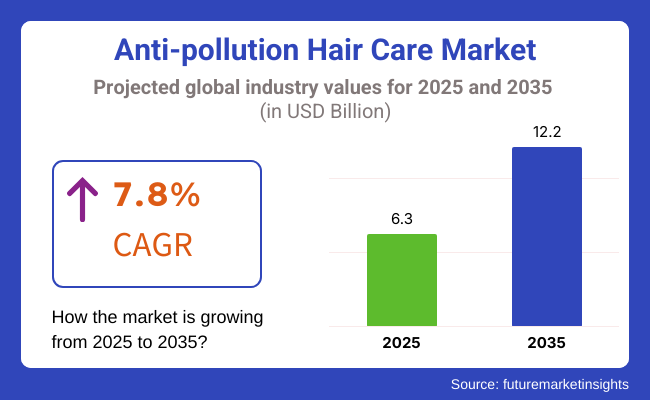

The anti-pollution hair care market is set to witness significant growth between 2025 and 2035, driven by increasing consumer awareness about the damaging effects of pollution on hair health. The market is expected to grow from USD 6.3 billion in 2025 to USD 12.2 billion by 2035, reflecting a CAGR of 7.8% over the forecast period.

The industry is maintaining a steady course, with the lead taken by the growing awareness of consumers about the detrimental effects of environmental pollutants on hair health. Various factors such as air pollution, UV radiation, and hard water exposure add to hair damage, scalp irritation, and premature hair aging, and thus request specialized hair care answers to these problems. The growing inclination towards clean beauty and personal hygiene products that are primarily focused on wellness is a further driving force for progress.

The prime factor of economic expansion is seen in the rise in the number of urban inhabitants and the deterioration of environmental conditions in the cosmopolitan areas. Customers tend to prefer the use of hair care products that are created with the aim to counteract oxidative stress, detoxify, and protect hair from external aggressors.

The use of activated charcoal, antioxidants, plant extracts, and UV filters is becoming more common in anti-pollution shampoos and conditioners. Apart from this, the ambition of brands to produce multi-functional products that clean and, at the same time, rehydrate, repair, and nourish the scalp is driving growth. Products that are free of sulfate, paraben, and organic components are also marking their presence as the product innovation that fulfills the consumer's demand for Earth-friendly, non-toxic beauty products.

Processing breakthroughs in the crafting of hair care items are allowing the anti-pollution approaches to get even better. Layouts of nano-encapsulation and incorporation of bioengineered protective barriers in hair care products that provide long-lasting effects by warding off pollutants are the main reasons for such advanced technologies being applied. Also, the rising digital marketing and social media channels promoting these products are boosting sales and growing awareness about them.

The competition posed by alternative forms of hair treatment, such as deep-conditioning techniques and individual production of natural remedies, are some of the things that may hinder the full establishment of dedicated anti-pollution products.

Though they are facing challenges, they also have a lot of opportunities to improve and increase their sales. The demand for individualized hair care and scalp detox has been a propellant of innovation. Additionally, the growth of e-commerce and direct-to-consumer sales are making anti-pollution hair care products more widely available across the world. With consumers continually focusing on hair health in reaction to environmental stresses, the anti-pollution hair care sector will experience an upswing in the coming years.

There was continuous growth between 2020 and 2024 owing to increasing knowledge about the adverse impact of pollution on hair health. The rising levels of air pollutants such as fine dust, smoke, and UV radiation increased the demand for protective and corrective hair care products among consumers.

Brands reacted by creating products containing antioxidants, plant extracts, and sun blockers that protect hair against environmental aggressors. Micellar water shampoos and serums have become favored products because they can clean and cleanse the scalp gently.

The industry surged immensely in cities, where pollution is significant, and customers were looking for solutions to problems such as dryness, dullness, and hair breakage brought on by pollutants. However, the price of the product and mistrust by consumers of product benefits remained the toughest challenges. Social media and influencer marketing accounted for the most significant drivers of product awareness and uptake.

The anti-pollution hair care industry between 2025 and 2035 is expected to witness revolutionary breakthroughs driven by biotechnology and personalized care products. Machine learning and AI will make it possible to have customized hair care advice based on exposure and user hair type. Biotechnology will bring us the creation of bioengineered ingredients that harden hair and offer long-term protection against pollution and oxidative stress.

Probiotic-enriched products will emerge to feed the scalp and restore natural microbiome balance. Sustainable packaging and sustainable ingredient sourcing will be the new standard in the industry as consumers become more interested in eco-friendly products. Adaptive protection technology hair care products, which change according to levels of pollution and environmental conditions, will revolutionize the industry.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Development of antioxidant-enriched hair care products with vitamin C, green tea, activated charcoal, and sea algae to counteract pollution damage. Growing demand for detox clays and probiotics to regulate scalp microbiome. | Hair diagnostics powered by AI tailor anti-pollution treatments according to current air quality. Bioengineered plant extracts form a natural barrier against pollution. Keratin and peptides grown in the lab repair pollution-induced hair damage at the molecular level. |

| Transition to sulfate-free, silicone-free, and paraben-free anti-pollution shampoos and conditioners. Brands introduced waterless versions (solid bars, powders, and foams) to reduce water wastage. Biodegradable packaging was a top concern. | Zero-waste haircare products replace conventional packaging. AI-based ingredient sourcing ensures sustainable supply chains. Self-cleaning, pollution-repelling hair treatments use nanotechnology to prevent dirt and pollutants from sticking to hair strands. |

| Invention of UV-guard serums and heat-protection sprays to shield against sun and environmental damage. Invention of microbiome-surfacing scalp treatments to purify inflammation due to pollution. | Pollution exposure is detected by smart hair sensors, which suggest personalized cleansing regimes. AI adaptive hair care adjusts product formulations according to daily weather and pollution conditions. Auto-activated scalp masks respond to pH and toxin levels. |

| Increased need from urban consumers who are subjected to pollution, hard water, and extreme weather conditions. Brands introduced anti-pollution hair detox kits for use at home. Direct-to-consumer (DTC) clean beauty brands are expanding their attention to scalp well-being. | Subscription services based on AI personalization offer customized anti-pollution hair care based on seasonal patterns of pollution. DNA hair diagnostics analyze genetic susceptibility to damage from pollution. Personalized on-demand hair care formulated with real-time environmental data. |

The industry is growing because of factors such as consumers looking for solutions to fight back against environmental damage caused by pollutants, UV, and free radicals. Growing urbanization, industrial pollution, and environmental concerns regarding climate change are necessitating protective hair care products.

Customers prefer shampoos, conditioners, and serums with antioxidants, plant extracts, and pollution-fighting agents such as charcoal, green tea, and moringa. The move towards sulfate-free, paraben-free, and silicone-free products is part of clean beauty trends.

Hair oils and serums are becoming popular for their light, barrier-forming benefits, and styling products, including anti-pollution shields to safeguard against damage from external aggressors. The professional and salon segment concentrates on deep detoxes and hair shields.

As consumers are being influenced by sustainability, businesses are making investments in sustainable packaging and ethical sourcing. Online engagement and influencer marketing also increase the visibility of the product, hence making anti-pollution hair care a primary segment.

There is a growth due to increasing concerns about the destruction of the environment and the health of the hair. However, the very strict rules regarding the ingredients of cosmetic products, their safety, and sustainability claims make compliance a big issue. Companies need to not only make sure that they are in accordance with the changes of the global norms but also gain the necessary approvals in order to keep the trust of customers.

The instability in the supply chain, which includes the availability of natural ingredients fluctuating, climate-related agricultural risks, and price changes of key raw materials, has the most direct effect on the production level. Relying on certain plant extracts and antioxidants makes it worse. Enterprises are advised to diversify their sources and integrate sustainability into their products in order to tackle supply issues.

The rapidly changing industrial scenario due to competition from multi-functional hair care products and natural alternatives turns out to be a big obstacle for companies in separating themselves from the competition.

The consumer demand for more holistic solutions, such as scalp care, which includes microbiome-friendly substrates, is on the rise. In order to stay ahead of the game, brands have to focus on the effectiveness proven by clinical tests, use ingredients without any additives considered harmful by consumers, and provide things such as UV and heat protection as extra benefits.

Transparency in marketing and testing by third parties will be the keys to creating loyalty and ensuring a long future in the business. Informing consumers about the benefits of the products will also be important.

The growth is affected by economic downturns, changes in the beauty sector, and the mounting need for eco-friendly packaging. Companies that want to succeed in the long run should concentrate their efforts on the introduction of new products, environmentally friendly practices, and offering individualized goods that align with customer needs as well as meet the requirements set by the law.

The shampoo segment will hold the largest share of 37.5% by 2025. The increasing concentration of air pollution, dust, and particulate matter (PM2. and PM10) in cities is raising consumer awareness of protective and detoxifying hair products. Anti-pollution shampoos with activated charcoal, antioxidants, and plant extracts that release dirt, fight free radicals, and protect the scalp from oxidative stress.

On-target anti-pollution shampoos from big names such as L'Oréal, Unilever (TRESemmé), and Procter & Gamble (Pantene) have hit on green tea, vitamin E, and niacinamide to combat environmental damage. Also impacting the category is the clean beauty and sulfate-free movement.

The Conditioner Segment accounts for 21.0%, as it is pivotal in restoring and shielding any damage caused by pollution to the hair. Anti-pollution conditioners are stocked with ceramides, essential oils, and UV protectants to guard against pollutants, while turnover retains moisture and fortifies the locks. Dove, Herbal Essences, and Aveda have even introduced conditioners made to counteract moisture loss, frizz, and discoloration brought on by environmental stress.

As air and water pollution is becoming more of a concern among people, including food hygiene, consumers are following several steps to prevent hair from getting damaged and looking for holistic anti-pollution solutions in shampoo and conditioners. Obsessive concern for the tech behind a product is on the rise, particularly with the ultra-high levels of anti-pollution tech, bioactive ingredients, scalp microbiome care, etc.

By packaging type, bottles are favored and account for 72.0% share in 2025. Used bottles are still the most popular packaging type because they are strong, easy to use, and can protect the product. Brands such as L'Oréal, Dove, and Pantene still use PET and HDPE bottles that are recyclable, thanks to sustainability trends and the demand from customers for more sustainable packaging. Pump and squeeze bottles also have precise dispensing, minimizing product wastage and consumer convenience.

Pouches and sachets likewise account for a 28% share, with rising demand for portable, single-serve, and refillable packages further driving sales. Sachets are, therefore, popular in developing nations where the use of a product can be triggered through economic affordability on a sample-size basis.

Sachets of anti-pollution shampoo and conditioner have also been launched by brands such as Head & Shoulders and Sunsilk to target price-sensitive consumers. Refill pouches are equally trending as part of the sustainability movement, with brands such as Love Beauty and Planet and The Body Shop launching eco-friendly refill stations and alternative packaging.

Heightened awareness around environmental issues is also leading the industry towards biodegradable, recyclable, and refillable packaging solutions. With companies producing various innovative methods using sustainable packaging materials and reduced plastic use, flexible and sustainable alternatives in packaging solutions are anticipated to increase extensively.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.9% |

| UK | 6.5% |

| France | 6.3% |

| Germany | 6.7% |

| Italy | 6.2% |

| South Korea | 7.0% |

| Japan | 6.8% |

| China | 7.5% |

| Australia | 6.4% |

| New Zealand | 6.1% |

The USA will grow at a CAGR of 6.9% between 2025 and 2035, driven by increasing urban pollution levels, increased consumer concern about scalp and hair protection, and advancements in detoxifying and fortifying hair products. Key leaders such as L'Oréal, Aveda, and Briogeo continue to introduce high-end hair detox products that have activated charcoal, clay, and micellar technology.

Metropolitan consumers seek out high-tech anti-pollution active ingredients that protect against environmental aggressors such as smog and UV. The shift toward organic and sulfate-free products continues to bolster demand. Players in the clean beauty space are utilizing digital platforms to build more access, and online sales have contributed significantly to growth.

Increased investment in niche hair care solutions by direct-to-consumer brands built around scalp wellness has accelerated with the surge in direct-to-consumer brands based on scalp well-being. Growing awareness has also led to increasing demand for product benefits combining pollution shields with intense moisturizing attributes among United States consumers.

The UK is anticipated to grow at a CAGR of 6.5% from 2025 to 2035. Sulfate-free, antioxidant-rich, and pH-balanced hair protection products are in demand as consumers look for healthier hair care products. Neal's Yard Remedies, The Body Shop, and Kérastase are driving innovation in scalp detox treatments with herbal and organic product lines.

Green beauty trends have led to increased sales of products with environmentally friendly packaging and refillable containers. Sales from online and offline beauty stores are increasing at an extremely rapid rate, with the online platform significantly contributing to brand visibility. British consumers are very open to clean beauty trends, leading to surging demand for eco-friendly hair care products.

There is a rise in plant-based and cruelty-free anti-pollution hair treatments that appeal to the ethical consumer segment. The effect of EU regulations on clean formulas also forces brands to focus on transparency in the sourcing of ingredients.

France is expected to grow at a CAGR of 6.3% from 2025 to 2035. The French consumers prioritize high-quality, dermatologist-recommended hair care products that protect from pollution, along with nourishment. Luxury players such as Klorane, Rene Furterer, and Christophe Robin are leading with plant-based detox products enriched with chamomile, oat milk, and green tea extracts.

Demand for hair care products that maintain scalp health is driving the development of new micellar and probiotic shampoos. The premium hair care industry is expanding as French consumers seek out professional-strength anti-pollution treatments. Greater concern over the effects of air pollution has driven consumers to increasingly look for light, non-greasy products offering daily protection against urban pollutants and environmental stressors.

Germany is expected to record a CAGR of 6.7% from 2025 to 2035. Germans prefer dermatologically recommended, high-performance, and eco-friendly hair care products. Key leaders, including Schwarzkopf, Weleda, and Wella, dominate with innovations in hair care products.

The growing demand for herbal and natural products has seen increased sales of herbal and plant-based detox shampoos and serums. Consumers are particularly keen on scalp detox and hair strengthening due to water quality issues in the cities. German brands emphasize biodegradable packaging and sustainable sourcing since the nation is very environmentally aware. Increased sales also come from the rise of luxury hair clinics offering anti-pollution therapy.

Italy is expected to expand by a rate of 6.2% between 2025 and 2035. Italian consumers opt for hair care products that contain Mediterranean ingredients such as olive oil, citrus extracts, and sea minerals. Companies such as Davines, Alfaparf Milano, and Kemon focus on botanical-based pollution protection solutions.

Sustainability is also a leading driver, with a number of Italian hair care brands adopting refillable packaging and sustainable sourcing. Rising demand for light and daily detoxification products has driven growth in anti-pollution hair mists and leave-in treatments. Professional salon brand influence is widespread, with many consumers seeking upmarket, salon-quality products that protect against environmental aggressors.

South Korea's anti-pollution hair care market is anticipated to grow at a CAGR of 7.0% from 2025 to 2035. K-beauty trends are the key drivers of innovation, with companies such as Amorepacific, Innisfree, and Ryo leading the way in scalp-centric formulations. Hair health is crucial to Korean consumers, and this has resulted in scalp exfoliators, probiotic shampoos, and hair essences with pollution-defense properties being in vogue.

Advanced science is leading the way, too, with the majority of brands incorporating microbiome research and fermented ingredients to increase hair strength. Functionals such as cleansing and moisturizing hair care products have made overnight treatments and anti-pollution hair serums mainstream. Social media advertising and online shopping are fueling brand growth in both domestic and international industries.

Japan's anti-pollution hair care industry is expected to account for a CAGR of 6.8% over 2025 to 2035. Shiseido, Kao, and Milbon are some of the Japanese companies that prioritize gentle but highly effective anti-pollution products for sensitive scalps. Tsubaki oil, matcha, and seaweed extracts-based products are gaining popularity because of their detoxifying and repair properties.

Lightweight, non-stripping hair products are popular since consumers are seeking products that provide moisture and also protect hair against environmental stressors. Greater attention to overall hair health has fueled the trend toward multi-benefit shampoos and hair masks that rebalance the scalp microbiome. Japanese consumers also welcome refillable package solutions as the country responds to the national green beauty values.

China is expanding at 7.5% CAGR from 2025 to 2035. Disposable incomes have risen, and the intensive influence of K-beauty and J-beauty trends drive growth heavily. Players such as Shiseido, P&G China, and Inoherb are focusing on high-tech ingredients that address hair loss and pollution damage.

Live streaming and social media are central in product marketing, with taste shaped by influencers and opinion leaders. Cross-border online shopping has become larger, opening doors for overseas brands to steal revenue share within the Chinese marketplace. Premium pollution scalp care goods become more in demand as there is a higher awareness of how air pollution affects the condition of the hair.

The anti-pollution hair care market in Australia will have a CAGR of 6.4% for the forecast period 2025 to 2035. The climate of the country is extreme, with high UV and city pollution, and thus, there is a demand for protective and moisturizing hair care products. Locally established companies such as Aesop, Kevin Murphy, and BondiBoost concentrate on natural, sulfate-free hair care products containing local botanical extracts such as Kakadu plum, macadamia oil, and tea tree extract.

Consumers are increasingly seeking scalp health-driven products, such as detox shampoos and UV protectant sprays. Sustainability is paramount, and Australian brands are more likely to focus on biodegradable packaging and responsible sourcing. The industry also features new direct-to-consumer brands that use social media to sell clean, sustainable hair care products.

New Zealand is expected to achieve a CAGR of 6.1% between 2025 and 2035. New Zealand's clean beauty trend propels the industry with a focus on organic and environmentally friendly ingredients. Local brands such as Ethique, Ecostore, and Trilogy dominate with strong shampoos, natural detox, and scalp-balancing treatments.

Rising pollution levels in urban areas and heightened sensitivity towards environmental degradation drive expansion. New Zealand consumers are also sensitive to transparency in the sourcing of ingredients, requiring hair care products that employ sustainably sourced plant ingredients such as Manuka honey and sea kelp. The growing popularity of online shopping also expands reach, enabling local brands to reach more consumers locally and globally.

The industry is on the upswing, propelled by increasing consumer awareness regarding environmental degradation effects on hair, rising urban pollution levels, and growing demand for clean-label and protective hair care products. For instance, consumers are looking for shampoos, conditioners, serums, and masks that claim to contain antioxidants, botanical extracts, and UV protectants to protect against pollutants, heavy metals, and free radicals.

Key leaders like L'Oréal, Procter & Gamble, Unilever, and Henkel are growing their portfolios with pollution-protection hair care products containing detoxifying ingredients, activated charcoal, and vitamin-infused formulations. New-age indie brands are also distinguishing themselves through organic and sulfate-free formulations, appealing to environmentally friendly consumers.

Microbiome-friendly hair care, scalp detoxification, and blue light protection are some upcoming trends. Companies are integrating biotechnology, plant-based actives, and sustainable packaging in the innovative treatments of these products for enhanced consumer appeal and to meet regulatory standards.

Leading strategic factors include scientific ID of anti-pollution claims, premiumization of hair care products, and expansion into extremely polluted urban markets. While the demand grows, brands are leveraging influencer marketing, salon partnerships, and e-commerce channels against the grain toward strengthening consumer engagement and market penetration.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| L’Oréal (Kérastase, L’Oréal Paris, Garnier) | 20-25% |

| Procter & Gamble (Pantene, Herbal Essences, Head & Shoulders) | 15-20% |

| Unilever (TRESemmé, Dove, Love Beauty & Planet) | 12-16% |

| Henkel (Schwarzkopf, Syoss) | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| L’Oréal | Beyond advanced anti-pollution hair treatments, these might include micellar technology and protective botanical extracts from Kérastase and Garnier. |

| Procter & Gamble | The hair care portfolio is further enhanced by the inclusion of Pantene Pro-V Miracles range, Herbal Essences Bio: Renew, and scalp detox treatments featuring the provenance of natural antioxidants. |

| Unilever | The strengthening of the anti-pollution segments would comprise sulfate-free and environmentally social formulas under the TRESemmé, Dove, and Love Beauty & Planet brands. |

| Henkel | Innovating with the Schwarzkopf and Syoss ranges featuring pollution shield technology as well as deep-cleansing charcoal formulas. |

Key Company Insights

L'Oréal (20-25%)

Dominating premium and mass markets with scientifically backed formulations against pollution, the company is working on antioxidant hair care and sustainable packaging initiatives.

Procter & Gamble (15-20%)

It is expanding into the anti-pollution hair care space with scalp-purifying and detox treatments while also increasing offerings of naturally sourced ingredients.

Unilever (12-16%)

It is increasing its sulfate-free and organic hair care range with deep conditioning, protective, and pollution-resistant solutions designed for urban markets worldwide.

Henkel (8-12%)

It further strengthens its position by embedding active detoxifying agents and professional-grade anti-pollution hair care products.

Other Key Players (30-40% Combined)

The segmentation is into Shampoos, Conditioners, Hair Masks, Serums & Oils, and Others.

The segmentation is into activated charcoal, antioxidants (Vitamin C and Vitamin E), botanical extracts, marine extracts, and others.

The segmentation is into supermarkets/hypermarkets, specialty stores, pharmacies/drug stores, online stores, and others.

The segmentation is into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Anti-Pollution Hair Care industry is projected to witness a CAGR of 7.8% between 2025 and 2035.

The Anti-Pollution Hair Care industry stood at USD 5.4 billion in 2024.

The Anti-Pollution Hair Care industry is anticipated to reach USD 12.2 billion by 2035 end.

Shampoos and serums with pollution-defense formulas are set to record the highest CAGR of 7.9%, driven by rising concerns about hair damage due to pollution.

The key players operating in the Anti-Pollution Hair Care industry include L’Oréal, Unilever, Procter & Gamble, Henkel, The Estée Lauder Companies, and Coty Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by End User, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Packaging, 2023 to 2033

Figure 28: Global Market Attractiveness by End User, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Packaging, 2023 to 2033

Figure 58: North America Market Attractiveness by End User, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Packaging, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Packaging, 2023 to 2033

Figure 118: Europe Market Attractiveness by End User, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Packaging, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Packaging, 2023 to 2033

Figure 178: MEA Market Attractiveness by End User, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Pollution Skin Care Industry Analysis – Size, Share & Forecast 2025-2035

Anti-Pollution Skin Care Products Market Trends - Growth & Forecast 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Promoters / Anti-Hair Loss Agents Market Size and Share Forecast Outlook 2025 to 2035

Hair Extension Market Size and Share Forecast Outlook 2025 to 2035

Hair Bond Multiplier Market Size and Share Forecast Outlook 2025 to 2035

Hair Loss Prevention Products Market Size and Share Forecast Outlook 2025 to 2035

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Finishing Stick Market Size and Share Forecast Outlook 2025 to 2035

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Mask Market Size and Share Forecast Outlook 2025 to 2035

Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Hair Removal Wax Pen Market Size and Share Forecast Outlook 2025 to 2035

Hair Perfume Market Size and Share Forecast Outlook 2025 to 2035

Hair Dryer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Hair Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA