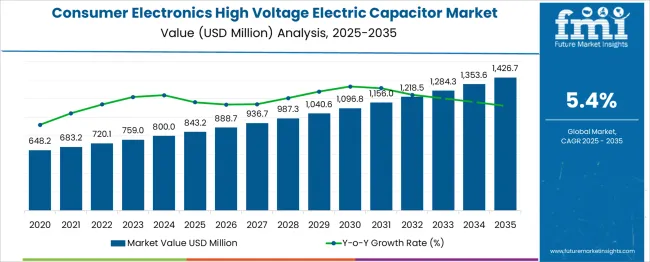

The Consumer Electronics High Voltage Electric Capacitor Market is estimated to be valued at USD 843.2 million in 2025 and is projected to reach USD 1426.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period. The growth pattern reflects steady value addition, though year-on-year increments reveal both mild acceleration and periods of deceleration. From 2025 to 2029, annual gains increase from USD 45.5 million to USD 53.3 million, indicating early-stage acceleration supported by rising demand for high-voltage components in smart devices, power-dense systems, and compact energy storage modules. Between 2030 and 2032, growth slows slightly, with annual additions plateauing in the range of USD 56 million to USD 62.5 million. This suggests a short deceleration window, potentially influenced by maturity in certain subsegments or slower adoption cycles in mid-range consumer electronics. However, post-2032, acceleration resumes as the market expands by USD 66.0 million between 2034 and 2035, the highest gain across the period. This return to stronger growth may result from component redesigns for next-generation devices, system miniaturization, and emerging use cases in edge computing and AI-powered consumer applications. The overall pattern indicates a stable market with controlled growth, punctuated by moderate shifts in velocity rather than sharp deviations or structural slowdowns.

| Metric | Value |

|---|---|

| Consumer Electronics High Voltage Electric Capacitor Market Estimated Value in (2025 E) | USD 843.2 million |

| Consumer Electronics High Voltage Electric Capacitor Market Forecast Value in (2035 F) | USD 1426.7 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

The consumer electronics high voltage electric capacitor market is advancing steadily, driven by the growing integration of power electronics into modern devices and the increasing demand for energy-efficient circuit components. The rising adoption of advanced display technologies, electric drives, and fast-charging protocols in personal and household electronics has created a consistent need for high-voltage capacitors with stable performance.

Design miniaturization combined with the need for improved thermal stability and frequency response is encouraging the use of capacitors that can withstand high voltage without compromising reliability. As OEMs aim to reduce power losses and improve efficiency in compact devices, high-voltage capacitors are being adopted as core components across product categories.

The market outlook is further strengthened by increasing R&D activities focused on developing dielectric materials with better energy density, alongside industry initiatives to comply with stricter energy consumption standards. With technological advancements and expanding consumer electronics production across Asia-Pacific and North America, high-voltage capacitor demand is expected to rise consistently in the coming years..

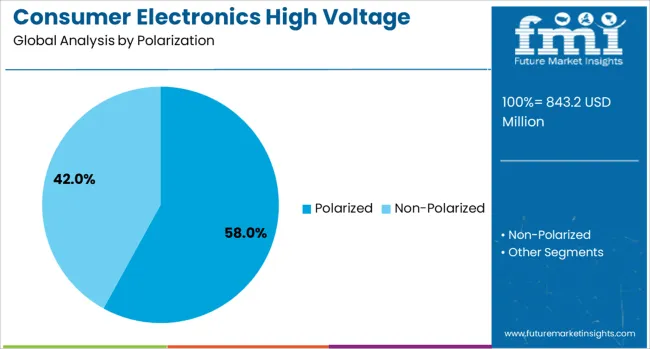

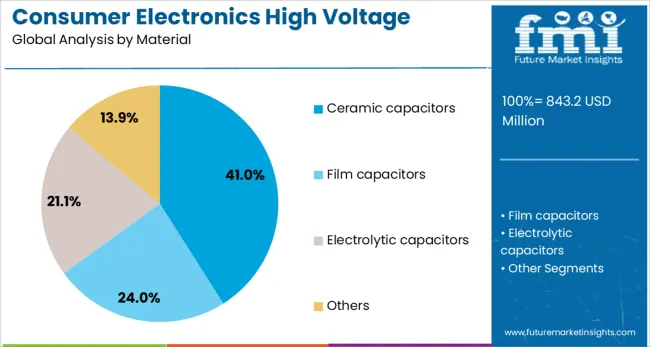

The consumer electronics high voltage electric capacitor market is segmented by polarization, material, and geographic regions. The consumer electronics high voltage electric capacitor market is divided into Polarized and Non-Polarized. The consumer electronics high voltage electric capacitor market is classified into Ceramic capacitors, Film capacitors, Electrolytic capacitors, and Others. Regionally, the consumer electronics high voltage electric capacitor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polarized segment is expected to hold 58% of the Consumer Electronics High Voltage Electric Capacitor market revenue share in 2025, making it the leading category under the polarization segment. This dominance has been driven by the ability of polarized capacitors to provide higher capacitance values within compact footprints, which is essential in densely packed electronic circuits.

Polarized designs are known for their high energy storage capacity, which supports their deployment in power supply stabilization, signal filtering, and energy buffering applications within consumer electronics. Their widespread adoption has also been influenced by their relatively low cost and ease of integration into surface-mounted and printed circuit board configurations.

In products where directional voltage polarity can be controlled, such as smartphones, televisions, and computing devices, polarized capacitors have been favored for their efficiency and space-saving benefits. As manufacturers continue to design increasingly compact and power-efficient devices, polarized capacitors are likely to retain their leading role across high-voltage applications..

The ceramic capacitors segment is projected to account for 41% of the Consumer Electronics High Voltage Electric Capacitor market revenue share in 2025, positioning it as the leading category under the material segment. This growth has been attributed to the superior thermal stability, low equivalent series resistance, and non-polar nature of ceramic capacitors, which make them ideal for high-frequency and high-voltage circuits.

Ceramic materials allow capacitors to perform reliably under varying voltage and temperature conditions, which is essential for maintaining consistent functionality in mobile devices, wearables, and entertainment systems. Their compact size, coupled with high dielectric strength, has facilitated broad adoption in applications demanding performance, reliability, and miniaturization.

Ceramic capacitors have also gained traction due to their lead-free composition and compliance with environmental directives such as RoHS, which global electronics manufacturers are increasingly prioritizing. With the trend toward sleeker, multifunctional consumer electronics, ceramic capacitors have been positioned as a preferred material choice for next-generation circuit designs..

The consumer electronics high voltage electric capacitor segment is gaining traction as devices demand higher power density, faster charge and discharge cycles, and improved energy storage capabilities. Capacitors rated for high voltage are increasingly integral in applications such as televisions, power supplies, inverters, home appliances, and audio systems, where they stabilize voltage and filter noise.

Advancements in dielectric materials, miniaturization trends, and the need for improved thermal stability in compact designs are shaping the market. Asia-Pacific remains the production hub, led by China, Japan, and South Korea, while North America and Europe drive demand for premium, high-reliability components. The push for longer product lifecycles, better energy efficiency, and compatibility with next-gen consumer devices is driving innovation. However, raw material cost volatility, miniaturization challenges, and intense competition from low-cost manufacturers are affecting margins. Key trends include the integration of multilayer ceramic capacitors (MLCCs) in high-voltage ranges, improved polymer films, and designs optimized for high-frequency switching environments.

The increasing complexity of consumer electronics, particularly in high-definition displays, advanced audio equipment, and power electronics, is driving the adoption of high voltage capacitors capable of handling transient loads and delivering stable performance. Devices such as LED and OLED TVs, gaming consoles, and smart appliances rely on these components for voltage regulation and filtering under fluctuating power conditions. Miniaturization trends demand capacitors that can deliver high voltage ratings within smaller footprints without compromising reliability. Innovations in ceramic and film dielectric technologies are allowing higher capacitance density, improved temperature tolerance, and extended operating life. The proliferation of high-frequency switching power supplies in consumer devices is also creating demand for capacitors designed to operate efficiently in such environments, reducing energy losses and enhancing device performance.

Despite the market’s potential, high voltage capacitor manufacturing involves significant investment in precision equipment, dielectric processing, and quality control systems. The use of advanced materials like high-purity ceramics or specialized polymer films increases production costs, which can be difficult to recover in price-sensitive consumer markets. Intense competition, especially from low-cost manufacturers in emerging economies, exerts downward pressure on margins for established players. Moreover, maintaining reliability standards under high voltage stress in compact devices is technically challenging, leading to higher R&D expenditures. Volatility in raw material prices, such as tantalum, aluminum, and specialty ceramics, further complicates cost structures. Regulatory requirements for environmental compliance, particularly restrictions on hazardous substances, add another layer of complexity and operational cost.

The growing adoption of connected home devices, wearables, and IoT-enabled consumer electronics presents opportunities for high voltage capacitor suppliers to design compact, efficient, and high-reliability components tailored to low-profile form factors. Advances in dielectric materials, such as high-performance ceramic composites and improved polypropylene films—enable capacitors to achieve higher voltage ratings with reduced size and improved thermal stability. Manufacturers integrating high voltage capacitors into smart energy management systems, wireless charging platforms, and high-power LED lighting solutions are positioned to benefit from increasing consumer demand for performance and efficiency. The expansion of 5G-enabled devices, with their need for stable and rapid energy delivery in compact hardware, further widens the application base for high voltage capacitors in the consumer electronics segment.

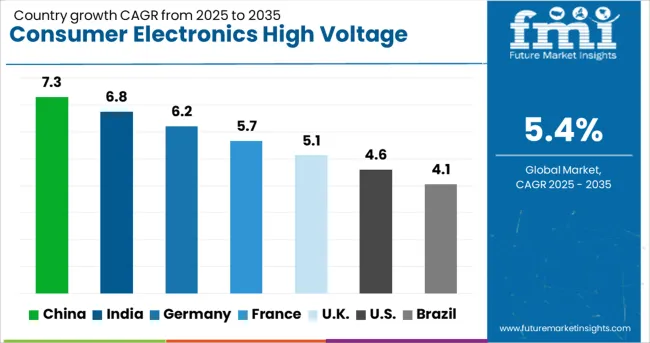

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

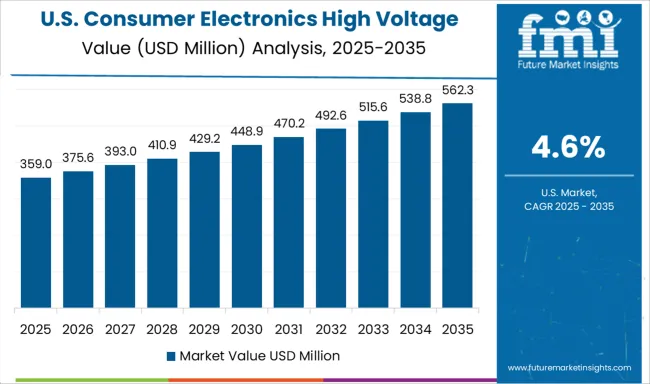

| USA | 4.6% |

| Brazil | 4.1% |

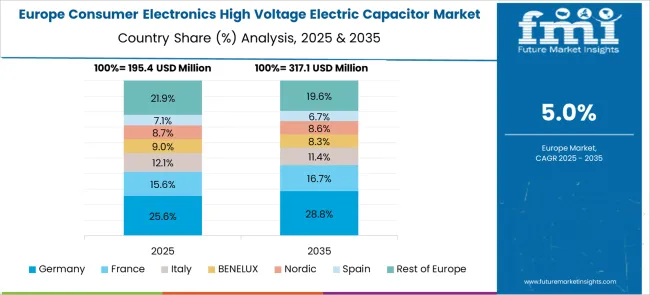

The global consumer electronics high voltage electric capacitor market is expected to grow at a CAGR of 5.4% from 2025 to 2035. China leads with a 7.3% CAGR, outperforming the global average by a 1.35x factor due to large-scale domestic electronics manufacturing and growing export demand. India follows at 6.8%, registering a 1.26x multiple, supported by component localization and expanding semiconductor ecosystems. Germany (OECD) stands at 6.2%, benefiting from EV electronics demand and recording a 1.15x increase over the global rate. The United Kingdom (OECD) slightly underperforms at 5.1%, while the United States (OECD) trails at 4.6%, reflecting comparatively lower component production capacity.

China accounted for a 7.3% share in 2025, driven by large-scale manufacturing of LED televisions, air conditioners, and microwave ovens. High-voltage ceramic and film capacitors were integrated into power supply modules and inverter circuits to ensure surge protection and energy efficiency. Local OEMs partnered with raw material suppliers in Jiangsu and Hunan for metallized polypropylene films with high dielectric stability. Capacitor manufacturers focused on radial and axial leaded configurations for compact electronics. As energy storage and IoT-enabled devices expanded, demand for pulse capacitors with self-healing features grew within the Chinese appliance sector.

India held a 6.8% share in 2025, supported by rising domestic electronics assembly. High-voltage capacitors were used extensively in televisions, ceiling fans with BLDC motors, and induction cooktops. Companies like V Guard and Crompton Greaves incorporated radial-type film capacitors in fan motor circuits to ensure voltage stability. The BIS quality standardization framework drove adoption of safety-certified capacitors in home appliances. With inverter technology gaining traction in entry-level washing machines and refrigerators, demand for capacitors rated above 400V increased. Regional clusters in Pune and Chennai focused on scalable production of polyester and polypropylene dielectric capacitors.

Germany posted a 6.2% market share in 2025, supported by demand for power-efficient and safety-compliant household appliances. High-voltage capacitors with flame-retardant coatings and low ESR (Equivalent Series Resistance) were integrated into appliance SMPS circuits. Domestic brands like Miele and Bosch emphasized capacitor durability under fluctuating grid voltages. Radial lead capacitors with polyester dielectrics were favored in energy-efficient tumble dryers, dishwashers, and kitchen hoods. Capacitor suppliers in Stuttgart and Nuremberg developed compact, high-capacitance modules suitable for embedded electronics in IoT appliances.

The United Kingdom accounted for a 5.1% market share in 2025. High-voltage capacitors were adopted in compact appliance systems like kettle thermostats, cordless vacuum cleaners, and portable induction plates. British contract manufacturers relied on capacitor imports from the EU and China, integrating axial and SMD types with voltage ratings of 250V to 800V. Safety certification from BS EN 60384 standards shaped sourcing decisions for electronics subassemblies. Growing use of embedded microcontrollers and switched-mode power supplies in budget appliances required high-reliability capacitor components.

The USA held a 4.6% share in 2025, influenced by demand for premium white goods and smart HVAC systems. High-voltage capacitors were used in systems requiring high ripple current handling, including inverter-based kitchen appliances and central AC units. USA brands like Whirlpool and GE prioritized multilayer ceramic capacitors and axial film types for consistent performance across voltage spikes. Silicon Valley-based capacitor startups focused on embedded capacitor arrays for compact electronics. Emphasis was placed on RoHS-compliant, low-inductance designs suited for power factor correction and surge dampening.

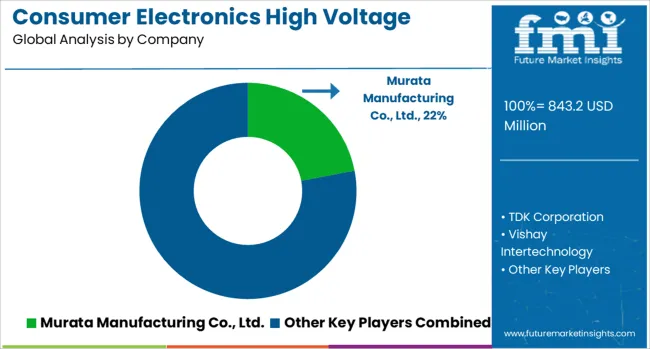

The consumer electronics high voltage electric capacitor market includes manufacturers supplying compact, surface-mount, and leaded capacitors designed for energy storage, voltage regulation, and noise suppression in appliances, televisions, monitors, and power adapters. Murata Manufacturing Co., Ltd. leads with multilayer ceramic capacitors (MLCCs) and film capacitors tailored for high-voltage consumer applications, focusing on compact form factors and long-term voltage stability. TDK Corporation offers high-voltage MLCCs and aluminum electrolytic capacitors used in LCD backlighting, battery protection circuits, and high-frequency inverter designs. Vishay Intertechnology delivers a broad range of film and ceramic capacitors for power management in consumer devices, emphasizing high dielectric strength and low ESR performance. KYOCERA Corporation produces high-voltage ceramic capacitors with a focus on miniaturization and thermal resistance, suitable for densely packed circuit boards in audio and imaging equipment. Panasonic Corporation supplies hybrid polymer, film, and ceramic capacitors supporting high ripple currents and voltage surges, commonly integrated into home electronics and smart appliances. Key market drivers include dielectric material reliability, capacitance stability under thermal cycling, compliance with safety standards, and performance under rapid charge-discharge conditions found in modern consumer electronics.

Samsung Electro‑Mechanics introduced 630 V MLCCs targeting EV and wearable applications, while Vishay Intertechnology expanded its high‑voltage MLCC series for telecom and defense electronics. Murata, TDK, and KEMET (under Yageo) increased production capacity in Asia to serve rising demand across smartphones, home automation, and portable computing. OEMs adopted real‑time monitoring features for predictive maintenance in high‑power devices. Asia‑Pacific continued to lead market volume with widespread consumer electronics manufacturing and infrastructure upgrades.

| Item | Value |

|---|---|

| Quantitative Units | USD 843.2 Million |

| Polarization | Polarized and Non-Polarized |

| Material | Ceramic capacitors, Film capacitors, Electrolytic capacitors, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Murata Manufacturing Co., Ltd., TDK Corporation, Vishay Intertechnology, KYOCERA Corporation, and Panasonic Corporation |

| Additional Attributes | Dollar sales by capacitor type (film, ceramic, electrolytic) and application (power supplies, motor drives, consumer devices), demand driven by EVs, telecom, and smart appliances, led by Asia Pacific with North America catching up, innovation in high voltage compact designs and long life reliability. |

The global consumer electronics high voltage electric capacitor market is estimated to be valued at USD 843.2 million in 2025.

The market size for the consumer electronics high voltage electric capacitor market is projected to reach USD 1,426.7 million by 2035.

The consumer electronics high voltage electric capacitor market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in consumer electronics high voltage electric capacitor market are polarized and non-polarized.

In terms of material, ceramic capacitors segment to command 41.0% share in the consumer electronics high voltage electric capacitor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Consumer Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Consumer Packaging Industry Analysis in India Forecast and Outlook 2025 to 2035

Consumer Foam Market Size and Share Forecast Outlook 2025 to 2035

Consumer Packaging Industry Analysis in China Size and Share Forecast Outlook 2025 to 2035

Consumer Cloud Subscription Market Size and Share Forecast Outlook 2025 to 2035

Consumer Packaging Industry Analysis in Brazil Size and Share Forecast Outlook 2025 to 2035

Consumer Electronic Accessories Market Size and Share Forecast Outlook 2025 to 2035

Consumer Facing AI Products Market Size and Share Forecast Outlook 2025 to 2035

Consumer Video Feedback Software Market Size and Share Forecast Outlook 2025 to 2035

Consumer Network Attached Storage Market Size and Share Forecast Outlook 2025 to 2035

Consumerware Market Size and Share Forecast Outlook 2025 to 2035

Consumer Metaverse Market Size and Share Forecast Outlook 2025 to 2035

Consumer Appliances Market Analysis by Product Type, Technology, Sales Channel, End User and Region 2025 to 2035

Consumer Electronic Sensors Market Trends - Growth & Forecast 2025 to 2035

Consumer Robotics Market Insights - Growth & Forecast 2025 to 2035

Indonesia Consumer Packaging Market Trends & Forecast 2024-2034

Consumer Packaging Market Trends & Industry Growth Forecast 2024-2034

Consumer Drones Market

Consumer Communication Services Market

Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA