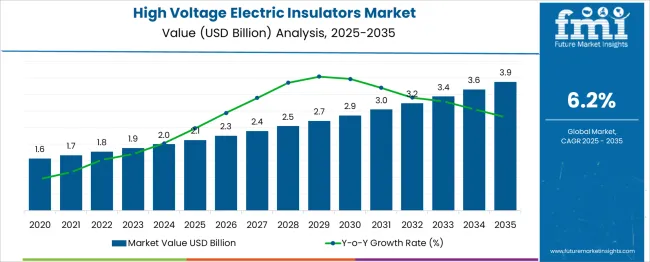

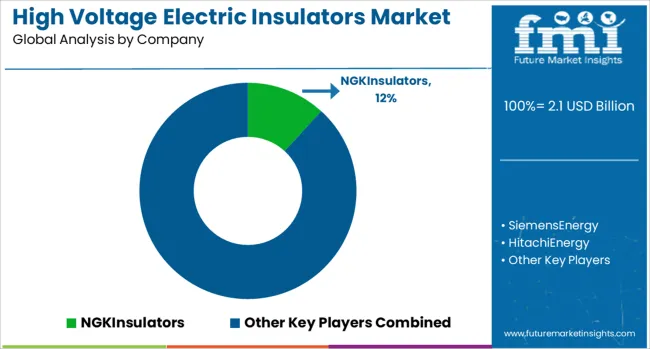

The High Voltage Electric Insulators Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

Year‑on‑year absolute growth fluctuates between USD 0.1 billion and 0.3 billion, while percentage gains swing from 3.4 % to 9.5 %, yielding a 6.4 % mean YOY increase and a 1.9 percentage-point standard deviation (a 29 % coefficient of variation).

Early‑period surges of 9.5 % (2026) and 8.0 % (2029) coincide with intensified grid-reinforcement efforts and post-pandemic stimulus in power infrastructure, whereas mid‑cycle dips to 4.2 %–4.3 % (2027–2028) align with project commissioning gaps and inventory adjustments. A renewed uptick above 7.0 % (2030, 2035) corresponds with ultra‑high‑voltage line rollouts and renewable interconnection mandates. Annual increments grow from USD 0.1 billion in trough years to USD 0.3 billion at peak, confirming gradual acceleration as utilities phase in advanced composite insulators for higher voltage classes.

The volatility profile suggests manufacturers should employ flexible capacity strategies, smoothing production during mid‑cycle plateaus while scaling rapidly during peak commissioning waves. Precise inventory alignment with EPC project pipelines and targeted R&D in hybrid polymer-ceramic formulations will optimize margins and secure long‑term supply agreements under evolving transmission standards.

| Metric | Value |

|---|---|

| High Voltage Electric Insulators Market Estimated Value in (2025 E) | USD 2.1 billion |

| High Voltage Electric Insulators Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The high‑voltage electric insulators market retains a focused yet influential position within several grid‑related parent segments. In the power transmission and distribution equipment space, 7 % of annual outlays is attributed to insulators because these devices remain standard on overhead lines, transformers, and switchgear bushings. Within the high‑voltage electrical components category, 11 % of expenditure is captured by insulators, as circuit breakers, surge arresters, and disconnectors are accompanied by insulated interfaces in every kV class above 66 kV. Substation infrastructure and grid hardware spending allocates 9 % to this product group, indicating the need for reliable clearance and creepage distances around energized conductors.

The electrical insulation materials market, which also includes tapes, composites, and liquids, assigns 5 % to rigid porcelain and polymer units that endure harsh outdoor service. Energy infrastructure reliability and protection budgets dedicate 4 % to high‑voltage insulators because outage‑prevention strategies are structured around insulation integrity paired with fault detection and surge mitigation.

Although the percentages appear modest, grid expansion, voltage‑uprating projects, and increasing renewable injections are accelerating replacement cycles. Polymer housings, hydrophobic coatings, and composite cores are being adopted to cut weight, curb maintenance, and extend service life, reinforcing the strategic role of high‑voltage insulators in modern power networks.

The high voltage electric insulators market is gaining traction as the global energy landscape undergoes a significant shift towards grid resilience, renewable integration, and long-distance power transmission. The push for modernizing electrical infrastructure has led to increased investments in high-voltage and ultra-high-voltage networks, particularly in regions with aging grids and expanding renewable energy corridors.

This trend has accelerated demand for advanced insulators that ensure mechanical durability, electrical strength, and environmental resistance. Industry stakeholders are increasingly adopting insulators that provide improved reliability and performance under extreme operational conditions, driven by regulatory pressure to reduce outage frequency and improve grid efficiency.

Innovations in insulation technology, coupled with rising demand for electricity in urban and industrial zones, are contributing to long-term market expansion. Furthermore, collaborative efforts between transmission operators, material science developers, and grid equipment manufacturers are paving the way for durable, cost-effective insulator solutions that meet evolving power system demands across emerging and developed economies.

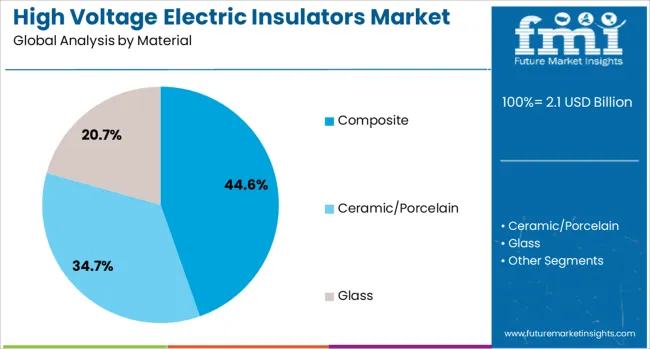

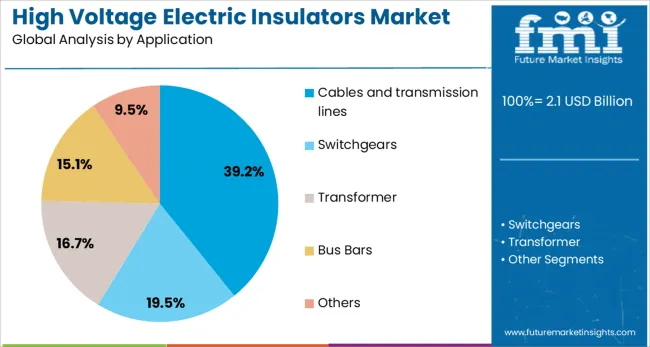

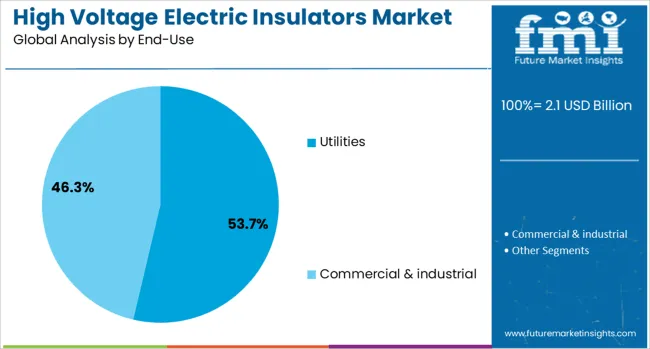

The high voltage electric insulators market is segmented by material, application, end-use, rating, installation, and geographic regions. The high voltage electric insulators market is divided by material into Composite, Ceramic/Porcelain, and Glass. In terms of application, the high voltage electric insulators market is classified into Cables and transmission lines, Switchgears, Transformers, Bus Bars, and Others. The high voltage electric insulators market is segmented based on end-use into Utilities and Commercial & Industrial. The high voltage electric insulators market is segmented into > 220 kV to ≤ 400 kV, > 145 kV to ≤ 220 kV, > 400 kV to ≤ 800 kV, > 800 kV to ≤ 1,200 kV, and > 1,200 kV. By installation of the high voltage electric insulators, the market is segmented into Transmission, Distribution, Substation, Railways, and Others. Regionally, the high voltage electric insulators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The composite segment is expected to account for 44.6% of the total revenue share in the high voltage electric insulators market by 2025, emerging as the leading material category. This dominance is attributed to the superior mechanical strength, lighter weight, and enhanced resistance to environmental stress offered by composite insulators.

Their adoption has been encouraged by the need for insulators that can operate reliably under conditions of high pollution, humidity, and temperature variation. Unlike traditional ceramic or glass counterparts, composite materials have enabled easier installation and reduced structural load on towers and poles, particularly in high-altitude and coastal regions.

The segment’s growth is also being influenced by advancements in polymer technology, which have improved hydrophobicity and minimized leakage currents, enhancing long-term performance. Utilities and transmission companies have increasingly favored composite insulators for retrofitting existing infrastructure and deploying new transmission lines, reflecting a broader shift towards lightweight and low-maintenance solutions in the global power grid.

The cables and transmission lines segment is projected to hold 39.2% of the total revenue share in the high voltage electric insulators market by 2025. The segment’s growth is being fueled by the expanding network of high-voltage transmission systems designed to meet the rising global electricity demand and integrate renewable energy sources across long distances.

Insulators used in cables and transmission lines are required to endure high mechanical stress and maintain dielectric integrity under fluctuating load conditions, especially in cross-country and inter-regional power transfer applications. The increasing focus on grid reliability and reduction of transmission losses has led to the deployment of advanced insulator systems that support longer spans, higher voltages, and reduced line sag.

Utilities and grid operators are leveraging software-defined monitoring and predictive maintenance techniques to optimize the lifespan of insulators installed along transmission corridors, which has elevated demand for materials and designs specifically tailored for cable and line configurations.

The utilities segment is expected to represent 53.7% of the total revenue share in the high voltage electric insulators market by 2025, positioning it as the most dominant end-use sector. The segment's prominence is supported by the extensive investment in transmission and distribution infrastructure upgrades by public and private utility providers.

With rising electricity consumption and increased penetration of distributed energy resources, utilities are under pressure to enhance grid resilience and operational efficiency. High voltage insulators are playing a critical role in this transformation by enabling the safe and efficient transfer of power over long distances, minimizing leakage currents, and preventing flashovers in harsh operating environments.

The utilities sector has also prioritized the adoption of maintenance-free and high-performance insulators to reduce operational costs and unplanned downtimes. Strategic grid expansion initiatives, coupled with regulatory compliance on grid safety and sustainability, are further accelerating the use of advanced insulators across utility-scale transmission networks.

High voltage electric insulators are being deployed to ensure reliable insulation and structural support in transmission lines, substations, and distribution installations. Applications include glass, porcelain, and composite insulator types selected for dielectric strength and environmental resilience. Growth has been observed across power utility networks, renewable energy interconnections, and industrial installations. Manufacturers offering high-performance materials, pollution-resistant finishes, and long-term reliability certifications are positioned to serve this critical infrastructure sector.

High voltage insulators have been specified to withstand extreme environmental conditions such as salt fog, pollution and UV exposure while maintaining dielectric integrity. Composite materials with silicone or epoxy housings have been utilised for their hydrophobic surfaces which reduce contamination‑related leakage. Insulator designs featuring optimized creepage distances and graded stress profiles have improved performance across high-pollution corridors and coastal installations. Asset networks have benefitted from reduced outage incidents and lower inspection requirements when premium-grade insulators have been deployed. Utilities have adopted certified long-term performance ratings to ensure maintenance intervals can be extended without compromising safety or electrical separation. As grid expansion and renewable energy integration continue, demand for reliable high voltage insulators has increased steadily.

Practical deployment of high voltage insulators has been limited by the need for standards-compliant materials and site-specific design adaptation. Selection of insulator type must match voltage class, mechanical load and environmental severity, complicating procurement. Certification under IEC and ANSI standards has required comprehensive testing for dielectric, mechanical and thermal performance, which adds lead time and cost. Composite insulator aging and material degradation under constant electrical stress may reduce service life if poor material quality is selected. Installation precision around torque specifications and alignment is critical to avoid premature stress or flashover risk. Replacement of aging insulators in existing grid assets is often delayed due to outage planning and logistical constraints. As market requirements for tailored insulator variants have expanded, scalability has been restricted for standard product lines.

Demand has been stimulated by growth in prefabricated substation modules where insulators are preinstalled with switchgear to reduce on-site assembly time. Offshore wind farm projects have required specialized insulator configurations for sea‑water resistance and mechanical loading. Hybrid power systems combining solar, wind, and storage have driven need for compact insulator solutions suited to microgrid switchyards. Electrification of rail networks and industrial plants has opened avenues for medium‑voltage composite insulators in harsh operating environments. Partnerships with EPC firms for turnkey substation packages have created recurring procurement opportunities. Innovations in recyclable ceramic formulations are under exploration to lower lifecycle impact while maintaining performance in diverse climates.

Composite insulators featuring silicone housings and fiber‑reinforced cores are increasingly adopted to capitalize on lightweight handling and self‑cleaning surface properties. Designs with integrated sensors for real‑time condition monitoring have been introduced to detect leakage current, temperature rise, and partial discharge. Automated inspection using drones with infrared and ultraviolet imaging is being applied to assess insulator health without manual climbing. Development of nano‑enhanced coating technologies has aimed to improve hydrophobicity and resistance to surface degradation. Standardized modular designs are being released to fit multiple voltage classes, reducing SKUs and simplifying supply chains. Digital twins of transmission assets are being created to simulate insulator performance under varying load and weather scenarios.

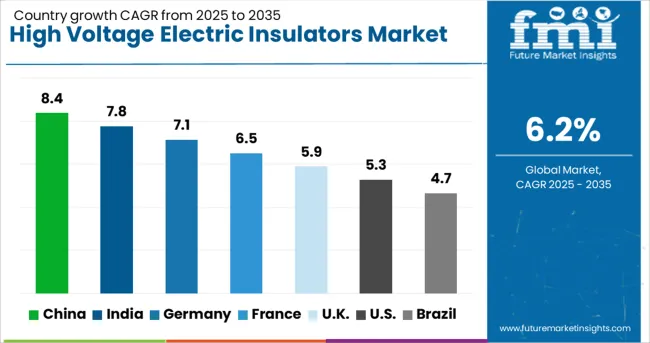

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The global high voltage electric insulators market is projected to grow at a 6.2% CAGR between 2025 and 2035. China leads at 8.4%, driven by transmission network upgrades and integration of renewable power generation. India follows with 7.8%, supported by substation expansion and grid modernization for rural electrification. Germany records 7.1%, influenced by high-performance insulator adoption in rail and offshore energy systems. France posts 6.5%, benefiting from smart grid deployment and upgrades in high-voltage lines. The United Kingdom grows at 5.9% as utilities prioritize grid resilience and high-capacity distribution infrastructure. The analysis includes insights from 40+ countries, with five highlighted below for reference.

India is expected to grow at 7.8% CAGR, supported by rapid electrification programs and grid extension projects under national energy policies. Demand is rising for composite insulators in transmission networks, driven by their superior contamination resistance and lightweight structure. Investments in renewable energy corridors and inter-state power transfer systems are creating significant opportunities for insulator deployment. Substation upgrades and installation of high-capacity transmission lines in challenging terrains require advanced polymeric designs. Local manufacturers are forming alliances with technology providers to supply insulators with improved hydrophobicity and longer service life.

China is forecast to post an 8.4% CAGR, driven by large-scale grid interconnection projects and expanding ultra-high-voltage (UHV) transmission lines. The country’s investments in inter-regional power transfer to integrate wind and solar capacity create strong demand for advanced insulators. High mechanical strength porcelain and polymer insulators dominate installations in overhead transmission and distribution networks. Manufacturers are focusing on mass production of hollow core composite insulators for UHV applications to reduce weight and improve performance under extreme weather conditions. Domestic suppliers are also increasing exports to Asia and Africa, supported by competitive pricing and state-backed financing.

Germany is projected to grow at 7.1% CAGR, supported by extensive grid reinforcement and offshore wind integration projects. High-voltage insulators are being deployed in submarine cable terminations, HVDC substations, and interconnector systems. Utilities are increasingly shifting toward composite insulators that provide enhanced performance under heavy pollution and saltwater exposure. Domestic manufacturers are innovating with silicone rubber materials for improved hydrophobicity and arc resistance. Regulatory mandates to minimize outage risks in high-density industrial zones further drive investments in advanced insulation technology. Export of high-specification insulators to neighboring European markets remains a consistent revenue stream.

France is forecast to grow at a 6.5% CAGR, fueled by the modernization of its high-voltage grid and adoption of smart energy infrastructure. Expansion of interconnection lines with neighboring countries and upgrades to existing substations increase demand for polymer-based insulators. Investments in offshore energy and regional transmission networks require insulators with improved mechanical and electrical properties. French utilities are prioritizing maintenance-friendly designs and insulators capable of operating in humid and saline environments. Local suppliers are developing hybrid insulators that combine mechanical strength with superior resistance to surface leakage and environmental stress.

The United Kingdom is expected to post a 5.9% CAGR, driven by the need for robust transmission networks supporting renewable integration and electric mobility. Utilities are investing in extra-high-voltage substations and interconnectors linking offshore energy sources to the main grid. Composite and polymer insulators dominate installations due to their light weight and superior performance in polluted environments. Adoption of condition-monitoring technologies for insulators in high-voltage corridors ensures predictive maintenance and minimizes outages. Partnerships between utilities and advanced material suppliers are fostering innovation in long-life, arc-resistant designs suitable for harsh operational conditions.

The high voltage electric insulators market is shaped by a mix of global manufacturers and regional specialists, including NGK Insulators, Siemens Energy, Hitachi Energy, Hubbell, Sediver, Aditya Birla Insulators, CYG Insulator, PFISTERER, and Deccan Enterprises. NGK Insulators leads with its advanced ceramic and composite insulator technologies, supported by extensive R&D and a global footprint. Siemens Energy and Hitachi Energy emphasize integrated solutions combining insulators with grid automation and power management systems. Hubbell and Sediver focus on innovation in polymeric and glass insulators designed for high mechanical strength and contamination resistance. Aditya Birla Insulators and CYG Insulator strengthen their market presence through cost-effective products tailored for emerging markets, while PFISTERER and Deccan Enterprises specialize in customized insulator solutions for specific high-voltage applications. The market exhibits moderate entry barriers due to the need for stringent quality certifications, high capital investment, and technical expertise in materials science. Competitive advantage is driven by material innovation, manufacturing precision, durability under harsh environmental conditions, and compliance with IEC and ANSI standards. Increasing demand for smart grid infrastructure and renewable energy integration is encouraging product development focused on lightweight, high-performance insulators that improve grid reliability. Regional players such as LAPP Insulators, Newell Porcelain, and Olectra Greentech contribute to local supply chains and customization. Future competition will emphasize digital monitoring integration, longer service life, and eco-friendly manufacturing processes. Key performance indicators include dielectric strength, mechanical load capacity, and resistance to pollution and weathering, which collectively determine product selection in high-voltage power transmission and distribution projects worldwide.

In August 2024, at CIGRE 2024, Hitachi Energy unveiled two SF₆‑free high‑voltage circuit breakers, including a 550 kV unit and a 420 kV live‑tank breaker part of its EconiQ® portfolio for eco‑efficient insulation without greenhouse gases.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Material | Composite, Ceramic/Porcelain, and Glass |

| Application | Cables and transmission lines, Switchgears, Transformer, Bus Bars, and Others |

| End-Use | Utilities and Commercial & industrial |

| Rating | > 220 kV to ≤ 400 kV, > 145 kV to ≤ 220 kV, > 400 kV to ≤ 800 kV, > 800 kV to ≤ 1,200 kV, and > 1,200 kV |

| Installation | Transmission, Distribution, Substation, Railways, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NGKInsulators, SiemensEnergy, HitachiEnergy, Hubbell, Sediver, AdityaBirlaInsulators, CYGInsulator, PFISTERER, DeccanEnterprises, LAPPInsulators, NewellPorcelain, OlectraGreentech, GammaInsulators, DoubletreeSystems, PioneerPultrutechEngineering, SAAGridTechnology, WanxiePowerTechnology, MeisterInternational, and GIPRO |

| Additional Attributes | Dollar sales by insulator type (porcelain, glass, polymer/composite) and application (transmission lines, substations, distribution networks); demand driven by grid expansion, modernization, and renewable integration. Asia‑Pacific leads adoption due to rapid electrification, while Europe and North America focus on retrofits and smart grid resilience. Innovations include hybrid composite insulators, nanoparticle-enhanced polymers, and smart sensor-embedded units for condition monitoring and predictive maintenance. Environmental considerations include eco-friendly materials, long service life to minimize replacements, and compliance with pollution exposure regulations. |

The global high voltage electric insulators market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the high voltage electric insulators market is projected to reach USD 3.9 billion by 2035.

The high voltage electric insulators market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in high voltage electric insulators market are composite, ceramic/porcelain and glass.

In terms of application, cables and transmission lines segment to command 39.2% share in the high voltage electric insulators market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Automotive High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Capacitors Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Direct Current (HVDC) Capacitor Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Oil Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA