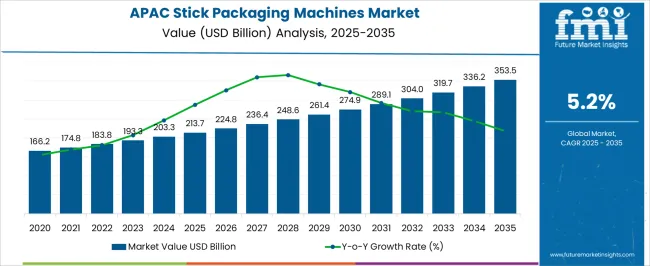

The Asia Pacific Stick Packaging Machines Market is estimated to be valued at USD 213.7 billion in 2025 and is projected to reach USD 353.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Asia Pacific Stick Packaging Machines Market Estimated Value in (2025 E) | USD 213.7 billion |

| Asia Pacific Stick Packaging Machines Market Forecast Value in (2035 F) | USD 353.5 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Asia Pacific stick packaging machines market is experiencing robust growth due to rising demand for convenient, portion controlled, and single serve packaging solutions across food, beverage, and pharmaceutical industries. Rapid urbanization, evolving consumer lifestyles, and the expansion of e commerce have accelerated the preference for compact packaging formats that enhance portability and reduce material waste.

Manufacturers are investing in advanced automation technologies, precision engineering, and improved sealing mechanisms to meet the requirements of high speed operations and diverse product forms. Additionally, regulatory focus on sustainable packaging practices is encouraging the adoption of stick packs that optimize material usage while maintaining product integrity.

The outlook remains positive as companies increasingly integrate digital control systems, multi lane capabilities, and customization features to cater to the region’s growing packaged food and healthcare markets.

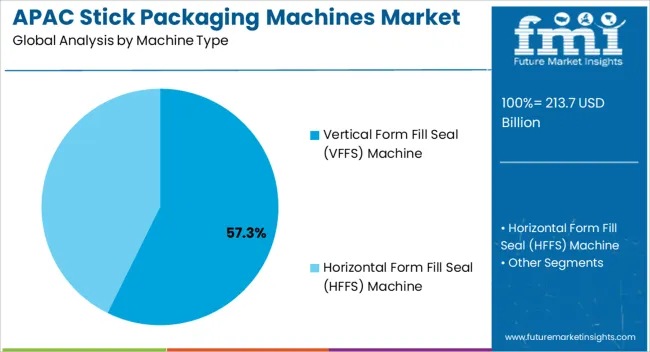

The vertical form fill seal machine segment is projected to represent 57.30% of the total revenue by 2025 within the machine type category, making it the leading segment. This growth is attributed to the versatility of these machines in handling multiple product formats, efficient material utilization, and capability for high speed production.

Their adaptability to varying package sizes and cost effectiveness in operations have made them highly suitable for both large and mid scale manufacturers.

The rising demand for flexible and sustainable packaging solutions across food and pharmaceutical applications has further supported their dominance, establishing VFFS machines as the preferred choice in the regional market.

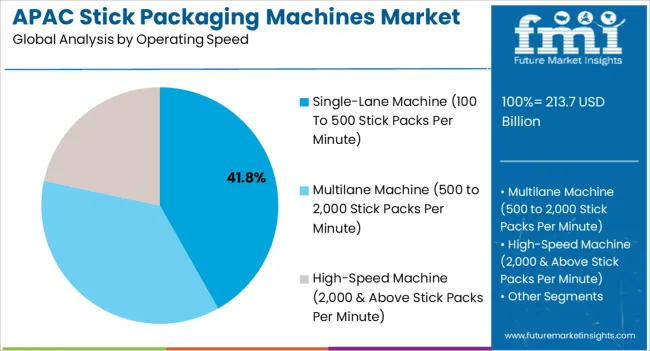

The single lane machine segment with an operating speed of 100 to 500 stick packs per minute is expected to hold 41.80% of the total market revenue by 2025, positioning it as the most significant segment under operating speed. Its dominance is supported by widespread demand among small and medium enterprises that require efficient yet cost effective packaging solutions.

These machines balance throughput efficiency with lower maintenance requirements, making them attractive for companies with moderate production volumes.

Their ease of installation, compact footprint, and ability to maintain consistent packaging quality have reinforced their adoption across the region.

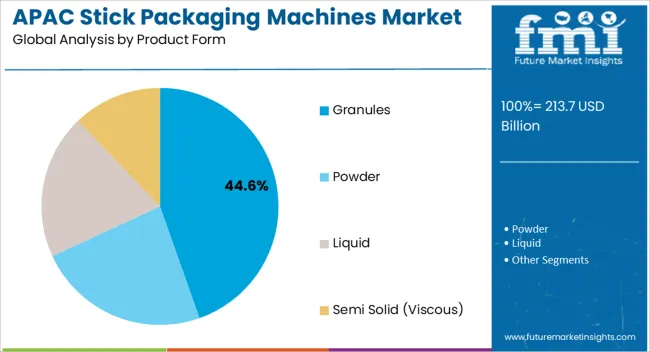

The granules product form segment is anticipated to contribute 44.60% of the total market revenue by 2025, making it the largest segment within product form. The strong performance is driven by extensive application in packaging sugar, coffee, spices, and pharmaceutical granules, where precise portioning and product protection are critical.

Stick packs for granules enhance shelf life, improve convenience, and support brand differentiation through easy to use formats. Growing consumption of instant beverages and ready to mix products across Asia Pacific has further strengthened the uptake of granule based stick packaging.

These factors collectively reinforce the leadership of this segment within the product form category.

Asia Pacific stick packaging machines market recorded a CAGR of 1.0% during the historical period. It stood at a market value of USD 213.7 million in 2025 from USD 166.2 million in 2020.

Convenience and portability are crucial drivers for the adoption of stick packaging machines in skincare and haircare across Asia Pacific. Consumers often seek products that are easy to carry and use on-the-go, especially when it comes to personal care items.

Stick packaging offers a compact and travel-friendly solution. It allows consumers to conveniently apply creams, serums, or balms directly to their skin or hair without the need for additional tools or containers.

Stick packaging machines also provide precise and controlled application, which is highly desired in skincare and haircare products. These sectors often require specific dosage or targeted application of their formulations.

Stick packaging allows for precise delivery, ensuring that the right amount of product is dispensed with each use. This accuracy enhances user experience and ensures effectiveness of the skincare or haircare treatment.

Stick packaging further offers aesthetic appeal and branding opportunities for skincare and haircare companies. Slim and elongated shape of stick packs provides a sleek and modern look that can enhance visual appeal of the product.

Surface area of stick packaging also allows for creative branding, product information, and eye-catching designs. This enables Asia Pacific-based skincare & haircare companies to differentiate their products and establish a unique brand identity in a competitive market.

In February 2025, for instance, Cosmogen, a pioneer in personal care product manufacturing based in France, unveiled Paper Stick. It is the firm’s patented and designed stick packaging made of 78% of FSC-certified paper. This opulent rendition provides a simple yet elegant gesture, resembling a lipstick.

Rising demand for single-serve food & beverage products has significantly contributed to growth in Asia Pacific stick packaging machines market. Stick packs are small, convenient, and portable packaging solutions.

They can cater to increasing preference for on-the-go consumption and portion control. One of the key drivers behind this trend is changing lifestyles of modern consumers, who are often busy and seek quick and easy food & beverage options. Single-serve stick packs offer a convenient solution by providing pre-measured portions that require minimal preparation time.

Stick packs also help to extend the shelf life of perishable food & beverage products, ensuring their freshness and quality. This is particularly crucial in the context of increasing urbanization and growing demand for packaged products in developing countries.

Sachet packaging offers cost-effective benefits for both manufacturers and consumers. Manufacturers can optimize their production processes by utilizing efficient sachet packaging machines, reducing material and labor costs. Consumers, on the other hand, can access affordable and portion-controlled products, minimizing wastage and expenses.

Stick packaging machine manufacturers in Asia Pacific are focusing on innovating their existing packaging solutions. They are aiming to leverage the opportunity generated by increasing demand for process automation.

Numerous companies are already working on developing packaging automation products to gain an early-mover advantage in the market. However, a few multinational machinery manufacturers are planning to enter into joint ventures or partnerships with well-established automation companies.

They are aiming to establish their presence in the market, as well as gain a competitive edge and grow rapidly in the region. Automation of existing packaging systems might create tremendous growth opportunities in the market for new entrants and established players.

Few of the most desired characteristics in automated machinery are real-time diagnostics, safety features, easy-integration, and quick change-overs. A handful of benefits of smart manufacturing are:

| Country | China |

|---|---|

| Market Share (2025) | 39.5% |

| Market Share (2035) | 37.3% |

| BPS Analysis | -220 |

| Country | India |

|---|---|

| Market Share (2025) | 22.7% |

| Market Share (2035) | 24.0% |

| BPS Analysis | 130 |

| Country | Japan |

|---|---|

| Market Share (2025) | 15.9% |

| Market Share (2035) | 14.5% |

| BPS Analysis | -140 |

| Country | South Korea |

|---|---|

| Market Share (2025) | 8.5% |

| Market Share (2035) | 9.5% |

| BPS Analysis | 100 |

| Country | Association of Southeast Asian Nations Countries |

|---|---|

| Market Share (2025) | 10.6% |

| Market Share (2035) | 11.3% |

| BPS Analysis | 70 |

| Country | Australia & New Zealand |

|---|---|

| Market Share (2025) | 2.7% |

| Market Share (2035) | 3.4% |

| BPS Analysis | 70 |

High Demand for Single-service Medicines in India to Fuel Sales of Stick Packaging Equipment

India emerged as the fifth world’s largest retail space. According to India Brand Equity Foundation, the retail sector is expected to reach USD 2 trillion in India by 2035. Retail sector in the country is one of the fastest-growing marketplaces, and it forms around 10% of GDP.

Increasing purchasing power and population are a couple of the reasons behind the same. This has led to increased demand for consumer goods, including food, pharmaceuticals, and personal care products.

Stick packaging machines are commonly used to package single-serve portions of these products, making them convenient for consumers. As a result, India is anticipated to offer an incremental opportunity of USD 39.2 million, growing at a CAGR of 5.6% over the next ten years.

Stick Pack Sachet Machines to Gain Traction in Japan with Rising Demand for Cosmetics

Japan is one of the leading markets for cosmetics and personal care products in Asia Pacific. According to the International Trade Administration, and the United States Department of Commerce, the cosmetics & personal care sector size of Japan was USD 166.2 billion in 2020.

Japan is also the third-largest market for personal care and cosmetics after the United States and China. It is a hub with 3,000 cosmetics and beauty care companies. Owing to this, Japan stick packaging machines market is set to account for around 15.9% of share in 2025, with a considerable CAGR of 4.1% from 2025 to 2035.

VFFS Stick Pack Filling Machines to Witness Exponential Demand across Asia Pacific

In terms of machine type, the vertical form fill seal (VFFS) machine segment is likely to dominate the Asia Pacific stick packaging machines market by 2035. It is set to record a share of more than 86.8% in 2025.

VFFS machines are known for their high-speed operation and efficient packaging capabilities. They can quickly form, fill, and seal bags or pouches.

It can further result in increased production efficiency and productivity for manufacturers. This would allow companies to meet growing demand for packaged products while minimizing downtime and maximizing output.

VFFS machines also offer cost-effective packaging solutions for manufacturers. They typically require fewer materials compared to other packaging methods, further reducing packaging costs.

Their high-speed operation and automation capabilities would contribute to labor cost savings by minimizing the need for manual intervention in the packaging process. The horizontal form fill seal (HFFS) machine segment, on the other hand, is expected to rise with a CAGR of 7.2% over the forecast period.

Demand for Sachet Stick Pack Machines to Surge among Personal Care & Cosmetics Firms

By end-use, the personal care and cosmetics segment is set to generate a stick packaging machines market share of more than 23.6% in 2025. It is further projected to create an incremental opportunity worth USD 27.8 million during the forecast period. Rising stick packaging machine sales among hair oil and shampoo companies in Asia Pacific is projected to drive the segment.

Stick packaging machines contribute to sustainable packaging practices in the shampoo and hair oil sectors. These machines require less packaging material compared to traditional formats such as bottles or jars, resulting in reduced packaging waste.

As sustainability becomes an increasing concern for consumers and manufacturers alike, adopting stick packaging machines aligns with environmental goals. It can also demonstrate a commitment to eco-friendly practices.

Stick packaging further offers opportunities for product differentiation and effective branding for shampoo and hair oil manufacturers. Elongated surface area of stick packs provides ample space for creative and visually appealing designs.

They might enable manufacturers to showcase their brand identity and attract consumer attention on store shelves. Unique packaging designs and branding elements can help products stand out in a competitive market, increasing brand recognition and consumer preference.

Key players in Asia Pacific stick packaging machines industry are adopting several strategies to maintain their competitive edge and capitalize on growing demand. They are focusing on continuous product innovation to develop advanced and technologically superior stick packaging machines.

It includes incorporating features such as higher production capacity, improved efficiency, better flexibility in packaging options, and enhanced automation capabilities. By offering innovative solutions, companies aim to attract customers and differentiate themselves in the market.

Several other key players are entering into strategic partnerships and collaborations with start-up companies in the packaging sector. These collaborations might help in leveraging each other's strengths and expertise, facilitating development of comprehensive packaging solutions. By joining forces, companies can expand their product offerings, access new areas, and refine their competitiveness.

Recent activities and collaborations implemented by leading players in the market are:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 213.7 billion |

| Projected Market Valuation (2035) | USD 353.5 billion |

| Value-based CAGR (2025 to 2035) | 5.2% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) |

| Segments Covered | Machine Type, Operating Speed, Product Form, End Use, Country |

| Key Countries Covered | China, India, Japan, South Korea, Association of Southeast Asian Nations Countries, Australia & New Zealand |

| Key Companies Profiled | Omori Machinery Co., Ltd.; Pakona Engineers; Perfect Automation Pty Ltd.; Emrich Packaging Machinery Pty Ltd.; TNA Australia Pty Ltd.; Mentpack Packaging Machines; Mespack SL; Sanko Machinery Co. Ltd; UFlex Ltd.; Syntegon Technology GmbH; Korber AG; Marchesini Group S.p.A; TOYO MACHINE MANUFACTURING CO., LTD.; Wraptech Machines Pvt. Ltd.; IMA Group; BSP Packaging Co Ltd. |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

The global Asia Pacific stick packaging machines market is estimated to be valued at USD 213.7 billion in 2025.

The market size for the Asia Pacific stick packaging machines market is projected to reach USD 353.5 billion by 2035.

The Asia Pacific stick packaging machines market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in Asia Pacific stick packaging machines market are vertical form fill seal (vffs) machine and horizontal form fill seal (HFFS) machine.

In terms of operating speed, single-lane machine (100 to 500 stick packs per minute) segment to command 41.8% share in the Asia Pacific stick packaging machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Asia Textile Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Asia Neopentyl Glycol (NPG) Market Analysis and Forecast for 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Solid State Transformers Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Gasoline Injection Technologies Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific In-Car Entertainment System Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Plastic Additives Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Asia Pacific Wild Rice Market Report – Trends, Growth & Forecast 2025–2035

Asia Pacific Vinegar and Vinaigrette Market Insights – Growth, Demand & Forecast 2025–2035

Asia Pacific Whole Grain and High Fiber Foods Market Outlook – Size, Share & Forecast 2025–2035

Asia Pacific Wood Vinegar Market Analysis – Demand, Size & Forecast 2025–2035

Asia Pacific Tartrazine Market Analysis – Trends, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA