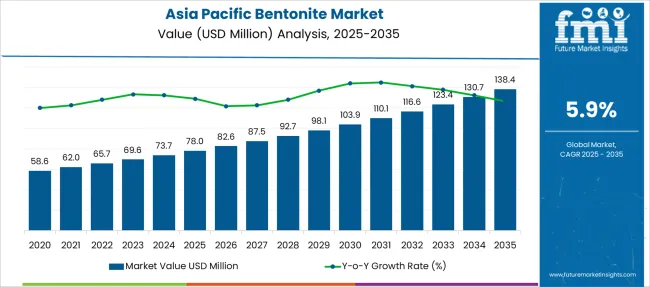

The Asia Pacific Bentonite Market is estimated to be valued at USD 78.0 million in 2025 and is projected to reach USD 138.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Asia Pacific Bentonite Market Estimated Value in (2025 E) | USD 78.0 million |

| Asia Pacific Bentonite Market Forecast Value in (2035 F) | USD 138.4 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

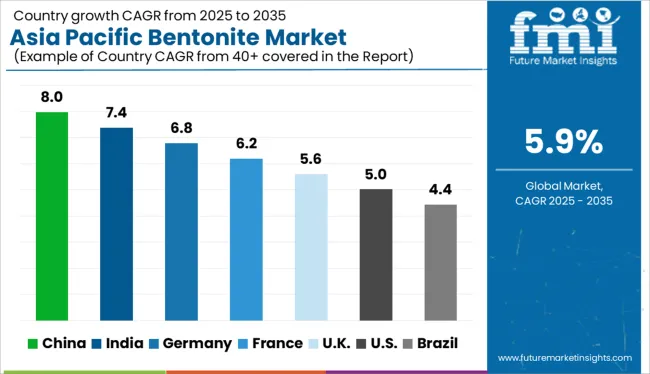

The Asia Pacific bentonite market is experiencing notable expansion, supported by increased consumption across a diverse range of industries such as foundry, oil and gas drilling, iron ore pelletizing, cosmetics, and construction. Demand is being driven by the region’s manufacturing growth, rising population, and infrastructure investments, particularly in China, India, and Southeast Asia.

The preference for locally sourced minerals and rapid urbanization has amplified the need for processed bentonite in applications including civil engineering, environmental protection, and personal hygiene products. Regulatory efforts to manage industrial waste, especially through absorbent materials, are further encouraging bentonite adoption in wastewater treatment systems.

In the years ahead, market growth is expected to benefit from technological advancements in bentonite processing, enhanced export infrastructure, and growing regional demand for performance minerals that support both ecological safety and industrial productivity Rising collaborations among mining companies and end-use sectors are anticipated to further strengthen the regional value chain and expand bentonite utilization across emerging economies.

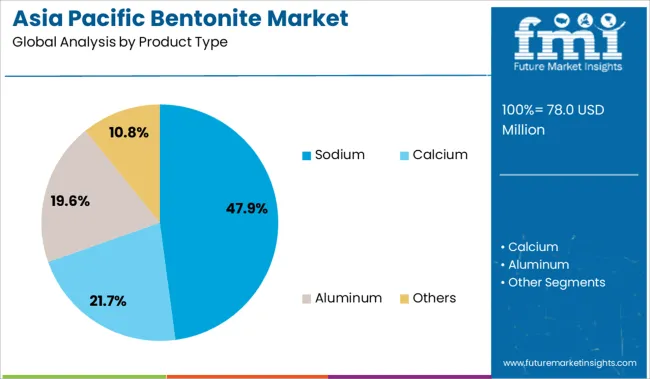

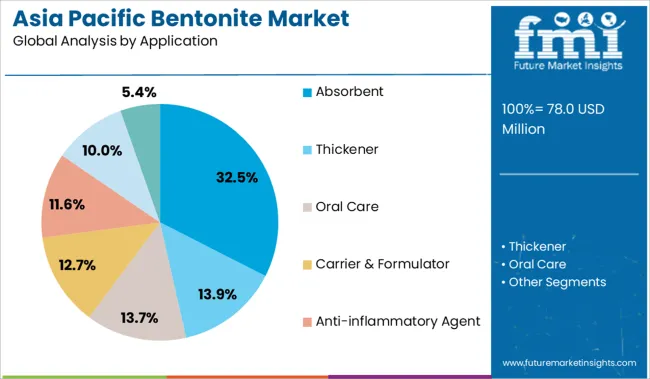

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Sodium, Calcium, Aluminum, and Others. In terms of Application, the market is classified into Absorbent, Thickener, Oral Care, Carrier & Formulator, Anti-inflammatory Agent, Wettable Powder, Water Dispersible Granule & Suspension Concentrate, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sodium segment is anticipated to account for 47.9% of the total revenue share in the Asia Pacific bentonite market in 2025. This leading position is being influenced by sodium bentonite’s superior swelling capacity, high viscosity, and binding strength, which are critical performance parameters in drilling fluids, iron ore pelletizing, and geosynthetic clay liners.

Its ability to absorb large volumes of water and form impervious barriers has supported its widespread use in environmental containment and civil engineering projects. Industrial users in the region have increasingly favored sodium bentonite due to its cost efficiency in bulk usage and adaptability across both high and low pressure environments.

The ease of availability in key producing countries within Asia Pacific, combined with rising mining output and favorable logistics, has further contributed to this segment's leadership In addition, demand from the foundry industry and growing need for high-performance sealing materials in infrastructure and landfill applications have reinforced the dominance of sodium bentonite across commercial supply chains.

The absorbent application segment is projected to hold 32.5% of the overall revenue share in the Asia Pacific bentonite market by 2025, driven by its extensive use in pet care, personal hygiene, industrial spill control, and wastewater treatment. Bentonite’s natural absorbent qualities, especially when processed into granules or powders, have positioned it as a cost-effective and eco-friendly material for fluid containment and odor control.

Rising awareness around hygiene and environmental safety has accelerated its integration into consumer products and industrial filtration systems. In recent years, increased demand for bentonite-based cat litter and chemical absorbents has significantly boosted this segment's growth.

Moreover, absorbent-grade bentonite is being increasingly utilized in chemical manufacturing zones and food processing units to manage spills and maintain hygiene standards The growing focus on sustainable waste management and stringent industrial discharge regulations across key Asia Pacific economies have further supported the uptake of absorbent bentonite, making it a preferred solution for environmental control systems.

Demand for bentonite grew at a 2.2% CAGR between 2020 and 2024 in Asia Pacific. Owing to its extensive consumption in various applications, the market is anticipated to expand at a considerable rate over the assessment period. Increasing consumption of bentonite is projected to propel sales at 5.9% CAGR over the forecast period.

Bentonite has high absorption properties, high alkalinity, and antibacterial properties. Furthermore, it enhances soil microbial properties. The increasing need for food crops is propelling sales of bentonite in the agricultural sector. The high commercial potential of bentonite as a catalyst to promote chemical reactions and the use of bentonite in wastewater treatment is anticipated to create opportunities for growth in the forthcoming years.

The combination of bentonite and cyclodextrin has the potential to promote a variety of chemical reactions in aqueous solutions under ultra-sonication, including the synthesis of xanthan, knoevenagel condensation, and octal hydro quinazolinones. It can also function as a catalyst in esterification reactions.

In the chemical industry, a catalyst is extremely important. The chemical sector is expanding due to the strong demand for specialty and commodity chemicals, which will provide opportunities for growth in the bentonite market.

According to the latest study conducted by Food and Drug Administration on a bentonite sample, bentonite can have high levels of lead in it. Lead is a naturally occurring metal and bentonite tends to absorb it. High lead composition in bentonite can cause metal poisoning in the human body which can lead to death. Various government authorities and regulatory bodies are planning to put regulations on the sales and production of bentonite regarding lead content.

Bentonite is a natural material and is it is extracted from mines around the world. Owing to this there are various federal laws and government rules for the mining operation and exploration activities. For exploration activity and mining operations, government approval is required.

Owing which various government authorities and regulatory bodies are planning to put regulations on the sales and production of bentonite regarding lead content in it. Which is expected to hamper sales over the upcoming assessment period of 2025 to 2035.

Expansion in the Pharmaceutical Sector Will Boost Sales of Bentonite in China

China is the second-largest pharmaceutical market in the world. The government is increasing investment in the medical sector. Bentonite is used in the production of OTC Lotions, oral care, and various other pharmaceutical products. Growing investment in the pharmaceutical sector is expected to bolster the sales of bentonite over the forecast period in China.

The cosmetics and personal care sectors are growing sectors in China. Bentonite is used in a wide range of applications in the cosmetic industry. Bentonite has features such as excellent water absorption capacity, detoxification, and acne treatment, which make it ideal for personal care and cosmetics products.

High Popularity of Bentonite Clay Masks Will Fuel Growth

Bentonite offers high absorption capacity, and detoxifying ability, and helps in removing dirt. Owing to this reason it is widely used in the personal care industry for various applications. It is used as a thickener, absorbent, filler, texturizer, and binder in skin and hair care products and color cosmetics. Furthermore, it is used as a healing ingredient to treat diaper rash and clean impurities.

Individuals are indulging in self-care activities at home and are preferring natural ingredients, due to which, demand for personal care products & consumption of bentonite is expected to grow. In addition to this, bentonite clay masks are gaining popularity across the globe and are being preferred by individuals with acne-prone skin.

Sales of bentonite in the personal care sector are expected to increase at a CAGR of 6.3% over the forecast period and reach about USD 31,548.6 Thousand by the end of 2035.

Expansion of the Agricultural Sector in India and China Will Spur Demand for Bentonite

Bentonite improves soil microbial properties. Organic compounds present in soil accelerate the mineralization of organic matter and disrupt the natural metabolic process of soil organisms. Bentonite with a combination of manure can be effective to maintain or increase the soil organic matter sustainably.

Bentonite clay has a nutrient-holding capacity for soils. Its 2:1 lattice structure allows it to absorb a lot of water. It can be found in abundance and is simple to process and mine, making it less expensive than alternatives.

Demand in the agricultural sector is expected to grow at a CAGR of 5.5% during the forecast period, reaching USD 16,304.1 Thousand by 2035.

Key players operating in the Asia Pacific bentonite market are focusing on acquisitions and expansion strategies to increase revenue. They are also investing in research and development to improve their product portfolios.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 78.0 million |

| Projected Market Valuation (2035) | USD 138.4 million |

| Value-based CAGR (2025 to 2035) | 5.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Thousand for Value and Kilograms for Volume |

| Key Countries Covered | China, India, Japan, Indonesia, Malaysia, Thailand, Vietnam, South Korea, and the Rest of Asia Pacific. |

| Key Segments Covered | Product Type, Applications, End-Use & Countries. |

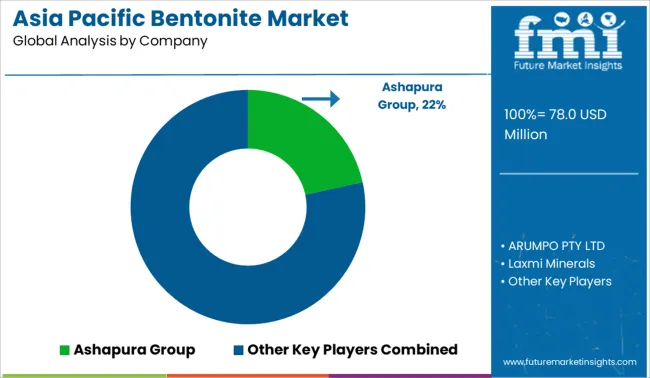

| Key Companies Profiled | Ashapura Group; Kunimine Industries Co. Ltd; Wyo-Ben Inc; Manek Mineral Group; Arumpo Bentonite Pty Ltd; Organic Industries Pvt. Ltd; Swell Well Minechem Pvt. Ltd.; Dae Minerals Co., Ltd; Nova Gas Technologies Inc.; Boc Gases Ireland Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global asia pacific bentonite market is estimated to be valued at USD 78.0 million in 2025.

The market size for the asia pacific bentonite market is projected to reach USD 138.4 million by 2035.

The asia pacific bentonite market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in asia pacific bentonite market are sodium, calcium, aluminum and others.

In terms of application, absorbent segment to command 32.5% share in the asia pacific bentonite market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Asia Textile Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Asia Neopentyl Glycol (NPG) Market Analysis and Forecast for 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Solid State Transformers Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Gasoline Injection Technologies Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific In-Car Entertainment System Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Plastic Additives Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Asia Pacific Wild Rice Market Report – Trends, Growth & Forecast 2025–2035

Asia Pacific Vinegar and Vinaigrette Market Insights – Growth, Demand & Forecast 2025–2035

Asia Pacific Whole Grain and High Fiber Foods Market Outlook – Size, Share & Forecast 2025–2035

Asia Pacific Wood Vinegar Market Analysis – Demand, Size & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA