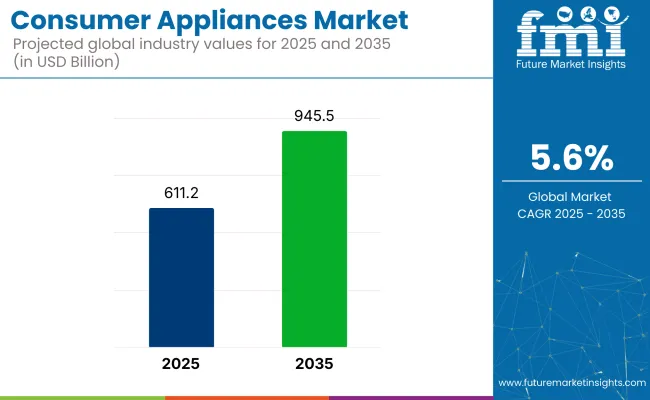

The consumer appliances market is set for substantial growth between 2025 and 2035, driven by technological advancements, increasing demand for energy-efficient solutions, and rising disposable incomes. The industry is projected to expand from USD 611.2 billion in 2025 to USD 945.5 billion by 2035, reflecting a CAGR of 5.6% over the forecast period.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 611.2 billion |

| Industry Value (2035F) | USD 945.5 billion |

| CAGR (2025 to 2035) | 5.6% |

The industry is on a path of consistent increase owing to the development of consumer lifestyles, an increase in disposable incomes and the improvements in the technologies used in smart homes. Consumer devices, like kitchen devices, home entertainment devices and climate control devices, are essential in improving the convenience, energy savings, and overall home automation. Thus, the need for smart devices connected to the internet and AI capabilities is a major factor for the industry expansion.

The most important factor in the expansion of the industry is the amplification of the smart and energy-saving appliance trend. Consumers are interested the most in appliances that have IoT connectivity, voice control, and automation features that integrate seamlessly with other devices in the smart home ecosystem. Furthermore, the energy-efficient appliances that use sustainable materials and have eco-friendly certifications are being adopted as a result of environmental concerns which are affecting the decision of the buyer.

Moreover, the digital marketing and e-commerce boom is positively impacting the industry segment. The internet is providing a wide range of products with competitive prices and household delivery of latest gadgets available to consumers. On top of that, the involvement of the brands which sell directly to the customers is visible through diverse online advertisements and catered suggestions to the customers along with the created loyalty to the brand.

The technological proliferation in the area of artificial intelligence (AI), machine learning, and sensor-driven automation is taking the user experience with consumer appliances to the next level by improving the durability and performance. The things like ovens that clean themselves, air conditioners that adapt to the environment, and the washing machines that are operated by AI are changing the way people view appliances regarding the comfort and effectiveness they get from them.

Nonetheless, the industry deals with threats like the rise and fall of costs of raw materials, the interruption of supply chains, and the entry of new competitors who are offering even better products. The questions of compliance with regulations on energy efficiency and electronic waste disposal are also creating an impact on the manufacturers' plans concerning production processes and pricing.

The potential for business expansion is not only due to these problems alone, but also significantly because of the increasing consumer demand for area stacks and multifunctional appliances that come with investments in green manufacturing. Furthermore, smart housing with integrated appliance solutions will be another factor for innovation in the industry. The industry will experience the increase in the long run as people continually look for comfort, frugality, and green living.

The industry is facing pivotal transformation with increasing technological innovation, energy savings, and intelligent connectivity. The residential sector continues to hold sway with increasing consumer interest in energy-saving, AI-equipped, and IoT-compatible appliances. Increasing disposable income and urbanization are propelling demand for high-end home appliances like intelligent refrigerators, washing machines, and air conditioners.

In the commercial industry, equipment like commercial refrigerators, ovens, and HVAC are critical for the hospitality and retail markets, but price sensitivity is high. Industrial use, while a smaller industry, emphasizes durability, efficiency, and conformity with sustainability standards.

The smart appliances industry is experiencing high demand, with consumers focusing on connectivity, automation, and sustainability. Voice control, app-based functionality, and AI-powered energy management are the major innovations driving the market. As the industry moves towards green and energy-efficient solutions, companies are investing in sustainable manufacturing and increased durability to address changing consumer needs.

From 2020 to 2024, the industry underwent a major transformation driven by advancements in smart technology, energy efficiency, and sustainability. Leading brands such as Samsung, LG, and Whirlpool added IoT connectivity to their products, allowing consumers to control appliances remotely using smartphones and voice assistants. From AI-powered appliances that cook food to perfection, such as self-adjusting washers and prediction-fueled fridges, these devices became more convenient while using less energy.

Sales of green appliances improved, and manufacturers began incorporating inverter technology, recyclable content, and eco-friendly compressors. The crisis accelerated the move toward hygiene-minded appliances such as vacuums that use U.V. lamps to sterilize dirt and steam-propelled washers. Chip shortages, supply chain disruptions and raw material price turmoil were other bodies blows, raising costs and delaying new-product introductions.

In a decade from 2025 to 2035, AI, automation and green innovation's impact will be more tired to the consumer appliances business. So, appliances will auto-repair - on-board diagnostic AI will find faults and fix them autonomously. Dyson and Miele will popularize robot aides in the industry by combining cleanliness functions with home management through AI. Transition to solid-state refrigeration and waterless cleaning technologies will save orders of magnitude of energy and water.

On-demand, local 3D printing of appliance parts will cut the dependency on international supply chains. The launch of modular appliances will make it easier to replace components as opposed to the entire devices, which is good for the principles of the circular economy. Blockchain-enabled warranty tracking and predictive maintenance solutions will extend appliance lifespan, reducing e-waste. Sustainability laws will incentivize biodegradable plastic, solar-powered devices, and closed-loop recycling, the start of hyper-efficient, eco-friendly consumer goods.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Smart home-compatible appliance demand growth driven by mobile applications and voice control. Emergence of AI-based learning appliances with user behavior-adjusted settings. Growing use of IoT -connected appliances with usage tracking and predictive maintenance. | All home appliances that are fully automated and through which devices talk to each other and auto-optimize. Self-healing appliances with AI power that identify and repair minor faults. Holographic screens and voice commands rather than buttons and screens. |

| Shifting towards low-power and low-water-using appliances with intelligent optimization functionality. Use of low-carbon and recyclable materials for appliance production. Solar- and kinetic-energy-harvested appliances. | Home appliances that do not emit emissions using renewable forms of energy such as hydrogen or kinetic energy. Power use dynamically managed through AI-optimized power distribution networks. Circular economies by law dictated for longevity in design and recyclability of the appliance. |

| Household owners opted for multi-feature appliances that integrated features (washer-dryer pairs, air purifiers-heaters). Expansion of user-configurable appliances with modular parts. AI-driven shopping services suggested appliances based on household usage. | Modular appliances allow consumers to update parts without replacing entire units. Miniaturized, AI-driven customization software adjusts appliance controls based on individual usage patterns. On-demand, 3D-printed appliance accessories provide new functionality. |

| Increased demand for slim, minimalist, and space-efficient appliances due to urbanization and small living quarters. Emergence of portable and foldable appliances for apartments and travel. Expansion of multi-purpose kitchen and laundry appliances. | Collapsible and shape-shifting appliances adapt to consumer requirements. Wall-integrated and ceiling-mounted appliances liberate space in small dwellings. Intelligent furniture-appliance hybrids integrate various home functions perfectly. |

| Post-pandemic surge in touchless appliances with motion sensors and voice control. Higher demand for self-sanitizing appliances with UV disinfection. Growth of anti-microbial materials in refrigerators, washing machines, and dishwashers. | Self-sterilizing surfaces and hygiene monitoring through AI do not allow bacteria to grow. Nano-coating technology keeps the surface germ-free. Self-cleaning appliances make manual maintenance unnecessary. |

As consumer appliances are highly dependent on the global manufacturing hubs, they are exposed to the weaknesses in the supply chain. The production might be delayed and the cost might increase due to the interruptions which are the direct effects of trade restrictions, logistical challenges, and geopolitical tensions. These risks can be lowered by fortifying local supply chains and diversifying providing strategies.

Fluctuations in consumer preferences and economic recessions dictate the course of demand, while factors like inflation, average disposable income, and environment dictate the products that consumers prefer. Companies need to adjust to the new reality and come up with cool marketing strategies, and exclusive products such as energy-efficient and smart appliances as well as flexible pricing to keep their clients happy and survive the competition.

The quick pace of innovation not only contributes to the technological progress but also creates opportunities and risks like the requirement of the constant investment in the research and development of the new products. The issue of the obsolesce of the product and the inclusion in the smart home ecosystems that are just being developed require a totally new way of thinking and product development to be the couturier in the industry.

The high competition both from long-established brands and newcomers makes pricing, and profitability, very tight. The assurance that the products have the unique quality features, excellent service after sale, and trustworthy brand will prevail to some extent in competition. Manufacturers should as well opine on cybersecurity threats in the connected devices by the enhancement of data protection, and compliance with privacy regulations.

| Segment | Share (2025) |

|---|---|

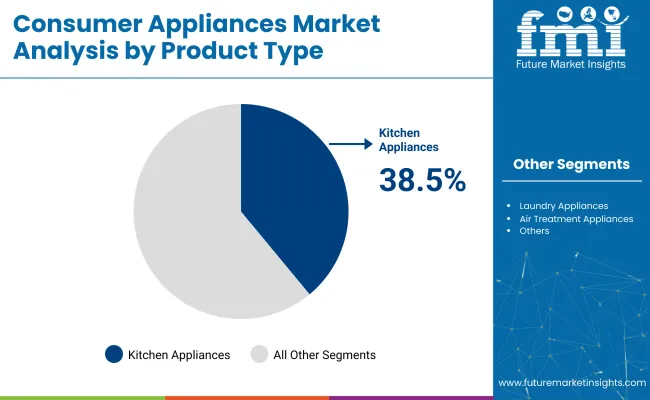

| Kitchen Appliances | 38.5% |

Significant growth is on the horizon for the industry in 2025, with kitchen appliances claiming the largest industry share (38.5%) followed by small appliances (22.4%). Demand for both segments is being driven by greater emphasis on efficiency, convenience, and smart home integration.

The growing urbanization and rising disposable incomes are paving the way for kitchen appliances to enjoy the highest share (fridges, ovens, microwaves, and dishwashers. Consumers are indeed opening their wallets for IoT-enabled smart appliances, pushing energy-efficient appliances that offer better convenience and connectivity.

Top manufacturers like Whirlpool, Samsung, LG, and Bosch are coming up with AI-powered cooking assistants, voice-controlled devices and app-based food monitoring systems. North America and Europe are traffic drivers in the premium, connected solutions in the kitchen space due to the strong demand. In contrast, the Asia-Pacific industry is expanding rapidly owing to urbanization, a growing middle-class population, and changing consumer lifestyles.

Small appliances, including coffee makers, blenders, vacuum cleaners, and air purifiers, are starting to gain traction as a category with consumers as health and convenience purchases come to the fore. Brands like Dyson, Philips, Panasonic, and Breville are hitting the demand wave by offering smaller, high-performance solutions for today’s households where space cannot be compromised.

The e-commerce boom and digital-native consumer behavior are fueling revenue growth at scale, most notably in Chinese, Indian, and Southeast Asian markets, which have seen meteoric growth in online retail.

| Segment | Share (2025) |

|---|---|

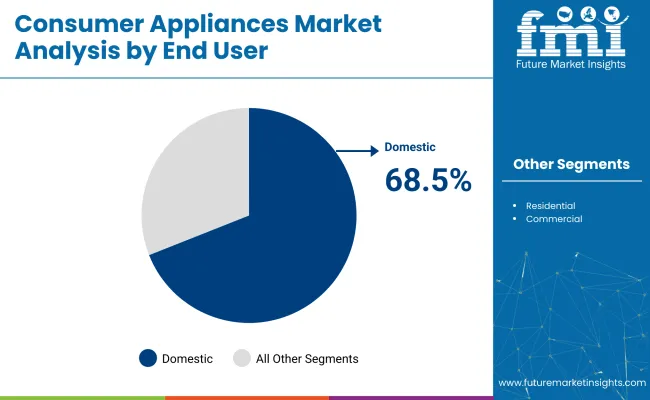

| Domestic | 68.5% |

The domestic segment of the industry is leading the industry with a 68.5% industry share, while The professional segment holds a 31.5% share in the alignments. An accelerating growth of the domestic section is owing to the rising demand for smart, multi-functional, and energy-efficient home appliances.

High demand for domestic and kitchen appliances and small household appliances is due to urbanization, increasing disposable income and adoption of smart homes. To provide added convenience and energy efficiency for the user, major consumer brands, including LG, Samsung, Whirlpool, and Bosch, are adapting by introducing a new generation of IoT-powered, voice-controlled, and AI-enabled appliances.

High-end, high-tech solutions in North America and Europe are leading as premium appliances are well represented. Asia-Pacific, by contrast, has strong demand because of urban housing projects, increasing purchasing power for the middle class and government rebates for purchases of energy-efficient appliances.

The professional segment, including commercial kitchens, hospitality, and industrial appliances, is also on a steady growth path. Increasing investment in restaurant chains, hotels, and cloud kitchens is fueling the demand for high-performance, durable, and energy-efficient commercial appliances.

Companies such as Electrolux, Rational, and Hobart are at the forefront of this category and offer commercial-grade refrigerants, ovens, and cleaning equipment designed to meet business requirements. Although professional appliances are still most common in Europe and North America, Asia-Pacific is a rapidly expanding area of the world driven mainly by the food service sector.

Emerging technologies, energy-saving programs, and automation trends are expected to revolutionize the landscape of consumer appliances units worldwide, with both the residential and professional industry segments contributing extremely towards driving the future growth of the consumer appliances space across the globe.

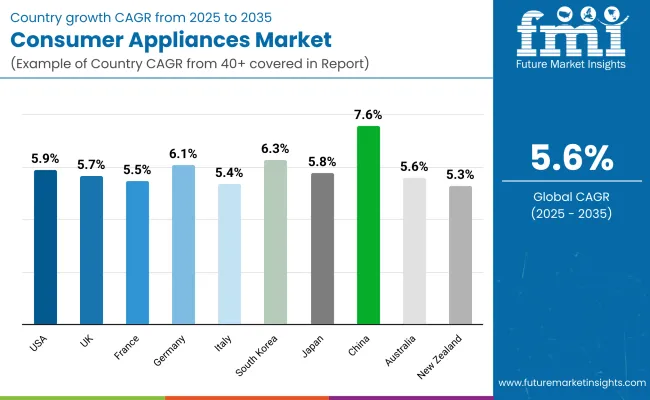

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

| UK | 5.7% |

| France | 5.5% |

| Germany | 6.1% |

| Italy | 5.4% |

| South Korea | 6.3% |

| Japan | 5.8% |

| China | 7.6% |

| Australia | 5.6% |

| New Zealand | 5.3% |

The USA industry is influenced by increased smart home technology, energy-efficient appliances, and increased disposable incomes. Voice-controlled and IoT-controlled appliance sales are growing, mainly from urban consumers.

E-commerce is expanding the reach of products, with direct-to-consumer sales picking up momentum. Refrigerators, washing machines, and kitchen appliances experience ongoing innovation, while environmental regulations push manufacturers to adopt sustainable solutions. Whirlpool and GE Appliances are two of the leaders, but their overseas rivals are gaining industry share with aggressive marketing and new technology.

High-end, space-saving appliances and home automation are driving the UK Urbanization has created a demand for clean, multi-functional appliances. British consumers are interested in energy saving, with increasing large-scale use of A+++ rated appliances. High-end cleaning and kitchen appliances are gaining ground, with Bosch and Dyson at the forefront.

The industry also witnessed the development of domestic appliances based on artificial intelligence that further made life more automated and convenient. Policies by the government promoting energy saving on the customer's end also have an impact on consumer decisions, which again fuels demand for eco-friendly options.

France's industry consists of both smart and traditional technology. French consumers prefer good-looking and efficient kitchen and cleaning appliances, as well as the retailing of networked devices controlled by remote boosts, especially in urban areas. Government policies toward energy efficiency drive the sale of energy-efficient dishwashers, washing machines, and refrigerators. Innovations and designs from industry leaders Groupe SEB and Electrolux dominate industry leadership. Rises in high-end kitchen gadgets and e-commerce drive it.

Germany is the leader in its focus on long-life, high-performance, and energy-saving appliances. Technologically advanced home automation technology is becoming popular, and artificially intelligent kitchen and cleaning equipment is gaining industry share. Technologically sophisticated long-life products of brands such as Miele and Siemens are best loved by German consumers.

The regulatory climate is very conducive to energy saving, and this compels manufacturers to design low-energy but high-performance appliances. As city living spaces narrow down, low-space yet high-performance equipment becomes more desirable. Also, customer convenience is boosted with the integration of home automation systems and devices, driving the industry forward.

Italy's industry is driven by a high demand for fashion-forward, design-centric products that perfectly balance form and function. The increasing need for combined kitchen appliances is consistent with the trend for contemporary, space-efficient home designs.

Intelligent kitchens with AI-based and voice-controlled appliances are a trend of significant significance. Energy efficiency is a major driver, and government tax credits motivate individuals to adopt environmentally friendly devices. The industry is also seeing high-end coffee machines and gourmet cooking ranges, an indicator of the country's strong coffee and food culture.

The South Korean industry is a global leader in smart home technology with profoundly high penetration levels of AI-powered and IoT-equipped appliances. Consumers increasingly need auto-vacuum cleaners, smart refrigerators, and washers amidst fast city lives.

The latest craze is home automation, and the consumer will do well with the appliances capable of integrating flawlessly into the smart home network. Samsung and LG are industry leaders in high-tech products, such as AI-based energy management systems. Space and slim appliances are also gaining popularity in the urban areas of the country.

In Japan, space and technological advancements power consumer appliances. Slim and highly efficient appliances reign where space is a constraint in urban areas. Multi-functional and power-saving products such as smart toilets and kitchen appliances are revolutionizing the trend in the industry.

Voice-controlled and self-learning products are the favorite among Japanese consumers due to their simplicity. Panasonic and Sharp are the companies that are making big bets on AI technology, with products offering maximum efficiency at minimum power consumption. The demand for age-friendly appliances is also growing with the growth in the number of older adults in the nation.

The industry is witnessing continuous innovation in smart and energy-efficient appliances, with Xiaomi, Midea, and Haier taking the lead. Consumers are also switching to app-based, voice-controlled, and IoT-enabled appliances. Sustainability is also gaining rapid traction, and green appliances are in reasonable demand.

Local and foreign brand growth gets boosted by competition, resulting in product diversification and price competitiveness. The development of e-commerce platforms further boosts sales momentum, making it readily accessible for the consumer.

The severe climate of the country requires air-conditioner-packed appliances, refrigerators, and energy-smart washers. Smart integration is necessary, as well as increases in the industry with IoT-enabled appliances used by consumers. Green use patterns lead to the application of green and solar appliances. Internet purchasing continues to hold the upper hand, where buyers have increased competition and choice resulting from online shopping outlets.

Environmentally friendly green appliances with high energy efficiency are greatly appreciated by customers, as there is a very high level of environmental awareness in the nation. Customers look for space-saving, multi-functional appliances, especially in urban areas.

Smart kitchen and laundry appliances with built-in AI capabilities are increasingly popular. Customers like brands that provide long-lasting, high-quality products and a low environmental footprint. Increasing online platforms increases the range of the industry and makes it easy to transition through various smart and green products.

The worldwide industry is witnessing unprecedented growth due to rising disposable incomes, a behavioral change among consumers, and technology being upgraded at a very fast pace. Consumers are adopting more networked, efficient, and smart products with more convenience and efficiency.

Each consumer appliances, from kitchen appliances to home comfort products and personal care products, is undergoing change. The application of artificial intelligence (AI) and the Internet of Things (IoT) has transformed the industry with advanced-level automation and offsite control.

Whirlpool, Samsung Electronics, LG Electronics, Haier, and Bosch are also spending big on R&D to introduce newer features like voice control, adaptive energy management, and predictive maintenance. The battle is intense, with vendors distinguishing on the basis of technology, greenness, and customer experience. Efficiency is dominated by regulatory bodies as well as customers who want a lower carbon footprint and lower cost.

The industry is also experiencing enhanced consolidation through mergers and strategic acquisitions. More use of intelligent manufacturing methods, artificial intelligence, and data analysis is also fueling manufacturing and supply chain optimization.

Consumer tastes are shifting towards performance and design-focused functional appliances where performance and looks are equally matched. As awareness of sustainability increases, firms are adopting recyclable parts, environmentally friendly refrigerants, and sustainable technology. The industry is in constant flux, with the players in the industry constantly introducing the next generation of technology and changing consumer attitudes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Whirlpool | 20-25% |

| Samsung Electronics | 15-20% |

| LG Electronics | 10-15% |

| Haier | 8-12% |

| Bosch (BSH Group) | 5-9% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Whirlpool | Offers kitchen and home appliances with smart IoT integration and energy-efficient designs. |

| Samsung Electronics | Provides AI-driven smart home appliances with voice control and advanced connectivity. |

| LG Electronics | Focuses on AI-enabled, energy-efficient home appliances with sustainability initiatives. |

| Haier | Expanding through acquisitions, offering smart, high-performance appliances globally. |

| Bosch (BSH Group) | It specializes in energy-efficient, smart appliances with a strong commitment to sustainability. |

Key Company Insights

Whirlpool (20-25%)

Whirlpool remains a dominant force in the industry, focusing on IoT-enabled, energy-efficient appliances. Sustainability is a priority, with efforts to reduce carbon footprints and use eco-friendly materials.

Samsung Electronics (15-20%)

Samsung continues to innovate with AI-driven automation and mobile-controlled appliances. The company prioritizes energy efficiency and sustainability, reducing energy consumption in its products.

LG Electronics (10-15%)

LG leads in smart home solutions, leveraging AI for personalized experiences. It expands its connected appliance industry while emphasizing energy efficiency and sustainable designs.

Haier (8-12%)

Haier expands globally by acquiring brands and integrating IoT into its appliances. The company focuses on automation, efficiency, and eco-friendly solutions, targeting emerging markets.

Bosch (BSH Group) (5-9%)

Bosch is known for energy-efficient appliances and smart home integration. It prioritizes sustainability, reducing environmental impact through eco-friendly technologies.

Other Key Players (25-30% Combined)

By product type, the industry is segmented into kitchen appliances (refrigerators, ovens, microwaves, dishwashers), laundry appliances (washing machines, dryers), air treatment appliances (air conditioners, air purifiers, humidifiers), personal care appliances (hair dryers, electric shavers, oral care devices), and others.

By technology, the industry is categorized into smart appliances, conventional appliances, energy-efficient appliances, and IoT-enabled appliances.

By sales channel, the segment includes supermarkets/hypermarkets, specialty stores, online, departmental stores, and others.

By end user, the industry is divided into residential and commercial applications.

By region, the industry is analyzed across North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The industry is expected to reach USD 611.2 billion in 2025.

The industry is projected to grow at a CAGR of 5.6% to reach USD 945.5 billion by 2035.

China is expected to experience the highest growth, with a CAGR of 7.6% during the forecast period.

The kitchen appliances segment is one of the most widely used categories in the industry.

Leading companies include Whirlpool, Samsung Electronics, LG Electronics, Haier, Bosch (BSH Group), Miele, Fisher & Paykel, GE Appliances, KitchenAid, Maytag, and Amana.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Consumer Packaging Industry Analysis in India Forecast and Outlook 2025 to 2035

Consumer Foam Market Size and Share Forecast Outlook 2025 to 2035

Consumer Packaging Industry Analysis in China Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Consumer Cloud Subscription Market Size and Share Forecast Outlook 2025 to 2035

Consumer Packaging Industry Analysis in Brazil Size and Share Forecast Outlook 2025 to 2035

Consumer Electronic Accessories Market Size and Share Forecast Outlook 2025 to 2035

Consumer Facing AI Products Market Size and Share Forecast Outlook 2025 to 2035

Consumer Video Feedback Software Market Size and Share Forecast Outlook 2025 to 2035

Consumer Network Attached Storage Market Size and Share Forecast Outlook 2025 to 2035

Consumerware Market Size and Share Forecast Outlook 2025 to 2035

Consumer Metaverse Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronic Sensors Market Trends - Growth & Forecast 2025 to 2035

Consumer Robotics Market Insights - Growth & Forecast 2025 to 2035

Consumer Electronics Market - Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Consumer Electronics Packaging Manufacturers

Indonesia Consumer Packaging Market Trends & Forecast 2024-2034

Consumer Packaging Market Trends & Industry Growth Forecast 2024-2034

Consumer Drones Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA