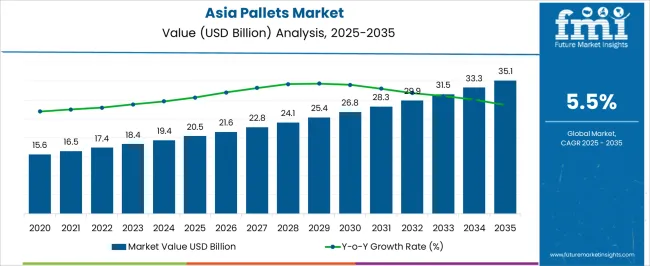

The Asia Pallets Market is estimated to be valued at USD 20.5 billion in 2025 and is projected to reach USD 35.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Asia Pallets Market Estimated Value in (2025 E) | USD 20.5 billion |

| Asia Pallets Market Forecast Value in (2035 F) | USD 35.1 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Asia pallets market is witnessing steady expansion as a result of increasing industrialization, growth in cross border trade, and rising demand for efficient logistics solutions. The growing e commerce sector, coupled with expanding manufacturing output, has created a strong need for durable and standardized pallet formats.

Governments in the region are encouraging modernization of supply chain infrastructure, which is driving the adoption of pallets that support mechanized handling and international shipping compliance. Advancements in pallet design and material durability are further strengthening adoption across diverse industries including retail, food and beverage, and pharmaceuticals.

With heightened emphasis on sustainability, reusable and recyclable pallets are being preferred, particularly in large scale distribution channels. The overall market outlook remains positive, with companies investing in automation friendly pallet solutions to improve operational efficiency and reduce handling costs.

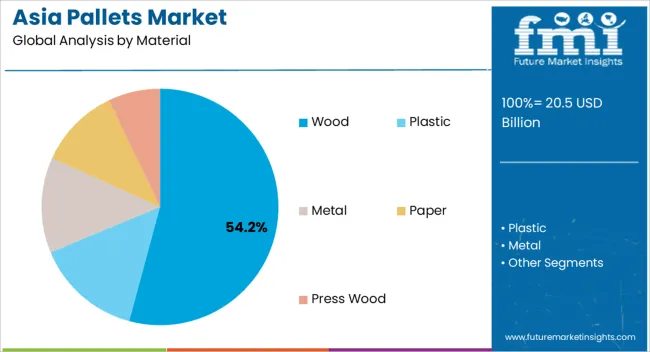

The wood material segment is projected to hold 54.20% of the overall market revenue by 2025, positioning it as the dominant material type. This growth is being driven by the availability of raw materials, cost effectiveness, and ease of repair and recycling.

Wooden pallets provide high load bearing capacity and are widely accepted for domestic and export applications.

Their adaptability across multiple industries and compliance with phytosanitary standards have reinforced their extensive use in the region.

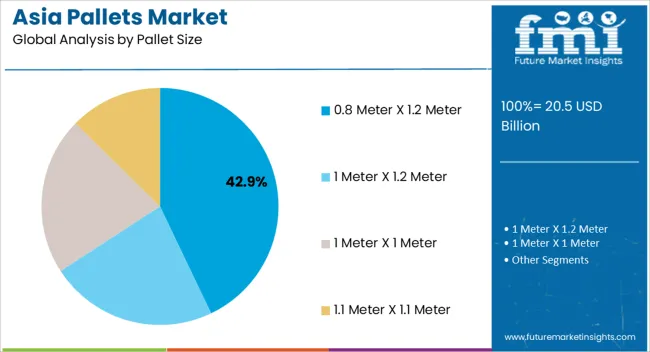

The 0.8 meter x 1.2 meter pallet size segment is estimated to account for 42.90% of market revenue by 2025, establishing itself as the leading size format.

This size standard aligns with international shipping and warehousing practices, offering optimal space utilization in containers and warehouses.

Its suitability for a broad range of goods and seamless integration into automated logistics systems has accelerated adoption, consolidating its leadership in the pallet size category.

Asia pallets market exhibited a CAGR of 2.0% during the historical period with a value of USD 17,187.3 million in 2025 from USD 15,568.2 million in 2020. It is projected to showcase 5.8% CAGR from 2025 to 2035.

Historical market overview for the Asia pallets industry has been characterized by significant growth and change. The region is emerging as a global manufacturing hub, fueling demand for pallets.

Wooden pallets are currently dominating the market in terms of material. These pallets have traditionally been the preferred choice due to their cost effectiveness, versatility, and ease of use.

Vast forests in countries such as China and Indonesia would support the production of wooden pallets on a large scale. However, in recent years, there has been a gradual shift to alternative materials such as plastic and metal pallets.

It is due to factors such as increased durability, hygiene requirements, and surging need for higher load capacity. These changes have opened up new opportunities for pallet manufacturers and contributed to diversification of the market.

With increasing attention to sustainability and environmental issues, more attention has been paid to the development and adoption of environmentally friendly pallets. A few of these are recycled or biodegradable materials. This trend is in line with global sustainability goals and reflects changing dynamics of the Asia pallets market.

Government initiatives and regulations focused on improving logistics and supply chain efficiency are further driving demand for pallets in Asia. Governments are implementing measures to enhance infrastructure, promote standardization, and encourage sustainable packaging practices.

These initiatives might push companies to adopt pallets as a preferred choice for material handling, storage, and transportation. These would further align with the broader objectives of supply chain optimization and sustainability.

Asia has emerged as the world's largest and fastest growing e-commerce market due to factors such as increasing internet penetration, smartphone adoption, and changing preferences. Rise of online shopping has led to a significant increase in demand for efficient logistics and supply chain solutions, including pallets.

Impact of e-commerce sector on the pallets industry is the need for warehouse and order fulfillment operations. E-commerce companies often operate large fulfillment centers and warehouses to manage their inventory and ensure timely delivery to customers.

Pallets would play an important role in this process by facilitating efficient storage, as well as handling and transportation of goods. Industrial demand for efficient logistics & supply chain solutions and need for warehouse & order fulfillment processes are projected to drive the market. Cross-border trade requirements and use of automation & robotics in warehouses are also expected to push demand for pallets in the e-commerce sector.

Growing emphasis on sustainability and environmental responsibility in Asia is projected to propel demand for pallets made from eco-friendly materials and practices. Asia's increasing awareness of environmental concerns presents an opportunity for the pallet sector to expand. It would help offer pallets made from recycled materials, sustainable wood sources, or alternative materials that reduce carbon footprint and waste.

For instance, Eco Pallet, headquartered in Bengaluru, specializes in producing lightweight pallets crafted from recycled wood materials. By utilizing sustainable materials, it contributes to ecological preservation and reduces demand for virgin timber.

Eco Pallet's innovative approach not only offers efficient material handling solutions but also promotes environmental consciousness and sustainable practices in the pallet sector. Its pallets are affordable and certified by the Indian Institute of Packing.

As demand for perishable goods such as fresh produce, meat, and pharmaceuticals increases in Asia, so does the need for cold chain logistics. Pallets play a critical role in maintaining the integrity and quality of temperature-sensitive products during transportation & storage. Expansion of cold chain logistics would create new opportunities for the market, as specialized pallets designed for these applications are in demand.

In October 2025, Snowman Logistics Limited introduced Fifth-Party Logistics (5PL) services in India, expanding its range of logistics solutions. Implementation of 5PL services demonstrates the company’s commitment to offering comprehensive and advanced logistics solutions to its clients.

By venturing into 5PL, Snowman Logistics aims to provide integrated supply chain management solutions. It also wants to leverage its expertise & infrastructure to optimize operations and enhance efficiency in the logistics sector. Such unique developments are set to create new opportunities in Asia.

| Country | China |

|---|---|

| Market Share (2025) | 61.6% |

| Market Share (2035) | 60.0% |

| BPS Analysis | -160 |

| Country | India |

|---|---|

| Market Share (2025) | 7.8% |

| Market Share (2035) | 9.4% |

| BPS Analysis | 160 |

| Country | Japan |

|---|---|

| Market Share (2025) | 5.5% |

| Market Share (2035) | 4.4% |

| BPS Analysis | -110 |

| Country | South Korea |

|---|---|

| Market Share (2025) | 4.9% |

| Market Share (2035) | 6.1% |

| BPS Analysis | 130 |

| Country | Australia |

|---|---|

| Market Share (2025) | 6.2% |

| Market Share (2035) | 4.9% |

| BPS Analysis | -130 |

| Country | Malaysia |

|---|---|

| Market Share (2025) | 2.1% |

| Market Share (2035) | 2.8% |

| BPS Analysis | 70 |

| Country | Indonesia |

|---|---|

| Market Share (2025) | 3.4% |

| Market Share (2035) | 4.0% |

| BPS Analysis | 60 |

| Country | Thailand |

|---|---|

| Market Share (2025) | 1.4% |

| Market Share (2035) | 1.1% |

| BPS Analysis | -30 |

| Country | Singapore |

|---|---|

| Market Share (2025) | 1.8% |

| Market Share (2035) | 1.4% |

| BPS Analysis | -40 |

| Country | Philippines |

|---|---|

| Market Share (2025) | 0.8% |

| Market Share (2035) | 1.1% |

| BPS Analysis | 30 |

| Country | Vietnam |

|---|---|

| Market Share (2025) | 1.1% |

| Market Share (2035) | 1.3% |

| BPS Analysis | 30 |

| Country | Sri Lanka |

|---|---|

| Market Share (2025) | 0.3% |

| Market Share (2035) | 0.4% |

| BPS Analysis | 10 |

| Country | Bangladesh |

|---|---|

| Market Share (2025) | 1.2% |

| Market Share (2035) | 0.9% |

| BPS Analysis | -30 |

Demand for Heavy Duty Plastic Pallets to Surge in China with Demand from E-commerce Firms

China stands out as a prominent player in the Asia pallets market due to its extensive manufacturing sector. Its position as the world's one of the largest exporters has also contributed to the country's rising demand for pallets.

With a strong manufacturing sector that spans automotive, electronics, textiles, and consumer goods sectors, China has a significant need for pallets. These are needed to efficiently handle, store, and transport goods in manufacturing facilities.

Growth of e-commerce in China has further fueled demand for pallets. As the world's largest e-commerce market, the country has witnessed an increase in online retail sales, leading to the need for smooth and streamlined warehousing and distribution operations.

Pallets enable efficient order picking, sorting, and inventory management while facilitating a consistent flow of goods in e-commerce fulfillment centers. Demand for pallets and export packaging for international shipping remains strong.

It is due to the country’s constant efforts to strengthen trade ties and expand export-oriented sectors. China pallets market is expected to record a CAGR of 5.1% from 2025 to 2035. It is likely to create an incremental opportunity of USD 8,694.2 million during the projected years.

Sales of Warehouse Storage Racks to Expand in India amid High Demand for Perishable Goods

India holds a significant Asia pallet market share due to its rapidly growing economy and large population. These are further driving domestic consumption and manufacturing activities.

India's strong agricultural sector plays an important role in the pallets industry. Agriculture is a crucial contributor to the economy in India. Need for pallets is very important in the agricultural supply chain.

Pallets are used to transport and store agricultural products, including fruits, vegetables, grains, and other perishable items. Efficient handling and storage capabilities offered by pallets are essential to maintaining the quality & freshness of these agricultural products.

India's economic growth, agriculture, manufacturing, and retail sectors have further propelled demand. India pallets market is expected to record a CAGR of 7.4% and create an incremental opportunity of USD 1,716.4 million during the projected years.

Demand for Hardwood Pallets to Skyrocket with Need for High Flexibility

Wooden pallets hold the most prominent share in the Asia pallets market due to abundance of wood sources in several countries such as China, Indonesia, Malaysia, and Vietnam. These countries have vast forests and wood reserves, which are economical and easy materials for the production of pallets.

Wood is a flexible material that can be easily changed and repaired, allowing individual pallet dimensions and load capacity to suit different applications. This flexibility makes wooden pallets suitable for multiple sectors.

A few of these include manufacturing, logistics, agriculture, and retail, where different products and loads need to be accommodated. Wooden pallets are also widely compatible with forklifts, pallet jacks, and other material handling equipment. These allow for seamless integration into existing supply chain operations.

Wooden pallets are expected to hold around 79.4% of the market share in 2025. The segment is also estimated to offer incremental an opportunity worth USD 8,196.3 million during the forecast period.

Demand for Block Pallet Jacks to Surge as Need for Efficient Loading and Unloading Rises

Block pallets consist of solid blocks or cubes in each corner, providing a solid support and load-bearing capacity. This design ensures an even distribution of cargo weight, reducing the risk of product damage during transportation and storage.

Enhanced stability of block pallets makes them ideal for heavy and bulky goods, as well as for sectors that require safe placement and efficient use of storage. Four-way entry design also allows easy access from all sides.

It helps in facilitating fast and efficient loading & unloading operations, superior stability, compatibility with handling equipment, versatility, ease of maintenance, and durability of block pallets. The block pallets segment is expected to record a CAGR of 5.8% during the projected years from 2025 to 2035.

Pallet companies in Asia are expanding their product offerings by developing a wide range of pallet types and sizes to meet the diverse needs of different sectors & supply chains. This includes standard pallets, custom-designed pallets, lightweight pallets, and specialized pallets for specific applications.

With an increasing focus on environmental sustainability, pallet companies are adopting eco-friendly practices. This involves using sustainable materials such as recycled wood or plastic, to manufacture pallets. Additionally, they are implementing recycling and waste reduction programs to minimize their ecological footprint.

For instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 20.5 billion |

| Projected Market Valuation (2035) | USD 35.1 billion |

| Value-based CAGR (2025 to 2035) | 5.5% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) |

| Segments Covered | Material, Product, Pallet Size, Medium of Recycling, End-use, Country |

| Key Countries Covered | China, India, Japan, South Korea, Australia, Malaysia, Indonesia, Thailand, Singapore, Philippines, Vietnam, Sri Lanka, Bangladesh, Rest of Asia |

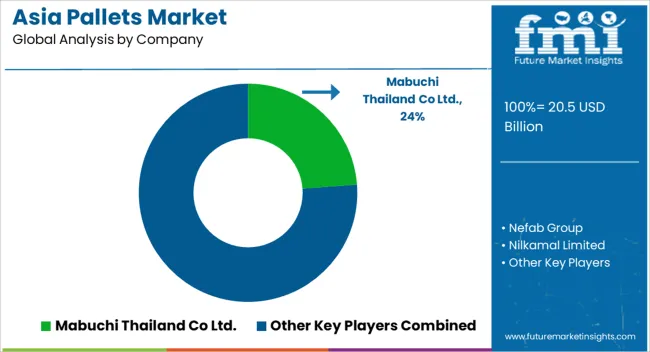

| Key Companies Profiled | Mabuchi Thailand Co Ltd.; Nefab Group; Nilkamal Limited; Brambles Limited; Enno Marketing Services PTE Ltd; Long Thanh Plastic Co., Ltd.; Penno Packtech Co., Ltd; Mapac Technology; Atlanta Global; Aristoplast Products Pvt. Ltd; Pesonex; Hanoi Sin Timber Industry Sdn Bhd.; Linyi Kunpeng Wood Co., Ltd; Vishakha Mouldings Private Limited; Taik Sin Timber Industry Sdn Bhd.; BE Packaging and Logistic Sdn Bhd; Green Forest Pac Sdn Bhd; TBK Resources Sdn Bhd; Teruntum Pallets Industries Sdn. Bhd.; GPac™ Technology (M) Sdn Bhd; Pallet & Timber Sdn. Bhd.; Shing Fuat Timber Enterprise; SC Wooden; LEAP; Toyo Lumber Co, Ltd; Misarma Enterprise Sdn Bhd (MSM); Meiji Rubber & Chemical Co. Ltd; BMR Pallets; PT Yanasurya Bhaktipersada; DIC Corporation; Conitex Sonoco |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

The global Asia pallets market is estimated to be valued at USD 20.5 billion in 2025.

The market size for the Asia pallets market is projected to reach USD 35.1 billion by 2035.

The Asia pallets market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in Asia pallets market are wood, plastic, metal, paper and press wood.

In terms of product, stringer pallet segment to command 48.7% share in the Asia pallets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Solid State Transformers Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Gasoline Injection Technologies Market Size and Share Forecast Outlook 2025 to 2035

Asia Textile Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Pallets Market Analysis - Size, Share, and Forecast 2025 to 2035

Asia Pacific In-Car Entertainment System Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Plastic Additives Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Asia Pacific Wild Rice Market Report – Trends, Growth & Forecast 2025–2035

Asia Pacific Vinegar and Vinaigrette Market Insights – Growth, Demand & Forecast 2025–2035

Asia Pacific Whole Grain and High Fiber Foods Market Outlook – Size, Share & Forecast 2025–2035

Asia Pacific Wood Vinegar Market Analysis – Demand, Size & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA