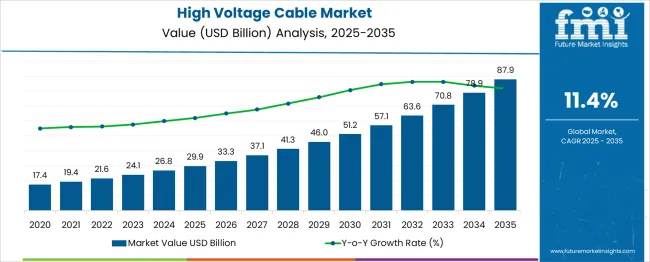

The High Voltage Cable Market is estimated to be valued at USD 29.9 billion in 2025 and is projected to reach USD 87.9 billion by 2035, registering a compound annual growth rate (CAGR) of 11.4% over the forecast period. A rolling CAGR analysis highlights significant phases of acceleration and steady expansion over the forecast period. Between 2025 and 2030, the market grows from USD 29.9 billion to USD 51.2 billion, contributing USD 21.3 billion in growth, with a CAGR of 13.3%. This phase experiences higher-than-average growth due to the increasing demand for high-voltage cables in power transmission and distribution, driven by growing urbanization, infrastructure development, and the global shift toward renewable energy sources.

The demand for high voltage cables is especially strong in emerging economies, where electrification projects are expanding rapidly. From 2030 to 2035, the market continues to grow, moving from USD 51.2 billion to USD 87.9 billion, contributing USD 36.7 billion in growth, with a slightly lower CAGR of 9.6%. This phase reflects the market's maturation, where growth stabilizes as the technology becomes more widespread and a larger portion of global infrastructure projects are completed. The overall rolling CAGR analysis indicates robust early-stage growth driven by new infrastructure investments, followed by a steady expansion phase as high voltage cable technology becomes an integral part of global energy networks.

| Metric | Value |

|---|---|

| High Voltage Cable Market Estimated Value in (2025 E) | USD 29.9 billion |

| High Voltage Cable Market Forecast Value in (2035 F) | USD 87.9 billion |

| Forecast CAGR (2025 to 2035) | 11.4% |

The high voltage cable market is expanding significantly, supported by global initiatives focused on upgrading power transmission networks and integrating renewable energy sources. The emphasis on reducing transmission losses and enhancing grid reliability has accelerated investments in advanced cable technologies capable of handling higher voltages and currents. Aging infrastructure in developed regions and rapid electrification in emerging economies are fueling the demand for cables that support long-distance, high-capacity power transfer.

Innovations in insulation materials and manufacturing processes have improved cable durability and safety, enabling their use in increasingly challenging environments. Regulatory frameworks encouraging underground cabling for urban and environmentally sensitive areas have further shaped market dynamics.

The integration of smart grid technologies and digital monitoring solutions complements the evolution of high voltage cables, optimizing operational efficiency. Moving forward, the market is expected to benefit from rising infrastructure development and the transition towards cleaner energy systems worldwide.

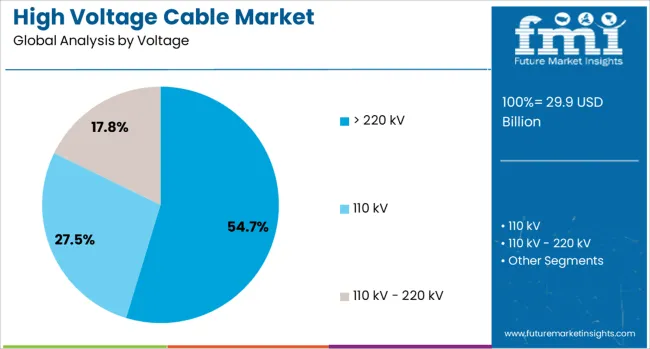

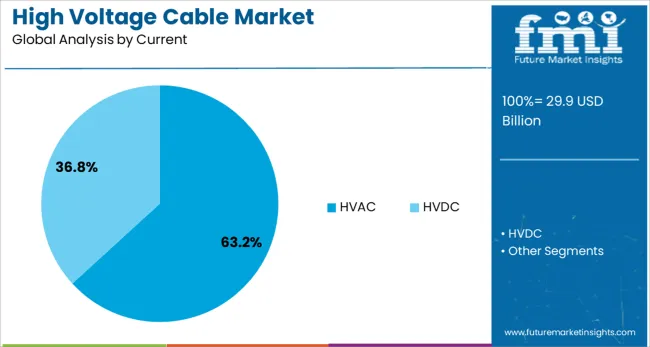

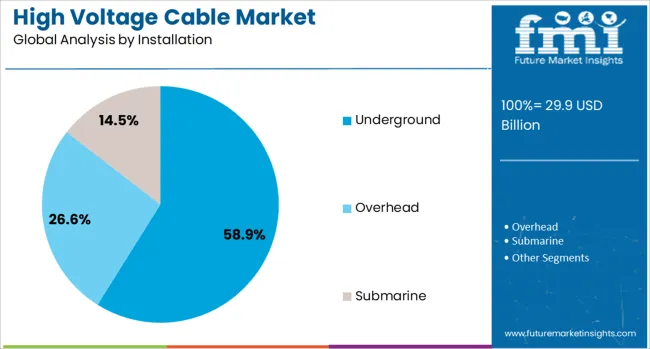

The high voltage cable market is segmented by voltage, current, installation, and geographic regions. By voltage, the high-voltage cable market is divided into > 220 kV and 110 kV - 220 kV. In terms of the current high voltage cable market, it is classified into HVAC and HVDC. Based on the installation of the high voltage cable, the market is segmented into Underground, Overhead, and Submarine. Regionally, the high voltage cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The voltage segment exceeding 220 kV is anticipated to capture 54.7% of the high voltage cable market revenue in 2025, reflecting its critical role in bulk power transmission across long distances. This segment's dominance is supported by the increasing need for high-capacity transmission lines to connect power generation sources such as renewables and thermal plants to load centers.

Cables operating above 220 kV provide the necessary insulation and mechanical strength to withstand higher electrical stresses and environmental factors. Their ability to minimize energy losses and maintain system stability has been a key factor driving their widespread adoption.

Technological advancements in conductor design and insulation materials have enhanced the performance and lifespan of cables in this category. Furthermore, the integration of these cables within expanding smart grid infrastructures supports efficient power management and fault detection, reinforcing their importance in modern power networks.

The HVAC current segment is projected to hold 63.2% revenue share in the high voltage cable market by 2025, primarily due to its widespread use in alternating current power transmission systems globally. HVAC cables offer advantages in terms of established infrastructure compatibility and cost-effectiveness for medium to high voltage applications.

Their operational reliability and maturity in design make them preferable for grid operators managing conventional and renewable energy integration. Advances in HVAC cable manufacturing, including improved conductor and insulation technologies, have enhanced their efficiency and thermal performance.

Additionally, the flexibility in installation and maintenance procedures associated with HVAC systems supports their continued preference in utility and industrial sectors. The ongoing evolution of HVAC technology to support higher voltages and increased load capacities is expected to sustain this segment’s growth in the foreseeable future.

The underground installation segment is forecasted to hold 58.9% share of the high voltage cable market revenue in 2025, driven by growing urbanization and environmental considerations. Underground cables are increasingly favored for their ability to reduce transmission losses, protect against weather-related disruptions, and minimize visual and land use impacts compared to overhead lines.

Regulatory policies promoting urban development and ecosystem preservation have accelerated the deployment of underground cabling systems. Technological improvements in cable materials and installation techniques have made underground cables more reliable and easier to maintain, addressing previous cost and accessibility challenges.

The segment’s expansion is also supported by heightened safety standards and increasing demand for resilient power infrastructure in densely populated and industrial areas. As smart city initiatives progress, underground cable installations are anticipated to become the backbone of modern, secure power networks.

The high voltage cable market is expanding due to the increasing demand for efficient, reliable power transmission over long distances. These cables are essential in the transmission of electricity from power plants to end-users, especially in industries and large infrastructure projects. With the growth of renewable energy integration, smart grid development, and urbanization, high voltage cables are playing a critical role in modern energy infrastructure. Despite challenges like high installation costs and technological complexities, opportunities are emerging with innovations in cable technology and growing global energy demands.

The growing demand for energy, particularly from renewable sources such as wind and solar, is driving the adoption of high voltage cables. These cables are critical for the transmission of electricity generated from renewable sources, especially when located far from urban centers. The shift toward renewable energy is increasing the need for long-distance transmission, further boosting the demand for high voltage cables. Urbanization and industrialization also play a role, as more cities and industries require reliable power distribution. The expansion of smart grid systems to enhance grid efficiency and reduce losses is another key factor contributing to the growing demand for high voltage cables.

The high voltage cable market faces several challenges, particularly the high installation costs involved in laying the cables. These cables are often installed underground or underwater, which increases both the complexity and expense of the process. Moreover, ensuring the reliability and safety of high voltage cables over time requires advanced monitoring systems and regular maintenance. These cables also need to withstand various environmental conditions, adding to the operational cost. Additionally, technological advancements in cable insulation and materials are necessary to maintain high performance, but these advancements often come with increased costs, making it challenging for utilities to implement upgrades cost-effectively.

There are significant opportunities in the high voltage cable market driven by technological advancements and the expansion of power grids. Innovations such as improved insulation materials and advanced monitoring systems are enhancing the efficiency, reliability, and durability of high voltage cables. The integration of smart grid technology offers another growth opportunity, as it requires the deployment of more advanced transmission infrastructure, including high voltage cables. The global push towards renewable energy sources creates a need for new and expanded transmission networks to connect distant renewable power plants to urban centers, driving the demand for high voltage cables.

A prominent trend in the high voltage cable market is the increasing deployment of underground cables, especially in urban areas where space is limited and aesthetic concerns are important. Underground cables also offer better protection from environmental damage, making them a preferred choice in sensitive or high-risk areas. Another trend is the growth of cross-border electricity transmission, which is driving the need for international high voltage cable networks to facilitate electricity trade and improve grid reliability across regions. These trends highlight the growing demand for advanced cable solutions to meet the evolving needs of the global energy infrastructure.

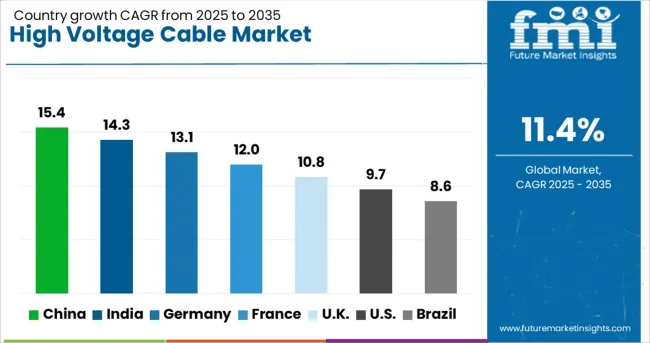

| Country | CAGR |

|---|---|

| China | 15.4% |

| India | 14.3% |

| Germany | 13.1% |

| France | 12.0% |

| UK | 10.8% |

| USA | 9.7% |

| Brazil | 8.6% |

The global high voltage cable market is projected to grow at a CAGR of 11.4% from 2025 to 2035. China leads the market with a strong 15.4% growth rate, driven by rapid urbanization, industrial expansion, and major infrastructure projects. India follows with a 14.3% CAGR, fueled by the growing power needs and ongoing renewable energy projects. Germany is experiencing steady growth at 13.1%, supported by its energy transition strategy and power grid upgrades. The UK shows moderate growth at 10.8%, driven by renewable energy integration and offshore wind farm expansion. The United States, with a 9.7% CAGR, has slower growth due to its mature infrastructure but continues to benefit from energy transition initiatives. The analysis includes over 40 countries, with the top five detailed below.

China is expected to grow at a CAGR of 15.4% through 2035 in the high voltage cable market. The country’s rapid industrialization and infrastructural expansion have led to a significant increase in power generation and distribution needs. China is heavily investing in renewable energy projects, which require efficient power transmission systems, including high voltage cables. The government's commitment to improving energy infrastructure and promoting sustainable energy solutions is driving the demand for high voltage cables. China's efforts to modernize its power grid, particularly through smart grid technologies, are also contributing to the market’s growth.

India is projected to grow at a CAGR of 14.3% through 2035 in the high voltage cable market. The country's rapid infrastructure development, coupled with the expansion of power generation and distribution networks, is significantly increasing the demand for high voltage cables. India’s growing focus on renewable energy sources, such as solar and wind power, requires advanced power transmission systems, driving demand for high voltage cables. Government initiatives such as the “Power for All” program and investments in grid modernization are further contributing to the market’s expansion. As India strives to achieve energy efficiency and sustainable infrastructure, the market for high voltage cables continues to grow.

Germany is projected to grow at a CAGR of 13.1% through 2035 in the high voltage cable market. As Europe’s largest economy, Germany is investing heavily in renewable energy projects and grid modernization. The transition towards cleaner energy, supported by government incentives and regulations, is driving the adoption of high voltage cables in the country. Germany’s efforts to improve energy efficiency and meet its climate goals are increasing the demand for efficient power transmission systems. Furthermore, Germany’s leadership in the manufacturing of electrical equipment and technology for renewable energy systems is supporting the expansion of the high voltage cable market.

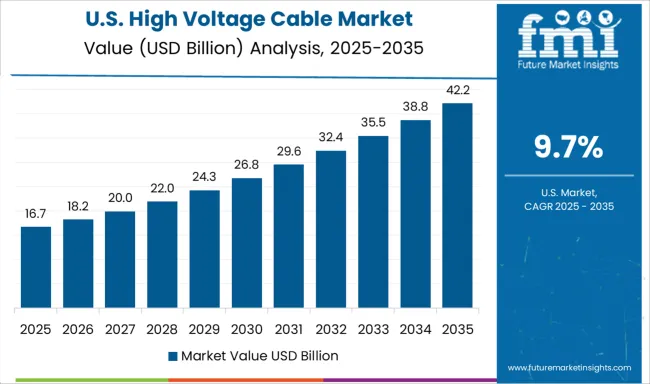

The United States is projected to grow at a CAGR of 9.7% through 2035 in the high voltage cable market. The USA is investing heavily in upgrading its aging infrastructure and transitioning to renewable energy sources. With the push for clean energy, the demand for high voltage cables is growing to support the transmission of electricity from renewable energy sources such as solar and wind power. Additionally, the USA government’s emphasis on modernizing the power grid and improving energy efficiency is further driving the need for advanced power transmission systems. The continued focus on electric vehicles and smart cities also supports the growing adoption of high voltage cables.

The United Kingdom is expected to grow at a CAGR of 10.8% through 2035 in the high voltage cable market. The UK is heavily investing in offshore wind farms, solar power plants, and grid modernization to meet its climate goals. The country’s focus on achieving net-zero emissions by 2050 and improving energy efficiency is driving the demand for high voltage cables in the transmission and distribution of power. The UK’s commitment to renewable energy, coupled with increasing energy demands, is pushing the market for high voltage cables forward. With a growing need for power infrastructure and the rise in renewable energy projects, the UK market is set to see significant growth in the coming years.

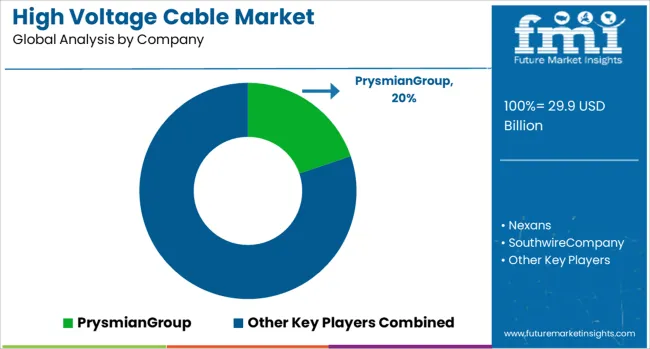

The high voltage cable market is shaped by a combination of multinational engineering leaders, regional specialists, and integrated energy solution providers catering to power transmission, renewable energy, and industrial infrastructure projects. Nexans stands out as a global leader with a broad portfolio of extruded and insulated high voltage cables, leveraging technological expertise and large-scale project execution capabilities. Prysmian Group dominates through advanced conductor design, HVDC solutions, and integrated system offerings, emphasizing reliability and long-term performance in demanding transmission networks. Southwire Company and General Cable, now part of Prysmian, maintain strong positions in North America, offering engineered solutions for utility and industrial clients with an emphasis on turnkey project support.

Regional players such as LS Cable & System, KEI Industries, and Sumitomo Electric Industries specialize in high-quality local manufacturing, enabling competitive pricing and rapid deployment for grid modernization and renewable energy projects. Hitachi Cable and Furukawa Electric focus on research-driven differentiation, providing advanced insulation technologies, high-capacity conductors, and fire-resistant cables for critical infrastructure applications. Expansion strategies include greenfield manufacturing plants, joint ventures with EPC contractors, and long-term supply agreements with utilities.

Competition is driven by technological innovation, project execution capabilities, and regulatory compliance with IEC, IEEE, and local grid standards. Companies differentiate through lifecycle performance, fault tolerance, and maintenance-friendly designs. Emerging market penetration, particularly in Asia-Pacific, the Middle East, and Africa, along with the growing adoption of offshore wind, HVDC lines, and smart grids, offers substantial growth opportunities for leading and emerging players in the high voltage cable ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.9 Billion |

| Voltage | > 220 kV, 110 kV, and 110 kV - 220 kV |

| Current | HVAC and HVDC |

| Installation | Underground, Overhead, and Submarine |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | PrysmianGroup, Nexans, SouthwireCompany, LSCable&System, SumitomoElectricIndustries, MitsubishiElectric, NKT, FurukawaElectric, TaihanCables&Solution, ElsewedyElectric, BruggKabel, alfanarGroup, RiyadhCables, Ducab, JeddahCables, TFKable, PowerPlusCable, IljinElectric, GuptaPower, ZMSCable, and ZTTCable |

| Additional Attributes | Dollar sales by cable type (underground, overhead, submarine) and end-use segments (power transmission, renewable energy, industrial applications, infrastructure). Demand dynamics are driven by the increasing need for efficient power transmission systems, the growth of renewable energy projects, and the expanding infrastructure development in emerging markets. Regional trends show strong growth in North America and Europe, where energy efficiency and grid modernization are a priority, while Asia-Pacific is experiencing rapid expansion driven by industrialization and infrastructure development. |

The global high voltage cable market is estimated to be valued at USD 29.9 billion in 2025.

The market size for the high voltage cable market is projected to reach USD 87.9 billion by 2035.

The high voltage cable market is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in high voltage cable market are > 220 kv, 110 kv and 110 kv - 220 kv.

In terms of current, HVAC segment to command 63.2% share in the high voltage cable market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Capacitors Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Direct Current (HVDC) Capacitor Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Oil Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Electric Insulators Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Direct Current Power Supply Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA