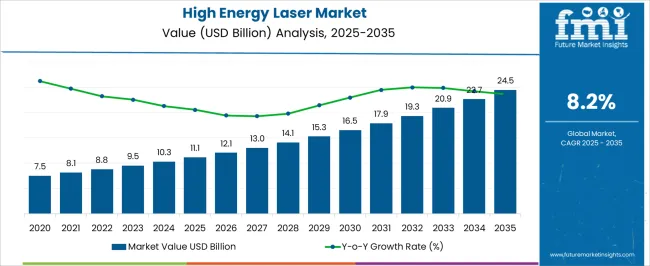

The high energy laser market is estimated to be valued at USD 11.1 billion in 2025 and is projected to reach USD 24.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

This growth is influenced by rising demand in defense, aerospace, and industrial manufacturing sectors, where high energy lasers are valued for their precision, speed, and efficiency. Their adoption in applications such as directed energy systems, precision cutting, and material processing highlights their expanding role in both commercial and defense environments. The progression reflects consistent year-on-year gains, demonstrating the shift toward high-performance solutions in critical industries. From 2030 to 2035, the market is forecast to advance further from USD 16.5 billion to USD 24.5 billion, indicating a smooth growth curve without volatility. This phase highlights continued interest in laser-based systems for defense modernization, advanced communication technologies, and high-end industrial applications.

The predictable growth suggests manufacturers and stakeholders will see expanding opportunities as lasers gain preference for their accuracy, reduced operating costs, and versatility across sectors. The steady curve shape implies a strong long-term outlook, underpinned by continuous investments in defense contracts, industrial automation, and energy-efficient production methods. As adoption spreads across multiple regions, the high energy laser market is expected to maintain momentum and create meaningful value for participants through this ten-year cycle.

| Metric | Value |

|---|---|

| High Energy Laser Market Estimated Value in (2025 E) | USD 11.1 billion |

| High Energy Laser Market Forecast Value in (2035 F) | USD 24.5 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The high energy laser market secures a notable share across several defense and technology-driven parent markets, with its contribution varying depending on the application focus. Within the directed energy weapons market, high energy lasers account for nearly 35%, reflecting their growing role in next-generation precision strike and missile defense systems. In the defense technology and military systems market, their share is around 10%, as they compete with conventional weapons, electronic warfare tools, and kinetic systems while still gaining momentum through modernization programs. Within the aerospace and defense electronics market, high energy lasers represent close to 6%, highlighting their specialized use among a wide spectrum of electronic subsystems for surveillance, communications, and control. In the advanced laser systems market, which includes industrial, medical, and defense lasers, high energy lasers capture about 8%, underscoring their importance in the military segment but limited presence compared to industrial laser applications.

Finally, within the homeland security and strategic defense market, high energy lasers contribute around 12%, driven by their deployment in border defense, critical infrastructure protection, and counter-unmanned aerial systems. Taken together, these percentages illustrate that high energy lasers maintain their strongest influence in directed energy weapons while steadily expanding their footprint in strategic defense and aerospace domains. Their modest but growing shares in broader defense and electronics markets emphasize both their niche character and their rising significance as militaries invest in advanced, cost-efficient, and high-precision energy-based systems.

The market is experiencing accelerated growth, driven by rising adoption in defense, industrial, and precision manufacturing applications. Advancements in beam control, power scaling, and energy efficiency have enhanced operational reliability and expanded deployment scenarios. Growing demand for cost-effective and high-precision solutions has been supported by technological improvements that allow for reduced maintenance and improved output stability.

Defense modernization programs across multiple regions have fueled demand for both lethal and non-lethal laser systems, while industrial sectors are increasingly leveraging these technologies for high-speed cutting, welding, and material processing. The shift toward directed-energy solutions has also been encouraged by the ability to deliver pinpoint accuracy with minimal collateral impact.

Continued R&D investment, along with cross-sector partnerships, is expected to support new use cases, making high energy lasers more versatile and commercially viable With expanding capabilities and integration into advanced platforms, the market is positioned for sustained long-term growth across multiple sectors.

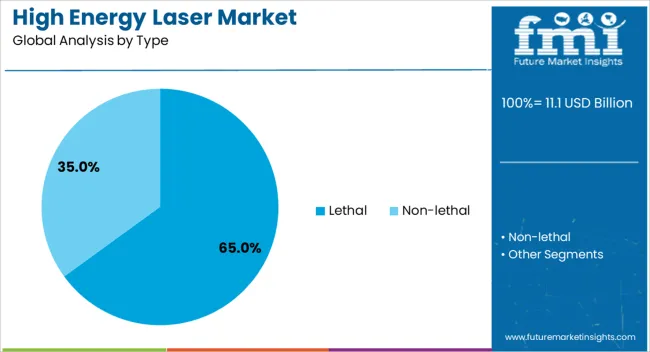

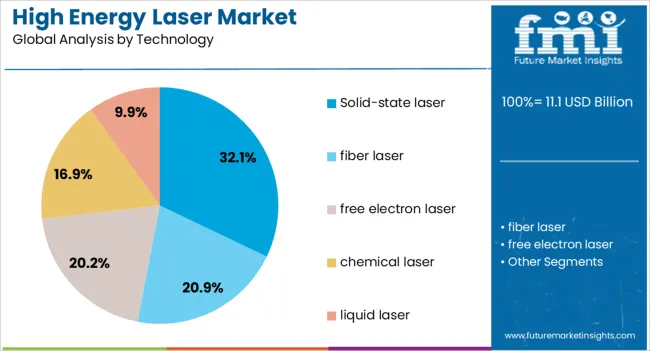

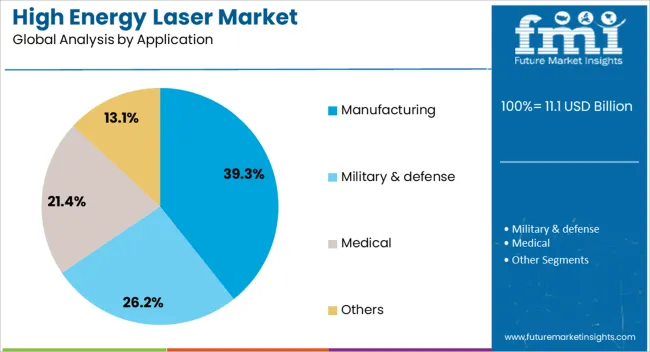

The high energy laser market is segmented by type, technology, application, and geographic regions. By type, high energy laser market is divided into lethal and non-lethal. In terms of technology, high energy laser market is classified into solid-state laser, fiber laser, free electron laser, chemical laser, and liquid laser. Based on application, high energy laser market is segmented into manufacturing, military & defense, medical, and others. Regionally, the high energy laser industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lethal type segment is projected to hold 65% of the high energy laser market revenue share in 2025, establishing it as the leading type category. This dominance has been driven by the growing emphasis on advanced defense capabilities that offer precision targeting with reduced collateral damage.

Military modernization programs have increasingly prioritized directed-energy systems due to their speed-of-light engagement capabilities and reduced logistical burdens compared to conventional munitions. The lethal category’s rise has also been supported by operational advantages such as deep magazine capacity, lower per-shot costs, and adaptability to different combat environments.

Integration of lethal laser systems into ground, naval, and airborne platforms has been enabled by advancements in compact power sources and improved beam control technologies With ongoing geopolitical tensions and the demand for advanced defense deterrence strategies, lethal high energy lasers have continued to attract substantial government investment, reinforcing their dominant market position.

The solid state laser technology segment is expected to account for 32.10% of the market revenue share in 2025, making it the leading technology category. Growth in this segment has been attributed to its higher efficiency, compact size, and operational durability compared to alternative technologies. Solid state lasers have gained preference due to their ability to generate high beam quality while maintaining stable performance in challenging environmental conditions.

The technology supports a range of applications, from military defense systems to industrial manufacturing, by enabling faster targeting and precision material processing. Advancements in thermal management and modular design have further improved their scalability, allowing deployment across multiple platforms.

Reduced operational and maintenance costs, coupled with the ability to integrate with evolving control software, have enhanced their appeal As industries and defense sectors seek reliable and adaptable laser solutions, solid state technology is expected to maintain its leadership in the market.

The manufacturing application segment is anticipated to command 39.30% of the market revenue share in 2025, establishing itself as the leading application category. The segment’s growth has been propelled by the increasing demand for high-precision material processing in automotive, aerospace, electronics, and heavy machinery industries. High energy lasers offer unparalleled accuracy, faster processing speeds, and the ability to work with a wide range of materials, which enhances production efficiency.

The adoption of these systems in manufacturing has been reinforced by their ability to deliver consistent quality with minimal waste, supporting cost optimization efforts. Integration with automation and robotics has further expanded their use in advanced production lines.

Continuous technological improvements have enabled better beam control, reduced power consumption, and enhanced compatibility with Industry 4.0 initiatives As manufacturers prioritize productivity, precision, and scalability, high energy lasers are expected to remain an essential tool in modern production environments.

The high energy laser market is advancing as defense agencies adopt directed-energy solutions for precision engagement, threat neutralization, and cost efficiency. Opportunities are expanding in aerospace, industrial manufacturing, and research applications, while trends emphasize higher power scaling, modular deployment, and advanced targeting integration. Challenges remain in energy supply, thermal management, and cost barriers. In my opinion, long-term growth will favor companies capable of delivering reliable, mobile, and affordable laser systems, positioning them as critical assets in both military modernization and emerging civilian industries worldwide.

Demand for high energy lasers has been propelled by their growing role in defense systems, offering precision targeting, rapid engagement, and cost-effective per-shot performance compared to conventional munitions. Defense agencies are prioritizing laser adoption for counter-drone operations, missile interception, and vehicle protection systems. Their ability to neutralize threats with minimal collateral damage makes them highly attractive for military modernization programs. In my opinion, demand will continue to rise as global defense forces seek advanced, reliable, and scalable directed-energy solutions to strengthen security and operational dominance.

Opportunities are emerging beyond defense, with aerospace and industrial sectors showing interest in high energy lasers. Aircraft integration for missile defense and satellite protection is creating new adoption pathways. Industrial opportunities include heavy-duty cutting, welding, and drilling, where lasers deliver higher precision and reduced processing times. Research institutions are also exploring high energy lasers for medical and nuclear fusion applications. I believe companies that diversify offerings across both defense and civilian industries will secure long-term opportunities, benefiting from the expanding scope of laser applications worldwide.

Trends in the high energy laser market highlight the focus on scaling power output and improving mobility. Defense organizations are moving toward mobile and modular systems that can be deployed on ships, aircraft, and ground vehicles. Industry players are investing in beam-combining technologies to increase range and effectiveness. Another trend is the integration of lasers with advanced tracking and targeting systems for greater accuracy. In my opinion, these developments point toward a decisive shift, where high energy lasers are evolving into adaptable tools suited for multi-domain operations.

Challenges include the high cost of development, complex integration with existing defense platforms, and significant energy requirements. Reliable power supply systems remain critical, especially for mobile platforms where energy storage is limited. Heat management and optical degradation issues also pose hurdles for long-term use. Competition from conventional missile defense systems creates another barrier for broader adoption. In my assessment, overcoming these challenges will require innovations in energy storage, thermal management, and cost-efficient design to ensure high energy lasers become viable alternatives in global defense and industrial markets.

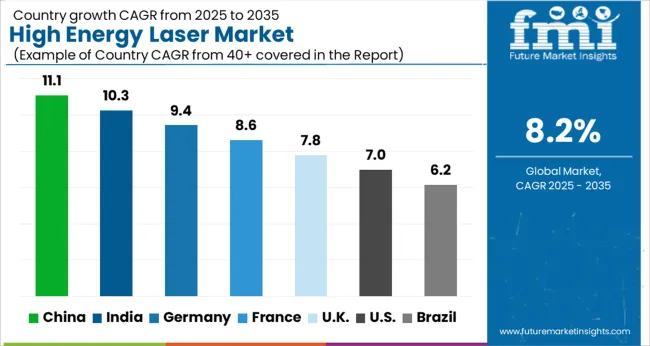

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The global high energy laser market is projected to grow at a CAGR of 8.2% from 2025 to 2035. China leads with a growth rate of 11.1%, followed by India at 10.3%, and Germany at 9.4%. The United Kingdom records a growth rate of 7.8%, while the United States shows the slowest growth at 7%. Expansion is being fueled by increasing defense modernization programs, applications in aerospace and industrial manufacturing, and rising interest in directed-energy weapons. Emerging markets such as China and India are recording rapid growth due to escalating defense budgets and technology adoption, while developed markets like the USA, UK, and Germany are emphasizing advanced R&D, integration in combat platforms, and wider industrial applications. This analysis covers insights from 40+ countries, highlighting key markets for reference.

The high energy laser market in China is projected to grow at a CAGR of 11.1%. China is investing heavily in directed-energy weapons as part of its defense modernization programs. Significant applications in aerospace, naval defense, and missile interception systems are boosting demand. Beyond defense, industries such as automotive and manufacturing are adopting laser systems for welding, cutting, and precision applications. Continuous state-led funding and collaboration between research institutes and defense contractors are ensuring rapid technological progress and commercial adoption of high energy lasers.

The high energy laser market in India is expected to grow at a CAGR of 10.3%. Rising defense expenditure and government-backed projects to develop indigenous laser weapon systems are major drivers. The growing need for border security and missile defense systems further boosts adoption. Expanding aerospace and industrial sectors are integrating high energy lasers for precision-based applications. Collaborations with global defense firms and investments in domestic R&D under the “Make in India” initiative are expected to expand production capacity and enhance India’s market presence.

The high energy laser market in Germany is projected to grow at a CAGR of 9.4%. Germany’s strong defense and industrial base is fueling adoption of high energy laser systems. Defense contractors are developing prototypes for naval and land-based directed-energy weapons, focusing on precision and cost efficiency. Industrial applications in automotive, shipbuilding, and precision manufacturing also contribute to demand. Government investments in R&D and collaboration with EU defense projects provide additional growth momentum. Germany’s reputation as a leader in advanced manufacturing and engineering underpins steady market expansion.

The high energy laser market in the UK is projected to grow at a CAGR of 7.8%. Defense programs targeting the development of next-generation directed-energy weapons for land and naval forces are the primary drivers. The country is also investing in aerospace applications, where lasers are used for targeting and communications. Industrial adoption is rising gradually, particularly in welding and material processing applications. Research partnerships between universities, defense contractors, and government agencies are ensuring ongoing innovation and market advancement.

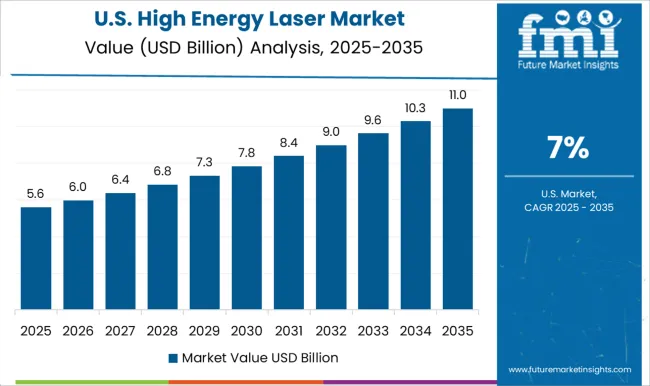

The high energy laser market in the USA is projected to grow at a CAGR of 7%. While slower compared to emerging economies, the USA remains the global leader in R&D and deployment of laser-based defense systems. Significant investments by the Department of Defense in missile interception, drone neutralization, and naval laser platforms are sustaining demand. Industrial applications, including advanced manufacturing, aerospace, and automotive, also contribute to adoption. Strong presence of leading defense contractors and continuous innovation in solid-state and fiber lasers ensure steady expansion, despite a more mature market environment.

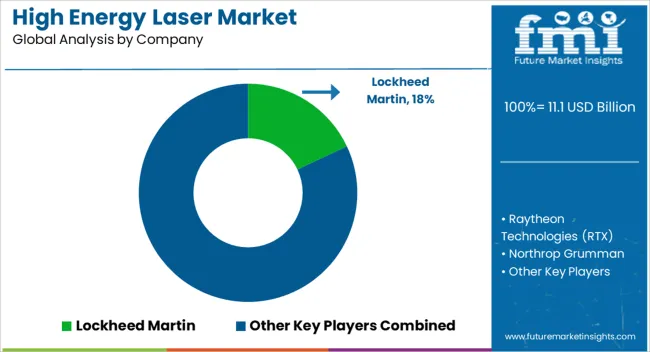

Competition in the high energy laser market has been shaped by defense contractors and advanced technology firms that direct significant resources into directed-energy systems. Lockheed Martin has been regarded as a leader, with extensive work on scalable laser weapon systems that integrate into land, air, and naval platforms. RTX Corporation has been competing by demonstrating high-energy laser systems for vehicle-mounted and ground-based defense, highlighting rapid deployment and battlefield adaptability. Northrop Grumman has been focusing on beam control technologies and integration with missile defense architectures, positioning itself as a key innovator. BAE Systems has been strengthening its role with modular directed-energy solutions, emphasizing adaptability across different mission requirements. General Dynamics has been contributing through advanced systems integration and research collaborations aimed at making laser weapons practical for combat readiness. Rheinmetall has been expanding its footprint in Europe, where high-energy laser demonstrators for ground and naval defense have been emphasized.

L3Harris has been recognized for contributions in power management, beam combination, and subsystems that enable operational deployment of laser technologies. Other emerging firms and specialized suppliers have been complementing the market by offering components, optics, and subsystems that support these large defense contractors. Strategic positioning among these companies has been influenced by their ability to scale prototypes into deployable solutions while securing defense contracts. Lockheed Martin, RTX Corporation, and Northrop Grumman have been regarded as front-runners, leveraging strong defense ties and advanced research to demonstrate functional, combat-ready laser systems. BAE Systems and Rheinmetall have been focusing on modular platforms, providing defense agencies with flexibility in integrating lasers into existing vehicles or naval ships. General Dynamics has been emphasizing collaborative approaches, enhancing its credibility through partnerships and integration expertise. L3Harris has been positioned as an essential enabler, supplying technologies that ensure lasers operate efficiently in demanding environments. The competitive field has therefore been shaped by performance validation, contract wins, and integration capability, with long-term leadership granted to companies capable of combining engineering scale with proven battlefield readiness.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.1 billion |

| Type | Lethal and Non-lethal |

| Technology | Solid-state laser, fiber laser, free electron laser, chemical laser, and liquid laser |

| Application | Manufacturing, Military & defense, Medical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin, RTX Corporation, Northrop Grumman, BAE Systems, General Dynamics, Rheinmetall, L3Harris, and Others |

| Additional Attributes | Dollar sales by product type (solid-state, fiber, gas, diode lasers), Dollar sales by application (defense, aerospace, industrial, research), Trends in directed energy weapons and precision targeting, Use in missile defense, UAVs, and ship-based systems, Growth of industrial cutting and welding applications, Regional development hubs across North America, Europe, and Asia-Pacific. |

The global high energy laser market is estimated to be valued at USD 11.1 billion in 2025.

The market size for the high energy laser market is projected to reach USD 24.5 billion by 2035.

The high energy laser market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in high energy laser market are lethal and non-lethal.

In terms of technology, solid-state laser segment to command 32.1% share in the high energy laser market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA