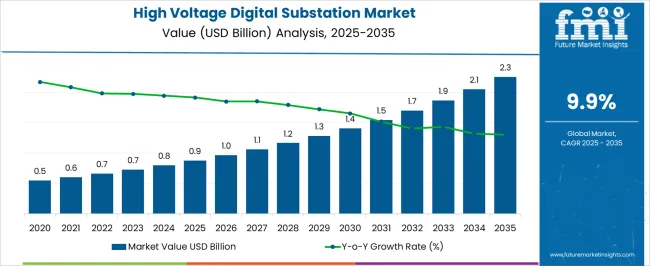

The High Voltage Digital Substation Market is estimated to be valued at USD 0.9 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 9.9% over the forecast period. Digital substations leverage intelligent electronic devices (IEDs), advanced sensors, and communication networks to improve operational efficiency, reliability, and safety in high-voltage power distribution. Within the market, the deployment of IEDs and smart sensors is expected to account for a substantial portion of growth, as these technologies enable real-time monitoring, fault detection, and automated control, which are critical for modern power grids.

Communication protocols, including IEC 61850 and Ethernet-based solutions, also contribute significantly to market development by ensuring interoperability among devices and seamless integration with supervisory control and data acquisition (SCADA) systems. Additionally, software platforms for asset management, predictive maintenance, and cybersecurity represent emerging technology segments with increasing adoption, supporting overall market expansion. The progressive shift from conventional substations to fully digitalized architectures is anticipated to enhance the contribution of integrated technological solutions, reflecting both CapEx and OpEx efficiencies over time.

The technology contributions in high voltage digital substations are weighted toward intelligent hardware, communication standards, and software-enabled operational enhancements. The interplay among these technologies will shape adoption patterns, influence cost structures, and drive the market toward higher reliability, scalability, and digital integration over the forecast period.

| Metric | Value |

|---|---|

| High Voltage Digital Substation Market Estimated Value in (2025 E) | USD 0.9 billion |

| High Voltage Digital Substation Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 9.9% |

The high voltage digital substation market is expanding rapidly due to increasing grid modernization efforts, rising energy demand, and the integration of renewable energy sources into utility networks. The transition from conventional to digital substations is being driven by the need for real time monitoring, improved operational efficiency, and enhanced safety.

Governments and utilities are investing in advanced automation, remote asset management, and intelligent control technologies to support sustainable and resilient power infrastructure. Digital substations reduce operational costs, increase fault detection accuracy, and facilitate faster restoration times.

As utilities focus on minimizing transmission losses and managing distributed energy resources, digital substation deployment is expected to accelerate. The outlook remains optimistic as utilities adopt future ready infrastructure capable of adapting to evolving energy demands and decentralized generation patterns.

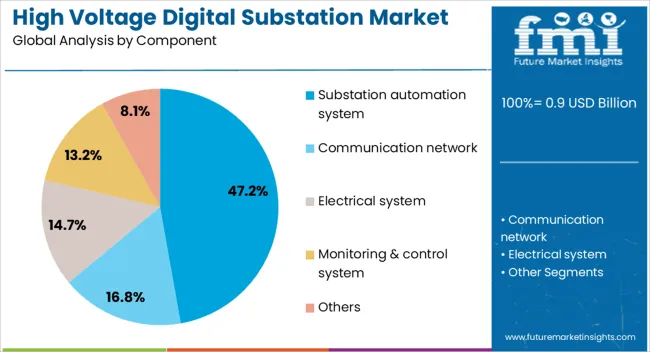

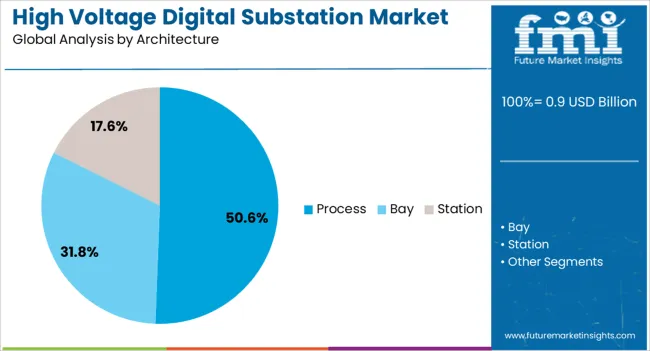

The high-voltage digital substation market is segmented by component, architecture, end-use, installation, and geographic region. By component, the high-voltage digital substation market is divided into Substation automation systems, communication networks, electrical systems, monitoring and control systems, and Others. In terms of architecture, the high voltage digital substation market is classified into Process, Bay, and Station.

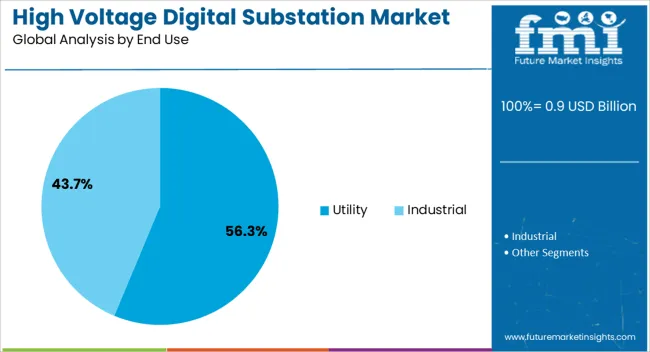

Based on end use, the high voltage digital substation market is segmented into Utility and Industrial. By installation, the high voltage digital substation market is segmented into New and Refurbished. Regionally, the high-voltage digital substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, the Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The substation automation system segment is expected to account for 47.20% of the total market revenue by 2025 within the component category, making it the leading segment. This dominance is attributed to the growing emphasis on automated control, real-time data acquisition, and predictive maintenance capabilities.

Substation automation systems facilitate seamless communication between devices and central control units, enhancing grid stability and facilitating fault isolation. Their ability to support advanced protection schemes and enhance situational awareness has increased their relevance in modern substation design.

Additionally, automation reduces the need for manual intervention and operational downtime, contributing to improved system reliability. These factors have positioned substation automation systems as the cornerstone of digital transformation in high voltage substations.

The process architecture segment is projected to capture 50.60% of total market revenue by 2025 in the architecture category, making it the dominant segment. This growth is driven by the segment’s ability to connect primary equipment to digital interfaces directly, reducing copper wiring and enabling streamlined data transmission.

Process architecture improves system modularity, enhances safety through reduced electrical exposure, and facilitates efficient diagnostics and maintenance. It also enables quicker configuration changes and reduced installation time, which are crucial in dynamic grid environments.

The architecture's support for real-time communication and monitoring aligns with industry demand for smarter substations, reinforcing its leading position in the market.

The utility segment is expected to hold 56.30% of total revenue by 2025 within the end use category, establishing it as the most significant segment. This leadership is due to the ongoing investments in utility scale grid infrastructure upgrades and the growing need to handle increased load from distributed generation sources.

Utilities are leveraging digital substations to enhance reliability, reduce operational costs, and meet regulatory standards for grid performance. The demand for scalable, secure, and remotely operable infrastructure has made digital solutions a strategic priority for utility providers.

As the sector continues to expand grid capacity and improve energy delivery efficiency, utilities are expected to remain the largest contributors to the high voltage digital substation market.

The market has been expanding due to growing demand for smart grid solutions, enhanced operational efficiency, and improved reliability in power transmission. Digital substations have been valued for their ability to integrate advanced protection, monitoring, and control systems while reducing physical footprint and maintenance requirements. Market growth has been supported by technological advancements in communication protocols, cybersecurity, and automation. Rising adoption of renewable energy sources, grid modernization programs, and energy management initiatives have further reinforced the relevance of high voltage digital substations globally.

The market has been primarily driven by the integration of smart grid technologies and automation solutions. Digital substations have enabled real-time monitoring, remote control, and predictive maintenance, reducing downtime and operational costs for utilities. Intelligent electronic devices (IEDs), sensors, and communication networks have facilitated seamless data exchange between substations and control centers. The deployment of IEC 61850-compliant systems has enhanced interoperability across devices and vendors. Additionally, utilities have adopted digital substations to accommodate variable renewable energy sources such as wind and solar power, ensuring grid stability and reliability. Investments in smart grid infrastructure, modernization of legacy transmission networks, and government initiatives promoting energy efficiency have collectively reinforced adoption of high voltage digital substations in multiple regions globally.

Technological innovations have strengthened the market by improving operational efficiency, reliability, and safety. Advanced communication protocols, cloud-based monitoring, and cybersecurity measures have enhanced the protection and control of substations. Modular and scalable architectures have allowed flexible deployment in urban, industrial, and utility environments. Integration of advanced analytics, machine learning, and predictive maintenance algorithms has enabled early fault detection and optimized asset utilization. Moreover, fiber-optic communication and process bus technology have reduced cabling complexity while improving signal accuracy. These advancements have facilitated higher automation levels, lower maintenance costs, and improved system longevity. As a result, digital substations have become increasingly attractive for utilities seeking to modernize transmission networks and enhance operational performance.

The market has been shaped by regulatory mandates, government policies, and grid modernization programs worldwide. Utilities have been encouraged to adopt advanced monitoring and control systems to improve reliability, reduce outages, and meet environmental standards. Standards such as IEC 61850, IEEE, and NERC guidelines have been implemented to ensure interoperability, safety, and cybersecurity compliance. Government funding and incentives for renewable energy integration, smart grid projects, and energy efficiency initiatives have further driven market adoption. Collaboration between utility operators, technology providers, and regulatory bodies has enabled large-scale deployment of digital substations while promoting innovation in automation, communication, and cybersecurity solutions across power transmission networks globally.

Despite growth, the market has faced challenges related to high initial investment, integration complexity, and cybersecurity risks. Legacy substations have required significant retrofitting to adopt digital technologies, increasing costs and implementation time. Skilled workforce shortages in digital substation operation, system integration, and maintenance have limited adoption in some regions. Cybersecurity threats, including unauthorized access and data breaches, have necessitated continuous monitoring and advanced security measures. The interoperability issues between legacy devices and new digital components have influenced deployment strategies. Manufacturers and utilities have responded by offering modular solutions, training programs, and secure communication protocols to reduce complexity and ensure reliable, safe, and efficient operation of high voltage digital substations globally.

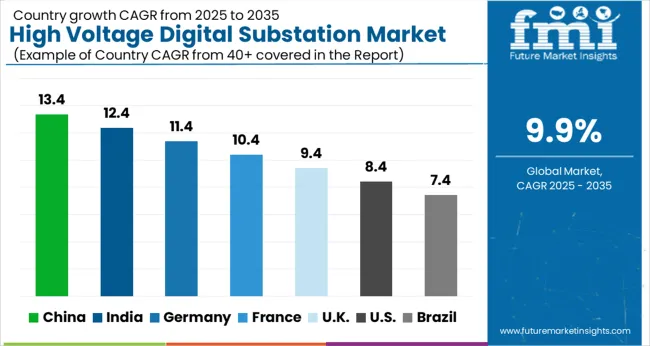

| Country | CAGR |

|---|---|

| China | 13.4% |

| India | 12.4% |

| Germany | 11.4% |

| France | 10.4% |

| UK | 9.4% |

| USA | 8.4% |

| Brazil | 7.4% |

The market is projected to expand at a CAGR of 9.9% between 2025 and 2035, driven by modernization of power grids, adoption of smart substation technologies, and increasing energy demand. China leads with a 13.4% CAGR, supported by large-scale grid digitalization and investments in smart infrastructure. India follows at 12.4%, driven by government initiatives to modernize transmission networks and enhance energy efficiency. Germany, at 11.4%, benefits from advanced electrical infrastructure and renewable integration projects. The UK, growing at 9.4%, focuses on upgrading aging substations with digital solutions, while the USA, at 8.4%, sees steady adoption from modernization and reliability enhancement programs. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 13.4%, supported by the ongoing modernization of electrical grids and smart infrastructure initiatives. Investments in renewable energy integration and digital monitoring technologies are driving demand. Government policies focusing on energy efficiency and grid stability further accelerate market expansion. Equipment manufacturers are deploying advanced SCADA systems, intelligent sensors, and automation technologies to improve operational efficiency. Partnerships between domestic and international technology providers are enhancing market penetration and innovation.

India is forecasted to expand at a CAGR of 12.4%, fueled by growing electricity demand and modernization of transmission networks. Government initiatives promoting digital substations and grid automation are supporting adoption. Market players are investing in digital SCADA solutions, predictive maintenance technologies, and substation automation systems. Collaborations between power utilities and technology providers are accelerating deployment. Increasing focus on reducing transmission losses and improving energy management is further stimulating growth.

Germany is anticipated to grow at a CAGR of 11.4%, driven by smart grid initiatives and increasing integration of renewable energy. Adoption of high voltage digital substations is supported by regulatory mandates and sustainability goals. Manufacturers are emphasizing intelligent monitoring, data analytics, and cyber-secure substation solutions to enhance reliability. Investment in digitalization and automation reduces operational costs and ensures grid resilience. Market expansion is further supported by partnerships between local utilities and international technology firms.

The United Kingdom is forecasted to grow at a CAGR of 9.4%, supported by modernization of aging grid infrastructure and focus on smart energy systems. Market players are deploying automated switchgear, sensors, and real-time monitoring technologies to enhance operational efficiency. Government incentives for digital substations and renewable integration further encourage adoption. Collaborations between utilities and technology providers are expanding deployment. Rising emphasis on reducing energy losses and improving reliability contributes to market growth.

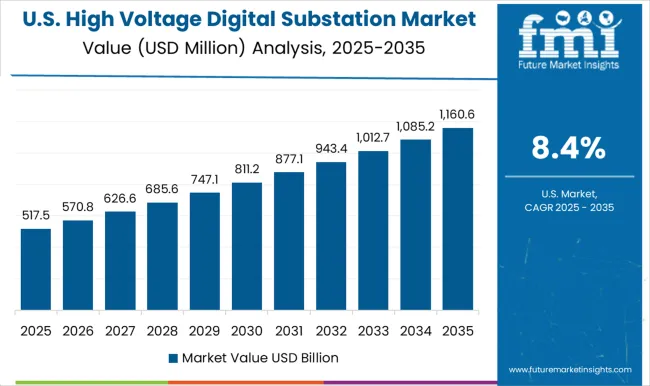

The United States is projected to grow at a CAGR of 8.4%, driven by investments in grid digitalization and modernization. High voltage digital substations are increasingly adopted to support renewable energy integration, improve grid reliability, and optimize operational efficiency. Market expansion is supported by advanced SCADA systems, intelligent sensors, and predictive maintenance solutions. Partnerships between utilities and technology providers enhance deployment and technology adoption. Regulatory frameworks and infrastructure development programs further encourage market growth.

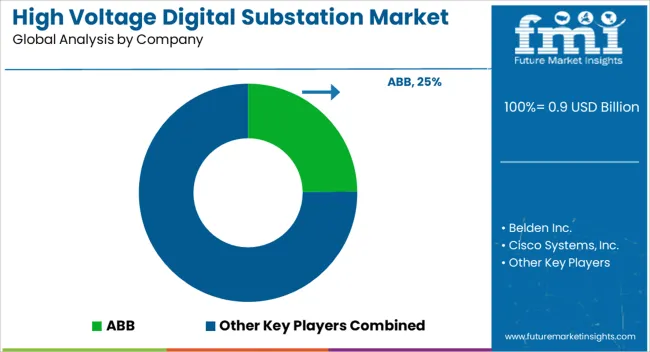

The market is advancing rapidly as utilities and industrial operators transition from conventional substations to digitally integrated solutions. Leading players such as ABB, Siemens, and Schneider Electric have been at the forefront of providing innovative digital substation technologies, including IEC 61850-based communication systems, intelligent protection relays, and advanced monitoring tools. These companies focus on enhancing grid reliability, operational efficiency, and real-time diagnostics through smart sensors and automation. General Electric, Hitachi Energy, Toshiba Energy Systems & Solutions, and Eaton provide comprehensive high-voltage solutions encompassing hardware, software, and integrated control systems.

Companies like Cisco Systems, Inc., Belden Inc., and WAGO specialize in industrial networking and communication protocols, ensuring secure and reliable data transfer between substation devices. Regional players such as Larson & Toubro Limited, NR Electric Co. Ltd., Powell Industries, and Ormazabal complement global offerings by catering to localized infrastructure requirements with customized digital solutions. The market growth is driven by increasing electricity demand, modernization of aging grids, and the adoption of renewable energy sources, which necessitate smart grid infrastructure. Emphasis on predictive maintenance, remote monitoring, and cyber-secure operations further strengthens the position of these providers. Collectively, these companies are shaping the future of digital substations, offering technologically advanced, resilient, and scalable solutions for modern power systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.9 Billion |

| Component | Substation automation system, Communication network, Electrical system, Monitoring & control system, and Others |

| Architecture | Process, Bay, and Station |

| End Use | Utility and Industrial |

| Installation | New and Refurbished |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Belden Inc., Cisco Systems, Inc., Eaton, General Electric, Hubbell, Hitachi Energy, Locamation, Larson & Toubro Limited, NR Electric Co. Ltd., Netcontrol Group, Ormazabal, Powell Industries, Siemens, Schneider Electric, Toshiba Energy Systems & Solutions Corporation, WAGO, and WEG |

| Additional Attributes | Dollar sales by equipment type and substation category, demand dynamics across transmission and distribution sectors, regional trends in smart grid adoption, innovation in digital monitoring, protection, and control systems, environmental impact of energy efficiency improvements, and emerging use cases in renewable integration and grid automation. |

The global high voltage digital substation market is estimated to be valued at USD 0.9 billion in 2025.

The market size for the high voltage digital substation market is projected to reach USD 2.3 billion by 2035.

The high voltage digital substation market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in high voltage digital substation market are substation automation system, communication network, electrical system, monitoring & control system and others.

In terms of architecture, process segment to command 50.6% share in the high voltage digital substation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility-Scale High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

High Purity Carbonyl Iron Powder (CIP) Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

High Frequency Chest-Wall Oscillation Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA