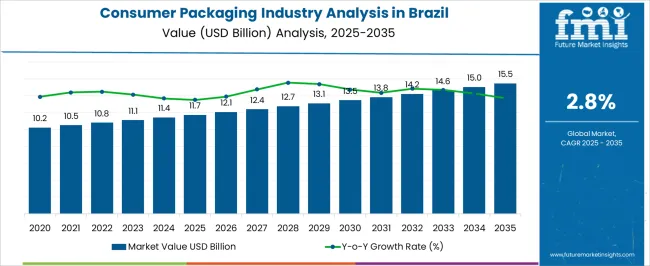

The Consumer Packaging Industry Analysis in Brazil is estimated to be valued at USD 11.7 billion in 2025 and is projected to reach USD 15.5 billion by 2035, registering a compound annual growth rate (CAGR) of 2.8% over the forecast period.

| Metric | Value |

|---|---|

| Consumer Packaging Industry Analysis in Brazil Estimated Value in (2025 E) | USD 11.7 billion |

| Consumer Packaging Industry Analysis in Brazil Forecast Value in (2035 F) | USD 15.5 billion |

| Forecast CAGR (2025 to 2035) | 2.8% |

The consumer packaging industry in Brazil is experiencing steady growth, driven by rising consumer demand for packaged goods, rapid urbanization, and expanding retail channels. Changing lifestyles, growing middle-class consumption, and increased e-commerce penetration have accelerated demand for efficient and durable packaging solutions.

The market benefits from continuous innovation in sustainable and lightweight materials, supported by government initiatives to reduce environmental impact. Current dynamics are influenced by cost optimization strategies, advancements in automation, and the integration of recyclable materials into packaging production.

With evolving consumer preferences for convenience and environmentally friendly packaging, the future outlook for the industry remains positive. Strong domestic demand and foreign investment in Brazil’s food, beverage, and personal care sectors further reinforce industry growth.

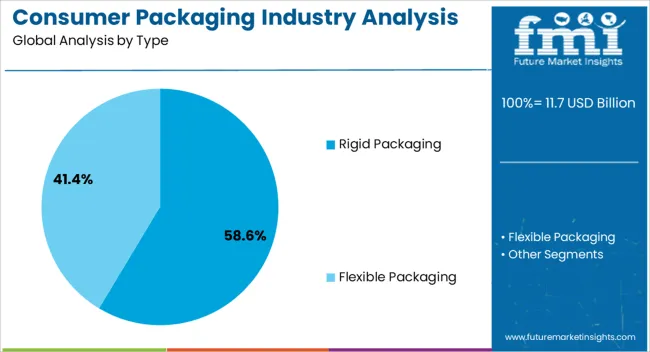

The rigid packaging segment dominates the type category with approximately 58.60% share, supported by its ability to provide strength, durability, and product protection. Its widespread use in food, beverage, and personal care industries has reinforced its position, as rigid formats ensure longer shelf life and enhanced product safety.

The segment benefits from consumer preference for tamper-resistant and reusable packaging options. Technological advancements in lightweight rigid formats have further improved cost efficiency and sustainability.

With Brazil’s increasing demand for durable and premium packaging solutions, rigid packaging is expected to remain a dominant format.

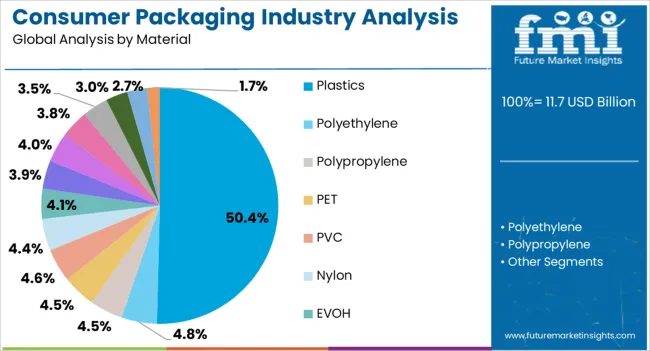

The plastics segment accounts for approximately 50.40% share in the material category, reflecting its versatility, cost-effectiveness, and adaptability in various packaging designs. Plastic materials are extensively used in bottles, containers, and flexible formats across multiple industries.

Growth is reinforced by innovations in recyclable and bio-based plastics that address environmental concerns while retaining performance. The segment also benefits from established supply chains and high-volume production capacity.

Despite rising regulatory pressures on single-use plastics, demand for advanced sustainable plastic solutions ensures continued relevance in Brazil’s consumer packaging landscape.

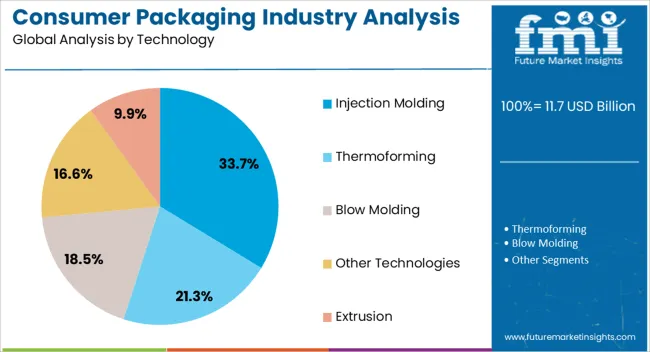

The injection molding segment leads the technology category with approximately 33.70% share, supported by its efficiency in producing complex, durable, and high-quality packaging products. The technology allows for precise customization, catering to brand-specific requirements in food, beverage, and personal care sectors.

Its ability to deliver high production output with consistent quality has driven adoption in Brazil’s fast-growing packaging industry. The segment benefits from continuous innovation in molds, automation, and recyclable resin applications, aligning with sustainability goals.

With increasing demand for cost-effective yet high-performance packaging solutions, injection molding is expected to maintain its leading role in the industry.

Sustainable Packaging Innovations Transforming Brazil’s Landscape

Demand for consumer packaging products in Brazil increased at a CAGR of 1.2% during the historical period. Total revenue in the country reached around USD 11.7 billion in 2025. This was due to factors like:

In the forecast period, sales of consumer packaging products in Brazil are projected to soar at 2.8% CAGR, totaling USD 15.5 billion by 2035. This can be attributed to factors like rising demand for packaged food products, shifting preference toward sustainable packaging in Brazil, and advancements in packaging technology.

Packaging solutions with convenient features like easy-open tabs, resealable zippers, and portion control are becoming popular. Similarly, simplicity and minimalism in consumer packaging are gaining traction across Brazil.

Succeeding in the packaging industry is an enormous task, especially due to the implementation of stringent regulations. As a result, leading consumer packaging manufacturers are embracing innovation to counter environmental regulations and stay ahead of the competition. For instance, they use sustainable materials in their packaging.

| Particular | Value CAGR |

|---|---|

| H1 | 2.8% (2025 to 2035) |

| H2 | 3.0% (2025 to 2035) |

| H1 | 2.3.% (2025 to 2035) |

| H2 | 2.7% (2025 to 2035) |

Booming Food and Beverage and Personal Care Industries

Brazil’s food & beverage industry is witnessing steady growth, driven by rapid urbanization and the growing popularity of packaged food items. This will likely uplift demand for food packaging in Brazil throughout the forecast period.

The beverage segment is forecasted to be the fastest-growing segment, expanding at a CAGR of 4.8% during the forecast period. This growth is mainly influenced by the growing consumption of alcoholic and sports drinks across the country.

According to the World Health Organization (WHO), Brazil's alcohol consumption per capita is poised to increase by over 8% per year till 2025. Driven by this, sales of consumer packaging products or beverage packaging in Brazil, like bottles, cans, etc., are expected to rise steadily.

The personal care industry is also witnessing steady growth in Canada owing to increasing health awareness among consumers and the rising export of personal care products. This will likely create demand for aesthetic packaging, thereby fostering revenue growth.

According to the Brazilian Association of the Toiletries, Perfumery, and Cosmetics Industry (ABIHPEC), the country’s personal care exports grew by over 17% QOQ in the first quarter of 2025. This rising export of personal care products is expected to create growth opportunities for consumer packaging manufacturers through 2035.

Growing Usage of Sustainable Packaging in Brazil

The trend of incorporating paper-based packaging is gaining immense popularity in Brazil owing to the increasing pressure from retail. This, in turn, is expected to open new growth windows for the industry.

Several retailers in Brazil are actively advocating for and embracing paper packaging solutions as a means to meet regulatory standards, maintain a positive brand image, and cater to a discerning consumer base.

According to data from ABRE (Brazilian Packaging Association), the country's overall share of paper-based packaging increased by almost 6% year over year in 2025. This transition toward sustainable packaging solutions will likely foster industry expansion through 2035.

Several consumers in Brazil are also opting for on-the-go food products, consequently putting easy-to-use packaging in the limelight. A study conducted by UFRGS (Universidad Federal de Río Grande del Sur) in 2025 revealed that over 55% of consumers in Brazil prioritize packaging that makes it easy to consume or transport food products.

The section below shows the plastics segment dominating Brazil’s industry. It is projected to advance at 2.9% CAGR between 2025 and 2035. Based on the packaging format, the rigid packaging segment is poised to exhibit a higher CAGR of 3.7% during the forecast period.

| Material Type | Value CAGR (2025 to 2035) |

|---|---|

| Plastics | 2.9% |

| Paper | 2.3% |

Based on material, the plastic segment holds a prominent value share of about 50%, despite the environmental impact of plastic and the stringent regulations and policies against it. Over the forecast period, demand for plastic packaging is poised to increase at 2.9% CAGR. This can be attributed to several advantages of plastic packaging, including:

Packaging giants across Brazil are increasingly using plastics to produce consumer packaging products like films, bottles, and trays, owing to its attractive advantages. This will likely improve the share of the target segment during the forecast period.

Consumers are also using plastic packaging to reduce packaging and transportation costs. Similarly, initiatives and support from the country’s government regarding plastic recyclability and the hike in polymer import tariffs are pushing the integration of materials such as rPET and Bio-Pet into product packaging. This is expected to boost the segment further across the country.

The widespread usage of plastic packaging, however, has raised environmental concerns. As a result, manufacturers are shifting their focus to sustainable plastic alternatives like bioplastics, including polylactic acid (PLA) and starch-based plastics. They are also improving their recycling infrastructure.

Although plastics remain dominant, paper packaging is slowly gaining traction in Brazil. Packaging products such as plastic food trays and sacks are gradually being replaced by paper.

The growing food delivery industry in the country is also driving demand for paper packaging. For instance, a leading Brazil-based food delivery platform named iFood reported a y-o-y growth of 20% in paper bags.

While the competition between plastics and paper is getting closer, the emerging statistics predict the plastic segment will hold a slight edge throughout the forecast period. This will likely be due to the growing usage of bioplastics across the packaging industry in Brazil.

| Packaging Format | Value CAGR |

|---|---|

| Flexible Packaging | 2.3% |

| Rigid Packaging | 3.7% |

The clash between rigid and flexible packaging has been raging for decades, with each format offering unique advantages. Currently, the flexible packaging segment dominates the Brazil industry, holding a share of 60.0%. This is due to its features like lightweight and compact nature.

Emerging trends, however, reveal rigid packaging to gain immense traction across Brazil. This can be attributed to durability, barrier properties, reusability, and the premium look and feel of rigid packaging. As per the latest report, demand for rigid packaging is set to increase at 3.7% CAGR through 2035.

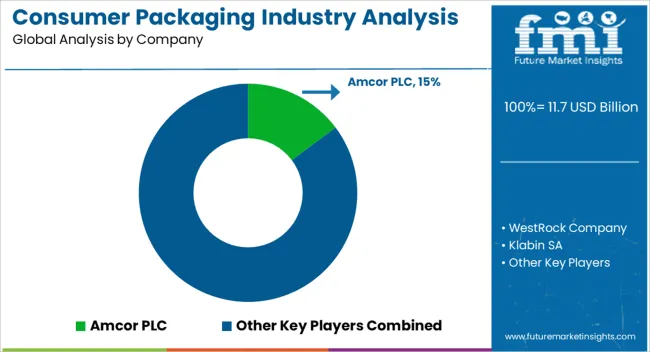

Brazil’s consumer packaging industry is highly competitive, with several key players operating. Top consumer packaging companies listed in the report include WestRock Company, Amcor PLC, Klabin SA, Tetra Pak International SA, Sonoco Products Company, Smurfit Kappa Group, NEFAB Embalagens LTDA, Graphic Packaging International LLC, SSI Schaefer LTDA, and Trivium Packaging.

Leading manufacturers of consumer packaging products in Brazil are innovating to introduce new eco-friendly packaging solutions with novel designs. This not only helps them to woo eco-conscious consumers but also counter environmental regulations. They are continuously increasing their product portfolios to cater to the growing demand from urban households.

Several companies also employ tactics like distribution agreements, partnerships, facility expansions, acquisitions, and mergers to strengthen their presence in Brazil and other regions. This is resulting in a highly competitive and innovative industry that is driving growth and delivering more advanced and sustainable packaging solutions for consumers worldwide.

Recent Developments in the Brazil Consumer Packaging Industry

| Attribute | Details |

|---|---|

| Base Value (2025) | USD 11.1 billion |

| Projected Industry Value (2035) | USD 14.7 billion |

| Expected Growth Rate (2025 to 2035) | 2.8% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion, Volume in tons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Packaging Format, Material, End-use, Level of Packaging, Technology, Distribution Channel |

| Key Companies Profiled | WestRock Company; Amcor PLC; Klabin SA; Tetra Pak International SA; Sonoco Products Company; Smurfit Kappa Group; NEFAB Embalagens LTDA; Graphic Packaging International LLC; SSI Schaefer LTDA; Trivium Packaging |

The global consumer packaging industry analysis in Brazil is estimated to be valued at USD 11.7 billion in 2025.

The market size for the consumer packaging industry analysis in Brazil is projected to reach USD 15.5 billion by 2035.

The consumer packaging industry analysis in Brazil is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in consumer packaging industry analysis in Brazil are rigid packaging and flexible packaging.

In terms of material, plastics segment to command 50.4% share in the consumer packaging industry analysis in Brazil in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Consumer Packaging Industry Analysis in India Forecast and Outlook 2025 to 2035

Consumer Packaging Industry Analysis in China Size and Share Forecast Outlook 2025 to 2035

Indonesia Consumer Packaging Market Trends & Forecast 2024-2034

Consumer Packaging Market Trends & Industry Growth Forecast 2024-2034

Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Consumer Electronics Packaging Manufacturers

Sachet Packaging Industry Analysis in Asia Pacific - Size, Share, and Forecast 2025 to 2035

Europe Cement Packaging Market Analysis – Trends & Forecast 2024-2034

North America Cement Packaging Industry Analysis – Trends & Forecast 2024-2034

Europe Barrier Packaging Market Growth – Demand & Forecast 2024-2034

Reusable Consumer Packaging Market

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Analyzing Post-Consumer Recycled Packaging Market Share & Industry Leaders

Protective Packaging Industry Analysis in United States and Canada - Size, Share, and Forecast 2025 to 2035

End-of-line Packaging Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Bubble Wrap Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Korea Bubble Wrap Packaging Market Growth – Trends & Forecast 2023-2033

Western Europe Bubble Wrap Packaging Market Analysis – Growth & Forecast 2023-2033

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA