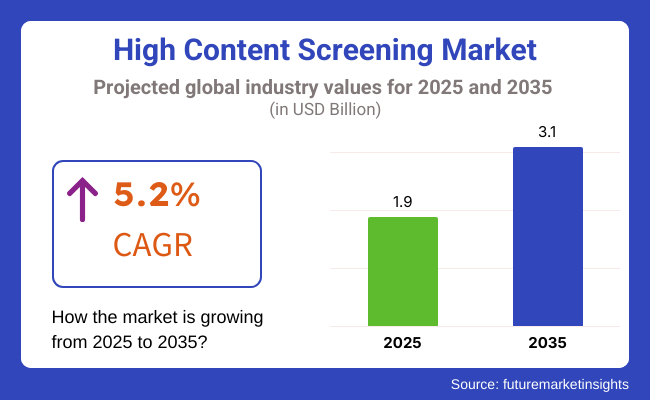

The global high content screening (HCS) market is projected to expand steadily, growing from USD 1.9 billion in 2025 to USD 3.1 billion by 2035, at a CAGR of 5.2%. The 2024 valuation stood at USD 1.84 billion. This sustained growth is attributed to increased adoption of image-based drug discovery, phenotypic screening, and precision oncology platforms in early-stage translational research and preclinical trials.

HCS platforms, combining advanced fluorescence microscopy and automated image analysis, enable high-throughput profiling of drug candidates across diverse therapeutic areas, including oncology, neurology, and infectious diseases. A 2023 study published in Nature Methods revealed that AI-powered HCS systems can reduce screening time by up to 30% while improving image fidelity and consistency. This efficiency gain is vital for pharmaceutical R&D, where time-to-market and data reproducibility are critical KPIs.

Key players such as Thermo Fisher Scientific, PerkinElmer, BD Biosciences, and Yokogawa Electric Corporation are introducing integrated HCS instruments supporting 3D cell cultures, label-free imaging, and cloud-native data workflows. These innovations aim to meet stringent regulatory compliance, support multiplexed assays, and align with Good Laboratory Practice (GLP) guidelines.

In a Q3 2023 investor update, Jennifer Cannon, President of Commercial Operations at Thermo Fisher, emphasized the company's direction: “Accelerating biologics development through automation, speed-to-market, and simplified workflows” (Thermo Fisher Investor News)-positioning HCS as a strategic pillar in modern drug discovery and biotech innovation. North America leads the global HCS market, accounting for over 40% of total revenue.

Growth is supported by the presence of leading biopharmaceutical companies, NIH-funded research consortia, and the early deployment of AI-integrated screening technologies in clinical and academic settings. Partnerships between contract research organizations (CROs) and tech developers have further boosted regional momentum.

Europe follows, driven by strategic funding from the Horizon Europe framework and precision medicine mandates in Germany, France, and the United Kingdom. Projects such as the European Open Science Cloud (EOSC) and Innovative Medicines Initiative (IMI2) have strengthened public-private collaborations, encouraging broader adoption of high-throughput cell imaging platforms and predictive toxicology tools across both research institutions and clinical labs.

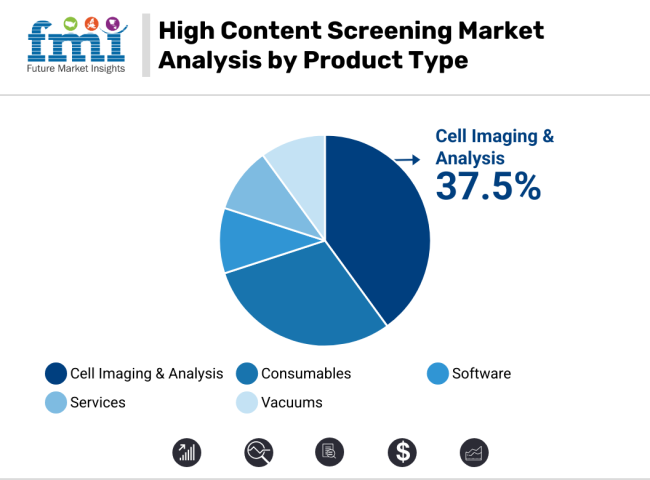

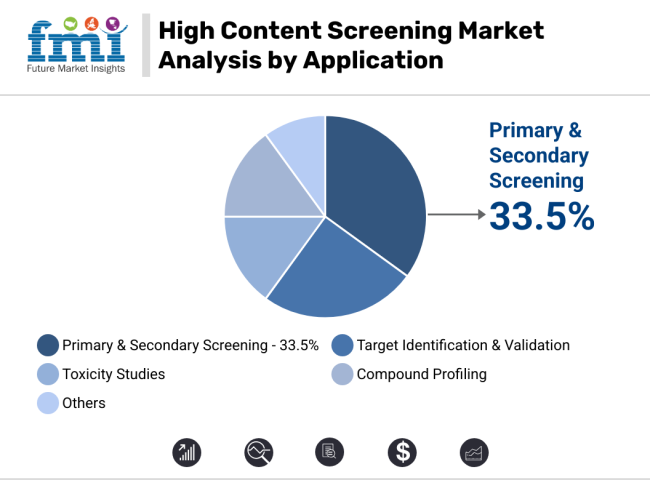

The high content screening market is driven by strong demand for cell imaging systems and early-phase screening tools. Cell imaging leads with 37.5% share due to AI integration and regulatory readiness, while primary and secondary screening dominate applications, fueled by drug discovery needs, Tox21 compliance, and CRO adoption trends.

The cell imaging systems segment is projected to account for 37.5% of total high content screening market revenue in 2025, underscoring its critical role in multiplexed cellular imaging workflows. These systems enable real-time visualization of dynamic biological phenomena such as mitosis, apoptosis, and intracellular trafficking, forming the technological core of HCS platforms.

Advancements in AI-driven image analytics, automated fluorescence capture, and cloud-integrated data storage are driving adoption across both academic research and commercial drug development. As demand for phenotypic profiling and precision medicine escalates-especially in oncology, neurology, and infectious disease pipelines-vendors are tailoring systems for GLP-compliant, scalable deployment. The segment is poised to grow at a 5% CAGR through 2035, with increasing utility in regulatory-grade screening environments and biopharmaceutical R&D settings.

Primary and secondary screening applications are set to command 33.5% of total HCS revenue in 2025, cementing their role in early-phase drug discovery and preclinical safety validation. These assays facilitate rapid analysis of large compound libraries to evaluate toxicity, target engagement, and phenotypic response. Their effectiveness has increased with the integration of 3D spheroid models, organoids, and co-culture systems, allowing more predictive insights for translational research.

Regulatory frameworks such as the FDA’s Tox21 program have elevated HCS as a preferred method for in vitro safety profiling. Concurrently, the rising trend of outsourcing in biotech has prompted contract research organizations (CROs) to adopt flexible, multi-assay high-content screening (HCS) platforms that enable high-throughput hit validation and lead optimization across oncology, immunology, and central nervous system (CNS) drug pipelines.

The HCS market is growing due to AI integration, rising precision medicine investments, and demand for 3D imaging tools. Challenges include cost barriers, data complexity, and regulatory gaps. Opportunities lie in cloud-based platforms, CRO partnerships, and growth in the Asia Pacific. Trends show a clear shift toward automation, CRISPR integration, and predictive analytics.

Rising demand for advanced tools is driving adoption

Growth is being propelled by the increasing reliance on image-based drug discovery and phenotypic screening in early-stage R&D. Enhanced AI-integrated HCS platforms have enabled faster data analysis and higher reproducibility. The rising interest in precision oncology, particularly for immunotherapy and cell-based assays, has accelerated adoption. Regulatory support from initiatives like the FDA’s Tox21 program has increased demand for non-animal, high-throughput testing.

The availability of 3D cell culture models and multiplexed assays has further validated HCS as an essential tool. Additionally, expanding use in infectious disease research has created strong market momentum post-COVID, especially in pharmaceutical and academic labs across North America and Europe.

High deployment costs and complexity hinder scalability

High capital costs for system deployment have restricted access among small research labs and mid-sized biotech firms. The requirement for specialized image analysis expertise has slowed onboarding for inexperienced teams. Integration with legacy laboratory information management systems (LIMS) remains difficult in several settings. Regulatory variability across regions has delayed harmonized validation of HCS protocols. Data complexity, particularly in multi-dimensional readouts, has created bottlenecks in result interpretation.

Slow adoption in low-income countries has also widened the digital health gap. Vendor dependency for hardware and software updates has raised long-term total cost of ownership, limiting budget approvals in price-sensitive environments.

Cloud integration and CRO partnerships unlock new growth.

Growing interest in cloud-based bioinformatics platforms and AI-powered image analysis is creating new SaaS-based HCS models. Integration with organoid platforms and patient-derived xenografts (PDX) is opening doors for more predictive oncology research. Increased funding in personalized medicine from national governments and public-private partnerships is fostering deeper market penetration. Expansion in contract research organizations (CROs) is increasing demand for scalable HCS systems.

Pharmaceutical outsourcing trends are driving the need for regulatory-compliant, automation-ready platforms. Untapped demand across Asia-Pacific, especially in India and Southeast Asia, offers lucrative prospects. Advancements in label-free imaging and miniaturized assays are further enhancing market adaptability.

Automation and 3D models shape emerging market trends

The shift from 2D to 3D cell-based models is accelerating. AI and machine learning tools are increasingly embedded in HCS workflows to automate phenotypic classification. Rising use of high-throughput screening (HTS) for toxicology studies is being observed in compliance-heavy industries. Collaborative R&D models between pharma companies and academic research centers are expanding. Interest in cloud-native data storage and remote experiment monitoring is reshaping post-pandemic lab operations.

Automation of cell-based assays is improving reproducibility and throughput. Integration with CRISPR screening platforms is allowing real-time genome-wide functional analysis, aligning HCS with genomic medicine and target validation pipelines.

Future Market Insights provides an in-depth country-wise breakdown of the High Content Screening (HCS) market, highlighting growth driven by AI-based cellular imaging, rising investments in drug discovery, and advanced phenotypic screening applications. Major countries such as the United States, Japan, and South Korea are seeing strong demand, backed by public funding, technological advancements, and expanding pharmaceutical R&D.

The United States HCS market is projected to grow at a CAGR of 5.4% from 2025 to 2035. Demand is being driven by rising investments in drug discovery, expanding use of automated imaging, and the integration of AI in image analysis. NIH and BARDA collectively invest over USD 45 billion annually in life sciences, substantially increasing HCS platform deployment across phenotypic and toxicity screening. Institutions like the Broad Institute are accelerating platform adoption in oncology research.

Market leaders such as Thermo Fisher Scientific and Molecular Devices are embedding deep learning algorithms into high-throughput imaging systems, enhancing assay precision. Rising demand for 3D models and organ-on-a-chip platforms is also boosting sales in academic and commercial labs. Cloud-based imaging workflows and AI-powered analytics are enabling faster, more scalable screening operations across the United States.

The HCS market in the United Kingdom is forecast to grow at a CAGR of 5.1% from 2025 to 2035. Growth is supported by government funding for AI-based drug discovery and precision medicine initiatives. Organizations such as NHS and BBSRC are enabling the expansion of HCS systems in disease modeling and drug screening. Leading universities, including Cambridge and Oxford, are deploying platforms for CRISPR-based screening and high-throughput 3D imaging.

More than GBP 1 billion has been invested in life sciences by the government, supporting deeper collaborations between biotech firms and research institutions. Increased demand for automated phenotypic assays and multiplexed workflows is being driven by a growing ecosystem of small and mid-sized biotech firms. Sales of cloud-compatible HCS systems are also expanding, particularly in translational medicine and oncology research labs.

The European Union HCS market is anticipated to grow at a CAGR of 5.2% during the forecast period. Growth is driven by the EU’s Horizon Europe program, which has allocated EUR 95 billion toward scientific R&D and next-generation drug discovery. Countries such as Germany, France, and the Netherlands are leading in phenotypic screening using AI-assisted imaging and CRISPR-based technologies. Institutions including EMBL and Max Planck are advancing the field with 3D cellular modeling and organoid screening systems.

Adoption of robotics for reproducibility and GLP compliance is rising. Increasing demand for non-animal toxicology screening and regenerative medicine applications is expanding the market. High-throughput platforms tailored for gene editing, especially in stem cell research, are gaining traction in academic and pharmaceutical sectors across Europe.

The high content screening market in Japan is expected to grow at a CAGR of 5.3% from 2025 to 2035. Government funding totaling JPY 250 billion (~USD 1.8 billion) has been allocated toward biomedical research and drug discovery innovations. Key institutions such as RIKEN and Kyoto University are using HCS tools in stem cell differentiation and regenerative therapies. Pharmaceutical companies like Takeda and Astellas are investing in automated platforms for rapid compound screening and functional genomics. Integration of AI with microscopy has enhanced automated phenotypic classification and real-time analysis.

Demand for 3D cell models and cloud-integrated imaging systems is increasing. Japan’s robust ecosystem in iPSC technology, combined with regulatory focus on precision medicine, is creating a strong growth trajectory for HCS across preclinical and translational research spaces.

Demand for high content screening in South Korea is projected to grow at a CAGR of 5.4% between 2025 and 2035-The government has committed KRW 3 trillion (~USD 2.3 billion) to life sciences and biopharma innovation, significantly boosting HCS demand. Institutions like KAIST and POSTECH are pioneering AI-based HCS technologies, optimizing cellular analysis and drug screening. Market players such as Samsung Biologics and Celltrion are adopting high-throughput imaging systems for lead identification and safety validation.

Expansion of organ-on-a-chip applications and 3D cell models is advancing early-stage toxicity profiling. Rising demand for cloud-enabled, automation-compatible screening solutions is accelerating adoption in biotech clusters and CRO environments. South Korea’s market is rapidly scaling in response to global pharmaceutical outsourcing and next-gen screening requirements.

The high content screening market displays moderate concentration, with Tier 1 companies maintaining a dominant global presence. Market entry is restricted by high capital investment, regulatory complexity, and the need for advanced imaging and data analytics capabilities. Compliance with FDA, GLP, and OECD standards is essential for system validation and adoption.

Tier 1 players such as Thermo Fisher Scientific, Danaher Corporation, and PerkinElmer Inc. lead with integrated platforms combining automation, AI-powered image analysis, and cloud-enabled data management. Thermo Fisher’s 2024 launch of the Iliad™ Transmission Electron Microscope exemplifies its innovation strategy focused on multimodal, high-resolution cell imaging.

Tier 2 firms including BD, GE Healthcare, Olympus, and Merck KGaA focus on diagnostic imaging and regional customization, targeting clinical and academic research needs. Tier 3 players such as Yokogawa, Sysmex, and BioTek Instruments Inc. offer niche solutions. Yokogawa’s 2024 release of the Cell Voyager CQ3000 supports fast 3D imaging in drug screening workflows. Key strategies across tiers include product innovation, regional expansion, and AI integration. Strategic collaborations and CRO partnerships are also rising to support scalable HCS adoption. High R&D costs and the need for skilled personnel further limit new market entrants.

Recent High Content Screening Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.9 billion |

| Projected Market Size (2035) | USD 3.1 billion |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Products Analyzed (Segment 1) | Cell Imaging & Analysis, Consumables, Software, Services, Vacuums |

| Industries Analyzed (Segment 2) | Pharmaceutical & Healthcare, Biotechnology, Educational Institutions, Independent CRO, Government Organizations, Others |

| Applications Analyzed (Segment 3) | Primary & Secondary Screening, Target Identification & Validation, Toxicity Studies, Compound Profiling, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Companies Profiled | Thermo Fisher Scientific Inc., Becton, Dickinson and Company, GE Healthcare, Olympus Corporation, PerkinElmer Inc., Sysmex Corporation, Merck KGaA , Danaher Corporation, Yokogawa Electric Corporation, BioTek Instruments Inc. |

| Additional Attributes | FMI provides segment-wise dollar sales from 2020 to 2035, growth variance across applications and industries, competitive share benchmarking for top 10 players, pricing intelligence by product category, opportunity analysis for underpenetrated regional markets, import-export trade dynamics, and investment feasibility for emerging players and CRO-focused models. |

The overall High Content Screening Market was USD 1.9 billion in 2025.

High Content Screening Market value is predicted to reach USD 3.1 billion by 2035.

The growth of the High content screening market can be attributed to the increasing drug discovery activities, increasing adoption in pharmaceutical and biotech research, advances in imaging technology, and the demand for efficient cell analysis in toxicity studies and precision medicine development.

High Content Screening Market is driven by IOT and AI in USA, UK, Europe EU, Japan and South Korea.

Healthcare and Biotechnology to have the largest share in the evaluation period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Industry, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Industry, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Industry, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Industry, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Industry, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Industry, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Industry, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

High Purity Carbonyl Iron Powder (CIP) Market Size and Share Forecast Outlook 2025 to 2035

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

High Frequency Chest-Wall Oscillation Devices Market Size and Share Forecast Outlook 2025 to 2035

High-purity Fluoropolymer Valves Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Pharmaceutical Packaging Films for Blister Market Size and Share Forecast Outlook 2025 to 2035

High Current Ion Implanter Market Size and Share Forecast Outlook 2025 to 2035

High Rate Discharge Test Machine Market Size and Share Forecast Outlook 2025 to 2035

High-precision Confocal Sensor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Carbon Fiber Precursor Market Size and Share Forecast Outlook 2025 to 2035

High Heat Waste Packaging Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

High-power Objective Lens Market Size and Share Forecast Outlook 2025 to 2035

High Purity PFA Resins Market Size and Share Forecast Outlook 2025 to 2035

High Purity Mullite Powder Market Size and Share Forecast Outlook 2025 to 2035

High Precision Heavy Load Bearings Market Size and Share Forecast Outlook 2025 to 2035

High Performance Mercury Sorbent Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA