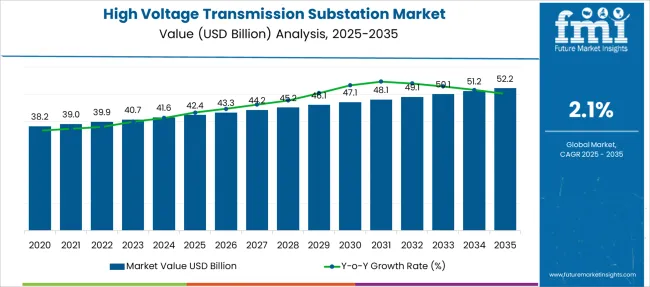

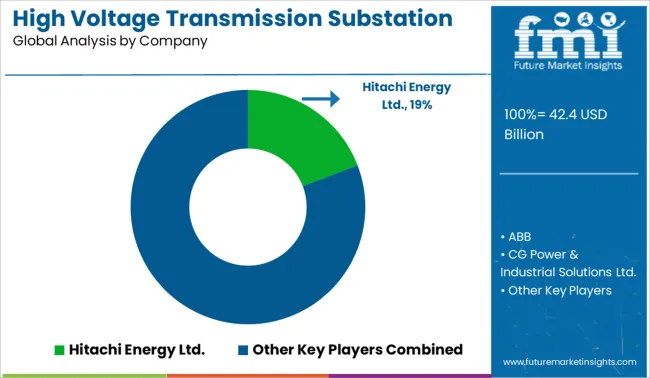

The High Voltage Transmission Substation Market is estimated to be valued at USD 42.4 billion in 2025 and is projected to reach USD 52.2 billion by 2035, registering a compound annual growth rate (CAGR) of 2.1% over the forecast period.

| Metric | Value |

|---|---|

| High Voltage Transmission Substation Market Estimated Value in (2025 E) | USD 42.4 billion |

| High Voltage Transmission Substation Market Forecast Value in (2035 F) | USD 52.2 billion |

| Forecast CAGR (2025 to 2035) | 2.1% |

The high voltage transmission substation market is growing rapidly due to the increasing demand for reliable and efficient power transmission infrastructure. Industry advancements have focused on improving grid stability and integrating renewable energy sources, which require enhanced substation capabilities. Digital technologies have become a key driver, enabling better control, monitoring, and automation within substations.

Investments in upgrading aging electrical grids and expanding transmission capacity have also contributed to market expansion. Governments and utilities are prioritizing infrastructure modernization to reduce losses and improve system resilience.

The trend towards smart grids and the need for real-time data analytics have further accelerated the adoption of advanced substation technologies. The market is expected to benefit from ongoing regulatory support and increasing power demand globally. Segmental growth is anticipated to be led by Digital technology, the Substation Automation System component, and new substations under the category segment.

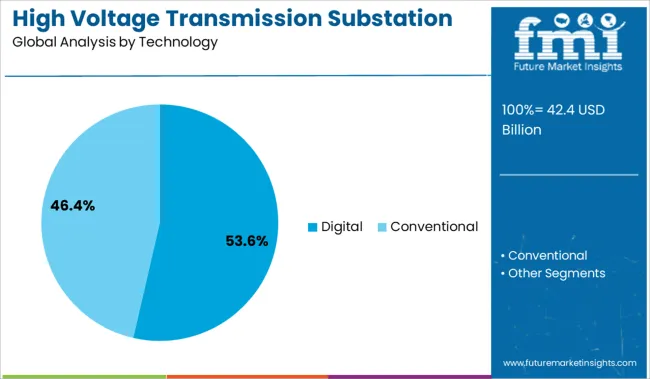

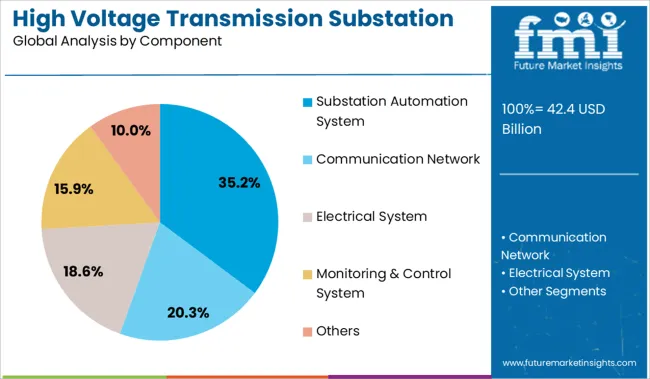

The market is segmented by Technology, Component, Category, and End Use and region. By Technology, the market is divided into Digital and Conventional. In terms of Component, the market is classified into Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others.

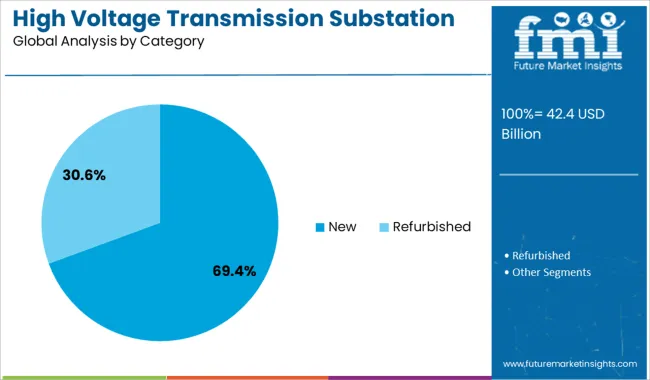

Based on Category, the market is segmented into New and Refurbished. By End Use, the market is divided into Utility and Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Digital technology segment is projected to contribute 53.6% of the high voltage transmission substation market revenue in 2025, maintaining its position as the leading technology type. This growth is driven by the need for enhanced data acquisition, control, and communication capabilities in modern substations. Digital systems allow for real-time monitoring and remote operation, improving the efficiency and reliability of power transmission.

The integration of digital platforms supports predictive maintenance and reduces downtime, which is critical for power system operators. Furthermore, the scalability of digital technologies enables utilities to upgrade existing infrastructure without major overhauls.

As the power sector moves towards automation and smart grid implementation, the Digital segment is expected to retain its dominant role.

The Substation Automation System component segment is expected to hold 35.2% of the market revenue in 2025, establishing itself as the key component type. Growth in this segment is attributed to the increasing use of automation to improve operational efficiency and safety. Automation systems enable centralized control of various substation functions such as protection, monitoring, and communication.

These systems help reduce manual interventions and allow for quicker fault detection and response. The trend toward integrating advanced sensors and intelligent electronic devices within substations has further propelled the adoption of automation systems.

As grid modernization efforts continue, the demand for substation automation is likely to grow significantly.

The New substation category segment is projected to account for 69.4% of the market revenue in 2025, dominating the category share. This is driven by ongoing infrastructure investments aimed at expanding transmission capacity to meet growing electricity demand. The construction of new substations allows for the incorporation of the latest technologies and design standards, improving overall system performance.

Additionally, new substations are essential for integrating renewable energy sources into the grid, supporting decarbonization goals. Market expansion in developing regions and the replacement of obsolete infrastructure in mature markets are contributing factors.

The preference for new substations reflects the strategic priorities of utilities to enhance grid reliability and efficiency in the face of evolving energy landscapes.

National grid operators and private utilities are expanding high-capacity substations to support cross-border interconnections and improve power reliability. The shift from centralized to hybrid grid models is further boosting investments in 220 kV and above substations. Automation and digital control systems are being embedded to enhance fault diagnostics and remote operability. However, cost-intensive infrastructure and land acquisition hurdles remain barriers in densely populated regions and emerging economies. Manufacturers, EPC firms, and utility consortia are working toward compact, modular solutions to mitigate space and cost constraints.

Increasing pressure on national transmission grids has intensified investments in high voltage substations designed to accommodate higher load flows and interregional energy transfers. Utilities and transmission system operators are deploying 220 kV, 400 kV, and ultra-high voltage (UHV) substations to manage renewable energy inflow from large-scale solar and wind installations. Demand for grid stability and reduced power losses has pushed governments to implement multi-stage grid expansion programs. These substations are also central to reducing congestion on aging networks, ensuring uninterrupted supply during peak demand. Grid modernization policies in the United States, China, Germany, and India are accelerating the deployment of switchgear-integrated substations. GIS-based substations are gaining traction in metropolitan and space-limited zones.

The development of cross-border electricity trade and transnational power corridors presents an opportunity for high voltage transmission substations. Regional transmission bodies across Europe, Southeast Asia, and Africa are investing in interconnected grid frameworks to stabilize power supply and enable surplus export. Substations play a critical role in regulating voltage, managing synchronization, and ensuring grid compatibility across different national infrastructures. Interconnectors between countries such as France–UK, China–Laos, and Egypt–Sudan require high-capacity substations for grid-balancing functions. These large-scale infrastructure projects are opening up demand for modular substation systems, FACTS integration, and real-time SCADA controls. Global utilities and infrastructure financiers are prioritizing projects that improve regional transmission reliability and support energy-sharing agreements.

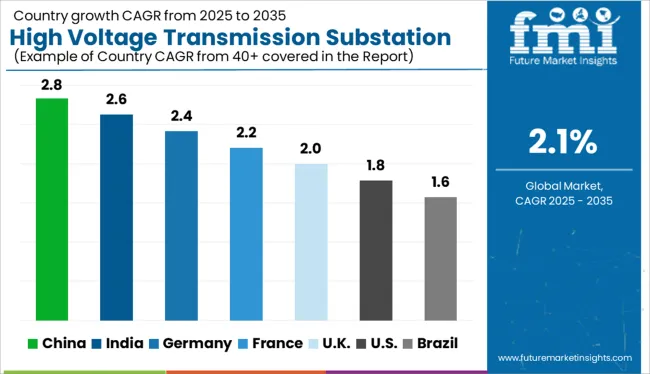

| Country | CAGR |

|---|---|

| China | 2.8% |

| India | 2.6% |

| Germany | 2.4% |

| France | 2.2% |

| UK | 2.0% |

| USA | 1.8% |

| Brazil | 1.6% |

The global high voltage transmission substation market is projected to expand at a CAGR of 2.1% from 2025 to 2035. China leads the pack at 2.8%, with large-scale upgrades and inland grid connections dominating installations. India follows at 2.6%, driven by HV infrastructure additions across state-backed transmission corridors. Germany and France, posting 2.4% and 2.2% respectively, have focused on retrofitting brownfield substations with gas-insulated switchgear. The United Kingdom, at 2.0%, is integrating substations into offshore wind and hybrid grid projects. While BRICS countries scale capacity to meet demand peaks, OECD markets emphasize modernization of aging infrastructure and digital substation deployment across select geographies. The report includes analysis of over 40 countries, with five profiled below for reference.

Demand for high voltage transmission substations in China is growing at a CAGR of 2.8% from 2025 to 2035. Demand will be shaped by inland grid integration, clean energy corridor connectivity, and substation clustering across high-load provinces. Substations rated above 400 kV are prioritized to stabilize multi-regional transmission. GIS units are being selected over AIS types due to land-use efficiency in semi-urban settings. Project development is coordinated through provincial utilities with unified SCADA overlays and digital automation layers. Equipment manufacturers are focusing on switchgear resilience, arc protection, and modular configuration for hybrid networks. National planning supports capacity additions aligned with hydropower and solar mega-parks.

Sales of high voltage substation in India are expanding at a CAGR of 2.6% through 2035. Demand will be driven by high-capacity interregional corridors, particularly for renewable power evacuation. Public sector undertakings are accelerating GIS and hybrid switchyard commissioning in high-transmission zones. Substations at 765 kV level are being deployed to reduce losses and improve redundancy. Control center upgrades with automation capabilities are being integrated to support faster response. India’s zonal transmission schemes prioritize phased commissioning across load-intensive clusters. Capital allocation has been tilted toward plug-and-play deployment packages and centralized tendering mechanisms.

Adoption of high voltage transmission substation is expected to grow at a CAGR of 2.4% between 2025 and 2035. Modernization efforts are focused on digital retrofitting, GIS adoption, and lifecycle extension of aging 220–400 kV units. Substations are being rebuilt with integrated protection relays and IEC 61850-ready platforms. Utility providers are deploying modular bays with reduced maintenance requirements. Remote monitoring systems are becoming standard in retrofit projects. Resilience upgrades are prioritized in regions with high renewable infeed. Digital twin solutions are expected to influence future grid diagnostics and scheduling protocols across federal networks.

Demand for high voltage substation in France is projected to expand at a CAGR of 2.2% from 2025 to 2035. New deployments are aligned with interconnectivity mandates and utility-scale grid balancing. GIS units are replacing AIS technology to accommodate higher energy throughput within compact footprints. Hybrid substations are gaining traction due to their ability to integrate with flexible renewable energy sources. Transmission operators are emphasizing reliability and fast switching in control rooms. Modular installation kits are being adopted to reduce site labor intensity. Regional utilities are aligning digital protocols with centralized asset monitoring strategies.

Sales of high voltage substation in the United Kingdom are projected to grow at a CAGR of 2% through 2035. Expansion is being led by offshore wind grid coupling and reinforcement of transmission routes into mainland networks. GIS units with intelligent relay systems are being favored for remote installations. Installation contracts emphasize minimal downtime and high modularity. Replacement demand is expected to outweigh new project announcements in coming years. Substations with integrated fiber-optic sensing and real-time SCADA are being standardized in transmission-heavy regions. EPC firms are leveraging regional hubs for quicker commissioning and maintenance rollouts.

The high voltage transmission substation industry is led by Hitachi Energy, Siemens, and ABB, who deliver turnkey systems combining digital control, HV equipment, and lifecycle services. General Electric and Schneider Electric focus on modular substations and grid automation. Regional players like CG Power and L&T target emerging economies with GIS and hybrid systems. Mid-tier firms including Rockwell Automation and Locamation offer digital interfaces, while Tesco Automation supports SCADA-based operations. Competitive pressure has intensified due to equipment shortages and demand from grid expansions. Leading companies now prioritize three core strategies: automation to reduce outages, enhanced climate resilience, and seamless renewable integration—backed by predictive diagnostics, utility partnerships, and full-spectrum digital capabilities for substations.

In January 2025, Hitachi Energy was selected to supply 500 kV high-voltage circuit breakers for Transgrid’s HumeLink project in New South Wales. The equipment will support renewable power transmission across a 365 km network connecting Wagga Wagga, Bannaby, and Maragle.

| Item | Value |

|---|---|

| Quantitative Units | USD 42.4 Billion |

| Technology | Digital and Conventional |

| Component | Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others |

| Category | New and Refurbished |

| End Use | Utility and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hitachi Energy Ltd., ABB, CG Power & Industrial Solutions Ltd., Efacec, Eaton, General Electric, L&T Electrical and Automation, Locamation, Open System International, Inc., Rockwell Automation, Inc., Schneider Electric, Siemens, Texas Instruments Incorporated, and Tesco Automation Inc. |

| Additional Attributes | Dollar sales by substation type and voltage class are increasing, with gas-insulated (GIS) and hybrid substations capturing greater market share. Demand is rising for modular configurations and digitally enabled upgrades. EPC contractors and specialized system integrators are playing a larger role in turnkey deployments. Regions are moving toward eco-compatible materials and prefabricated components to address the accelerating pace of urban grid development. |

The global high voltage transmission substation market is estimated to be valued at USD 42.4 billion in 2025.

The market size for the high voltage transmission substation market is projected to reach USD 52.2 billion by 2035.

The high voltage transmission substation market is expected to grow at a 2.1% CAGR between 2025 and 2035.

The key product types in high voltage transmission substation market are digital and conventional.

In terms of component, substation automation system segment to command 35.2% share in the high voltage transmission substation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA