The sachet packaging industry analysis in asia pacific is projected to reach USD 4.5 billion in 2025 in terms of overall revenue. According to FMI study, the industry will grow at a CAGR of 8% and will reach USD 9.7 billion by 2035.

In 2024, Asia Pacific's small-format packaging market exhibited quantifiable expansion, led by increasing demand for food and beverages, pharmaceuticals, and cosmetics applications. Customer demand for single-use, cheap, and convenient packaging led the growth of the industry.

Specifically, India and China saw an increase in sachet packaging use, primarily in rural areas where price is an issue. The food industry, especially the FMCG segment, grew swiftly, with sachets being widely used in snacks, condiments, and beverages for affordability and convenience.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.5 billion |

| Industry Value (2035F) | USD 9.7 billion |

| CAGR (2025 to 2035) | 8.0% |

The industry is poised for growth due to the rising demand for cost-effective and simple packaging in food, beverages, and personal care items. Advances trends dictate that packaging should be cost-effective and easy to use for food and beverages, along with personal care items.

Advances in recyclable and biodegradable types of packaging will certainly be the trend of the day in the coming years, as this aspect of packaging takes an increasingly higher precedence among consumers. Providers of packaging and fast-moving consumer goods manufacturers will get the most benefit from such an addition while forms of traditional packaging will be left behind.

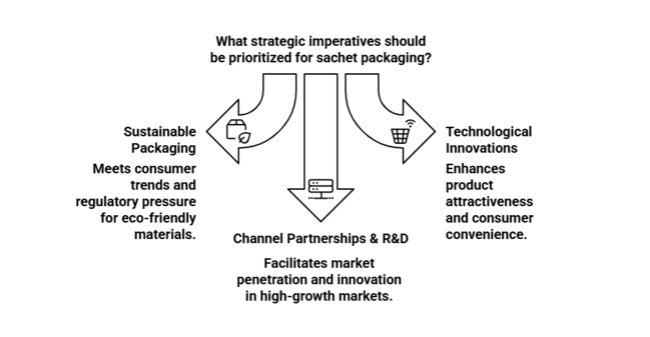

Invest in Sustainable Packaging Solutions

Executives must invest in the creation and implementation of sustainable, eco-friendly packaging materials for sachets. This will not only keep up with consumer trends toward sustainability but also meet growing regulatory pressure on environmental footprints.

Leverage Technological Innovations in Packaging

Executives must prioritize the adoption of smart packaging technologies, including digital printing and tamper-evident functionality, to drive product attractiveness and fulfill consumer demands for convenience and security. This approach fits with the movement toward more sophisticated, consumer-friendly packaging solutions.

Deepen Channel Partnerships and Expand R&D Capabilities

Management must prioritize the formation of strong relationships with major distributors and suppliers in high-growth industries, specifically in India and China, as well as growing R&D to enhance the performance and efficiency of small-format packaging. These initiatives will enhance market reach and support innovation in response to evolving consumer packaging requirements.

| Risk | Probability - Impact |

|---|---|

| Regulatory Changes | High - High |

| Raw Material Shortages | Medium - High |

| Intense Competition from Alternatives | High - Medium |

| Priority | Immediate Action |

|---|---|

| Sustainability Integration | Conduct industry research on emerging eco-friendly packaging trends. |

| Technology Advancement | Assess the feasibility of sustainable material adoption for sachets. |

| Regional Expansion | Establish strategic partnerships with key distributors in India. |

To maintain competitiveness, companies must prioritize investment in green packaging materials and innovative solutions tailored to emerging consumer preferences. This tactical decision emphasizes the need to focus on green products, allowing the client to lead regulatory changes and respond quickly to changing industry dynamics.

In the future, the strategy needs to incorporate technology-led packaging innovation, especially in domains like digital printing and intelligent packaging functionalities. Furthermore, further partnerships with local distributors will be essential to realize deep regional penetration. Through the integration of sustainability and innovation, the client can gain a sustainable competitive advantage and establish itself as a leader in the fast-evolving packaging industry.

| Country | Government Regulations & Impact |

|---|---|

| China |

|

| Japan |

|

| South Korea |

|

| India |

|

| Australia |

|

| Association of Southeast Asian Nations (ASEAN) |

|

| Rest of Asia Pacific |

|

From 2025 to 2035, the pack size range of 1 ml to 10 ml will be the most profitable, following the growing industry for single-dose and portion-controlled packaging among sectors such as food, healthcare, and beauty. Riding the increased urbanization, convenience, and e-commerce penetration, this pack size segment is expected to grow at a CAGR of around 8.4% in 2025 to 2035, marginally ahead of the overall industry growth rate of 7.2%.

The fast-moving consumer goods (FMCG) sector specifically uses this range due to its simplicity, affordability, and the rapidly increasing popularity of on-the-go consumption. Besides, the pharmaceutical industry's preference for smaller pack sizes to ensure accurate drug delivery further supports this segment's growth.

Between 2025 and 2035, the segment of plastic material will be the most profitable due to its flexible, light, and economical characteristics, which render it the go-to option for small-format packaging across various applications, such as food, pharmaceuticals, and personal care. The segment will be expected to increase at a CAGR of about 7.6% in the period from 2025 to 2035.

Despite increased environmental pressures, plastic is a prominent material in the Asia-Pacific industry owing to its low manufacturing costs, high durability, and barrier properties that preserve product integrity. Additionally, technological developments in biodegradable plastic and recycling machines will work towards neutralizing concerns about environmental effects, and hence, plastic can continue to be an important stakeholder in the industry.

Between 2025 and 2035, the most profitable segment will be food applications due to the expanding demand for convenience, single-serve packaging, and shelf-stable packaging in the fast-growing food industry. This category is expected to expand at a CAGR of around 8.3% between 2025 and 2035, which is higher than the overall rate of growth for the industry.

The rising consumer demand for ready-to-consume and on-the-go food products, especially from emerging economies such as India, Vietnam, and Indonesia, is mainly driving this growth. Moreover, the advancements in food preservation methods, including vacuum packing and barrier films, are improving the shelf life of food products. With urbanization and disposable income increasing in the industry, the future for food sachets looks bright.

Between 2025 and 2035, the vertical form fill seal (VFFS) machinery industry shall be the most profitable, supported by the strong demand for automated and high-speed packaging machines for the food and beverage sector. With continuing growth in the demand for rapid production and high volumes, the VFFS segment is forecasted to record a CAGR of around 8.1% between 2025 and 2035, higher compared to other available packaging machinery choices.

VFFS machines have several advantages, such as lower labor costs, better production efficiency, and the capacity to produce a range of packaging forms. All of these advantages are making VFFS technology the go-to choice for manufacturers wanting to increase output in anticipation of growing consumer demand for sachet-packaged offerings.

China's sachet packaging industry is expected to grow at a CAGR of 8.1% from 2025 to 2035. With over half of the world's packaged products being produced and consumed in China, the small-format packaging market is greatly influenced by China. Urbanization of the Chinese population-perhaps the major population in the world-is leading to enormous demand for convenience and low-priced packing.

With rising environmental regulations and heightened awareness towards sustainable practices, Chinese companies are now moving towards using biodegradable and recyclable materials for packaging. Laws such as the Plastic Waste Management Act and the working of the "Green Supply Chain" compel business houses to resort to eco-friendly materials.China also leads the automation and digital tech front, and its policies will increase the level of automation in the production process further and address demand in the industry.

Sales in Japan for the sachet packaging sector are expected to expand at a 7.3% CAGR from 2025 to 2035. The packaging sector is poised to increase as consumers are seeking cheaper and convenient alternatives, particularly in food, beverages, and personal care.

There's an actual emphasis on recyclable and biodegradable packaging since people are increasingly becoming concerned with sustainability. Those manufacturing packaging and those in the fast-moving consumer goods sector will most likely be rewarded the most, while older forms of packaging may find it challenging to cope.

In Japan, established consumer industry and huge demand for convenience products are fueling the growth in small-format packaging. The government is cracking down on plastic rubbish, prompting companies to move to use recyclable materials and reduce plastics.

Japan's population is also generating a demand for convenient packaging, especially in medicine and food. With more people living in small houses, there's increased demand for space-saving and convenient packages.

The sachet packaging landscape in South Korea is anticipated to grow at a CAGR of 7.8% between 2025 and 2035. South Korea features an advanced packaging industry characterized by significant demand for eco-friendly and sustainable materials.

The government's emphasis on waste management and recycling by implementing the Extended Producer Responsibility (EPR) program is fueling the industry for sustainable materials such as recyclable and biodegradable sachets. Moreover, growing consumers' demand for portion-sized and convenient packages in the food and cosmetics segments also provides further scope for expansion. The country's first-in-class technology adoption, including automation, will spur the industry ahead.

India's sachet packaging sector is expected to register a CAGR of 9.2% during the period 2025 to 2035. With its vast population and expanding middle class, India showcases a significant market opportunity for small-format packaging because of the increasing demand for affordable consumer products. The rising need for affordable and convenient packaging in fast-moving consumer goods (FMCG), personal care, and food sectors is driving industry expansion.

Government efforts to encourage eco-friendly packaging and enhance consumer awareness of environmental issues are fueling the adoption of biodegradable materials. Additionally, the rise of urban living and the increase in online shopping are anticipated to drive the need for small-sized packaging in India.

The sachet packaging landscape in Australia is expected to grow at a CAGR of 6.4% from 2025 to 2035. Australia has put in place sustainable practices which includes a target to reduce single use plastics by 2025 which in turn is greatly affecting the packaging industry. We are seeing a shift in the industry towards the use of recyclable and compostable packages in an effort to meet these new regulations.

In the food, beverage, and pharmaceutical industries we see an up and coming trend of convenient packaging which is a result of busy urban lives and a growing e-commerce segment. Also at play is the issue of environmental consciousness which is from the large group of consumers that is driving the push for sustainable options thus we are to see growth in this area for the next ten years.

The ASEAN industry is anticipated to see sachet packaging grow at a CAGR of 8.6% from 2025 to 2035. As a fast-emerging and diversified consumer base industry, the ASEAN countries are experiencing phenomenal convenience packaging growth. This expansion is most evident in the food and beverage, cosmetics, and personal care sectors.

Southeast Asian governments are increasingly adopting multi-faceted plastic waste control policies alongside the use of sustainable materials. Environmental packaging efforts are spearheaded by Singapore, Malaysia, and Thailand, but the rest are not lagging in mitigating their ecological impact. Through economic development, urbanization is also driving sachet demand and is further emphasized in the booming e-commerce sector.

The rest of Asia-Pacific is expected to witness growth in the sachet packaging industry at a CAGR of 7.5% between 2025 and 2035. The Asia-Pacific region, excluding large names such as China and India, still retains a large share of the small-format packaging market. Indonesia, the Philippines, and Vietnam are witnessing a lot of individuals migrating to cities and increasing demand for packaged products such as food, beverages, and cosmetics.

With additional government regulations and increasing plastic waste concerns, there is pressure to make the transition to improved packaging materials. And with increasing incomes and online shopping continuing to expand, demand for new, convenient, and sustainable small-format packaging will continue to rise.

Across the board, domestic and international manufacturers are scrambling to meet shifting customer demand and green standards. Key players such as Amcor, Huhtamaki, and UFlex are making significant investments in flexible packaging technology, sustainable packaging material, and automation technology to sustain their market position.

These companies are leading the charge and beginning to include recyclable laminates, compostable pack films, and monomaterial sachets in their product portfolios to meet tighter governance and growing interest in environmentally friendly small-packaging solutions. Strategic partnerships particularly with local co-packers and material science companies are driving supply chain simplification and last mile delivery efficiencies in India, China and Indonesia.

Local players are, however, leveraging low-cost production and geographical proximity to fast-moving consumer goods (FMCG) centers to expand their presence. Big players are aiming for growth through entry into categories like herbal cosmetics, pharma-grade sachets, and nutraceuticals.UFlex, for example, has ramped up R&D expenditure to manufacture biodegradable sachet variants as a response to impending regional bans on multilayer plastics.

Market competitive edge in 2035 will be a function of the extent to which a company can adopt green practices, integrate smart packaging, and forge strategic alliances to address the need for cost-effective and environmentally friendly packaging in Asia Pacific.

In 2025, the industry remains highly competitive, with global leaders leveraging sustainability and innovation to capture market share, while regional players continue to thrive on affordability and distribution strength. Amcor Plc retains its leadership with an estimated 26% market share, fueled by its deep integration with leading FMCG brands and continued rollout of recyclable and compostable sachet formats across India, China, and Southeast Asia.

HuhtamäkiOyj strengthens its position to approximately 19%, supported by expansion of its eco-friendly product lines and enhanced presence in high-growth ASEAN markets. UFlex Limited maintains a solid 13% share, driven by its investment in biodegradable multilayer laminates and its leadership in India’s sachet-heavy personal care and food sectors.

Constantia Flexibles is expected to join the fray with a share estimated at 8%, on the back of inorganic growth and innovation in the field of mono-material packaging. Local and regional manufacturers such as Swiss Pac Pvt. Ltd., Petals Packaging Company, and Asian Flexi Pack hold a collective share of 34%, on the back of price agility, local service, and responsiveness to new product classes.

| Company | Estimated Market Share (2025) |

| Amcor Plc | 26% |

| Huhtamäki Oyj | 19% |

| UFlex Limited | 13% |

| Constantia Flexibles Group GmbH | 8% |

| Local & Regional Players | 34% |

The industry is segmented into 1 ml to 10 ml, 11 ml to 20 ml, 21 ml to 30 ml, and 30 ml & Above.

The industry is segmented into plastic, paper, and aluminum foil.

The industry is segmented into Food, Personal Care & Cosmetics, Pharmaceutical, and Industrial.

The industry is bifurcated into vertical form fill seal (VFFS) and horizontal form fill seal (HFFS).

The industry is studied across China, Japan, South Korea, India, Australia, the Association of Southeast Asian Nations, and the Rest of Asia Pacific.

Rising demand for single-serve convenience, expanding applications in food and personal care, and a shift toward sustainable, low-cost formats are driving growth in the industry.

The industry will advance through innovations in eco-friendly materials and automation, driven by consumer preference for convenience and sustainability.

Key players in the industry include Amcor Plc, Huhtamäki Oyj, UFlex Limited, Constantia Flexibles, and a mix of regional manufacturers.

Plastic will continue to dominate the industry due to its cost-efficiency and versatility, though demand for paper and foil alternatives is growing.

The industry is projected to expand significantly, supported by robust demand across consumer goods, food, and pharmaceutical sectors in high-growth markets such as China and India.

Table 01: Asia Pacific Sachet Packaging Market Value (US$ billion) and Volume (billion Units) 2018(H) to 2033(F), By Pack Size

Table 02: Asia Pacific Sachet Packaging Market Value (US$ billion) and Volume (billion Units) 2018(H) to 2033(F) by Material Type

Table 03: (A) Asia Pacific Sachet Packaging Market Value (US$ billion) and Volume (billion Units) 2018(H) to 2033(F), By Application

Table 04: (B) Asia Pacific Sachet Packaging Market Value (US$ billion) and Volume (billion Units) 2018(H) to 2033(F), By Application

Table 05: Asia Pacific Sachet Packaging Market Value (US$ billion) and Volume (billion Units) 2018(H) to 2033(F), By Packaging Machinery

Table 06: Asia Pacific Sachet Packaging Market Value (US$ billion) and Volume (billion Units) 2018(H) to 2033(F), by County

Figure 01: Asia Pacific Sachet Packaging Market Value Share, by Pack Size, 2018(H), 2023(E) & 2033(F)

Figure 02: Asia Pacific Sachet Packaging Market Y-o-Y growth, by Pack Size, 2018(H) to 2033(F)

Figure 03: Asia Pacific Sachet Packaging Market Attractiveness Analysis, by Pack Size, 2018(H) to 2033(F)

Figure 04: Asia Pacific Sachet Packaging Market Value Share, by Material Type, 2018(H), 2023(E) & 2033(F)

Figure 05: Asia Pacific Sachet Packaging Market Y-o-Y growth, by Material Type 2018(H) to 2033(F)

Figure 06: Asia Pacific Sachet Packaging Market Attractiveness Analysis, by Material Type, 2018(H) to 2033(F)

Figure 07: Asia Pacific Sachet Packaging Market Value Share, by Application, 2018(H), 2023(E) & 2033(F)

Figure 08: Asia Pacific Sachet Packaging Market Y-o-Y growth, by Application 2018(H) to 2033(F)

Figure 09: Asia Pacific Sachet Packaging Market Attractiveness Analysis, by Application, 2018(H) to 2033(F)

Figure 10: Asia Pacific Sachet Packaging Market Value Share, by Packaging Machinery, 2018(H), 2023(E) & 2033(F)

Figure 11: Asia Pacific Sachet Packaging Market Y-o-Y growth, by Packaging Machinery 2018(H) to 2033(F)

Figure 12: Asia Pacific Sachet Packaging Market Attractiveness Analysis, by Packaging Machinery, 2018(H) to 2033(F)

Figure 13: Asia Pacific Sachet Packaging Market Value Share, by Country, 2018(H), 2023(E) & 2033(F)

Figure 14: Asia Pacific Sachet Packaging Market Y-o-Y growth, by Country, 2018(H) to 2033(F)

Figure 15: Asia Pacific Sachet Packaging Market Attractiveness Analysis, by Country, 2018(H) to 2033(F)

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Dental Market Analysis – Growth, Trends & Forecast 2024-2034

Epoxy Resin Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Asia-Pacific Religious Tourism Market Growth – Forecast 2024-2034

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Underground Coal Gasification Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Solid State Transformers Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Gasoline Injection Technologies Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific In-Car Entertainment System Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Plastic Additives Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Asia Pacific Wild Rice Market Report – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA