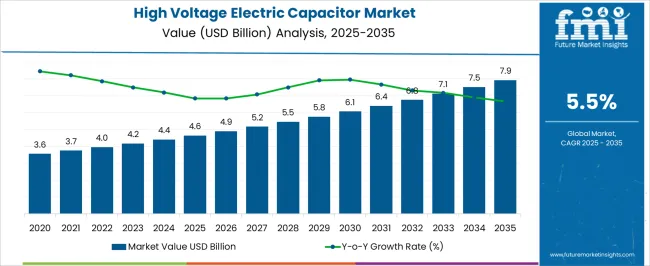

The high voltage electric capacitor market is estimated to be valued at USD 4.6 billion in 2025 and is projected to reach USD 7.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The high voltage electric capacitor market is expected to expand from USD 4.6 billion in 2025 to USD 7.9 billion in 2035, with a CAGR of 5.5%. This growth translates into an absolute dollar opportunity of USD 3.3 billion over the decade. The market shows steady annual increases, from USD 4.6 billion in 2025 to USD 4.9 billion in 2027, USD 5.5 billion in 2030, and reaching USD 7.1 billion by 2033. This steady upward trend indicates substantial revenue potential, providing businesses with a predictable growth trajectory and opportunities to capture market share throughout the 2025–2035 period.

Over the next ten years, the market for high voltage electric capacitors will generate an absolute dollar opportunity of USD 3.3 billion as it grows from USD 4.6 billion in 2025 to USD 7.9 billion in 2035 at a CAGR of 5.5%. The incremental growth each year highlights consistent demand, with key milestones including USD 5.2 billion in 2028 and USD 6.8 billion in 2034. This ongoing increase underscores the potential for manufacturers and suppliers to expand production and align investments with market growth, ensuring they benefit from the expanding market value.

| Metric | Value |

|---|---|

| High Voltage Electric Capacitor Market Estimated Value in (2025 E) | USD 4.6 billion |

| High Voltage Electric Capacitor Market Forecast Value in (2035 F) | USD 7.9 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The high voltage electric capacitor market is part of the broader global capacitor industry, which includes low, medium, and high voltage segments. The parent market is projected to grow steadily, driven by increasing demand for energy storage, grid stability, and industrial applications. High voltage capacitors account for a significant portion of this market, estimated at around 25% of total capacitor revenues in 2025. With the overall capacitor market expected to reach approximately USD 18.4 billion by 2035, high voltage capacitors’ share growth from USD 4.6 billion in 2025 to USD 7.9 billion in 2035 at a CAGR of 5.5% indicates a faster growth rate than some other segments.

Within the parent market, medium voltage capacitors hold around 35%, while low voltage capacitors cover roughly 40%. High voltage capacitors are increasingly contributing to overall market expansion due to rising industrial demand and infrastructure investments. The absolute dollar opportunity of USD 3.3 billion in the high voltage segment represents approximately 18% of the total incremental growth in the parent capacitor market over the same period. This demonstrates that high voltage capacitors are a key driver, accounting for a significant portion of market growth, and presents opportunities for manufacturers to capture value and expand their footprint in the broader capacitor industry.

The high voltage electric capacitor market is experiencing steady expansion, supported by the increasing demand for efficient power management solutions in industrial, commercial, and utility sectors. The rising need for grid stability, power quality improvement, and voltage regulation is driving adoption across global power infrastructure projects. High voltage capacitors are playing a pivotal role in supporting renewable energy integration, enabling efficient transmission over long distances, and minimizing energy losses in transmission and distribution networks.

Continuous investments in upgrading aging grid infrastructure in both developed and emerging economies are further contributing to market growth. Technological advancements in capacitor design and materials are improving energy density, operational lifespan, and reliability under high-stress conditions.

Environmental regulations promoting energy efficiency and reduction of transmission losses are encouraging utilities and industries to deploy advanced capacitor technologies As the shift toward renewable energy and smart grid systems accelerates, high voltage electric capacitors are expected to see increasing deployment, positioning the market for sustained growth over the coming years.

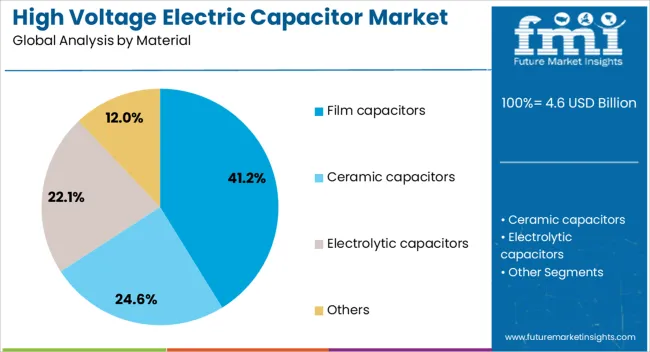

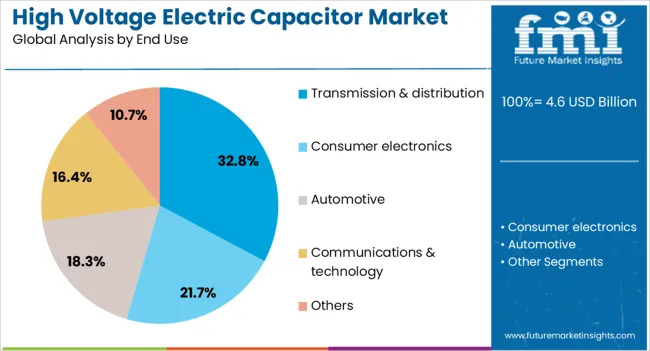

The high voltage electric capacitor market is segmented by material, end use, and geographic regions. By material, high voltage electric capacitor market is divided into film capacitors, ceramic capacitors, electrolytic capacitors, and others. In terms of end use, high voltage electric capacitor market is classified into transmission & distribution, consumer electronics, automotive, communications & technology, and others. Regionally, the high voltage electric capacitor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The film capacitors segment is projected to hold 41.2% of the high voltage electric capacitor market revenue share in 2025, making it the leading material type. This dominance is being driven by the segment’s ability to offer high dielectric strength, excellent insulation resistance, and superior thermal stability, which are critical for high-voltage applications. Film capacitors are known for their long operational life, low energy losses, and consistent performance under fluctuating load conditions, making them suitable for demanding environments.

The ability to maintain capacitance stability over time and across temperature ranges further enhances their reliability in transmission, distribution, and industrial systems. Manufacturers are increasingly focusing on producing film capacitors with advanced metallized films and improved encapsulation techniques to enhance durability and reduce maintenance needs.

Their resistance to moisture absorption and capability to withstand high pulse loads are additional factors driving adoption As demand grows for efficient, low-loss components in energy infrastructure and power electronics, film capacitors are expected to retain their leadership position in the market.

The transmission and distribution segment is anticipated to account for 32.8% of the high voltage electric capacitor market revenue share in 2025, making it the largest end-use category. This leadership is being reinforced by the critical role capacitors play in maintaining voltage stability, improving power factor, and reducing transmission losses in large-scale electrical networks. Increasing electricity consumption, coupled with the expansion of renewable energy projects, is placing greater emphasis on grid efficiency and reliability.

High voltage capacitors in transmission and distribution systems help manage reactive power, enabling utilities to optimize system performance and meet regulatory efficiency standards. Large-scale investments in grid modernization, particularly in emerging markets, are accelerating adoption.

Additionally, the need to integrate distributed energy resources and manage fluctuating supply from renewable sources is further boosting demand The segment’s growth is also supported by ongoing replacement of aging infrastructure with advanced capacitor banks capable of handling higher loads and providing enhanced operational flexibility.

The high voltage electric capacitor market is expanding due to rising demand for grid stabilization, reactive power compensation, and renewable energy integration. North America and Europe lead adoption with advanced capacitors for transmission networks, industrial equipment, and high-voltage substations. Asia-Pacific shows rapid growth driven by infrastructure expansion, renewable integration, and industrial electrification. Manufacturers differentiate through capacitance, voltage rating, dielectric material, and thermal stability. Regional variations in grid standards, energy policies, and industrial requirements strongly influence adoption, operational reliability, and global competitiveness.

High voltage capacitors are increasingly adopted to maintain voltage stability and reactive power compensation in transmission and distribution networks. North America and Europe prioritize capacitors for utility-scale power grids, industrial facilities, and renewable integration to reduce losses and improve efficiency. Asia-Pacific markets focus on cost-effective, reliable capacitors to stabilize rapidly expanding grids and support heavy industrial load centers. Differences in voltage levels, network configurations, and load profiles affect capacitor specifications, size, and installation requirements. Leading suppliers provide capacitors with high voltage ratings, thermal endurance, and low dielectric losses, while regional manufacturers focus on practical, locally sourced alternatives. Grid stabilization contrasts shape adoption, operational efficiency, and market competitiveness globally.

The choice of dielectric material significantly influences high voltage capacitor performance and adoption. North America and Europe emphasize capacitors using polypropylene, ceramic, or oil-impregnated paper to ensure high insulation strength, long service life, and minimal dielectric losses. Asia-Pacific markets adopt cost-efficient dielectric materials tailored for specific voltage classes and environmental conditions. Differences in insulation requirements, thermal management, and durability affect capacitor longevity, efficiency, and system reliability. Leading suppliers invest in advanced dielectric formulations and quality-controlled manufacturing processes, while regional players focus on practical, high-volume production. Dielectric material contrasts shape adoption, operational reliability, and competitiveness in the global high voltage capacitor market.

Reliability and low maintenance are critical for high voltage capacitor adoption in industrial and utility applications. North America and Europe prioritize capacitors with long service life, predictive diagnostics, and low failure rates to reduce downtime and maintenance costs. Asia-Pacific markets focus on robust capacitors capable of withstanding environmental stressors such as temperature fluctuations, humidity, and dust. Differences in expected lifecycle, maintenance practices, and operational environments influence procurement decisions, downtime management, and adoption rates. Leading suppliers provide capacitors with integrated monitoring and high fault tolerance, while regional manufacturers offer durable, cost-effective designs. Reliability contrasts shape adoption, operational continuity, and competitiveness globally.

Compliance with electrical standards, safety regulations, and certification requirements strongly influences high voltage capacitor adoption. North America and Europe adhere to IEC, IEEE, and local utility standards, ensuring consistent performance, safety, and interoperability in high-voltage systems. Asia-Pacific regulations vary; developed regions follow international norms, while emerging markets adopt local standards focusing on cost-effectiveness and safety. Differences in certification rigor, compliance processes, and industry expectations affect market acceptance, procurement timelines, and adoption. Leading suppliers deliver fully certified, standard-compliant capacitors, while regional players focus on practical, regulation-aligned designs. Regulatory and standards contrasts shape adoption, credibility, and competitiveness globally.

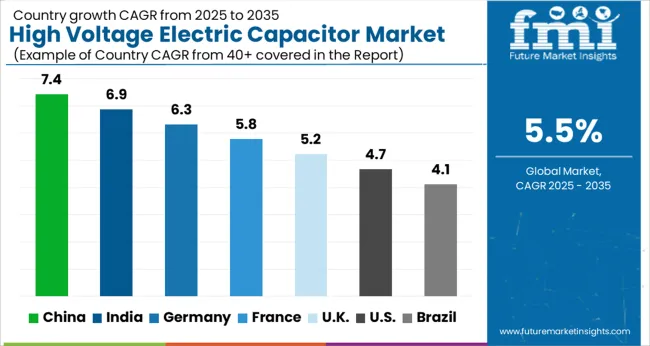

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

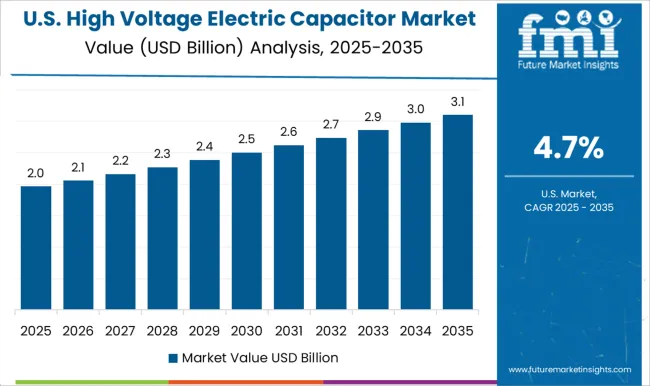

| USA | 4.7% |

| Brazil | 4.1% |

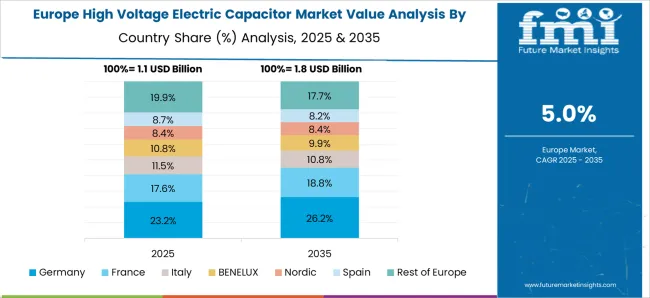

The global high voltage electric capacitor market is projected to grow at a 5.5% CAGR through 2035, driven by demand in power transmission, industrial equipment, and renewable energy integration. Among BRICS nations, China led with 7.4% growth as large-scale manufacturing and deployment across power grids and industrial facilities were executed, while India at 6.9% expanded production and installation capacities to meet rising energy infrastructure requirements. In the OECD region, Germany at 6.3% maintained steady deployment under stringent compliance frameworks, while the United Kingdom at 5.2% integrated high voltage capacitors into commercial and industrial networks. The USA, growing at 4.7%, supported consistent adoption across energy distribution and industrial applications under federal and state-level regulatory standards. This report includes insights on 40+ countries; the top countries are shown here for reference.

The high voltage electric capacitor market in China is projected to grow at a CAGR of 7.4%, driven by demand from power distribution, renewable energy projects, and industrial automation. Adoption is being encouraged by capacitors that offer high reliability, thermal stability, and long operational life. Manufacturers are being urged to supply advanced, cost effective, and durable products. Distribution through electrical contractors, industrial suppliers, and utility companies is being strengthened. Research in dielectric materials, efficiency optimization, and high voltage performance is being conducted. Increasing electricity consumption, grid modernization, and renewable energy installations are considered key factors driving the high voltage electric capacitor market in China.

In India, the high voltage electric capacitor market is expected to grow at a CAGR of 6.9%, supported by adoption in power utilities, industrial automation, and renewable energy systems. Emphasis is being placed on capacitors that provide stable performance, reliability, and cost efficiency. Local manufacturers are being encouraged to improve production capabilities and offer competitive products. Distribution through utility suppliers, industrial contractors, and electrical equipment distributors is being expanded. Training programs and technical workshops are being conducted to promote proper installation and maintenance. Expansion of industrial capacity, renewable energy projects, and electrical infrastructure modernization are recognized as primary drivers of the high voltage electric capacitor market in India.

Germany is witnessing steady growth in the high voltage electric capacitor market at a CAGR of 6.3%, driven by demand for energy efficient and high performance capacitors in industrial and utility applications. Adoption is being encouraged by capacitors that offer long lifespan, high thermal stability, and compliance with European standards. Manufacturers are being urged to supply advanced, reliable, and environmentally compliant products. Distribution through utility companies, industrial suppliers, and electrical contractors is being optimized. Research in advanced dielectric materials, efficiency enhancement, and voltage handling is being pursued. Renewable energy projects, smart grid initiatives, and industrial automation are considered key factors driving the high voltage electric capacitor market in Germany.

The high voltage electric capacitor market in the United Kingdom is projected to grow at a CAGR of 5.2%, supported by demand from power distribution networks, industrial automation, and renewable energy systems. Adoption is being emphasized for capacitors that offer high performance, thermal stability, and reliability for grid and industrial applications. Manufacturers are being encouraged to supply long lasting, efficient, and safe products. Distribution through industrial suppliers, utility companies, and electrical contractors is being strengthened. Awareness campaigns and technical demonstrations are being conducted to encourage proper usage and adoption. Grid modernization, industrial growth, and renewable energy expansion are recognized as major contributors to the high voltage electric capacitor market in the United Kingdom.

The high voltage electric capacitor market in the United States is projected to grow at a CAGR of 4.7%, driven by adoption in renewable energy, industrial, and utility sectors. Emphasis is being placed on capacitors that provide stable voltage handling, long operational life, and efficiency. Manufacturers are being urged to develop advanced, reliable, and cost effective products. Distribution through utility companies, industrial suppliers, and electrical contractors is being maintained. Research in dielectric materials, voltage stability, and high performance designs is being pursued. Expansion of smart grids, renewable energy installations, and industrial automation are considered primary drivers of the high voltage electric capacitor market in the United States.

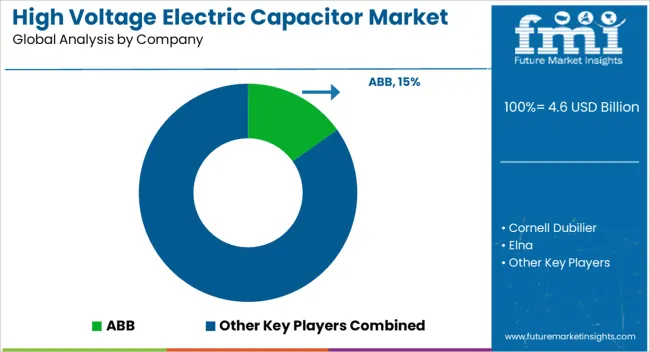

The high voltage electric capacitor market is supported by a range of established global suppliers providing reliable, high-performance capacitors for industrial, energy, and electronic applications. Key players include ABB, Cornell Dubilier, Elna, Havells, Kemet, Kyocera AVX, Murata Manufacturing, Panasonic, Samsung Electro-Mechanics, Schneider Electric, Siemens, Taiyo Yuden, TDK, and Vishay Intertechnology. These companies focus on delivering capacitors that meet stringent voltage, temperature, and durability requirements, catering to sectors such as power transmission, renewable energy, transportation, and industrial automation.

Market growth is driven by increasing demand for efficient energy storage solutions, renewable energy integration, and advanced electronic systems requiring stable voltage regulation. Companies like ABB, Siemens, and Schneider Electric leverage their expertise in power solutions to offer capacitors suitable for high-voltage applications, while Murata, Kemet, and TDK provide compact, high-performance solutions for electronics and industrial equipment. Panasonic, Samsung Electro-Mechanics, and Kyocera AVX also contribute with technologically advanced products that ensure long life, low losses, and reliability under extreme conditions. Competition in the high voltage capacitor market is influenced by technological innovation, quality, and product reliability.

Leading suppliers invest heavily in research and development to improve capacitor efficiency, miniaturize components, and enhance safety features. Collaborations and partnerships are common strategies to accelerate product innovation and expand market reach. As the demand for electrification, industrial automation, and renewable energy systems rises globally, companies like Vishay Intertechnology, Elna, and Cornell Dubilier are positioned to capitalize on these opportunities by offering high-voltage capacitors that meet evolving industrial and consumer requirements. The market continues to expand as these suppliers drive advancements in performance, efficiency, and sustainability across applications.

| Items | Values |

|---|---|

| Quantitative Units | USD 4.6 billion |

| Material | Film capacitors, Ceramic capacitors, Electrolytic capacitors, and Others |

| End Use | Transmission & distribution, Consumer electronics, Automotive, Communications & technology, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Cornell Dubilier, Elna, Havells, Kemet, Kyocera AVX, Murata Manufacturing, Panasonic, Samsung Electro-Mechanics, Schneider Electric, Siemens, Taiyo Yuden, TDK, and Vishay Intertechnology |

| Additional Attributes | Dollar sales vary by capacitor type, including power capacitors, snubber capacitors, and filter capacitors; by voltage rating, spanning medium voltage to extra-high voltage; by application, such as power transmission, renewable energy systems, industrial machinery, and electric utilities; by end-use, covering utilities, industrial plants, and renewable energy projects; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by grid modernization, renewable integration, and demand for power quality improvement. |

The global high voltage electric capacitor market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the high voltage electric capacitor market is projected to reach USD 7.9 billion by 2035.

The high voltage electric capacitor market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in high voltage electric capacitor market are film capacitors, ceramic capacitors, electrolytic capacitors and others.

In terms of end use, transmission & distribution segment to command 32.8% share in the high voltage electric capacitor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA