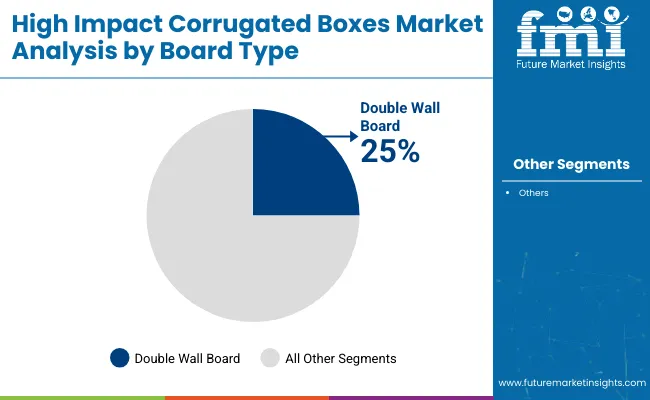

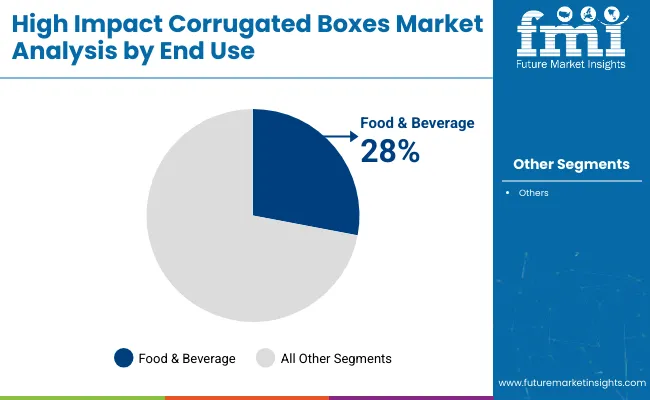

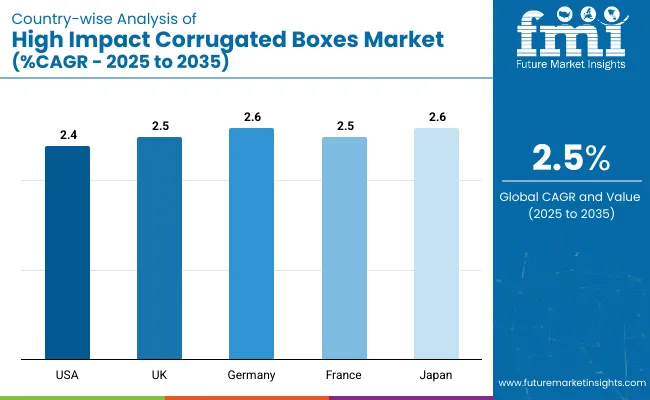

Germany and Japan are projected to be the fastest-growing countries with a CAGR of 2.6% through 2035. Slotted boxes are set to dominate the product type segment with a 36% market share in 2025, while double wall boards will lead the board type category with 25%. The food and beverage sector will account for 28% of global demand. The USA and the UK are also expected to witness growth, with CAGRs of 2.4% and 2.5%, respectively. International Paper is anticipated to remain the leading supplier.

The market is segmented into product type, board type, end use, and region. By product type the market is divided into slotted box, folder box, telescope box, and die cut box. Based on board type, the market is categorized into single face board, single wall board, double wall board, and triple wall board.

In terms of end use, the market is segmented into food & beverage, electrical & electronics, homecare, automotive & allied industries, healthcare, personal care & cosmetics, and other industries (textiles & apparel, furniture, toys & sporting goods, and industrial equipment). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

Slotted boxes are projected to lead the product type segment, accounting for 36% of the global market share by 2025. These boxes have been considered the most cost-effective and structurally reliable choice, making them highly preferred by manufacturers across e-commerce, food & beverage, and electronics sectors.

The double wall board segment is expected to lead the market, securing 25% of the global market share by 2025. Known for its exceptional strength and durability, this board type is widely adopted for packaging heavy-duty, fragile, or high-value goods across various industries, including electronics, automotive, and industrial equipment.

The food and beverage segment is anticipated to be led by the end-use category, capturing 28% of the global market share in 2025. This leadership is driven by the constant demand for safe, durable, and hygienic packaging to protect perishable and processed food products during storage and transportation.

The high impact corrugated boxes market is experiencing steady growth, driven by increasing demand for durable and compliant packaging solutions, material-efficient manufacturing practices, and continuous advancements in automated box production technologies.

Recent Trends in the High Impact Corrugated Boxes Market

Challenges in the High Impact Corrugated Boxes Market

The USA high impact corrugated boxes market is expected to grow at a CAGR of 2.4% from 2025 to 2035. This steady growth is being supported by the expansion of e-commerce, demand for robust packaging in FMCG and electronics, and the nation’s increasing preference for recyclable and impact-resistant packaging formats across various industries.

The UK high impact corrugated boxes market is projected to expand at a CAGR of 2.5% during the forecast period. Increased regulatory pressure on plastic reduction, along with the country’s commitment to carbon-neutral packaging, has boosted demand for corrugated solutions, particularly in retail, food, and healthcare applications that require both durability and regulation-friendly materials.

Germany’s high impact corrugated boxes market is forecasted to grow at a CAGR of 2.6% from 2025 to 2035. As a manufacturing and logistics hub, the country has embraced recyclable corrugated solutions in industrial packaging, supported by stringent EU directives and strong demand from the automotive and electronics sectors.

Sales in the high impact corrugated boxes market in France are anticipated to grow at a CAGR of 2.5% over the forecast period. The emphasis on sustainable material sourcing and consumer goods protection has strengthened the adoption of corrugated boxes across retail and logistics channels. French packaging firms are also investing in biodegradable coatings and digital printing to enhance product appeal and performance.

Japan’s high impact corrugated boxes market is set to expand at a CAGR of 2.6% through 2035. With a highly developed manufacturing economy, the country continues to rely on precision-engineered corrugated packaging for electronics, automotive parts, and high-value goods. Compact packaging design are increasingly being prioritized in local production strategies.

The high impact corrugated boxes market is moderately consolidated, with several global leaders holding significant shares while regional and niche players continue to innovate. Competitive dynamics are shaped by pricing strategies, technological advancements in smart and automated packaging, strategic plant expansions, and mergers or partnerships to enhance footprint and capabilities.

Tier-one firms, such as International Paper, WestRock (now Smurfit Kappa), DS Smith, Georgia-Pacific, and Oji Holdings, are competing through large-scale investments in high tech manufacturing facilities, innovative eco-friendly product lines, and targeted acquisitions. They are scaling automation in box plants and forming partnerships with logistics and retail companies to secure long-term supply agreements.

Recent High Impact Corrugated Boxes Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 75.32 billion |

| Projected Market Size (2035) | USD 96.42 billion |

| CAGR (2025 to 2035) | 2.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in metric tons |

| By Product Type | Slotted Box, Folder Box, Telescope Box, and Die Cut Box |

| By Board Type | Single Face Board, Single Wall Board, Double Wall Board, and Triple Wall Board |

| By End Use | Food & Beverage, Electrical & Electronics, Homecare, Automotive & Allied Industries, Healthcare, Personal Care & Cosmetics, Other Industries (Textiles & Apparel, Furniture, Toys & Sporting Goods, and Industrial Equipment) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | International Paper, D.S. Smith Plc, Oji Holdings Corporation, Georgia-Pacific LLC, WestRock Company, Elson International LLC, Aero Box LLC, Stamar Packaging Company Pvt. Ltd., Albert Paper Products Co., Associated Sales & Bag Company |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The market is expected to reach USD 96.42 billion by 2035.

The global market is projected to grow at a CAGR of 2.5% during this period.

Slotted boxes are expected to lead with a 36% market share in 2025.

Double wall board is expected to hold a 25% share of the market in 2025.

Germany and Japan are anticipated to be the fastest-growing markets with a CAGR of 2.6% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA