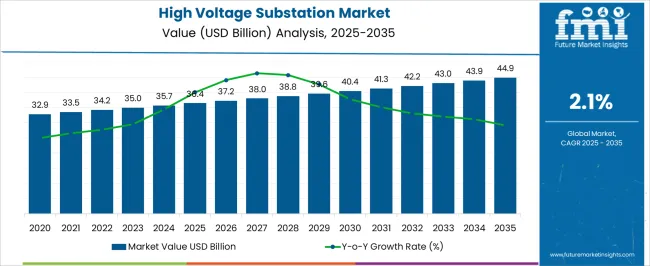

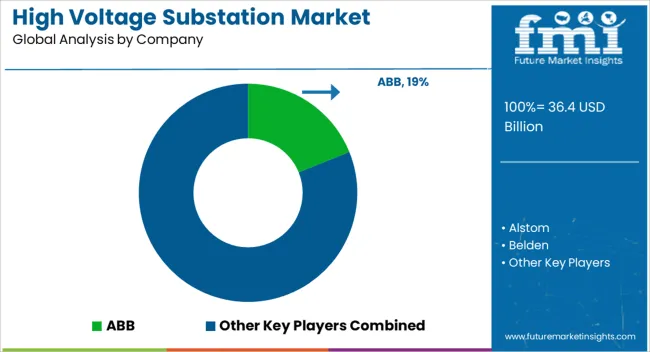

The High Voltage Substation Market is estimated to be valued at USD 36.4 billion in 2025 and is projected to reach USD 44.9 billion by 2035, registering a compound annual growth rate (CAGR) of 2.1% over the forecast period. Regulatory bodies set stringent standards for safety, environmental compliance, and grid reliability, which directly affect project timelines, capital expenditure, and operational practices.

Compliance with environmental regulations, such as emission controls, waste management, and noise restrictions, imposes additional requirements on substation design, construction, and maintenance, influencing both cost structures and technology selection.

Safety standards and electrical codes mandate rigorous testing, certification, and inspection of high-voltage equipment, which ensures operational reliability but also extends project delivery schedules. Incentives and subsidies in certain regions, aimed at modernizing grid infrastructure and improving energy efficiency, contribute positively to adoption but are often tied to compliance with performance and safety criteria.

Conversely, delays in regulatory approvals or frequent updates to standards can create uncertainty and slow investment, particularly in regions with complex permitting processes. The regulatory environment plays a critical role in shaping the High Voltage Substation market.

While compliance drives higher quality, safer, and more reliable infrastructure, it also imposes additional costs and procedural requirements, moderating growth rates. Stakeholders are required to integrate regulatory considerations into strategic planning, risk management, and technology selection to navigate evolving standards effectively and maintain long-term market competitiveness.

| Metric | Value |

|---|---|

| High Voltage Substation Market Estimated Value in (2025 E) | USD 36.4 billion |

| High Voltage Substation Market Forecast Value in (2035 F) | USD 44.9 billion |

| Forecast CAGR (2025 to 2035) | 2.1% |

The high voltage substation market is experiencing robust growth as nations prioritize grid modernization, renewable integration, and energy reliability. Increasing energy demand, aging transmission infrastructure, and the transition toward smart grid ecosystems are driving large scale investments in high voltage substations across both developed and emerging economies.

National energy security initiatives and regulatory mandates for power quality, grid stability, and sustainable energy distribution are further accelerating the adoption of technologically advanced substation systems. Advancements in digital monitoring, automation, and remote control capabilities are reshaping traditional substations into intelligent nodes that support real time performance management and fault detection.

As energy transition goals become more prominent, substations are being redefined as critical assets in supporting hybrid energy grids and high capacity transmission corridors. This transformation is expected to continue as utilities and governments emphasize grid resilience and operational agility.

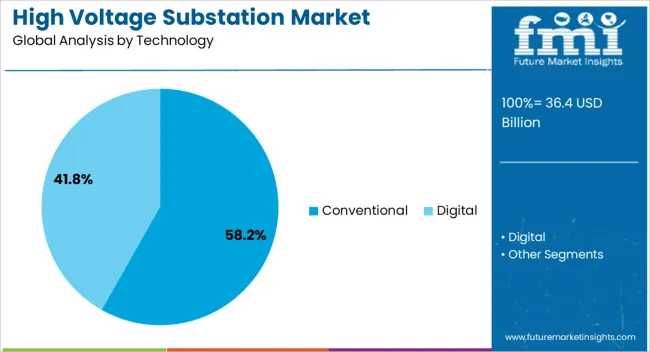

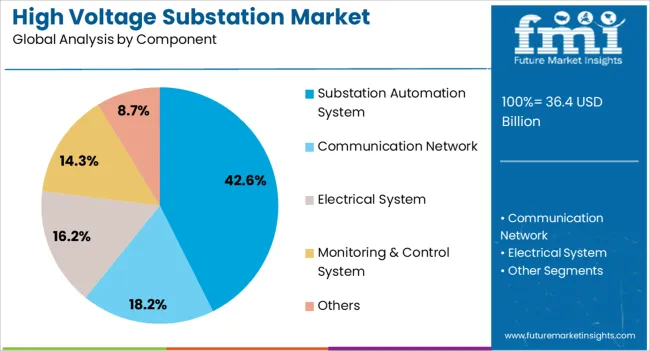

The high voltage substation market is segmented by technology, component,category, and geographic regions. By technology, the high voltage substation market is divided into Conventional and Digital. In terms of components, the high voltage substation market is classified into Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others.

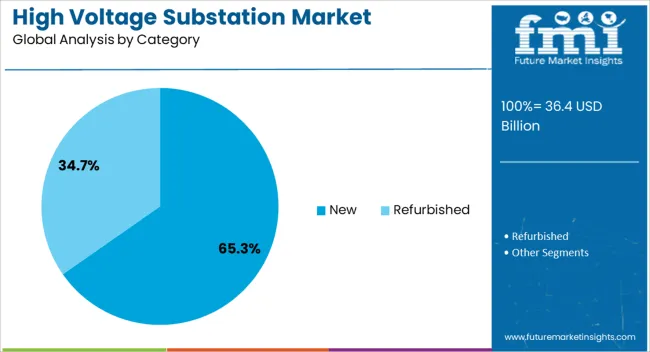

Based on category, the high voltage substation market is segmented into New and Refurbished. Regionally, the high voltage substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conventional technology segment is projected to account for 58.20% of total market revenue by 2025 within the technology category, positioning it as the leading segment. This dominance is due to widespread legacy infrastructure that remains operational in mature power grids and continues to receive upgrades for enhanced performance.

Utilities favor conventional systems for their proven reliability, cost-effectiveness, and compatibility with existing high-voltage network designs. Additionally, the availability of skilled personnel familiar with traditional grid architectures supports ongoing investment in conventional substation models.

While digital transformation initiatives are advancing, the large installed base and ease of maintenance of conventional systems reinforce their continued relevance and market share.

Substation automation systems are expected to contribute 42.60% of total market revenue by 2025 within the component category, making it one of the most rapidly advancing segments. Growth in this segment is driven by the need for real time grid control, fault monitoring, and asset optimization.

Automation systems reduce human error, enhance safety, and enable faster response to outages or anomalies. As utilities adopt predictive maintenance and condition-based monitoring strategies, automation platforms are being widely implemented to streamline operations.

Their integration with communication protocols and SCADA systems enhances visibility across transmission assets, justifying their rising demand across high voltage installations.

The new substation category is projected to hold 65.30% of the total market share by 2025, positioning it as the dominant segment. This is being driven by extensive grid expansion projects, electrification of rural regions, and integration of utility scale renewable energy sources requiring dedicated high voltage infrastructure.

Investments in building new substations are also supported by urbanization trends, industrial growth, and cross border interconnection programs. New installations provide the advantage of incorporating advanced automation, digital sensors, and flexible designs from the outset, offering long term performance and scalability benefits.

As energy networks continue to evolve, new substations are being deployed to address capacity upgrades and technology alignment, sustaining their lead within the category segment.

The market has been expanding due to increasing demand for reliable electricity transmission, grid modernization, and integration of renewable energy sources. Substations have been utilized to step up or step down voltage levels, ensuring efficient power distribution across industrial, commercial, and residential sectors. Market growth has been reinforced by investments in smart grid technologies, automation, and advanced monitoring systems. The need to replace aging infrastructure, enhance energy efficiency, and comply with safety and regulatory standards has further accelerated adoption of high voltage substations worldwide.

The market has been significantly influenced by the expansion of electricity transmission and distribution networks. Rising urbanization, industrialization, and electrification initiatives have increased the need for substations capable of handling higher voltages and large power loads. Utilities have deployed high voltage substations to improve grid reliability, reduce transmission losses, and manage peak load demand efficiently. Integration with renewable energy sources such as wind, solar, and hydroelectric power has further reinforced adoption. Modern substations have been equipped with advanced monitoring systems, protective relays, and automation technologies to ensure seamless operation. Strategic investments by governments and private utilities have facilitated the establishment of substations in urban, industrial, and remote areas, ensuring consistent and stable power delivery across regions.

Technological developments have strengthened the market by improving operational efficiency, safety, and longevity of equipment. Innovations such as digital relays, SCADA systems, and fiber-optic communication have enabled real-time monitoring, remote control, and predictive maintenance. Advanced insulation materials, modular switchgear, and compact substation designs have reduced physical footprint and installation complexity. Condition monitoring technologies have been employed to detect faults early and optimize asset utilization. Furthermore, implementation of IEC 61850 standards and process bus technology has improved interoperability and reduced cabling requirements. These technological improvements have allowed utilities to enhance reliability, reduce operational costs, and integrate new energy sources, positioning high voltage substations as a core component of modern power infrastructure.

The market has been shaped by regulatory guidelines, safety standards, and grid modernization initiatives. Compliance with national and international standards, including IEEE, IEC, and NERC, has ensured operational safety, interoperability, and environmental sustainability. Governments have provided funding and incentives for grid expansion, renewable energy integration, and infrastructure upgrades, encouraging utilities to modernize substations. Energy efficiency regulations and carbon reduction targets have further motivated the adoption of advanced substation technologies. Collaborative efforts between utilities, manufacturers, and regulators have facilitated the deployment of high voltage substations with enhanced automation, protection systems, and monitoring capabilities. These initiatives have driven market growth while supporting reliable electricity transmission and sustainable energy practices worldwide.

Despite growth opportunities, the market has faced challenges related to high capital expenditure, complex installation, and maintenance requirements. Retrofitting or upgrading aging substations has required substantial investment and planning, particularly in densely populated or remote areas. Skilled workforce shortages in substation operation, digital systems integration, and maintenance have posed operational challenges. Exposure to environmental conditions, including extreme temperatures, humidity, and lightning, has influenced equipment longevity and reliability. Additionally, cybersecurity risks associated with automated and remotely monitored substations have necessitated continuous monitoring and protective measures. Market participants have addressed these challenges by adopting modular designs, predictive maintenance solutions, and staff training programs, ensuring safe, efficient, and reliable operation of high voltage substations globally.

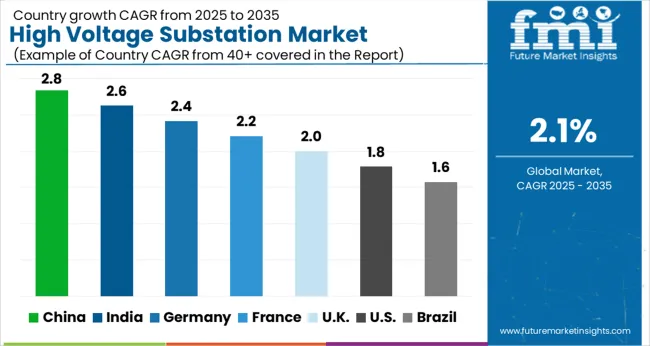

| Countries | CAGR |

|---|---|

| China | 2.8% |

| India | 2.6% |

| Germany | 2.4% |

| France | 2.2% |

| UK | 2.0% |

| USA | 1.8% |

| Brazil | 1.6% |

The market is expected to grow at a CAGR of 2.1% from 2025 to 2035, supported by grid expansion, aging infrastructure upgrades, and demand for reliable electricity transmission. China leads with a 2.8% CAGR, driven by large-scale substation construction and modernization projects. India follows at 2.6%, supported by national grid enhancement programs and rural electrification initiatives. Germany, at 2.4%, benefits from ongoing upgrades to aging transmission networks. The UK, growing at 2.0%, focuses on modernization and efficiency improvements, while the USA, at 1.8%, experiences steady demand for substation expansion and reliability projects. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 2.8%, supported by the expansion and upgrade of its power transmission networks. Investments in smart grid initiatives and modernization of existing substations are driving market demand. Adoption of advanced monitoring and automation systems ensures operational efficiency and reduces downtime. Government policies promoting energy security and reliability further accelerate the market expansion. Collaboration between domestic manufacturers and technology providers enhances the deployment of high voltage substation solutions.

India is forecasted to grow at a CAGR of 2.6%, driven by increasing electricity demand and the expansion of transmission infrastructure. Government initiatives supporting grid stability and substation modernization accelerate adoption. Market players are deploying advanced switchgear, intelligent monitoring, and protective relays to enhance performance. Investments in digital technologies and smart grid integration ensure improved operational efficiency and reliability. Partnerships between power utilities and solution providers further support market penetration.

Germany is projected to grow at a CAGR of 2.4%, driven by renewable energy integration and regulatory support for grid modernization. Investments in automation, intelligent monitoring, and digital substation technologies enhance reliability. Market adoption is influenced by the need to reduce transmission losses and improve energy efficiency. Utilities are increasingly collaborating with technology providers to deploy advanced substation solutions.

The United Kingdom is expected to grow at a CAGR of 2.0%, supported by upgrades to aging transmission networks and smart grid adoption. Digital substation solutions, automated monitoring systems, and advanced switchgear are increasingly deployed. Market growth is enhanced by government policies encouraging infrastructure modernization and operational efficiency. Partnerships between utilities and technology providers further accelerate adoption of high voltage substation solutions.

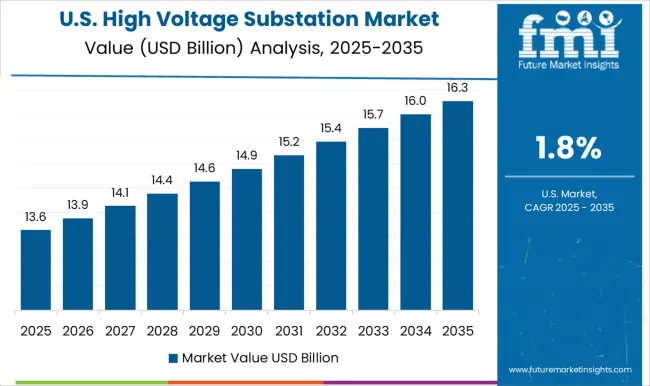

The United States is forecasted to grow at a CAGR of 1.8%, influenced by investments in transmission network upgrades and smart grid deployment. Adoption of advanced monitoring, automation, and protective systems ensures grid reliability and reduces operational risks. Market growth is further supported by regulatory incentives for infrastructure modernization. Collaboration between utilities and technology providers accelerates deployment of high voltage substation solutions.

The market is witnessing robust growth as utilities and industrial operators focus on improving power transmission reliability and efficiency. Major global players such as ABB, Siemens, and Schneider Electric dominate the market by offering advanced substation technologies, including protection and control systems, transformers, switchgear, and automation solutions.

These companies integrate intelligent monitoring, predictive maintenance, and real-time diagnostic tools to ensure operational continuity and grid stability. General Electric, Hitachi Energy, Mitsubishi Electric, and Eaton provide comprehensive high-voltage solutions that combine hardware, software, and system integration services.

Companies like Cisco Systems, Belden, Rockwell Automation, and Texas Instruments focus on communication networks, industrial control, and secure data transmission within substations, enhancing operational intelligence. Regional players, including Alstom, L&T Electrical and Automation, Efacec, Netcontrol Group, SIFANG, and Tesco Automation, address localized infrastructure needs, delivering customized solutions for efficient power distribution and grid management.

The market is driven by increasing electricity demand, modernization of aging transmission infrastructure, and the expansion of renewable energy integration. Emphasis on safety, reliability, and regulatory compliance further strengthens the position of these providers. Collectively, these companies are advancing high-voltage substation technologies to meet the evolving requirements of modern power systems, enabling smarter, more resilient, and efficient grid operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 36.4 Billion |

| Technology | Conventional and Digital |

| Component | Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others |

| Category | New and Refurbished |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Alstom, Belden, Cisco Systems, Eaton, Efacec, General Electric, Grid to Great, Hitachi Energy, L&T Electrical and Automation, Mitsubishi Electric, Netcontrol Group, Open System International, Rockwell Automation, Schneider Electric, Siemens, SIFANG, Tesco Automation, Texas Instruments Incorporated, and Toshiba |

| Additional Attributes | Dollar sales by substation type and voltage class, demand dynamics across transmission and distribution networks, regional trends in power infrastructure development, innovation in switchgear, automation, and monitoring systems, environmental impact of energy losses and equipment lifecycle, and emerging use cases in renewable integration and smart grid expansion. |

The global high voltage substation market is estimated to be valued at USD 36.4 billion in 2025.

The market size for the high voltage substation market is projected to reach USD 44.9 billion by 2035.

The high voltage substation market is expected to grow at a 2.1% CAGR between 2025 and 2035.

The key product types in high voltage substation market are conventional and digital.

In terms of component, substation automation system segment to command 42.6% share in the high voltage substation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

High Purity Carbonyl Iron Powder (CIP) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA